Key Insights

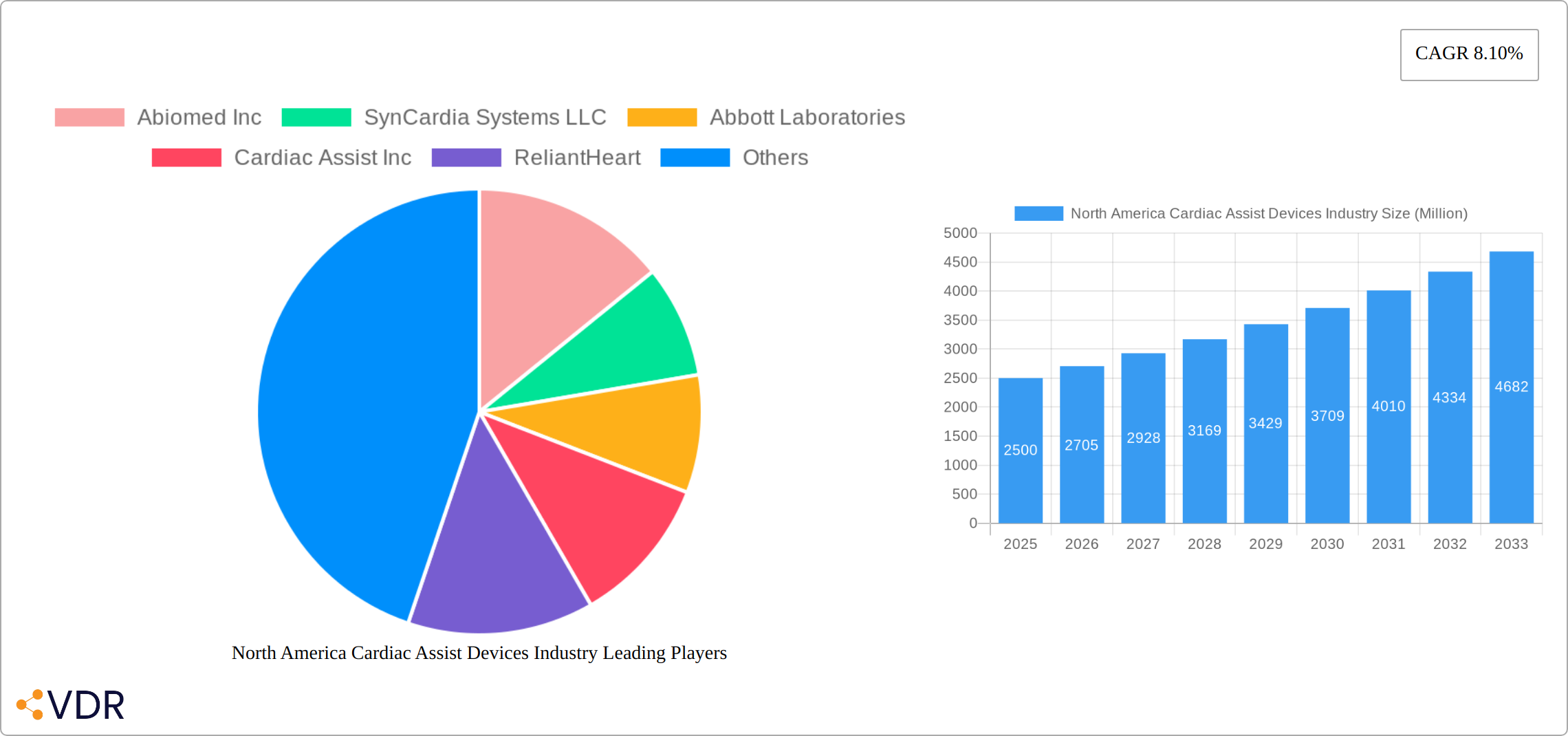

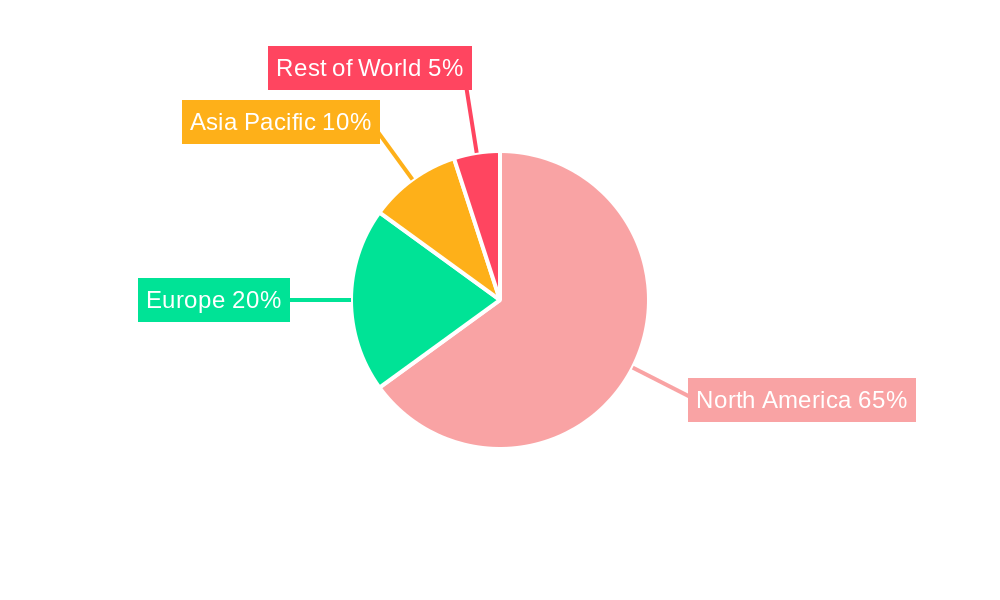

The North American cardiac assist devices market, encompassing Intra-aortic Balloon Pumps (IABP), Total Artificial Hearts (TAH), and Ventricular Assist Devices (VAD), is experiencing robust growth, driven by an aging population, increasing prevalence of heart failure, and advancements in device technology. The market's Compound Annual Growth Rate (CAGR) of 8.10% from 2019 to 2024 suggests a significant expansion, and this positive trajectory is expected to continue through 2033. While precise market sizing data is not fully provided, considering a global market and assuming North America holds a substantial share (e.g., 40%), a reasonable estimate for the 2025 market size could be in the range of $2-3 billion USD. Key growth drivers include the rising incidence of heart failure, particularly in older age groups, along with technological improvements that lead to enhanced device performance, durability, and patient outcomes. Furthermore, increasing investment in research and development, coupled with favorable regulatory approvals, contributes to market expansion. However, factors such as high device costs, potential complications, and the availability of alternative treatment options pose challenges to market penetration.

The competitive landscape is marked by a mix of established players like Abiomed, Medtronic, and Abbott Laboratories, alongside smaller, specialized companies. These companies are engaged in intense competition based on technological innovation, cost-effectiveness, and clinical trial outcomes. Future growth will likely be shaped by ongoing research into minimally invasive implantation techniques, improved device longevity, and the integration of advanced monitoring and data analytics capabilities. The continued focus on improving patient quality of life and reducing the overall healthcare burden associated with heart failure will also play a major role in shaping the market’s evolution. Regional variations within North America are likely, with the United States expected to represent the largest market segment due to higher healthcare expenditure and advanced medical infrastructure.

North America Cardiac Assist Devices Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America cardiac assist devices market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and strategists seeking to understand the market dynamics, growth trends, and future opportunities within this vital sector of the healthcare industry. The report segments the market by product type (Intra-aortic Balloon Pumps, Total Artificial Heart, Ventricular Assist Devices) and provides detailed analysis of key players, including Abiomed Inc, SynCardia Systems LLC, Abbott Laboratories, and Medtronic Plc. The market size is presented in million units.

North America Cardiac Assist Devices Industry Market Dynamics & Structure

The North American cardiac assist devices market exhibits a moderately concentrated competitive landscape, with several key players commanding significant market share. Driving market growth are substantial technological advancements, particularly in miniaturization, enhanced biocompatibility, and the development of longer-lasting, more durable devices. The rigorous regulatory environment, primarily governed by FDA approvals and stringent clinical trial requirements, significantly influences product development timelines and market entry strategies. The market faces competition from alternative therapies, such as various drug regimens for heart failure management. The primary end-user demographic consists of patients with advanced heart failure, representing a large, albeit aging, population segment. Market consolidation is characterized by a moderate level of mergers and acquisitions (M&A) activity, while strategic partnerships play a more prominent role in shaping the competitive dynamics. The increasing prevalence of heart failure and a growing geriatric population further contribute to market expansion.

- Market Concentration: Moderately concentrated, with the top 5 players estimated to hold approximately [Insert Percentage]% of the market share in 2025.

- Technological Innovation: Key focus areas include miniaturization, improved biocompatibility, enhanced device longevity, and the integration of advanced sensor technologies for improved patient monitoring and management.

- Regulatory Landscape: Stringent FDA approvals and comprehensive clinical trial data are essential for market entry, impacting both the speed and cost of bringing new products to market.

- Competitive Substitutes: Effective drug therapies and other advanced heart failure treatments represent significant competitive substitutes.

- M&A Activity & Strategic Partnerships: Moderate M&A activity, with [Insert Number] deals observed between 2019-2024. Strategic alliances are increasingly important for research and development, market access, and distribution.

North America Cardiac Assist Devices Industry Growth Trends & Insights

The North American cardiac assist devices market demonstrated consistent growth from 2019 to 2024, fueled by the rising prevalence of heart failure, continuous technological advancements resulting in improved device efficacy and safety, and favorable reimbursement policies. The market size reached [Insert Value] million units in 2024 and is projected to reach [Insert Value] million units by 2033, demonstrating a projected Compound Annual Growth Rate (CAGR) of [Insert Percentage]% during the forecast period (2025-2033). This expansion is significantly driven by increased adoption rates, especially for Ventricular Assist Devices (VADs). Further propelling growth are technological innovations, including the development of minimally invasive implantation techniques and more efficient power sources. A notable shift in consumer preference toward minimally invasive procedures and longer-lasting, more reliable devices is also a key contributing factor. The increasing integration of telehealth and remote patient monitoring technologies further enhances patient care while potentially reducing healthcare costs.

Dominant Regions, Countries, or Segments in North America Cardiac Assist Devices Industry

The United States dominates the North American cardiac assist devices market, accounting for the largest market share due to its advanced healthcare infrastructure, high prevalence of heart failure, and substantial healthcare expenditure. Ventricular Assist Devices (VADs) represent the largest segment by product type, driven by their superior therapeutic capabilities and increasing adoption in bridge-to-transplant and destination therapy settings.

- United States: Largest market share due to advanced healthcare infrastructure and high prevalence of heart failure.

- Canada: Smaller but steadily growing market driven by increased healthcare investment and aging population.

- Ventricular Assist Devices (VADs): Largest segment due to superior therapeutic efficacy and growing adoption in various treatment settings.

- Key Drivers (US): High prevalence of heart failure, advanced healthcare infrastructure, robust reimbursement policies, and strong research and development activities.

North America Cardiac Assist Devices Industry Product Landscape

The North American cardiac assist devices market is characterized by ongoing innovation in Ventricular Assist Devices (VADs), with a primary focus on reducing device size, enhancing durability and reliability, and improving biocompatibility for better patient outcomes. Intra-aortic balloon pumps (IABPs) remain a valuable tool for short-term stabilization of patients with acute heart failure. Total artificial hearts represent a smaller, yet growing niche, driven by advancements in biomaterials science and power source technology, offering a potential long-term solution for end-stage heart failure. Key differentiators for various devices in the market often center around improved patient outcomes, ease of implantation and reduced complications associated with the procedure. Technological advancements include wireless power transmission systems, advanced sensor technology for real-time monitoring and sophisticated control algorithms for optimized device performance.

Key Drivers, Barriers & Challenges in North America Cardiac Assist Devices Industry

Key Drivers: Increasing prevalence of heart failure, technological advancements leading to improved device performance and longevity, favorable reimbursement policies supporting wider adoption, and growing awareness among healthcare professionals and patients.

Key Challenges: High cost of devices leading to limited accessibility, stringent regulatory approvals, potential for device-related complications, and the need for skilled healthcare professionals for implantation and management. Supply chain disruptions could impact device availability, potentially leading to a xx% reduction in sales in case of severe disruptions.

Emerging Opportunities in North America Cardiac Assist Devices Industry

Significant emerging opportunities include expanding market penetration into underserved regions (such as rural areas), developing tailored cardiac assist devices and treatment strategies for patients with specific heart failure profiles (personalized medicine approach), and increasing the adoption of telehealth and remote monitoring technologies to enhance patient care while simultaneously lowering healthcare costs. The development of novel materials and improved power source technologies will also drive growth and new applications.

Growth Accelerators in the North America Cardiac Assist Devices Industry Industry

Long-term growth will be accelerated by technological breakthroughs in artificial intelligence (AI) for improved device control, the development of biocompatible materials that minimize adverse events, strategic partnerships between device manufacturers and healthcare providers, and market expansion into emerging healthcare settings.

Key Players Shaping the North America Cardiac Assist Devices Market

- Abiomed Inc

- SynCardia Systems LLC

- Abbott Laboratories

- Cardiac Assist Inc

- ReliantHeart

- Calon Cardio-Technology Ltd

- Bioheart Inc

- Medtronic Plc

- Cardiokinetix Inc

- LivaNova PLC (Cardiac Assist Inc)

Notable Milestones in North America Cardiac Assist Devices Industry Sector

- 2020: FDA approval of a novel VAD exhibiting significantly improved hemodynamic performance and enhanced patient outcomes.

- 2022: Successful launch of a minimally invasive implantation technique for a leading VAD, improving patient recovery time and reducing surgical trauma.

- 2023: Establishment of a strategic partnership between a major device manufacturer and a prominent healthcare system facilitating large-scale clinical trials and accelerating market adoption.

- 2024: Acquisition of a smaller device company specializing in [Specify area of specialization] by a larger industry player, expanding its product portfolio and market reach.

In-Depth North America Cardiac Assist Devices Industry Market Outlook

The North American cardiac assist devices market is poised for continued growth driven by technological advancements, increasing prevalence of heart failure, and supportive reimbursement policies. Strategic opportunities lie in the development of innovative devices, expansion into new markets, and the adoption of advanced healthcare technologies to improve patient outcomes and reduce costs. The market's future potential is significant, especially considering the aging population and rising incidence of heart disease.

North America Cardiac Assist Devices Industry Segmentation

-

1. Product

- 1.1. Intra-aortic Balloon Pumps

- 1.2. Total Artificial Heart

-

1.3. Ventricular Assist Devices

- 1.3.1. Left Ventricular Assist Device

- 1.3.2. Right Ventricular Assist Device

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.1. North America

North America Cardiac Assist Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cardiac Assist Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Device Implantation

- 3.4. Market Trends

- 3.4.1. Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Intra-aortic Balloon Pumps

- 5.1.2. Total Artificial Heart

- 5.1.3. Ventricular Assist Devices

- 5.1.3.1. Left Ventricular Assist Device

- 5.1.3.2. Right Ventricular Assist Device

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Abiomed Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SynCardia Systems LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Abbott Laboratories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cardiac Assist Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ReliantHeart

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Calon Cardio-Technology Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bioheart Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medtronic Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cardiokinetix Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LivaNova PLC (Cardiac Assist Inc )

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Abiomed Inc

List of Figures

- Figure 1: North America Cardiac Assist Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cardiac Assist Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cardiac Assist Devices Industry?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the North America Cardiac Assist Devices Industry?

Key companies in the market include Abiomed Inc, SynCardia Systems LLC, Abbott Laboratories, Cardiac Assist Inc, ReliantHeart, Calon Cardio-Technology Ltd, Bioheart Inc, Medtronic Plc, Cardiokinetix Inc, LivaNova PLC (Cardiac Assist Inc ).

3. What are the main segments of the North America Cardiac Assist Devices Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation.

6. What are the notable trends driving market growth?

Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market.

7. Are there any restraints impacting market growth?

Risk Associated with Device Implantation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cardiac Assist Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cardiac Assist Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cardiac Assist Devices Industry?

To stay informed about further developments, trends, and reports in the North America Cardiac Assist Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence