Key Insights

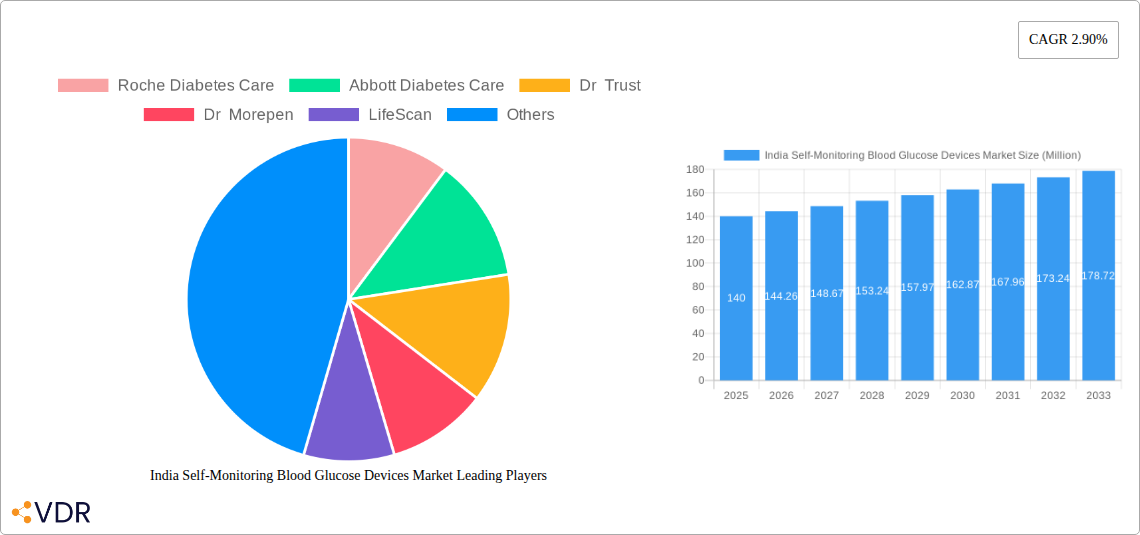

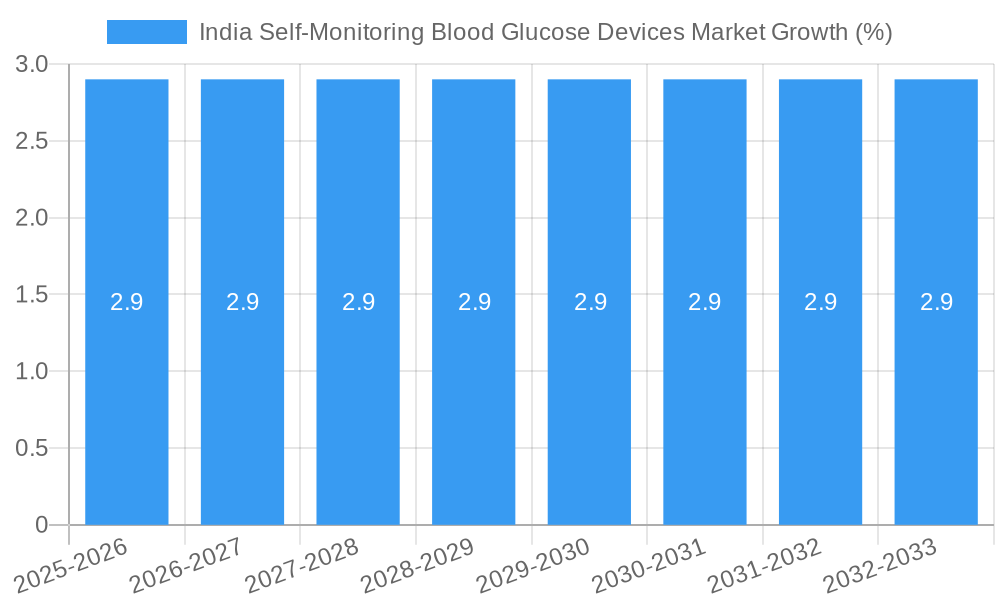

The India Self-Monitoring Blood Glucose (SMBG) Devices Market is poised for significant expansion, projected to reach a substantial valuation. Driven by a rising prevalence of diabetes, increasing health consciousness among the population, and a growing demand for convenient and accessible diabetes management solutions, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.90%. This robust growth trajectory indicates a strong future for SMBG devices in India, reflecting their crucial role in empowering individuals with diabetes to actively manage their condition. The market's value is estimated to be in the hundreds of millions, underscoring its economic importance. Key growth drivers include the increasing adoption of digital health solutions, favorable government initiatives promoting diabetes awareness and screening, and the continuous innovation in device technology leading to more user-friendly and accurate glucometers and test strips. The expanding distribution networks and increasing affordability of these devices further contribute to their widespread accessibility across urban and semi-urban areas.

The market landscape is characterized by intense competition among established global players and emerging domestic manufacturers, all vying for a larger market share. The primary segments within the SMBG market are glucometer devices, test strips, and lancets. The demand for test strips is particularly high due to their consumable nature. While the market exhibits strong growth potential, certain restraints such as the initial cost of advanced devices for some segments of the population and the need for greater awareness and adoption in remote rural areas present challenges. However, the overarching trends of preventive healthcare, technological advancements in continuous glucose monitoring (CGM) systems as a future evolution, and the increasing focus on personalized diabetes management are expected to significantly outweigh these restraints, ensuring a dynamic and evolving market. Companies are actively investing in research and development to introduce innovative products and expand their reach to cater to the diverse needs of the Indian diabetic population.

India Self-Monitoring Blood Glucose Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the India Self-Monitoring Blood Glucose Devices Market, encompassing glucometers, test strips, and lancets. With a focus on the parent market of diabetes management and the child market of home-use diagnostic devices, this study delves into market dynamics, growth trends, regional dominance, product innovations, key players, and future opportunities. Leveraging a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report offers critical insights for stakeholders navigating the burgeoning Indian diabetes care landscape. Understand market penetration, adoption rates, and the impact of technological advancements on millions of units and evolving consumer preferences.

India Self-Monitoring Blood Glucose Devices Market Market Dynamics & Structure

The India Self-Monitoring Blood Glucose Devices Market is characterized by a dynamic and evolving structure, driven by increasing diabetes prevalence and growing health awareness. Market concentration is moderate, with a few major global players holding significant shares, alongside a growing number of domestic manufacturers.

- Technological Innovation Drivers: The primary drivers of technological innovation include the development of connected glucometers with Bluetooth connectivity, enabling seamless data sharing with healthcare providers and family members, and the introduction of non-invasive blood glucose monitoring technologies, albeit still in early stages for widespread adoption in India. Advancements in test strip technology for improved accuracy and reduced pain are also crucial.

- Regulatory Frameworks: The regulatory landscape, overseen by bodies like the Central Drugs Standard Control Organisation (CDSCO), is becoming more stringent, emphasizing product quality, safety, and efficacy. This encourages adherence to global standards and fosters trust among consumers.

- Competitive Product Substitutes: While self-monitoring devices are the primary tools, the market also faces indirect competition from professional diagnostic services and emerging CGM (Continuous Glucose Monitoring) devices, which offer more comprehensive data but at a higher price point.

- End-User Demographics: The end-user demographic is broad, encompassing individuals diagnosed with Type 1 and Type 2 diabetes, gestational diabetes, and pre-diabetic individuals. There's a growing segment of tech-savvy consumers seeking convenience and integrated health solutions.

- M&A Trends: Mergers and acquisitions (M&A) are observed as companies aim to expand their product portfolios, gain market share, and leverage technological advancements. For instance, collaborations for manufacturing and distribution are crucial for scaling operations. The market is anticipated to see increased activity as larger players seek to consolidate their position and smaller, innovative companies look for strategic partnerships.

India Self-Monitoring Blood Glucose Devices Market Growth Trends & Insights

The India Self-Monitoring Blood Glucose Devices Market is poised for robust growth, fueled by an escalating diabetes epidemic and a proactive approach towards health management by the Indian populace. Projections indicate a significant market size evolution, moving from an estimated xx million units in the historical period to reach substantial figures in the forecast period, driven by increasing adoption rates and a paradigm shift in consumer behavior towards proactive health monitoring. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10% between 2025 and 2033.

The increasing prevalence of diabetes in India, projected to be one of the highest globally, forms the bedrock of this market's expansion. This surge necessitates regular blood glucose monitoring for effective management and prevention of long-term complications. Technological disruptions are playing a pivotal role, with the introduction of smart glucometers offering enhanced connectivity, user-friendly interfaces, and data integration capabilities. These advancements are not only improving the accuracy and efficiency of monitoring but also making the process more accessible and less intimidating for a wider user base.

Consumer behavior has undergone a significant transformation, with a growing emphasis on preventive healthcare and self-management of chronic conditions. This shift is evident in the increasing demand for home-use diagnostic devices. The growing awareness about the long-term economic and health implications of uncontrolled diabetes is compelling individuals to invest in regular monitoring. Furthermore, the rising disposable incomes, especially in urban and semi-urban areas, are making these devices more affordable and accessible. The penetration of these devices is expected to climb from xx% in 2025 to an estimated xx% by 2033, indicating a substantial increase in market penetration. The younger demographic is also showing increased interest in adopting these technologies, facilitated by the proliferation of smartphones and digital health platforms. This trend signifies a move towards a more integrated and data-driven approach to diabetes care, transforming the parent market of diabetes management.

Dominant Regions, Countries, or Segments in India Self-Monitoring Blood Glucose Devices Market

The India Self-Monitoring Blood Glucose Devices Market exhibits dominance across various segments, with the Test Strips segment emerging as a significant growth driver. While Glucometer Devices represent the initial entry point for many users, the recurring purchase of test strips underpins sustained market value and volume. The Lancets segment, while essential, constitutes a smaller portion of the overall market value.

Key Drivers of Dominance:

Test Strips: The Backbone of Sustained Demand:

- High Consumption Rate: Each blood glucose test requires at least one test strip, leading to a consistent and high-volume demand. Individuals with diabetes often perform multiple tests daily.

- Recurring Revenue Stream: Unlike glucometers, which are a one-time purchase, test strips generate a continuous revenue stream for manufacturers and distributors.

- Technological Advancements: Innovations in test strip accuracy, faster results, and smaller blood sample requirements further enhance their appeal and drive adoption.

- Market Share: Test strips are estimated to hold approximately 50-55% of the total market revenue, with a projected growth rate closely mirroring the overall market.

- Economic Policies: Government initiatives promoting affordable healthcare and diabetes management indirectly support the widespread availability and affordability of test strips.

Glucometer Devices: The Gateway to Monitoring:

- Increasing Diabetes Diagnosis: The rising incidence of diabetes in India directly translates to a higher demand for glucometer devices.

- Technological Sophistication: The introduction of smart glucometers with connectivity features and improved user interfaces is driving upgrades and new purchases.

- Brand Loyalty: Once a user adopts a particular glucometer brand, they tend to stick with its compatible test strips, reinforcing the brand's position.

- Market Share: Glucometer devices account for roughly 35-40% of the market revenue, with significant growth potential due to technological advancements and increasing awareness.

- Infrastructure: The expanding healthcare infrastructure, including clinics and pharmacies, ensures wider availability of glucometer devices across the nation.

Lancets: Essential but Smaller Share:

- Necessity for Testing: Lancets are indispensable for obtaining blood samples for testing, ensuring their consistent demand.

- Disposable Nature: Their single-use nature ensures repeated purchases.

- Market Share: Lancets represent approximately 5-10% of the market revenue due to their lower individual cost.

- Innovation: Developments in retractable and less painful lancets are enhancing user experience.

Regional Dominance:

The Western and Southern regions of India are projected to be dominant in terms of market share and growth due to higher per capita income, better healthcare infrastructure, increased awareness of chronic diseases, and a higher concentration of pharmaceutical and medical device companies. These regions are likely to witness greater adoption of advanced self-monitoring blood glucose devices, including connected glucometers and potentially early adoption of CGM technologies.

India Self-Monitoring Blood Glucose Devices Market Product Landscape

The product landscape of the India Self-Monitoring Blood Glucose Devices Market is characterized by continuous innovation aimed at enhancing accuracy, ease of use, and patient convenience. Smart glucometers with Bluetooth connectivity are a significant advancement, allowing seamless data syncing to mobile applications for tracking and analysis. These applications often provide insights, trends, and reminders, transforming the user experience. Furthermore, advancements in test strip technology focus on requiring smaller blood samples, delivering faster results, and improving accuracy even under varying environmental conditions. Disposable lancets are also evolving, with designs prioritizing reduced pain and increased safety, such as retractable mechanisms.

Key Drivers, Barriers & Challenges in India Self-Monitoring Blood Glucose Devices Market

Key Drivers:

The India Self-Monitoring Blood Glucose Devices Market is propelled by several key drivers. The escalating prevalence of diabetes, a direct consequence of changing lifestyles and dietary habits, creates a consistent and growing demand for monitoring devices. Increased health consciousness among the Indian population, particularly post-pandemic, has fostered a proactive approach to managing chronic conditions. Technological advancements, such as connected glucometers and improved test strip accuracy, enhance user experience and data reliability. Government initiatives promoting diabetes awareness and affordable healthcare also play a crucial role. The growing disposable income in urban and semi-urban areas makes these devices more accessible.

Barriers & Challenges:

Despite strong growth, the market faces several barriers and challenges. High cost of consumables, particularly test strips, remains a significant affordability concern for a large segment of the population, impacting the volume of tests performed. Limited awareness and understanding of the importance of regular self-monitoring among rural populations and lower socioeconomic groups pose a significant challenge. Inadequate healthcare infrastructure and access in remote areas hinder product reach and effective utilization. Counterfeit products entering the market pose a threat to genuine manufacturers and patient safety. The lack of standardized reimbursement policies for these devices and consumables further complicates market penetration. Supply chain disruptions, although easing, can still impact product availability.

Emerging Opportunities in India Self-Monitoring Blood Glucose Devices Market

Emerging opportunities within the India Self-Monitoring Blood Glucose Devices Market are multifaceted. The untapped potential in rural and semi-urban areas presents a significant avenue for market expansion through localized distribution networks and awareness campaigns. The increasing adoption of digital health platforms and telemedicine creates an opportunity for integrated glucose monitoring solutions that seamlessly connect with healthcare providers. The development of affordable and accurate connected glucometers tailored for the Indian market, focusing on essential features rather than premium ones, can cater to a broader demographic. Furthermore, there is a growing interest in combining blood glucose monitoring with other health parameters, paving the way for multi-functional health tracking devices.

Growth Accelerators in the India Self-Monitoring Blood Glucose Devices Market Industry

Several catalysts are accelerating the growth of the India Self-Monitoring Blood Glucose Devices Market Industry. Strategic partnerships between device manufacturers and healthcare providers, pharmaceutical companies, and digital health platforms are crucial for expanding reach and providing comprehensive diabetes management solutions. Technological breakthroughs in non-invasive or minimally invasive glucose monitoring, while still nascent, represent a future growth accelerator. Government policies that incentivize domestic manufacturing, coupled with favorable regulatory pathways for new technologies, can foster innovation and market penetration. Sustained awareness campaigns by NGOs and healthcare organizations are effectively educating the public about the importance of self-monitoring, thereby driving adoption. The increasing focus on preventive healthcare and early detection of chronic diseases is a fundamental growth accelerator.

Key Players Shaping the India Self-Monitoring Blood Glucose Devices Market Market

- Roche Diabetes Care

- Abbott Diabetes Care

- Dr Trust

- Dr Morepen

- LifeScan

- Menarini

- BeatO

- Arkray Inc

- Ascensia Diabetes Care

Notable Milestones in India Self-Monitoring Blood Glucose Devices Market Sector

- May 2023: Roche Diabetes Care collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of blood glucose devices. Production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, bearing the ‘Made in India’ tag.

- March 2022: Zyla Health launched an integrated offering with Accu-Chek, combining a smart glucometer with continuous diabetes care from leading doctors and experts, available on Amazon & Flipkart.

In-Depth India Self-Monitoring Blood Glucose Devices Market Market Outlook

The India Self-Monitoring Blood Glucose Devices Market presents a robust outlook for future growth, fueled by persistent demographic and epidemiological trends. The increasing penetration of smartphones and internet connectivity, coupled with the government's focus on digital India initiatives, will significantly accelerate the adoption of connected glucometers and integrated digital health solutions. Strategic partnerships between device manufacturers, pharmaceutical firms, and telemedicine providers will further enhance patient accessibility and care delivery. The ongoing advancements in diagnostic accuracy and user-friendliness of devices, alongside the growing emphasis on preventive healthcare, will continue to drive demand. Investment in rural market penetration and targeted awareness programs will be key to unlocking untapped potential, solidifying the market's trajectory towards becoming a cornerstone of chronic disease management in India.

India Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

India Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. India

India Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Roche Diabetes Care

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Abbott Diabetes Care

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dr Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dr Morepen

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LifeScan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Menarini

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BeatO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arkray Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ascensia Diabetes Care

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Roche Diabetes Care

List of Figures

- Figure 1: India Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2024

List of Tables

- Table 1: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: South India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: East India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: East India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: West India India Self-Monitoring Blood Glucose Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: West India India Self-Monitoring Blood Glucose Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 19: India Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: India Self-Monitoring Blood Glucose Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 2.90%.

2. Which companies are prominent players in the India Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Abbott Diabetes Care, Dr Trust, Dr Morepen, LifeScan, Menarini, BeatO, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the India Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 140 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in India.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

May 2023: Roche Diabetes Care has collaborated with Sanmina-SCI India and Parekh Integrated Services for manufacturing and distribution of the blood glucose devices. The production of Accu-Chek Active metres will take place in Sanmina’s multi-client manufacturing site in Chennai, in line with globally approved quality standards, the company has said. The new Accu-Chek Active product packs will now display the ‘Made in India’ tag.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the India Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence