Key Insights

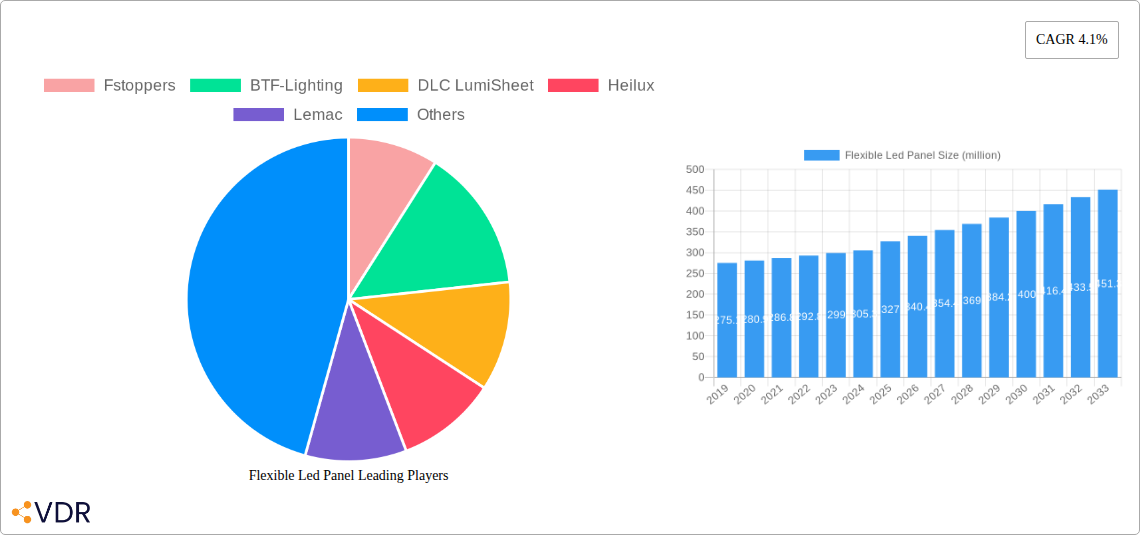

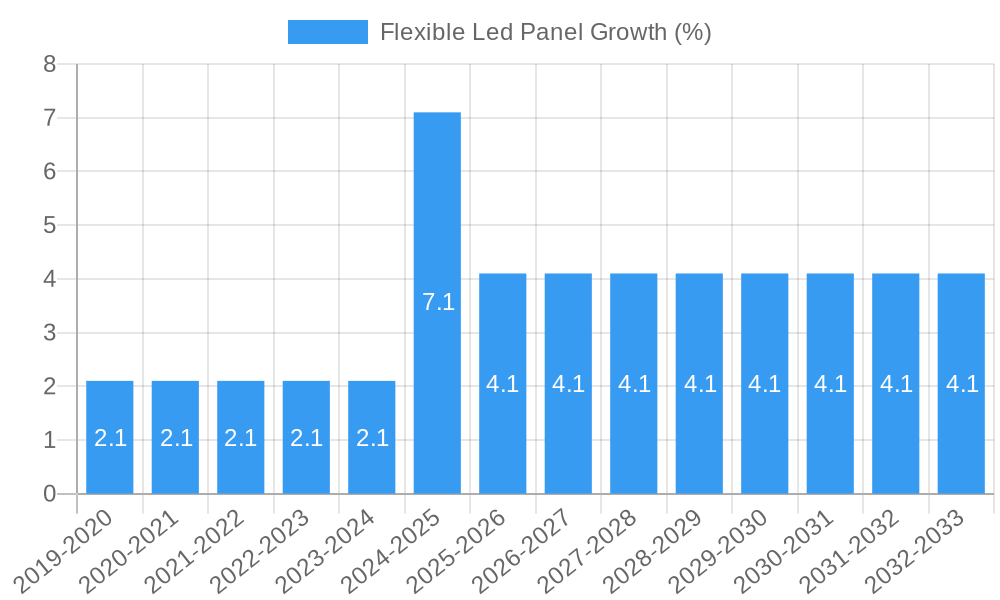

The global Flexible LED Panel market is poised for robust expansion, projected to reach a substantial market size of $327 million by 2025. This growth is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 4.1% from 2019 to 2033, indicating sustained demand and innovation within the sector. A primary driver for this upward trajectory is the increasing adoption of flexible LED panels in urban lightning engineering. The ability to conform to diverse architectural designs, coupled with enhanced energy efficiency and durability, makes them an attractive solution for modernizing city infrastructure, improving public spaces, and creating dynamic visual displays. Furthermore, the entertainment and leisure sectors are significantly contributing to market growth. From immersive concert stages and dynamic theme park attractions to vibrant retail displays and event backdrops, flexible LED panels offer unparalleled creative freedom and visual impact. The inherent adaptability and ease of installation are key factors driving their preference in these fast-paced environments, enabling a more engaging and memorable audience experience.

Household use also represents a burgeoning segment, as consumers increasingly embrace smart home technology and personalized interior design. Flexible LED panels are finding their way into accent lighting, mood setting, and unique decorative applications within residential spaces, blending functionality with aesthetic appeal. This diversification in application underscores the versatility of flexible LED technology. The market is broadly segmented by type into Fiberboard Based and Metal Based panels, each catering to specific performance and application requirements. While fiberboard-based options offer lightweight and cost-effectiveness, metal-based panels often provide superior heat dissipation and structural integrity for demanding applications. Looking ahead, the market is anticipated to witness continued innovation in materials and manufacturing processes, potentially leading to even greater flexibility, higher brightness, and improved energy efficiency, further solidifying its growth trajectory.

Unveiling the Flexible LED Panel Market: A Comprehensive Growth & Strategy Report (2019-2033)

This in-depth report provides a critical analysis of the global Flexible LED Panel market, charting its evolution, identifying key growth drivers, and forecasting future trajectories. Spanning the historical period of 2019-2024 and projecting to 2033 with a base year of 2025, this study offers unparalleled insights into market dynamics, competitive landscapes, and emerging opportunities for industry professionals. We delve into both the parent market and its crucial child markets, delivering actionable intelligence to inform strategic decision-making.

Flexible Led Panel Market Dynamics & Structure

The Flexible LED Panel market exhibits a moderately concentrated structure, with a blend of established players and emerging innovators driving technological advancements. Key companies like BTF-Lighting, DLC LumiSheet, and PixelFLEX are at the forefront of innovation, continuously pushing the boundaries of flexibility, brightness, and energy efficiency. Technological innovation, particularly in areas of improved lumen output, thinner profiles, and enhanced durability, serves as a primary driver of market growth. Regulatory frameworks, while varied across regions, are increasingly focusing on energy efficiency standards and safety certifications, influencing product development and market entry. Competitive product substitutes, such as traditional rigid LED panels and other lighting technologies, present a challenge, but the unique advantages of flexibility and adaptability of LED panels continue to carve out significant market share. End-user demographics are expanding, with increasing adoption in both commercial and residential sectors. Mergers and acquisition trends are observed as larger entities seek to acquire innovative technologies and expand their product portfolios, with an estimated xx million units in deal volumes anticipated in the forecast period. Innovation barriers include high research and development costs and the need for specialized manufacturing processes.

Flexible Led Panel Growth Trends & Insights

The global Flexible LED Panel market is poised for robust expansion, driven by a confluence of factors that are reshaping the lighting industry. Over the study period of 2019–2033, the market is projected to witness a significant upward trajectory in terms of size and adoption rates. In the base year of 2025, the market is estimated to be valued at approximately $X,XXX million units, with a projected Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025–2033. This impressive growth is fueled by escalating demand from diverse applications, ranging from eye-catching architectural lighting and dynamic entertainment venues to personalized household illumination.

Technological disruptions have been instrumental in this growth. Advances in LED encapsulation techniques, substrate materials like fiberboard and metal, and driver circuitry have enabled the creation of panels with superior flexibility, thinner form factors, and extended lifespans. This has opened up novel design possibilities, allowing for seamless integration into curved surfaces, creative signage, and wearable technology. Consumer behavior is also evolving, with a growing appreciation for dynamic and customizable lighting solutions that enhance ambiance and user experience. The increasing awareness of energy efficiency and sustainability further propends the adoption of LED technology, positioning Flexible LED Panels as a superior choice over conventional lighting. Market penetration is expanding across various sectors, moving beyond niche applications to become a mainstream lighting solution. The economic landscape, with favorable investment in infrastructure and smart city initiatives, also plays a crucial role in bolstering market demand. The report leverages advanced analytical frameworks and industry-specific data to deliver these comprehensive insights, painting a clear picture of market evolution and future potential.

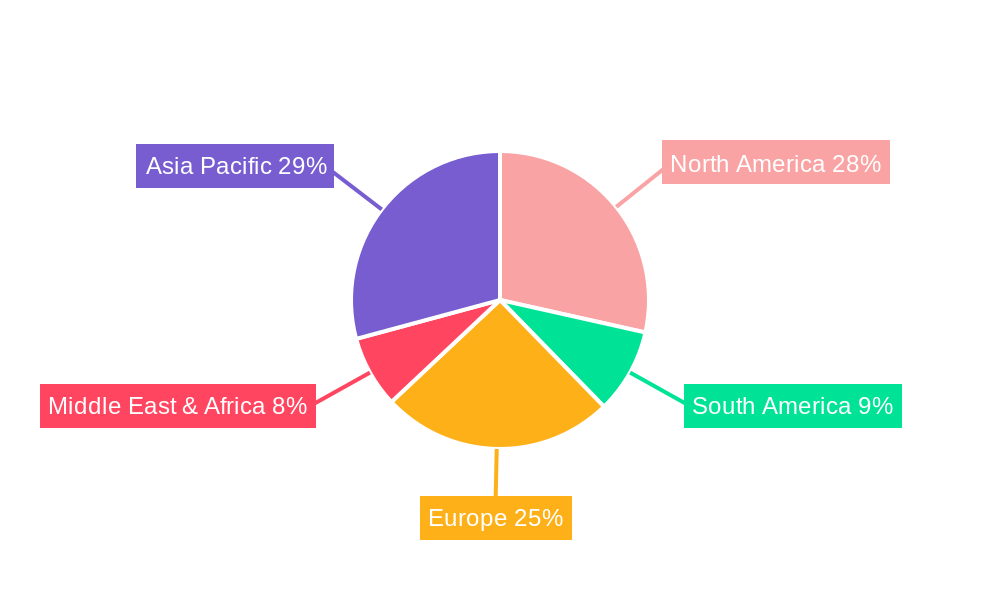

Dominant Regions, Countries, or Segments in Flexible Led Panel

The Entertainment & Leisure Places segment, within the broader Application category, is emerging as a dominant force driving growth in the Flexible LED Panel market. This segment is experiencing unprecedented demand due to the increasing sophistication of visual experiences in concert halls, theme parks, casinos, and hospitality venues. The ability of flexible LED panels to create immersive, dynamic, and visually stunning displays, such as large-scale video walls, stage backdrops, and interactive installations, is a key differentiator. Economic policies supporting the growth of the entertainment industry, coupled with a strong consumer desire for unique and engaging leisure activities, are significant economic drivers. Furthermore, countries with robust tourism sectors and a high concentration of entertainment facilities, such as the United States, China, and various European nations, are at the forefront of this adoption.

Within the Type category, Metal Based flexible LED panels are witnessing considerable traction due to their superior durability, heat dissipation capabilities, and suitability for applications requiring structural integrity. This type of panel is particularly favored in outdoor advertising, large-format digital signage, and industrial applications where resilience is paramount. Government initiatives promoting urban beautification and smart city development, often incorporating dynamic digital displays, are indirectly fueling the demand for these robust solutions. The market share for metal-based flexible LED panels is projected to reach XX% by 2033, driven by ongoing research into advanced metal alloys and manufacturing techniques that enhance flexibility without compromising strength. The growth potential in this segment is substantial, especially in regions undergoing rapid infrastructure development and technological upgrading, such as parts of Asia-Pacific and the Middle East.

Flexible Led Panel Product Landscape

The Flexible LED Panel product landscape is characterized by rapid innovation and a diverse range of applications. Companies are focusing on developing panels with enhanced color accuracy, higher refresh rates, and superior brightness, catering to demanding visual applications. Innovations include ultra-thin, rollable panels that can be integrated into virtually any surface, and transparent flexible LED displays that offer unique aesthetic possibilities for architectural and retail environments. Applications range from dynamic digital signage and interactive displays in retail spaces to stunning visual effects in entertainment venues and custom lighting solutions for automotive and consumer electronics. Performance metrics like lumen output per watt, color rendering index (CRI), and pixel pitch are continually being improved to meet the evolving needs of the market.

Key Drivers, Barriers & Challenges in Flexible Led Panel

Key Drivers:

- Technological Advancements: Continuous innovation in LED chips, materials, and manufacturing processes leading to improved flexibility, brightness, and energy efficiency.

- Growing Demand for Dynamic Visuals: Increasing adoption in entertainment, advertising, and retail sectors for creating immersive and engaging visual experiences.

- Energy Efficiency and Sustainability: LED technology's inherent energy savings and longer lifespan align with global sustainability goals.

- Urbanization and Smart City Initiatives: Integration into public infrastructure for dynamic signage, information displays, and aesthetic lighting.

Key Barriers & Challenges:

- High Initial Investment Costs: The advanced technology and manufacturing processes can lead to higher upfront costs compared to traditional lighting solutions.

- Supply Chain Volatility: Reliance on specialized components and potential disruptions in the global supply chain can impact availability and pricing, with an estimated XX% impact on production timelines.

- Technical Expertise for Installation: Complex installations may require specialized knowledge and skilled labor, potentially limiting adoption in some markets.

- Competition from Mature Technologies: Established lighting solutions continue to offer cost-effective alternatives in certain segments.

- Regulatory Hurdles: Varying standards and certifications across different regions can create market access challenges, impacting a XX% segment of the market.

Emerging Opportunities in Flexible Led Panel

Emerging opportunities in the Flexible LED Panel market lie in the burgeoning fields of augmented reality (AR) and virtual reality (VR) integration, where flexible displays can serve as immersive backdrops or wearable components. The automotive sector presents a significant untapped market for interior and exterior custom lighting solutions. Furthermore, the increasing demand for personalized and adaptable home lighting solutions, driven by smart home technology adoption, opens up avenues for innovation in decorative and functional flexible LED panels. The development of biodegradable or easily recyclable flexible LED panel materials also presents a strong opportunity aligned with growing environmental consciousness.

Growth Accelerators in the Flexible Led Panel Industry

The Flexible LED Panel industry's long-term growth is being significantly accelerated by breakthroughs in material science, leading to more durable, pliable, and cost-effective substrates. Strategic partnerships between LED manufacturers, display technology developers, and end-user application specialists are fostering integrated solutions and driving market penetration. The ongoing expansion of digital out-of-home (DOOH) advertising and the increasing investment in smart city infrastructure globally are creating sustained demand for high-impact visual displays. Moreover, the continuous miniaturization and integration of LED technology are paving the way for novel applications in areas like consumer electronics and medical devices.

Key Players Shaping the Flexible Led Panel Market

- Fstoppers

- BTF-Lighting

- DLC LumiSheet

- Heilux

- Lemac

- Lynda

- Pololu

- PixelFLEX

- MOG Technologies

- Panny Hire

- Lumen Couture

- Unspecified

- LEDSINO

- Colorlight LED

- Bollywood Film Equipments

- Linsn LED

- Leadleds

- REEFILM

- Ledbe

- Q-Tran

- LEDYi Lighting

Notable Milestones in Flexible Led Panel Sector

- 2019: Introduction of ultra-thin, high-transparency flexible LED panels for architectural applications.

- 2020: Significant advancements in pixel pitch resolution for flexible LED displays, enabling sharper imagery.

- 2021: Increased adoption of fiberboard-based flexible LED panels for cost-sensitive consumer electronics.

- 2022: Development of advanced control systems allowing for seamless integration and real-time content manipulation on flexible LED screens.

- 2023: Emergence of large-scale, flexible LED video walls in major entertainment venues worldwide.

- 2024: Enhanced energy efficiency standards for flexible LED panels, meeting stricter environmental regulations.

In-Depth Flexible Led Panel Market Outlook

The outlook for the Flexible LED Panel market remains exceptionally positive, driven by a sustained wave of technological innovation and expanding application frontiers. Growth accelerators such as advancements in material science, strategic collaborations, and the proliferation of smart city infrastructure are poised to fuel consistent expansion. The market's ability to adapt and integrate into diverse environments, from dynamic urban landscapes to personalized indoor settings, positions it for continued dominance. Anticipated market value is projected to reach $X,XXX million units by 2033, reflecting strong future potential and a fertile ground for strategic investments and new market entrants seeking to capitalize on the transformative power of flexible LED technology.

Flexible Led Panel Segmentation

-

1. Application

- 1.1. City Lightning Engineering

- 1.2. Entertainment & Leisure Places

- 1.3. Household Use

-

2. Type

- 2.1. Fiberboard Based

- 2.2. Matel Based

Flexible Led Panel Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flexible Led Panel REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. City Lightning Engineering

- 5.1.2. Entertainment & Leisure Places

- 5.1.3. Household Use

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fiberboard Based

- 5.2.2. Matel Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. City Lightning Engineering

- 6.1.2. Entertainment & Leisure Places

- 6.1.3. Household Use

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fiberboard Based

- 6.2.2. Matel Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. City Lightning Engineering

- 7.1.2. Entertainment & Leisure Places

- 7.1.3. Household Use

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fiberboard Based

- 7.2.2. Matel Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. City Lightning Engineering

- 8.1.2. Entertainment & Leisure Places

- 8.1.3. Household Use

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fiberboard Based

- 8.2.2. Matel Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. City Lightning Engineering

- 9.1.2. Entertainment & Leisure Places

- 9.1.3. Household Use

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fiberboard Based

- 9.2.2. Matel Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Flexible Led Panel Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. City Lightning Engineering

- 10.1.2. Entertainment & Leisure Places

- 10.1.3. Household Use

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fiberboard Based

- 10.2.2. Matel Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Fstoppers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BTF-Lighting

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DLC LumiSheet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Heilux

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lemac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lynda

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pololu

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PixelFLEX

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MOG Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panny Hire

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lumen Couture

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Unspecified

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LEDSINO

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Colorlight LED

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bollywood Film Equipments

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Linsn LED

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Leadleds

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 REEFILM

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ledbe

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Q-Tran

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 LEDYi Lighting

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Fstoppers

List of Figures

- Figure 1: Global Flexible Led Panel Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Flexible Led Panel Revenue (million), by Application 2024 & 2032

- Figure 3: North America Flexible Led Panel Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Flexible Led Panel Revenue (million), by Type 2024 & 2032

- Figure 5: North America Flexible Led Panel Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Flexible Led Panel Revenue (million), by Country 2024 & 2032

- Figure 7: North America Flexible Led Panel Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Flexible Led Panel Revenue (million), by Application 2024 & 2032

- Figure 9: South America Flexible Led Panel Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Flexible Led Panel Revenue (million), by Type 2024 & 2032

- Figure 11: South America Flexible Led Panel Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Flexible Led Panel Revenue (million), by Country 2024 & 2032

- Figure 13: South America Flexible Led Panel Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Flexible Led Panel Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Flexible Led Panel Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Flexible Led Panel Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Flexible Led Panel Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Flexible Led Panel Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Flexible Led Panel Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Flexible Led Panel Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Flexible Led Panel Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Flexible Led Panel Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Flexible Led Panel Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Flexible Led Panel Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Flexible Led Panel Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Flexible Led Panel Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Flexible Led Panel Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Flexible Led Panel Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Flexible Led Panel Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Flexible Led Panel Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Flexible Led Panel Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flexible Led Panel Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Flexible Led Panel Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Flexible Led Panel Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Flexible Led Panel Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Flexible Led Panel Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Flexible Led Panel Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Flexible Led Panel Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Flexible Led Panel Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Flexible Led Panel Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Flexible Led Panel Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Led Panel?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Flexible Led Panel?

Key companies in the market include Fstoppers, BTF-Lighting, DLC LumiSheet, Heilux, Lemac, Lynda, Pololu, PixelFLEX, MOG Technologies, Panny Hire, Lumen Couture, Unspecified, LEDSINO, Colorlight LED, Bollywood Film Equipments, Linsn LED, Leadleds, REEFILM, Ledbe, Q-Tran, LEDYi Lighting.

3. What are the main segments of the Flexible Led Panel?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 327 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Led Panel," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Led Panel report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Led Panel?

To stay informed about further developments, trends, and reports in the Flexible Led Panel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence