Key Insights

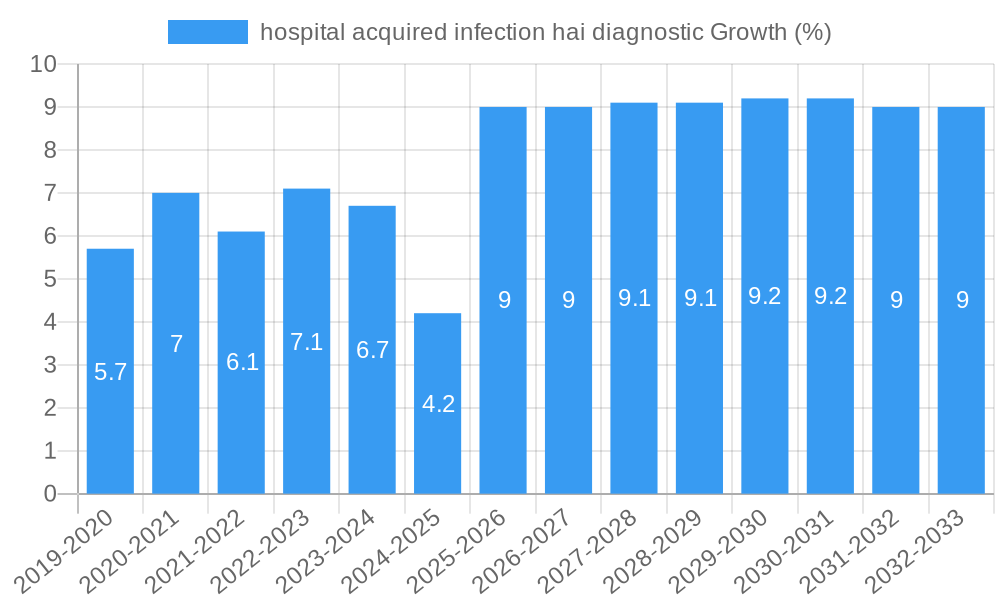

The global market for Hospital Acquired Infection (HAI) diagnostics is poised for substantial growth, estimated at $2500 million in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust expansion is primarily fueled by the increasing incidence of HAIs, coupled with a growing awareness among healthcare providers regarding their significant impact on patient outcomes and healthcare costs. The escalating strain on healthcare systems due to patient volume and the imperative to reduce readmission rates further amplify the demand for accurate and rapid HAI diagnostic solutions. Technological advancements, including the development of rapid molecular diagnostic tests, point-of-care testing, and multiplex assays, are playing a pivotal role in enhancing the efficiency and effectiveness of HAI detection. These innovations allow for quicker pathogen identification and antimicrobial susceptibility testing, enabling timely and targeted treatment, which is crucial for combating the rise of antibiotic-resistant organisms.

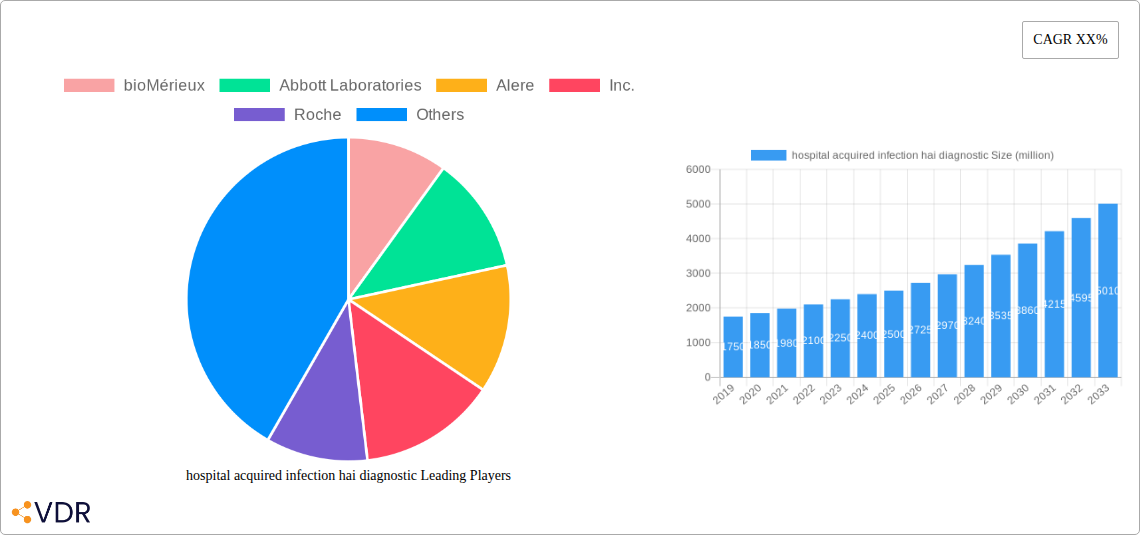

The market is segmented by application and type, with applications encompassing bloodstream infections, urinary tract infections, respiratory infections, surgical site infections, and others. The rising prevalence of healthcare-associated bloodstream infections and respiratory infections, particularly in critical care settings, drives significant demand within these segments. On the type front, the market is characterized by the dominance of molecular diagnostics and immunoassay-based tests, owing to their superior sensitivity and specificity. However, traditional culture-based methods, while time-consuming, continue to hold a share due to their established role in certain diagnostic pathways. Restraints such as the high cost of advanced diagnostic technologies and the need for skilled personnel to operate them are present. Nevertheless, the unwavering focus on infection control, coupled with supportive government initiatives and the increasing adoption of automated diagnostic platforms, is expected to mitigate these challenges and sustain the market's upward trajectory. Key players like bioMérieux, Abbott Laboratories, Roche, and Thermo Fisher Scientific are at the forefront, investing heavily in research and development to introduce innovative solutions that address the evolving landscape of HAI diagnostics.

Comprehensive Report Description: Hospital Acquired Infection (HAI) Diagnostic Market Analysis 2019-2033

This in-depth report provides a definitive analysis of the global Hospital Acquired Infection (HAI) diagnostic market, offering critical insights for stakeholders navigating this dynamic sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report delves into the historical trends and future trajectory of HAI diagnostics. We meticulously examine the parent and child market segments, providing a granular view of market evolution and opportunities. The report integrates high-traffic keywords essential for SEO optimization, ensuring maximum visibility for industry professionals seeking robust data and strategic guidance. All quantitative data is presented in million units for clear comprehension.

hospital acquired infection hai diagnostic Market Dynamics & Structure

The hospital acquired infection (HAI) diagnostic market is characterized by a moderately consolidated structure, with leading players like bioMérieux, Abbott Laboratories, Roche, and Siemens Healthcare holding significant market shares. Technological innovation is a primary driver, fueled by the relentless pursuit of faster, more accurate, and multiplexed diagnostic solutions to combat the rising threat of antimicrobial resistance (AMR) and novel pathogens. Regulatory frameworks, such as those established by the FDA and EMA, play a crucial role in shaping product development and market access, often necessitating rigorous validation and approval processes. Competitive product substitutes are evolving, with advancements in molecular diagnostics, mass spectrometry, and rapid point-of-care testing posing challenges to traditional culture-based methods. End-user demographics are expanding beyond hospitals to include clinics, long-term care facilities, and even home healthcare settings as diagnostic technologies become more portable and user-friendly. Mergers and acquisitions (M&A) are a recurring theme, with companies actively consolidating their portfolios, acquiring innovative technologies, and expanding their geographical reach. For instance, the historical period saw numerous strategic acquisitions aimed at bolstering capabilities in areas like rapid pathogen identification and antimicrobial susceptibility testing.

- Market Concentration: Moderately consolidated, with a few dominant players and a growing number of specialized innovators.

- Technological Innovation Drivers: Need for rapid and accurate pathogen identification, AMR detection, and point-of-care solutions.

- Regulatory Frameworks: Stringent approval processes influencing product development timelines and market entry strategies.

- Competitive Product Substitutes: Shift towards molecular diagnostics, PCR, NGS, and rapid antigen tests.

- End-User Demographics: Expanding beyond traditional hospitals to include outpatient settings and specialized care facilities.

- M&A Trends: Ongoing strategic acquisitions for technology enhancement and market expansion. The historical period (2019-2024) witnessed an estimated 35 M&A deals, contributing to market consolidation.

hospital acquired infection hai diagnostic Growth Trends & Insights

The hospital acquired infection (HAI) diagnostic market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). This expansion is driven by an increasing incidence of HAIs globally, coupled with a growing awareness among healthcare providers and governments regarding their significant economic and public health burden. The market size, estimated at $5.2 billion in 2025, is poised to reach an estimated $9.3 billion by 2033. Adoption rates of advanced diagnostic technologies are accelerating, particularly in developed economies, as healthcare systems prioritize early detection and intervention to reduce patient mortality, morbidity, and prolonged hospital stays. Technological disruptions, such as the advent of next-generation sequencing (NGS) for outbreak surveillance and the miniaturization of PCR-based systems for point-of-care testing, are fundamentally reshaping the diagnostic landscape. Consumer behavior shifts, influenced by increased patient advocacy and a demand for higher quality healthcare, are also pushing for more sophisticated and accessible diagnostic solutions. The ongoing battle against multidrug-resistant organisms (MDROs) further amplifies the demand for rapid and precise diagnostic tools that can guide appropriate antibiotic therapy, thereby preventing the spread of resistance. Furthermore, government initiatives and funding aimed at improving infection control and surveillance are acting as significant tailwinds for market growth. The increasing prevalence of immunocompromised patient populations, undergoing complex medical procedures, also contributes to a higher risk of HAIs, thereby driving demand for effective diagnostic solutions.

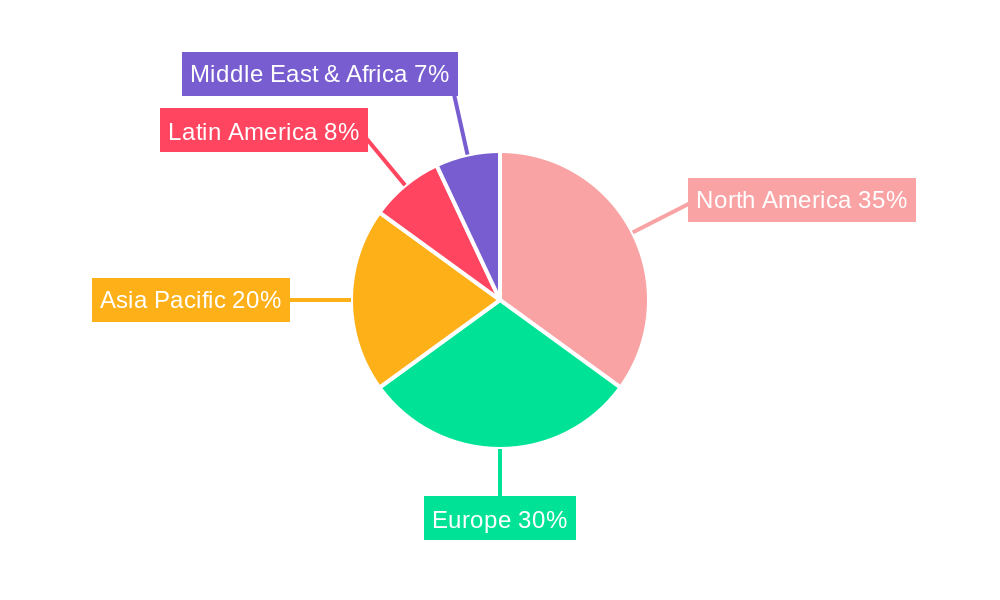

Dominant Regions, Countries, or Segments in hospital acquired infection hai diagnostic

The Application segment of Infectious Disease Diagnostics within the broader hospital acquired infection (HAI) diagnostic market is currently the dominant driver of growth, projected to account for approximately 65% of the market share by 2025. Within this, the sub-segment of Bacterial Infection Diagnostics is particularly strong, driven by the high prevalence of healthcare-associated bacterial infections such as Clostridioides difficile (C. diff) and Methicillin-resistant Staphylococcus aureus (MRSA).

North America, particularly the United States, stands as the dominant region, estimated to capture 38% of the global market share in 2025. This dominance is attributed to several key factors:

- Advanced Healthcare Infrastructure: The presence of sophisticated healthcare systems with high patient volumes and robust infection control protocols.

- High R&D Investment: Significant investment in research and development by leading diagnostic companies, fostering innovation and early adoption of new technologies.

- Stringent Regulatory Standards: While a barrier, stringent regulatory standards from bodies like the FDA also drive the development of high-quality, reliable diagnostic solutions.

- Prevalence of HAIs: A significant burden of HAIs, necessitating advanced diagnostic capabilities for effective management.

- Reimbursement Policies: Favorable reimbursement policies for diagnostic procedures that promote timely and accurate identification of infections.

Europe follows closely, holding an estimated 29% market share in 2025, propelled by strong government initiatives to combat HAIs and a well-established network of research institutions and diagnostic manufacturers. The Asia-Pacific region is emerging as a high-growth market, driven by increasing healthcare expenditure, a growing patient population, and a rise in the number of diagnostic laboratories equipped with advanced technologies.

In terms of Types, molecular diagnostics, including PCR and other nucleic acid amplification tests (NAATs), are experiencing the fastest growth and are expected to hold the largest market share in the Application segment of Bacterial Infection Diagnostics by 2025, estimated at $2.1 billion in value. This is due to their superior sensitivity, specificity, and speed compared to traditional culture methods, enabling rapid identification of pathogens and their resistance profiles. The overall market for Types is projected to reach $7.8 billion in 2025.

hospital acquired infection hai diagnostic Product Landscape

The hospital acquired infection (HAI) diagnostic product landscape is characterized by a rapid evolution towards multiplexed assays, syndromic panels, and point-of-care (POC) solutions. Innovations are focused on reducing turnaround times for pathogen identification and antimicrobial susceptibility testing (AST), crucial for timely patient management and infection control. Next-generation sequencing (NGS) technologies are gaining traction for whole-genome sequencing of pathogens, aiding in outbreak investigations and understanding transmission dynamics. Rapid antigen and molecular tests for common HAIs like influenza and respiratory syncytial virus (RSV) are becoming more prevalent, offering quick results at the bedside. Companies are also developing integrated platforms that combine sample preparation, amplification, and detection, simplifying workflows and reducing the need for specialized laboratory personnel. The emphasis is on delivering high-performance metrics, including enhanced sensitivity and specificity, minimal sample volume requirements, and broad pathogen coverage, to combat the escalating threat of antimicrobial resistance.

Key Drivers, Barriers & Challenges in hospital acquired infection hai diagnostic

Key Drivers: The hospital acquired infection (HAI) diagnostic market is propelled by several critical factors. The escalating global burden of HAIs, coupled with the growing threat of antimicrobial resistance (AMR), necessitates more sophisticated diagnostic tools. Technological advancements, such as the development of rapid molecular diagnostics and AI-powered analysis, are enabling faster and more accurate pathogen identification. Increasing healthcare expenditure worldwide, particularly in emerging economies, is expanding access to advanced diagnostic technologies. Furthermore, government initiatives and public health campaigns aimed at infection prevention and control create a favorable market environment.

Barriers & Challenges: Despite its growth, the market faces significant barriers and challenges. High development and regulatory approval costs for novel diagnostic assays can deter smaller companies. The stringent regulatory landscape, while ensuring quality, can lead to extended product launch timelines. Reimbursement policies for new diagnostic tests can be complex and vary significantly across regions, impacting market adoption. Supply chain disruptions and the availability of skilled laboratory personnel also pose ongoing challenges. Moreover, the initial capital investment required for advanced diagnostic platforms can be a deterrent for smaller healthcare facilities with limited budgets.

Emerging Opportunities in hospital acquired infection hai diagnostic

Emerging opportunities in the HAI diagnostic market lie in the development of novel diagnostics for less common but emerging pathogens, such as rare fungi and viruses, which pose increasing risks in immunocompromised patients. The expansion of POC diagnostics into non-hospital settings, like long-term care facilities and even remote patient monitoring, presents a significant growth avenue. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into diagnostic platforms for predictive analytics, outbreak detection, and treatment optimization holds immense potential. The growing demand for rapid AST methods that can provide actionable results within hours rather than days is another key opportunity, directly addressing the AMR crisis. The development of cost-effective, scalable solutions for low-resource settings is also a critical area for future growth.

Growth Accelerators in the hospital acquired infection hai diagnostic Industry

Several catalysts are accelerating growth in the HAI diagnostic industry. The significant global increase in healthcare-associated infections (HAIs) is a primary driver, compelling healthcare providers to invest in advanced detection and prevention methods. The escalating threat of antimicrobial resistance (AMR) is a critical catalyst, pushing for the development and adoption of rapid diagnostics that guide appropriate antibiotic therapy. Technological breakthroughs, including the refinement of PCR, isothermal amplification, and next-generation sequencing (NGS) technologies, are enhancing the speed, accuracy, and multiplexing capabilities of diagnostic tests. Strategic partnerships between diagnostic companies, academic institutions, and pharmaceutical firms are fostering innovation and accelerating the development pipeline. Furthermore, favorable government policies and increased funding for infection control and surveillance programs worldwide are providing significant impetus.

Key Players Shaping the hospital acquired infection hai diagnostic Market

- bioMérieux

- Abbott Laboratories

- Alere, Inc.

- Roche

- Siemens Healthcare

- Becton Dickenson

- Cepheid Inc.

- Thermo Fisher Scientific

- Seegene, Inc.

- Qiagen

Notable Milestones in hospital acquired infection hai diagnostic Sector

- 2019: Launch of rapid multiplex PCR panels for common HAI pathogens, significantly reducing turnaround times.

- 2020: Increased focus on syndromic testing solutions to identify multiple pathogens simultaneously.

- 2021: Advancements in CRISPR-based diagnostics for pathogen detection, promising higher specificity and lower cost.

- 2022: Expansion of AI-powered diagnostic platforms for outbreak prediction and early warning systems.

- 2023: Strategic acquisitions by major players to bolster their molecular diagnostics and POC testing portfolios.

- 2024: Growing adoption of whole-genome sequencing for routine surveillance of hospital outbreaks.

In-Depth hospital acquired infection hai diagnostic Market Outlook

The future outlook for the hospital acquired infection (HAI) diagnostic market is exceptionally promising, driven by ongoing advancements and a persistent global health imperative. The sustained increase in HAI incidence and the relentless rise of antimicrobial resistance will continue to fuel demand for sophisticated diagnostic solutions. Technological innovations in areas like microfluidics, AI integration, and advanced sequencing techniques will further enhance the speed, accuracy, and accessibility of HAI diagnostics. Growth accelerators such as expanding healthcare infrastructure in emerging economies and government investments in public health will broaden market reach. Strategic collaborations and mergers will continue to shape the competitive landscape, fostering innovation and market consolidation. The market is poised for substantial growth, with significant opportunities in developing rapid, cost-effective, and user-friendly diagnostic tools that can be deployed across diverse healthcare settings worldwide.

hospital acquired infection hai diagnostic Segmentation

- 1. Application

- 2. Types

hospital acquired infection hai diagnostic Segmentation By Geography

- 1. CA

hospital acquired infection hai diagnostic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. hospital acquired infection hai diagnostic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 bioMérieux

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Laboratories

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alere

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inc.

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roche

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Becton Dickenson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cepheid Inc.

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thermo Fisher Scientific

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Seegene

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Inc.

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Qiagen

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 bioMérieux

List of Figures

- Figure 1: hospital acquired infection hai diagnostic Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: hospital acquired infection hai diagnostic Share (%) by Company 2024

List of Tables

- Table 1: hospital acquired infection hai diagnostic Revenue million Forecast, by Region 2019 & 2032

- Table 2: hospital acquired infection hai diagnostic Revenue million Forecast, by Application 2019 & 2032

- Table 3: hospital acquired infection hai diagnostic Revenue million Forecast, by Types 2019 & 2032

- Table 4: hospital acquired infection hai diagnostic Revenue million Forecast, by Region 2019 & 2032

- Table 5: hospital acquired infection hai diagnostic Revenue million Forecast, by Application 2019 & 2032

- Table 6: hospital acquired infection hai diagnostic Revenue million Forecast, by Types 2019 & 2032

- Table 7: hospital acquired infection hai diagnostic Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the hospital acquired infection hai diagnostic?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the hospital acquired infection hai diagnostic?

Key companies in the market include bioMérieux, Abbott Laboratories, Alere, Inc., Roche, Siemens Healthcare, Becton Dickenson, Cepheid Inc., Thermo Fisher Scientific, Seegene, Inc., Qiagen.

3. What are the main segments of the hospital acquired infection hai diagnostic?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "hospital acquired infection hai diagnostic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the hospital acquired infection hai diagnostic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the hospital acquired infection hai diagnostic?

To stay informed about further developments, trends, and reports in the hospital acquired infection hai diagnostic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence