Key Insights

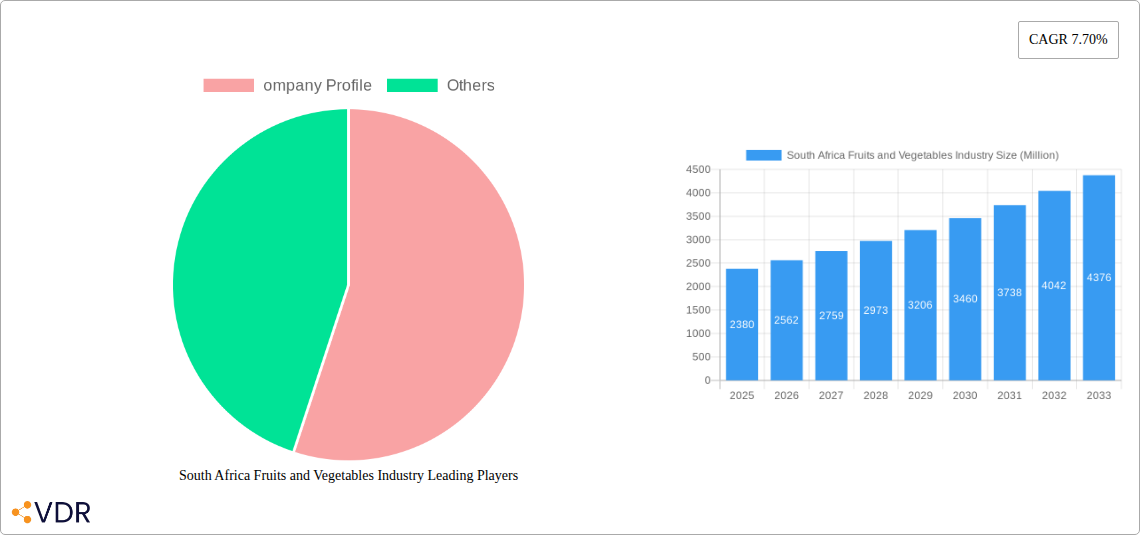

The South African fruits and vegetables industry is poised for robust growth, with a current market size estimated at ZAR 2.38 billion. This dynamic sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.70% over the forecast period from 2019 to 2033, indicating a significant upward trajectory. The market's expansion is propelled by a confluence of factors, including increasing consumer demand for healthier food options, a growing emphasis on locally sourced produce, and the country's favorable climate for diverse agricultural cultivation. Furthermore, advancements in agricultural technology and farming practices are enhancing production efficiency and quality, contributing to both domestic consumption and export potential. The industry encompasses a wide range of products, from staple vegetables to an array of globally popular fruits, catering to a broad consumer base and a variety of international markets.

South Africa Fruits and Vegetables Industry Market Size (In Billion)

Key drivers influencing this growth include the rising disposable incomes in South Africa, which allow for greater expenditure on fresh produce, and a greater awareness of the health benefits associated with a diet rich in fruits and vegetables. Government initiatives aimed at supporting the agricultural sector, such as subsidies and infrastructure development, also play a crucial role in fostering a conducive environment for market expansion. While the market benefits from strong domestic demand and a growing export market, potential restraints could emerge from fluctuating weather patterns, the impact of climate change on crop yields, and evolving international trade regulations. Nevertheless, the inherent strengths of South Africa's agricultural sector, coupled with ongoing innovation, suggest a promising outlook for sustained growth and profitability within the fruits and vegetables industry.

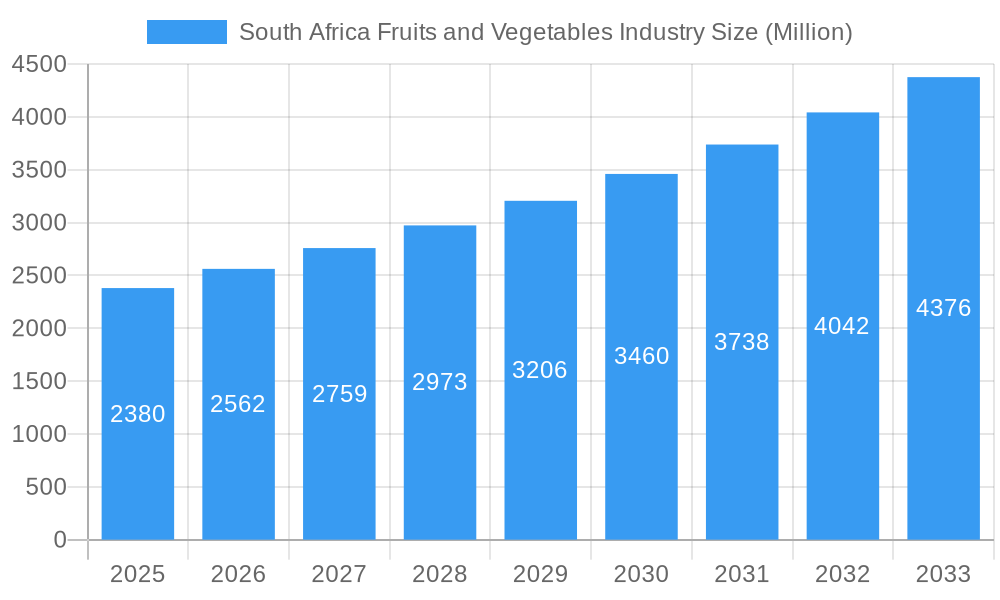

South Africa Fruits and Vegetables Industry Company Market Share

This comprehensive report offers an in-depth analysis of the South African fruits and vegetables industry, encompassing production, consumption, imports, and exports from 2019 to 2033. Leveraging extensive data and market insights, this report provides a strategic roadmap for stakeholders seeking to understand and capitalize on the dynamic landscape of this vital sector. With a base year of 2025 and a forecast period extending to 2033, the report delves into market structure, growth drivers, regional dominance, product innovation, challenges, and emerging opportunities, all presented with actionable insights for industry professionals.

South Africa Fruits and Vegetables Industry Market Dynamics & Structure

The South African fruits and vegetables industry is characterized by a moderate level of market concentration, with several large-scale commercial farms and a significant number of smallholder producers coexisting. Technological innovation, particularly in precision agriculture, improved irrigation systems, and post-harvest handling, is a key driver of efficiency and quality enhancements. Regulatory frameworks, including food safety standards and trade agreements, play a crucial role in shaping market access and competitiveness. The presence of competitive product substitutes, such as processed and preserved options, influences consumer choices. End-user demographics, including a growing middle class and increasing health consciousness, are shifting demand towards fresh, high-quality produce. Mergers and acquisitions (M&A) trends are observed as larger entities seek to consolidate market share and achieve economies of scale.

- Market Concentration: Moderate, with a mix of large commercial enterprises and numerous smallholder farmers.

- Technological Innovation: Driven by precision farming, advanced irrigation, and enhanced post-harvest technologies.

- Regulatory Frameworks: Stringent food safety standards and evolving trade policies impacting market access.

- Competitive Substitutes: Growing demand for fresh produce countered by the availability of processed and preserved alternatives.

- End-User Demographics: Shifting consumer preferences towards healthy eating and premium produce.

- M&A Trends: Consolidation strategies to enhance market presence and operational efficiency.

South Africa Fruits and Vegetables Industry Growth Trends & Insights

The South African fruits and vegetables industry is poised for significant growth, driven by a confluence of factors including an expanding population, increasing disposable incomes, and a burgeoning export market. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. Adoption rates of advanced farming techniques are steadily increasing, fueled by government initiatives and private sector investments aimed at improving productivity and sustainability. Technological disruptions, such as the integration of artificial intelligence in crop management and the rise of vertical farming, are set to revolutionize production methods. Consumer behavior shifts, including a heightened awareness of health and wellness, a preference for locally sourced produce, and a growing demand for organic and sustainably grown fruits and vegetables, are fundamentally reshaping market dynamics. The penetration of modern retail channels and e-commerce platforms is further expanding market reach and accessibility, contributing to overall market expansion.

The Vegetables segment, particularly staple crops like tomatoes, potatoes, and leafy greens, demonstrates robust production and consumption growth, driven by consistent domestic demand. The Fruits segment, with its diverse offerings ranging from citrus and berries to tropical fruits, showcases strong export potential, capitalizing on global demand for high-quality South African produce. Production Analysis reveals a steady increase in output, attributed to improved farming practices and favorable climatic conditions in key growing regions. Consumption Analysis indicates a rising trend, influenced by urbanization and changing dietary patterns. Import Analysis highlights the demand for specific varieties not readily available domestically, while Export Analysis showcases South Africa's growing prominence as a global supplier of premium fruits and vegetables, with key markets in Europe, Asia, and Africa.

- Market Size Evolution: Projected to experience substantial growth driven by population and economic factors.

- CAGR: Expected to be around XX% during the forecast period.

- Adoption Rates: Increasing uptake of modern agricultural technologies and sustainable practices.

- Technological Disruptions: AI in agriculture, vertical farming, and advanced analytics shaping future production.

- Consumer Behavior Shifts: Growing emphasis on health, sustainability, and local sourcing.

- Market Penetration: Expansion through modern retail and e-commerce channels.

Dominant Regions, Countries, or Segments in South Africa Fruits and Vegetables Industry

Within the South African fruits and vegetables industry, several regions and segments consistently drive market growth. The Western Cape province stands out as a dominant region, particularly for fruit production, owing to its favorable climate, fertile soils, and established export infrastructure. Its extensive vineyards, orchards, and berry farms contribute significantly to the nation's output and export revenue.

In terms of Vegetables: Production Analysis, the Highveld region (encompassing provinces like Gauteng, Free State, and Mpumalanga) leads in the cultivation of staple vegetables such as potatoes, onions, and maize, driven by proximity to major consumption centers and robust agricultural support. Consumption Analysis for vegetables is also heavily concentrated in urban areas like Johannesburg and Cape Town, fueled by a large and diverse population.

For Fruits: Production Analysis, beyond the Western Cape, the Limpopo province is a major contributor to the production of subtropical fruits like mangoes, avocados, and citrus. Consumption Analysis for fruits shows a broad appeal across all demographics, with a growing demand for exotic and readily available options.

The Export Analysis for both fruits and vegetables is heavily influenced by the Western Cape and Limpopo provinces. Key export drivers include stringent quality control, adherence to international standards, and favorable trade agreements. The Vegetables: Export Analysis highlights strong demand for products like sweet potatoes and certain leafy greens in neighboring African countries and select European markets. The Fruits: Export Analysis showcases South Africa's global competitiveness in exporting deciduous fruits, citrus, and increasingly, berries and avocados.

- Dominant Region: Western Cape for fruit production and exports, Highveld for staple vegetable production.

- Key Vegetable Production Drivers: Proximity to urban centers, favorable climate for staples.

- Key Fruit Production Drivers: Ideal climatic conditions, established export infrastructure.

- Dominant Consumption Hubs: Major urban centers like Johannesburg and Cape Town.

- Export Growth Drivers: Quality assurance, international standards, trade agreements.

- Growth Potential: Untapped demand in African markets and continued expansion in established European and Asian markets.

South Africa Fruits and Vegetables Industry Product Landscape

The South African fruits and vegetables industry boasts a diverse and evolving product landscape, characterized by an increasing emphasis on quality, variety, and value-added products. Innovations in breeding programs are yielding new cultivars with enhanced disease resistance, improved shelf life, and desirable taste profiles, catering to both domestic and international consumer preferences. Applications extend beyond fresh consumption to include processing for juices, jams, dried fruits, and frozen vegetables, expanding market reach and reducing post-harvest losses. Performance metrics such as yield per hectare, nutritional content, and visual appeal are key differentiators. Unique selling propositions often lie in the "South African origin" story, emphasizing natural growing conditions and sustainable practices. Technological advancements in packaging and cold chain logistics are crucial for maintaining product integrity and extending market reach.

Key Drivers, Barriers & Challenges in South Africa Fruits and Vegetables Industry

The South African fruits and vegetables industry is propelled by several key drivers, including a growing domestic population, increasing export demand, favorable government policies supporting agriculture, and technological advancements in farming practices. The demand for healthier food options and the country's potential to become a major food exporter are significant economic drivers.

However, the industry faces considerable barriers and challenges. These include:

- Climate Change and Water Scarcity: Unpredictable weather patterns and limited water resources pose significant threats to production yields and consistency.

- Supply Chain Inefficiencies: Inadequate infrastructure, high transportation costs, and post-harvest losses impact profitability and market competitiveness.

- Regulatory Hurdles: Navigating complex food safety regulations, import/export compliance, and land reform policies can be challenging.

- Pest and Disease Outbreaks: The constant threat of new and existing pests and diseases requires continuous investment in biosecurity and crop protection.

- Competition: Intense competition from international markets and domestic players, particularly on price.

Emerging Opportunities in South Africa Fruits and Vegetables Industry

Emerging opportunities within the South African fruits and vegetables industry are abundant, driven by evolving consumer preferences and global market trends. The increasing demand for organic and sustainably produced fruits and vegetables presents a significant growth avenue, with consumers willing to pay a premium for ethically sourced produce. Furthermore, the untapped potential of niche and exotic fruits and vegetables in both domestic and international markets offers lucrative prospects. The development of value-added products, such as pre-cut vegetables, ready-to-eat fruit salads, and specialized fruit-based snacks, caters to the convenience-driven lifestyles of modern consumers and expands market opportunities beyond fresh produce.

Growth Accelerators in the South Africa Fruits and Vegetables Industry Industry

Several key catalysts are accelerating long-term growth in the South African fruits and vegetables industry. Technological breakthroughs in precision agriculture, including AI-driven analytics for optimizing irrigation, fertilization, and pest control, are significantly enhancing farm productivity and resource efficiency. Strategic partnerships between producers, research institutions, and international buyers are crucial for market access, knowledge transfer, and product development. Market expansion strategies, including the exploration of new export markets in Africa and Asia, coupled with a focus on diversifying the product portfolio to include high-value crops, are instrumental in driving sustained growth. Investment in cold chain infrastructure and logistics further enhances competitiveness and reduces post-harvest losses.

Key Players Shaping the South Africa Fruits and Vegetables Industry Market

- Capespan Group

- Zest WEG Group

- Dutoit Agri

- Fruitways

- Sun Valley Group

- Groen Agro

- Stellenbosch Vineyards

- Paarl Fruit Growers

- The Fruit Authority

- Invicta Holdings

Notable Milestones in South Africa Fruits and Vegetables Industry Sector

- 2019: Increased investment in protected cropping and vertical farming technologies.

- 2020: Growing consumer demand for locally sourced and organic produce post-pandemic.

- 2021: South Africa secures new export market access for specific fruit varieties in Asia.

- 2022: Implementation of advanced traceability systems across the supply chain.

- 2023: Launch of new disease-resistant crop varieties developed through local research.

- 2024: Significant government funding allocated to improve irrigation infrastructure in water-scarce regions.

In-Depth South Africa Fruits and Vegetables Industry Market Outlook

The South African fruits and vegetables industry is on a trajectory of sustained growth, fueled by robust domestic demand and an expanding global footprint. The market outlook is characterized by increasing adoption of sustainable and technologically advanced farming practices, leading to higher yields and improved product quality. Future market potential lies in further diversifying export offerings, capitalizing on the growing demand for niche and exotic produce, and enhancing the value-added product segment. Strategic opportunities include leveraging e-commerce for wider market penetration, fostering collaborations for R&D, and addressing water scarcity through innovative solutions. The industry is well-positioned to benefit from global trends prioritizing health, sustainability, and traceable food systems.

South Africa Fruits and Vegetables Industry Segmentation

-

1. Vegetables

- 1.1. Production Analysis

- 1.2. Consumption Analysis

- 1.3. Import Analysis

- 1.4. Export Analysis

-

2. Fruits

- 2.1. Production Analysis

- 2.2. Consumption Analysis

- 2.3. Import Analysis

- 2.4. Export Analysis

-

3. Vegetables

- 3.1. Production Analysis

- 3.2. Consumption Analysis

- 3.3. Import Analysis

- 3.4. Export Analysis

-

4. Fruits

- 4.1. Production Analysis

- 4.2. Consumption Analysis

- 4.3. Import Analysis

- 4.4. Export Analysis

South Africa Fruits and Vegetables Industry Segmentation By Geography

- 1. South Africa

South Africa Fruits and Vegetables Industry Regional Market Share

Geographic Coverage of South Africa Fruits and Vegetables Industry

South Africa Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Increase in Health Consciousness Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Fruits and Vegetables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis

- 5.1.3. Import Analysis

- 5.1.4. Export Analysis

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis

- 5.2.3. Import Analysis

- 5.2.4. Export Analysis

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis

- 5.3.3. Import Analysis

- 5.3.4. Export Analysis

- 5.4. Market Analysis, Insights and Forecast - by Fruits

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis

- 5.4.3. Import Analysis

- 5.4.4. Export Analysis

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Vegetables

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1. ompany Profile

List of Figures

- Figure 1: South Africa Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Fruits and Vegetables Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2020 & 2033

- Table 2: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2020 & 2033

- Table 3: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2020 & 2033

- Table 4: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2020 & 2033

- Table 5: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2020 & 2033

- Table 7: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2020 & 2033

- Table 8: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Vegetables 2020 & 2033

- Table 9: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Fruits 2020 & 2033

- Table 10: South Africa Fruits and Vegetables Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Fruits and Vegetables Industry?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the South Africa Fruits and Vegetables Industry?

Key companies in the market include ompany Profile.

3. What are the main segments of the South Africa Fruits and Vegetables Industry?

The market segments include Vegetables, Fruits, Vegetables, Fruits.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Increase in Health Consciousness Among Consumers.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the South Africa Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence