Key Insights

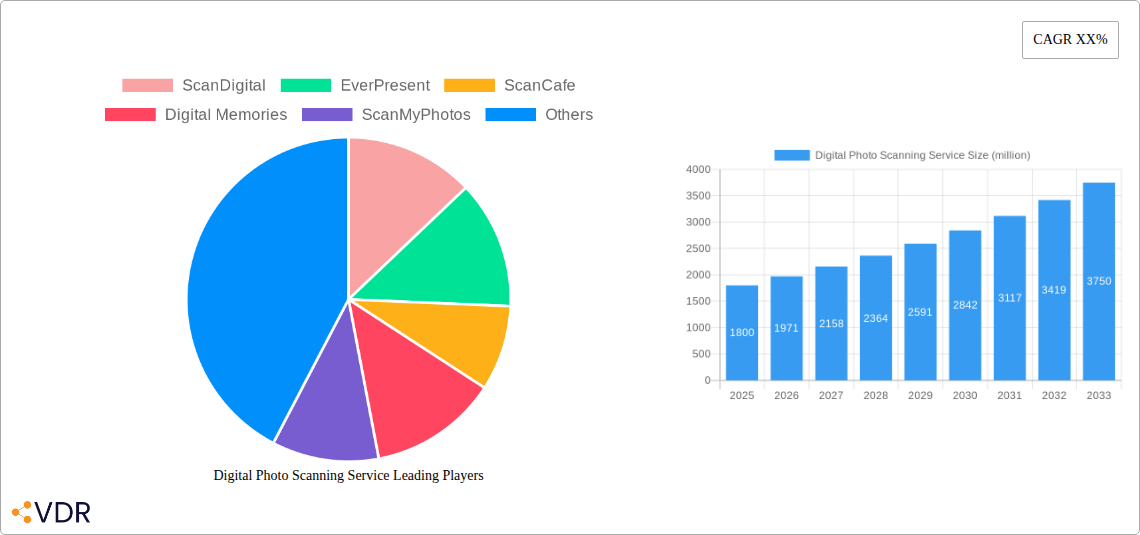

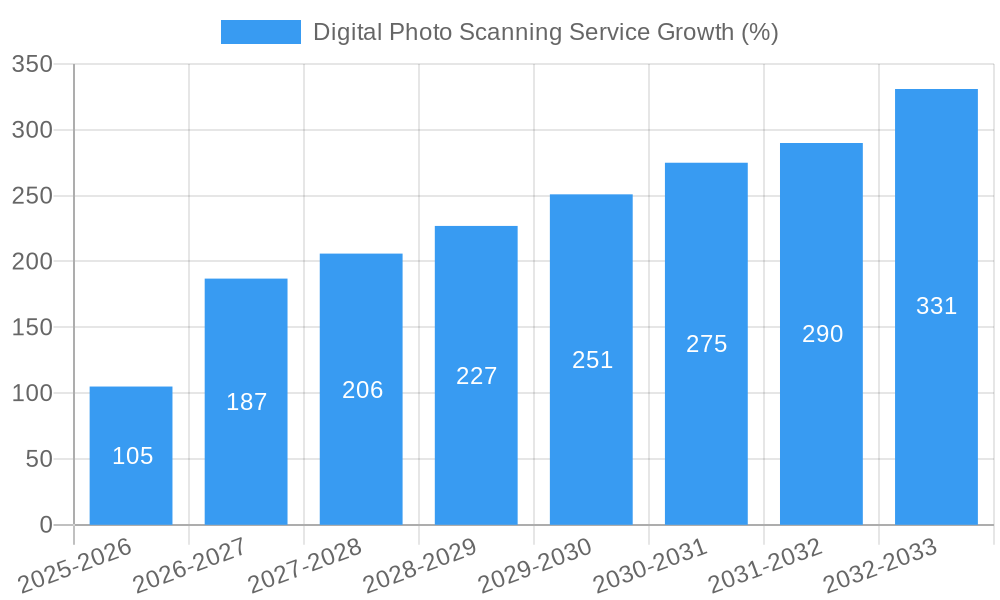

The Digital Photo Scanning Service market is poised for significant expansion, projected to reach a substantial market size of approximately $1.8 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.5% anticipated through 2033. This growth is primarily fueled by the increasing awareness among individuals and businesses of the impermanence of physical photographs and the pressing need to preserve precious memories and critical documents. The digital transformation wave continues to encourage the digitization of all forms of media, making photo scanning services indispensable for safeguarding heritage and ensuring accessibility. Drivers such as the rising prevalence of high-resolution scanners, advancements in AI-powered photo enhancement and organization tools, and the growing demand for cloud-based photo storage solutions are propelling the market forward. Furthermore, the increasing disposable income and a sentimental attachment to preserving family history are strong behavioral drivers contributing to this upward trajectory. The market is segmenting effectively, with personal applications for cherished memories and enterprise applications for digitizing archival documents and historical records both showing strong uptake.

Key trends shaping the digital photo scanning service market include the adoption of advanced scanning technologies that offer faster turnaround times and higher fidelity, alongside the integration of artificial intelligence for automated color correction, dust and scratch removal, and even facial recognition for easier organization. The convenience of mail-in services and the emergence of local scanning bureaus with a focus on quality and specialized media handling are also significant trends. However, certain restraints temper this growth. The initial cost of high-quality scanning equipment can be a barrier for smaller service providers, and the perception of DIY scanning solutions, although often less effective, presents a competitive challenge. Data security and privacy concerns, especially for sensitive personal or enterprise documents, remain paramount and require robust solutions from service providers. Despite these challenges, the overwhelming desire to prevent the loss of irreplaceable visual history, coupled with the convenience and accessibility offered by professional scanning services, ensures a bright and expanding future for this vital market.

This comprehensive report offers an in-depth analysis of the global Digital Photo Scanning Service market, providing actionable insights for industry professionals, investors, and stakeholders. Spanning the historical period of 2019-2024 and projecting future trends through 2033, this study leverages robust data and expert analysis to illuminate market dynamics, growth drivers, competitive landscape, and emerging opportunities.

Digital Photo Scanning Service Market Dynamics & Structure

The Digital Photo Scanning Service market is characterized by a moderately consolidated structure, with a mix of established players and emerging niche providers. Key companies like ScanDigital, EverPresent, and ScanCafe command significant market share, driven by their extensive service offerings and brand recognition. Technological innovation is a primary driver, with advancements in AI-powered photo correction, automated organization, and cloud integration enhancing service quality and user experience. Regulatory frameworks, though less prominent than in other tech sectors, focus on data privacy and intellectual property rights, influencing how digital assets are handled. Competitive product substitutes include DIY scanning solutions and integrated features within consumer electronics, posing a challenge to dedicated service providers. End-user demographics are increasingly skewed towards millennials and Gen X who seek to preserve and digitize legacy photo collections. Mergers and acquisitions (M&A) are expected to increase as larger players aim to expand their service portfolios and market reach.

- Market Concentration: Moderate, with key players holding substantial market share.

- Technological Innovation: Driven by AI for photo correction, cloud storage, and advanced digitization techniques.

- Regulatory Landscape: Primarily focused on data privacy and intellectual property.

- Competitive Substitutes: DIY scanning hardware, built-in smartphone scanning apps.

- End-User Demographics: Growing demand from individuals and families looking to preserve memories, particularly among tech-savvy generations.

- M&A Trends: Anticipated increase as companies seek consolidation and expansion.

Digital Photo Scanning Service Growth Trends & Insights

The Digital Photo Scanning Service market is poised for significant expansion, projected to grow from an estimated $1.5 billion in the base year 2025 to $3.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. This robust growth is fueled by an increasing societal awareness of the ephemeral nature of physical photographs and a growing desire to safeguard cherished memories for future generations. Adoption rates are steadily rising, propelled by the convenience and accessibility offered by professional scanning services. Technological disruptions, such as the development of higher-resolution scanning equipment and sophisticated cloud-based platforms, are not only improving the quality of digitized photos but also streamlining the entire process from collection to retrieval. Consumer behavior is shifting from passive storage of physical albums to active digital preservation and sharing. The pandemic also accelerated this trend, as individuals spent more time at home and rediscovered the value of their personal archives. Furthermore, the proliferation of digital frames and social media platforms creates an ongoing demand for digitized photo content. Market penetration, while still evolving, is projected to reach 45% of households with significant physical photo collections by 2033. The parent market for photo digitization services is estimated at $2.0 billion in 2025, with the digital photo scanning service segment representing a substantial and growing portion. The child market, encompassing specialized services like photo restoration and digitization of other media, is also showing strong ancillary growth, further indicating the broader trend towards digital memory preservation.

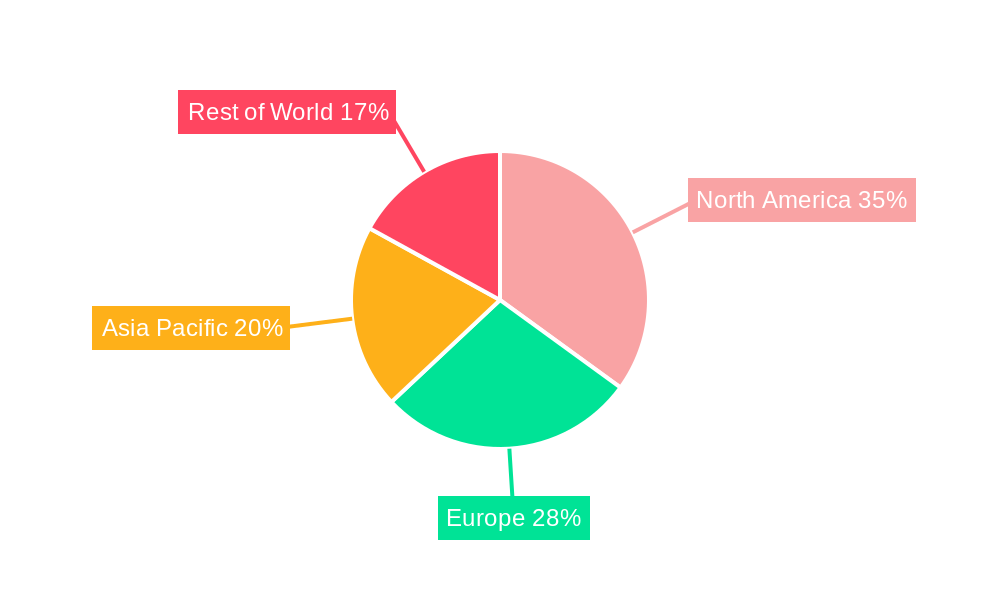

Dominant Regions, Countries, or Segments in Digital Photo Scanning Service

The North America region is currently dominating the Digital Photo Scanning Service market, driven by a strong confluence of factors including high disposable incomes, advanced technological adoption, and a deeply ingrained culture of preserving personal history. Within North America, the United States stands out as a key market. The Personal application segment within the broader market is the primary growth engine, accounting for an estimated 70% of the total market share in 2025, valued at approximately $1.05 billion. This dominance is attributed to the vast number of households with extensive collections of physical photographs, ranging from family albums and loose prints to slides and negatives.

- North America Dominance:

- High Disposable Income: Enables consumers to invest in premium memory preservation services.

- Technological Savvy: Consumers are quick to adopt new technologies and appreciate the convenience of digitized memories.

- Cultural Emphasis on Family History: A strong tradition of valuing and preserving familial legacies.

- Presence of Key Service Providers: Home to major players like ScanDigital and Legacybox Backup, fostering a competitive and innovative environment.

- United States as a Key Market:

- Large Population Base: A significant number of potential customers with substantial photo collections.

- Early Adoption of Digital Services: Consumers are accustomed to online ordering and mail-in services.

- Robust E-commerce Infrastructure: Facilitates seamless transaction and logistics for scanning services.

- Personal Application Segment Dominance:

- Emotional Value of Memories: The intrinsic desire to preserve irreplaceable family moments.

- Aging Populations and Legacy Preservation: Older generations are increasingly seeking to pass down memories to younger family members.

- Convenience and Time-Saving: Professional services eliminate the time-consuming and often difficult process of DIY scanning for individuals.

- Growth in Digital Sharing: The desire to easily share digitized photos with family and friends across social media and cloud platforms.

- Market Share: Estimated at 70% of the total market in 2025, valued at $1.05 billion.

- Growth Potential: Continues to exhibit strong growth as more individuals recognize the long-term benefits of digitizing their photo archives.

While the "Personal" segment leads, the "Enterprise" segment, catering to businesses for archival purposes, is showing nascent growth, particularly in sectors like historical societies and archival institutions. Within "Types," "Photo Storage" solutions that accompany scanning are gaining traction, and "Photo Correction" services are increasingly integrated as value-adds.

Digital Photo Scanning Service Product Landscape

The product landscape for Digital Photo Scanning Services is evolving with a focus on high-resolution digitization, versatile media handling, and integrated digital solutions. Companies are investing in advanced scanning technologies capable of capturing intricate details from prints, slides, and negatives, often exceeding 300-600 DPI for optimal clarity. Value-added services such as basic photo correction, color enhancement, and scratch removal are becoming standard offerings, significantly improving the aesthetic quality of digitized memories. Cloud storage and online gallery platforms are increasingly integrated, allowing customers to easily access, organize, and share their digitized collections. Unique selling propositions often lie in specialized services like the digitization of rare or damaged photos, and custom digitization workflows for large archives. Technological advancements are also seen in the development of more user-friendly ordering systems and secure shipping kits.

Key Drivers, Barriers & Challenges in Digital Photo Scanning Service

Key Drivers:

- Emotional Value of Memories: The intrinsic desire to preserve irreplaceable family history and heirlooms.

- Technological Advancements: Improved scanning quality, speed, and integrated digital platforms enhance service appeal.

- Convenience and Time Savings: Professional services offer a time-efficient alternative to DIY scanning.

- Aging Population: A growing demographic actively seeking to digitize legacy collections.

- Digital Sharing Culture: The increasing ease and desire to share memories online and with loved ones.

Key Barriers & Challenges:

- Price Sensitivity: The cost of professional scanning can be a deterrent for some consumers.

- DIY Scanning Accessibility: Affordable home scanners and smartphone apps offer alternatives, albeit often with lower quality.

- Data Security and Privacy Concerns: Customers are cautious about entrusting their personal photos to third-party services.

- Logistical Challenges: Shipping and handling of delicate physical media can lead to anxiety and potential damage.

- Perceived Complexity: Some potential customers may find the process of selecting and sending their photos daunting.

- Competition from Digital-Native Content: The rise of purely digital photos reduces the perceived urgency for digitizing older physical media.

Emerging Opportunities in Digital Photo Scanning Service

Emerging opportunities lie in expanding into underserved markets, such as rural areas with limited access to professional services, and developing specialized solutions for businesses requiring large-scale archival digitization. The integration of AI for automated photo tagging, facial recognition, and chronological organization presents a significant value-add for consumers. Furthermore, offering complementary services like photo restoration, video digitization, and the creation of personalized digital scrapbooks or merchandise can unlock new revenue streams. Evolving consumer preferences for subscription-based digital storage and access models also represent a promising avenue for growth. The demand for digitization of non-photo media, such as audio tapes and VHS, presents a synergistic expansion opportunity.

Growth Accelerators in the Digital Photo Scanning Service Industry

Growth acceleration in the Digital Photo Scanning Service industry is driven by several key catalysts. Technological breakthroughs in high-speed, high-resolution scanning equipment and advanced AI-powered image enhancement continue to improve service quality and turnaround times. Strategic partnerships with genealogy platforms, photo album manufacturers, and retirement communities are expanding customer reach and creating integrated offerings. Market expansion strategies, including targeted digital marketing campaigns emphasizing the emotional benefits of memory preservation and the ease of service, are crucial. Furthermore, the increasing awareness of potential data loss from physical media due to natural disasters or degradation fuels a sense of urgency among consumers, acting as a significant growth accelerator. The development of innovative, user-friendly packaging and shipping solutions designed to alleviate customer concerns about media safety is also a critical accelerator.

Key Players Shaping the Digital Photo Scanning Service Market

- ScanDigital

- EverPresent

- ScanCafe

- Digital Memories

- ScanMyPhotos

- FotoBridge

- Legacybox Backup

- Best Photo Scan

- Vintage Photo Lab

- ASDA

- Staples

- Photos2Archive

- Smooth Photo Scanning

- Snappy Snaps

- KODAK Digitizing Box

- Southtree

- DittoBee

- ProScan

- Nostalgic Media

- Dodge-Chrome

- Fototechnika

- Didlake

- Linhoff

- RetroMedia

- Memories Renewed

- VistaPix Media

- PicSave

- DiJiFi

Notable Milestones in Digital Photo Scanning Service Sector

- 2019: Increased adoption of AI for automated photo enhancement and organization by leading service providers.

- 2020: Surge in demand for digitizing personal photo collections driven by lockdowns and increased home-based activities.

- 2021: Introduction of enhanced cloud-based sharing platforms and integrated digital album creation tools.

- 2022: Expansion of services to include digitization of diverse media formats like VHS tapes and slides by key players.

- 2023: Growing focus on data security protocols and transparent privacy policies from service providers.

- Early 2024: Emerging partnerships with genealogy services to offer comprehensive family history preservation solutions.

In-Depth Digital Photo Scanning Service Market Outlook

- 2019: Increased adoption of AI for automated photo enhancement and organization by leading service providers.

- 2020: Surge in demand for digitizing personal photo collections driven by lockdowns and increased home-based activities.

- 2021: Introduction of enhanced cloud-based sharing platforms and integrated digital album creation tools.

- 2022: Expansion of services to include digitization of diverse media formats like VHS tapes and slides by key players.

- 2023: Growing focus on data security protocols and transparent privacy policies from service providers.

- Early 2024: Emerging partnerships with genealogy services to offer comprehensive family history preservation solutions.

In-Depth Digital Photo Scanning Service Market Outlook

The Digital Photo Scanning Service market is set for continued robust growth, driven by an enduring human desire to preserve personal histories and the ever-increasing accessibility of digital technologies. Growth accelerators, including technological innovations in scanning and AI-powered enhancements, coupled with strategic market expansion and a growing appreciation for digital legacy preservation, will fuel this upward trajectory. Emerging opportunities in niche markets and complementary service offerings will further diversify and expand the market. The shift towards subscription-based models and integrated digital solutions will likely define the future, ensuring that cherished memories remain accessible and shareable for generations to come. The market is expected to witness a steady increase in adoption as awareness grows and services become even more user-friendly and affordable.

Digital Photo Scanning Service Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Enterprise

-

2. Types

- 2.1. Photo Correction

- 2.2. Photo Storage

- 2.3. Other

Digital Photo Scanning Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Photo Scanning Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Photo Correction

- 5.2.2. Photo Storage

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Photo Correction

- 6.2.2. Photo Storage

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Photo Correction

- 7.2.2. Photo Storage

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Photo Correction

- 8.2.2. Photo Storage

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Photo Correction

- 9.2.2. Photo Storage

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Photo Scanning Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Photo Correction

- 10.2.2. Photo Storage

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ScanDigital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EverPresent

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ScanCafe

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Digital Memories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ScanMyPhotos

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FotoBridge

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Legacybox Backup

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Best Photo Scan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vintage Photo Lab

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ASDA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Staples

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Photos2Archive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Smooth Photo Scanning

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Snappy Snaps

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KODAK Digitizing Box

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Southtree

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 DittoBee

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 ProScan

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Nostalgic Media

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Dodge-Chrome

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Fototechnika

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Didlake

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Linhoff

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 RetroMedia

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Memories Renewed

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 VistaPix Media

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 PicSave

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 DiJiFi

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 ScanDigital

List of Figures

- Figure 1: Global Digital Photo Scanning Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Photo Scanning Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Photo Scanning Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Photo Scanning Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Digital Photo Scanning Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Digital Photo Scanning Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Photo Scanning Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Photo Scanning Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Photo Scanning Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Photo Scanning Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Digital Photo Scanning Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Digital Photo Scanning Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Photo Scanning Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Photo Scanning Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Photo Scanning Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Photo Scanning Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Digital Photo Scanning Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Digital Photo Scanning Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Photo Scanning Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Photo Scanning Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Photo Scanning Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Photo Scanning Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Digital Photo Scanning Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Digital Photo Scanning Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Photo Scanning Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Photo Scanning Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Photo Scanning Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Photo Scanning Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Digital Photo Scanning Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Digital Photo Scanning Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Photo Scanning Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Photo Scanning Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Digital Photo Scanning Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Digital Photo Scanning Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Digital Photo Scanning Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Digital Photo Scanning Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Digital Photo Scanning Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Photo Scanning Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Photo Scanning Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Digital Photo Scanning Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Photo Scanning Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Photo Scanning Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Digital Photo Scanning Service?

Key companies in the market include ScanDigital, EverPresent, ScanCafe, Digital Memories, ScanMyPhotos, FotoBridge, Legacybox Backup, Best Photo Scan, Vintage Photo Lab, ASDA, Staples, Photos2Archive, Smooth Photo Scanning, Snappy Snaps, KODAK Digitizing Box, Southtree, DittoBee, ProScan, Nostalgic Media, Dodge-Chrome, Fototechnika, Didlake, Linhoff, RetroMedia, Memories Renewed, VistaPix Media, PicSave, DiJiFi.

3. What are the main segments of the Digital Photo Scanning Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Photo Scanning Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Photo Scanning Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Photo Scanning Service?

To stay informed about further developments, trends, and reports in the Digital Photo Scanning Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence