Key Insights

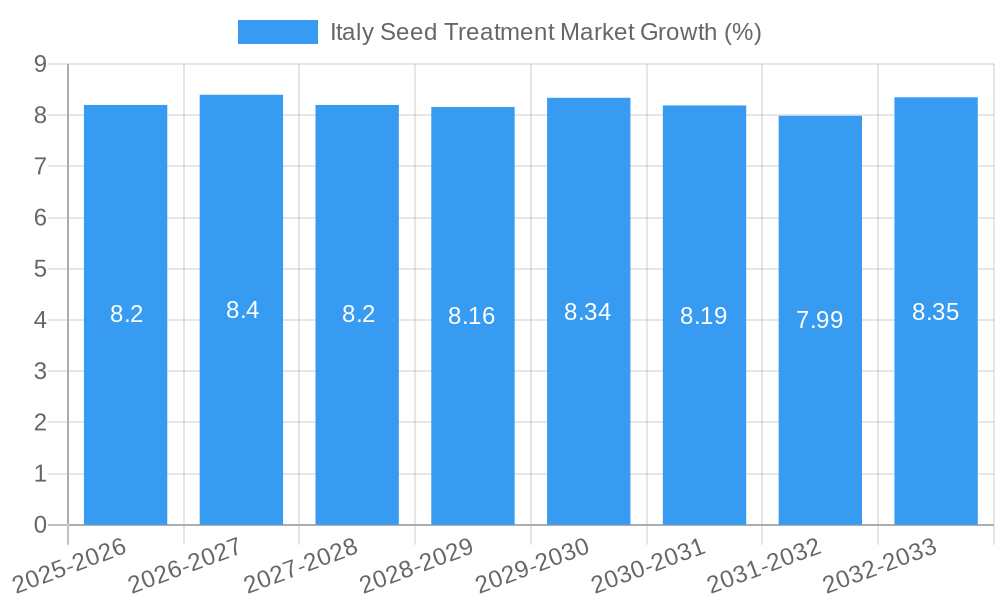

The Italian seed treatment market is poised for significant expansion, projected to reach a market size of approximately $550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.20% anticipated through 2033. This growth is primarily propelled by the increasing adoption of advanced agricultural practices aimed at enhancing crop yields and protecting against pests and diseases. Key drivers include the rising demand for food security, the need to minimize crop losses, and the inherent benefits of seed treatments such as improved germination rates, enhanced seedling vigor, and reduced reliance on foliar pesticide applications. The market is witnessing a strong preference for biological seed treatments, reflecting a global shift towards sustainable and eco-friendly farming solutions. Furthermore, technological advancements in application techniques, like seed coating and pelleted seeds, are improving efficacy and ease of use for farmers, further stimulating market adoption. The integration of digital farming tools also plays a role, enabling more precise and targeted application of seed treatments.

Segmentation analysis reveals that synthetic treatments continue to hold a significant share, particularly for fungicides and insecticides, due to their established efficacy and cost-effectiveness. However, the biological segment is experiencing rapid growth, driven by consumer demand for organic produce and stricter environmental regulations. The application landscape spans both commercial and farm-level operations, with commercial entities often leading in early adoption of innovative solutions. Seed coating and pelleting are emerging as dominant application techniques due to their precision and minimal environmental impact. Grains and cereals, along with fruits and vegetables, represent the largest crop segments for seed treatments in Italy, owing to their widespread cultivation and economic importance. Emerging trends include the development of multi-functional seed treatments that offer protection against a broader spectrum of threats, and the growing interest in biostimulants integrated into seed treatment formulations to enhance plant resilience and nutrient uptake.

This in-depth report provides a thorough analysis of the Italy Seed Treatment Market, covering historical performance, current dynamics, and future projections. Essential for agribusiness stakeholders, researchers, and investors, this study offers actionable insights into market segmentation, growth drivers, competitive landscape, and emerging opportunities. Our analysis spans from 2019 to 2033, with a detailed focus on the Base Year 2025 and the Forecast Period 2025–2033, leveraging historical data from 2019–2024.

Italy Seed Treatment Market Market Dynamics & Structure

The Italy Seed Treatment Market is characterized by a moderately consolidated structure, with key global players like Bayer CropScience AG, BASF SE, and Syngenta International AG holding significant market shares. Technological innovation is a primary driver, with continuous advancements in both synthetic and biological seed treatment formulations enhancing efficacy and environmental sustainability. Regulatory frameworks, while stringent, are also evolving to support the adoption of novel, eco-friendly solutions, particularly those derived from biological origins. Competitive product substitutes are emerging, ranging from conventional crop protection methods to integrated pest management strategies. End-user demographics are increasingly informed and concerned with sustainable agriculture, pushing demand towards seed treatments that offer precise application and reduced environmental impact. Mergers and acquisitions (M&A) trends, though not as prevalent as in other agricultural input markets, indicate strategic consolidations aimed at expanding product portfolios and market reach. For instance, recent years have seen targeted acquisitions of specialized biological seed treatment companies by larger corporations to bolster their sustainable offerings. Barriers to innovation include the lengthy and costly registration processes for new active ingredients and the need for extensive field trials to demonstrate efficacy across diverse Italian agro-climatic conditions. The market is witnessing a gradual shift towards more sophisticated application techniques like advanced seed coating and pelleting, promising enhanced seed protection and improved germination rates.

Italy Seed Treatment Market Growth Trends & Insights

The Italy Seed Treatment Market is poised for robust growth, driven by an increasing awareness of the economic and environmental benefits of seed-applied technologies. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.8% from 2025 to 2033. Adoption rates for seed treatments are steadily rising across all crop segments, fueled by a desire to maximize yield potential and minimize crop losses due to pests and diseases in the initial growth stages. Technological disruptions are playing a pivotal role, with the integration of digital tools for precision application and enhanced monitoring of seed treatment effectiveness. Consumer behavior shifts are also influencing the market, as there is a growing demand for sustainably produced food, which indirectly encourages the adoption of seed treatments that reduce the overall reliance on foliar sprays. The market penetration of seed treatments is expanding beyond traditional large-scale commercial farms to increasingly include smaller, farm-level operations seeking to optimize their resource utilization. This trend is supported by the availability of more accessible and cost-effective seed treatment solutions. The focus on integrated pest management (IPM) strategies is further bolstering the demand for seed treatments as a proactive first line of defense. Innovative formulations, including those incorporating biostimulants and beneficial microbes, are gaining traction, offering multi-faceted benefits such as improved plant vigor and enhanced nutrient uptake alongside pest and disease protection. The market is expected to reach an estimated value of approximately 350 million units in 2025, with significant potential for further expansion.

Dominant Regions, Countries, or Segments in Italy Seed Treatment Market

Within the Italy Seed Treatment Market, the Grains and Cereals crop type segment is a dominant force, exhibiting substantial growth and market share. This dominance is driven by Italy's significant agricultural output in key cereal crops like wheat, corn, and barley, which are staples in both domestic consumption and export markets. The inherent susceptibility of these crops to a wide range of soil-borne pathogens and early-season insect pests necessitates robust seed protection strategies.

- Chemical Origin: Synthetic remains the leading segment due to its established efficacy and broad-spectrum control capabilities. Italian farmers have long relied on synthetic insecticides and fungicides for reliable protection, and ongoing research continues to refine formulations for improved safety and targeted action.

- Product Type: Insecticide holds a significant market share, addressing critical threats from soil insects and early foliar pests that can devastate grain and cereal yields.

- Application: Commercial farms represent the largest application segment, owing to their scale of operations, access to advanced application technologies, and the economic imperative to maximize yields and minimize losses.

- Application Technique: Seed Coating is increasingly preferred for its precision and efficiency, ensuring an even distribution of the treatment across the seed surface and minimizing waste.

- Crop Type: Grains and Cereals continues to lead due to the vast acreage dedicated to these crops in Italy. The economic importance and yield variability of these crops make them prime candidates for seed treatment investment.

The dominance of these segments is further reinforced by:

- Economic Policies: Government subsidies and agricultural support programs often incentivize the adoption of modern farming practices, including the use of advanced seed treatments, to boost national food security and agricultural competitiveness.

- Infrastructure: Well-developed agricultural infrastructure, including seed processing facilities and efficient distribution networks for agricultural inputs, supports the widespread availability and application of seed treatments across the country.

- Market Share: Grains and cereals currently account for an estimated 45% of the total seed treatment market in Italy.

- Growth Potential: While synthetic treatments are dominant, there is a rapidly growing interest and investment in Biological seed treatments, indicating a significant future growth potential as regulations evolve and farmer awareness increases. This segment is projected to grow at a CAGR of over 9% during the forecast period.

Italy Seed Treatment Market Product Landscape

The Italy Seed Treatment Market product landscape is characterized by continuous innovation aimed at enhancing crop protection and yield potential. Key products include advanced synthetic insecticides and fungicides designed for broad-spectrum control, as well as a growing array of biological treatments harnessing beneficial microbes and natural compounds for enhanced plant health and disease resistance. Application techniques like advanced seed coating and pelleting ensure precise and uniform delivery of active ingredients, minimizing environmental impact and maximizing seed-to-seed protection. Performance metrics such as improved germination rates, enhanced seedling vigor, and significant reductions in pest infestation and disease incidence are key differentiators. Unique selling propositions often revolve around integrated solutions that combine multiple modes of action or provide synergistic benefits, such as improved nutrient uptake alongside pest control.

Key Drivers, Barriers & Challenges in Italy Seed Treatment Market

Key Drivers:

- Technological Advancements: Innovations in formulation chemistry, delivery systems (e.g., advanced seed coating), and biological agents are continuously improving efficacy and sustainability.

- Yield Maximization Imperative: Growing demand for food and increasing land scarcity drive the need for technologies that maximize crop yields per hectare, with seed treatments playing a crucial role in early-stage protection.

- Pest and Disease Pressure: Persistent and evolving threats from insect pests and soil-borne diseases necessitate proactive and reliable protection methods, making seed treatments a critical component of crop management.

- Government Support and Regulations: Favorable agricultural policies and evolving regulatory frameworks that encourage sustainable farming practices and the adoption of novel crop protection solutions are key drivers.

Key Barriers & Challenges:

- High Research and Development Costs: Developing new seed treatment products, especially biologicals, involves significant investment in R&D and long registration periods.

- Regulatory Hurdles: Stringent and time-consuming approval processes for new active ingredients and formulations can slow down market entry.

- Farmer Awareness and Education: While growing, there is still a need for continuous education and awareness programs to fully demonstrate the value proposition of seed treatments, especially for smaller-scale farmers.

- Environmental Concerns and Public Perception: While seed treatments aim to reduce overall pesticide use, concerns regarding potential impacts on non-target organisms and the environment require ongoing research and transparent communication.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials, affecting production and pricing of seed treatment products.

Emerging Opportunities in Italy Seed Treatment Market

Emerging opportunities in the Italy Seed Treatment Market lie in the continued expansion of biological seed treatments, offering sustainable and environmentally friendly solutions that cater to increasing consumer demand for organic and residue-free produce. The development of multi-functional seed treatments that combine pest and disease control with biostimulant properties for enhanced plant growth and stress tolerance presents a significant growth avenue. Furthermore, advancements in precision application technologies, including digital monitoring and smart delivery systems, offer opportunities for optimizing treatment efficacy and reducing application rates. Untapped markets within specific niche crop segments and the potential for integrating seed treatments with other digital agriculture solutions also represent lucrative avenues for innovation and market penetration.

Growth Accelerators in the Italy Seed Treatment Market Industry

Several factors are acting as significant growth accelerators for the Italy Seed Treatment Market. Technological breakthroughs in nanotechnology for improved active ingredient delivery, the development of highly specific and potent biological agents, and the integration of AI for predicting pest outbreaks and optimizing treatment regimes are revolutionizing the sector. Strategic partnerships between chemical manufacturers, seed companies, and research institutions are fostering innovation and accelerating the development and commercialization of new products. Market expansion strategies, including the focus on specific crop types with high susceptibility to pests and diseases and the development of tailored solutions for diverse agro-climatic regions within Italy, are also contributing to sustained growth. The increasing emphasis on sustainable agriculture and reduced environmental footprint aligns perfectly with the inherent benefits of seed treatments, further accelerating their adoption.

Key Players Shaping the Italy Seed Treatment Market Market

- Sumitomo Chemical Co Ltd

- Almo S P A

- Advanced Biological Marketing Inc

- FMC Corporation

- ADAMA Agricultural Solutions Ltd

- Syngenta International AG

- Nufarm Limited

- DuPont de Nemours Inc

- Monsanto Company (now part of Bayer CropScience AG)

- Bayer CropScience AG

- BASF SE

Notable Milestones in Italy Seed Treatment Market Sector

- 2019: Increased focus on regulatory approvals for novel biological seed treatment formulations.

- 2020: Launch of advanced seed coating technologies by major players to enhance uniform application and efficacy.

- 2021: Growing investment in R&D for biopesticide-based seed treatments driven by sustainability trends.

- 2022: Introduction of integrated seed solutions combining protection and early-stage growth enhancement.

- 2023: Increased adoption of farm-level application equipment for seed treatments, democratizing access.

- 2024: Emergence of data-driven advisory services linked to seed treatment applications for precision agriculture.

In-Depth Italy Seed Treatment Market Market Outlook

- 2019: Increased focus on regulatory approvals for novel biological seed treatment formulations.

- 2020: Launch of advanced seed coating technologies by major players to enhance uniform application and efficacy.

- 2021: Growing investment in R&D for biopesticide-based seed treatments driven by sustainability trends.

- 2022: Introduction of integrated seed solutions combining protection and early-stage growth enhancement.

- 2023: Increased adoption of farm-level application equipment for seed treatments, democratizing access.

- 2024: Emergence of data-driven advisory services linked to seed treatment applications for precision agriculture.

In-Depth Italy Seed Treatment Market Market Outlook

The Italy Seed Treatment Market is projected for substantial growth, propelled by a convergence of technological innovation, evolving agricultural practices, and increasing demand for sustainable food production. The market's future hinges on the successful integration of advanced synthetic and biological solutions, catering to diverse crop needs and farm-level requirements. Strategic partnerships and continued investment in R&D will be crucial for navigating regulatory landscapes and bringing novel, high-efficacy products to market. The increasing awareness among Italian farmers regarding the economic and environmental benefits of seed treatments positions the market for sustained expansion, offering significant opportunities for stakeholders to contribute to a more resilient and productive agricultural sector.

Italy Seed Treatment Market Segmentation

-

1. Chemical Origin

- 1.1. Synthetic

- 1.2. Biological

-

2. Product Type

- 2.1. Insecticide

- 2.2. Fungicide

- 2.3. Other Product Types

-

3. Application

- 3.1. Commercial

- 3.2. Farm-level

-

4. Application Technique

- 4.1. Seed Coating

- 4.2. Seed Pelleting

- 4.3. Seed Dressing

- 4.4. Other Application Techniques

-

5. Crop Type

- 5.1. Grains and Cereals

- 5.2. Pulses and Oil seeds

- 5.3. Fruits and Vegetables

- 5.4. Other Crop Types

-

6. Chemical Origin

- 6.1. Synthetic

- 6.2. Biological

-

7. Product Type

- 7.1. Insecticide

- 7.2. Fungicide

- 7.3. Other Product Types

-

8. Application

- 8.1. Commercial

- 8.2. Farm-level

-

9. Application Technique

- 9.1. Seed Coating

- 9.2. Seed Pelleting

- 9.3. Seed Dressing

- 9.4. Other Application Techniques

-

10. Crop Type

- 10.1. Grains and Cereals

- 10.2. Pulses and Oil seeds

- 10.3. Fruits and Vegetables

- 10.4. Other Crop Types

Italy Seed Treatment Market Segmentation By Geography

- 1. Italy

Italy Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Decreasing Arable Land

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Seed Treatment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Chemical Origin

- 5.1.1. Synthetic

- 5.1.2. Biological

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Insecticide

- 5.2.2. Fungicide

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Commercial

- 5.3.2. Farm-level

- 5.4. Market Analysis, Insights and Forecast - by Application Technique

- 5.4.1. Seed Coating

- 5.4.2. Seed Pelleting

- 5.4.3. Seed Dressing

- 5.4.4. Other Application Techniques

- 5.5. Market Analysis, Insights and Forecast - by Crop Type

- 5.5.1. Grains and Cereals

- 5.5.2. Pulses and Oil seeds

- 5.5.3. Fruits and Vegetables

- 5.5.4. Other Crop Types

- 5.6. Market Analysis, Insights and Forecast - by Chemical Origin

- 5.6.1. Synthetic

- 5.6.2. Biological

- 5.7. Market Analysis, Insights and Forecast - by Product Type

- 5.7.1. Insecticide

- 5.7.2. Fungicide

- 5.7.3. Other Product Types

- 5.8. Market Analysis, Insights and Forecast - by Application

- 5.8.1. Commercial

- 5.8.2. Farm-level

- 5.9. Market Analysis, Insights and Forecast - by Application Technique

- 5.9.1. Seed Coating

- 5.9.2. Seed Pelleting

- 5.9.3. Seed Dressing

- 5.9.4. Other Application Techniques

- 5.10. Market Analysis, Insights and Forecast - by Crop Type

- 5.10.1. Grains and Cereals

- 5.10.2. Pulses and Oil seeds

- 5.10.3. Fruits and Vegetables

- 5.10.4. Other Crop Types

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Chemical Origin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sumitomo Chemical Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Almo S P A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Advanced Biological Marketing Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FMC Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ADAMA Agricultural Solutions Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nufarm Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont de Nemours Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Monsanto Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bayer CropScience AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BASF SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Italy Seed Treatment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Seed Treatment Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Seed Treatment Market Revenue Million Forecast, by Chemical Origin 2019 & 2032

- Table 3: Italy Seed Treatment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Italy Seed Treatment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Italy Seed Treatment Market Revenue Million Forecast, by Application Technique 2019 & 2032

- Table 6: Italy Seed Treatment Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 7: Italy Seed Treatment Market Revenue Million Forecast, by Chemical Origin 2019 & 2032

- Table 8: Italy Seed Treatment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 9: Italy Seed Treatment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Italy Seed Treatment Market Revenue Million Forecast, by Application Technique 2019 & 2032

- Table 11: Italy Seed Treatment Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 12: Italy Seed Treatment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 13: Italy Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Italy Seed Treatment Market Revenue Million Forecast, by Chemical Origin 2019 & 2032

- Table 15: Italy Seed Treatment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Italy Seed Treatment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Italy Seed Treatment Market Revenue Million Forecast, by Application Technique 2019 & 2032

- Table 18: Italy Seed Treatment Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 19: Italy Seed Treatment Market Revenue Million Forecast, by Chemical Origin 2019 & 2032

- Table 20: Italy Seed Treatment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Italy Seed Treatment Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Italy Seed Treatment Market Revenue Million Forecast, by Application Technique 2019 & 2032

- Table 23: Italy Seed Treatment Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 24: Italy Seed Treatment Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Seed Treatment Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the Italy Seed Treatment Market?

Key companies in the market include Sumitomo Chemical Co Ltd, Almo S P A, Advanced Biological Marketing Inc, FMC Corporatio, ADAMA Agricultural Solutions Ltd, Syngenta International AG, Nufarm Limited, DuPont de Nemours Inc, Monsanto Company, Bayer CropScience AG, BASF SE.

3. What are the main segments of the Italy Seed Treatment Market?

The market segments include Chemical Origin, Product Type, Application, Application Technique, Crop Type, Chemical Origin, Product Type, Application, Application Technique, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Decreasing Arable Land.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Seed Treatment Market?

To stay informed about further developments, trends, and reports in the Italy Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence