Key Insights

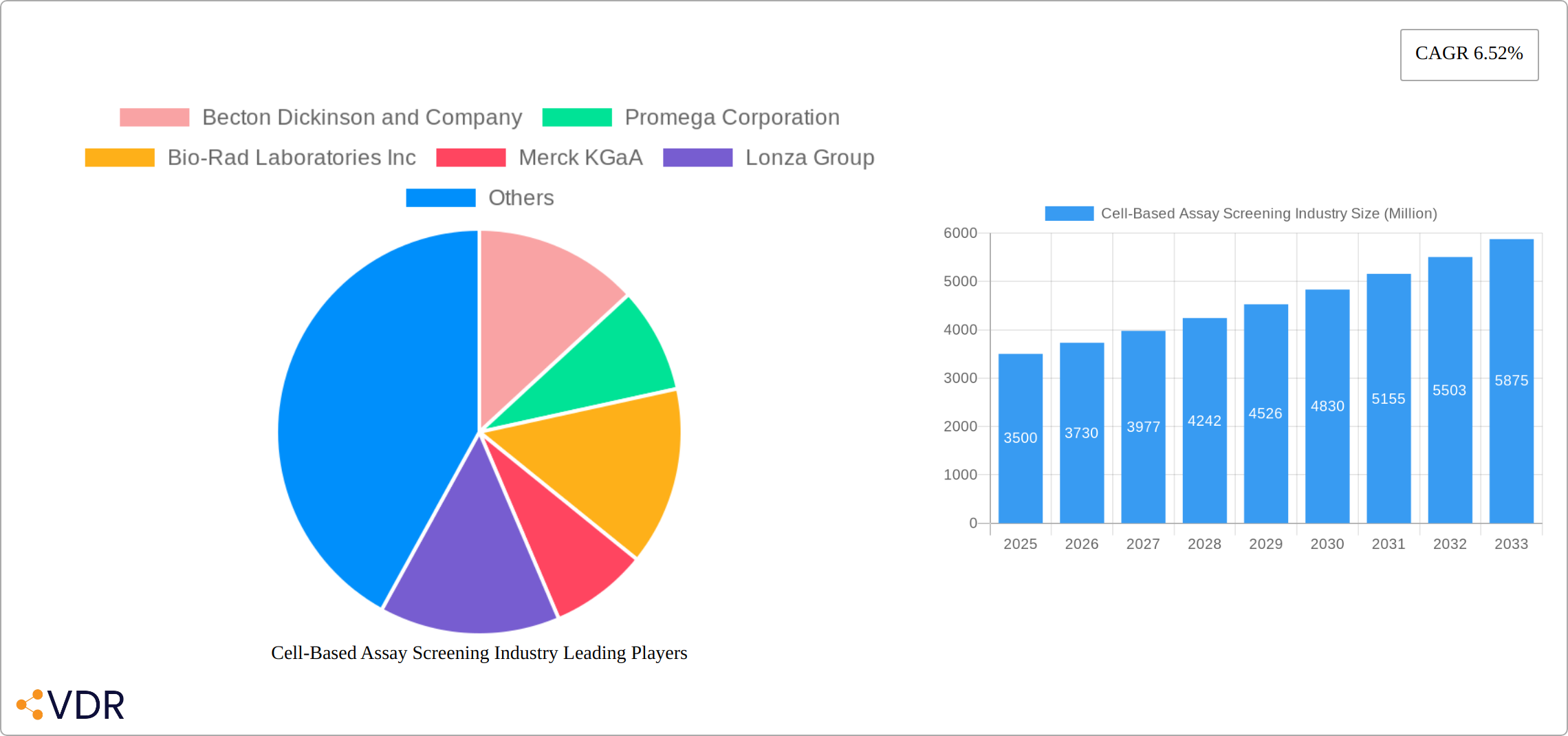

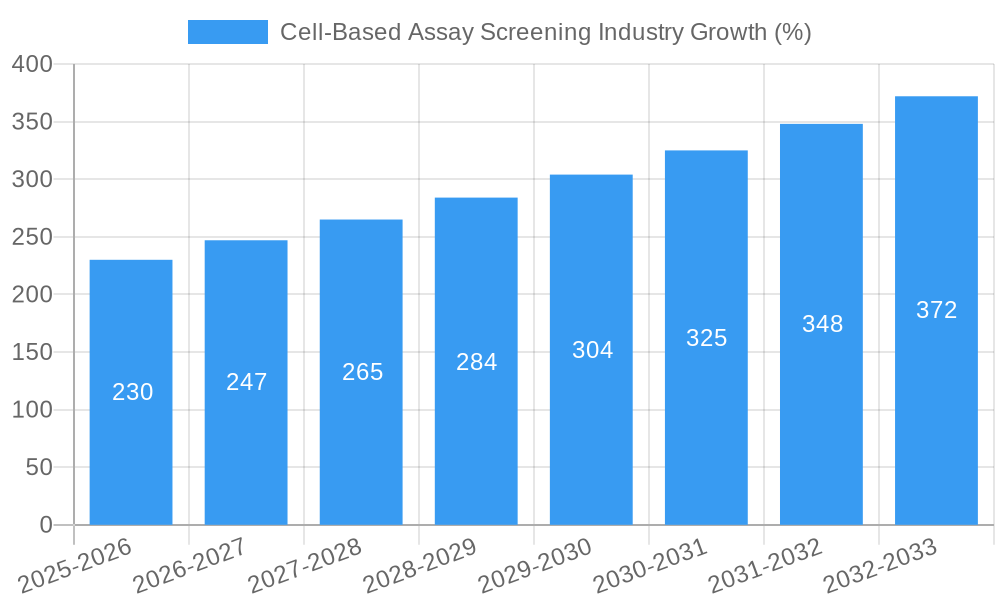

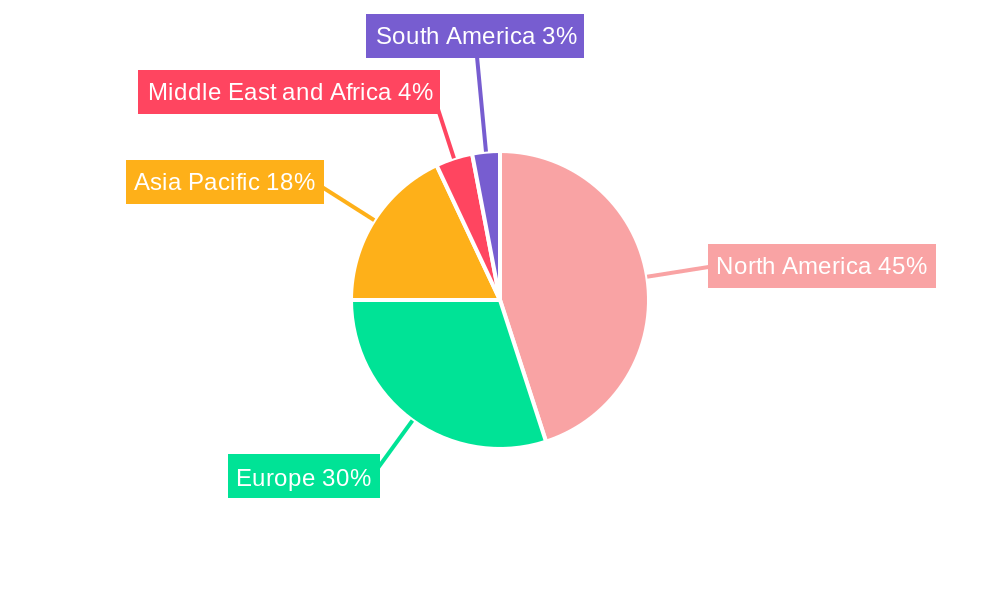

The cell-based assay screening market is experiencing robust growth, driven by the increasing demand for drug discovery and development, coupled with advancements in technologies like high-throughput screening and automated handling. The market's substantial size, estimated at several billion dollars in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.52% through 2033. Key drivers include the rising prevalence of chronic diseases necessitating new therapeutic interventions, the increasing adoption of personalized medicine approaches requiring sophisticated screening methods, and the continuous innovation in assay technologies leading to improved accuracy, efficiency, and throughput. Significant market segments include cell lines, reagents and kits, automated handling systems, and applications in drug discovery. Pharmaceutical and biotechnology companies are the major end-users, contributing a significant portion of the market revenue, followed by academic and government research institutions. North America and Europe currently hold the largest market shares due to established pharmaceutical industries and robust research infrastructure; however, the Asia-Pacific region is anticipated to witness significant growth fueled by expanding healthcare expenditure and increasing investments in research and development. Competition within the market is intense, with established players like Thermo Fisher Scientific, Becton Dickinson, and Promega dominating the landscape alongside several other key players.

The market's growth trajectory is influenced by several factors. Technological advancements, particularly in areas such as label-free detection and miniaturization of assays, are streamlining the screening process and reducing costs. However, challenges remain, including the high cost of advanced technologies and the complexity involved in developing and validating cell-based assays. Regulatory hurdles and stringent quality control requirements in the pharmaceutical industry also impact market growth. To overcome these obstacles, companies are focusing on developing cost-effective, automated solutions and collaborating with research institutions to accelerate the development and validation of new assays. The continued focus on innovative technologies and strategic partnerships will be critical in shaping the future of the cell-based assay screening market and unlocking its significant growth potential.

Cell-Based Assay Screening Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Cell-Based Assay Screening industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for industry professionals, investors, and researchers seeking a complete understanding of this rapidly evolving market. The market size is predicted to reach xx Million by 2033.

Cell-Based Assay Screening Industry Market Dynamics & Structure

The Cell-Based Assay Screening market, a sub-segment of the larger life sciences tools and consumables market, is characterized by moderate concentration with several major players dominating the landscape. Technological innovation, particularly in automation and high-throughput screening, is a key driver. Stringent regulatory frameworks, including those governing drug development and clinical trials, significantly impact market growth. Competitive pressures arise from substitute technologies and the emergence of new players. The end-user demographics are primarily driven by pharmaceutical and biotechnology companies, followed by academic and government institutes. Mergers and acquisitions (M&A) activity is moderate, with larger players seeking to expand their product portfolio and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: High-throughput screening, automation, and label-free detection are major drivers.

- Regulatory Landscape: Stringent FDA and EMA regulations influence market dynamics.

- Competitive Substitutes: Alternative screening methods and technologies exert competitive pressure.

- M&A Activity: Moderate level of consolidation, driven by expansion strategies and technological integration.

- End-User Demographics: Pharmaceutical and biotechnology companies represent the largest end-user segment (xx%), followed by academic and government institutes (xx%).

Cell-Based Assay Screening Industry Growth Trends & Insights

The Cell-Based Assay Screening market experienced significant growth during the historical period (2019-2024), driven by increasing R&D spending in the pharmaceutical and biotechnology sectors and the growing adoption of high-throughput screening technologies. The market is projected to continue its growth trajectory during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx% fueled by technological advancements, rising demand for personalized medicine, and increasing focus on drug discovery. The adoption rate of automated handling and label-free detection technologies is expected to significantly increase during the forecast period. Shifting consumer behavior towards more sophisticated and efficient screening methods also contributes to market growth. Market penetration is currently at xx% and projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Cell-Based Assay Screening Industry

North America currently dominates the Cell-Based Assay Screening market, driven by robust pharmaceutical and biotechnology industries, high R&D spending, and the presence of major market players. Europe follows as a significant market, with strong growth anticipated in Asia-Pacific, driven by expanding healthcare infrastructure and increasing investments in drug discovery.

By Product: Reagents and Kits holds the largest market share (xx%) followed by Cell Lines (xx%).

By Technology: High-throughput screening dominates (xx%), followed by automated handling (xx%).

By Application: Drug Discovery leads the market (xx%) followed by other applications (xx%).

By End-user: Pharmaceutical and Biotechnology Companies represent the largest segment (xx%), followed by Academic & Government Institutes (xx%).

- Key Drivers (North America): Strong R&D investments, presence of key players, advanced healthcare infrastructure.

- Key Drivers (Europe): Growing pharmaceutical industry, robust regulatory framework, increasing collaborations.

- Key Drivers (Asia-Pacific): Expanding healthcare infrastructure, rising disposable incomes, government initiatives.

Cell-Based Assay Screening Industry Product Landscape

The Cell-Based Assay Screening market is a dynamic landscape encompassing a wide array of products crucial for drug discovery and development. This includes a diverse range of cell lines (immortalized, primary, iPSC-derived), reagents and kits (optimized for specific assays and targets), microplates (various formats and surface treatments), sophisticated automated liquid handling systems, high-throughput screening (HTS) platforms, advanced imaging systems (including confocal microscopy and high-content screening), label-free detection technologies (impedance, optical, acoustic), flow cytometry systems, and other essential consumables. Technological advancements continuously drive innovation, leading to improvements in sensitivity, specificity, throughput, miniaturization, and ease of use. Product differentiation is keenly focused on factors such as assay speed, data quality, cost-effectiveness, and ease of integration into existing workflows. Unique selling propositions frequently highlight improved accuracy, reduced assay time, minimized hands-on time, and streamlined data analysis capabilities.

Key Drivers, Barriers & Challenges in Cell-Based Assay Screening Industry

Key Drivers:

- The escalating R&D investment in the pharmaceutical and biotechnology sectors, fueled by the demand for novel therapeutics.

- The widespread adoption of high-throughput screening (HTS) and ultra-high-throughput screening (uHTS) technologies to accelerate drug discovery.

- The growing emphasis on personalized medicine, requiring tailored assays for individual patient characteristics and genetic profiles.

- Continuous technological advancements in automation, miniaturization, artificial intelligence (AI)-driven image analysis, and label-free detection methodologies.

- The increasing prevalence of chronic diseases globally, driving the need for effective drug development.

Key Challenges and Restraints:

- The substantial upfront investment required for advanced technologies and the ongoing operational costs.

- The complexity of regulatory requirements and compliance standards for assay validation and data integrity.

- Intense competition among established players and the emergence of innovative start-ups.

- Potential supply chain disruptions impacting the availability and cost of reagents, consumables, and specialized equipment. Recent market fluctuations have resulted in significant price increases for certain reagents.

- The need for highly skilled personnel to operate complex systems and interpret complex datasets.

Emerging Opportunities in Cell-Based Assay Screening Industry

- Expansion into emerging markets characterized by growing healthcare infrastructure and investment in R&D.

- Development of innovative assays tailored to specific disease areas, including oncology, neurodegenerative disorders, and infectious diseases.

- Integration of AI and machine learning for sophisticated data analysis, predictive modeling, and improved assay design.

- Increased focus on personalized medicine and companion diagnostics to enhance treatment efficacy and patient outcomes.

- The growing use of organ-on-a-chip and other 3D cell culture models for improved physiological relevance.

Growth Accelerators in the Cell-Based Assay Screening Industry

Technological breakthroughs, particularly in areas such as AI-driven data analysis, miniaturization, improved cell culture models (e.g., 3D spheroids, organoids), and advanced imaging techniques, are significant growth catalysts. Strategic partnerships and collaborations between assay providers, pharmaceutical companies, and academic institutions are accelerating innovation and market penetration. Expansion into new therapeutic areas, such as oncology, immunotherapy, gene therapy, and regenerative medicine, creates substantial growth potential. The increasing adoption of cloud-based data management and analysis platforms also contributes to the industry's growth.

Key Players Shaping the Cell-Based Assay Screening Industry Market

- Becton Dickinson and Company

- Promega Corporation

- Bio-Rad Laboratories Inc

- Merck KGaA

- Lonza Group

- Thermo Fisher Scientific Inc

- Danaher Corporation

- Corning Inc

- Cell Signaling Technology

- PerkinElmer Inc

Notable Milestones in Cell-Based Assay Screening Industry Sector

- August 2022: Life Net Health LifeSciences launched Cell-Based Assay Services.

- May 2022: Beckman Coulter Life Sciences launched the Aquios STEM system.

In-Depth Cell-Based Assay Screening Industry Market Outlook

The Cell-Based Assay Screening market is poised for continued growth, driven by technological advancements, increasing R&D investment, and the expansion of personalized medicine. Strategic partnerships and market expansion into new therapeutic areas will further fuel growth. The development of more sophisticated, automated, and cost-effective assays presents significant opportunities for market players. The market is expected to witness significant consolidation through M&A activity.

Cell-Based Assay Screening Industry Segmentation

-

1. Product

-

1.1. Cell Lines

- 1.1.1. Primary Cell Lines

- 1.1.2. Stem Cell Lines

- 1.1.3. Others

- 1.2. Reagents and Kits

- 1.3. Microplates

- 1.4. Other Consumables

-

1.1. Cell Lines

-

2. Technology

- 2.1. Automated Handling

- 2.2. Flow Cytometry

- 2.3. Label-free Detection

- 2.4. High-throughput Screening

- 2.5. Others

-

3. Application

- 3.1. Drug Discovery

- 3.2. Other Applications

-

4. End-user

- 4.1. Academic & Government Institutes

- 4.2. Pharmaceutical and Biotechnology Companies

- 4.3. Others

Cell-Based Assay Screening Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell-Based Assay Screening Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases and Lifestyle Disorders; Increasing Investments in R&D for Drug Discovery; Rise in Technological Advancements in Cell-based Methodologies

- 3.3. Market Restrains

- 3.3.1. High Maintenance and Operational Costs; Lack of Skilled Personnel to Operate these Technologies

- 3.4. Market Trends

- 3.4.1. Drug Discovery is Expected to be the Fast Growing Segment in the Cell-Based Assay Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cell Lines

- 5.1.1.1. Primary Cell Lines

- 5.1.1.2. Stem Cell Lines

- 5.1.1.3. Others

- 5.1.2. Reagents and Kits

- 5.1.3. Microplates

- 5.1.4. Other Consumables

- 5.1.1. Cell Lines

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Automated Handling

- 5.2.2. Flow Cytometry

- 5.2.3. Label-free Detection

- 5.2.4. High-throughput Screening

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Drug Discovery

- 5.3.2. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-user

- 5.4.1. Academic & Government Institutes

- 5.4.2. Pharmaceutical and Biotechnology Companies

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Cell Lines

- 6.1.1.1. Primary Cell Lines

- 6.1.1.2. Stem Cell Lines

- 6.1.1.3. Others

- 6.1.2. Reagents and Kits

- 6.1.3. Microplates

- 6.1.4. Other Consumables

- 6.1.1. Cell Lines

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Automated Handling

- 6.2.2. Flow Cytometry

- 6.2.3. Label-free Detection

- 6.2.4. High-throughput Screening

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Drug Discovery

- 6.3.2. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-user

- 6.4.1. Academic & Government Institutes

- 6.4.2. Pharmaceutical and Biotechnology Companies

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Cell Lines

- 7.1.1.1. Primary Cell Lines

- 7.1.1.2. Stem Cell Lines

- 7.1.1.3. Others

- 7.1.2. Reagents and Kits

- 7.1.3. Microplates

- 7.1.4. Other Consumables

- 7.1.1. Cell Lines

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Automated Handling

- 7.2.2. Flow Cytometry

- 7.2.3. Label-free Detection

- 7.2.4. High-throughput Screening

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Drug Discovery

- 7.3.2. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-user

- 7.4.1. Academic & Government Institutes

- 7.4.2. Pharmaceutical and Biotechnology Companies

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Cell Lines

- 8.1.1.1. Primary Cell Lines

- 8.1.1.2. Stem Cell Lines

- 8.1.1.3. Others

- 8.1.2. Reagents and Kits

- 8.1.3. Microplates

- 8.1.4. Other Consumables

- 8.1.1. Cell Lines

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Automated Handling

- 8.2.2. Flow Cytometry

- 8.2.3. Label-free Detection

- 8.2.4. High-throughput Screening

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Drug Discovery

- 8.3.2. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-user

- 8.4.1. Academic & Government Institutes

- 8.4.2. Pharmaceutical and Biotechnology Companies

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Cell Lines

- 9.1.1.1. Primary Cell Lines

- 9.1.1.2. Stem Cell Lines

- 9.1.1.3. Others

- 9.1.2. Reagents and Kits

- 9.1.3. Microplates

- 9.1.4. Other Consumables

- 9.1.1. Cell Lines

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Automated Handling

- 9.2.2. Flow Cytometry

- 9.2.3. Label-free Detection

- 9.2.4. High-throughput Screening

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Drug Discovery

- 9.3.2. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-user

- 9.4.1. Academic & Government Institutes

- 9.4.2. Pharmaceutical and Biotechnology Companies

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Cell Lines

- 10.1.1.1. Primary Cell Lines

- 10.1.1.2. Stem Cell Lines

- 10.1.1.3. Others

- 10.1.2. Reagents and Kits

- 10.1.3. Microplates

- 10.1.4. Other Consumables

- 10.1.1. Cell Lines

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Automated Handling

- 10.2.2. Flow Cytometry

- 10.2.3. Label-free Detection

- 10.2.4. High-throughput Screening

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Drug Discovery

- 10.3.2. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-user

- 10.4.1. Academic & Government Institutes

- 10.4.2. Pharmaceutical and Biotechnology Companies

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Promega Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bio-Rad Laboratories Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Merck KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lonza Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Thermo Fisher Scientific Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Danaher Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Corning Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Cell Singnalling Technology*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Perkin Elmer Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Cell-Based Assay Screening Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cell-Based Assay Screening Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Cell-Based Assay Screening Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Cell-Based Assay Screening Industry Revenue (Million), by Technology 2024 & 2032

- Figure 15: North America Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 16: North America Cell-Based Assay Screening Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Cell-Based Assay Screening Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Cell-Based Assay Screening Industry Revenue (Million), by End-user 2024 & 2032

- Figure 19: North America Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 20: North America Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Cell-Based Assay Screening Industry Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Cell-Based Assay Screening Industry Revenue (Million), by Technology 2024 & 2032

- Figure 25: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Europe Cell-Based Assay Screening Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Cell-Based Assay Screening Industry Revenue (Million), by End-user 2024 & 2032

- Figure 29: Europe Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 30: Europe Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Product 2024 & 2032

- Figure 33: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Product 2024 & 2032

- Figure 34: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Technology 2024 & 2032

- Figure 35: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 36: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by End-user 2024 & 2032

- Figure 39: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 40: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Product 2024 & 2032

- Figure 43: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Product 2024 & 2032

- Figure 44: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Technology 2024 & 2032

- Figure 45: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by End-user 2024 & 2032

- Figure 49: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 50: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: South America Cell-Based Assay Screening Industry Revenue (Million), by Product 2024 & 2032

- Figure 53: South America Cell-Based Assay Screening Industry Revenue Share (%), by Product 2024 & 2032

- Figure 54: South America Cell-Based Assay Screening Industry Revenue (Million), by Technology 2024 & 2032

- Figure 55: South America Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 56: South America Cell-Based Assay Screening Industry Revenue (Million), by Application 2024 & 2032

- Figure 57: South America Cell-Based Assay Screening Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: South America Cell-Based Assay Screening Industry Revenue (Million), by End-user 2024 & 2032

- Figure 59: South America Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2024 & 2032

- Figure 60: South America Cell-Based Assay Screening Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 6: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: GCC Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 35: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 37: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 43: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 45: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 53: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 56: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 64: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 65: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 67: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: GCC Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 72: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 73: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 74: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 75: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Argentina Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell-Based Assay Screening Industry?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the Cell-Based Assay Screening Industry?

Key companies in the market include Becton Dickinson and Company, Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Lonza Group, Thermo Fisher Scientific Inc, Danaher Corporation, Corning Inc, Cell Singnalling Technology*List Not Exhaustive, Perkin Elmer Inc.

3. What are the main segments of the Cell-Based Assay Screening Industry?

The market segments include Product, Technology, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases and Lifestyle Disorders; Increasing Investments in R&D for Drug Discovery; Rise in Technological Advancements in Cell-based Methodologies.

6. What are the notable trends driving market growth?

Drug Discovery is Expected to be the Fast Growing Segment in the Cell-Based Assay Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Maintenance and Operational Costs; Lack of Skilled Personnel to Operate these Technologies.

8. Can you provide examples of recent developments in the market?

In August 2022, Life Net Health LifeSciences launched the Cell-Based Assay Services including cytotoxicity screening, biocompatibility assays, and others

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell-Based Assay Screening Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell-Based Assay Screening Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell-Based Assay Screening Industry?

To stay informed about further developments, trends, and reports in the Cell-Based Assay Screening Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence