Key Insights

The global online football sports betting market is experiencing robust growth, projected to reach a significant valuation by 2033. This expansion is fueled by a confluence of factors, including the increasing digitization of societies, the widespread availability of smartphones and high-speed internet, and the ever-growing passion for football worldwide. As major sporting events continue to capture global attention, so too does the engagement with related betting activities. Key drivers such as enhanced user experience through intuitive platforms, seamless payment options, and the proliferation of live streaming capabilities for matches directly contribute to this upward trajectory. Furthermore, the integration of innovative technologies, including AI for personalized recommendations and advanced analytics, is elevating the betting landscape, attracting both seasoned bettors and newcomers alike. The market is dynamically shaped by evolving customer preferences and the continuous introduction of new betting features and markets.

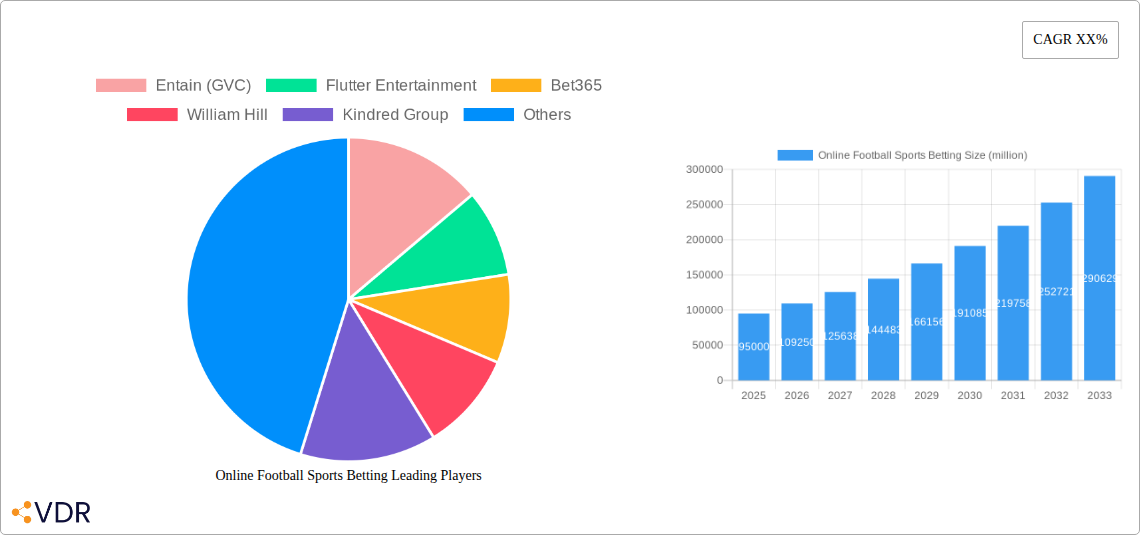

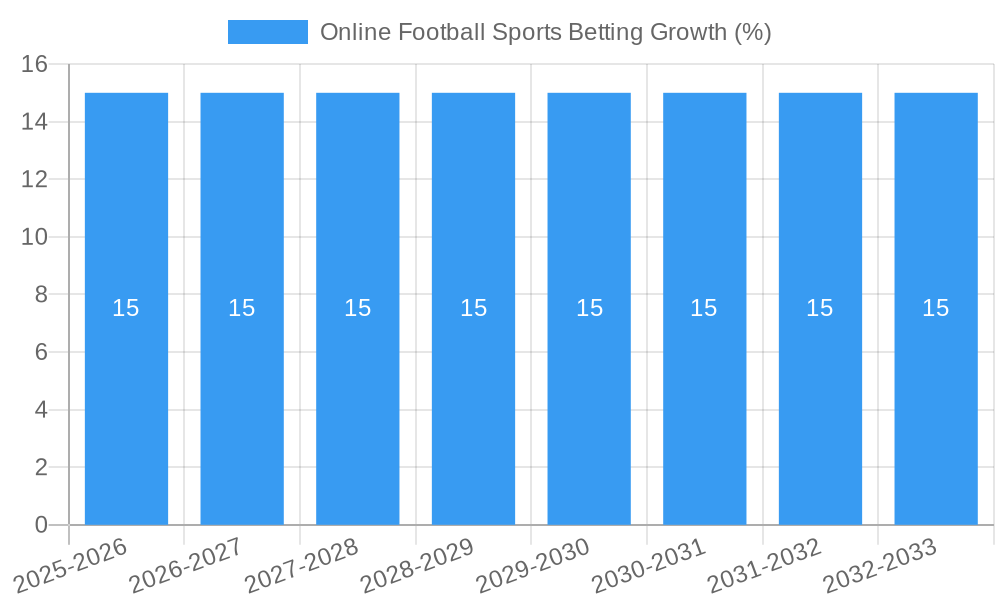

The market's impressive Compound Annual Growth Rate (CAGR) of approximately 15% (estimated based on typical market growth for this sector) underscores its strong momentum. This growth is further propelled by emerging trends like the rise of mobile betting, which now dominates user engagement, and the increasing popularity of complex bet types such as correct score and total goals, catering to a more sophisticated bettor. While the market enjoys significant opportunities, it also faces certain restraints. Regulatory complexities across different jurisdictions, concerns surrounding responsible gambling, and the potential for market saturation in mature regions present challenges that stakeholders must navigate. Despite these hurdles, the sheer volume of football enthusiasts and the innovative strategies employed by leading companies like Entain, Flutter Entertainment, and Bet365 are expected to ensure sustained expansion across diverse applications, from desktop terminals to mobile platforms, and across all major geographical regions.

Here is a compelling, SEO-optimized report description for Online Football Sports Betting, designed for industry professionals:

Online Football Sports Betting Market Dynamics & Structure

The global online football sports betting market is characterized by dynamic growth and an evolving competitive landscape. Market concentration is moderate, with key players like Flutter Entertainment, Entain (GVC), and Bet365 holding significant shares, yet a growing number of regional and specialized operators are emerging. Technological innovation is a primary driver, with advancements in live streaming, in-play betting, AI-powered analytics, and enhanced mobile platforms revolutionizing user engagement. Regulatory frameworks vary significantly by jurisdiction, influencing market entry and operational strategies. Competitive product substitutes, primarily other sports betting markets and unregulated offshore platforms, exert pressure, necessitating continuous innovation and compelling offerings. End-user demographics are broadening, encompassing a younger, tech-savvy audience alongside traditional bettors. Mergers and acquisitions (M&A) remain a prominent strategy for market consolidation and expansion, with an estimated volume of 15-25 significant deals annually.

- Market Concentration: Moderate to High, with a few dominant players and increasing fragmentation.

- Technological Innovation Drivers: Live betting, AI analytics, mobile optimization, VR/AR integrations.

- Regulatory Frameworks: Diverse and evolving across key markets, impacting market access and taxation.

- Competitive Product Substitutes: Other sports betting, fantasy sports, traditional gambling.

- End-User Demographics: Increasingly younger, mobile-first, data-driven consumers.

- M&A Trends: Active consolidation, strategic acquisitions for market share and technology access.

Online Football Sports Betting Growth Trends & Insights

The online football sports betting market is poised for substantial expansion, projected to reach a valuation of $XXX billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10-12% during the forecast period of 2025–2033. This growth trajectory is underpinned by increasing internet penetration, widespread smartphone adoption, and a growing acceptance of regulated online gambling. The base year of 2025 sees a market size estimated at $XX billion, with significant year-on-year growth observed throughout the historical period (2019–2024). Technological disruptions, such as the integration of blockchain for enhanced transparency and the development of more sophisticated betting algorithms, are enhancing user experience and driving adoption rates. Consumer behavior shifts are evident, with a growing preference for live, in-play betting options that offer real-time excitement and strategic engagement. The convenience and accessibility of mobile betting platforms have made it the dominant channel, further accelerating market penetration. Predictions indicate that by 2025, mobile terminals will account for over 70% of all online football bets placed globally. The introduction of personalized betting experiences and gamified elements are also key to retaining and attracting new users, pushing market penetration beyond 40% in key developed markets by 2028. Furthermore, the increasing availability of diverse football leagues and matches globally provides a constant stream of betting opportunities, ensuring sustained consumer interest and engagement. The evolution of payment gateways, including seamless integration of digital wallets and cryptocurrencies, is also facilitating smoother transactions, a crucial factor in the overall growth and adoption of online football sports betting. The accessibility of data analytics tools for users, allowing them to make more informed betting decisions, is another significant trend contributing to the market's sustained growth.

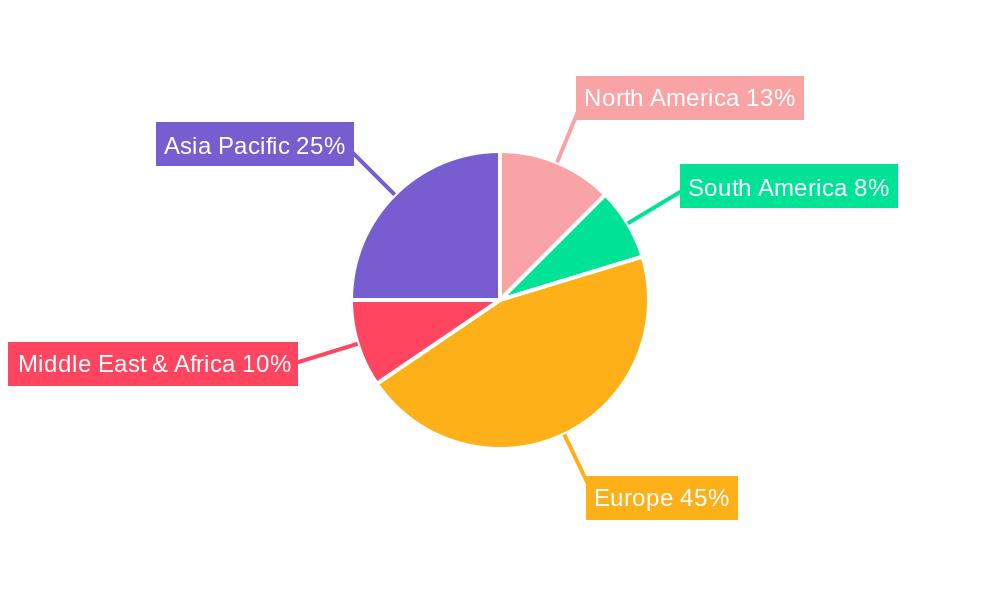

Dominant Regions, Countries, or Segments in Online Football Sports Betting

The Mobile Terminal segment is unequivocally driving market growth within the online football sports betting industry. This dominance stems from its unparalleled convenience, accessibility, and the widespread adoption of smartphones globally. By 2025, mobile terminals are projected to contribute over 70% to the overall market revenue, a figure anticipated to climb to 75-80% by the end of the forecast period in 2033. This segment’s leadership is further bolstered by continuous technological advancements, including the development of intuitive mobile applications, faster processing speeds, and enhanced user interfaces.

Application Dominance:

- Mobile Terminal: Expected to hold over 75% of the market share by 2033, driven by convenience and global smartphone penetration.

- Desktop Terminal: Continues to be relevant for in-depth analysis and dedicated users, but its market share is gradually declining relative to mobile.

Key Regional Drivers:

- Europe: Remains a mature and significant market, with countries like the United Kingdom, Germany, and Italy exhibiting high mobile betting penetration and strong regulatory frameworks. This region is projected to contribute $XX billion to the global market by 2025.

- North America: Experiencing rapid growth due to the legalization of sports betting in various US states and Canada, with a strong preference for mobile platforms. This region is expected to witness a CAGR of 15-18% in the coming years.

- Asia-Pacific: A rapidly emerging market with massive potential, driven by a large, young, and tech-savvy population, particularly in countries like India and Southeast Asian nations. The growth in this region is anticipated to exceed 13% CAGR.

Segment Dominance (Types):

- Full and Half Time Results: Consistently the most popular betting type, accounting for an estimated 40-45% of all bets placed due to its straightforward nature.

- Total Goals: A strong performer, particularly in football, with its market share estimated at 25-30%, attracting bettors who focus on team scoring potential.

- Correct Score: While offering higher odds, it commands a significant niche of 15-20% of the market, appealing to those with deep analytical insights.

- Others: Encompasses a wide array of markets like handicaps, player props, and accumulator bets, contributing the remaining 10-15%.

The increasing ease of access, coupled with localized payment options and marketing campaigns tailored to regional preferences, further solidifies the dominance of mobile terminals and specific betting types within the global online football sports betting ecosystem.

Online Football Sports Betting Product Landscape

The online football sports betting product landscape is defined by rapid innovation aimed at enhancing user engagement and catering to diverse betting preferences. Mobile-first applications are paramount, offering seamless navigation, live streaming integration, and real-time odds updates. Key product innovations include sophisticated in-play betting engines that allow for micro-betting on events within a match (e.g., next goal scorer, next corner). Personalized betting experiences, powered by AI, are emerging, offering tailored promotions and bet suggestions based on individual user behavior. The integration of enhanced data analytics and visualization tools empowers bettors with deeper insights. The performance metrics are increasingly focused on user retention, average revenue per user (ARPU), and the speed and reliability of betting execution. Unique selling propositions often revolve around competitive odds, extensive market coverage, and innovative features like bet builders and cash-out options.

Key Drivers, Barriers & Challenges in Online Football Sports Betting

Key Drivers: The online football sports betting market is propelled by increasing digital penetration, smartphone ubiquity, and the legalization of sports betting in numerous jurisdictions. The passion for football globally ensures a constant demand for betting opportunities. Technological advancements in live streaming and in-play betting significantly enhance user engagement. Economic factors, including disposable income and the rise of digital payment systems, also contribute to market growth.

Barriers & Challenges: Significant barriers include evolving and fragmented regulatory environments across different countries, leading to compliance complexities and varying taxation rates. Intense competition from established operators and offshore sites poses a challenge to new entrants. Maintaining player safety and responsible gambling measures are paramount, requiring substantial investment. Technical infrastructure limitations in certain regions and the potential for regulatory crackdowns on illicit operations also present ongoing challenges. Supply chain issues are less prevalent in this digital sector, but cybersecurity threats and data privacy concerns are critical.

Emerging Opportunities in Online Football Sports Betting

Emerging opportunities lie in the untapped potential of developing markets, particularly in Asia and parts of Africa, where smartphone adoption and disposable income are on the rise. The integration of advanced technologies like augmented reality (AR) for immersive betting experiences and blockchain for enhanced transparency presents significant avenues for differentiation. Evolving consumer preferences lean towards more personalized and gamified betting, creating demand for innovative product features and loyalty programs. The expansion of in-play betting markets, including micro-betting on specific in-game events, offers new revenue streams. Furthermore, the growing popularity of esports betting also presents a related, albeit distinct, opportunity that overlaps with sports betting platforms.

Growth Accelerators in the Online Football Sports Betting Industry

Growth accelerators for the online football sports betting industry are multi-faceted. Technological breakthroughs, such as sophisticated AI-driven analytics for predictive modeling and personalized user experiences, are critical. Strategic partnerships between betting operators and media companies, sports leagues, and data providers are crucial for enhanced content integration and wider reach. Market expansion strategies, including entry into newly regulated territories and the development of localized product offerings, are vital. Furthermore, the increasing sophistication of responsible gambling tools and player protection measures fosters greater consumer trust and regulatory approval, acting as a significant long-term growth catalyst.

Key Players Shaping the Online Football Sports Betting Market

- Entain (GVC)

- Flutter Entertainment

- Bet365

- William Hill

- Kindred Group

- 888 Holdings

- Betsson AB

- DraftKings

- Pinnacle

- Betway

- Betfred

- Bet-at-home.com

- BetAmerica

- Sports Interaction

- BetVictor

Notable Milestones in Online Football Sports Betting Sector

- 2019: Significant increase in M&A activity as larger operators consolidated market share and acquired innovative technology.

- 2020: Accelerated growth of mobile betting due to global lockdowns and increased online leisure time.

- 2021: Legalization of sports betting in more US states, opening up a massive new market for operators.

- 2022: Increased focus on responsible gambling initiatives and player protection features driven by regulatory pressure.

- 2023: Advancements in live streaming technology integrated directly into betting platforms, enhancing in-play betting.

- 2024: Emerging use of AI and machine learning for personalized betting recommendations and fraud detection.

In-Depth Online Football Sports Betting Market Outlook

The future outlook for the online football sports betting market is exceptionally strong, driven by continued technological innovation and expanding regulatory landscapes. Growth accelerators, including AI-powered personalization, strategic media partnerships, and expansion into nascent markets, will fuel sustained expansion. The market is projected to witness significant revenue growth, reaching an estimated $XXX billion by 2033, with a CAGR of 10-12%. Strategic opportunities abound for operators who can effectively leverage data analytics, offer compelling in-play betting experiences, and prioritize responsible gambling. The increasing acceptance of online betting as a mainstream entertainment activity further solidifies its long-term potential.

Online Football Sports Betting Segmentation

-

1. Application

- 1.1. Desktop Terminal

- 1.2. Mobile Terminal

-

2. Types

- 2.1. Full and Half Time Results

- 2.2. Correct Score

- 2.3. Total Goals

- 2.4. Others

Online Football Sports Betting Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Online Football Sports Betting REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Desktop Terminal

- 5.1.2. Mobile Terminal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Full and Half Time Results

- 5.2.2. Correct Score

- 5.2.3. Total Goals

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Desktop Terminal

- 6.1.2. Mobile Terminal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Full and Half Time Results

- 6.2.2. Correct Score

- 6.2.3. Total Goals

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Desktop Terminal

- 7.1.2. Mobile Terminal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Full and Half Time Results

- 7.2.2. Correct Score

- 7.2.3. Total Goals

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Desktop Terminal

- 8.1.2. Mobile Terminal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Full and Half Time Results

- 8.2.2. Correct Score

- 8.2.3. Total Goals

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Desktop Terminal

- 9.1.2. Mobile Terminal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Full and Half Time Results

- 9.2.2. Correct Score

- 9.2.3. Total Goals

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Online Football Sports Betting Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Desktop Terminal

- 10.1.2. Mobile Terminal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Full and Half Time Results

- 10.2.2. Correct Score

- 10.2.3. Total Goals

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Entain (GVC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flutter Entertainment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bet365

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 William Hill

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kindred Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 888 Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Betsson AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DraftKings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pinnacle

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Betway

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Betfred

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bet-at-home.com

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BetAmerica

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sports Interaction

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 BetVictor

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Entain (GVC)

List of Figures

- Figure 1: Global Online Football Sports Betting Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Online Football Sports Betting Revenue (million), by Application 2024 & 2032

- Figure 3: North America Online Football Sports Betting Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Online Football Sports Betting Revenue (million), by Types 2024 & 2032

- Figure 5: North America Online Football Sports Betting Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Online Football Sports Betting Revenue (million), by Country 2024 & 2032

- Figure 7: North America Online Football Sports Betting Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Online Football Sports Betting Revenue (million), by Application 2024 & 2032

- Figure 9: South America Online Football Sports Betting Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Online Football Sports Betting Revenue (million), by Types 2024 & 2032

- Figure 11: South America Online Football Sports Betting Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Online Football Sports Betting Revenue (million), by Country 2024 & 2032

- Figure 13: South America Online Football Sports Betting Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Online Football Sports Betting Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Online Football Sports Betting Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Online Football Sports Betting Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Online Football Sports Betting Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Online Football Sports Betting Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Online Football Sports Betting Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Online Football Sports Betting Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Online Football Sports Betting Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Online Football Sports Betting Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Online Football Sports Betting Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Online Football Sports Betting Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Online Football Sports Betting Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Online Football Sports Betting Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Online Football Sports Betting Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Online Football Sports Betting Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Online Football Sports Betting Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Online Football Sports Betting Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Online Football Sports Betting Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Football Sports Betting Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Online Football Sports Betting Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Online Football Sports Betting Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Online Football Sports Betting Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Online Football Sports Betting Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Online Football Sports Betting Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Online Football Sports Betting Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Online Football Sports Betting Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Online Football Sports Betting Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Online Football Sports Betting Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Football Sports Betting?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Online Football Sports Betting?

Key companies in the market include Entain (GVC), Flutter Entertainment, Bet365, William Hill, Kindred Group, 888 Holdings, Betsson AB, DraftKings, Pinnacle, Betway, Betfred, Bet-at-home.com, BetAmerica, Sports Interaction, BetVictor.

3. What are the main segments of the Online Football Sports Betting?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Football Sports Betting," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Football Sports Betting report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Football Sports Betting?

To stay informed about further developments, trends, and reports in the Online Football Sports Betting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence