Key Insights

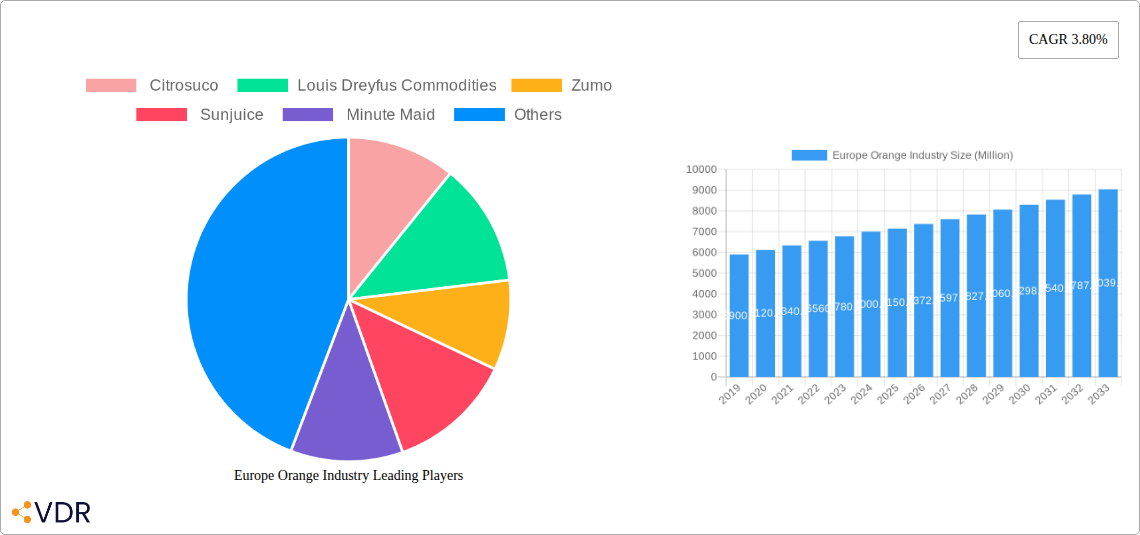

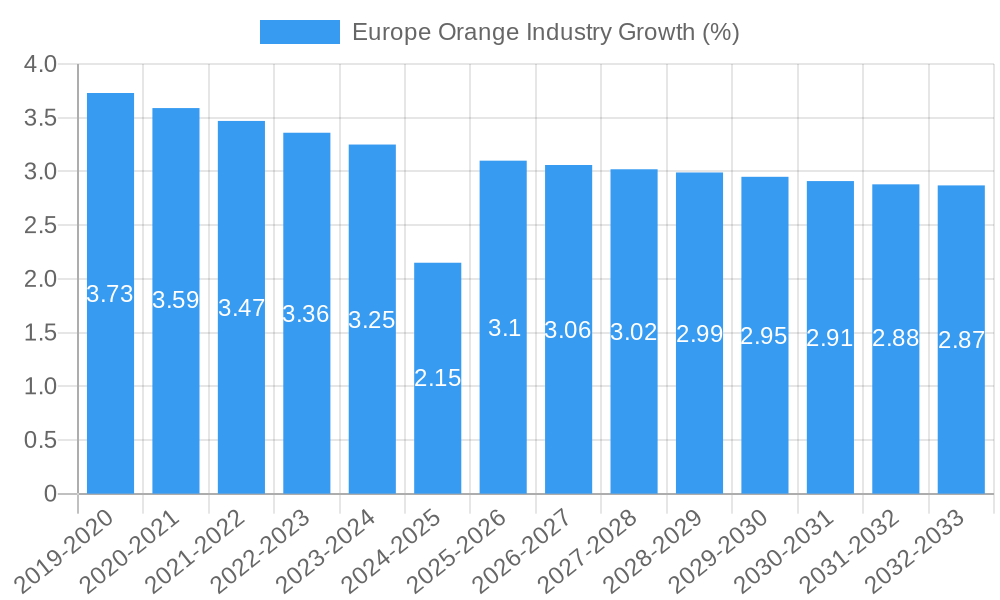

The European orange industry is poised for steady growth, projected to reach approximately USD 7.15 billion by 2025. Driven by a consistent Compound Annual Growth Rate (CAGR) of 3.80% throughout the study period (2019-2033), this expansion is underpinned by evolving consumer preferences towards healthier lifestyles and a growing demand for fresh juices and natural food products. Key market drivers include increasing disposable incomes across major European nations, leading to higher per capita consumption of oranges and related products. Furthermore, technological advancements in cultivation and processing techniques are enhancing production efficiency and product quality, contributing to market stability. The industry's resilience is further bolstered by the robust consumption patterns observed in countries like Spain, Italy, and France, which are significant producers and consumers, benefiting from favorable climatic conditions and established agricultural infrastructure.

However, the market is not without its challenges. Potential restraints such as fluctuating raw material costs due to unpredictable weather patterns affecting harvests and geopolitical factors can impact profitability. Stringent regulatory frameworks concerning food safety and environmental sustainability, while beneficial in the long run, can also pose initial compliance costs for businesses. The competitive landscape is characterized by a mix of large multinational corporations and smaller regional players, with companies like Citrosuco, Louis Dreyfus Commodities, and Minute Maid holding significant market positions. Segmentation reveals a strong emphasis on production and consumption analysis, with import and export markets playing a crucial role in balancing supply and demand across different European regions. The price trend analysis is expected to reflect a gradual upward movement, influenced by production yields and global demand for citrus fruits.

Europe Orange Industry Market Dynamics & Structure

The Europe orange industry is characterized by a dynamic interplay of production, consumption, and trade, influenced by stringent regulatory landscapes and evolving consumer preferences. Market concentration varies across parent and child markets, with some segments exhibiting consolidation among major players while others remain fragmented. Technological innovation drivers are primarily focused on enhancing crop yields, improving disease resistance, and optimizing processing efficiency. Regulatory frameworks, particularly those concerning food safety, phytosanitary measures, and sustainability, significantly shape market entry and operational strategies. Competitive product substitutes, including other fruit juices and functional beverages, pose a continuous challenge, necessitating continuous product differentiation and marketing efforts. End-user demographics reveal a growing demand for premium, fresh, and minimally processed orange products, alongside a steady consumption of concentrates and derivatives. M&A trends are indicative of a strategic push towards vertical integration and market consolidation to secure supply chains and enhance economies of scale.

- Market Concentration: Moderate to high in juice processing, with key players dominating segments like orange juice concentrates and ready-to-drink beverages.

- Technological Innovation Drivers: Advanced irrigation techniques, precision agriculture for pest and disease management, and novel processing technologies for extended shelf life and enhanced nutritional value.

- Regulatory Frameworks: Strict EU regulations on pesticide residues, food safety (e.g., HACCP), and origin labeling are paramount.

- Competitive Product Substitutes: Apple juice, other citrus juices (lemon, grapefruit), tropical fruit juices, and a growing range of functional beverages and plant-based alternatives.

- End-User Demographics: Increasing demand from health-conscious consumers, families seeking convenient breakfast options, and a growing older demographic favoring fortified products.

- M&A Trends: Strategic acquisitions to gain market share, secure raw material supply, and expand product portfolios, particularly in the ready-to-drink and fortified juice segments.

Europe Orange Industry Growth Trends & Insights

The Europe orange industry is poised for sustained growth, driven by a confluence of factors that are reshaping market dynamics from production to consumption. The overall market size is projected to experience a steady expansion, fueled by rising disposable incomes across various European nations and an increasing consumer focus on health and wellness. This trend is particularly evident in the fresh orange and premium juice segments, which are witnessing higher adoption rates as consumers seek natural and vitamin-rich alternatives. Technological disruptions are playing a crucial role, with advancements in agricultural practices contributing to improved yields and reduced crop losses. For instance, the implementation of precision agriculture techniques and the development of disease-resistant orange varieties are enhancing the efficiency and sustainability of orange cultivation.

Consumer behavior shifts are profoundly impacting the industry. There's a discernible move towards perceived "healthier" options, leading to increased demand for 100% pure orange juice, reduced sugar varieties, and functional orange products fortified with vitamins and minerals. The convenience factor remains paramount, driving growth in the ready-to-drink (RTD) orange juice market. However, this is also accompanied by a growing awareness of environmental sustainability, influencing consumer choices towards ethically sourced and packaged orange products. The parent market, encompassing raw orange production and primary processing, is experiencing robust growth, directly influencing the child markets of orange juice, concentrates, and other derived products. The historical period from 2019 to 2024 has laid the groundwork, with consistent demand for orange-based beverages. The base year of 2025 sets the stage for the forecast period from 2025 to 2033, during which a Compound Annual Growth Rate (CAGR) of approximately 3.5% to 4.2% is anticipated for the overall Europe orange industry. Market penetration for premium and organic orange juice is expected to increase significantly as consumers become more discerning. Innovations in packaging, such as smaller, single-serve formats and eco-friendly materials, are also catering to evolving lifestyle needs and environmental concerns, further accelerating market expansion.

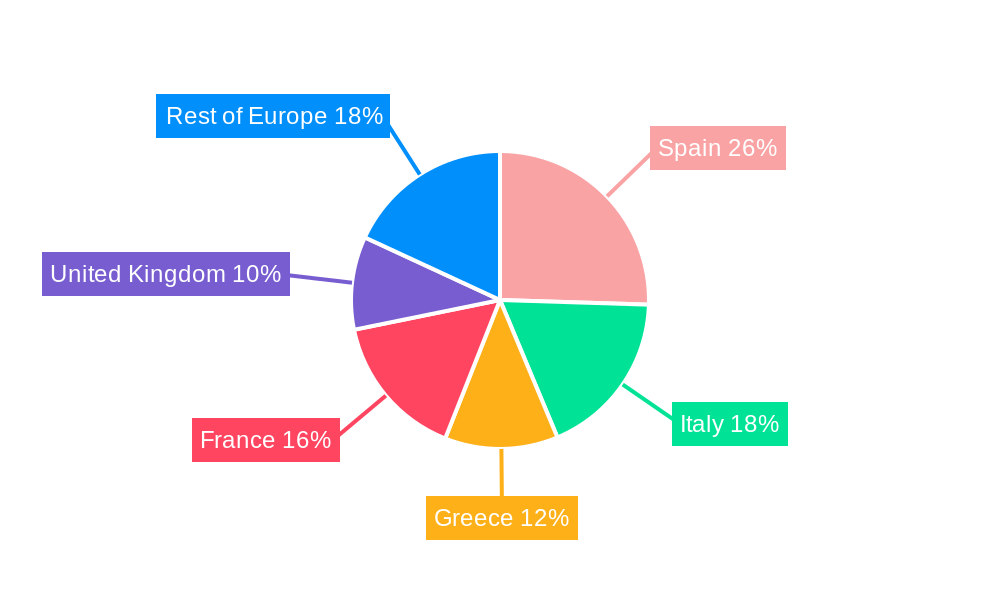

Dominant Regions, Countries, or Segments in Europe Orange Industry

The Europe orange industry's dominance is a multifaceted phenomenon, with key regions, countries, and segments exhibiting distinct growth drivers and market penetration. Within the Production Analysis, Southern European countries, particularly Spain and Italy, stand out as leading producers. Spain, with its vast Valencia region, accounts for a significant portion of the continent's orange output, benefiting from favorable climatic conditions and established agricultural infrastructure. Italy, another major player, contributes substantially to both fresh fruit and processing varieties.

In terms of Consumption Analysis, Western European countries, including Germany, France, the United Kingdom, and the Netherlands, represent the largest consumer markets. The sheer size of their populations, coupled with higher disposable incomes and a strong preference for ready-to-drink beverages and fresh produce, drives substantial demand. The Netherlands also serves as a critical hub for the re-export of orange juice and related products across Europe, making its consumption figures somewhat inflated due to trade activities.

The Import Market Analysis (Value & Volume) is largely dominated by the demand for concentrated orange juice and, to a lesser extent, fresh oranges. Spain is a significant importer itself, processing imported fruit to meet its own processing needs and for re-export. However, countries with limited domestic production, like Germany and the UK, rely heavily on imports, primarily from Spain, Italy, and increasingly from North Africa (e.g., Morocco, Egypt) and South Africa (though subject to phytosanitary challenges). The value of these imports is driven by the demand for reconstituted juices and the food service sector.

Conversely, the Export Market Analysis (Value & Volume) highlights Spain's preeminence. Spain exports substantial volumes of fresh oranges to various European countries and is also a major exporter of orange juice concentrate to non-EU markets. Italy also plays a role in exporting processed orange products. The value of these exports is influenced by quality, origin, and specific product formulations.

The Price Trend Analysis reveals that fresh orange prices are largely dictated by seasonal availability, weather patterns, and crop yields. Fluctuations in supply can lead to significant price variations. For processed products like orange juice concentrate, prices are influenced by global supply and demand dynamics, including factors like frost in major producing regions (e.g., Brazil), and currency exchange rates. The parent market's production volume directly impacts the price of its child market products. The market share of dominant players in these segments, coupled with their ability to influence supply chains and pricing, further solidifies their leadership. Economic policies promoting agricultural exports, robust trade agreements, and efficient logistics infrastructure are critical enablers of dominance in these regions and segments.

Europe Orange Industry Product Landscape

The Europe orange industry is characterized by a diverse product landscape catering to a wide spectrum of consumer preferences and industrial applications. Key innovations revolve around enhancing the nutritional profile and convenience of orange-based products. This includes the development of fortified orange juices enriched with vitamins (e.g., Vitamin D, B vitamins) and minerals, addressing growing consumer demand for functional foods. The introduction of reduced-sugar and no-added-sugar variants reflects a societal shift towards healthier beverage choices. In the fresh segment, advancements in cultivation focus on specific varietals offering improved sweetness, reduced acidity, and longer shelf life. For the child markets, particularly orange juice, there's a continuous drive for improved processing technologies that preserve natural flavors and maximize nutrient retention. Unique selling propositions often lie in the "100% pure," "not from concentrate," or "organic" certifications, appealing to health-conscious consumers. Technological advancements in aseptic packaging and cold-chain logistics are crucial for maintaining product quality and extending market reach for both fresh and processed orange products across the continent.

Key Drivers, Barriers & Challenges in Europe Orange Industry

Key Drivers:

- Growing Health and Wellness Trends: Increasing consumer demand for vitamin-rich, natural beverages drives the consumption of orange juice and fresh oranges.

- Convenience and Ready-to-Drink (RTD) Market Growth: The demand for on-the-go beverages fuels the market for pre-packaged orange juice.

- Versatile Applications: Oranges are used not only as juice but also in culinary applications, cosmetics, and as a source of essential oils, broadening their market appeal.

- Technological Advancements in Agriculture: Improved farming techniques, disease-resistant varieties, and precision agriculture enhance production efficiency and yield.

- Stable Import/Export Relationships: Established trade routes and agreements facilitate the flow of oranges and orange products across the continent and from key global suppliers.

Barriers & Challenges:

- Climate Change and Extreme Weather Events: Droughts, frosts, and hailstorms significantly impact orange crop yields and quality, leading to price volatility.

- Phytosanitary Restrictions and Pest Control: Stringent EU regulations on pests like the false codling moth (FCM) can disrupt imports from key producing countries, impacting supply chain stability.

- Intense Competition from Substitutes: A wide array of other fruit juices, functional beverages, and even water-based drinks compete for consumer attention and spending.

- Price Volatility and Supply Chain Disruptions: Fluctuations in raw material prices due to weather or geopolitical events can impact profitability for processors and retailers.

- Consumer Perception of Sugar Content: Growing awareness of sugar's health implications can lead some consumers to reduce their intake of traditional orange juice.

- Sustainability Concerns: Increasing pressure for eco-friendly packaging and sustainable sourcing practices adds complexity and cost to operations.

Emerging Opportunities in Europe Orange Industry

Emerging opportunities in the Europe orange industry lie in the expansion of premium and niche market segments. The growing consumer interest in functional foods presents a significant avenue, with opportunities in developing orange-based products fortified with specific vitamins, antioxidants, and probiotics to cater to targeted health needs. The demand for traceable and sustainably sourced produce is also on the rise, creating opportunities for brands that can demonstrate ethical farming practices and environmentally friendly packaging solutions. Furthermore, the development of value-added products beyond traditional juice, such as orange-infused snacks, natural flavorings, and cosmetic ingredients derived from orange by-products, offers untapped market potential. The "farm-to-table" movement also drives demand for fresh, high-quality oranges, creating opportunities for direct-to-consumer sales models and specialized retail partnerships.

Growth Accelerators in the Europe Orange Industry Industry

Several factors are acting as significant growth accelerators for the Europe orange industry. Technological breakthroughs in disease-resistant orange varieties and advanced pest management techniques are improving crop yields and reducing losses, leading to more stable and abundant supply. Strategic partnerships between growers, processors, and retailers are crucial for optimizing supply chains, ensuring consistent quality, and facilitating market access. Furthermore, innovative marketing campaigns that highlight the health benefits and natural goodness of oranges can effectively drive consumer demand, particularly among younger demographics. Expansion into emerging European markets with growing disposable incomes also presents a substantial opportunity for increased consumption of both fresh oranges and orange-based beverages. The development of novel processing techniques that enhance shelf life and preserve nutritional value further contributes to market growth by making products more accessible and appealing.

Key Players Shaping the Europe Orange Industry Market

- Citrosuco

- Louis Dreyfus Commodities

- Zumo

- Sunjuice

- Minute Maid

- Grupo Citrus

- Simply Orange

- Tropicana

Notable Milestones in Europe Orange Industry Sector

- September 2022: The European Union imposed new restrictions on South African citrus imports. The new phytosanitary requirements were meant to address false codling moth (FCM), a citrus pest native to South Africa, for which there is zero tolerance in the European Union. As a result, shipments from South Africa were disrupted.

- April 2022: Tropicana company announced the upcoming release of Tropicana Crunch, its new breakfast cereal, created specifically to be paired with orange juice instead of milk.

In-Depth Europe Orange Industry Market Outlook

The Europe orange industry is poised for continued expansion, driven by a robust consumer appetite for healthy and convenient options. The forecast period of 2025–2033 indicates sustained growth, with key accelerators including ongoing advancements in agricultural technology that promise higher yields and better resilience against climate challenges. The strategic alignment of major players, evidenced by past M&A activities, will likely lead to more efficient supply chains and product innovation. Opportunities for market penetration in less saturated European regions, coupled with the evolving demand for functional and sustainably produced orange products, offer significant future potential. The industry's ability to adapt to regulatory changes and consumer preferences will be critical in capitalizing on these growth prospects, ensuring a vibrant and dynamic market for years to come.

Europe Orange Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Orange Industry Segmentation By Geography

- 1. Spain

- 2. Italy

- 3. Greece

- 4. France

- 5. United Kingdom

Europe Orange Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Growing demand for oranges in processing industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Spain

- 5.6.2. Italy

- 5.6.3. Greece

- 5.6.4. France

- 5.6.5. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Spain Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Italy Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Greece Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. France Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. United Kingdom Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Germany Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Orange Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Citrosuco

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Louis Dreyfus Commodities

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Zumo

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Sunjuice

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Minute Maid

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Grupo Citrus

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Simply Orange

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Tropicana

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Citrosuco

List of Figures

- Figure 1: Europe Orange Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Orange Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Orange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Orange Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Europe Orange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Europe Orange Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: Germany Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: France Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Sweden Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Europe Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Europe Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 33: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 43: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 44: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 45: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 46: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 47: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 48: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 49: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 50: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 51: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 52: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 53: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 55: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 56: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 57: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 58: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 59: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 60: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 61: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 62: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 63: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 64: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 65: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 67: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 68: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 69: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 70: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 71: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 72: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 73: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 74: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 75: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 76: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 77: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 79: Europe Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 80: Europe Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 81: Europe Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 82: Europe Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 83: Europe Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 84: Europe Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 85: Europe Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 86: Europe Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 87: Europe Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 88: Europe Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 89: Europe Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Europe Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Orange Industry?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Europe Orange Industry?

Key companies in the market include Citrosuco , Louis Dreyfus Commodities, Zumo, Sunjuice , Minute Maid , Grupo Citrus , Simply Orange, Tropicana.

3. What are the main segments of the Europe Orange Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Growing demand for oranges in processing industry.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

September 2022: The European Union imposed new restrictions on South African citrus imports. The new phytosanitary requirements were meant to address false codling moth (FCM), a citrus pest native to South Africa, for which there is zero tolerance in the European Union. As a result, shipments from South Africa were disrupted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Orange Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Orange Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Orange Industry?

To stay informed about further developments, trends, and reports in the Europe Orange Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence