Key Insights

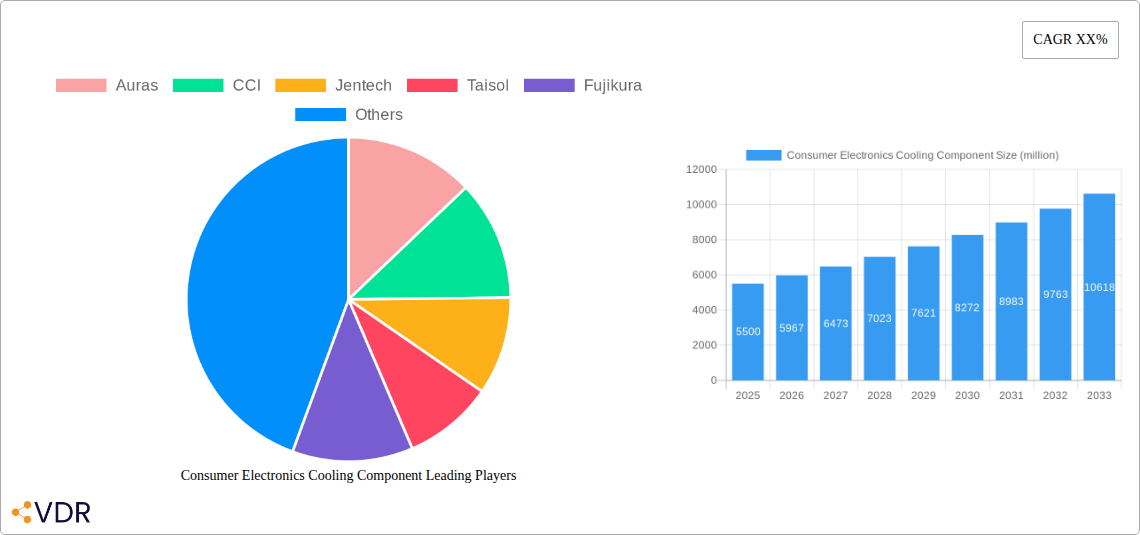

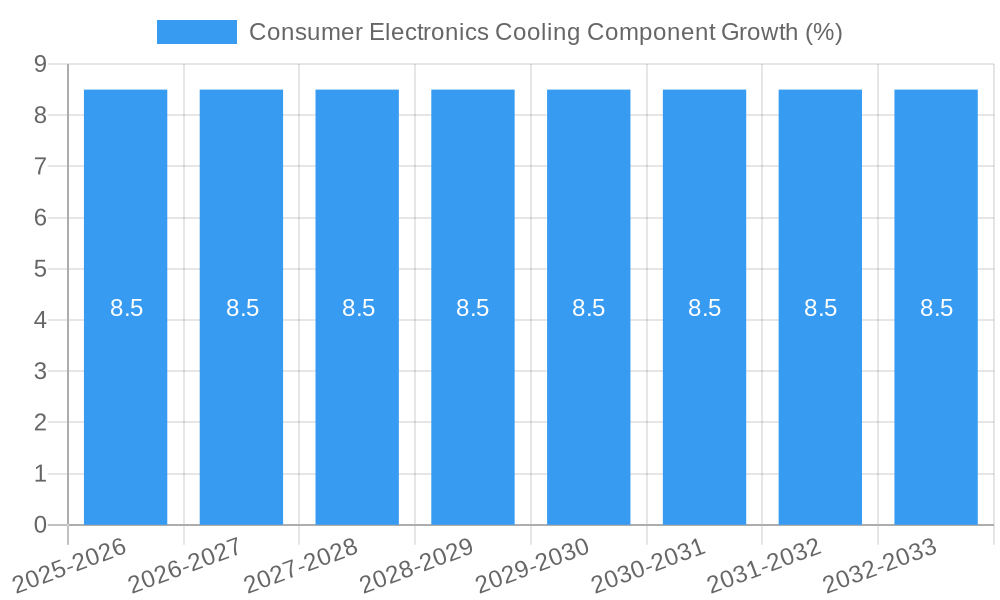

The global Consumer Electronics Cooling Component market is poised for significant expansion, projected to reach an estimated market size of approximately $5,500 million by 2025, and is expected to grow at a robust Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025-2033. This substantial growth is primarily fueled by the relentless innovation and increasing power density in consumer electronics. As devices like smartphones, tablets, and high-performance computers become more sophisticated, featuring faster processors and advanced graphics capabilities, the demand for effective thermal management solutions escalates. The "Other" application segment, encompassing wearables, gaming consoles, and smart home devices, is anticipated to be a key growth driver, mirroring the rapid adoption of these emerging technologies. Furthermore, advancements in cooling technologies such as vapor chambers and sophisticated heatpipe designs are crucial in meeting the thermal challenges presented by these compact and powerful devices, thus underpinning the market's upward trajectory.

Several critical drivers are shaping the Consumer Electronics Cooling Component market. The escalating demand for thinner, lighter, and more powerful portable devices necessitates advanced cooling solutions to prevent performance throttling and ensure user comfort. The proliferation of 5G technology, with its associated network infrastructure and user devices, also contributes to increased thermal loads. Moreover, the burgeoning market for Artificial Intelligence (AI) and Machine Learning (ML) powered devices, which often require high computational power, further amplifies the need for efficient cooling. While the market presents a promising outlook, certain restraints could temper growth. The cost sensitivity of the consumer electronics market may lead to a preference for more economical cooling solutions, potentially impacting the adoption of premium technologies. Supply chain disruptions and the fluctuating prices of raw materials essential for manufacturing these components could also pose challenges. However, the continuous drive for product miniaturization, enhanced performance, and the ever-growing consumer appetite for sophisticated electronics are expected to outweigh these challenges, ensuring a dynamic and evolving market landscape.

Consumer Electronics Cooling Component Market Dynamics & Structure

The global consumer electronics cooling component market exhibits a moderately concentrated structure, with key players like Delta Electronics, Cooler Master, and Fujikura holding significant market shares. This concentration is driven by substantial R&D investments, proprietary technologies, and established supply chains. Technological innovation remains a primary driver, fueled by the relentless pursuit of thinner, lighter, and more powerful consumer electronics. Advancements in materials science, miniaturization techniques, and thermal management solutions are continuously pushing the boundaries of heat dissipation. Regulatory frameworks, particularly those concerning environmental impact and energy efficiency, are also shaping product development and material choices. Competitive product substitutes, though present, often lack the specialized performance or integration capabilities of dedicated cooling components, limiting their disruptive potential. End-user demographics are increasingly sophisticated, demanding enhanced performance, portability, and extended battery life from their devices, directly influencing the need for advanced cooling. Mergers and acquisitions (M&A) trends indicate a strategic consolidation within the industry, as larger companies acquire smaller innovators to expand their technological portfolios and market reach. For instance, recent M&A activity has seen a XX% increase in deal volume as firms seek to integrate nascent cooling technologies or gain access to new customer segments. Innovation barriers, such as the high cost of advanced materials and the complexity of integrating novel cooling solutions into compact device architectures, persist.

- Market Concentration: Dominated by a few key players, indicating a mature yet competitive landscape.

- Technological Innovation: Driven by miniaturization, advanced materials, and performance enhancement demands.

- Regulatory Influence: Growing emphasis on energy efficiency and environmental compliance.

- Competitive Substitutes: Limited impact due to specialized performance requirements of advanced cooling.

- End-User Demands: Focus on performance, portability, and longevity driving innovation.

- M&A Trends: Strategic consolidation to acquire technology and market share, with an estimated XX% increase in deal volume observed.

- Innovation Barriers: High material costs and integration complexities.

Consumer Electronics Cooling Component Growth Trends & Insights

The global consumer electronics cooling component market is projected to experience robust growth throughout the forecast period. The market size is estimated to reach USD $XX billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This impressive expansion is underpinned by several key trends. The escalating demand for high-performance computing in smartphones, tablets, and gaming consoles necessitates sophisticated thermal management solutions to prevent throttling and ensure optimal functionality. As devices become more powerful and compact, the challenge of dissipating heat intensifies, driving higher adoption rates for advanced cooling components like vapor chambers and advanced heat pipes. Technological disruptions, such as the development of novel thermoelectric cooling technologies and liquid cooling solutions for consumer-grade devices, are further accelerating market penetration.

Consumer behavior shifts also play a crucial role. The increasing popularity of mobile gaming, virtual and augmented reality experiences, and the growing trend of remote work and online education have all contributed to a heightened reliance on powerful, portable electronic devices. This reliance directly translates into a need for reliable and efficient cooling to support sustained peak performance. Furthermore, the trend towards ultra-thin and fanless designs in laptops and tablets, driven by aesthetic preferences and portability, necessitates innovative cooling components that can operate effectively in confined spaces. The market penetration of advanced cooling solutions is expected to grow significantly as manufacturers strive to meet these evolving consumer expectations. The integration of artificial intelligence and machine learning in device management is also indirectly fueling the need for better cooling, as these technologies often demand considerable processing power and generate significant heat.

- Market Size Evolution: Projected to reach USD $XX billion in 2025, with significant growth anticipated.

- CAGR: Expected to be XX% from 2025–2033, indicating a strong growth trajectory.

- Adoption Rates: Rising significantly due to increased demand for high-performance and compact devices.

- Technological Disruptions: Innovations in thermoelectric cooling and liquid cooling are poised to impact the market.

- Consumer Behavior Shifts: Increased demand for mobile gaming, VR/AR, and portable high-performance devices are key drivers.

- Market Penetration: Advanced cooling solutions are becoming standard in premium and performance-oriented devices.

- Indirect Drivers: AI and ML integration in devices are indirectly boosting cooling component demand.

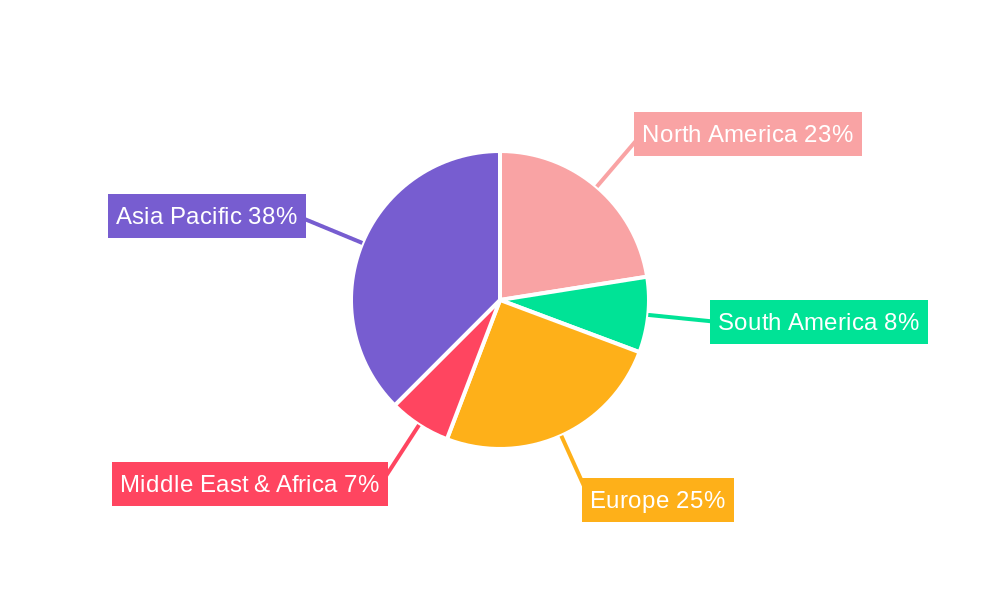

Dominant Regions, Countries, or Segments in Consumer Electronics Cooling Component

The Asia-Pacific region is poised to dominate the global consumer electronics cooling component market, driven by its robust manufacturing capabilities, significant consumer base, and the presence of major electronics brands. Countries like China, South Korea, and Taiwan are pivotal hubs for consumer electronics production, creating a substantial localized demand for cooling components. The sheer volume of production for smartphones, tablets, and computers within this region directly translates to a substantial market share for thermal films, heat pipes, and vapor chambers.

Within the Asia-Pacific, China stands out as a dominant country due to its extensive manufacturing ecosystem and the presence of leading original equipment manufacturers (OEMs) and component suppliers. The government's supportive policies for the technology sector, coupled with significant investments in research and development, further bolster its position. The country's large domestic market, characterized by a burgeoning middle class with increasing disposable income, also contributes to the high demand for consumer electronics, and consequently, their cooling components.

From an application perspective, the Computer segment is a leading driver of growth. The continuous evolution of laptops, desktops, and servers, with increasing processing power and graphics capabilities, necessitates more advanced and efficient cooling solutions. Gaming PCs, workstations, and high-performance laptops are particularly demanding in terms of thermal management. The Cell Phone segment also holds significant sway, with the miniaturization and increasing power of smartphones requiring innovative and compact cooling components.

Regarding types, Thermal Film is expected to witness substantial growth due to its versatility, cost-effectiveness, and ease of integration across various consumer electronics. However, Heatpipes and Vapor Chambers are increasingly becoming indispensable for high-performance applications, particularly in premium smartphones, gaming laptops, and VR/AR devices, where efficient and rapid heat dissipation is critical. The technological advancements in these more sophisticated cooling types are crucial for pushing the boundaries of device performance and enabling new form factors. The growth potential for vapor chambers, in particular, is significant as manufacturers seek to manage the heat generated by increasingly powerful mobile processors.

- Dominant Region: Asia-Pacific, driven by manufacturing prowess and consumer demand.

- Dominant Country: China, due to its extensive manufacturing ecosystem and large domestic market.

- Leading Application Segment: Computer, followed closely by Cell Phone, due to increasing processing power and miniaturization.

- Key Types Driving Growth: Thermal Film for its versatility, while Heatpipes and Vapor Chambers are crucial for high-performance devices.

- Growth Factors in Asia-Pacific: Supportive government policies, R&D investments, and a strong manufacturing base.

- Market Share & Growth Potential: Asia-Pacific holds the largest market share, with significant growth potential driven by technological advancements and consumer demand.

Consumer Electronics Cooling Component Product Landscape

The consumer electronics cooling component product landscape is characterized by continuous innovation in materials, designs, and thermal transfer efficiency. Manufacturers are focusing on developing ultra-thin, lightweight, and highly efficient solutions to meet the evolving demands of modern devices. Advanced thermal films utilize composite materials with superior thermal conductivity, offering enhanced heat dissipation in confined spaces. Heat pipes are evolving with optimized wick structures and fluid dynamics to improve their capacity for transporting heat away from critical components. Vapor chambers are becoming increasingly sophisticated, employing advanced manufacturing techniques to achieve superior thermal spreading and performance, especially in high-power density applications. These product innovations are crucial for enabling the next generation of powerful, yet compact, consumer electronics.

Key Drivers, Barriers & Challenges in Consumer Electronics Cooling Component

Key Drivers:

- Increasing Device Performance: The relentless pursuit of higher processing speeds, graphical capabilities, and AI integration in consumer electronics necessitates more effective cooling to prevent thermal throttling and ensure optimal performance.

- Miniaturization and Thinning Trends: The demand for sleeker, more portable devices requires innovative cooling solutions that can dissipate heat efficiently within extremely confined spaces.

- Growth in High-Power Applications: The proliferation of mobile gaming, virtual reality, and demanding productivity applications drives the need for advanced cooling technologies.

- Advancements in Materials Science: Development of new materials with enhanced thermal conductivity and lightweight properties directly contributes to improved cooling component performance.

Barriers & Challenges:

- Cost of Advanced Materials and Manufacturing: High-performance cooling components often involve expensive materials and complex manufacturing processes, impacting overall device cost.

- Integration Complexity: Effectively integrating advanced cooling solutions into increasingly complex and miniaturized device architectures poses significant engineering challenges.

- Supply Chain Disruptions: Geopolitical events, raw material shortages, and logistics issues can disrupt the supply of critical components and materials.

- Evolving Standards and Regulations: Adapting to changing environmental regulations and energy efficiency standards can require significant R&D investment.

- Competitive Pressures: Intense competition among component manufacturers can lead to price wars and reduced profit margins.

Emerging Opportunities in Consumer Electronics Cooling Component

Emerging opportunities lie in the development of eco-friendly and sustainable cooling solutions, utilizing recycled materials or bio-based composites. The growing demand for passive cooling technologies that require no power consumption is another significant area. Furthermore, the integration of smart cooling systems that adapt to varying thermal loads using AI algorithms presents a lucrative avenue. Untapped markets in emerging economies with a rapidly growing middle class and increasing adoption of advanced consumer electronics also offer substantial growth potential. Innovative applications in wearable technology and compact IoT devices that require efficient, miniature cooling solutions represent a niche but growing opportunity.

Growth Accelerators in the Consumer Electronics Cooling Component Industry

Key growth accelerators in the consumer electronics cooling component industry include disruptive technological breakthroughs in next-generation thermal management materials, such as advanced phase-change materials and graphene-based composites, promising significantly higher thermal conductivity and lower weight. Strategic partnerships between component manufacturers and leading electronics OEMs are crucial for co-development and early adoption of innovative cooling solutions. Furthermore, market expansion strategies focusing on the burgeoning demand for gaming laptops, high-performance tablets, and advanced wearable devices will significantly fuel long-term growth by addressing specific, high-demand applications.

Key Players Shaping the Consumer Electronics Cooling Component Market

- Auras

- CCI

- Jentech

- Taisol

- Fujikura

- Forcecon Tech

- Delta Electronics

- Jones Tech

- Celsia

- Tanyuan Technology

- Aavid

- Furukawa

- Cooler Master

Notable Milestones in Consumer Electronics Cooling Component Sector

- 2021: Introduction of advanced graphene-based thermal pads offering significantly improved heat dissipation for high-performance laptops.

- 2022: Launch of ultra-thin vapor chambers for premium smartphones, enabling thinner designs without compromising performance.

- 2023: Development of novel thermoelectric cooling modules with enhanced energy efficiency for portable devices.

- 2024: Significant M&A activity with larger players acquiring specialized cooling technology startups to bolster their portfolios.

- 2025 (Estimated): Increased adoption of liquid cooling solutions in gaming laptops and compact desktop PCs, moving beyond niche applications.

In-Depth Consumer Electronics Cooling Component Market Outlook

The future of the consumer electronics cooling component market is exceptionally promising, driven by sustained innovation and escalating consumer demand for increasingly powerful and compact devices. Growth accelerators such as breakthrough advancements in thermal materials and strategic collaborations between component suppliers and device manufacturers will propel the industry forward. Market expansion efforts targeting high-growth application segments like gaming, augmented reality, and advanced computing will unlock significant potential. The industry is on the cusp of further transformation with the increasing integration of smart cooling technologies, promising enhanced efficiency and personalized thermal management, ensuring a dynamic and robust market trajectory.

Consumer Electronics Cooling Component Segmentation

-

1. Application

- 1.1. Computer

- 1.2. Cell Phone

- 1.3. Tablet

- 1.4. Other

-

2. Types

- 2.1. Thermal Film

- 2.2. Heatpipe

- 2.3. Vapor Chamber

Consumer Electronics Cooling Component Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Consumer Electronics Cooling Component REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Computer

- 5.1.2. Cell Phone

- 5.1.3. Tablet

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Thermal Film

- 5.2.2. Heatpipe

- 5.2.3. Vapor Chamber

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Computer

- 6.1.2. Cell Phone

- 6.1.3. Tablet

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Thermal Film

- 6.2.2. Heatpipe

- 6.2.3. Vapor Chamber

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Computer

- 7.1.2. Cell Phone

- 7.1.3. Tablet

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Thermal Film

- 7.2.2. Heatpipe

- 7.2.3. Vapor Chamber

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Computer

- 8.1.2. Cell Phone

- 8.1.3. Tablet

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Thermal Film

- 8.2.2. Heatpipe

- 8.2.3. Vapor Chamber

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Computer

- 9.1.2. Cell Phone

- 9.1.3. Tablet

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Thermal Film

- 9.2.2. Heatpipe

- 9.2.3. Vapor Chamber

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Consumer Electronics Cooling Component Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Computer

- 10.1.2. Cell Phone

- 10.1.3. Tablet

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Thermal Film

- 10.2.2. Heatpipe

- 10.2.3. Vapor Chamber

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Auras

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CCI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jentech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taisol

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujikura

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Forcecon Tech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Delta Electronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jones Tech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Celsia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tanyuan Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aavid

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Furukawa

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cooler Master

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Auras

List of Figures

- Figure 1: Global Consumer Electronics Cooling Component Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Consumer Electronics Cooling Component Revenue (million), by Application 2024 & 2032

- Figure 3: North America Consumer Electronics Cooling Component Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Consumer Electronics Cooling Component Revenue (million), by Types 2024 & 2032

- Figure 5: North America Consumer Electronics Cooling Component Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Consumer Electronics Cooling Component Revenue (million), by Country 2024 & 2032

- Figure 7: North America Consumer Electronics Cooling Component Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Consumer Electronics Cooling Component Revenue (million), by Application 2024 & 2032

- Figure 9: South America Consumer Electronics Cooling Component Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Consumer Electronics Cooling Component Revenue (million), by Types 2024 & 2032

- Figure 11: South America Consumer Electronics Cooling Component Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Consumer Electronics Cooling Component Revenue (million), by Country 2024 & 2032

- Figure 13: South America Consumer Electronics Cooling Component Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Consumer Electronics Cooling Component Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Consumer Electronics Cooling Component Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Consumer Electronics Cooling Component Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Consumer Electronics Cooling Component Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Consumer Electronics Cooling Component Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Consumer Electronics Cooling Component Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Consumer Electronics Cooling Component Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Consumer Electronics Cooling Component Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Consumer Electronics Cooling Component Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Consumer Electronics Cooling Component Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Consumer Electronics Cooling Component Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Consumer Electronics Cooling Component Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Consumer Electronics Cooling Component Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Consumer Electronics Cooling Component Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Consumer Electronics Cooling Component Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Consumer Electronics Cooling Component Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Consumer Electronics Cooling Component Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Consumer Electronics Cooling Component Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Consumer Electronics Cooling Component Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Consumer Electronics Cooling Component Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Consumer Electronics Cooling Component Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Consumer Electronics Cooling Component Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Consumer Electronics Cooling Component Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Consumer Electronics Cooling Component Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Consumer Electronics Cooling Component Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Consumer Electronics Cooling Component Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Consumer Electronics Cooling Component Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Consumer Electronics Cooling Component Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Electronics Cooling Component?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Consumer Electronics Cooling Component?

Key companies in the market include Auras, CCI, Jentech, Taisol, Fujikura, Forcecon Tech, Delta Electronics, Jones Tech, Celsia, Tanyuan Technology, Aavid, Furukawa, Cooler Master.

3. What are the main segments of the Consumer Electronics Cooling Component?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Electronics Cooling Component," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Electronics Cooling Component report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Electronics Cooling Component?

To stay informed about further developments, trends, and reports in the Consumer Electronics Cooling Component, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence