Key Insights

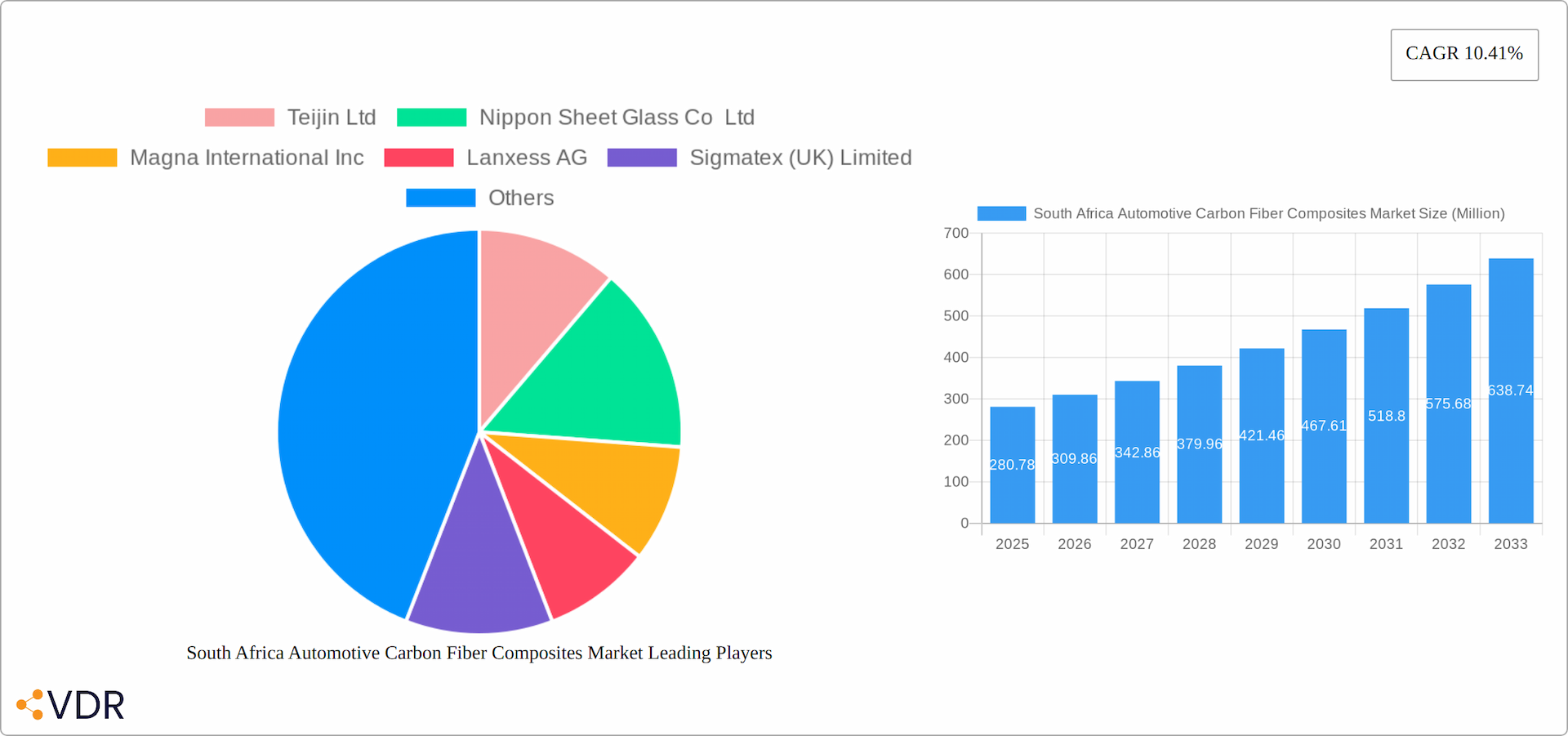

The South African automotive carbon fiber composites market is poised for significant growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. The market, valued at approximately $280.78 million in 2025, is projected to experience a robust Compound Annual Growth Rate (CAGR) of 10.41% from 2025 to 2033. This expansion is fueled by several key factors. The rising adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) necessitates lighter and stronger materials, making carbon fiber composites an attractive choice for various automotive components, including structural assemblies, powertrain components, and interior and exterior parts. Furthermore, the ongoing investment in automotive manufacturing infrastructure within South Africa contributes to the market's growth. While challenges such as the high initial cost of carbon fiber composites and the need for specialized manufacturing processes exist, these are being mitigated by ongoing technological advancements and increasing economies of scale. The market segmentation reveals that passenger cars currently dominate the vehicle type segment, with injection molding and compression molding being the most prevalent manufacturing processes. Key players in the South African market are likely to include international companies with established presence in the region alongside emerging local businesses capitalizing on the opportunities presented by the expanding automotive sector. The focus on sustainable manufacturing practices is another factor driving market growth, as carbon fiber composites can offer environmental benefits over traditional materials.

South Africa Automotive Carbon Fiber Composites Market Market Size (In Million)

The regional focus on Africa, specifically South Africa, indicates a promising market due to the growing automotive manufacturing base and rising disposable incomes. However, the market faces challenges including infrastructure limitations and a relatively smaller automotive production scale compared to more developed regions. Nonetheless, government initiatives to promote local manufacturing and attract foreign investment could significantly boost the market's trajectory. The forecast period of 2025-2033 promises substantial opportunities for market participants, particularly those capable of adapting to technological advancements and offering cost-effective solutions that cater to the unique demands of the South African automotive industry. Understanding the specific segmental trends within the market—by vehicle type, application, and manufacturing process—is crucial for stakeholders to effectively strategize for success in this burgeoning sector.

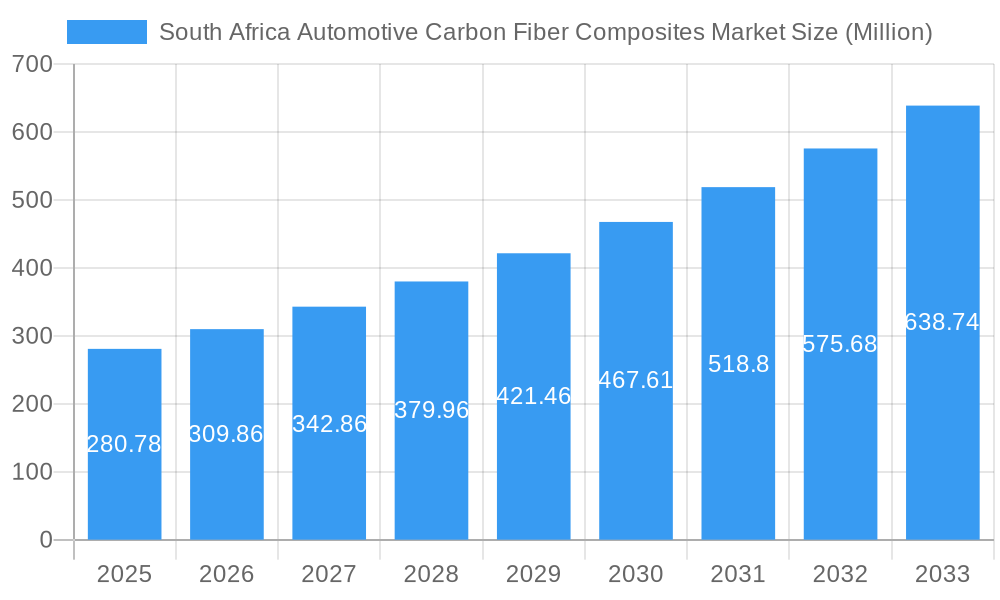

South Africa Automotive Carbon Fiber Composites Market Company Market Share

South Africa Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa automotive carbon fiber composites market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on market dynamics, growth trends, key players, and future opportunities. The South African automotive industry is experiencing significant growth, making this market a particularly attractive area for investment and expansion. This report meticulously examines the parent market (Automotive Composites) and the child market (Carbon Fiber Composites within Automotive), delivering a granular view of this dynamic sector. The market size is projected in Million units.

South Africa Automotive Carbon Fiber Composites Market Dynamics & Structure

The South Africa automotive carbon fiber composites market is characterized by moderate concentration, with a few major international players alongside local manufacturers. Technological innovation, particularly in material science and manufacturing processes, is a key driver. Stringent regulatory frameworks focused on fuel efficiency and emissions are pushing adoption. Competitive substitutes, such as aluminum and steel, present challenges, although carbon fiber's superior strength-to-weight ratio offers a compelling advantage. The end-user demographic skews towards higher-end vehicle segments, with growth expected across all vehicle types. M&A activity has been relatively low in recent years; however, the consolidation of the global carbon fiber supply chain will likely impact South Africa’s market.

- Market Concentration: Moderately concentrated, with xx% market share held by top 5 players.

- Technological Innovation: Significant advancements in fiber production, resin systems, and manufacturing processes.

- Regulatory Framework: Stringent emission standards and fuel efficiency regulations are driving demand.

- Competitive Substitutes: Aluminum and steel remain significant competitors, but carbon fiber's unique properties provide a differentiating factor.

- End-User Demographics: Primarily high-end passenger vehicles, with increasing penetration in commercial vehicles.

- M&A Trends: Relatively low M&A activity to date, with potential for increased consolidation in the forecast period. xx number of deals completed between 2019 and 2024.

South Africa Automotive Carbon Fiber Composites Market Growth Trends & Insights

The South African automotive carbon fiber composites market is experiencing steady growth, driven by increasing demand for lightweight vehicles and improved fuel efficiency. The market size is estimated at xx Million units in 2025, with a projected CAGR of xx% from 2025 to 2033. This growth is fueled by technological advancements leading to reduced production costs and improved performance characteristics of carbon fiber composites. Consumer preferences are shifting towards vehicles with enhanced safety features and improved fuel economy, further driving market expansion. Adoption rates are expected to increase significantly across all vehicle segments. The market faces challenges from the high initial investment costs and complexities associated with the manufacturing process.

Dominant Regions, Countries, or Segments in South Africa Automotive Carbon Fiber Composites Market

While data specific to regional breakdown within South Africa is limited, the Gauteng province, due to its concentration of automotive manufacturing facilities, is likely the dominant region. Passenger cars currently represent the largest segment by vehicle type, followed by commercial vehicles. Within applications, structural assembly dominates, accounting for the largest market share, with powertrain components following. Compression molding remains the most widely adopted manufacturing process due to its established infrastructure.

- By Vehicle Type: Passenger Cars (xx Million units, xx% market share), Commercial Vehicles (xx Million units, xx% market share). Passenger car segment growth is driven by the increasing demand for lightweight and fuel-efficient vehicles within the luxury and premium segments.

- By Application: Structural Assembly (xx Million units, xx% market share), Powertrain Component (xx Million units, xx% market share), Interior (xx Million units, xx% market share), Exterior (xx Million units, xx% market share), Others (Underbody etc.) (xx Million units, xx% market share). The structural assembly application is driven by a constant push to improve vehicle safety and reduce weight in an effort to improve fuel economy.

- By Manufacturing Process: Compression Molding (xx Million units, xx% market share), Injection Molding (xx Million units, xx% market share), Resin Transfer Molding (xx Million units, xx% market share), Others (Oven Molding etc.) (xx Million units, xx% market share). The dominance of compression molding is due to its maturity and established processes within the South African market.

South Africa Automotive Carbon Fiber Composites Market Product Landscape

The South African market witnesses a diverse range of carbon fiber composites, encompassing various fiber types, resin systems, and manufacturing processes. Innovations focus on enhancing mechanical properties, reducing production costs, and improving surface finish. Key products include high-strength carbon fiber fabrics, prepregs, and molded components optimized for specific automotive applications. Unique selling propositions often center on weight reduction, improved crashworthiness, and enhanced design flexibility. Recent advancements involve the integration of advanced materials such as graphene and carbon nanotubes to further boost performance characteristics.

Key Drivers, Barriers & Challenges in South Africa Automotive Carbon Fiber Composites Market

Key Drivers: The South African automotive industry is experiencing a significant push towards lightweighting and sustainability, driven by both government initiatives and market demands. The South African government's focus on promoting local manufacturing and reducing carbon emissions, particularly through incentives for fuel-efficient vehicles, is a primary catalyst. This aligns perfectly with the increasing consumer demand for lightweight vehicles offering improved fuel economy, enhanced safety features, and reduced environmental impact. Furthermore, ongoing technological advancements in carbon fiber production are steadily decreasing manufacturing costs and broadening its appeal to a wider range of automotive applications. This makes carbon fiber a more competitive alternative to traditional materials.

Key Barriers & Challenges: Despite the significant potential, several factors hinder widespread adoption of carbon fiber composites in the South African automotive sector. The high initial capital expenditure required for establishing carbon fiber composite manufacturing facilities remains a major obstacle for many players. The intricate nature of the manufacturing process, coupled with the demand for highly skilled labor, poses a considerable challenge. This skills gap necessitates substantial investment in training and development programs to support industry growth. The intense competition from well-established materials like steel and aluminum, which benefit from economies of scale and readily available infrastructure, continues to exert pressure on market penetration. Moreover, inherent vulnerabilities in the supply chain, along with potential fluctuations in raw material prices, introduce significant risk factors that need careful management.

Emerging Opportunities in South Africa Automotive Carbon Fiber Composites Market

Despite the challenges, the South African automotive carbon fiber composites market presents several compelling opportunities. The burgeoning commercial vehicle segment and the rapidly expanding electric vehicle (EV) market offer significant potential for growth. The inherent lightweight nature of carbon fiber composites offers compelling advantages for EVs, improving range and performance. Furthermore, innovation in hybrid materials, combining carbon fiber with other materials to optimize cost and performance characteristics, presents exciting prospects. The growing consumer awareness of vehicle safety and environmental sustainability creates a favorable landscape for carbon fiber composite adoption. Finally, exploring niche applications within the automotive sector, focusing on specialized components and high-performance vehicles, offers untapped avenues for growth and market differentiation.

Growth Accelerators in the South Africa Automotive Carbon Fiber Composites Market Industry

Several key factors can accelerate the growth trajectory of the South African automotive carbon fiber composites market. Strategic collaborations between established automotive manufacturers and specialized carbon fiber composite suppliers are crucial for fostering innovation and scaling up production. The adoption of advanced and more cost-effective manufacturing processes, such as automated fiber placement (AFP) and automated tape laying (ATL), will significantly improve efficiency and reduce production costs. Government support through incentives that promote lightweight vehicles, along with policies that encourage local manufacturing and technology transfer, are essential catalysts for market expansion. Continuous advancements in carbon fiber materials science and engineering will further unlock new possibilities and drive the long-term growth of this dynamic sector. Investing in research and development is key to unlocking the full potential of carbon fiber composites within the South African automotive landscape.

Key Players Shaping the South Africa Automotive Carbon Fiber Composites Market Market

- Teijin Ltd

- Nippon Sheet Glass Co Ltd

- Magna International Inc

- Lanxess AG

- Sigmatex (UK) Limited

- Mitsubishi Chemical Group Corporation (MCG)

- Solvay SA

- BFG International

- Hexcel Corporation

- Menzolit

- SGL Carbon SE

- BASF SE

Notable Milestones in South Africa Automotive Carbon Fiber Composites Market Sector

- June 2023: Solvay announced the formation of Syensqo, a new independent company focused on composites, signaling a significant investment in the global carbon fiber market, including South Africa.

- April 2023: SGL Carbon launched its new 50k carbon fiber, suitable for automotive applications, expanding product offerings in the South African market.

In-Depth South Africa Automotive Carbon Fiber Composites Market Market Outlook

The South African automotive carbon fiber composites market shows immense potential for future growth, driven by sustained demand for lightweight and fuel-efficient vehicles. Strategic partnerships, technological innovations, and supportive government policies are crucial for unlocking this potential. The market is projected to see significant expansion in the coming years, presenting opportunities for both established players and new entrants. Focusing on cost-effective manufacturing processes and tapping into new applications will be key success factors.

South Africa Automotive Carbon Fiber Composites Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Application

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others (Underbody, Etc.)

-

3. Manufacturing Process

- 3.1. Compression Molding

- 3.2. Injection Molding

- 3.3. Resin Transfer Molding

- 3.4. Others (Oven Molding, Etc.)

South Africa Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. South Africa

South Africa Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of South Africa Automotive Carbon Fiber Composites Market

South Africa Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Passengers Cars to Gain Traction During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others (Underbody, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.3.1. Compression Molding

- 5.3.2. Injection Molding

- 5.3.3. Resin Transfer Molding

- 5.3.4. Others (Oven Molding, Etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Teijin Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Sheet Glass Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Magna International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lanxess AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sigmatex (UK) Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation (MCG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Solvay SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BFG International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hexcel Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Menzolit

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SGL Carbon SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BASF S

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Teijin Ltd

List of Figures

- Figure 1: South Africa Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 4: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Manufacturing Process 2020 & 2033

- Table 8: South Africa Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.41%.

2. Which companies are prominent players in the South Africa Automotive Carbon Fiber Composites Market?

Key companies in the market include Teijin Ltd, Nippon Sheet Glass Co Ltd, Magna International Inc, Lanxess AG, Sigmatex (UK) Limited, Mitsubishi Chemical Group Corporation (MCG), Solvay SA, BFG International, Hexcel Corporation, Menzolit, SGL Carbon SE, BASF S.

3. What are the main segments of the South Africa Automotive Carbon Fiber Composites Market?

The market segments include Vehicle Type, Application, Manufacturing Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 280.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Passengers Cars to Gain Traction During the Forecast Period.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

June 2023: Solvay announced the new names of the future independent publicly traded companies that will result from its planned separation, which the company reported in March 2022. The new names are Solvay and Syensqo, effective upon completion of the planned separation of Solvay, with Syensqo operating the company's composites business and supplying carbon fiber materials to automakers worldwide, including customers from South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the South Africa Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence