Key Insights

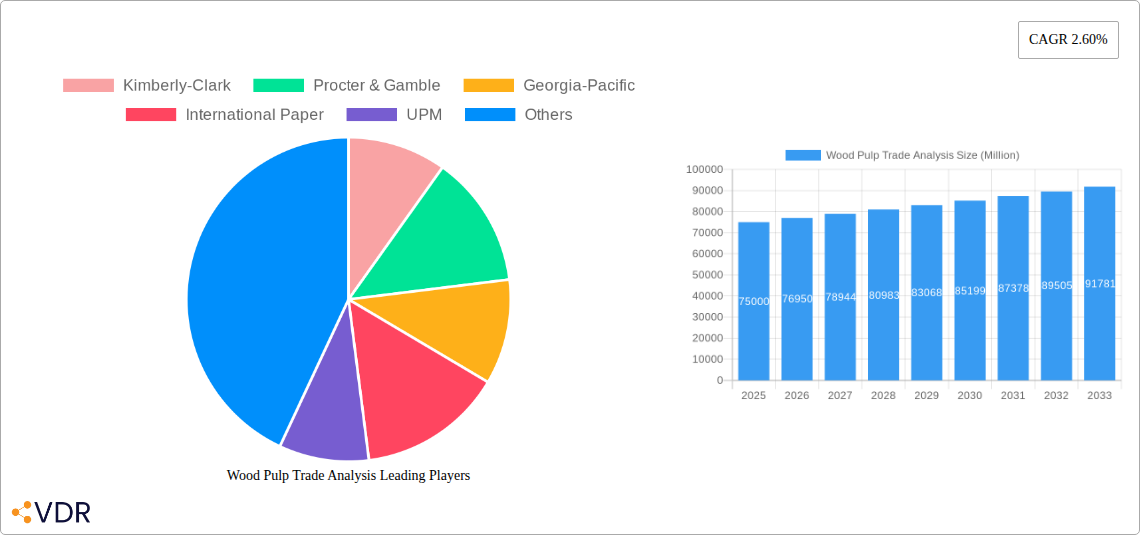

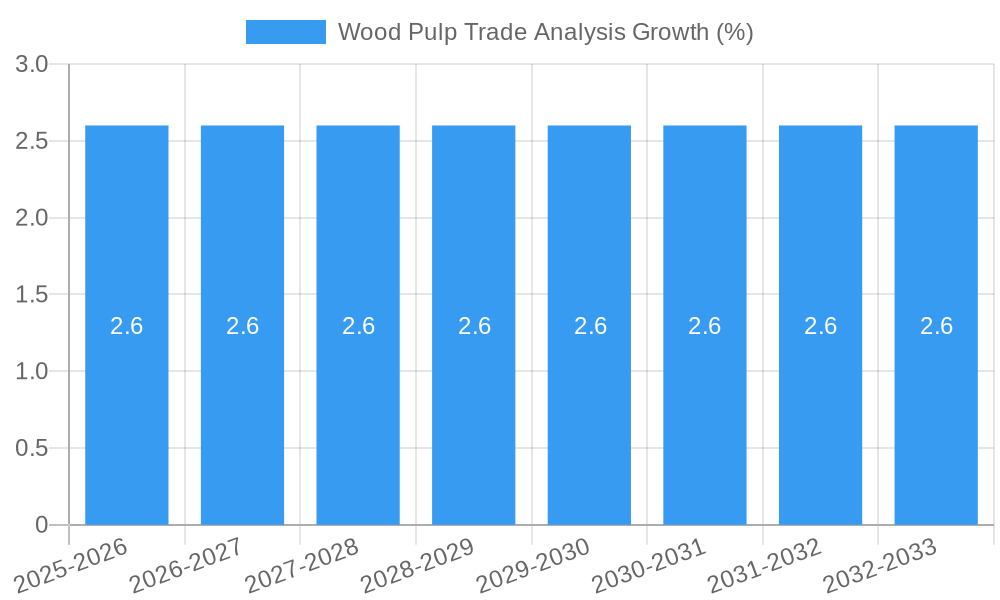

The global wood pulp trade is poised for steady growth, with an estimated market size of $XX Million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.60% through 2033. This sustained expansion is primarily fueled by robust demand from key end-use industries such as packaging, hygiene products, and printing and writing papers. The burgeoning e-commerce sector, in particular, continues to drive the need for corrugated packaging, a significant consumer of wood pulp. Furthermore, increasing disposable incomes in emerging economies, especially in the Asia Pacific region, are leading to higher consumption of paper-based products, further bolstering market growth. Innovations in pulp production technologies, aimed at improving efficiency and sustainability, are also contributing to market dynamics.

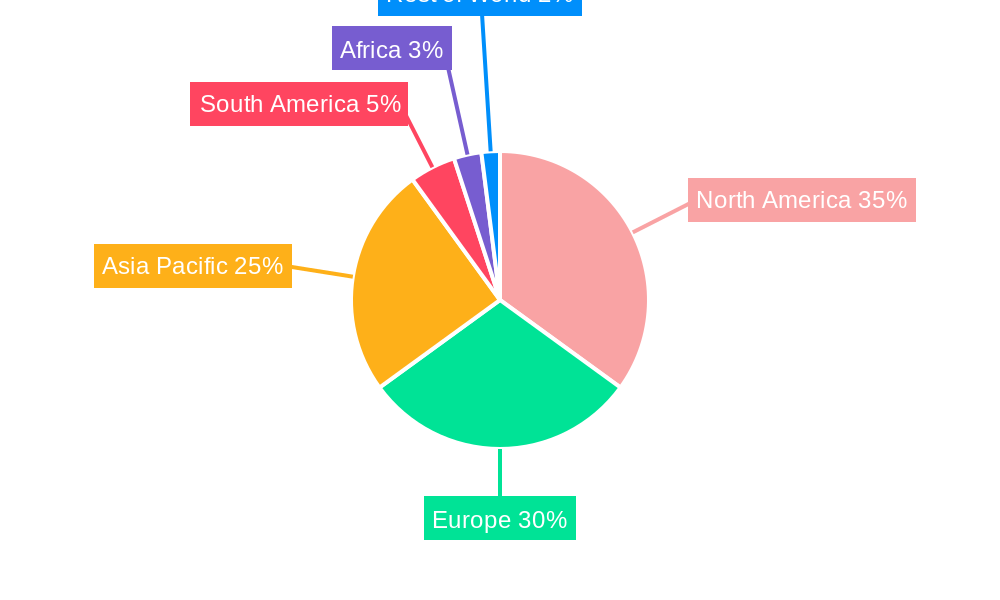

However, the wood pulp trade faces certain headwinds that could temper its growth trajectory. Rising operational costs, including energy and raw material procurement, coupled with stringent environmental regulations concerning forestry and effluent discharge, present significant restraints. Geopolitical uncertainties and fluctuations in currency exchange rates can also impact trade flows and pricing. Despite these challenges, the market is witnessing a notable trend towards increased production and consumption of unbleached and recycled pulp as sustainability becomes a paramount concern for manufacturers and consumers alike. The North America and Europe regions are expected to remain dominant in terms of both production and consumption, while Asia Pacific is anticipated to exhibit the fastest growth due to its expanding industrial base and consumer market. Key players like Kimberly-Clark, Procter & Gamble, and International Paper are strategically investing in capacity expansions and sustainable sourcing to maintain their competitive edge.

This in-depth report provides a meticulous analysis of the global wood pulp trade market, encompassing a study period from 2019 to 2033, with 2025 as both the base and estimated year. Delving into historical trends from 2019-2024 and projecting future growth through 2033, this analysis offers critical insights for stakeholders in the pulp and paper industry. We meticulously examine parent market and child market dynamics, providing actionable intelligence for strategic decision-making. All quantitative data is presented in Million units for clarity and accessibility.

Wood Pulp Trade Analysis Market Dynamics & Structure

The wood pulp market exhibits a moderately concentrated structure, influenced by significant players like Kimberly-Clark, Procter & Gamble, Georgia-Pacific, International Paper, and UPM, which collectively hold substantial market share. Technological innovation acts as a key driver, particularly in improving pulping efficiency and developing sustainable forestry practices. However, innovation is sometimes hindered by the high capital investment required for advanced technologies and the long gestation periods for research and development. Regulatory frameworks, including environmental protection laws and international trade agreements, significantly shape market access and production standards. Competitive product substitutes, such as recycled paper and alternative fiber sources, exert pressure on virgin wood pulp demand. End-user demographics are shifting, with growing demand for packaging materials driven by e-commerce and a decline in printing and writing paper consumption due to digitization. Mergers and acquisitions (M&A) are observed as a strategic tool for market consolidation and portfolio expansion, with a notable volume of deals in recent years aimed at securing supply chains and enhancing market reach. For instance, recent M&A activity indicates a trend towards vertical integration and increased operational scale.

- Market Concentration: Moderately concentrated with key players holding significant share.

- Technological Drivers: Efficiency improvements, sustainable forestry, bio-based pulp innovations.

- Regulatory Impact: Environmental standards, trade policies, and sustainability mandates.

- Substitute Competition: Recycled pulp, agricultural fibers, and synthetic alternatives.

- End-User Shifts: Declining NP/PWP, growing PP demand.

- M&A Trends: Consolidation, vertical integration, supply chain security, an estimated XX M&A deals in the historical period.

Wood Pulp Trade Analysis Growth Trends & Insights

The global wood pulp trade market is poised for robust expansion, driven by evolving consumer preferences and the increasing demand for sustainable packaging solutions. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by rising adoption rates of innovative wood pulp-based products in diverse applications, ranging from hygiene products to advanced composite materials. Technological disruptions, such as advancements in chemical pulping processes and the development of high-yield pulping methods, are enhancing production efficiency and reducing environmental footprints. Consumer behavior shifts are profoundly impacting the market; the burgeoning e-commerce sector fuels an insatiable demand for packaging paper, a key child market for wood pulp. Conversely, the pervasive influence of digitization continues to dampen demand for traditional newsprint and printing writing papers, highlighting a significant paradigm shift in consumption patterns. The market penetration of specialty wood pulp grades, designed for specific high-performance applications, is also on the rise. The total market size is estimated to reach $XXX Billion by 2033, up from an estimated $XXX Billion in 2025.

- Market Size Evolution: Projected CAGR of XX% from 2025-2033, reaching an estimated $XXX Billion by 2033.

- Adoption Rates: Increasing adoption of sustainable wood pulp products and advanced packaging.

- Technological Disruptions: Innovations in pulping, bio-refining, and fiber treatment.

- Consumer Behavior Shifts: Transition from PWP to PP driven by e-commerce and digitalization.

- Market Penetration: Growing penetration of specialty pulp grades for niche applications.

Dominant Regions, Countries, or Segments in Wood Pulp Trade Analysis

The production analysis of wood pulp is largely dominated by regions with abundant forest resources and established pulp and paper industries. North America, particularly the United States and Canada, along with Nordic countries like Sweden and Finland, are leading global producers, accounting for approximately XX% of the total global production. This dominance is attributed to extensive coniferous and deciduous forests, advanced forestry management practices, and significant investments in pulp manufacturing infrastructure.

In terms of consumption analysis, Asia-Pacific, led by China, is emerging as the largest consuming region, driven by its massive manufacturing base and a rapidly growing middle class. The region accounts for nearly XX% of global wood pulp consumption. This surge is primarily fueled by the escalating demand for packaging paper, a critical child market, to support the booming e-commerce and FMCG sectors.

The import market analysis (value & volume) is also significantly influenced by the Asia-Pacific region, particularly China and India, which rely heavily on imports to meet their burgeoning demand for various wood pulp grades. The value of global wood pulp imports is estimated at $XX Billion in 2025, with Asia-Pacific representing XX% of this value. The volume of imports is projected to reach XXX Million tons in 2025.

Conversely, the export market analysis (value & volume) is dominated by established pulp-producing nations in North America and Europe. These regions export substantial volumes of softwood and hardwood pulp to meet global demand. The value of global wood pulp exports is estimated at $XX Billion in 2025, with North America contributing XX% and Europe contributing XX%. The projected export volume stands at XXX Million tons for 2025.

The price trend analysis indicates a dynamic market influenced by supply-demand imbalances, raw material costs, and geopolitical factors. Historically, prices have fluctuated, with an average annual increase of XX% observed during the historical period. The packaging paper (PP) segment is the primary driver of growth within the child market spectrum, outperforming the declining newsprint papers (NP) and printing writing papers (PWP) segments.

- Production Dominance: North America (XX%) and Europe (XX%) due to vast forest resources and advanced infrastructure.

- Consumption Leadership: Asia-Pacific (XX%) driven by manufacturing and e-commerce growth.

- Import Hubs: China and India in Asia-Pacific, reflecting their substantial demand.

- Export Powerhouses: North America and Europe, supplying global markets.

- Segment Growth Driver: Packaging Paper (PP) segment experiencing significant expansion.

Wood Pulp Trade Analysis Product Landscape

The wood pulp trade encompasses a variety of product types crucial for diverse industrial applications. Key products include bleached and unbleached softwood kraft pulp, hardwood kraft pulp, and mechanical pulp. Softwood pulp is prized for its long fibers, providing strength and durability for paper and board production, while hardwood pulp offers brightness and smoothness for fine papers. Innovations are continuously enhancing pulp performance, leading to the development of specialized grades such as fluff pulp for absorbent hygiene products and high-purity dissolving pulp for rayon and cellulose derivatives. The application landscape is broad, spanning from essential printing and writing papers to high-strength packaging boards, tissue products, and bio-based materials, showcasing the versatility and critical role of wood pulp in the modern economy.

Key Drivers, Barriers & Challenges in Wood Pulp Trade Analysis

The wood pulp trade market is propelled by several key drivers. The escalating global demand for sustainable packaging solutions, fueled by the rise of e-commerce and increasing environmental awareness, is a primary growth catalyst. Advancements in pulping technologies leading to improved efficiency and reduced environmental impact also play a crucial role. Furthermore, the growing demand for tissue and hygiene products in emerging economies represents a significant opportunity.

However, the market faces several barriers and challenges. Fluctuations in raw material costs, particularly timber prices, can significantly impact profitability. Stringent environmental regulations and evolving sustainability standards necessitate continuous investment in greener technologies and practices. Supply chain disruptions, such as logistical bottlenecks and geopolitical instability, can hinder trade flows and increase costs. Intense competition from recycled fiber and other alternative materials also poses a challenge.

- Key Drivers:

- Rising demand for sustainable packaging.

- Technological advancements in pulping.

- Growth in tissue and hygiene products.

- Key Barriers & Challenges:

- Volatile raw material costs.

- Strict environmental regulations.

- Supply chain disruptions.

- Competition from recycled fiber.

Emerging Opportunities in Wood Pulp Trade Analysis

Emerging opportunities in the wood pulp trade lie in the expanding market for biodegradable and compostable packaging materials, where wood pulp can be a key component. The development of advanced bio-based materials and composites utilizing wood pulp fibers presents a significant untapped market. Furthermore, the increasing global focus on circular economy principles creates opportunities for companies that can efficiently integrate recycled pulp with virgin pulp production. The growing demand for specialty pulp grades in niche applications, such as in the textile and pharmaceutical industries, also offers promising avenues for growth.

Growth Accelerators in the Wood Pulp Trade Analysis Industry

Long-term growth in the wood pulp trade industry is being accelerated by several factors. Breakthroughs in bio-refining technologies are enabling the extraction of higher-value co-products from wood pulp processing, diversifying revenue streams and enhancing sustainability. Strategic partnerships between pulp producers, packaging manufacturers, and end-users are fostering innovation and market penetration for new products. Furthermore, market expansion strategies focusing on emerging economies with growing disposable incomes and increasing demand for consumer goods are crucial growth accelerators.

Key Players Shaping the Wood Pulp Trade Analysis Market

- Kimberly-Clark

- Procter & Gamble

- Georgia-Pacific

- International Paper

- UPM

Notable Milestones in Wood Pulp Trade Analysis Sector

- December 2022: The Indian Institute of Technology (IIT) Roorkee, in association with Shah Paper Mills Limited, launched a new project to develop the advanced packaging research laboratory and skill development program at the Department of Paper Technology, Saharanpur Campus. The institute has been fostering collaboration with paper industries from India, focusing on providing cutting-edge innovation research and skill development globally, enhancing the R&D landscape for packaging.

- April 2022: According to the Investment Information and Credit Rating Agency of India Limited (ICRA), the paper industry in India is going through a paradigm shift from a demand perspective. Demand for newsprint papers (NP) and printing writing papers (PWP) is declining, and the impact of digitization is becoming more pronounced. In contrast, the packaging paper (PP) segment is growing, with rising demand for packaging from e-commerce, food and food products, FMCG, and the pharmaceutical sector, signifying a significant market restructuring.

In-Depth Wood Pulp Trade Analysis Market Outlook

- December 2022: The Indian Institute of Technology (IIT) Roorkee, in association with Shah Paper Mills Limited, launched a new project to develop the advanced packaging research laboratory and skill development program at the Department of Paper Technology, Saharanpur Campus. The institute has been fostering collaboration with paper industries from India, focusing on providing cutting-edge innovation research and skill development globally, enhancing the R&D landscape for packaging.

- April 2022: According to the Investment Information and Credit Rating Agency of India Limited (ICRA), the paper industry in India is going through a paradigm shift from a demand perspective. Demand for newsprint papers (NP) and printing writing papers (PWP) is declining, and the impact of digitization is becoming more pronounced. In contrast, the packaging paper (PP) segment is growing, with rising demand for packaging from e-commerce, food and food products, FMCG, and the pharmaceutical sector, signifying a significant market restructuring.

In-Depth Wood Pulp Trade Analysis Market Outlook

The wood pulp trade market outlook is decidedly optimistic, with growth accelerators such as innovation in biodegradable materials and the expanding circular economy paving the way for a sustainable future. Strategic opportunities abound in catering to the burgeoning demand for advanced packaging solutions and specialty pulp grades in developing economies. The industry's ability to adapt to evolving consumer preferences and leverage technological advancements will be key to unlocking its full potential and ensuring sustained growth in the coming years.

Wood Pulp Trade Analysis Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Wood Pulp Trade Analysis Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

- 2.5. Netherlands

- 2.6. Sweden

- 2.7. Russia

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. India

- 3.4. South Korea

- 3.5. Japan

- 3.6. Indonesia

-

4. South America

- 4.1. Brazil

- 4.2. Chile

-

5. Africa

- 5.1. South Africa

Wood Pulp Trade Analysis REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Huge Demand in Packaging and Industrial Papers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Wood Pulp Trade Analysis Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Kimberly-Clark

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Procter & Gamble

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Georgia-Pacific

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 International Paper

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 UPM

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.1 Kimberly-Clark

List of Figures

- Figure 1: Global Wood Pulp Trade Analysis Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Wood Pulp Trade Analysis Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America Wood Pulp Trade Analysis Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America Wood Pulp Trade Analysis Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Wood Pulp Trade Analysis Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Wood Pulp Trade Analysis Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Wood Pulp Trade Analysis Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: Europe Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: Europe Wood Pulp Trade Analysis Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: Europe Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: Europe Wood Pulp Trade Analysis Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: Europe Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: Europe Wood Pulp Trade Analysis Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: Europe Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: Europe Wood Pulp Trade Analysis Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: Europe Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: Europe Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Asia Pacific Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 47: Asia Pacific Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 48: South America Wood Pulp Trade Analysis Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: South America Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: South America Wood Pulp Trade Analysis Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: South America Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: South America Wood Pulp Trade Analysis Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: South America Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: South America Wood Pulp Trade Analysis Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: South America Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: South America Wood Pulp Trade Analysis Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: South America Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: South America Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 59: South America Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

- Figure 60: Africa Wood Pulp Trade Analysis Revenue (Million), by Production Analysis 2024 & 2032

- Figure 61: Africa Wood Pulp Trade Analysis Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 62: Africa Wood Pulp Trade Analysis Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 63: Africa Wood Pulp Trade Analysis Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 64: Africa Wood Pulp Trade Analysis Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Africa Wood Pulp Trade Analysis Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Africa Wood Pulp Trade Analysis Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Africa Wood Pulp Trade Analysis Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Africa Wood Pulp Trade Analysis Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 69: Africa Wood Pulp Trade Analysis Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 70: Africa Wood Pulp Trade Analysis Revenue (Million), by Country 2024 & 2032

- Figure 71: Africa Wood Pulp Trade Analysis Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Belgium Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherland Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Nordics Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Japan Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Korea Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Southeast Asia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Australia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Indonesia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Phillipes Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Thailandc Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Argentina Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Peru Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Chile Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Ecuador Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Venezuela Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Arab Emirates Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Saudi Arabia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East and Africa Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 51: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 52: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 53: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 54: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 55: United States Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Canada Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Mexico Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 59: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 60: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 61: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 62: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 63: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Germany Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: United Kingdom Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Italy Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: France Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Netherlands Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Sweden Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Russia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 72: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 73: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 74: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 75: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 76: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 77: China Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Australia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: India Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: South Korea Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: Japan Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Indonesia Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 83: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 84: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 85: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 86: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 87: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 88: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 89: Brazil Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Chile Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

- Table 91: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 92: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 93: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 94: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 95: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 96: Global Wood Pulp Trade Analysis Revenue Million Forecast, by Country 2019 & 2032

- Table 97: South Africa Wood Pulp Trade Analysis Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wood Pulp Trade Analysis?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Wood Pulp Trade Analysis?

Key companies in the market include Kimberly-Clark , Procter & Gamble , Georgia-Pacific, International Paper , UPM .

3. What are the main segments of the Wood Pulp Trade Analysis?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Huge Demand in Packaging and Industrial Papers.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

December 2022: The Indian Institute of Technology (IIT) Roorkee, in association with Shah Paper Mills Limited, launched a new project to develop the advanced packaging research laboratory and skill development program at the Department of Paper Technology, Saharanpur Campus. The institute has been fostering collaboration with paper industries from India, focusing on providing cutting-edge innovation research and skill development globally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wood Pulp Trade Analysis," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wood Pulp Trade Analysis report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wood Pulp Trade Analysis?

To stay informed about further developments, trends, and reports in the Wood Pulp Trade Analysis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence