Key Insights

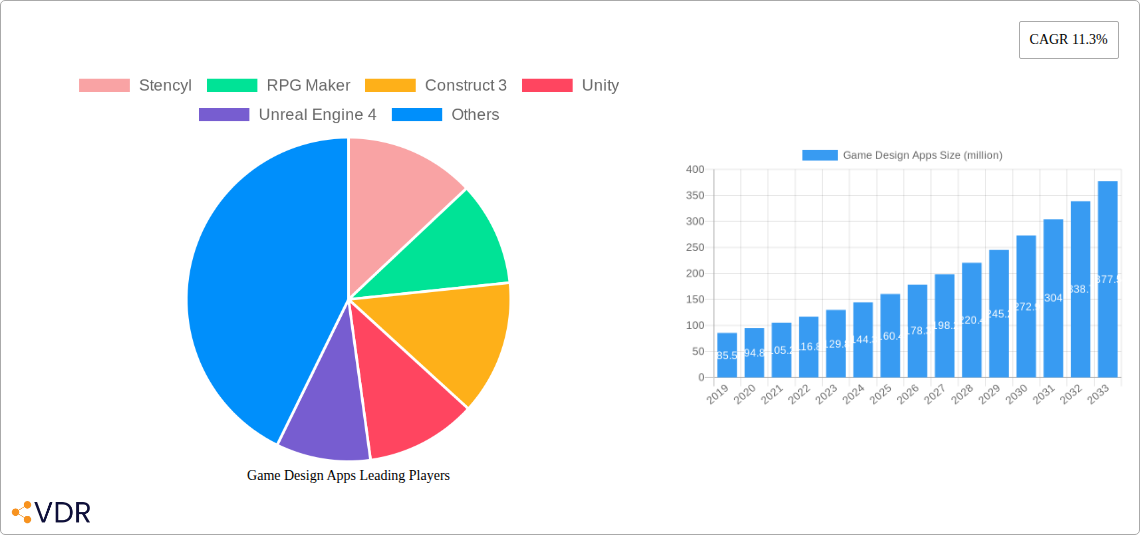

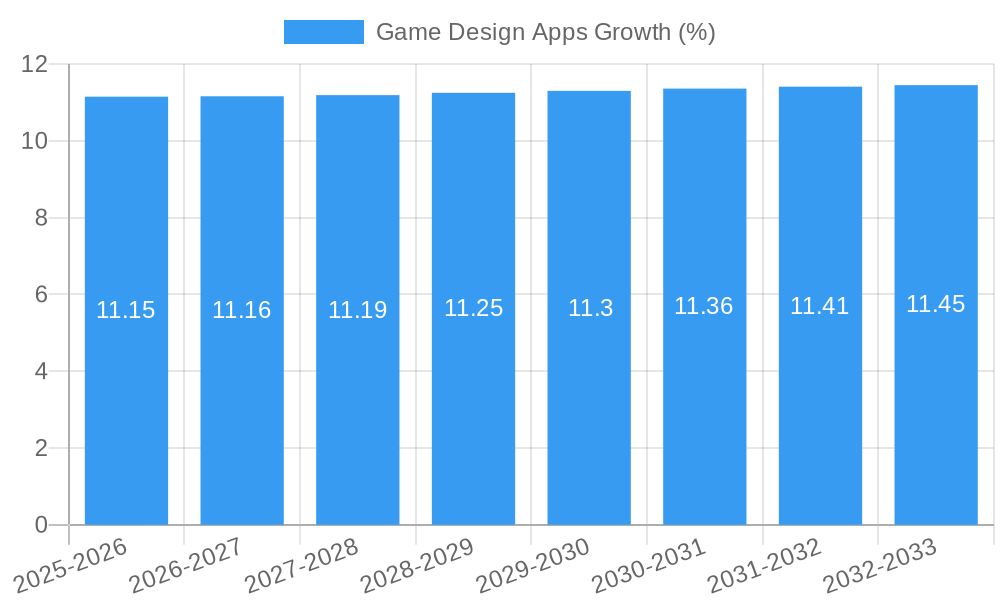

The global Game Design Apps market is poised for significant expansion, projected to reach a substantial valuation by 2033. With a robust Compound Annual Growth Rate (CAGR) of 11.3%, this dynamic sector is set to experience a consistent and impressive upward trajectory. This growth is primarily fueled by the increasing demand for interactive entertainment across various platforms and the burgeoning accessibility of game development tools. The market is experiencing a surge driven by factors such as the democratization of game creation, allowing individuals and smaller teams to develop sophisticated games, and the growing adoption of mobile gaming, which necessitates a constant influx of new and engaging titles. Furthermore, the proliferation of indie game development studios and the sustained interest from large enterprises in creating immersive gaming experiences contribute significantly to market momentum. The ease of use and advanced functionalities offered by modern game design applications are lowering the barrier to entry, thereby attracting a wider pool of creators.

The market is segmented by application into Large Enterprises and SMEs, indicating a broad appeal across different scales of development. The prevalence of iOS and Android operating systems as primary development and deployment platforms highlights the mobile-centric nature of the industry. While specific drivers for the market were not explicitly detailed, it is reasonable to infer that technological advancements in graphics rendering, intuitive user interfaces, and cross-platform compatibility are key enablers. The market's impressive CAGR suggests that these drivers are effectively outweighing any potential restraints. Emerging trends likely include the integration of AI in game development workflows, the rise of cloud-based game design solutions, and an increasing focus on hyper-casual and casual game genres due to their broad consumer appeal and rapid development cycles. The competitive landscape is robust, featuring established players like Unity and Unreal Engine, alongside innovative solutions such as Construct 3 and GameMaker Studio 2, all contributing to a vibrant ecosystem of game design tools.

This in-depth report provides an exhaustive analysis of the global Game Design Apps market, from its historical trajectory (2019-2024) through its projected future (2025-2033). We delve into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, emerging opportunities, and the strategic moves of leading players. This report is an essential resource for industry professionals seeking to understand the competitive ecosystem, capitalize on emerging trends, and make informed strategic decisions. Our analysis covers a wide spectrum of game development tools, from beginner-friendly platforms to professional-grade engines, catering to diverse user segments including Large Enterprises and SMEs, and applications across iOS and Android platforms.

Game Design Apps Market Dynamics & Structure

The global Game Design Apps market exhibits a dynamic and evolving structure, influenced by a confluence of technological advancements, evolving regulatory landscapes, and increasing end-user adoption. Market concentration is moderately fragmented, with a few dominant players like Unity and Unreal Engine 4 commanding significant market share, particularly within the professional development sphere. However, a burgeoning ecosystem of niche and specialized apps, such as Stencyl, Construct 3, RPG Maker, and GameMaker Studio 2, caters to specific genres and skill levels, fostering a healthy competitive environment. Technological innovation is primarily driven by the relentless pursuit of more intuitive user interfaces, enhanced visual fidelity, cross-platform compatibility, and the integration of emerging technologies like AI and AR/VR. Regulatory frameworks, while not overly restrictive, are increasingly focusing on data privacy and content moderation, subtly influencing app development and distribution strategies. Competitive product substitutes are abundant, ranging from open-source alternatives to proprietary software, forcing developers to continually innovate and differentiate. End-user demographics are expanding beyond traditional gamers to include educational institutions, content creators, and businesses leveraging game design principles for simulations and training. Mergers and acquisitions (M&A) trends are notable, with larger entities acquiring promising startups to enhance their technological capabilities and market reach. For instance, the acquisition of smaller engine developers by major tech firms is a recurring theme, indicating a consolidation strategy to capture market share and talent. Barriers to innovation are often rooted in the high cost of R&D, the need for specialized talent, and the ever-increasing user expectations for cutting-edge features.

- Market Concentration: Moderately fragmented with leading players and a growing niche segment.

- Technological Innovation Drivers: Intuitive UI, visual fidelity, cross-platform capabilities, AI/AR/VR integration.

- Regulatory Frameworks: Focus on data privacy and content moderation.

- Competitive Product Substitutes: Diverse range from open-source to proprietary software.

- End-User Demographics: Expanding beyond gamers to education, content creation, and enterprise.

- M&A Trends: Consolidation of smaller developers by larger entities.

- Innovation Barriers: High R&D costs, talent acquisition, rising user expectations.

Game Design Apps Growth Trends & Insights

The global Game Design Apps market is poised for significant expansion, driven by a multifaceted interplay of market size evolution, rapid adoption rates, disruptive technological advancements, and profound shifts in consumer behavior. The market size, which stood at approximately $2,500 million units in the base year 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This impressive growth trajectory is fueled by the democratization of game development, making sophisticated tools accessible to a broader audience than ever before. Platforms like GDevelop and Defold have lowered the entry barrier for aspiring game developers, leading to increased adoption rates among independent creators and smaller studios. The proliferation of mobile gaming continues to be a primary catalyst, with iOS and Android platforms serving as the primary deployment targets for a vast majority of new game titles. Technological disruptions, such as the advancements in cloud-based development environments and the increasing power of mobile hardware, are enabling the creation of more complex and visually stunning games on a wider range of devices. Furthermore, the rise of casual gaming, hyper-casual games, and the burgeoning creator economy are significantly influencing consumer behavior, fostering a constant demand for new and engaging gaming experiences. This, in turn, propels the need for efficient and versatile game design apps. The integration of AI in game development, for instance, is streamlining asset creation and playtesting, further accelerating the development cycle. The increasing demand for personalized gaming experiences also encourages developers to utilize flexible and powerful tools. The penetration of game design software within educational institutions, for teaching coding and creative problem-solving, is a nascent yet rapidly growing segment contributing to the overall market expansion. The historical data from 2019 to 2024 indicates a steady upward trend, with a market size of approximately $1,800 million units in 2019, showcasing consistent growth even before the base year estimation. This historical performance underscores the inherent resilience and ongoing appeal of the game design sector. The transition towards more accessible, yet powerful, game creation tools is a key trend that will continue to drive adoption and innovation across all market segments.

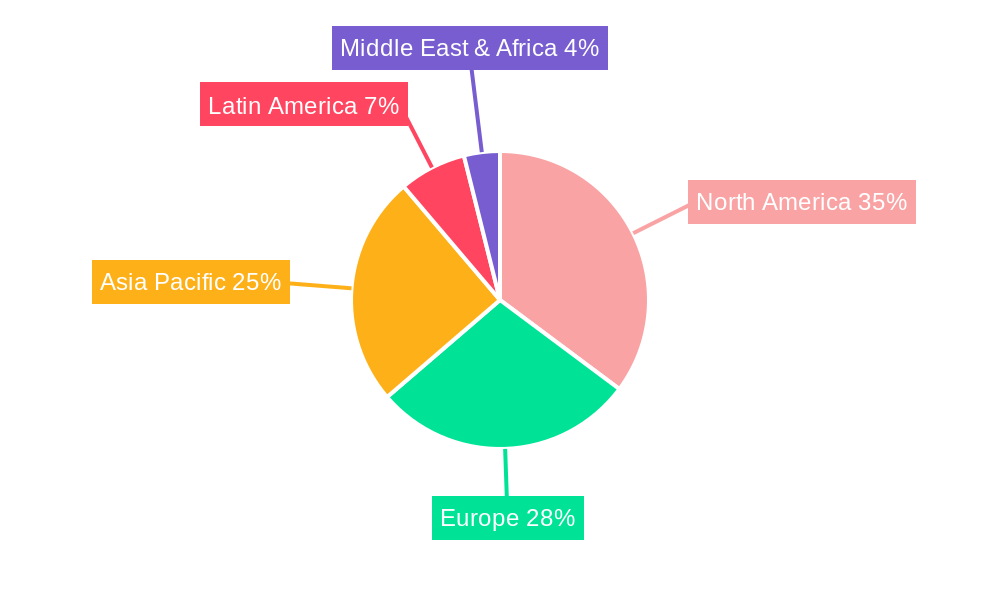

Dominant Regions, Countries, or Segments in Game Design Apps

The global Game Design Apps market exhibits distinct regional strengths and segment dominance, with North America emerging as the leading region, primarily driven by the United States. The robust economic policies supporting innovation, the presence of a highly skilled workforce, and a well-established venture capital ecosystem contribute significantly to this dominance. The United States alone accounts for an estimated 30% of the global Game Design Apps market share in 2025. This leadership is further bolstered by the concentration of major game development studios and technology giants that invest heavily in research and development of game design tools. The sheer volume of game development activities, from AAA titles to independent projects, necessitates advanced and versatile design applications, creating a sustained demand.

In terms of Application segments, Large Enterprises represent a substantial portion of the market, driven by their need for comprehensive and scalable game development solutions that can support complex projects and large teams. These enterprises often utilize professional-grade engines like Unity and Unreal Engine 4 for their extensive feature sets and robust support. However, the Small and Medium-sized Enterprises (SMEs) segment is experiencing rapid growth, fueled by the increasing accessibility and affordability of game design apps like GameMaker Studio 2, Construct 3, and Stencyl. SMEs are leveraging these tools to create innovative indie games and enter niche markets, contributing to market diversification.

The Type segment of iOS and Android platforms are intrinsically linked to the growth of mobile gaming, which continues to dominate the overall gaming landscape. Both platforms are critical for reaching a vast global audience, and game design apps that offer seamless cross-platform deployment capabilities are highly sought after. The continued innovation in mobile hardware and the increasing pervasiveness of smartphones worldwide ensure the sustained demand for game design applications targeting these mobile ecosystems. The market share within the mobile segment is split, with Android holding a slightly larger share due to its global reach, while iOS often commands higher revenue per user. The growth potential in emerging markets within Asia and Latin America, particularly for mobile game development, is also a significant factor contributing to the overall market expansion and regional demand for these applications.

- Leading Region: North America, driven by the United States.

- Key Drivers in North America: Supportive economic policies, skilled workforce, venture capital, concentration of development studios.

- Dominant Application Segment: Large Enterprises, with significant growth in SMEs.

- Key Drivers in SME Segment: Accessibility, affordability, indie game development, niche markets.

- Dominant Type Segment: iOS and Android platforms due to mobile gaming dominance.

- Growth Potential: Emerging markets in Asia and Latin America for mobile game development.

Game Design Apps Product Landscape

The product landscape of Game Design Apps is characterized by continuous innovation, expanding applications, and evolving performance metrics. Leading platforms such as Unity and Unreal Engine 4 continue to push boundaries with advanced rendering capabilities, sophisticated physics engines, and extensive asset stores. Niche tools like RPG Maker and Twine offer specialized functionalities for specific game genres, enabling rapid prototyping and focused development. The integration of AI-powered tools for asset generation and code optimization is becoming increasingly prevalent, enhancing efficiency. GameSalad and GameMaker Studio 2 remain popular for 2D game development, offering user-friendly interfaces for rapid creation. New entrants and established players alike are focusing on improving cross-platform deployment, AR/VR integration, and cloud-based collaboration features. The performance metrics being emphasized include faster build times, lower resource consumption, and enhanced debugging capabilities.

Key Drivers, Barriers & Challenges in Game Design Apps

The Game Design Apps market is propelled by several key drivers. The relentless growth of the global gaming industry, fueled by an ever-increasing player base and diverse gaming preferences, is the foremost catalyst. Technological advancements in hardware and software, such as the evolution of GPUs and the development of user-friendly game engines, continue to lower the barrier to entry for aspiring developers. The rise of the creator economy and the increasing demand for interactive content across various platforms, including mobile and PC, also significantly contribute to market expansion. Furthermore, the integration of game design principles in education and enterprise training simulations presents a growing avenue for adoption.

However, the market is not without its barriers and challenges. High development costs and the need for specialized technical expertise can still deter smaller studios or individual creators. The intense competition within the gaming industry and the saturation of app stores lead to challenges in market visibility and user acquisition for new games. Evolving platform policies and monetization models from major app stores can also pose regulatory hurdles and impact revenue streams. Additionally, the rapid pace of technological change requires continuous investment in skill development and software updates to remain competitive. Supply chain issues, particularly for hardware components that impact development, can indirectly affect the game design software market.

Emerging Opportunities in Game Design Apps

Emerging opportunities in the Game Design Apps sector are largely centered around democratizing advanced features and tapping into new creative frontiers. The continued development of no-code/low-code platforms is opening doors for individuals with limited programming knowledge to create sophisticated games, fostering a surge in independent game development. The increasing demand for interactive educational content presents a significant untapped market, with game design apps being ideal tools for creating engaging learning experiences. Furthermore, the growing interest in immersive technologies like augmented reality (AR) and virtual reality (VR) creates a demand for specialized game design tools that facilitate the creation of VR/AR content. The integration of generative AI for asset creation and gameplay balancing offers a revolutionary path to accelerate development cycles and unlock new creative possibilities.

Growth Accelerators in the Game Design Apps Industry

Several factors are acting as significant growth accelerators for the Game Design Apps industry. The relentless innovation in graphics processing units (GPUs) and the increasing processing power of mobile devices are enabling the development of more visually impressive and complex games, driving demand for sophisticated design tools. The widespread adoption of cloud computing solutions is facilitating seamless collaboration among distributed development teams and enabling the development of large-scale, online multiplayer experiences. Strategic partnerships between game engine developers and hardware manufacturers, as well as between software providers and educational institutions, are expanding the reach and adoption of game design platforms. Furthermore, the ongoing evolution of cross-platform development capabilities allows developers to deploy their creations across multiple devices and operating systems with greater ease, significantly broadening market reach.

Key Players Shaping the Game Design Apps Market

- Unity

- Unreal Engine 4

- Blender

- Autodesk

- Stencyl

- RPG Maker

- Construct 3

- GameMaker Studio 2

- GameSalad

- Defold

- Twine

- Nuclino

- GDevelop

- ZBrush

Notable Milestones in Game Design Apps Sector

- 2019: Release of Unity 2019.x LTS, bringing significant performance improvements and new features for mobile development.

- 2020: Unreal Engine 5 announced, showcasing advancements in real-time rendering with Nanite and Lumen technologies.

- 2021 (Q1): Construct 3 released major updates focusing on performance and expanded asset integration.

- 2021 (Q3): Stencyl introduced enhanced 3D capabilities and improved workflow for cross-platform projects.

- 2022 (Q2): GameMaker Studio 2 received significant overhauls to its IDE and export modules for improved developer experience.

- 2022 (Q4): Defold gained traction with its focus on lightweight, performance-oriented 2D game development.

- 2023 (Q1): RPG Maker MZ launched, offering a wealth of new features and improved usability for JRPG creation.

- 2023 (Q3): GDevelop saw increased adoption due to its user-friendly, no-code approach to game development.

- 2024 (Q1): Emergence of AI-driven asset creation tools within various game design platforms, signaling a new era in content generation.

In-Depth Game Design Apps Market Outlook

The Game Design Apps market outlook is exceptionally promising, driven by sustained technological innovation and the ever-expanding demand for interactive digital experiences. The continued evolution of AI and machine learning in game development will further accelerate creation cycles and enable more personalized gameplay. The increasing accessibility of powerful, yet user-friendly, tools will empower a new generation of creators, fostering a more diverse and vibrant game development landscape. Strategic partnerships and the increasing adoption of game design principles in non-gaming sectors like education and enterprise will unlock new revenue streams and market segments. The growing focus on cross-platform development will ensure that games created with these tools reach the widest possible audience. The overall trajectory indicates robust growth, with ample opportunities for both established players and emerging innovators to thrive in this dynamic and creative industry.

Game Design Apps Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Types

- 2.1. iOS

- 2.2. Android

Game Design Apps Segmentation By Geography

- 1. DE

Game Design Apps REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Game Design Apps Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. iOS

- 5.2.2. Android

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. DE

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Stencyl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPG Maker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Construct 3

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unity

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unreal Engine 4

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blender

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Autodesk

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Twine

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GameSalad

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Defold

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GameMaker Studio 2

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nuclino

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 GDevelop

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 ZBrush

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Stencyl

List of Figures

- Figure 1: Game Design Apps Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: Game Design Apps Share (%) by Company 2024

List of Tables

- Table 1: Game Design Apps Revenue million Forecast, by Region 2019 & 2032

- Table 2: Game Design Apps Revenue million Forecast, by Application 2019 & 2032

- Table 3: Game Design Apps Revenue million Forecast, by Types 2019 & 2032

- Table 4: Game Design Apps Revenue million Forecast, by Region 2019 & 2032

- Table 5: Game Design Apps Revenue million Forecast, by Application 2019 & 2032

- Table 6: Game Design Apps Revenue million Forecast, by Types 2019 & 2032

- Table 7: Game Design Apps Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Design Apps?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the Game Design Apps?

Key companies in the market include Stencyl, RPG Maker, Construct 3, Unity, Unreal Engine 4, Blender, Autodesk, Twine, GameSalad, Defold, GameMaker Studio 2, Nuclino, GDevelop, ZBrush.

3. What are the main segments of the Game Design Apps?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 232 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4500.00, USD 6750.00, and USD 9000.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Game Design Apps," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Game Design Apps report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Game Design Apps?

To stay informed about further developments, trends, and reports in the Game Design Apps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence