Key Insights

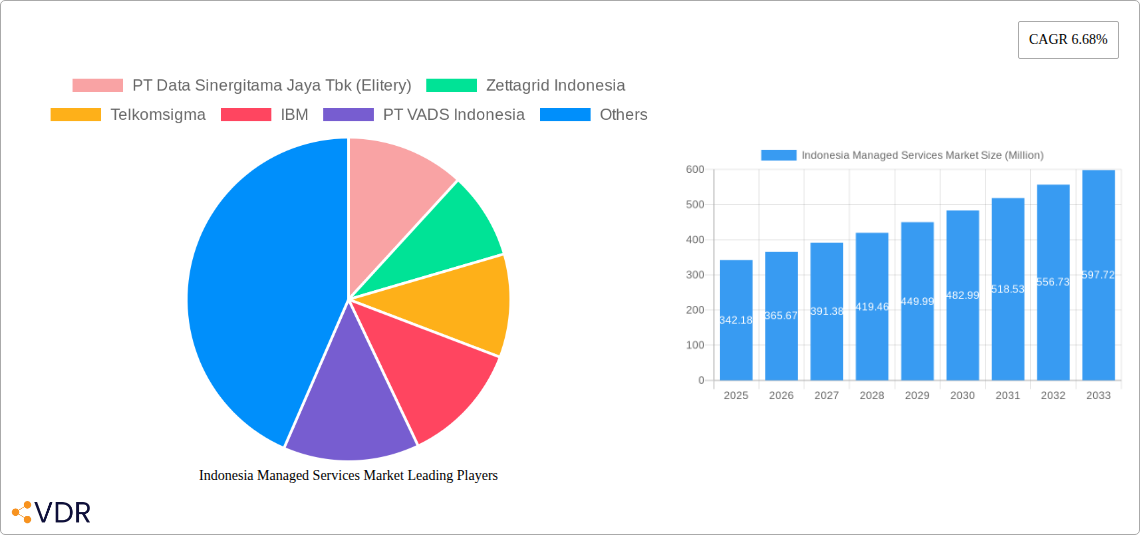

The Indonesia Managed Services Market is experiencing robust growth, projected to reach a market size of $342.18 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.68% from 2019 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of cloud computing and digital transformation initiatives across various Indonesian industries is fueling demand for outsourced IT management solutions. Businesses are increasingly recognizing the cost-effectiveness and efficiency gains associated with managed services, allowing them to focus on core competencies while leaving IT infrastructure management to specialized providers. Secondly, the growing need for enhanced cybersecurity measures in a digitally connected world is driving demand for managed security services. Finally, the expanding telecommunications infrastructure and improving digital literacy rates within Indonesia are creating a fertile ground for managed service providers to thrive. The market is segmented by service type (e.g., cloud managed services, IT infrastructure management, cybersecurity services), deployment model (cloud, on-premise, hybrid), and industry vertical (e.g., BFSI, healthcare, retail).

Competition within the Indonesia Managed Services Market is intense, with both global giants like IBM and AWS, and local players such as PT Data Sinergitama Jaya Tbk (Elitery), Zettagrid Indonesia, and Telkomsigma vying for market share. The success of these providers hinges on their ability to offer customized solutions tailored to the specific needs of Indonesian businesses, coupled with strong local expertise and support. While the market presents significant opportunities, challenges such as a potential skills gap in the IT sector and the need to overcome legacy infrastructure limitations in some industries could present hurdles to sustained growth. However, the continued government support for digitalization initiatives and the increasing adoption of advanced technologies are expected to mitigate these challenges and propel the market towards its projected growth trajectory. Future market trends are expected to be shaped by the emergence of innovative service offerings such as AI-powered managed services and the increasing adoption of edge computing technologies.

Indonesia Managed Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia Managed Services Market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating in or planning to enter this dynamic market. The report analyzes the parent market of IT services and the child market of cloud managed services, providing granular detail for strategic decision-making. Market values are presented in Million units.

Indonesia Managed Services Market Dynamics & Structure

The Indonesian Managed Services Market is experiencing significant growth, driven by increasing digitalization and the adoption of cloud technologies. Market concentration is moderate, with a few large players dominating alongside numerous smaller, specialized providers. Technological innovation, particularly in areas like AI and automation, is a key driver, while regulatory frameworks play a crucial role in shaping market development. The market faces competition from alternative solutions, such as in-house IT teams, but the increasing complexity of IT management is driving demand for managed services. End-user demographics are diverse, encompassing SMEs and large enterprises across various industries. M&A activity has been relatively modest but is expected to increase as larger players consolidate their market positions.

- Market Concentration: Moderate, with a few dominant players and numerous smaller firms. The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Strong driver, especially AI, automation, and cloud-native technologies. Innovation barriers include a skills gap and investment costs.

- Regulatory Framework: Government initiatives promoting digitalization are creating favorable conditions but also introduce regulatory complexities.

- Competitive Substitutes: In-house IT teams pose some competition, but the trend is towards outsourcing for efficiency and cost optimization.

- End-User Demographics: Diverse, including SMEs, large enterprises, and government bodies across various sectors (Finance, Telecom, Manufacturing etc.).

- M&A Trends: Low to moderate activity in recent years, with a predicted increase in the next 5 years. xx M&A deals projected between 2025-2030.

Indonesia Managed Services Market Growth Trends & Insights

The Indonesian Managed Services Market exhibited strong growth during the historical period (2019-2024). Fueled by rapid digital transformation, rising adoption of cloud-based services, and increasing demand for IT infrastructure management, the market size expanded from xx Million in 2019 to xx Million in 2024. This signifies a CAGR of xx%. The market penetration rate is currently at xx%, with significant potential for growth, particularly in less digitally mature sectors. Technological disruptions such as the rise of serverless computing and edge computing are creating new opportunities and reshaping market dynamics. Consumer behavior shifts towards cloud-first strategies further propel market expansion. The forecast period (2025-2033) anticipates continued strong growth driven by these factors, with the market size expected to reach xx Million by 2033 and a projected CAGR of xx%.

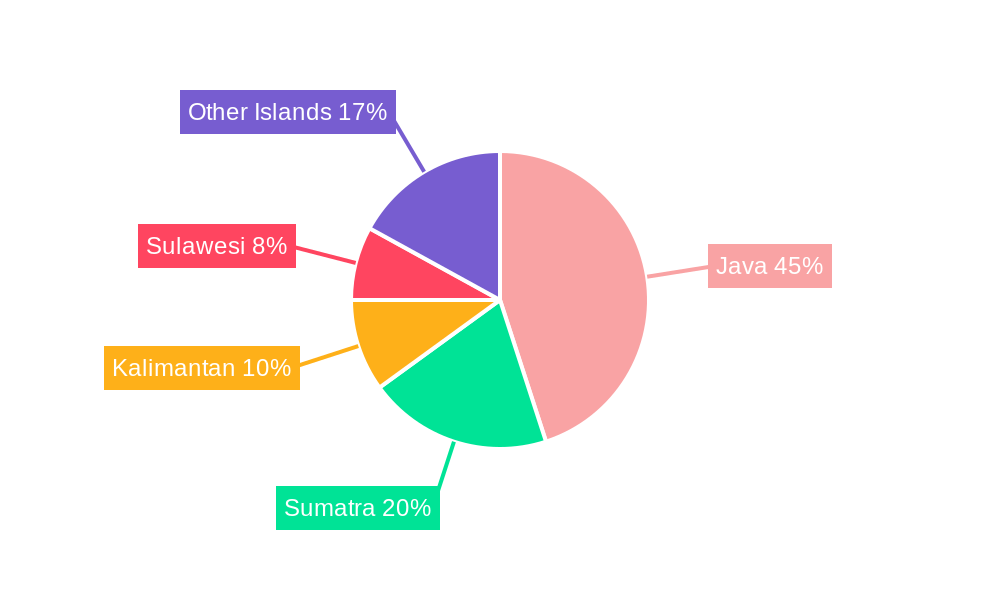

Dominant Regions, Countries, or Segments in Indonesia Managed Services Market

The Java region, particularly Jakarta and surrounding areas, holds the largest share of the Indonesian Managed Services Market. This dominance is driven by factors such as a higher concentration of businesses, advanced digital infrastructure, and a more skilled IT workforce. Other regions like Bali and Sumatra are also exhibiting rapid growth driven by tourism and expanding industries, yet still lag behind Java.

- Key Drivers in Java:

- High concentration of businesses and multinational corporations.

- Well-developed digital infrastructure, including high-speed internet access and data centers.

- Large pool of skilled IT professionals.

- Supportive government policies encouraging digital transformation.

- Growth Potential in Other Regions:

- Expansion of digital infrastructure in less developed regions.

- Increasing adoption of cloud services by businesses outside Java.

- Government initiatives to promote digital inclusion across Indonesia.

- Growth of specific industries (e.g., tourism in Bali) driving demand.

The market's growth is also strongly influenced by the increasing adoption of cloud managed services as opposed to traditional IT solutions.

Indonesia Managed Services Market Product Landscape

The Indonesian Managed Services market offers a wide range of products, including cloud managed services (IaaS, PaaS, SaaS), IT infrastructure management, cybersecurity services, and application management. Recent product innovations focus on AI-powered automation, enhancing efficiency and reducing operational costs. Key performance metrics include uptime, service level agreements (SLAs), and customer satisfaction. Many providers are differentiating themselves through specialized solutions tailored to specific industry needs and unique selling propositions around strong security, compliance and cost-effectiveness.

Key Drivers, Barriers & Challenges in Indonesia Managed Services Market

Key Drivers:

- Increased digitalization across all sectors.

- Rising adoption of cloud computing and related services.

- Government initiatives supporting digital transformation.

- Growing demand for IT infrastructure management and cybersecurity.

Key Challenges:

- Skills gap in the IT sector, limiting service delivery and innovation.

- High infrastructure investment costs, particularly in less-developed regions.

- Cybersecurity threats and data privacy concerns.

- Competition from international and local providers.

Emerging Opportunities in Indonesia Managed Services Market

- Untapped markets in smaller cities and rural areas.

- Growing demand for specialized managed services like AI/ML and IoT.

- Increasing adoption of hybrid and multi-cloud environments.

- Expansion of managed services into emerging sectors like Fintech and e-commerce.

Growth Accelerators in the Indonesia Managed Services Market Industry

Strategic partnerships between local and international providers are creating new opportunities for market expansion and innovation. Technological breakthroughs in areas like AI and automation are driving efficiency improvements and creating new service offerings. Government initiatives supporting digital transformation are further accelerating growth.

Key Players Shaping the Indonesia Managed Services Market Market

- PT Data Sinergitama Jaya Tbk (Elitery)

- Zettagrid Indonesia

- Telkomsigma

- IBM

- PT VADS Indonesia

- Eranyacloud

- Accord Innovations Indonesia

- Amazon Web Services

- PT Cyberindo Mega Persada (CBNCloud)

- Microsoft

Notable Milestones in Indonesia Managed Services Market Sector

- May 2024: Elitery becomes a Google Cloud Managed Services Provider (MSP), strengthening its position in the cloud computing market.

- April 2024: Epsilon Telecommunications partners with Moratelindo to improve internet connectivity for Indonesian businesses.

In-Depth Indonesia Managed Services Market Market Outlook

The Indonesian Managed Services Market is poised for sustained growth driven by increasing digitalization, robust economic growth, and government support. Strategic opportunities lie in leveraging technological advancements, expanding into untapped markets, and forging strategic partnerships. The market's future is bright, with potential for significant expansion across all segments and regions.

Indonesia Managed Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Service

- 1.2. Managed Network Service

- 1.3. Managed IT Infrastructure and Data Center Service

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

Indonesia Managed Services Market Segmentation By Geography

- 1. Java

- 2. Sumatra

- 3. Kalimantan

- 4. Other Regions

Indonesia Managed Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises

- 3.4. Market Trends

- 3.4.1. The Cloud Segment to Drive the Indonesian Managed Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Service

- 5.1.2. Managed Network Service

- 5.1.3. Managed IT Infrastructure and Data Center Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Java

- 5.3.2. Sumatra

- 5.3.3. Kalimantan

- 5.3.4. Other Regions

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Java Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Managed Security Service

- 6.1.2. Managed Network Service

- 6.1.3. Managed IT Infrastructure and Data Center Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Sumatra Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Managed Security Service

- 7.1.2. Managed Network Service

- 7.1.3. Managed IT Infrastructure and Data Center Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Kalimantan Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Managed Security Service

- 8.1.2. Managed Network Service

- 8.1.3. Managed IT Infrastructure and Data Center Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Other Regions Indonesia Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Managed Security Service

- 9.1.2. Managed Network Service

- 9.1.3. Managed IT Infrastructure and Data Center Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 PT Data Sinergitama Jaya Tbk (Elitery)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zettagrid Indonesia

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Telkomsigma

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IBM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PT VADS Indonesia

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Eranyacloud

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Accord Innovations Indonesia

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Amazon Web Services

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 PT Cyberindo Mega Persada (CBNCloud)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Microsof

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 PT Data Sinergitama Jaya Tbk (Elitery)

List of Figures

- Figure 1: Indonesia Managed Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Managed Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Managed Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 5: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 6: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 7: Indonesia Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Managed Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 11: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 12: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 13: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 16: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 17: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 18: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 19: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 21: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 22: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 23: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 24: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 25: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

- Table 27: Indonesia Managed Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Indonesia Managed Services Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 29: Indonesia Managed Services Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 30: Indonesia Managed Services Market Volume Million Forecast, by Deployment Type 2019 & 2032

- Table 31: Indonesia Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Indonesia Managed Services Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Managed Services Market?

The projected CAGR is approximately 6.68%.

2. Which companies are prominent players in the Indonesia Managed Services Market?

Key companies in the market include PT Data Sinergitama Jaya Tbk (Elitery), Zettagrid Indonesia, Telkomsigma, IBM, PT VADS Indonesia, Eranyacloud, Accord Innovations Indonesia, Amazon Web Services, PT Cyberindo Mega Persada (CBNCloud), Microsof.

3. What are the main segments of the Indonesia Managed Services Market?

The market segments include Service Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 342.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises.

6. What are the notable trends driving market growth?

The Cloud Segment to Drive the Indonesian Managed Services Market.

7. Are there any restraints impacting market growth?

Growing Adoption of Cloud Computing Services; The Rise of Small and Medium-sized Enterprises.

8. Can you provide examples of recent developments in the market?

May 2024: Elitery, a prominent cloud solutions provider, announced its new status as a Google Cloud Managed Services Provider (MSP). As a Google Cloud MSP, Elitery serves as a trusted partner, assisting businesses in fully leveraging Google Cloud's capabilities through expert management, support, and optimization services. This achievement not only solidifies Elitery's leadership in Indonesia's cloud computing sector but also positions it as one of the first local partners to collaborate with Google Cloud as an MSP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Managed Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Managed Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Managed Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Managed Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence