Key Insights

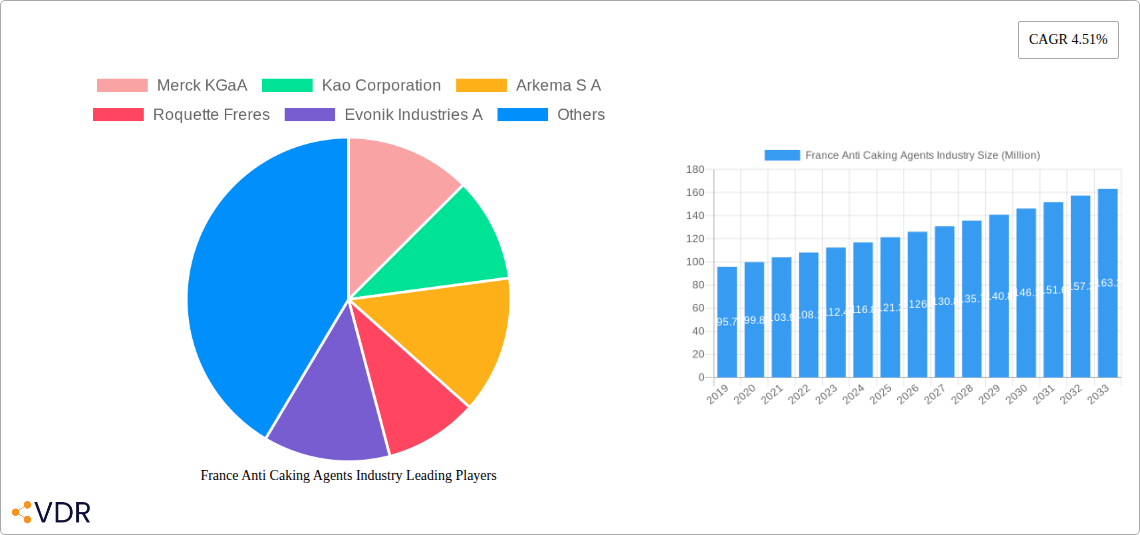

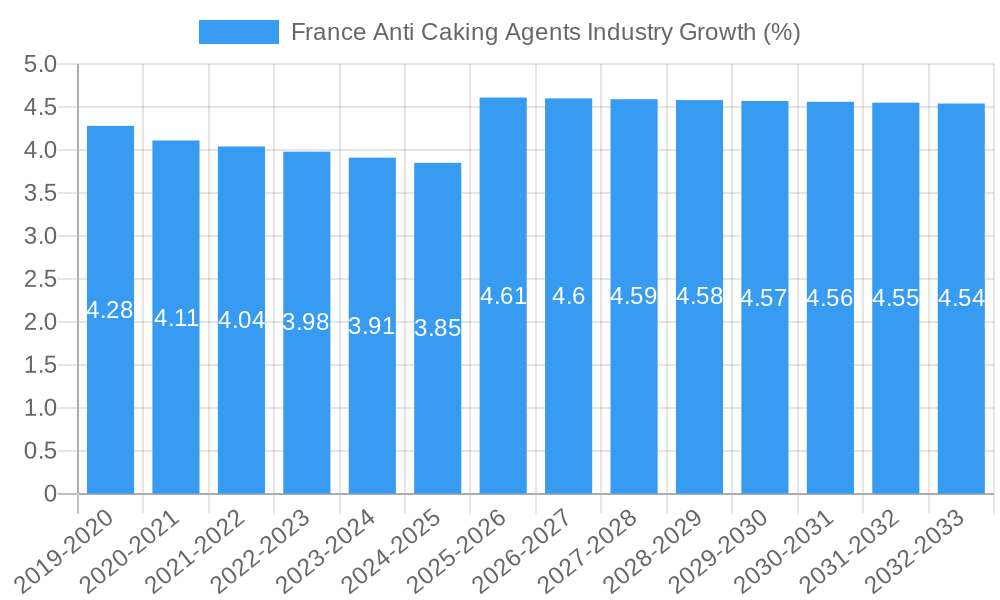

The France anti-caking agents market is poised for steady growth, projected to reach approximately $115 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.51% extending through 2033. This expansion is fueled by increasing demand across various sectors, primarily the food and beverage industry. Within this segment, bakery products and dairy products represent significant application areas, driven by consumer preferences for convenience and extended shelf life of processed foods. The cosmetic and personal care sector also contributes to market growth, utilizing anti-caking agents to improve product texture and consistency, particularly in powders and makeup formulations. Furthermore, the animal feed industry is a growing consumer of these agents, ensuring optimal nutrient distribution and preventing clumping in animal feed products. The prevalence of calcium compounds and sodium compounds as key types of anti-caking agents underscores their cost-effectiveness and widespread applicability.

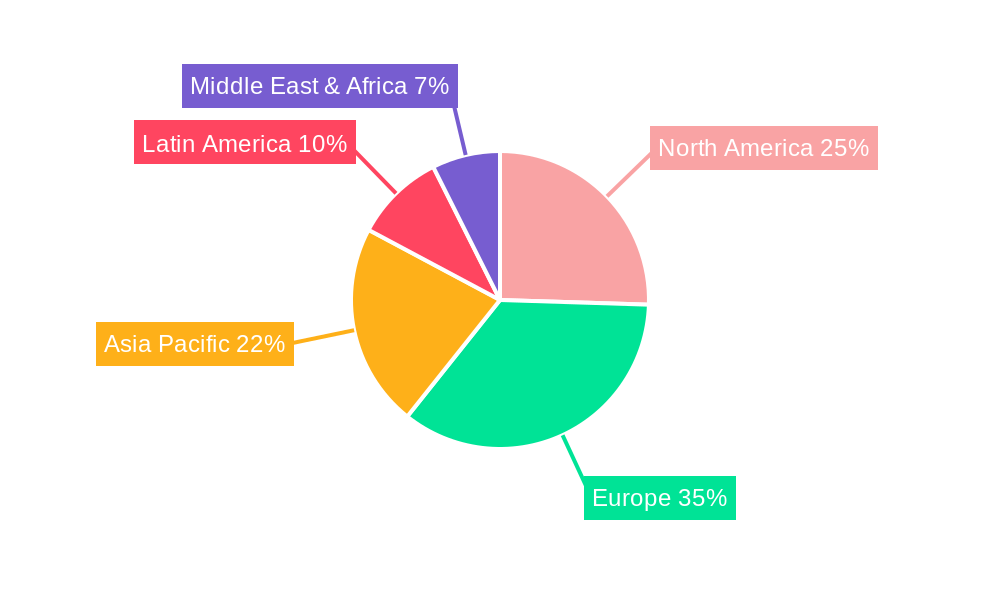

Despite the positive growth trajectory, the market faces certain restraints, including stringent regulatory frameworks concerning food additives and potential consumer concerns about synthetic ingredients, pushing for a greater adoption of natural alternatives. However, ongoing research and development into novel, naturally derived anti-caking agents, coupled with increasing awareness of their functional benefits, are expected to mitigate these challenges. Key players like Merck KGaA, Kao Corporation, Arkema S.A., Roquette Freres, Evonik Industries AG, and BASF SE are actively engaged in innovation and market expansion within France, focusing on product diversification and strategic partnerships to capture a larger market share. The European region, with France being a significant contributor, is expected to maintain a strong market presence due to its well-established food processing and cosmetic industries.

France Anti-Caking Agents Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Gain unparalleled insights into the dynamic France Anti-Caking Agents market. This in-depth report, spanning 2019–2033, provides a granular analysis of market size, growth trends, key players, and future opportunities. Leveraging data from 2019–2024 historical periods and a Base Year of 2025, with forecasts extending to 2033, this report is essential for industry professionals seeking to navigate the evolving landscape of anti-caking agents in France. The market is segmented by type (Calcium Compounds, Sodium Compounds, Magnesium Compounds, Others) and application (Food and Beverage - Bakery Products, Dairy Products, Soups & Sauces, Beverages, Others; Cosmetic and Personal Care, Feed).

France Anti Caking Agents Industry Market Dynamics & Structure

The France Anti-Caking Agents market exhibits a moderate to high level of concentration, with key global and regional players dominating market share. Technological innovation is a significant driver, focusing on developing novel, highly effective, and naturally derived anti-caking agents to meet stringent regulatory demands and evolving consumer preferences for cleaner labels. Regulatory frameworks, including those set by the European Food Safety Authority (EFSA), play a crucial role in dictating product formulations, usage levels, and approved applications, influencing product development and market entry strategies. Competitive product substitutes, such as alternative processing techniques or less processed ingredients, present a constant challenge, requiring continuous innovation in anti-caking agent performance and cost-effectiveness. End-user demographics are shifting, with increased demand for specialized anti-caking agents in niche applications within the food and beverage sector, as well as a growing interest in personal care and animal feed. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market access, and consolidate their positions.

- Market Concentration: Dominated by a few key global chemical manufacturers, with a growing presence of specialized local producers.

- Technological Innovation: Focus on natural and bio-based anti-caking agents, improved solubility, and enhanced performance in diverse conditions.

- Regulatory Landscape: Strict adherence to EFSA guidelines and national food safety regulations is paramount.

- Competitive Substitutes: Innovations in food processing and ingredient formulation pose a challenge.

- End-User Demographics: Growing demand from diverse food sub-segments, cosmetics, and animal feed industries.

- M&A Trends: Strategic acquisitions to enhance market reach and technological capabilities, with an estimated xx M&A deals in the historical period.

France Anti Caking Agents Industry Growth Trends & Insights

The France Anti-Caking Agents market is projected to experience steady growth throughout the forecast period, driven by several interconnected factors. The increasing demand for processed and convenience foods in France, a consequence of evolving consumer lifestyles and a growing elderly population, directly translates into a higher requirement for effective anti-caking agents to maintain product quality, shelf life, and consumer appeal. For instance, the bakery products segment, a cornerstone of the French diet, relies heavily on these additives to prevent clumping in flours, powdered mixes, and finished goods like cakes and pastries, thus ensuring consistent texture and ease of use. Similarly, the dairy products sector, encompassing powdered milk, cheese powders, and infant formula, benefits significantly from anti-caking agents to prevent agglomeration, thereby preserving flowability and preventing moisture absorption.

Technological disruptions are continuously reshaping the market. Advancements in nanotechnology and encapsulation techniques are leading to the development of more efficient and targeted anti-caking solutions, which can be used at lower concentrations while delivering superior results. Furthermore, the growing consumer awareness regarding ingredient sourcing and perceived health benefits is propelling the demand for naturally derived and food-grade anti-caking agents. This trend is pushing manufacturers to invest in research and development of plant-based or mineral-derived alternatives, such as silica derived from rice hulls or specific starch derivatives, to cater to the "clean label" movement.

Consumer behavior shifts are also playing a pivotal role. The desire for visually appealing and functionally superior food products, coupled with increased online grocery shopping where product integrity is paramount during transit, further amplifies the need for effective anti-caking agents. The cosmetic and personal care industry, a burgeoning segment for these agents, utilizes them in powdered makeup, bath salts, and dry cosmetic formulations to ensure smooth application and prevent caking. The animal feed sector also presents a consistent demand, where anti-caking agents prevent feed clumping, ensuring uniform nutrient distribution and ease of handling. The overall market size is estimated to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% from the base year. Market penetration for advanced anti-caking agents is expected to rise, particularly in specialized food applications and emerging cosmetic formulations.

Dominant Regions, Countries, or Segments in France Anti Caking Agents Industry

Within the French anti-caking agents market, the Food and Beverage application segment emerges as the undisputed dominant force, accounting for an estimated xx% of the total market share in 2025. This dominance is primarily driven by the sub-segment of Bakery Products, which represents a substantial portion of consumer spending and daily consumption in France. The inherent need to maintain the flowability and prevent clumping of dry ingredients like flour, sugar, and leavening agents in pre-mixes and baked goods makes anti-caking agents indispensable. The French patisserie tradition, with its wide array of powdered sugar decorations, cake mixes, and instant baking ingredients, further fuels this demand.

Following closely, Dairy Products represent another significant contributor to the dominance of the Food and Beverage segment. Powdered milk, cheese powders used in snacks and convenience meals, and infant formulas all rely on anti-caking agents to ensure product homogeneity, ease of reconstitution, and extended shelf life. The robust dairy industry in France, known for its premium quality and diverse offerings, necessitates high-performance additives. The Soups & Sauces sub-segment also plays a crucial role, particularly in powdered soup mixes, bouillon cubes, and spice blends, where anti-caking agents prevent the formation of lumps and ensure consistent flavor distribution upon rehydration.

While less significant than the bakery and dairy sectors, Beverages in powdered form, such as instant coffee, tea mixes, and sports drink powders, also contribute to the overall demand. The growing trend of flavored and functional powdered beverages further solidifies this niche. The Cosmetic and Personal Care segment, while smaller in comparison, is experiencing robust growth. The demand for powdered cosmetics, such as foundations, blushes, and eyeshadows, where smooth application and preventing caking are critical for consumer satisfaction, is steadily increasing. Similarly, the Feed industry, encompassing animal nutrition, represents a stable and consistent market. Anti-caking agents are essential for maintaining the free-flowing properties of animal feed pellets and powders, ensuring consistent nutrient intake for livestock and poultry.

The dominance of the Food and Beverage segment is underpinned by favorable economic policies supporting the food processing industry, robust infrastructure facilitating the distribution of ingredients, and consistent consumer demand for processed food products. The estimated market size for the Food and Beverage segment alone is projected to reach xx Million units by 2033, with a CAGR of xx%. This segment's growth potential is further amplified by continuous product innovation and the introduction of new convenience food options in the French market.

France Anti Caking Agents Industry Product Landscape

The France Anti-Caking Agents industry is characterized by a product landscape focused on enhancing performance and addressing specific application needs. Key innovations include the development of highly porous and amorphous silica variants with superior moisture absorption capabilities, offering excellent flowability to powdered products. Advances in chemical synthesis have led to the production of more efficient magnesium carbonate and calcium carbonate grades, tailored for specific particle size distributions and surface treatments to optimize anti-caking efficacy in bakery and confectionery applications. Furthermore, the industry is witnessing a trend towards naturally derived anti-caking agents, such as modified starches and plant-based fiber extracts, appealing to the growing demand for clean-label products. These innovations aim to provide cost-effective solutions with minimal impact on the sensory properties of the final product, ensuring superior texture and shelf-life for food, cosmetic, and feed applications.

Key Drivers, Barriers & Challenges in France Anti Caking Agents Industry

Key Drivers:

- Growing Demand for Processed Foods: An increasing consumer preference for convenience foods, ready-to-eat meals, and baking mixes drives the need for anti-caking agents to maintain product quality and shelf life.

- Technological Advancements: Innovations in product formulation and manufacturing processes, leading to more efficient and specialized anti-caking agents.

- Clean Label Trend: Rising consumer demand for natural and minimally processed ingredients is pushing for the development of bio-based anti-caking agents.

- Expansion of Cosmetic and Feed Industries: Growing applications in powdered cosmetics and the consistent need in animal feed for free-flowing formulations.

Barriers & Challenges:

- Regulatory Scrutiny: Strict regulations regarding the use and labeling of food additives can impact product development and market entry, with potential for evolving restrictions.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as silicon dioxide or calcium carbonate, can affect production costs and profit margins.

- Competition from Substitutes: Alternative processing methods or less processed ingredients can sometimes reduce the reliance on chemical anti-caking agents.

- Consumer Perception: Negative consumer perceptions surrounding chemical additives, even if approved, can create market resistance.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials, affecting production schedules and lead times. The estimated impact of these disruptions could lead to xx% increase in production costs.

Emerging Opportunities in France Anti Caking Agents Industry

Emerging opportunities in the France Anti-Caking Agents industry lie in the development and promotion of highly specialized, natural, and multifunctional anti-caking agents. The expanding market for gourmet powdered ingredients and artisanal food mixes presents a niche for premium, naturally derived anti-caking solutions that offer enhanced texture and shelf-stability without compromising on perceived health benefits. Furthermore, the growing trend of personalized nutrition and functional foods, particularly in powdered formats, opens avenues for tailored anti-caking agents that can encapsulate sensitive ingredients or improve the dispersibility of complex formulations. The cosmetic industry's continuous innovation in powdered makeup and dry skincare products also offers significant growth potential for novel anti-caking agents that improve application feel and product longevity.

Growth Accelerators in the France Anti Caking Agents Industry Industry

Several catalysts are accelerating the growth of the France Anti-Caking Agents industry. Technological breakthroughs in material science are enabling the creation of more advanced anti-caking agents with superior moisture control and particle dispersion properties, allowing for lower usage rates and improved cost-effectiveness. Strategic partnerships between anti-caking agent manufacturers and food processors or cosmetic formulators are fostering co-development of innovative solutions tailored to specific product needs, thereby expanding market reach and adoption. Furthermore, market expansion strategies, including the penetration of existing products into new food categories or the exploration of untapped geographical regions within France, are significant growth drivers. The increasing focus on sustainable manufacturing processes and the development of eco-friendly anti-caking agents also align with evolving market demands and regulatory pressures, acting as a crucial growth accelerator.

Key Players Shaping the France Anti Caking Agents Industry Market

- Merck KGaA

- Kao Corporation

- Arkema S A

- Roquette Freres

- Evonik Industries A

- BASF SE

Notable Milestones in France Anti Caking Agents Industry Sector

- 2020: Introduction of advanced silica-based anti-caking agents with enhanced moisture absorption, leading to improved flowability in powdered food products.

- 2021: Increased R&D investment in bio-based anti-caking agents from plant-derived sources to cater to the growing clean-label demand.

- 2022: Launch of new grades of magnesium compounds optimized for bakery applications, offering superior performance in high-humidity environments.

- 2023: Strategic acquisition of a smaller specialized chemical producer by a major player to expand product portfolio and market reach.

- 2024: Development of novel encapsulation techniques for anti-caking agents to protect sensitive ingredients in complex food formulations.

In-Depth France Anti Caking Agents Industry Market Outlook

The future outlook for the France Anti-Caking Agents industry is exceptionally promising, driven by sustained demand from core sectors and emerging application areas. Growth accelerators such as continuous technological innovation, the development of sustainable and natural anti-caking solutions, and strategic collaborations will underpin market expansion. The industry is poised to benefit from the increasing sophistication of the French food processing sector and the growing consumer inclination towards convenience and high-quality products. As regulatory landscapes evolve and consumer preferences shift towards healthier and cleaner ingredients, manufacturers who invest in research and development of novel, eco-friendly anti-caking agents will be well-positioned for significant growth and market leadership. The forecast indicates a robust market expansion, driven by innovation and an increasing understanding of the vital role these agents play in product integrity and consumer satisfaction.

France Anti Caking Agents Industry Segmentation

-

1. Type

- 1.1. Calcium Compounds

- 1.2. Sodium Compounds

- 1.3. Magnesium Compounds

- 1.4. Others

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery Products

- 2.1.2. Dairy Products

- 2.1.3. Soups & Sauces

- 2.1.4. Beverages

- 2.1.5. Others

- 2.2. Cosmetic and Personal Care

- 2.3. Feed

-

2.1. Food and Beverage

France Anti Caking Agents Industry Segmentation By Geography

- 1. France

France Anti Caking Agents Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Growing Demand in Bakery Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Calcium Compounds

- 5.1.2. Sodium Compounds

- 5.1.3. Magnesium Compounds

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery Products

- 5.2.1.2. Dairy Products

- 5.2.1.3. Soups & Sauces

- 5.2.1.4. Beverages

- 5.2.1.5. Others

- 5.2.2. Cosmetic and Personal Care

- 5.2.3. Feed

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 7. France France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe France Anti Caking Agents Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Merck KGaA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kao Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Arkema S A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Roquette Freres

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Evonik Industries A

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 Merck KGaA

List of Figures

- Figure 1: France Anti Caking Agents Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Anti Caking Agents Industry Share (%) by Company 2024

List of Tables

- Table 1: France Anti Caking Agents Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Anti Caking Agents Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: France Anti Caking Agents Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: France Anti Caking Agents Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Anti Caking Agents Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe France Anti Caking Agents Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Anti Caking Agents Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: France Anti Caking Agents Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: France Anti Caking Agents Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Anti Caking Agents Industry?

The projected CAGR is approximately 4.51%.

2. Which companies are prominent players in the France Anti Caking Agents Industry?

Key companies in the market include Merck KGaA, Kao Corporation, Arkema S A, Roquette Freres, Evonik Industries A, BASF SE.

3. What are the main segments of the France Anti Caking Agents Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Growing Demand in Bakery Industry.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Anti Caking Agents Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Anti Caking Agents Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Anti Caking Agents Industry?

To stay informed about further developments, trends, and reports in the France Anti Caking Agents Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence