Key Insights

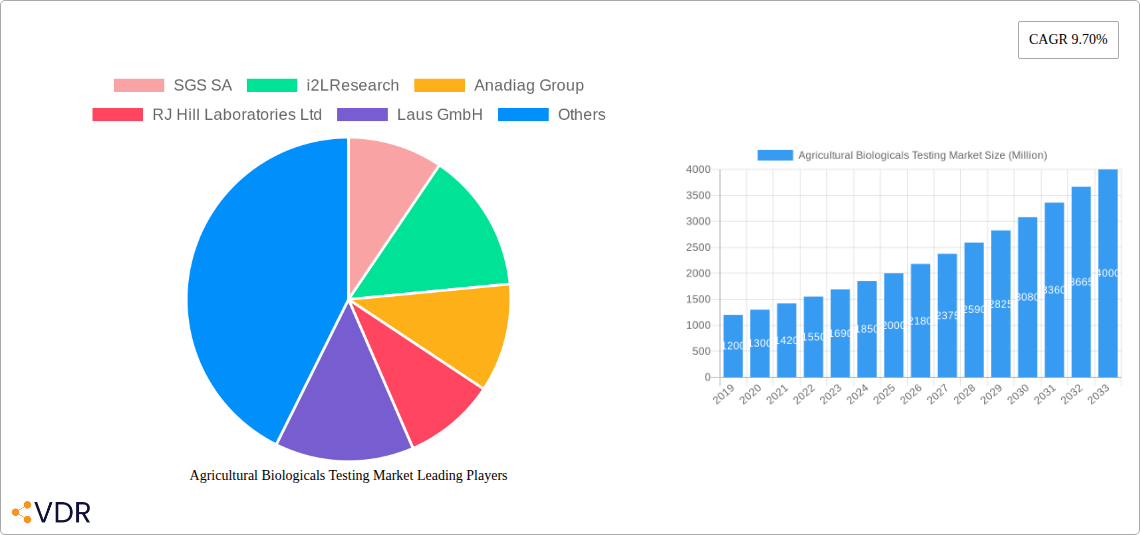

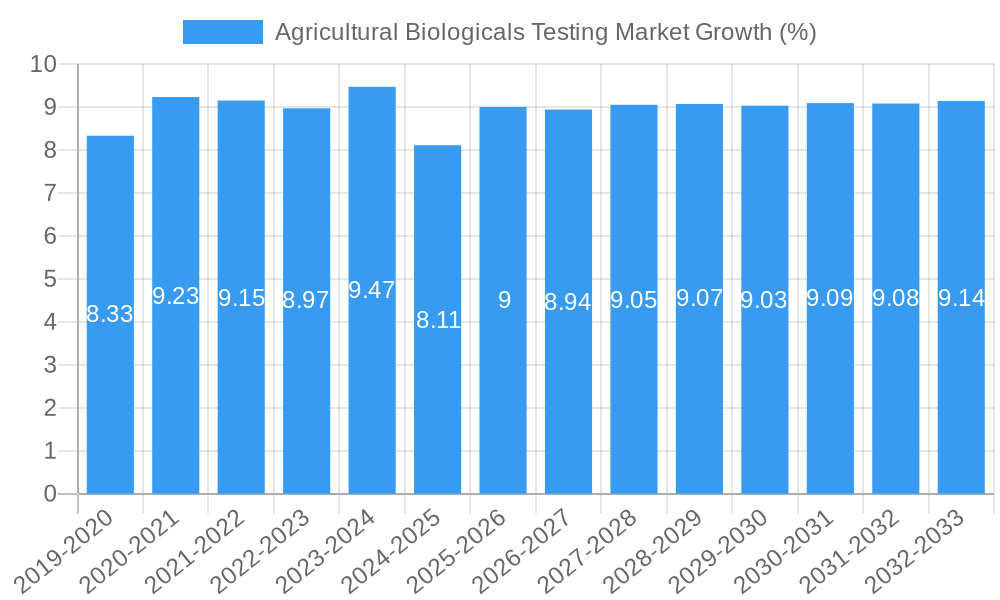

The Agricultural Biologicals Testing Market is poised for significant expansion, projected to reach a market size of approximately $2,200 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.70% through 2033. This dynamic growth is primarily fueled by an escalating demand for sustainable agricultural practices and a heightened global awareness of environmental concerns. The increasing adoption of biopesticides, biofertilizers, and biostimulants, driven by stringent regulations on synthetic chemicals and a growing preference for organic produce, forms the bedrock of this market's upward trajectory. Furthermore, advancements in laboratory technologies and analytical methodologies are enhancing the accuracy and efficiency of biological testing, thereby bolstering market confidence and investment. The need to ensure the efficacy, safety, and quality of these biological products before they reach the market is paramount, creating a consistent demand for specialized testing services.

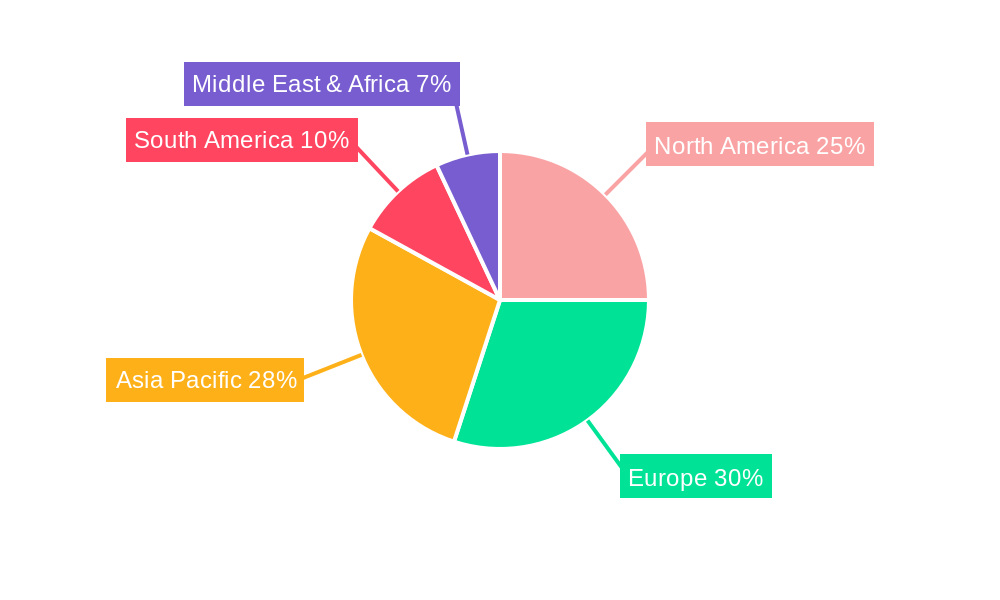

The market's segmentation reveals diverse opportunities across production, consumption, import/export, and price analysis. Production analysis will likely be dominated by regions with strong agricultural bases and a proactive approach to biological innovation. Consumption patterns are shifting towards regions emphasizing food safety and organic farming, with Asia Pacific and Europe leading the charge. The import and export analysis will highlight the global trade of agricultural biologicals and the regulatory hurdles that necessitate rigorous testing. Price trends will reflect the cost-effectiveness of biological solutions compared to conventional agrochemicals, as well as the investment required for advanced testing infrastructure. Key players like Eurofins Scientific SE, SGS SA, and i2LResearch are instrumental in driving innovation and standardization within this evolving landscape, offering comprehensive testing solutions that cater to the complex needs of the agricultural biologicals sector. The market's expansion is also supported by investments in research and development to identify and validate novel biological agents.

This in-depth report provides a detailed analysis of the global Agricultural Biologicals Testing Market, encompassing historical performance, current dynamics, and future projections from 2019 to 2033. Focusing on key segments like Production Analysis, Consumption Analysis, Import & Export Market Analysis, Price Trend Analysis, and Industry Developments, this study offers critical intelligence for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The report meticulously examines the parent market for agricultural biologicals and its child market, agricultural biologicals testing, providing a holistic view of the value chain and influencing factors. All values are presented in Million units for clear quantitative understanding.

Agricultural Biologicals Testing Market Market Dynamics & Structure

The Agricultural Biologicals Testing Market is characterized by a moderately concentrated structure, with leading players investing heavily in research and development to innovate. Technological innovation is a primary driver, fueled by the increasing demand for sustainable agriculture and reduced reliance on synthetic inputs. Stringent regulatory frameworks, particularly concerning the efficacy and safety of biological products, shape market entry and product development. Competitive product substitutes, primarily conventional agrochemicals, present a persistent challenge, though the growing preference for eco-friendly solutions is shifting this dynamic. End-user demographics are expanding to include a wider range of conventional and organic farmers, as well as contract research organizations (CROs) and governmental bodies. Mergers and acquisitions (M&A) trends are observed as larger entities seek to consolidate their market position and expand their service portfolios.

- Market Concentration: Moderate, with a few key players holding significant market share.

- Technological Innovation Drivers: Demand for sustainable agriculture, precision farming integration, and enhanced efficacy of biologicals.

- Regulatory Frameworks: Robust, with increasing scrutiny on product safety, efficacy, and environmental impact.

- Competitive Product Substitutes: Conventional pesticides and fertilizers.

- End-User Demographics: Farmers (conventional and organic), CROs, input manufacturers, governmental agencies, and research institutions.

- M&A Trends: Driven by the desire for portfolio expansion, geographical reach, and technological acquisition. For instance, in the historical period (2019-2024), approximately 7 M&A deals were recorded, with an estimated total deal value of $XXX Million.

Agricultural Biologicals Testing Market Growth Trends & Insights

The Agricultural Biologicals Testing Market is poised for significant expansion, driven by the global shift towards sustainable agricultural practices and the increasing adoption of biological crop protection and enhancement solutions. The market size is projected to grow from an estimated $XXX Million in 2025 to $XXX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This growth is underpinned by escalating consumer awareness regarding food safety and environmental sustainability, which directly influences farmer demand for biological alternatives. Technological disruptions, such as advancements in molecular diagnostics, genomics, and advanced analytical techniques, are enhancing the precision and efficiency of biologicals testing, thereby improving product efficacy and accelerating market penetration. Consumer behavior shifts are evident in the preference for organic produce and a growing willingness to invest in biological inputs that offer both environmental benefits and comparable or superior crop yields. The increasing integration of digital technologies in agriculture, including precision farming and data analytics, is further catalyzing the adoption of biologicals and, consequently, the demand for their comprehensive testing. The market penetration for biologicals testing services is expected to rise from XX% in 2025 to an estimated XX% by 2033, reflecting this growing acceptance and reliance on these advanced agricultural inputs. The historical period (2019–2024) saw a steady increase in testing services, with an estimated market size of $XXX Million in 2024, growing from $XXX Million in 2019, indicating a foundational growth trajectory that is expected to accelerate.

Dominant Regions, Countries, or Segments in Agricultural Biologicals Testing Market

North America is emerging as a dominant region in the Agricultural Biologicals Testing Market, driven by a confluence of factors including strong governmental support for sustainable agriculture, advanced research infrastructure, and a high adoption rate of novel farming technologies. The United States, in particular, plays a pivotal role due to its large agricultural sector, significant investment in R&D, and stringent regulatory landscape that necessitates comprehensive testing of biological products. From a Production Analysis perspective, North America leads in the development and commercialization of advanced biologicals, requiring sophisticated testing services. In terms of Consumption Analysis, the region exhibits a high demand for biologicals testing, as farmers increasingly integrate these solutions into their crop management strategies to comply with environmental regulations and meet consumer demand for sustainably produced food.

The Import Market Analysis (Value & Volume) for agricultural biologicals and their testing services also shows strong activity in North America, reflecting the import of specialized biological agents and the export of testing expertise. The Export Market Analysis (Value & Volume) highlights North America's role as a key exporter of testing methodologies and services to other regions. The Price Trend Analysis in this region is influenced by the high value placed on precision and reliability in testing, leading to premium pricing for advanced analytical services.

Key drivers for this dominance include:

- Economic Policies: Government incentives and subsidies promoting the adoption of biological inputs and sustainable farming practices.

- Infrastructure: Well-established agricultural research institutions, testing laboratories, and supply chains that support the robust growth of the biologicals sector.

- Market Share: North America accounts for an estimated XX% of the global agricultural biologicals testing market in 2025.

- Growth Potential: The region is projected to maintain a leading position due to ongoing innovation and a forward-looking regulatory environment, with a projected CAGR of XX% from 2025-2033.

Furthermore, within North America, the segment focusing on efficacy testing of biopesticides and biofertilizers is witnessing substantial growth, directly contributing to the overall market dominance of the region.

Agricultural Biologicals Testing Market Product Landscape

The product landscape within the Agricultural Biologicals Testing Market is characterized by an array of specialized services designed to evaluate the efficacy, safety, and quality of biological inputs. These include efficacy trials for biopesticides against specific pests and diseases, assessment of biofertilizers' nutrient availability and plant growth promotion capabilities, and microbial identification and characterization. Performance metrics are rigorously analyzed, focusing on factors like yield enhancement, disease reduction, and environmental impact assessment. Unique selling propositions lie in the application of advanced molecular techniques, rapid diagnostic tools, and integrated field and laboratory testing protocols that provide comprehensive data for regulatory submissions and product development. Technological advancements are leading to faster turnaround times and more cost-effective testing solutions.

Key Drivers, Barriers & Challenges in Agricultural Biologicals Testing Market

Key Drivers: The primary forces propelling the Agricultural Biologicals Testing Market are the escalating demand for sustainable and organic agriculture, driven by consumer preference for healthier food options and environmental consciousness. Favorable government policies and incentives promoting the use of biological inputs, coupled with ongoing technological advancements in molecular biology and analytics, significantly contribute to market growth. The need to comply with increasingly stringent regulatory requirements for product registration and efficacy validation also acts as a major driver.

Barriers & Challenges: Significant challenges include the high cost and lengthy duration of biological efficacy testing, which can deter smaller manufacturers. The variability in the performance of biological products due to environmental factors poses a challenge for consistent testing. Furthermore, the lack of standardized testing protocols across different regions and the ongoing competition from established conventional agrochemicals present hurdles. Supply chain disruptions and the limited availability of skilled personnel for specialized testing services also impact market dynamics. The estimated annual cost of regulatory compliance for a new biological product can range from $XXX to $XXX thousand, posing a barrier for smaller enterprises.

Emerging Opportunities in Agricultural Biologicals Testing Market

Emerging opportunities in the Agricultural Biologicals Testing Market are abundant, driven by the growing demand for specialized testing for novel biological applications. This includes the expansion of testing services for microbiome-based agricultural solutions, plant health stimulants, and bio-stimulants designed to enhance crop resilience against climate change impacts. Untapped markets in developing economies with increasing agricultural modernization present significant growth potential. Evolving consumer preferences for traceable and sustainably produced food are also creating demand for comprehensive testing that verifies the environmental and health benefits of biological inputs. The development of on-farm diagnostic tools and portable testing devices represents another promising avenue.

Growth Accelerators in the Agricultural Biologicals Testing Market Industry

The long-term growth of the Agricultural Biologicals Testing Market is being accelerated by several key catalysts. Technological breakthroughs in areas like next-generation sequencing and advanced bioinformatics are enabling more precise and rapid analysis of biological efficacy and safety. Strategic partnerships between testing laboratories, biological input manufacturers, and academic institutions are fostering innovation and creating synergistic growth opportunities. Market expansion strategies, including geographical diversification into emerging agricultural economies and the development of integrated service offerings that cover the entire product lifecycle from R&D to regulatory approval, are crucial growth accelerators. The increasing focus on circular economy principles in agriculture is also driving demand for testing of recycled nutrient sources and bio-based soil amendments.

Key Players Shaping the Agricultural Biologicals Testing Market Market

- SGS SA

- i2LResearch

- Anadiag Group

- RJ Hill Laboratories Ltd

- Laus GmbH

- Staphyt S A

- Biotecnologie B T Srl

- Apal Agricultural Laboratory

- Bionema Limited

- Eurofins Scientific SE

- Syntech Researc

Notable Milestones in Agricultural Biologicals Testing Market Sector

- 2019: Launch of advanced molecular diagnostic tools for rapid microbial identification in agricultural samples.

- 2020: Increased regulatory scrutiny on biological product efficacy, leading to a surge in demand for comprehensive testing services.

- 2021: Acquisition of a specialized biosafety testing firm by a major agrochemical company, signaling industry consolidation and strategic investment.

- 2022: Development of novel field-based testing protocols for biofertilizers, enabling faster on-site efficacy assessment.

- 2023: Introduction of AI-powered data analysis platforms for biologicals testing, enhancing accuracy and efficiency.

- 2024: Emergence of a new regulatory framework in key European markets focusing on the environmental impact of biological inputs, driving demand for specialized ecotoxicology testing.

In-Depth Agricultural Biologicals Testing Market Market Outlook

- 2019: Launch of advanced molecular diagnostic tools for rapid microbial identification in agricultural samples.

- 2020: Increased regulatory scrutiny on biological product efficacy, leading to a surge in demand for comprehensive testing services.

- 2021: Acquisition of a specialized biosafety testing firm by a major agrochemical company, signaling industry consolidation and strategic investment.

- 2022: Development of novel field-based testing protocols for biofertilizers, enabling faster on-site efficacy assessment.

- 2023: Introduction of AI-powered data analysis platforms for biologicals testing, enhancing accuracy and efficiency.

- 2024: Emergence of a new regulatory framework in key European markets focusing on the environmental impact of biological inputs, driving demand for specialized ecotoxicology testing.

In-Depth Agricultural Biologicals Testing Market Market Outlook

The outlook for the Agricultural Biologicals Testing Market remains exceptionally positive, propelled by the overarching trend towards sustainable agriculture and the increasing global acceptance of biological solutions. Growth accelerators, including technological advancements in diagnostics and data analytics, coupled with strategic collaborations and market expansion initiatives, will continue to fuel this expansion. The market is expected to witness a significant surge as regulatory bodies worldwide harmonize and streamline testing requirements for biological products, further validating their efficacy and safety. Strategic opportunities lie in catering to the burgeoning demand for specialized testing in areas like microbiome research, climate-resilient crop solutions, and circular agriculture, promising substantial returns for stakeholders.

Agricultural Biologicals Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Agricultural Biologicals Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agricultural Biologicals Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Government Regulations Favoring Agricultural Biologicals are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest Of North America

- 12. Europe Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Spain

- 12.1.5 Germany

- 12.1.6 Rest of Europe

- 13. Asia Pacific Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Africa Agricultural Biologicals Testing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Rest of Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SGS SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 i2LResearch

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Anadiag Group

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 RJ Hill Laboratories Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Laus GmbH

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Staphyt S A

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Biotecnologie B T Srl

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Apal Agricultural Laboratory

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Bionema Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Eurofins Scientific SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Syntech Researc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 SGS SA

List of Figures

- Figure 1: Global Agricultural Biologicals Testing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Africa Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Africa Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Agricultural Biologicals Testing Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America Agricultural Biologicals Testing Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America Agricultural Biologicals Testing Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America Agricultural Biologicals Testing Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America Agricultural Biologicals Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America Agricultural Biologicals Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America Agricultural Biologicals Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America Agricultural Biologicals Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America Agricultural Biologicals Testing Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America Agricultural Biologicals Testing Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: South America Agricultural Biologicals Testing Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: South America Agricultural Biologicals Testing Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: South America Agricultural Biologicals Testing Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: South America Agricultural Biologicals Testing Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: South America Agricultural Biologicals Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: South America Agricultural Biologicals Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: South America Agricultural Biologicals Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: South America Agricultural Biologicals Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: South America Agricultural Biologicals Testing Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: South America Agricultural Biologicals Testing Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: South America Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Europe Agricultural Biologicals Testing Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Europe Agricultural Biologicals Testing Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Europe Agricultural Biologicals Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Europe Agricultural Biologicals Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Europe Agricultural Biologicals Testing Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Europe Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Europe Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 48: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 61: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 62: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 63: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 64: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 69: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 70: Asia Pacific Agricultural Biologicals Testing Market Revenue (Million), by Country 2024 & 2032

- Figure 71: Asia Pacific Agricultural Biologicals Testing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest Of North America Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: South Africa Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Africa Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 34: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 38: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: United States Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Mexico Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 43: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 44: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 45: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 46: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 47: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Brazil Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Argentina Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of South America Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 52: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 53: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 54: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 55: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 56: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: United Kingdom Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Germany Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: France Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Italy Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Spain Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Russia Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Benelux Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Nordics Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Europe Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 67: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 68: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 69: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 70: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 71: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Turkey Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Israel Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: GCC Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: North Africa Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Africa Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Middle East & Africa Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 79: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 80: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 81: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 82: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 83: Global Agricultural Biologicals Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 84: China Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: India Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Japan Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 87: South Korea Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: ASEAN Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 89: Oceania Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of Asia Pacific Agricultural Biologicals Testing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Biologicals Testing Market?

The projected CAGR is approximately 9.70%.

2. Which companies are prominent players in the Agricultural Biologicals Testing Market?

Key companies in the market include SGS SA, i2LResearch, Anadiag Group, RJ Hill Laboratories Ltd, Laus GmbH, Staphyt S A, Biotecnologie B T Srl, Apal Agricultural Laboratory, Bionema Limited, Eurofins Scientific SE, Syntech Researc.

3. What are the main segments of the Agricultural Biologicals Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Government Regulations Favoring Agricultural Biologicals are Driving the Market.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Biologicals Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Biologicals Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Biologicals Testing Market?

To stay informed about further developments, trends, and reports in the Agricultural Biologicals Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence