Key Insights

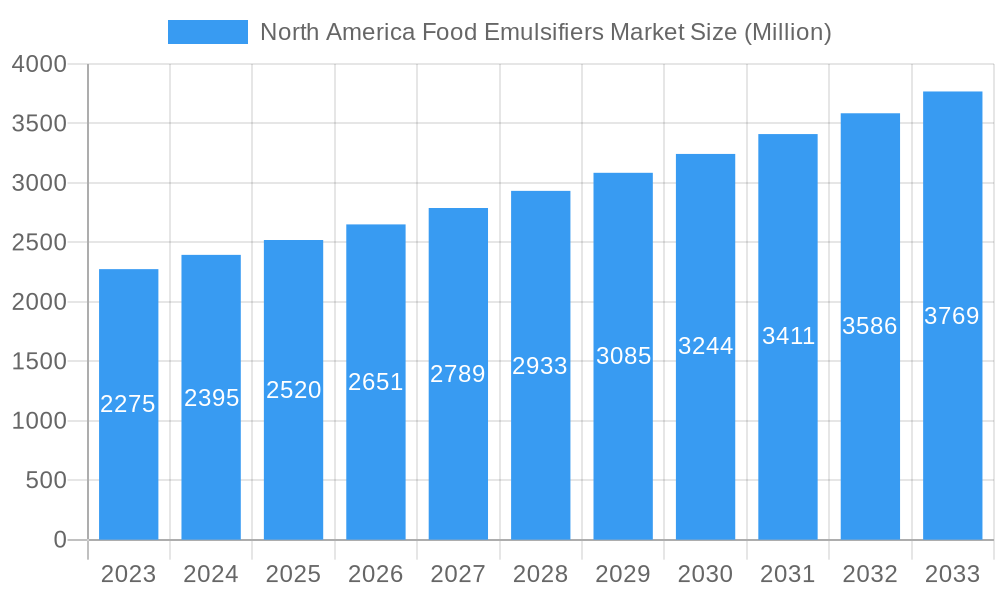

The North America food emulsifiers market is projected for substantial growth, expected to reach $4.1 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. This expansion is driven by increasing consumer preference for processed and convenience foods, where emulsifiers are vital for texture, stability, and shelf-life enhancement. Key growth factors include the rising demand for dairy, frozen goods, bakery items, and confectionery, all heavily reliant on emulsifiers. Furthermore, heightened industry awareness of emulsifiers' functional benefits and cost-effectiveness in improving product quality and reducing waste significantly contributes to market acceleration. The growing demand for clean-label and natural emulsifiers is also prompting R&D investment to meet evolving consumer expectations.

North America Food Emulsifiers Market Market Size (In Billion)

Challenges for the market include raw material price volatility (vegetable oils, animal fats) impacting production costs and stringent food additive regulations across regions. However, continuous technological innovation in emulsifier development and their expanding use in emerging sectors like plant-based alternatives and functional foods are expected to overcome these obstacles. The United States is anticipated to lead the market due to its large consumer base and developed food processing sector, followed by Canada and Mexico. The "Rest of North America" region also offers significant growth opportunities.

North America Food Emulsifiers Market Company Market Share

North America Food Emulsifiers Market: Comprehensive Insights & Future Outlook (2024-2033)

This comprehensive report provides critical analysis and actionable insights into the North America Food Emulsifiers Market. It forecasts market dynamics, growth trends, key players, and emerging opportunities within the dynamic food ingredient sector. Understand the foundational and derived market segments influencing the future of food processing.

North America Food Emulsifiers Market Market Dynamics & Structure

The North America Food Emulsifiers Market is characterized by moderate concentration, with key players like Cargill Incorporated, DuPont, BASF SE, Archer Daniels Midland, and Kerry Group holding significant shares. Technological innovation is a primary driver, with ongoing research focused on natural emulsifiers, improved functionality, and cost-effective production methods. Regulatory frameworks, including those from the FDA in the United States, play a crucial role in dictating product safety and labeling standards, influencing formulation choices and market entry barriers. The availability of competitive product substitutes, such as hydrocolloids and proteins, necessitates continuous innovation and product differentiation by emulsifier manufacturers. End-user demographics are shifting towards a demand for healthier, cleaner-label products, driving the adoption of plant-based and natural emulsifiers. Mergers and acquisitions (M&A) are a notable trend, aimed at consolidating market positions, expanding product portfolios, and gaining access to new technologies or geographical markets. For instance, recent M&A activities in the food ingredients sector highlight a strategic push towards vertical integration and diversification, with an estimated XX deal volumes in the historical period. Innovation barriers include the high cost of research and development for novel emulsifiers and the lengthy regulatory approval processes for new ingredients.

- Market Concentration: Moderate, with established multinational corporations leading the pack.

- Technological Innovation: Focus on natural, plant-based, and high-performance emulsifiers.

- Regulatory Frameworks: Stringent safety and labeling requirements influence product development.

- Competitive Product Substitutes: Hydrocolloids and proteins offer alternative functionalities.

- End-User Demographics: Growing demand for clean-label and natural ingredients.

- M&A Trends: Strategic consolidation for market expansion and portfolio enhancement.

- Innovation Barriers: High R&D costs and complex regulatory approvals.

North America Food Emulsifiers Market Growth Trends & Insights

The North America Food Emulsifiers Market is poised for substantial growth, driven by evolving consumer preferences and advancements in food processing technologies. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% from the base year 2025 to 2033, reaching an estimated market size of USD XXXX Million in 2025. This expansion is fueled by an increasing demand for processed and convenience foods, where emulsifiers play a vital role in improving texture, stability, and shelf-life. Adoption rates of advanced emulsifier solutions, particularly those derived from natural sources like lecithin and monoglycerides, are rising rapidly due to their perceived health benefits and consumer acceptance. Technological disruptions, such as the development of enzyme-modified emulsifiers and encapsulated ingredients, are opening new avenues for product innovation and enhanced functionality in diverse food applications. Consumer behavior shifts towards healthier eating habits and a preference for recognizable ingredients are accelerating the demand for clean-label emulsifiers, leading to a decline in the usage of synthetic alternatives. Market penetration of specialized emulsifiers tailored for specific applications, such as plant-based dairy alternatives and low-fat baked goods, is also on the rise. The increasing awareness of the functional benefits of emulsifiers, beyond simple stabilization, including moisture retention and fat reduction, is further stimulating market growth. The report utilizes comprehensive XXX data to provide these detailed insights into the market's trajectory.

Dominant Regions, Countries, or Segments in North America Food Emulsifiers Market

The United States stands as the dominant region within the North America Food Emulsifiers Market, accounting for an estimated XX% of the market share in the base year 2025, with a projected market size of USD XXXX Million. This dominance is attributed to several key factors, including its large and mature food processing industry, high consumer spending power, and significant investments in research and development. The country’s advanced regulatory framework, while stringent, also fosters innovation and the adoption of new technologies. Economically, the United States boasts a robust economy with a strong demand for a wide variety of food products, from dairy and bakery to confectionery and processed meats. Infrastructure, including sophisticated supply chains and distribution networks, ensures efficient market access for emulsifier manufacturers.

Within the Type segment, Monoglycerides, Diglycerides, and Derivatives are anticipated to lead the market, driven by their versatility and cost-effectiveness across a broad spectrum of food applications. Their ability to improve dough conditioning, crumb structure, and shelf-life in baked goods, alongside their application in stabilizing dairy products and confectionery, makes them indispensable. The market size for this segment is estimated at USD XXXX Million in 2025.

In terms of Application, Bakery is a significant growth driver, representing approximately XX% of the total market value in 2025, with an estimated market size of USD XXXX Million. Emulsifiers are crucial for enhancing dough handling, improving the volume and texture of bread and cakes, and extending the shelf-life of baked goods. The constant innovation in the bakery sector, including the demand for gluten-free and reduced-fat options, further boosts the need for specialized emulsifiers.

- Dominant Geography: United States, driven by a large food processing industry and high consumer demand.

- Leading Type Segment: Monoglycerides, Diglycerides, and Derivatives, due to their wide applicability and cost-efficiency.

- Key Application Segment: Bakery, fueled by continuous product innovation and demand for improved texture and shelf-life.

- Economic Policies: Favorable policies supporting food innovation and processing contribute to market growth.

- Infrastructure: Well-developed supply chains and distribution networks facilitate market penetration.

- Growth Potential: High, owing to a large consumer base and ongoing demand for processed foods.

North America Food Emulsifiers Market Product Landscape

Product innovation in the North America Food Emulsifiers Market is focused on enhancing functionalities and meeting evolving consumer demands for natural and sustainable ingredients. Key developments include the introduction of plant-derived emulsifiers from sources like sunflower and soy lecithin, offering improved emulsification properties and cleaner labels. Innovations in enzyme-modified emulsifiers are also gaining traction, providing superior performance in challenging applications such as low-fat products and plant-based alternatives. These advancements allow for better texture, stability, and mouthfeel in a wide range of food products, from dairy and bakery items to confectionery and convenience meals. Performance metrics are continually being refined, with a focus on achieving superior oil-in-water emulsion stability, moisture retention, and reduced syneresis.

Key Drivers, Barriers & Challenges in North America Food Emulsifiers Market

Key Drivers: The North America Food Emulsifiers Market is propelled by several key drivers. The increasing demand for convenience and processed foods, coupled with a growing global population, fuels the need for ingredients that enhance product quality and shelf-life. Advancements in food technology and a focus on clean-label formulations are driving the adoption of natural and plant-based emulsifiers. Furthermore, the expanding use of emulsifiers in emerging applications like plant-based dairy alternatives and functional foods presents significant growth opportunities.

Barriers & Challenges: Despite the robust growth, the market faces several challenges. Volatility in the prices of raw materials, such as vegetable oils, can impact production costs and profitability. Stringent regulatory requirements and the time-consuming approval processes for new emulsifiers can hinder market entry for smaller players. Consumer perception regarding synthetic emulsifiers and a growing preference for ‘free-from’ labels pose a continuous challenge, necessitating greater transparency and education. Supply chain disruptions, as experienced recently, can also affect the availability and timely delivery of key emulsifier ingredients, impacting manufacturers’ production schedules and, consequently, their market share.

Emerging Opportunities in North America Food Emulsifiers Market

Emerging opportunities within the North America Food Emulsifiers Market lie in the burgeoning plant-based food sector, where emulsifiers are crucial for replicating the texture and mouthfeel of traditional animal-derived products. The demand for non-GMO and sustainably sourced emulsifiers presents a significant avenue for growth, aligning with increasing consumer consciousness. Innovations in the development of multi-functional emulsifiers that offer enhanced textural properties alongside improved nutritional profiles are also creating new market niches. Furthermore, the expanding convenience food market, particularly in ready-to-eat meals and snacks, offers a substantial opportunity for customized emulsifier solutions that extend shelf-life and maintain product integrity.

Growth Accelerators in the North America Food Emulsifiers Market Industry

Several catalysts are accelerating the growth of the North America Food Emulsifiers Market. Technological breakthroughs in enzymatic synthesis and encapsulation are leading to the development of highly efficient and specialized emulsifiers, enabling novel product formulations and improved performance. Strategic partnerships between ingredient manufacturers and food processing companies are fostering innovation and faster market penetration of new emulsifier solutions. Furthermore, the increasing global focus on food security and waste reduction is driving the demand for emulsifiers that enhance product stability and extend shelf-life, thereby minimizing food spoilage. Market expansion strategies targeting underserved regions and developing economies also act as significant growth accelerators.

Key Players Shaping the North America Food Emulsifiers Market Market

- Cargill Incorporated

- DuPont

- Stepan Co

- BASF SE

- Archer Daniels Midland

- Kerry Group

- Ingredion Incorporated

Notable Milestones in North America Food Emulsifiers Market Sector

- 2023: Launch of new line of plant-based emulsifiers by a major player, responding to clean-label trends.

- 2022: Strategic acquisition of a specialized emulsifier manufacturer by a key industry leader to expand its portfolio.

- 2021: Introduction of novel enzyme-modified emulsifiers for improved performance in dairy alternatives.

- 2020: Increased investment in R&D for sustainable sourcing of raw materials for emulsifier production.

- 2019: Significant advancements in encapsulation technology for enhanced emulsifier stability and controlled release.

In-Depth North America Food Emulsifiers Market Market Outlook

The North America Food Emulsifiers Market is set to witness sustained growth, propelled by ongoing innovation and evolving consumer demands. Key growth accelerators, including the development of advanced, high-performance emulsifiers and strategic collaborations within the food industry, will continue to shape the market landscape. The increasing preference for natural and clean-label ingredients presents a significant opportunity for market expansion, driving research into novel plant-based emulsifiers. The market's future outlook is characterized by a strong focus on sustainability, functional benefits, and customized solutions for diverse food applications, ensuring its continued relevance and expansion in the coming years.

North America Food Emulsifiers Market Segmentation

-

1. Type

- 1.1. Lecithin

- 1.2. Monoglycerides, Diglycerides, and Derivatives

- 1.3. Sorbitan Esters

- 1.4. Polyglycerol Esters

- 1.5. Other Types

-

2. Application

- 2.1. Dairy and Frozen Products

- 2.2. Bakery

- 2.3. Meat, Poultry, and Seafood

- 2.4. Beverages

- 2.5. Confectionery

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Mexico

- 3.3. Canada

- 3.4. Rest of North America

North America Food Emulsifiers Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

- 4. Rest of North America

North America Food Emulsifiers Market Regional Market Share

Geographic Coverage of North America Food Emulsifiers Market

North America Food Emulsifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Growing Demand for Specialty Food Ingredient

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lecithin

- 5.1.2. Monoglycerides, Diglycerides, and Derivatives

- 5.1.3. Sorbitan Esters

- 5.1.4. Polyglycerol Esters

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy and Frozen Products

- 5.2.2. Bakery

- 5.2.3. Meat, Poultry, and Seafood

- 5.2.4. Beverages

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Mexico

- 5.4.3. Canada

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lecithin

- 6.1.2. Monoglycerides, Diglycerides, and Derivatives

- 6.1.3. Sorbitan Esters

- 6.1.4. Polyglycerol Esters

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy and Frozen Products

- 6.2.2. Bakery

- 6.2.3. Meat, Poultry, and Seafood

- 6.2.4. Beverages

- 6.2.5. Confectionery

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Mexico

- 6.3.3. Canada

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico North America Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lecithin

- 7.1.2. Monoglycerides, Diglycerides, and Derivatives

- 7.1.3. Sorbitan Esters

- 7.1.4. Polyglycerol Esters

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy and Frozen Products

- 7.2.2. Bakery

- 7.2.3. Meat, Poultry, and Seafood

- 7.2.4. Beverages

- 7.2.5. Confectionery

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Mexico

- 7.3.3. Canada

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Canada North America Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lecithin

- 8.1.2. Monoglycerides, Diglycerides, and Derivatives

- 8.1.3. Sorbitan Esters

- 8.1.4. Polyglycerol Esters

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy and Frozen Products

- 8.2.2. Bakery

- 8.2.3. Meat, Poultry, and Seafood

- 8.2.4. Beverages

- 8.2.5. Confectionery

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Mexico

- 8.3.3. Canada

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lecithin

- 9.1.2. Monoglycerides, Diglycerides, and Derivatives

- 9.1.3. Sorbitan Esters

- 9.1.4. Polyglycerol Esters

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy and Frozen Products

- 9.2.2. Bakery

- 9.2.3. Meat, Poultry, and Seafood

- 9.2.4. Beverages

- 9.2.5. Confectionery

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Mexico

- 9.3.3. Canada

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Dupont

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stepan Co *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BASF SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Archer Daniels Midland

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kerry Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ingredion Incorporated

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Food Emulsifiers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Food Emulsifiers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Food Emulsifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Food Emulsifiers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Food Emulsifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Food Emulsifiers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Food Emulsifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Food Emulsifiers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Food Emulsifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Food Emulsifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Food Emulsifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Food Emulsifiers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: North America Food Emulsifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Food Emulsifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Food Emulsifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Food Emulsifiers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: North America Food Emulsifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Food Emulsifiers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Food Emulsifiers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Food Emulsifiers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: North America Food Emulsifiers Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Food Emulsifiers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Emulsifiers Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Food Emulsifiers Market?

Key companies in the market include Cargill Incorporated, Dupont, Stepan Co *List Not Exhaustive, BASF SE, Archer Daniels Midland, Kerry Group, Ingredion Incorporated.

3. What are the main segments of the North America Food Emulsifiers Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Growing Demand for Specialty Food Ingredient.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Emulsifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Emulsifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Emulsifiers Market?

To stay informed about further developments, trends, and reports in the North America Food Emulsifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence