Key Insights

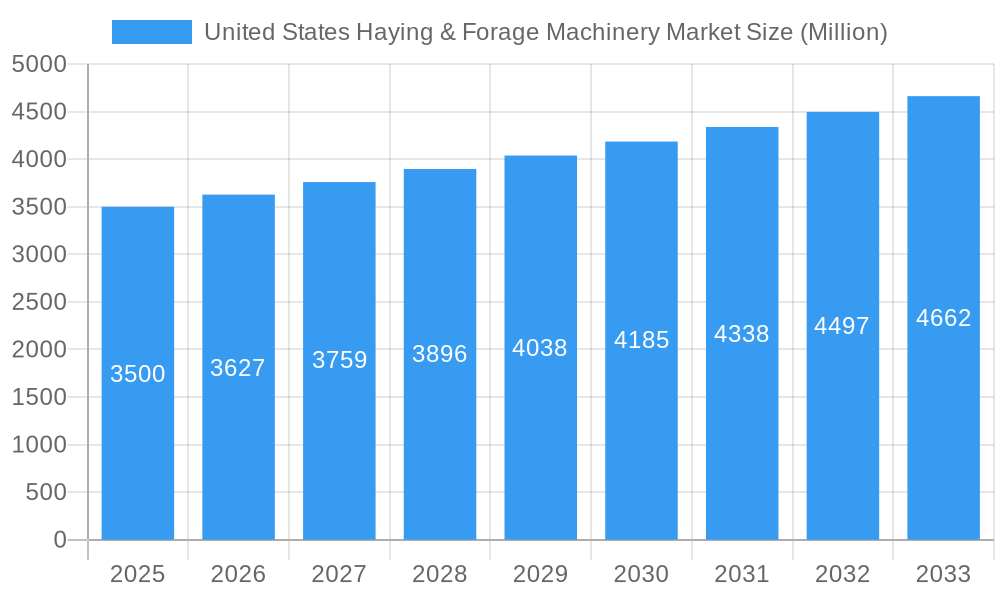

The United States haying and forage machinery market is projected to experience robust growth, driven by increasing demand for efficient and high-quality forage for livestock and the growing dairy and beef industries. With a reported market size of approximately $3,500 million in the base year of 2025 and a Compound Annual Growth Rate (CAGR) of 3.60%, the market is estimated to reach a significant valuation by 2033. Key drivers include the adoption of advanced agricultural technologies to enhance productivity and reduce labor costs, alongside favorable government policies supporting agricultural modernization. Furthermore, the growing emphasis on sustainable farming practices and the need for optimized feed management are spurring innovation in haying and forage equipment, leading to the introduction of more precise and eco-friendly machinery. The market's expansion is also attributed to the increasing mechanization in the U.S. agricultural sector, as farmers invest in cutting-edge equipment to remain competitive and meet the rising global demand for animal protein.

United States Haying & Forage Machinery Market Market Size (In Billion)

The market is segmented into several key product categories, including Mowers, Balers, and Forage Harvesters, with "Others" encompassing a range of specialized equipment. Mowers and balers are expected to witness steady demand due to their fundamental role in hay production, while forage harvesters will likely see accelerated growth driven by the need for efficient ensiling and high-quality silage for livestock. Major industry players such as Deere & Company, CNH Industrial, and AGCO Corporation are leading the market through continuous product development and strategic acquisitions. Emerging trends include the integration of smart technologies, such as GPS guidance, data analytics, and automation, into haying and forage machinery, enhancing operational efficiency and precision farming capabilities. While the market benefits from strong demand, potential restraints could arise from fluctuating commodity prices, increasing operational costs for farmers, and the initial capital investment required for advanced machinery. Nevertheless, the overall outlook for the U.S. haying and forage machinery market remains positive, supported by technological advancements and the enduring importance of the livestock sector.

United States Haying & Forage Machinery Market Company Market Share

Here's a comprehensive, SEO-optimized report description for the United States Haying & Forage Machinery Market, incorporating your specified details and structure.

United States Haying & Forage Machinery Market Report: Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a complete market analysis of the United States Haying & Forage Machinery Market. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report offers critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the strategic moves of major players. Essential for industry professionals, farmers, agricultural equipment manufacturers, investors, and policymakers seeking to understand the evolving landscape of hay and forage production machinery in the U.S.

United States Haying & Forage Machinery Market Market Dynamics & Structure

The United States Haying & Forage Machinery Market is characterized by a moderate to high level of market concentration, with a few major global players dominating the landscape, holding approximately 70% market share. Technological innovation is a significant driver, fueled by advancements in precision agriculture, GPS guidance, data analytics for crop yield optimization, and increased adoption of automated and semi-automated machinery. Regulatory frameworks, particularly those related to emissions standards and agricultural subsidies, play a crucial role in shaping market adoption and product development. Competitive product substitutes, such as advancements in feed preservation techniques and alternative feed sources, exert some pressure but do not fundamentally alter the demand for efficient harvesting machinery. End-user demographics show a growing trend towards larger, technologically sophisticated farming operations seeking to maximize efficiency and minimize labor costs. Mergers and Acquisitions (M&A) trends are notable, with companies strategically acquiring smaller innovators or consolidating to expand their product portfolios and geographic reach. For instance, recent years have seen approximately 3-5 significant M&A deals in the broader agricultural machinery sector impacting this market.

- Market Concentration: Dominated by key global manufacturers, with an estimated 70% market share held by the top 5 companies.

- Technological Innovation Drivers: Precision farming technologies (GPS, sensors), automation, data analytics, and fuel efficiency.

- Regulatory Frameworks: EPA emission standards, USDA agricultural programs, and equipment safety regulations.

- Competitive Product Substitutes: Advancements in silage technology, feed additives, and alternative feed sources.

- End-User Demographics: Shifting towards larger, tech-savvy farms, with a focus on efficiency and sustainability.

- M&A Trends: Strategic acquisitions to enhance product offerings, expand market access, and gain technological advantages, with an average of 3-5 major deals observed annually.

United States Haying & Forage Machinery Market Growth Trends & Insights

The United States Haying & Forage Machinery Market is poised for substantial growth, driven by an increasing demand for high-quality forage and hay, coupled with the need for enhanced agricultural productivity and efficiency. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% during the forecast period. Adoption rates for advanced machinery are steadily increasing, influenced by the rising operational costs of traditional methods and the availability of financing options for agricultural equipment. Technological disruptions are primarily centered around the integration of smart technologies, enabling real-time monitoring, data-driven decision-making, and improved field performance. For instance, the penetration of AI-powered machinery for optimizing cutting and baling processes is expected to surge. Consumer behavior shifts within the agricultural sector are leaning towards sustainable farming practices and machinery that minimizes environmental impact, thus favoring energy-efficient models and precision application tools. The growing emphasis on livestock health and productivity also directly fuels the demand for superior quality forage, necessitating advanced haying and forage equipment.

- Market Size Evolution: Projected to grow at a CAGR of 4.5%-5.5% between 2025 and 2033.

- Adoption Rates: Steadily increasing for advanced machinery due to operational cost pressures and financing availability.

- Technological Disruptions: Integration of AI, IoT, and data analytics for precision farming and operational efficiency.

- Consumer Behavior Shifts: Growing preference for sustainable, eco-friendly, and technologically advanced agricultural solutions.

- Market Penetration: Expected to see a significant increase in penetration of smart and automated haying and forage machinery.

Dominant Regions, Countries, or Segments in United States Haying & Forage Machinery Market

Within the United States Haying & Forage Machinery Market, the Midwest region, often referred to as the "Corn Belt," stands out as the dominant force driving market growth. This dominance is attributed to its vast agricultural land, significant livestock population, and a strong historical reliance on dairy and beef production, which directly correlates with the demand for high-quality forage and hay. The key segments contributing to this regional strength are Balers and Forage Harvesters, which are essential for efficient silage production and haymaking. The Midwest region's market share within the U.S. is estimated to be around 40% of the total market value. Economic policies, such as farm subsidies and incentives for adopting modern agricultural technologies, alongside robust rural infrastructure that supports the deployment and maintenance of heavy machinery, further bolster this region's leadership.

- Dominant Region: Midwest United States.

- Key Segments: Balers and Forage Harvesters are the primary contributors.

- Market Share: Estimated at 40% of the total U.S. market value for the Midwest.

- Key Drivers:

- Extensive agricultural land and a large livestock population.

- Significant dairy and beef production requiring high-quality forage.

- Favorable economic policies and agricultural subsidies.

- Well-developed rural infrastructure for machinery deployment.

- High adoption rates of modern farming technologies.

United States Haying & Forage Machinery Market Product Landscape

The product landscape of the United States Haying & Forage Machinery Market is evolving rapidly with a strong emphasis on enhanced efficiency, durability, and technological integration. Mowers are seeing advancements in cutting width, precision height control, and reduced fuel consumption. Balers are characterized by innovations in bale density, wrapping technology for improved preservation, and automated tying systems. Forage Harvesters are witnessing a surge in onboard processing capabilities, sophisticated data collection for yield mapping, and improved crop flow management. The "Others" segment, which includes tedders, rakes, and wrappers, is also benefiting from technological advancements that streamline the entire hay and forage production chain. Unique selling propositions revolve around reduced crop loss, improved forage quality, lower operating costs, and enhanced operator comfort through ergonomic designs and user-friendly interfaces.

Key Drivers, Barriers & Challenges in United States Haying & Forage Machinery Market

The United States Haying & Forage Machinery Market is propelled by several key drivers, including the escalating global demand for animal protein and dairy products, the increasing need for efficient farm operations to boost profitability, and government initiatives promoting sustainable agriculture. Technological advancements in automation and precision farming further act as significant growth accelerators.

Conversely, the market faces considerable barriers and challenges. High upfront investment costs for advanced machinery can be prohibitive for small to medium-sized farms. The availability of skilled labor to operate and maintain sophisticated equipment is also a growing concern. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact manufacturing timelines and costs. Furthermore, stringent environmental regulations and the need for adaptable machinery to meet diverse forage requirements present ongoing challenges.

- Key Drivers:

- Rising demand for animal products and dairy.

- Focus on agricultural efficiency and profitability.

- Government support for sustainable farming.

- Technological innovation in automation and precision agriculture.

- Key Barriers & Challenges:

- High initial capital investment.

- Shortage of skilled labor.

- Supply chain disruptions and raw material cost fluctuations.

- Stringent environmental regulations.

- Need for adaptable machinery for diverse forage needs.

Emerging Opportunities in United States Haying & Forage Machinery Market

Emerging opportunities in the United States Haying & Forage Machinery Market are largely centered on the increasing adoption of precision agriculture technologies, which allow for optimized forage production and reduced waste. The growing demand for organic and sustainably produced feed presents a niche market for specialized machinery. Furthermore, the development of AI-powered diagnostic tools for machinery maintenance and predictive failure analysis offers significant potential for service providers and manufacturers. The expansion of precision feeding systems in the livestock sector indirectly drives the demand for consistently high-quality forage, creating an impetus for advanced harvesting and processing equipment.

Growth Accelerators in the United States Haying & Forage Machinery Market Industry

Long-term growth in the United States Haying & Forage Machinery Market is being significantly accelerated by breakthroughs in robotics and autonomous machinery, promising to address labor shortages and enhance operational efficiency. Strategic partnerships between machinery manufacturers and technology firms are fostering the development of integrated solutions that offer unparalleled data insights and farm management capabilities. Market expansion strategies, including the introduction of modular and adaptable machinery designs catering to a wider range of farm sizes and specific crop needs, are also crucial growth catalysts. The increasing focus on data-driven farming, where machinery plays a pivotal role in collecting and processing information for yield optimization, is a fundamental driver for sustained market expansion.

Key Players Shaping the United States Haying & Forage Machinery Market Market

- Foton Lovol

- PÖTTINGER Landtechnik GmbH

- IHI

- Deere & Company

- Lely

- CLAAS KGaA mbH

- Vermee

- Kverneland Group

- CNH Industrial

- Krone North America Inc

- KUHN Group

- AGCO Corporation

- Kubota

Notable Milestones in United States Haying & Forage Machinery Market Sector

- 2019: Launch of advanced GPS-guided mowers offering enhanced precision in cutting.

- 2020: Introduction of AI-powered forage harvesters with real-time crop analysis capabilities.

- 2021: Significant advancements in autonomous baling technology, reducing manual intervention.

- 2022: Increased investment in sustainable and eco-friendly machinery designs by major manufacturers.

- 2023: Rollout of integrated data platforms connecting balers and harvesters for comprehensive farm management.

- 2024: Introduction of highly fuel-efficient engines in new generations of forage machinery.

- 2025: Expected widespread adoption of smart sensor technology for crop quality monitoring across baler types.

- 2026: Anticipated release of highly modular and adaptable forage harvesting systems.

In-Depth United States Haying & Forage Machinery Market Market Outlook

The outlook for the United States Haying & Forage Machinery Market remains exceptionally strong, with future growth projected to be driven by ongoing technological integration, particularly in the realms of automation and data analytics. Strategic partnerships and collaborative research and development efforts will continue to unlock innovative solutions that enhance productivity and sustainability. The market's expansion will also be fueled by the increasing adoption of smart machinery that supports precision agriculture, allowing for optimized resource utilization and reduced environmental impact. Opportunities for market penetration in emerging agricultural segments and the development of specialized equipment for niche forage needs present further avenues for growth and diversification.

United States Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

United States Haying & Forage Machinery Market Segmentation By Geography

- 1. United States

United States Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of United States Haying & Forage Machinery Market

United States Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increase in Forage Cultivation Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Foton Lovol

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PÖTTINGER Landtechnik GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHI

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lely

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS KGaA mbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vermee

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kverneland Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Krone North America Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KUHN Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AGCO Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Kubota

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Foton Lovol

List of Figures

- Figure 1: United States Haying & Forage Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Haying & Forage Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Haying & Forage Machinery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: United States Haying & Forage Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Haying & Forage Machinery Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the United States Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the United States Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increase in Forage Cultivation Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the United States Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence