Key Insights

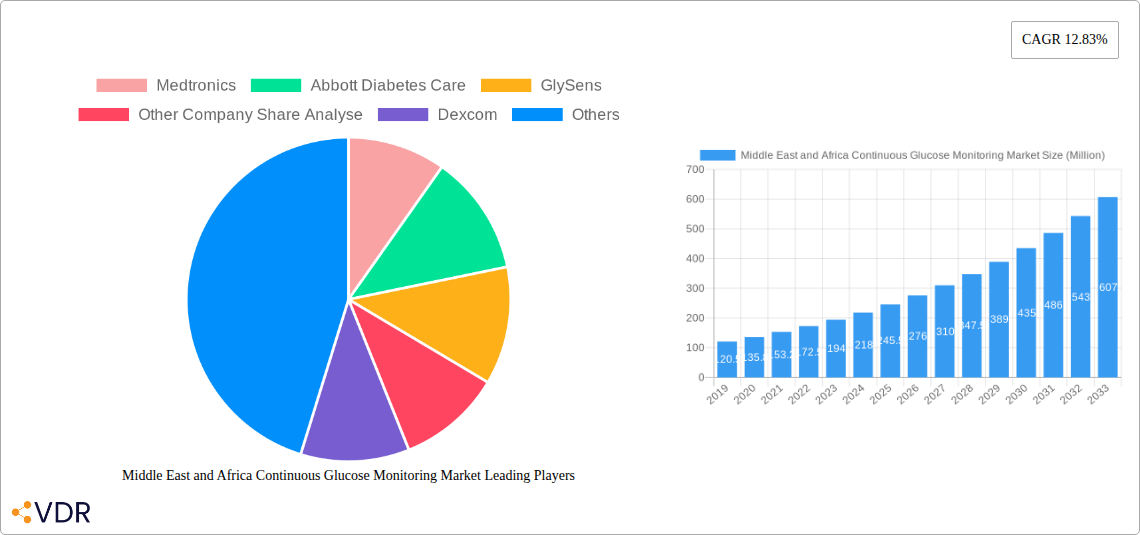

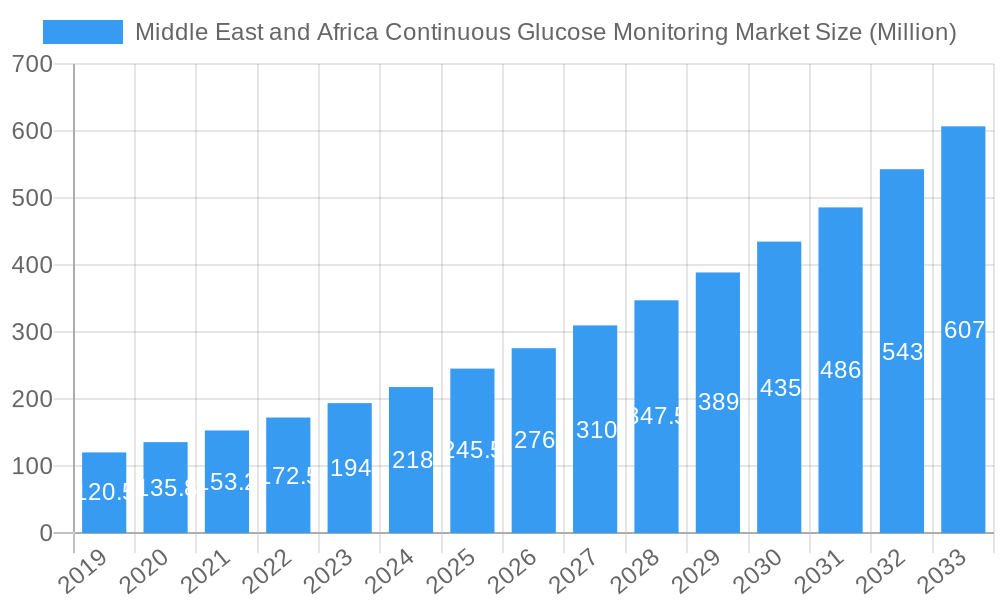

The Middle East and Africa (MEA) Continuous Glucose Monitoring (CGM) market is poised for significant expansion, projected to reach a substantial USD 261.03 million by 2025. This robust growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 12.83% from 2019 to 2033, indicating a dynamic and rapidly evolving landscape. Key drivers propelling this surge include the increasing prevalence of diabetes across the region, a growing awareness of advanced diabetes management solutions, and the improving healthcare infrastructure in several MEA nations. The adoption of sophisticated technologies like CGM is becoming increasingly vital in providing patients with real-time glucose data, enabling better treatment adherence and reducing the risk of long-term complications. Furthermore, the expanding access to these devices through both online and offline distribution channels is democratizing their availability, making them more accessible to a wider patient population.

Middle East and Africa Continuous Glucose Monitoring Market Market Size (In Million)

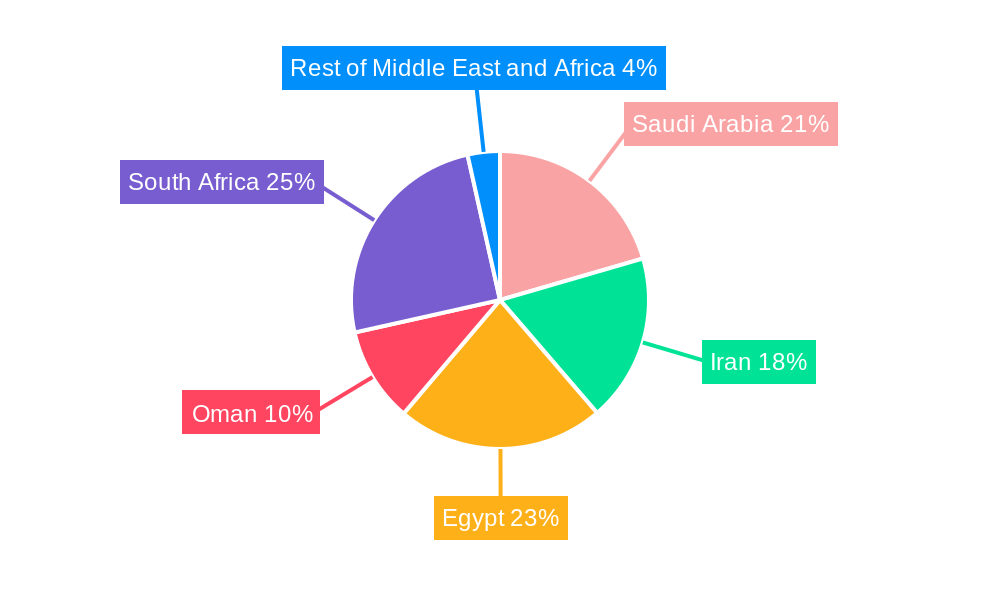

The market is segmented into crucial components, with Sensors and Durables playing a pivotal role in technological advancements and product offerings. The distribution channels are equally diverse, encompassing both online platforms, offering convenience and wider reach, and traditional offline channels like hospitals and pharmacies, ensuring a comprehensive market penetration. Geographically, while South Africa and Egypt are anticipated to be strong contributors, Saudi Arabia and Iran are also showing promising growth trajectories, reflecting significant investments in healthcare and a rising demand for innovative medical devices. Emerging trends such as the integration of CGM with insulin pumps and the development of wearable CGM technologies are expected to further accelerate market growth. However, challenges like the high cost of devices and limited reimbursement policies in certain regions may act as restraints, necessitating strategic approaches from market players to ensure widespread affordability and accessibility.

Middle East and Africa Continuous Glucose Monitoring Market Company Market Share

This in-depth report provides a definitive analysis of the Middle East and Africa (MEA) Continuous Glucose Monitoring (CGM) market, offering critical insights into its dynamics, growth trajectory, and competitive landscape. Covering the historical period of 2019-2024, base year 2025, and extending to a comprehensive forecast period of 2025-2033, this report equips industry stakeholders with the data and foresight needed to navigate this rapidly evolving sector. We delve into parent and child market segments, analyze key drivers, barriers, and emerging opportunities, and present a detailed product landscape, all while adhering to SEO best practices with high-traffic keywords for maximum visibility. All quantitative values are presented in Million units for clarity and immediate comprehension.

Middle East and Africa Continuous Glucose Monitoring Market Dynamics & Structure

The Middle East and Africa Continuous Glucose Monitoring (CGM) market is characterized by a dynamic interplay of technological advancements, evolving regulatory frameworks, and shifting end-user demographics, driving significant market concentration towards innovative players. Technological innovation serves as a primary catalyst, with companies actively investing in developing more accurate, user-friendly, and integrated CGM systems. Key drivers include the increasing prevalence of diabetes across the MEA region, a growing awareness of the benefits of proactive glucose management, and the rising adoption of connected health technologies. However, the market also faces certain innovation barriers, such as the high cost of advanced CGM devices, limited reimbursement policies in several MEA countries, and the need for robust digital infrastructure to support data transmission and analysis. Regulatory frameworks are gradually improving, with some nations establishing clearer guidelines for medical device approvals and data privacy, which bodes well for market expansion. Competitive product substitutes, primarily traditional blood glucose meters, still hold a considerable market share, but their limitations in providing real-time, continuous data are increasingly pushing users towards CGM solutions. End-user demographics are tilting towards a younger, tech-savvy population in urban centers, alongside a growing geriatric population at higher risk of diabetes complications. Mergers and Acquisitions (M&A) trends are nascent but are expected to accelerate as larger global players seek to establish a stronger foothold in this promising, yet fragmented, market. The market is projected to see an M&A deal volume of approximately 3-5 in the forecast period.

- Market Concentration: Dominated by a few key global players with a growing presence of regional distributors.

- Technological Innovation Drivers: Miniaturization of sensors, enhanced data analytics, remote monitoring capabilities, and integration with insulin delivery systems.

- Regulatory Frameworks: Gradual but steady evolution, with increasing focus on device efficacy, safety, and data protection.

- Competitive Product Substitutes: Traditional blood glucose meters (BGM) remain a significant alternative, though CGM offers superior insights.

- End-User Demographics: Rising prevalence of Type 1 and Type 2 diabetes, increasing disposable income in certain MEA countries, and growing digital health literacy.

- M&A Trends: Expected to increase as companies seek market access and synergistic product portfolios.

Middle East and Africa Continuous Glucose Monitoring Market Growth Trends & Insights

The Middle East and Africa Continuous Glucose Monitoring (CGM) market is poised for substantial growth, driven by a confluence of factors that are reshaping diabetes management across the region. The market size evolution indicates a significant upward trajectory, with projected market expansion from an estimated xx Million units in 2025 to xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This robust growth is fueled by increasing adoption rates of CGM devices, spurred by greater awareness of their benefits in preventing hypo- and hyperglycemia, thereby reducing long-term complications. Technological disruptions, such as the development of closed-loop systems and the integration of CGM with artificial intelligence for personalized treatment recommendations, are further accelerating market penetration. Consumer behavior shifts are also playing a crucial role; individuals with diabetes are becoming more proactive in managing their condition, seeking devices that offer comprehensive data, actionable insights, and a better quality of life. The demand for real-time glucose data is no longer limited to individuals with Type 1 diabetes but is rapidly expanding to those with Type 2 diabetes and gestational diabetes. The accessibility of these advanced technologies, while still a challenge in some parts of the region, is improving with the advent of more affordable sensor options and wider distribution networks. The integration of CGM data into electronic health records (EHRs) and the rise of telehealth platforms are creating a more connected and efficient diabetes care ecosystem, further enhancing user engagement and driving market adoption. The market penetration of CGM devices, currently estimated at around xx% in key MEA markets, is expected to surge significantly, reaching close to xx% by 2033. This growth is underpinned by a rising middle class, increased healthcare expenditure, and government initiatives aimed at improving chronic disease management. The increasing focus on preventative healthcare and early intervention is also a significant contributor to the expanding CGM market in the MEA region.

Dominant Regions, Countries, or Segments in Middle East and Africa Continuous Glucose Monitoring Market

The Middle East and Africa Continuous Glucose Monitoring (CGM) market is experiencing robust growth, with specific regions, countries, and segments emerging as key drivers of this expansion. Saudi Arabia stands out as a dominant force, propelled by its significant investment in healthcare infrastructure, a high prevalence of diabetes, and a government focus on adopting advanced medical technologies. The country’s economic policies actively encourage the adoption of innovative healthcare solutions, making it a prime market for CGM devices.

Among the segments, Sensors are the primary revenue generators within the Components segment, exhibiting a market share of approximately xx% in 2025 and projected to reach xx% by 2033. This dominance is attributed to the continuous need for sensor replacement, making them the recurring purchase that underpins the entire CGM ecosystem. The Online Distribution Channel is also rapidly gaining traction, especially in more developed MEA economies, driven by the convenience of direct-to-consumer sales and increased e-commerce penetration. This channel is expected to capture an increasing market share, from xx% in 2025 to xx% by 2033.

In terms of geographical dominance, Saudi Arabia is projected to hold a substantial market share of approximately xx% in 2025, expanding to xx% by 2033. This is driven by several factors:

- High Diabetes Prevalence: Saudi Arabia has one of the highest rates of diabetes globally, creating a large and growing patient pool.

- Government Initiatives: Significant investment in healthcare modernization and the adoption of digital health solutions.

- Economic Prosperity: High disposable incomes support the adoption of premium medical devices.

- Early Adoption of Technology: A population that is generally receptive to new technologies and advanced healthcare solutions.

Egypt and South Africa are also emerging as significant growth hubs, characterized by large populations and increasing awareness of diabetes management. While facing economic challenges, their vast patient numbers and improving healthcare accessibility are contributing to their growing market share. Iran presents a unique market with a substantial diabetes burden, though its growth is influenced by economic conditions and import regulations.

The Rest of Middle East and Africa region, while fragmented, holds immense untapped potential. Countries with developing healthcare systems and increasing focus on chronic disease management will become increasingly important contributors to the overall market growth. The dominance of these regions and segments is a testament to the increasing focus on proactive diabetes management and the adoption of cutting-edge medical technologies across the MEA.

Middle East and Africa Continuous Glucose Monitoring Market Product Landscape

The MEA Continuous Glucose Monitoring (CGM) market's product landscape is characterized by continuous innovation focused on enhancing user experience, accuracy, and connectivity. Key product advancements include the development of longer-lasting sensors, miniaturized and discreet designs, and improved data analytics platforms that provide deeper insights into glucose trends. Products like Dexcom's G7 exemplify this evolution with its integrated Share and Follow features, enabling seamless data sharing and customizable alerts for both users and caregivers. Abbott's ongoing research into bio-wearables, aiming to integrate glucose and ketone monitoring into a single, small sensor, highlights the industry's drive towards comprehensive metabolic health tracking. Performance metrics are constantly being refined, with newer systems boasting increased accuracy (Mean Absolute Relative Difference - MARD), faster warm-up times, and enhanced alarm functionalities. The emphasis is on providing a user-friendly interface that empowers individuals with diabetes to make informed decisions about their treatment and lifestyle.

Key Drivers, Barriers & Challenges in Middle East and Africa Continuous Glucose Monitoring Market

Key Drivers:

- Rising Diabetes Prevalence: The escalating incidence of Type 1 and Type 2 diabetes across the MEA region is the primary growth driver for CGM adoption.

- Technological Advancements: Innovations in sensor accuracy, miniaturization, and data integration are making CGM more appealing and effective.

- Growing Health Awareness: Increased patient and healthcare provider understanding of the benefits of continuous glucose monitoring in managing diabetes and preventing complications.

- Government Healthcare Initiatives: Supportive policies and investments in chronic disease management and digital health infrastructure in select MEA countries.

- Demand for Remote Monitoring: The growing trend of telehealth and remote patient management is boosting the demand for connected CGM devices.

Barriers & Challenges:

- High Cost of Devices: The significant price point of CGM systems and consumables remains a major barrier to widespread adoption, especially in lower-income countries within the region.

- Limited Reimbursement Policies: Inadequate or non-existent reimbursement schemes for CGM devices in many MEA nations restrict affordability for a large segment of the population.

- Lack of Awareness and Education: Insufficient understanding of CGM technology and its benefits among both patients and some healthcare professionals.

- Infrastructure Limitations: Inadequate digital connectivity and data management infrastructure in certain areas hinder the effective use of real-time monitoring.

- Regulatory Hurdles: Diverse and evolving regulatory landscapes across MEA countries can create complexities for market entry and product approval.

- Supply Chain Disruptions: Potential challenges in logistics and distribution networks can impact the consistent availability of CGM devices and supplies.

Emerging Opportunities in Middle East and Africa Continuous Glucose Monitoring Market

The MEA Continuous Glucose Monitoring (CGM) market presents significant emerging opportunities for growth. Untapped markets in North and Sub-Saharan Africa, with their large, underserved populations, represent substantial potential for expansion. Innovative applications, such as integrating CGM data with personalized nutrition and exercise plans, or developing predictive analytics for diabetic complications, are gaining traction. Evolving consumer preferences are leaning towards more integrated, user-friendly, and discreet devices, creating demand for next-generation CGM technologies. The increasing focus on preventative healthcare and early diagnosis of diabetes will further drive the adoption of proactive management tools like CGM. Furthermore, strategic partnerships with local healthcare providers, insurers, and government health programs can unlock access to these burgeoning markets and facilitate wider adoption.

Growth Accelerators in the Middle East and Africa Continuous Glucose Monitoring Market Industry

Several key catalysts are accelerating the long-term growth of the Middle East and Africa Continuous Glucose Monitoring (CGM) market. Technological breakthroughs, particularly in sensor longevity, improved accuracy, and seamless connectivity with insulin pumps and smart devices, are continuously enhancing the value proposition of CGM. Strategic partnerships between global CGM manufacturers and regional distributors or healthcare conglomerates are crucial for expanding market reach and overcoming localized challenges. Market expansion strategies, including direct-to-consumer models, targeted awareness campaigns, and collaborations with diabetes advocacy groups, are vital for driving adoption. The increasing focus on value-based healthcare, where CGM plays a role in reducing long-term complications and associated healthcare costs, is also a significant growth accelerator.

Key Players Shaping the Middle East and Africa Continuous Glucose Monitoring Market Market

- Medtronic

- Abbott Diabetes Care

- Dexcom

- Senseonics

- GlySens

- Other Company Share Analyse

Notable Milestones in Middle East and Africa Continuous Glucose Monitoring Market Sector

- February 2023: Dexcom announced the launch of Dexcom G7 Continuous Glucose Monitoring in South Africa, enhancing diabetes management with its Share and Follow features and customizable alerts for comprehensive glucose insights.

- June 2022: Abbott announced that it is developing a new bio-wearable capable of continuously monitoring both glucose and ketone levels in a single sensor, aiming for the same small size as the FreeStyle Libre 3 and connecting to Abbott's digital ecosystem for enhanced remote monitoring.

In-Depth Middle East and Africa Continuous Glucose Monitoring Market Market Outlook

The future outlook for the Middle East and Africa Continuous Glucose Monitoring (CGM) market is exceptionally promising, driven by ongoing growth accelerators. The increasing emphasis on proactive diabetes management, coupled with a growing demand for integrated digital health solutions, positions CGM as an indispensable tool. Technological advancements, such as the development of more affordable and accessible sensors, alongside expanding reimbursement coverage in key markets, will further fuel adoption. Strategic collaborations and government initiatives aimed at improving chronic disease care will play a pivotal role in unlocking the full potential of this market. The MEA CGM market is set to witness sustained expansion, offering significant opportunities for innovation, market penetration, and improved health outcomes for individuals living with diabetes across the region.

Middle East and Africa Continuous Glucose Monitoring Market Segmentation

-

1. Components

- 1.1. Sensors

- 1.2. Durables

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. Iran

- 3.3. Egypt

- 3.4. Oman

- 3.5. South Africa

- 3.6. Rest of Middle East and Africa

Middle East and Africa Continuous Glucose Monitoring Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. Egypt

- 4. Oman

- 5. South Africa

- 6. Rest of Middle East and Africa

Middle East and Africa Continuous Glucose Monitoring Market Regional Market Share

Geographic Coverage of Middle East and Africa Continuous Glucose Monitoring Market

Middle East and Africa Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The sensors segment holds the highest market share in the Middle East and African Continuous Glucose Monitoring Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. Iran

- 5.3.3. Egypt

- 5.3.4. Oman

- 5.3.5. South Africa

- 5.3.6. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. Iran

- 5.4.3. Egypt

- 5.4.4. Oman

- 5.4.5. South Africa

- 5.4.6. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. Saudi Arabia Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Components

- 6.1.1. Sensors

- 6.1.2. Durables

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. Iran

- 6.3.3. Egypt

- 6.3.4. Oman

- 6.3.5. South Africa

- 6.3.6. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Components

- 7. Iran Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Components

- 7.1.1. Sensors

- 7.1.2. Durables

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. Iran

- 7.3.3. Egypt

- 7.3.4. Oman

- 7.3.5. South Africa

- 7.3.6. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Components

- 8. Egypt Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Components

- 8.1.1. Sensors

- 8.1.2. Durables

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. Iran

- 8.3.3. Egypt

- 8.3.4. Oman

- 8.3.5. South Africa

- 8.3.6. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Components

- 9. Oman Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Components

- 9.1.1. Sensors

- 9.1.2. Durables

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. Iran

- 9.3.3. Egypt

- 9.3.4. Oman

- 9.3.5. South Africa

- 9.3.6. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Components

- 10. South Africa Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Components

- 10.1.1. Sensors

- 10.1.2. Durables

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. Iran

- 10.3.3. Egypt

- 10.3.4. Oman

- 10.3.5. South Africa

- 10.3.6. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Components

- 11. Rest of Middle East and Africa Middle East and Africa Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Components

- 11.1.1. Sensors

- 11.1.2. Durables

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Online

- 11.2.2. Offline

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. Iran

- 11.3.3. Egypt

- 11.3.4. Oman

- 11.3.5. South Africa

- 11.3.6. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Components

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Medtronics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Abbott Diabetes Care

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GlySens

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Other Company Share Analyse

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dexcom

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Senseonics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 Medtronics

List of Figures

- Figure 1: Middle East and Africa Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Continuous Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 2: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 3: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 10: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 11: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 18: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 19: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 26: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 27: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 34: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 35: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 42: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 43: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 45: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Components 2020 & 2033

- Table 50: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Components 2020 & 2033

- Table 51: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 52: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 53: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 55: Middle East and Africa Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Middle East and Africa Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Continuous Glucose Monitoring Market?

The projected CAGR is approximately 12.83%.

2. Which companies are prominent players in the Middle East and Africa Continuous Glucose Monitoring Market?

Key companies in the market include Medtronics, Abbott Diabetes Care, GlySens, Other Company Share Analyse, Dexcom, Senseonics.

3. What are the main segments of the Middle East and Africa Continuous Glucose Monitoring Market?

The market segments include Components, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

The sensors segment holds the highest market share in the Middle East and African Continuous Glucose Monitoring Market in the current year.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

February 2023: Dexcom announced the launch of Dexcom G7 Continuous Glucose Monitoring in South Africa. The Dexcom G7 includes the Dexcom Share and Follow feature. The user of the Dexcom Follow app can also create customizable alerts and alarms. Additionally, the G7 system provides a more comprehensive view of glucose levels over time, giving people with diabetes and their healthcare providers more information to make decisions about treatment and diabetes management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence