Key Insights

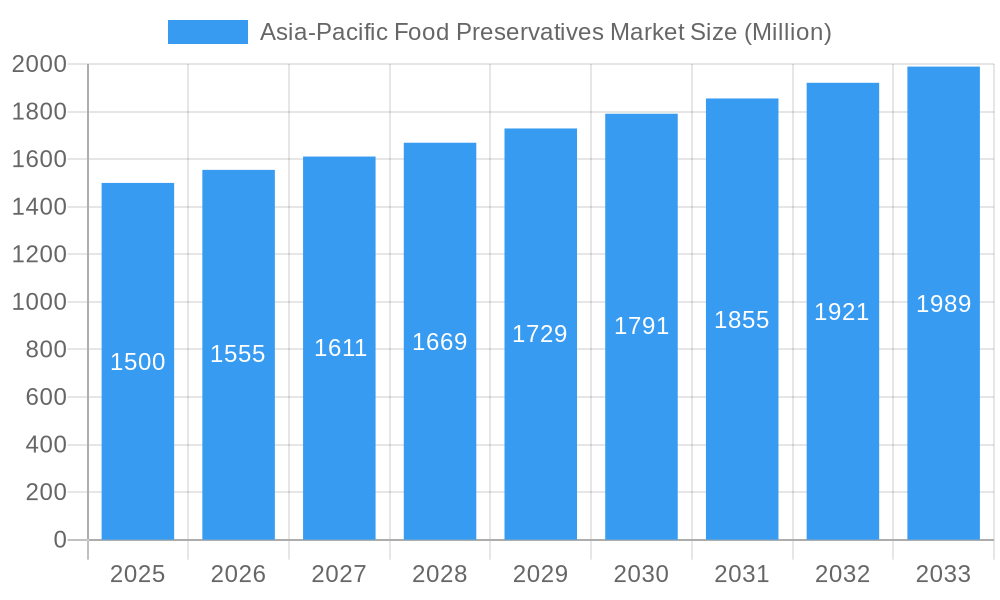

The Asia-Pacific food preservatives market is poised for significant growth, projected to reach approximately USD 1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.60% expected to continue through 2033. This expansion is primarily fueled by evolving consumer preferences towards longer shelf-life products and a growing demand for processed and convenience foods across the region. The rising middle class, coupled with increasing urbanization, is driving consumption of a wider variety of food products, necessitating effective preservation methods. Key drivers include the need to reduce food waste, ensure food safety, and maintain product quality during extended supply chains. Furthermore, advancements in food processing technologies and a greater awareness of hygiene standards are bolstering the market's trajectory. The demand for both natural and synthetic preservatives is on the rise, reflecting a dual market approach that caters to distinct consumer demands and regulatory landscapes.

Asia-Pacific Food Preservatives Market Market Size (In Billion)

The market segmentation highlights a diverse application landscape, with bakery, dairy and frozen products, and confectionery segments representing major consumers of food preservatives. The increasing popularity of ready-to-eat meals and snacks, particularly in emerging economies like India and China, is a significant contributor to this demand. While natural preservatives are gaining traction due to health-conscious consumer trends, synthetic preservatives continue to hold a substantial market share due to their efficacy and cost-effectiveness in a wide range of applications. However, regulatory scrutiny and consumer perception regarding the safety of certain synthetic preservatives present a notable restraint. Geographical analysis indicates that China and India are anticipated to be the dominant markets, driven by their large populations and rapid economic development. Initiatives aimed at improving food safety infrastructure and supporting domestic food processing industries further contribute to the robust growth outlook for the Asia-Pacific food preservatives market.

Asia-Pacific Food Preservatives Market Company Market Share

Asia-Pacific Food Preservatives Market: Comprehensive Insights and Forecast (2019–2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Food Preservatives Market, a critical sector driven by evolving consumer demands for extended shelf-life, food safety, and the adoption of cleaner labels. The study encompasses a detailed examination of market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and the strategic moves of leading players. Covering the period from 2019 to 2033, with a base year of 2025, this report offers invaluable intelligence for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within this dynamic market.

The report is meticulously structured to deliver actionable insights, utilizing high-traffic keywords such as "food preservatives Asia Pacific," "natural food preservatives," "synthetic food preservatives," "bakery preservatives," "dairy preservatives," "meat preservatives," and "beverage preservatives" to maximize search engine visibility. We delve into parent and child market segments, providing a granular understanding of market segmentation and growth trajectories. All quantitative values are presented in Million units for clarity and ease of comparison.

Asia-Pacific Food Preservatives Market Market Dynamics & Structure

The Asia-Pacific Food Preservatives Market exhibits a moderately concentrated structure, characterized by the presence of established global players alongside a growing number of regional manufacturers. Technological innovation remains a key driver, with significant investments in research and development (R&D) focused on enhancing the efficacy and safety of both natural and synthetic preservatives. Regulatory frameworks, particularly concerning food safety standards and permissible additive levels, play a crucial role in shaping market entry and product development strategies. The competitive landscape is influenced by the availability of effective, cost-efficient synthetic preservatives, which often hold a dominant market share, alongside the increasing consumer preference for natural alternatives. End-user demographics are shifting, with a rising middle class and increasing urbanization driving demand for processed and convenience foods, thereby boosting the demand for preservatives. Mergers and Acquisitions (M&A) trends are notable, with companies strategically acquiring smaller players to expand their product portfolios and geographical reach. For instance, the acquisition of Thai Preservatives by Corbion in 2022 highlights this consolidation.

- Market Concentration: Moderately concentrated with key global players holding significant market share.

- Technological Innovation: Driven by R&D in natural and synthetic preservatives, focusing on efficacy, safety, and clean-label solutions.

- Regulatory Frameworks: Strict food safety regulations and additive approvals influence product development and market access.

- Competitive Product Substitutes: Natural preservatives are gaining traction as substitutes for synthetic options, driven by consumer preference.

- End-User Demographics: Growing demand for convenience and processed foods among an expanding urban and middle-class population.

- M&A Trends: Strategic acquisitions to enhance market presence, product offerings, and technological capabilities.

Asia-Pacific Food Preservatives Market Growth Trends & Insights

The Asia-Pacific Food Preservatives Market is poised for significant expansion, projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This growth is underpinned by a confluence of factors, including the increasing demand for processed and packaged foods, rising disposable incomes across the region, and a heightened awareness of food safety and shelf-life extension. The adoption rate of innovative preservative solutions, particularly natural and bio-based alternatives, is accelerating as manufacturers respond to evolving consumer preferences and stringent regulatory landscapes. Technological disruptions, such as advancements in fermentation technologies for producing natural preservatives and the development of synergistic preservative blends, are further shaping the market. Consumer behavior shifts are profoundly influencing the demand for "clean label" products, pushing manufacturers to invest in and promote natural preservatives like sorbates, benzoates, and natamycin, alongside emerging plant-derived antimicrobials. The market penetration of food preservatives is expected to deepen across various food categories, including bakery, dairy, confectionery, and meat products, as manufacturers strive to meet the demands of a rapidly growing consumer base. The estimated market size for food preservatives in the Asia-Pacific region is projected to reach over $2,500 Million units by 2025, with substantial growth anticipated throughout the forecast period.

Dominant Regions, Countries, or Segments in Asia-Pacific Food Preservatives Market

Within the Asia-Pacific Food Preservatives Market, China stands out as the dominant region and country, driven by its massive population, rapid industrialization, and burgeoning food processing industry. The sheer scale of its consumer base, coupled with increasing disposable incomes and a growing demand for convenience foods, fuels the significant consumption of food preservatives across various applications. Economic policies that support the growth of the food and beverage sector, alongside substantial investments in food processing infrastructure, further solidify China's leading position. The market share held by China in the Asia-Pacific region is estimated to be over 40% in 2025.

Analyzing the segments, Synthetic preservatives continue to hold a substantial market share due to their cost-effectiveness and proven efficacy in preventing microbial spoilage and extending shelf life across a wide range of food products. However, the Natural preservatives segment is experiencing the most rapid growth, driven by escalating consumer demand for healthier and "cleaner label" food options. This shift is prompting significant R&D investments and product launches by key players.

In terms of applications, Bakery and Dairy and Frozen Products represent the largest application segments, as these industries heavily rely on preservatives to maintain product quality, safety, and extend shelf life. The Meat, Poultry, and Seafood segment also exhibits robust growth due to the perishability of these products and the need for effective preservation to meet consumer safety expectations.

- Dominant Country: China, fueled by population, industrialization, and food processing growth.

- Dominant Segment (by type): Synthetic preservatives currently dominate, but Natural preservatives show the highest growth rate.

- Dominant Segments (by application): Bakery and Dairy and Frozen Products lead in consumption.

- Key Drivers: Economic policies, urbanization, increasing disposable incomes, and consumer demand for convenience and food safety.

- Growth Potential: Significant untapped potential exists in emerging economies within the "Rest of Asia-Pacific" category as they develop their food processing capabilities.

Asia-Pacific Food Preservatives Market Product Landscape

The Asia-Pacific Food Preservatives Market is characterized by a dynamic product landscape where innovation is key to market differentiation. Players are actively developing and launching a range of preservative solutions, from traditional synthetic compounds like sodium benzoate and potassium sorbate to an increasing array of natural alternatives derived from plant extracts, fermentation, and essential oils. These innovations focus on improved efficacy against a broader spectrum of microorganisms, enhanced flavor neutrality, and better solubility and compatibility with diverse food matrices. For instance, the launch of natural preservative solutions by DuPont in 2021 exemplifies the industry's commitment to addressing the clean-label trend. Performance metrics, such as minimum inhibitory concentrations (MICs) and shelf-life extension capabilities, are critical in showcasing product superiority to food manufacturers. Unique selling propositions often revolve around "natural origin," "preservative-free claims," and "extended shelf life with no compromise on taste."

Key Drivers, Barriers & Challenges in Asia-Pacific Food Preservatives Market

The Asia-Pacific Food Preservatives Market is propelled by several key drivers, including the escalating demand for processed and convenience foods, the growing awareness of food safety and quality, and the expanding middle class with increased disposable incomes. Technological advancements in preservative formulations, particularly the development of natural and bio-based solutions, are also significant growth accelerators. Furthermore, supportive government initiatives aimed at improving food security and quality standards contribute to market expansion.

Conversely, the market faces notable barriers and challenges. Stringent and evolving regulatory frameworks across different countries can pose hurdles for market entry and product approvals. Consumer perception of synthetic preservatives as unhealthy or artificial creates resistance, driving demand for natural alternatives, which can sometimes be more expensive or less effective. Supply chain disruptions, raw material price volatility, and intense competition among established players and emerging local manufacturers also present significant challenges. The cost-effectiveness of natural preservatives compared to their synthetic counterparts remains a concern for some food manufacturers, particularly in price-sensitive markets.

Emerging Opportunities in Asia-Pacific Food Preservatives Market

Emerging opportunities within the Asia-Pacific Food Preservatives Market are primarily centered around the escalating demand for natural and organic food products. The "clean label" movement is creating a significant opening for plant-derived preservatives, fermentation-based antimicrobials, and innovative packaging solutions that extend shelf life without relying on artificial additives. Untapped markets in Southeast Asia and developing economies within the region present substantial growth potential as their food processing industries mature. Furthermore, the development of synergistic preservative blends that combine natural ingredients to achieve broad-spectrum efficacy offers a promising avenue for innovation. Personalized nutrition trends also open doors for specialized preservative solutions tailored to specific dietary needs and product categories.

Growth Accelerators in the Asia-Pacific Food Preservatives Market Industry

Several catalysts are accelerating long-term growth within the Asia-Pacific Food Preservatives Market. Technological breakthroughs in biotechnology are enabling the cost-effective production of novel natural preservatives with enhanced efficacy and consumer appeal. Strategic partnerships between ingredient suppliers and food manufacturers are fostering co-development of innovative solutions, accelerating market adoption. Market expansion strategies, including increased penetration into emerging economies and a focus on specific high-growth application segments like plant-based foods and ready-to-eat meals, are critical growth drivers. The increasing consumer demand for transparency and traceability in food products also compels manufacturers to adopt and promote effective and safe preservation techniques.

Key Players Shaping the Asia-Pacific Food Preservatives Market Market

- Cargill Incorporated

- Jungbunzlauer Suisse AG

- Archer Daniels Midland Company

- DuPont

- JEY'S F I Inc

- Kerry Group

- Koninklijke DSM NV

- Corbion NV

Notable Milestones in Asia-Pacific Food Preservatives Market Sector

- 2022: Corbion acquired Thai Preservatives, expanding its footprint and product portfolio in the Asia-Pacific region.

- 2021: DuPont launched a new range of natural preservative solutions, catering to the growing demand for clean-label ingredients.

- 2020: Archer Daniels Midland Company significantly invested in the research and development of plant-based preservatives, signaling a strategic focus on sustainable solutions.

In-Depth Asia-Pacific Food Preservatives Market Market Outlook

The Asia-Pacific Food Preservatives Market is projected for sustained growth, driven by robust consumer demand for safer, longer-lasting food products. The increasing emphasis on health and wellness, coupled with evolving regulatory landscapes, will continue to fuel the adoption of natural and bio-based preservatives. Strategic investments in R&D, coupled with potential M&A activities, will shape the competitive dynamics. Emerging economies within the region represent significant untapped potential, offering lucrative opportunities for market expansion. The market's future outlook is characterized by innovation in clean-label solutions and a growing acceptance of advanced preservation technologies.

Asia-Pacific Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Bakery

- 2.2. Dairy and Frozen Products

- 2.3. Confectionery

- 2.4. Meat, Poultry and Seafood

- 2.5. Beverages

- 2.6. Sauces and Salad Mixes

- 2.7. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Food Preservatives Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Food Preservatives Market Regional Market Share

Geographic Coverage of Asia-Pacific Food Preservatives Market

Asia-Pacific Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. China Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Confectionery

- 5.2.4. Meat, Poultry and Seafood

- 5.2.5. Beverages

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Dairy and Frozen Products

- 6.2.3. Confectionery

- 6.2.4. Meat, Poultry and Seafood

- 6.2.5. Beverages

- 6.2.6. Sauces and Salad Mixes

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Dairy and Frozen Products

- 7.2.3. Confectionery

- 7.2.4. Meat, Poultry and Seafood

- 7.2.5. Beverages

- 7.2.6. Sauces and Salad Mixes

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Dairy and Frozen Products

- 8.2.3. Confectionery

- 8.2.4. Meat, Poultry and Seafood

- 8.2.5. Beverages

- 8.2.6. Sauces and Salad Mixes

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Dairy and Frozen Products

- 9.2.3. Confectionery

- 9.2.4. Meat, Poultry and Seafood

- 9.2.5. Beverages

- 9.2.6. Sauces and Salad Mixes

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Dairy and Frozen Products

- 10.2.3. Confectionery

- 10.2.4. Meat, Poultry and Seafood

- 10.2.5. Beverages

- 10.2.6. Sauces and Salad Mixes

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jungbunzlauer Suisse AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JEY'S F I Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kerry Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke DSM NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corbion NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Food Preservatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Preservatives Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Asia-Pacific Food Preservatives Market?

Key companies in the market include Cargill Incorporated, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, DuPont, JEY'S F I Inc, Kerry Group, Koninklijke DSM NV, Corbion NV.

3. What are the main segments of the Asia-Pacific Food Preservatives Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

China Dominates the Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Thai Preservatives by Corbion in 2022 2. Launch of natural preservative solutions by DuPont in 2021 3. Investment in R&D of plant-based preservatives by Archer Daniels Midland Company in 2020

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence