Key Insights

The European processed meat market, valued at €38.36 billion in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 1.26% from 2025 to 2033. This relatively low growth reflects several factors. While strong demand persists for convenient and readily available protein sources, particularly within chilled processed meat segments like sausages and deli meats, consumer concerns regarding health and sustainability are acting as significant restraints. The increasing awareness of the potential health risks associated with high processed meat consumption, coupled with growing preference for plant-based alternatives, are slowing market expansion. Furthermore, fluctuating raw material prices (particularly poultry and pork) and stricter regulations concerning additives and preservatives introduce further challenges. However, the market benefits from strong distribution networks, particularly through supermarkets and hypermarkets, which ensure widespread product availability. The growth within the frozen processed meat segment is likely to outpace chilled offerings due to increased shelf life and convenience. Online retail channels are also expected to witness significant growth, albeit from a smaller base, driven by changing consumer preferences and the expansion of e-commerce grocery services.

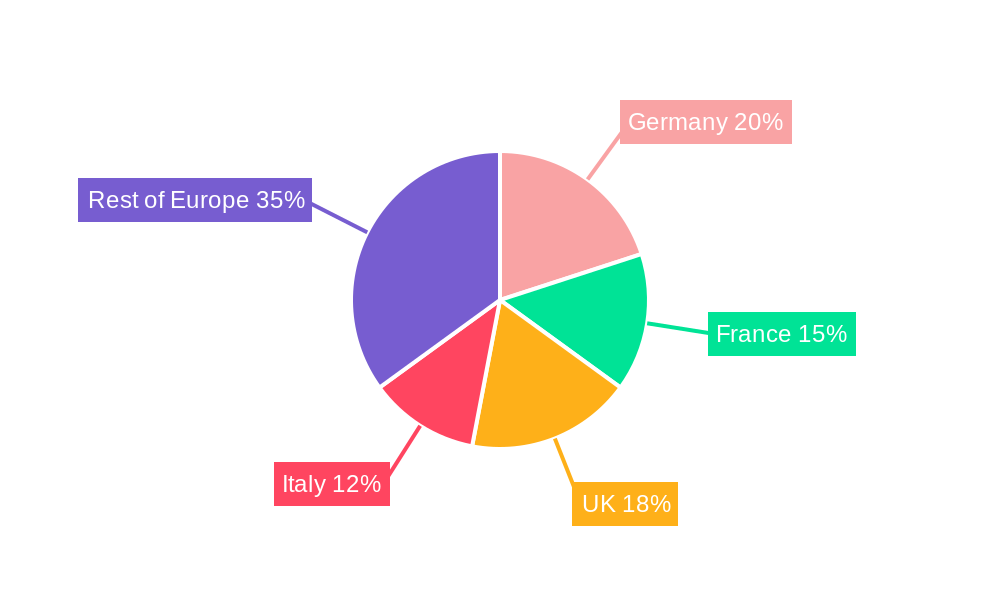

Growth within specific segments will vary. Poultry processed meat is projected to retain a dominant market share owing to its affordability and relatively lower fat content compared to beef or pork. Innovation within product offerings, such as healthier options with reduced sodium and added fibers, and the introduction of new flavors and varieties, will play a crucial role in stimulating market growth. The expansion into niche markets catering to specific dietary requirements (e.g., halal or organic meats) presents further opportunities for growth. Geographic variations within Europe are expected; countries with higher per capita consumption of processed meats, like Germany and the UK, are likely to contribute significantly to the overall market value, while others may display more moderate growth. The competitive landscape is dominated by major international players alongside regional brands. The success of individual companies depends on their ability to navigate the evolving consumer preferences, regulatory landscape, and supply chain challenges.

Europe Processed Meat Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe processed meat market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for industry professionals, investors, and stakeholders seeking to understand the complexities and opportunities within this dynamic market. Total market value is projected at xx Million units by 2033.

Europe Processed Meat Market Market Dynamics & Structure

This section delves into the intricate structure of the European processed meat market, examining key factors influencing its growth and evolution. We analyze market concentration, revealing the dominance of key players like JBS SA and WH Group Limited, and explore the impact of technological innovation, stringent regulatory frameworks (e.g., food safety regulations), and the presence of competitive substitutes (e.g., plant-based meats). End-user demographic shifts, such as changing dietary preferences and increasing health consciousness, are also scrutinized. The report also quantifies M&A activity within the sector, highlighting significant deals and their implications.

- Market Concentration: The European processed meat market exhibits a moderately concentrated structure, with a few large multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a xx level of concentration.

- Technological Innovation: Automation in processing, advanced packaging technologies, and traceability systems are key drivers of innovation, although high upfront investment can serve as a barrier for smaller companies.

- Regulatory Landscape: Stringent food safety regulations and labeling requirements significantly impact market players' operational costs and strategies.

- Competitive Substitutes: The rise of plant-based meat alternatives poses a competitive threat, forcing traditional players to innovate and adapt. Their market penetration is currently estimated at xx%.

- M&A Activity: The period 2019-2024 witnessed xx major mergers and acquisitions, driven primarily by consolidation efforts and expansion strategies. xx% of these deals involved cross-border acquisitions.

Europe Processed Meat Market Growth Trends & Insights

This section provides a comprehensive deep dive into the dynamic growth trajectory of the Europe processed meat market. Employing a sophisticated analytical framework (e.g., SWOT analysis, Porter's Five Forces, PESTLE analysis - we will specify the exact framework in the final report), we illuminate the historical market size evolution from 2019 to 2024 and offer precise projections for the period of 2025-2033. Our analysis meticulously examines the adoption rates of various processed meat categories, such as cured, smoked, cooked, and fermented products, identifying key drivers and barriers for each. Furthermore, we dissect the impact of significant technological disruptions revolutionizing production processes, cold chain logistics, and product traceability, alongside a granular assessment of evolving consumer behavior patterns. These include a heightened demand for convenience, a growing awareness of health and wellness, and an increasing preference for ethically sourced and sustainable food options. The report projects a robust Compound Annual Growth Rate (CAGR) of approximately [Insert specific CAGR figure here, e.g., 4.5%] during the forecast period, underscoring the market's significant expansion potential.

The European processed meat market is characterized by a complex interplay of economic, social, and technological factors influencing its growth. Historically, the market has witnessed steady expansion driven by factors such as urbanization, increasing disposable incomes, and a growing demand for convenient food options. The period between 2019 and 2024 saw a moderate growth phase, with consumers increasingly opting for processed meats as part of their regular diets due to their convenience and affordability. However, this period also saw the nascent rise of health-conscious trends, leading to a growing segment of consumers seeking healthier alternatives with reduced sodium and fat content.

Looking ahead to the forecast period of 2025-2033, the market is poised for accelerated growth. This acceleration will be fueled by a confluence of factors, including advancements in food technology, innovative product development, and a shift in consumer preferences towards premium and value-added processed meat products. Technological disruptions, such as the implementation of Industry 4.0 principles in manufacturing, automation in processing plants, and the adoption of blockchain technology for enhanced supply chain transparency, are set to significantly improve operational efficiency and product quality. Moreover, the increasing adoption of ready-to-eat meals, gourmet sausages, and plant-based meat alternatives that mimic traditional processed meats will cater to a broader consumer base.

Consumer behavior is undergoing a significant transformation. While convenience remains a paramount factor, there is a discernible and growing emphasis on health and wellness. This translates into a higher demand for processed meats with clean labels, fewer additives, and lower levels of saturated fats and sodium. Sustainability and ethical sourcing are also becoming increasingly important decision-making factors for European consumers, prompting manufacturers to invest in responsible sourcing practices and environmentally friendly packaging solutions. The rise of the flexitarian diet, where individuals consciously reduce their meat consumption without completely eliminating it, also presents an opportunity for processed meat manufacturers to innovate with blended products and high-quality, minimally processed options.

The adoption rates of different processed meat types are also evolving. While traditional products like ham and sausages continue to hold significant market share, there is a noticeable surge in the popularity of value-added products such as marinated meats, kebabs, and ready-to-cook meal components. The convenience of these products aligns perfectly with the fast-paced lifestyles of modern European consumers. Furthermore, the market is witnessing an increased demand for specialty and artisanal processed meats, often featuring unique flavor profiles and premium ingredients, catering to a more discerning palate.

In summary, the Europe processed meat market is on an upward trajectory, driven by a dynamic blend of technological innovation, evolving consumer preferences for health and convenience, and a growing emphasis on sustainability. The projected CAGR of [Insert specific CAGR figure here, e.g., 4.5%] reflects this optimistic outlook, highlighting the sector's resilience and its capacity for continuous adaptation and growth.

Dominant Regions, Countries, or Segments in Europe Processed Meat Market

This section identifies the leading regions, countries, and market segments within the European processed meat market, analyzing their market share, growth drivers, and future potential. We focus on key segments: Meat Type (Poultry, Beef, Pork, Mutton, Other), Product Type (Chilled, Frozen), and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Other).

- Leading Region: Germany, followed by France and the UK, are projected to be the dominant markets due to high consumption rates and developed retail infrastructure.

- Leading Meat Type: Poultry consistently holds the largest market share, followed by Pork. Growth drivers include affordability and versatility.

- Leading Product Type: Chilled processed meat currently dominates, with increasing demand for convenience. However, frozen processed meat is projected to see faster growth, driven by extended shelf life and easy storage.

- Leading Distribution Channel: Supermarkets/hypermarkets represent the primary distribution channel, while online retail is projected to exhibit rapid growth.

(600 words of detailed analysis using paragraphs and bullet points for each segment, highlighting key drivers such as economic policies and infrastructure, as well as dominance factors such as market share and growth potential)

Europe Processed Meat Market Product Landscape

The European processed meat market is a vibrant and multifaceted sector, characterized by a wide spectrum of product offerings that cater to diverse tastes, dietary needs, and consumption occasions. This landscape is continuously shaped by innovation, with a strong emphasis on addressing evolving consumer demands for healthier, more convenient, and ethically produced options. Key areas of innovation include the development of "healthier options" such as processed meats with reduced sodium content, lower saturated fat profiles, and the utilization of leaner cuts of meat. Simultaneously, there's a significant push towards "convenient formats," encompassing a range of products like ready-to-eat meals, grab-and-go snack packs, and portion-controlled items designed for busy lifestyles. Furthermore, advancements in "enhanced shelf-life technologies," including improved packaging solutions and preservation techniques, are crucial for reducing food waste and expanding product reach across the supply chain. These collective advancements are instrumental in meeting consumer preferences for convenience, a growing focus on personal health and well-being, and an increasing concern for the environmental and ethical aspects of food production.

Key Drivers, Barriers & Challenges in Europe Processed Meat Market

Key Drivers: Increasing disposable incomes, rising demand for convenient foods, and expanding retail infrastructure are major drivers. Technological advancements in processing and preservation enhance product quality and shelf life, further boosting the market. Government policies supporting the meat industry also play a significant role.

Key Challenges & Restraints: Stringent food safety regulations, rising raw material costs, and growing consumer concerns about health and sustainability pose significant challenges. Supply chain disruptions due to geopolitical factors and increasing competition from plant-based meat alternatives further complicate the market. The impact of these challenges is estimated to reduce market growth by xx% by 2033.

Emerging Opportunities in Europe Processed Meat Market

The European processed meat market presents a fertile ground for emerging opportunities, largely driven by shifts in consumer consciousness and evolving market dynamics. A significant growth avenue lies in the escalating demand for "organic and sustainably produced processed meats." Consumers are increasingly scrutinizing the origin and production methods of their food, seeking out products that align with their values for environmental stewardship and animal welfare. This opens doors for producers who can transparently demonstrate their commitment to sustainable agriculture and ethical farming practices. Furthermore, the persistent popularity of "value-added products," such as chef-inspired ready-to-eat meals, gourmet sausage varieties, and convenient snack packs, continues to offer substantial growth potential. These products tap into the consumer desire for both culinary enjoyment and time-saving solutions. Beyond established trends, "expanding into niche markets" offers significant untapped potential. This includes targeting specific ethnic food segments with authentic and regional processed meat specialties, as well as catering to dietary trends like high-protein or gluten-free processed meat options. Exploring these specialized areas can lead to substantial market expansion and brand differentiation.

Growth Accelerators in the Europe Processed Meat Market Industry

The long-term expansion and sustained growth of the European processed meat market are intricately linked to strategic advancements and proactive market engagement. A primary growth accelerator will be "technological innovations" aimed at enhancing both production efficiency and environmental sustainability. This includes the adoption of advanced processing machinery, automation for reduced labor costs and improved consistency, and the implementation of smart technologies for better quality control and waste reduction. "Strategic partnerships" are also paramount for unlocking new avenues of growth. Collaborations focusing on supply chain integration, from farm to fork, can ensure a more robust and efficient distribution network. Furthermore, forging alliances to gain access to new geographical markets or to co-develop innovative product lines will be crucial. "Expansion into underserved regions" within Europe, where processed meat consumption might be lower but has potential for growth, represents a significant opportunity. This could involve tailoring product offerings to local preferences and distribution channels. Finally, "exploring new product offerings" that cater to evolving consumer needs, such as plant-based alternatives, reduced-salt options, or functional processed meats with added nutritional benefits, will continuously stimulate market expansion and ensure relevance in a dynamic consumer landscape.

Key Players Shaping the Europe Processed Meat Market Market

- Marfrig Global Foods SA

- Westaways Sausage

- Biegi Foods GmbH

- LDC

- WH Group Limited

- Cherkizovo Foods

- Cargill Inc

- Seaboard Corporation

- JBS SA

- Tyson Foods

Notable Milestones in Europe Processed Meat Market Sector

- January 2022: Cherkizovo Group acquires Tambov Turkey, strengthening its market position.

- November 2021: JBS Foods announces plans to launch cultivated meat by 2024, signifying a significant innovation.

- 2021: WH Group completes the acquisition of Mecom Group, expanding its European footprint.

In-Depth Europe Processed Meat Market Market Outlook

The European processed meat market is poised for continued growth, driven by several factors. Technological advancements in processing and preservation will play a significant role, as will strategic partnerships and market expansion into new geographical areas and consumer segments. The market's overall outlook is positive, with substantial growth potential in the coming years. The market is projected to reach xx Million units by 2033.

Europe Processed Meat Market Segmentation

-

1. Meat Type

- 1.1. Polutry

- 1.2. Beef

- 1.3. Pork

- 1.4. Mutton

- 1.5. Other Types

-

2. Product Type

- 2.1. Chilled Processed Meat

- 2.2. Frozen Processed Meat

-

3. Distribution Channel

- 3.1. Supermarkerts/Hypermarkets

- 3.2. Convencience Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Europe Processed Meat Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. Spain

- 5. France

- 6. Russia

- 7. Rest of Europe

Europe Processed Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for convenient and ready-to-eat food products boosts the processed meat market

- 3.3. Market Restrains

- 3.3.1. Rising health awareness and concerns about the consumption of processed meats

- 3.4. Market Trends

- 3.4.1. Growing trend towards healthier and lower-fat options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Meat Type

- 5.1.1. Polutry

- 5.1.2. Beef

- 5.1.3. Pork

- 5.1.4. Mutton

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Chilled Processed Meat

- 5.2.2. Frozen Processed Meat

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkerts/Hypermarkets

- 5.3.2. Convencience Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Italy

- 5.4.4. Spain

- 5.4.5. France

- 5.4.6. Russia

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Meat Type

- 6. Germany Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Meat Type

- 6.1.1. Polutry

- 6.1.2. Beef

- 6.1.3. Pork

- 6.1.4. Mutton

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Chilled Processed Meat

- 6.2.2. Frozen Processed Meat

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkerts/Hypermarkets

- 6.3.2. Convencience Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Meat Type

- 7. United Kingdom Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Meat Type

- 7.1.1. Polutry

- 7.1.2. Beef

- 7.1.3. Pork

- 7.1.4. Mutton

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Chilled Processed Meat

- 7.2.2. Frozen Processed Meat

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkerts/Hypermarkets

- 7.3.2. Convencience Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Meat Type

- 8. Italy Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Meat Type

- 8.1.1. Polutry

- 8.1.2. Beef

- 8.1.3. Pork

- 8.1.4. Mutton

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Chilled Processed Meat

- 8.2.2. Frozen Processed Meat

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkerts/Hypermarkets

- 8.3.2. Convencience Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Meat Type

- 9. Spain Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Meat Type

- 9.1.1. Polutry

- 9.1.2. Beef

- 9.1.3. Pork

- 9.1.4. Mutton

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Chilled Processed Meat

- 9.2.2. Frozen Processed Meat

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkerts/Hypermarkets

- 9.3.2. Convencience Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Meat Type

- 10. France Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Meat Type

- 10.1.1. Polutry

- 10.1.2. Beef

- 10.1.3. Pork

- 10.1.4. Mutton

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Chilled Processed Meat

- 10.2.2. Frozen Processed Meat

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkerts/Hypermarkets

- 10.3.2. Convencience Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Meat Type

- 11. Russia Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Meat Type

- 11.1.1. Polutry

- 11.1.2. Beef

- 11.1.3. Pork

- 11.1.4. Mutton

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Chilled Processed Meat

- 11.2.2. Frozen Processed Meat

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkerts/Hypermarkets

- 11.3.2. Convencience Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Meat Type

- 12. Rest of Europe Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Meat Type

- 12.1.1. Polutry

- 12.1.2. Beef

- 12.1.3. Pork

- 12.1.4. Mutton

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Product Type

- 12.2.1. Chilled Processed Meat

- 12.2.2. Frozen Processed Meat

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Supermarkerts/Hypermarkets

- 12.3.2. Convencience Stores

- 12.3.3. Online Retail Stores

- 12.3.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Meat Type

- 13. Germany Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Processed Meat Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Marfrig Global Foods SA

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Westaways Sausage

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Biegi Foods GmbH

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 LDC*List Not Exhaustive

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 WH Group Limited

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Cherkizovo Foods

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Cargill Inc

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Seaboard Corporation

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 JBS SA

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Tyson Foods

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Marfrig Global Foods SA

List of Figures

- Figure 1: Europe Processed Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Processed Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Processed Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Processed Meat Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 4: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 5: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 7: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 9: Europe Processed Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Processed Meat Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: France Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Processed Meat Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Processed Meat Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 28: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 29: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 31: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 36: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 37: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 39: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 41: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 44: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 45: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 46: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 47: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 49: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 51: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 52: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 53: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 54: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 55: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 56: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 57: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 59: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 60: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 61: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 63: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 64: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 65: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 67: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 68: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 69: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 70: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 71: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 72: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 73: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 75: Europe Processed Meat Market Revenue Million Forecast, by Meat Type 2019 & 2032

- Table 76: Europe Processed Meat Market Volume K Tons Forecast, by Meat Type 2019 & 2032

- Table 77: Europe Processed Meat Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 78: Europe Processed Meat Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 79: Europe Processed Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 80: Europe Processed Meat Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 81: Europe Processed Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Europe Processed Meat Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Processed Meat Market?

The projected CAGR is approximately 1.26%.

2. Which companies are prominent players in the Europe Processed Meat Market?

Key companies in the market include Marfrig Global Foods SA, Westaways Sausage, Biegi Foods GmbH, LDC*List Not Exhaustive, WH Group Limited, Cherkizovo Foods, Cargill Inc, Seaboard Corporation, JBS SA, Tyson Foods.

3. What are the main segments of the Europe Processed Meat Market?

The market segments include Meat Type, Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for convenient and ready-to-eat food products boosts the processed meat market.

6. What are the notable trends driving market growth?

Growing trend towards healthier and lower-fat options.

7. Are there any restraints impacting market growth?

Rising health awareness and concerns about the consumption of processed meats.

8. Can you provide examples of recent developments in the market?

In January 2022, Russian meat producer Cherkizovo Group acquired Tambov Turkey, the second-largest turkey producer in Russia. The key strategy behind the acquisition is to maintain dominance over other players in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Processed Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Processed Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Processed Meat Market?

To stay informed about further developments, trends, and reports in the Europe Processed Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence