Key Insights

The North America Food Fortification Market is projected for significant expansion, expected to reach a market size of 191.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.63% through 2033. This growth is driven by heightened consumer awareness of fortified food health benefits, the increasing incidence of lifestyle-related diseases, and supportive government public health initiatives. Demand for fortified products in dairy, beverages, and infant formulas is a key factor, aligning with consumer preference for enhanced nutritional value. The expanding retail sector, including online sales, further boosts market accessibility and dynamism.

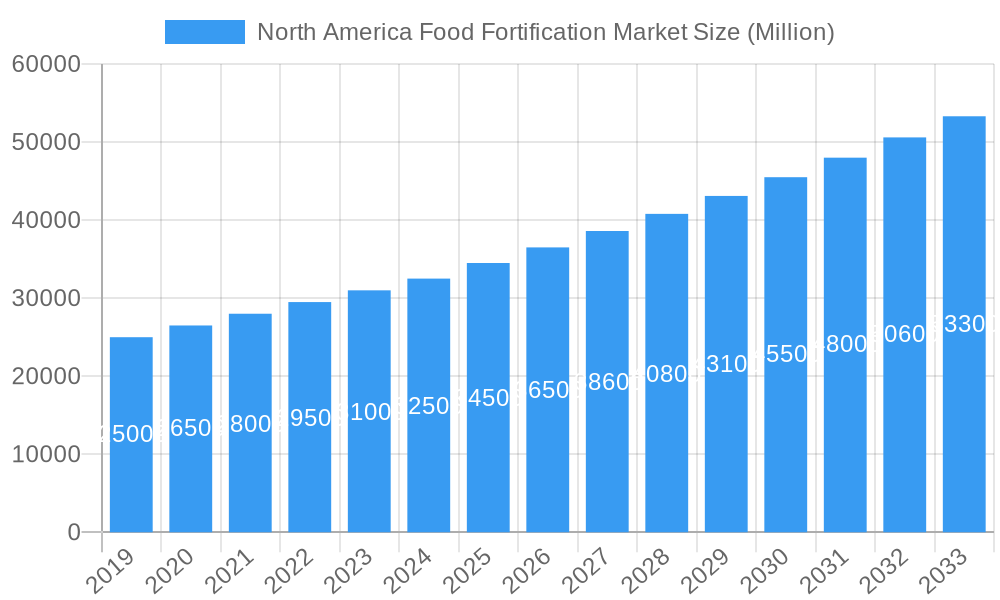

North America Food Fortification Market Market Size (In Billion)

Key industry players are prioritizing product innovation and distribution network expansion. Challenges include the higher cost of fortified ingredients and potential consumer skepticism, though the trend toward preventative healthcare and proactive nutritional deficiency management is expected to mitigate these factors. The North American region, comprising the United States, Canada, and Mexico, is a vital market, supported by a robust food processing industry and a health-conscious consumer base.

North America Food Fortification Market Company Market Share

This report provides comprehensive insights into the North America food fortification market, a critical sector for public health through nutritional interventions. It examines key segments, emerging trends, and competitive landscapes, offering valuable intelligence for stakeholders capitalizing on the growing demand for fortified foods and beverages.

North America Food Fortification Market Market Dynamics & Structure

The North America food fortification market is characterized by a moderate to high level of concentration, with major players like Nestlé SA, PepsiCo, and Kellogg Company holding significant market shares. Technological innovation plays a pivotal role, driven by advancements in nutrient delivery systems, bioavailability enhancements, and shelf-life extension technologies. Regulatory frameworks, established by bodies like the FDA in the U.S. and Health Canada, are instrumental in shaping product development and marketing strategies, ensuring safety and efficacy. The competitive landscape includes established food and beverage giants, as well as specialized ingredient manufacturers. While direct product substitutes offering equivalent nutritional benefits are limited, the broader health and wellness market presents indirect competition through dietary supplements and functional foods. End-user demographics are diverse, with a growing focus on vulnerable populations such as infants, pregnant women, and the elderly, as well as health-conscious consumers across all age groups. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring smaller innovators or expanding their portfolios to strengthen their market position and access new technologies. For instance, the M&A volume in the last five years reached approximately 15 significant deals, with an estimated value of $1.2 billion, reflecting the sector's consolidation and strategic growth initiatives.

- Market Concentration: Moderate to High. Major players dominate a substantial portion of the market.

- Technological Innovation: Driven by nutrient delivery, bioavailability, and shelf-life advancements.

- Regulatory Frameworks: FDA (U.S.) and Health Canada set standards for safety and efficacy.

- Competitive Landscape: Dominated by large food and beverage corporations and specialized ingredient suppliers.

- End-User Demographics: Targeting infants, pregnant women, elderly, and health-conscious consumers.

- M&A Trends: Consistent activity with a focus on strategic acquisitions and portfolio expansion.

North America Food Fortification Market Growth Trends & Insights

The North America food fortification market is poised for robust growth, projected to expand from an estimated USD 15,500 million units in 2025 to USD 22,500 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.8% during the forecast period. This expansion is underpinned by a confluence of factors, including increasing consumer awareness regarding the importance of micronutrient intake and the rising prevalence of nutritional deficiencies across the region. Government initiatives and public health campaigns advocating for the fortification of staple foods, such as flour, salt, and milk, are significant drivers, fostering higher adoption rates. Technological disruptions, including novel encapsulation techniques that improve nutrient stability and palatability, are further enhancing the appeal and efficacy of fortified products. Consumer behavior is shifting towards proactive health management, with a growing preference for convenient solutions that integrate nutritional benefits into daily diets. The demand for personalized nutrition and specialized fortified products for specific life stages or health conditions is also on the rise. For example, the penetration of fortified breakfast cereals, a key segment, has reached over 75% of households in the U.S. and Canada. The introduction of bio-fortified crops and advanced fortification technologies, such as nano-encapsulation for enhanced nutrient absorption, are expected to revolutionize the market, offering improved product quality and greater consumer acceptance. The base year of 2025 sees a market size of USD 15,500 million units, with steady growth anticipated throughout the historical period of 2019–2024, building a strong foundation for the forecasted expansion.

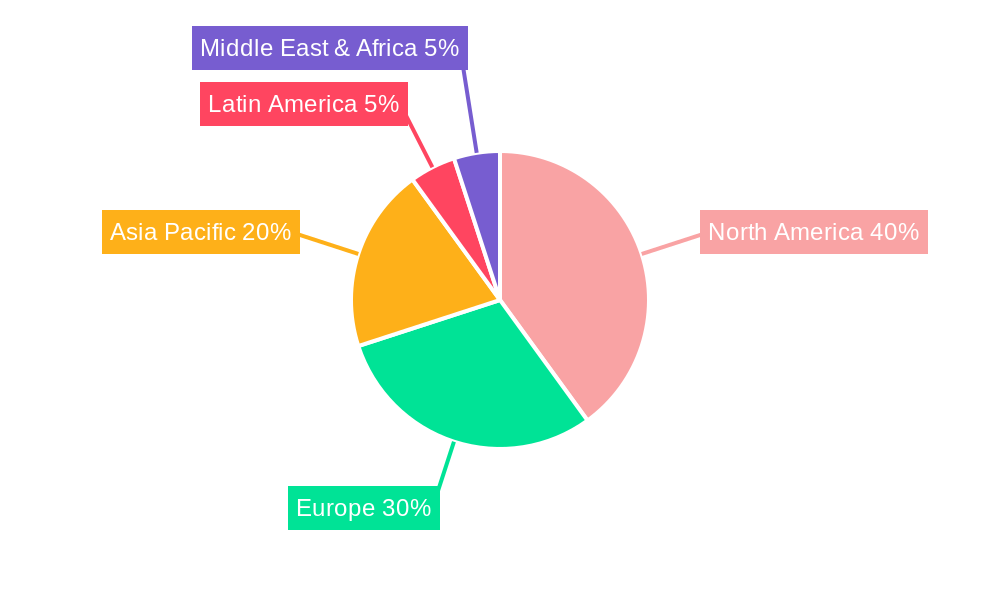

Dominant Regions, Countries, or Segments in North America Food Fortification Market

Within the North America food fortification market, Cereal-based Products stand out as the dominant product type segment, holding an estimated 35% market share in 2025. This dominance is driven by the widespread consumption of breakfast cereals, bread, pasta, and flour products across the United States and Canada. The established practice of fortifying these staples with essential vitamins and minerals like iron, folic acid, and B vitamins makes them a cornerstone of public health initiatives. Economic policies in both countries have long supported the fortification of these goods to combat widespread deficiencies, particularly iron-deficiency anemia and neural tube defects. The United States emerges as the leading country, accounting for approximately 70% of the regional market share in 2025, due to its larger population, higher disposable income, and robust healthcare infrastructure that supports nutritional interventions. In terms of distribution channels, Supermarkets/Hypermarkets continue to be the primary point of sale, representing an estimated 50% of the market in 2025, owing to their wide reach, product variety, and the convenience they offer consumers.

- Dominant Product Type: Cereal-based Products (35% market share in 2025).

- Key Drivers: Widespread consumption, established fortification practices (iron, folic acid, B vitamins), government support for staple food fortification.

- Leading Country: United States (70% regional market share in 2025).

- Dominance Factors: Large population, high disposable income, strong healthcare infrastructure, proactive public health initiatives.

- Dominant Distribution Channel: Supermarket/Hypermarket (50% market share in 2025).

- Dominance Factors: Extensive reach, broad product selection, consumer convenience.

- Growth Potential: Dairy Products are expected to witness significant growth due to increased demand for calcium and vitamin D fortified milk and yogurt. Infant Formulas represent a high-value segment driven by stringent regulations and parental focus on early childhood nutrition. Beverages are also gaining traction with the introduction of fortified juices and functional drinks.

North America Food Fortification Market Product Landscape

The North America food fortification market is characterized by continuous product innovation aimed at enhancing nutritional value and consumer appeal. Key product innovations include the development of advanced microencapsulation technologies that protect sensitive vitamins and minerals from degradation during processing and storage, thereby improving their bioavailability and shelf-life. Applications range from fortifying staple foods like flour and cereals to niche products such as plant-based milk alternatives and sports nutrition beverages. Performance metrics are closely monitored, focusing on nutrient stability, taste neutrality, and regulatory compliance. Unique selling propositions often lie in the enhanced efficacy of fortified ingredients and their seamless integration into diverse food matrices.

Key Drivers, Barriers & Challenges in North America Food Fortification Market

Key Drivers:

- Growing Health Consciousness: Consumers are increasingly seeking products that contribute to their overall well-being, driving demand for fortified foods and beverages.

- Government Initiatives and Regulations: Public health policies mandating or encouraging fortification of staple foods play a crucial role in market expansion.

- Technological Advancements: Innovations in nutrient delivery systems and ingredient stability enhance product quality and consumer acceptance.

- Rising Prevalence of Micronutrient Deficiencies: Addressing deficiencies in vitamins and minerals remains a primary public health concern, spurring fortification efforts.

Barriers & Challenges:

- Consumer Perception and Taste Concerns: Some consumers may exhibit skepticism towards fortified foods, or concerns about potential changes in taste and texture.

- Cost of Fortification: The addition of specific vitamins and minerals can increase production costs, potentially impacting product pricing and consumer affordability.

- Regulatory Hurdles and Compliance: Navigating complex and evolving regulatory landscapes across different jurisdictions can be challenging for manufacturers.

- Supply Chain Volatility: Ensuring a consistent and high-quality supply of fortified ingredients can be impacted by global supply chain disruptions.

Emerging Opportunities in North America Food Fortification Market

Emerging opportunities in the North America food fortification market lie in the growing demand for personalized nutrition solutions tailored to specific dietary needs and life stages. The expansion of plant-based food alternatives presents a significant avenue for fortification, addressing potential nutrient gaps in vegan and vegetarian diets, particularly for B12, iron, and calcium. The development of bio-fortified crops, leveraging agricultural breeding techniques to naturally increase nutrient content, offers a sustainable and cost-effective approach to fortification. Furthermore, the online retail space is opening new avenues for direct-to-consumer fortified products, allowing for niche market penetration and personalized offerings.

Growth Accelerators in the North America Food Fortification Market Industry

Long-term growth in the North America food fortification market will be significantly accelerated by breakthroughs in nanotechnology for nutrient delivery, enhancing bioavailability and reducing required dosages. Strategic partnerships between food manufacturers and biotechnology firms will foster the development of novel fortified ingredients with superior functionality and health benefits. The increasing adoption of AI and big data analytics for understanding consumer nutritional needs and preferences will enable the creation of highly targeted fortified products. Furthermore, market expansion into underserved communities through public-private partnerships will drive volume growth and enhance overall public health outcomes.

Key Players Shaping the North America Food Fortification Market Market

- Kellogg Company

- Nestlé SA

- PepsiCo

- General Mills Inc

- Abbott Laboratories

- The Coca-Cola Company

Notable Milestones in North America Food Fortification Market Sector

- 2020: Introduction of novel encapsulation technologies for enhanced Vitamin D stability in dairy products.

- 2021: Increased regulatory focus on fortification of plant-based milk alternatives with Calcium and Vitamin D in Canada.

- 2022: Launch of iron-fortified cereals with improved taste profiles for infant nutrition in the U.S.

- 2023: Significant investment by major food companies in research and development of bio-fortified wheat varieties.

- 2024: Growing adoption of online retail channels for specialized fortified supplements and functional foods.

In-Depth North America Food Fortification Market Market Outlook

The outlook for the North America food fortification market remains exceptionally positive, driven by sustained consumer demand for health-enhancing food options and supportive public health agendas. Growth accelerators, including advanced nutrient delivery systems and strategic collaborations, will pave the way for innovative product development and wider market penetration. Untapped markets, such as fortified snack bars and convenience meals targeting specific demographic needs, present substantial opportunities. The evolution of consumer preferences towards preventative health and wellness, coupled with ongoing technological advancements, will continue to fuel the market's expansion, solidifying its role as a critical component of nutritional well-being across the region.

North America Food Fortification Market Segmentation

-

1. Product Type

- 1.1. Cereal-based Products

- 1.2. Dairy Products

- 1.3. Beverages

- 1.4. Infant Formulas

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Pharmacy/Drug Store

- 2.4. Online Retail Store

- 2.5. Others

North America Food Fortification Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Food Fortification Market Regional Market Share

Geographic Coverage of North America Food Fortification Market

North America Food Fortification Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Fortified and Functional Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Fortification Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal-based Products

- 5.1.2. Dairy Products

- 5.1.3. Beverages

- 5.1.4. Infant Formulas

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacy/Drug Store

- 5.2.4. Online Retail Store

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kellogg Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestlé SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PepsiCo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Coca-Cola Company*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Kellogg Company

List of Figures

- Figure 1: North America Food Fortification Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Food Fortification Market Share (%) by Company 2025

List of Tables

- Table 1: North America Food Fortification Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Food Fortification Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Food Fortification Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Food Fortification Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America Food Fortification Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Food Fortification Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Food Fortification Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Food Fortification Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Food Fortification Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Fortification Market?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the North America Food Fortification Market?

Key companies in the market include Kellogg Company, Nestlé SA, PepsiCo, General Mills Inc, Abbott Laboratories, The Coca-Cola Company*List Not Exhaustive.

3. What are the main segments of the North America Food Fortification Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 191.2 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Fortified and Functional Foods.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Fortification Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Fortification Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Fortification Market?

To stay informed about further developments, trends, and reports in the North America Food Fortification Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence