Key Insights

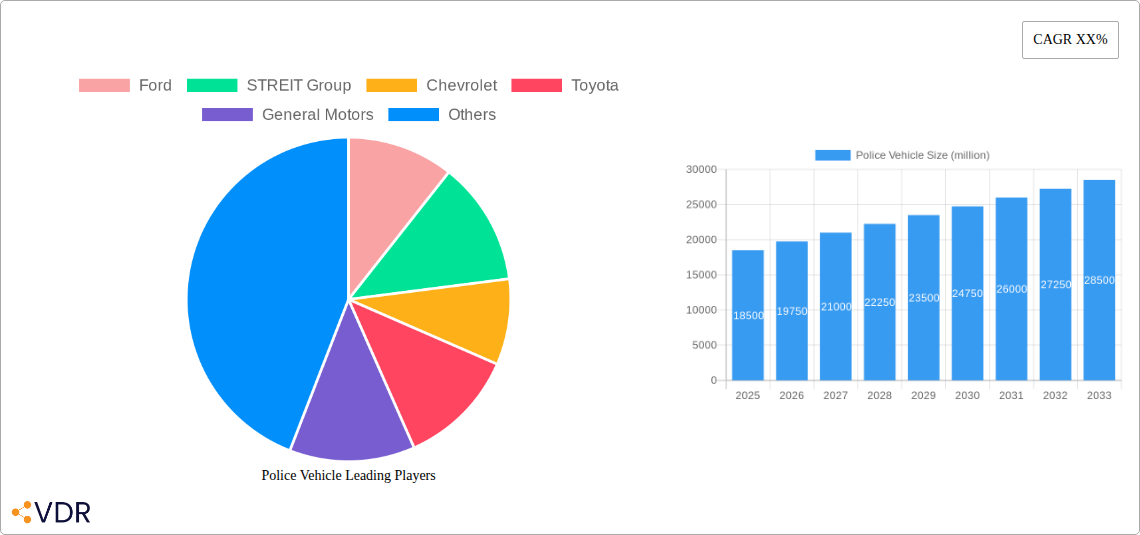

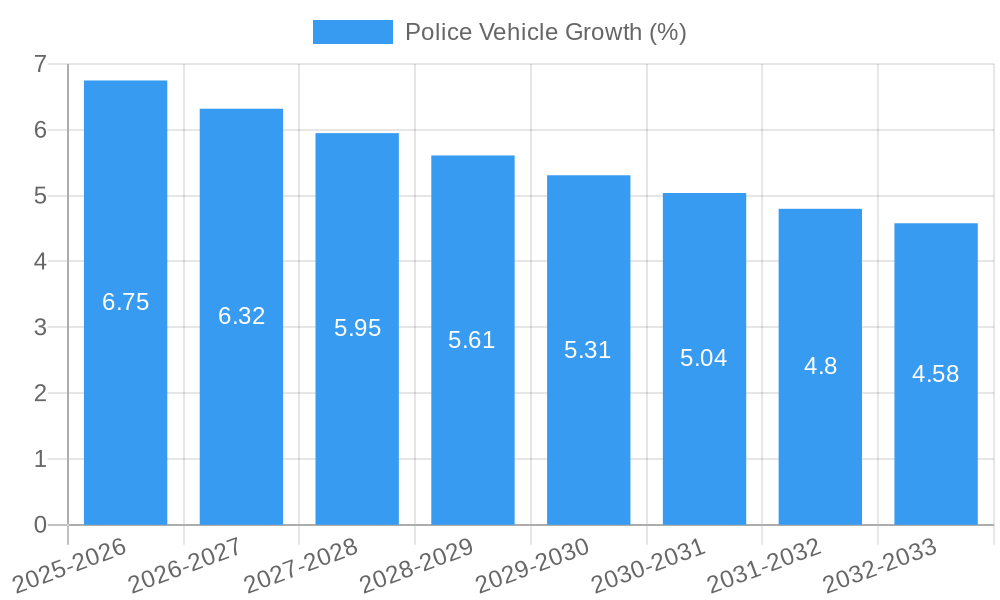

The global police vehicle market is poised for significant expansion, projected to reach an estimated USD 18,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This robust growth is propelled by escalating global security concerns, increasing instances of crime, and a growing emphasis on modernizing law enforcement fleets worldwide. The demand for specialized police vehicles equipped with advanced surveillance, communication, and protective features is rising, driven by the need for enhanced operational efficiency and officer safety. Furthermore, government initiatives focused on public safety and defense spending are acting as strong catalysts for market expansion. The market is experiencing a notable shift towards high-performance SUVs and armored vehicles, reflecting the evolving challenges faced by law enforcement agencies.

The market landscape for police vehicles is characterized by a diverse range of applications, with Criminal Police and Traffic Police segments holding substantial market share due to their critical operational roles. In terms of vehicle types, the demand for SUVs and Trucks is particularly pronounced, owing to their versatility, durability, and suitability for varied terrains and demanding patrol conditions. Armored vehicles are also gaining traction in regions with higher security threats. Key market players, including Ford, Chevrolet, Toyota, and General Motors, are actively investing in research and development to introduce innovative solutions that cater to the specific needs of police forces. Emerging trends such as the integration of AI-powered surveillance systems and advanced connectivity features are expected to shape the future of this market, presenting both opportunities and challenges for established and new entrants alike. While the substantial investment required for specialized vehicles and the lengthy procurement cycles can pose restraints, the overarching need for efficient and secure law enforcement operations will continue to drive market growth.

Police Vehicle Market Dynamics & Structure

The global police vehicle market exhibits moderate concentration, with key players like Ford, Chevrolet, Toyota, and General Motors holding significant shares in the traditional vehicle segments. However, the burgeoning armored vehicle segment sees specialists such as STREIT Group, INKAS, and Armormax leading the charge. Technological innovation is a primary driver, with advancements in powertrain efficiency (e.g., electric and hybrid police cruisers), advanced surveillance and communication systems, and enhanced ballistic protection for armored vehicles shaping product development. Regulatory frameworks, particularly those pertaining to vehicle safety standards, emissions, and the procurement processes of law enforcement agencies, play a crucial role in market entry and product design. Competitive product substitutes, while limited in core police functions, include specialized commercial vehicles adapted for law enforcement roles. End-user demographics, primarily government and municipal police departments, influence demand based on budget cycles, crime rates, and strategic policing priorities. Mergers and acquisitions (M&A) activity is sporadic, often focused on consolidating market share in niche segments or acquiring innovative technologies.

- Market Concentration: Moderate, with a mix of large automotive manufacturers and specialized armored vehicle producers.

- Technological Innovation Drivers: Electric powertrains, advanced communication, enhanced armor technology, AI-powered surveillance integration.

- Regulatory Frameworks: Safety certifications (e.g., NHTSA), emissions standards, ballistic protection ratings (e.g., NIJ).

- Competitive Product Substitutes: Modified commercial vehicles, advanced non-lethal enforcement technologies.

- End-User Demographics: Government agencies, municipal police departments, federal law enforcement.

- M&A Trends: Focused on niche segment consolidation and technology acquisition.

Police Vehicle Growth Trends & Insights

The police vehicle market is poised for substantial growth, projected to expand from approximately $15,500 million in 2019 to an estimated $22,300 million by 2033. This represents a Compound Annual Growth Rate (CAGR) of approximately 3.1% over the study period, with a stronger trajectory anticipated during the forecast period of 2025–2033. Market size evolution is underpinned by increasing global security concerns, rising crime rates in certain regions, and the continuous need for updated and technologically advanced law enforcement fleets. Adoption rates for traditional police cruisers and SUVs remain high, driven by fleet replacement cycles and the demand for reliable patrol vehicles. However, a significant growth accelerator is the escalating adoption of armored police vehicles, particularly in regions facing heightened security threats or organized crime.

Technological disruptions are fundamentally reshaping the market. The integration of advanced electronics, including sophisticated communication systems, real-time data analytics platforms, and in-car AI for suspect identification and traffic monitoring, is becoming standard. Furthermore, the shift towards electric and hybrid police vehicles is gaining momentum, driven by environmental regulations, reduced operational costs, and the desire for quieter patrol operations. Consumer behavior shifts, though indirect in the B2B police vehicle market, are evident in procurement decisions that increasingly prioritize long-term cost of ownership, sustainability, and advanced safety features. The market penetration of specialized police vehicles, especially armored variants and those equipped with cutting-edge technology, is expected to rise. The base year of 2025 is projected to see a market value of $19,500 million, with robust expansion anticipated throughout the forecast period. Historical data from 2019–2024 indicates a steady growth trend, setting a strong foundation for future expansion.

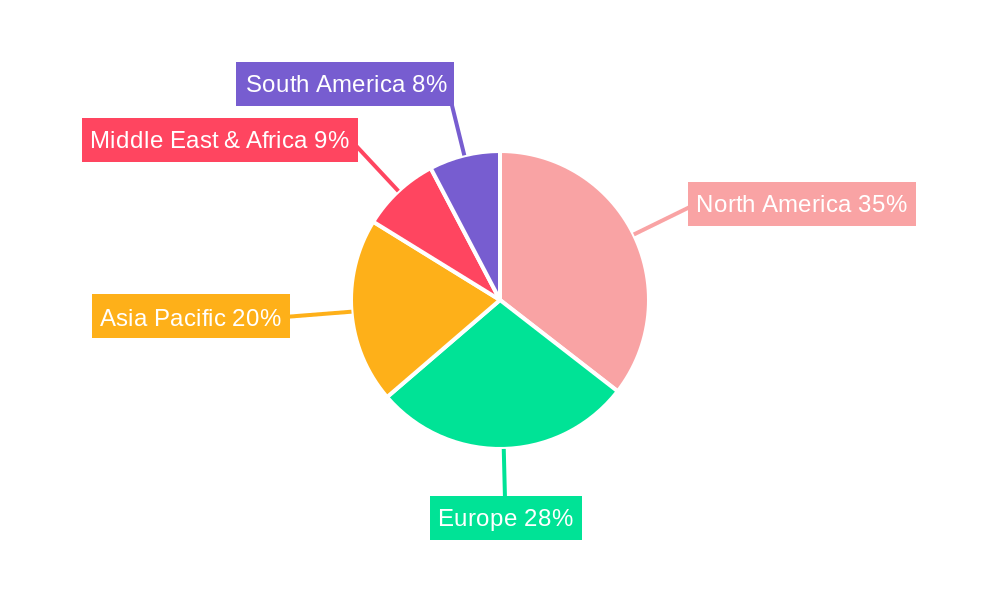

Dominant Regions, Countries, or Segments in Police Vehicle

The Armored Vehicle segment, within the broader Police Vehicle market, is a significant driver of growth, particularly when considering the parent market of law enforcement vehicles. This segment's dominance is fueled by escalating global security challenges, including terrorism, organized crime, and civil unrest, which necessitate enhanced protection for law enforcement personnel. Regions with higher geopolitical instability and a strong emphasis on national security, such as North America and parts of Europe and the Middle East, are leading the demand for armored police vehicles.

In terms of specific applications, Criminal Police and Policeman roles represent substantial demand for both standard and specialized vehicles. Criminal police units often require unmarked vehicles with advanced surveillance capabilities, while patrol officers rely on robust and technologically equipped cruisers for daily operations. The Traffic Police segment also contributes significantly, demanding vehicles that can effectively patrol highways and respond rapidly to incidents, often featuring specialized lighting and communication equipment.

Amongst the types, SUVs and Trucks are increasingly favored for their versatility, higher ground clearance, and robust build, making them suitable for diverse policing environments, from urban patrols to rugged terrain. These are often the chassis of choice for both standard and armored police vehicles. The market share and growth potential for armored SUVs and trucks are particularly strong, reflecting their dual utility. Countries with well-funded law enforcement agencies and a proactive approach to security, such as the United States, Canada, and various European nations, are key contributors to the dominance of these segments. Economic policies that prioritize public safety, coupled with infrastructure development that supports the deployment of specialized law enforcement equipment, further bolster the growth of these dominant segments. The market is estimated to reach $22,300 million by 2033, with armored vehicles playing a crucial role in this expansion.

Police Vehicle Product Landscape

The police vehicle product landscape is characterized by continuous innovation focused on enhancing law enforcement capabilities. Traditional cruisers and SUVs are now equipped with sophisticated command and control systems, advanced sensor suites, and optimized powertrains for improved fuel efficiency and performance. The emergence of electric and hybrid police vehicles is a significant development, offering reduced emissions and lower operational costs, aligning with global sustainability initiatives. Armored police vehicles, a rapidly expanding segment, feature advanced ballistic protection, reinforced chassis, and specialized security features to withstand hostile environments. Innovations in communication technology, real-time data integration, and AI-powered analytics are being incorporated across all vehicle types, improving situational awareness and operational effectiveness for law enforcement agencies.

Key Drivers, Barriers & Challenges in Police Vehicle

Key Drivers:

- Rising Global Security Concerns: Increased threats from terrorism, organized crime, and civil unrest necessitate advanced and protected law enforcement vehicles.

- Technological Advancements: Integration of AI, advanced communication systems, electric powertrains, and enhanced ballistic protection drives demand for modern fleets.

- Fleet Modernization & Replacement Cycles: Regular replacement of aging vehicles by law enforcement agencies fuels consistent demand.

- Government Funding & Public Safety Investments: Increased budgetary allocations for law enforcement equip agencies with the resources to procure specialized vehicles.

Barriers & Challenges:

- High Cost of Specialized Vehicles: Advanced technologies and armor significantly increase the price of police vehicles, posing budgetary constraints for some agencies.

- Supply Chain Disruptions: Global component shortages and logistical challenges can impact production timelines and vehicle availability.

- Regulatory Hurdles: Stringent safety, emissions, and performance standards can prolong development and homologation processes.

- Maintenance & Training Costs: Advanced technology requires specialized maintenance and extensive training for officers, adding to the total cost of ownership.

- Competitive Pressures: Intense competition among established manufacturers and new entrants can lead to price wars and margin pressures.

Emerging Opportunities in Police Vehicle

Emerging opportunities in the police vehicle sector lie in the growing demand for intelligent patrol vehicles equipped with AI-powered analytics for real-time threat assessment and crime prediction. The expansion of electric and hybrid police vehicle fleets presents a significant opportunity for manufacturers to tap into the sustainability goals of government agencies and reduce long-term operational expenses. Furthermore, the increasing need for specialized vehicles in non-traditional policing roles, such as disaster response, community outreach, and surveillance in remote areas, opens new market avenues. The development of modular vehicle systems that can be easily adapted for different policing functions also represents a promising area for innovation and market growth.

Growth Accelerators in the Police Vehicle Industry

Growth in the police vehicle industry is significantly accelerated by the relentless pursuit of technological innovation. The integration of connected vehicle technology, enabling seamless data sharing between vehicles and command centers, is a major catalyst. Strategic partnerships between automotive manufacturers and technology firms are crucial for developing next-generation policing solutions. Furthermore, market expansion strategies targeting emerging economies with developing law enforcement infrastructures are poised to drive long-term growth. The increasing focus on vehicle electrification, driven by both environmental mandates and cost-saving potentials, acts as a powerful accelerator for the adoption of hybrid and electric police vehicles.

Key Players Shaping the Police Vehicle Market

Ford STREIT Group Chevrolet Toyota General Motors Skoda Vauxhall Centigon Security Group INKAS Armormax EMIS The Armored Group Alpine Armoring Inc WELP Group Stellantis

Notable Milestones in Police Vehicle Sector

- 2019: Ford announces an expanded range of law enforcement vehicles, including specialized hybrid options.

- 2020: STREIT Group showcases advanced armored SUV prototypes for high-threat environments.

- 2021: General Motors introduces new electric vehicle platforms with potential for police applications.

- 2022: Toyota continues to dominate the patrol car market with its reliable and fuel-efficient models.

- 2023: The Armored Group receives significant contracts for armored personnel carriers for law enforcement.

- 2024: INKAS highlights advancements in ballistic protection for its security vehicles.

- 2025 (Estimated): Widespread adoption of integrated AI and real-time data systems in new police vehicle models.

- 2026 (Estimated): Increased market penetration of fully electric police cruisers in urban environments.

- 2028 (Estimated): Development and early adoption of advanced autonomous policing support vehicles.

- 2030 (Estimated): Significant growth in the global market for highly specialized armored law enforcement vehicles.

- 2032 (Estimated): Increased focus on sustainable materials and lifecycle management in police vehicle manufacturing.

- 2033 (Estimated): Continued evolution of vehicle-to-everything (V2X) communication capabilities for enhanced public safety.

In-Depth Police Vehicle Market Outlook

The police vehicle market is set for robust growth, driven by an ongoing need for advanced, safe, and efficient law enforcement tools. The integration of cutting-edge technologies, including AI, advanced communication, and electric powertrains, will define future offerings. Strategic market expansion and the increasing demand for specialized armored vehicles in response to evolving global security threats present significant opportunities. The industry's trajectory points towards a future where police vehicles are not just modes of transportation but sophisticated mobile command centers and integral components of a modernized public safety infrastructure.

Police Vehicle Segmentation

-

1. Application

- 1.1. Policeman

- 1.2. Criminal Police

- 1.3. Traffic Police

- 1.4. Others

-

2. Types

- 2.1. Cruiser

- 2.2. SUVs and Trucks

- 2.3. Armored Vehicle

- 2.4. Others

Police Vehicle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Police Vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Policeman

- 5.1.2. Criminal Police

- 5.1.3. Traffic Police

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cruiser

- 5.2.2. SUVs and Trucks

- 5.2.3. Armored Vehicle

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Policeman

- 6.1.2. Criminal Police

- 6.1.3. Traffic Police

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cruiser

- 6.2.2. SUVs and Trucks

- 6.2.3. Armored Vehicle

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Policeman

- 7.1.2. Criminal Police

- 7.1.3. Traffic Police

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cruiser

- 7.2.2. SUVs and Trucks

- 7.2.3. Armored Vehicle

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Policeman

- 8.1.2. Criminal Police

- 8.1.3. Traffic Police

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cruiser

- 8.2.2. SUVs and Trucks

- 8.2.3. Armored Vehicle

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Policeman

- 9.1.2. Criminal Police

- 9.1.3. Traffic Police

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cruiser

- 9.2.2. SUVs and Trucks

- 9.2.3. Armored Vehicle

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Police Vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Policeman

- 10.1.2. Criminal Police

- 10.1.3. Traffic Police

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cruiser

- 10.2.2. SUVs and Trucks

- 10.2.3. Armored Vehicle

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ford

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 STREIT Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevrolet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toyota

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Motors

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Skoda

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vauxhall

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Centigon Security Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 INKAS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Armormax

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EMIS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Armored Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Alpine Armoring Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 WELP Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Stellantis

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ford

List of Figures

- Figure 1: Global Police Vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Police Vehicle Revenue (million), by Application 2024 & 2032

- Figure 3: North America Police Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Police Vehicle Revenue (million), by Types 2024 & 2032

- Figure 5: North America Police Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Police Vehicle Revenue (million), by Country 2024 & 2032

- Figure 7: North America Police Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Police Vehicle Revenue (million), by Application 2024 & 2032

- Figure 9: South America Police Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Police Vehicle Revenue (million), by Types 2024 & 2032

- Figure 11: South America Police Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Police Vehicle Revenue (million), by Country 2024 & 2032

- Figure 13: South America Police Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Police Vehicle Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Police Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Police Vehicle Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Police Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Police Vehicle Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Police Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Police Vehicle Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Police Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Police Vehicle Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Police Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Police Vehicle Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Police Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Police Vehicle Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Police Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Police Vehicle Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Police Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Police Vehicle Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Police Vehicle Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Police Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Police Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Police Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Police Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Police Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Police Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Police Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Police Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Police Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Police Vehicle Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Police Vehicle?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Police Vehicle?

Key companies in the market include Ford, STREIT Group, Chevrolet, Toyota, General Motors, Skoda, Vauxhall, Centigon Security Group, INKAS, Armormax, EMIS, The Armored Group, Alpine Armoring Inc, WELP Group, Stellantis.

3. What are the main segments of the Police Vehicle?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Police Vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Police Vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Police Vehicle?

To stay informed about further developments, trends, and reports in the Police Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence