Key Insights

The United States Textured Vegetable Protein (TVP) market is projected to experience substantial expansion, forecasting a market size of $1617.5 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.5%. This growth trajectory is propelled by shifting consumer preferences towards sustainable and plant-based protein sources, aligning with increasing health consciousness and environmental awareness. The rising demand for meat alternatives, driven by ethical considerations surrounding animal agriculture, further fuels TVP adoption. Its inherent versatility, capable of replicating meat textures in diverse culinary applications, positions TVP for increased integration into processed foods, ready-to-eat meals, and plant-based meat substitutes.

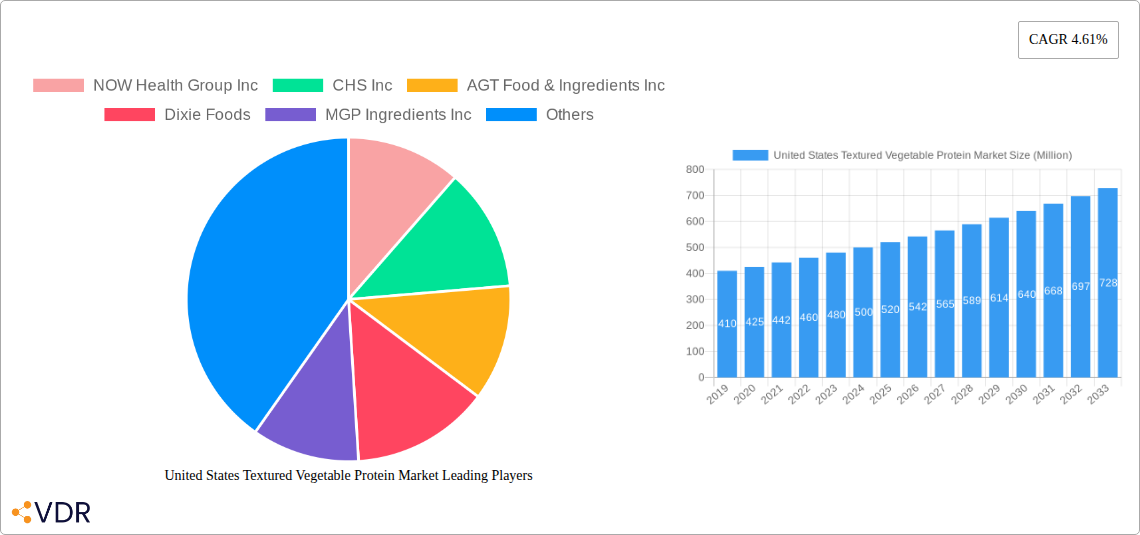

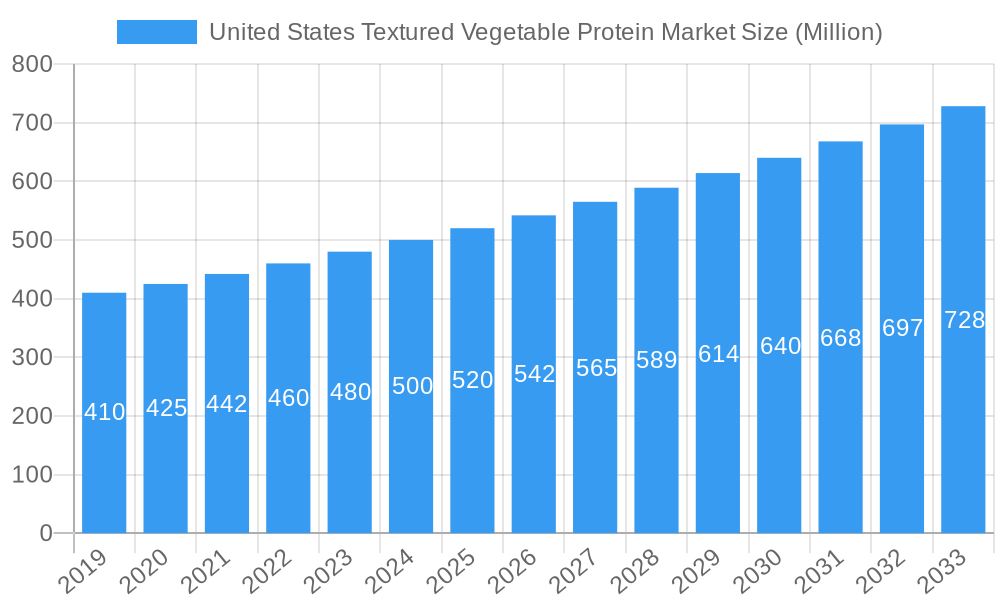

United States Textured Vegetable Protein Market Market Size (In Billion)

Segmentation analysis indicates a strong consumer preference for the Off-Trade distribution channel, encompassing convenience stores, online retail, and supermarkets/hypermarkets, highlighting a trend towards home consumption. The On-Trade segment also presents emerging opportunities as food service providers increasingly offer plant-based options to accommodate diverse dietary needs. While market demand is robust, potential restraints include perceptions of TVP as a highly processed ingredient, raw material price volatility, and the necessity for enhanced consumer education on its nutritional benefits and versatile applications. Nevertheless, ongoing advancements in processing technologies and ingredient formulation are actively addressing these challenges, fostering broader mainstream acceptance of TVP as a key protein source in the U.S. diet.

United States Textured Vegetable Protein Market Company Market Share

United States Textured Vegetable Protein Market Report: Growth, Trends, and Competitive Landscape (2019-2033)

This comprehensive report delves into the dynamic United States Textured Vegetable Protein (TVP) market, a burgeoning sector driven by escalating demand for plant-based protein alternatives and evolving consumer preferences for healthier, sustainable food options. The analysis covers a detailed market outlook from 2019 to 2033, with a deep dive into the base year of 2025 and robust forecast period from 2025 to 2033. We meticulously examine the market structure, growth trends, dominant segments, product landscape, key drivers and challenges, emerging opportunities, and the strategic initiatives of major players. This report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the significant growth potential of the U.S. TVP market. We present all values in Million units to provide a clear quantitative understanding of the market's scale and progression.

United States Textured Vegetable Protein Market Market Dynamics & Structure

The United States Textured Vegetable Protein (TVP) market is characterized by a moderate to high concentration, with a few key players holding significant market share, yet with a growing number of innovative smaller companies entering the space. Technological innovation is a primary driver, focusing on improving the texture, taste, and nutritional profile of TVP to better mimic traditional animal proteins. The regulatory framework, while generally supportive of food innovation, introduces compliance requirements related to labeling and food safety. Competitive product substitutes, such as soy protein isolates, pea protein concentrates, and other plant-based protein sources, present a constant challenge, pushing TVP manufacturers to differentiate through superior functionality and cost-effectiveness. End-user demographics are shifting towards younger, health-conscious consumers, as well as those seeking environmentally sustainable food choices. Mergers and acquisitions (M&A) trends are evident as larger companies seek to expand their plant-based portfolios and gain access to novel technologies and market segments. For instance, the acquisition of specialized ingredient suppliers by major food conglomerates signals a strategic move to consolidate market position and accelerate product development.

- Market Concentration: Dominated by a mix of established food ingredient giants and specialized plant-protein companies.

- Technological Innovation Drivers: Focus on enhancing flavor, texture, and nutritional value; developing novel processing techniques for improved digestibility and versatility.

- Regulatory Frameworks: Evolving FDA guidelines for plant-based food labeling and safety standards.

- Competitive Product Substitutes: Soy protein, pea protein, wheat gluten, and other emerging plant proteins.

- End-User Demographics: Growing demand from flexitarians, vegetarians, vegans, and health-conscious consumers.

- M&A Trends: Strategic acquisitions of innovative startups and ingredient companies to expand product lines and market reach.

United States Textured Vegetable Protein Market Growth Trends & Insights

The United States Textured Vegetable Protein (TVP) market is poised for substantial growth, fueled by a confluence of factors including heightened consumer awareness regarding health and sustainability, coupled with significant advancements in food technology. The market size is projected to witness a robust expansion, with its adoption rate steadily increasing across various food applications. This upward trajectory is underpinned by a growing preference for plant-based diets, driven by concerns over animal welfare, environmental impact, and perceived health benefits of reducing meat consumption. Technological disruptions are playing a pivotal role, with ongoing research and development focused on improving the sensory attributes of TVP, such as texture, mouthfeel, and flavor, to enhance its appeal as a direct substitute for meat. Innovations in processing techniques, such as extrusion and texturization methods, are creating TVP products that more closely mimic the fibrous structure of animal proteins, thereby expanding their utility in a wider array of dishes.

Consumer behavior shifts are critically influencing market dynamics. The increasing willingness of consumers to experiment with and adopt plant-based alternatives is a key growth accelerator. This trend is further amplified by the rising popularity of flexitarianism, where individuals are actively reducing their meat intake without necessarily eliminating it entirely, creating a vast market for versatile plant-based ingredients like TVP. Furthermore, the accessibility of TVP through various distribution channels, including online platforms and mainstream retail, has significantly contributed to its market penetration. The perceived health benefits associated with plant-based proteins, such as lower saturated fat content and higher fiber, are also a significant draw for health-conscious consumers. This segment of the market is actively seeking protein sources that align with their wellness goals, making TVP an attractive option.

Looking at market size evolution, we anticipate a compound annual growth rate (CAGR) of approximately 7.2% from 2025 to 2033. This growth is projected to translate into a market value of xx Million units by 2033. The historical period (2019-2024) has laid the foundation for this expansion, with increasing consumer acceptance and initial product development. The base year of 2025 stands as a pivotal point, with the market demonstrating significant momentum. Future growth will be further propelled by innovations in raw material sourcing, such as the development of novel protein crops, and advancements in ingredient functionality, enabling TVP to be used in even more sophisticated food formulations. The ongoing research into the nutritional synergy of different plant proteins will also contribute to the development of more complete and appealing TVP-based products.

Dominant Regions, Countries, or Segments in United States Textured Vegetable Protein Market

The United States Textured Vegetable Protein (TVP) market is experiencing its most significant growth and adoption within the Off-Trade distribution channel, particularly driven by the Supermarkets and Hypermarkets segment. This dominance is attributable to several interconnected factors, including evolving consumer purchasing habits, increased product availability, and the rising popularity of plant-based diets among a broad demographic. Supermarkets and hypermarkets serve as crucial touchpoints for consumers actively seeking healthier and more sustainable food options. They offer a wide variety of TVP products, ranging from standalone ingredients for home cooking to pre-prepared meals and meat alternatives that prominently feature TVP, making it highly accessible to a vast consumer base.

The economic policies within the United States have also fostered an environment conducive to the growth of the plant-based food sector. Government initiatives and private sector investments in sustainable agriculture and food innovation indirectly support the TVP market by ensuring a steady supply of raw materials and encouraging research and development. Furthermore, the infrastructure supporting retail operations, including robust logistics and supply chain networks, ensures that TVP products are readily available across diverse geographical locations, from urban centers to suburban communities. The market share within the Off-Trade segment is increasingly leaning towards supermarket sales, reflecting a broader trend of consumers consolidating their grocery shopping in these large format retail environments.

Within the Off-Trade channel, the Online Channel is also demonstrating rapid growth, catering to consumers seeking convenience and a wider selection of specialized products. While still a smaller segment compared to physical retail, its market share is expanding at an impressive pace, driven by the ease of online ordering and home delivery services. Convenience stores, while offering some basic TVP products, represent a smaller portion of the overall growth compared to supermarkets. The "Others" category within Off-Trade, which may include specialty health food stores and independent grocers, contributes to market diversity but does not hold the same scale of influence as major retail chains.

On-Trade channels, such as restaurants and food service establishments, are also increasingly incorporating TVP into their menus. This adoption is driven by consumer demand for plant-based options and by food service providers looking to diversify their offerings and cater to dietary preferences. However, the scalability and market share of TVP in the On-Trade segment are currently less dominant than in the Off-Trade channel, primarily due to the higher volume and broader reach of consumer purchasing in supermarkets and hypermarkets. The growth potential in this segment remains significant as more culinary establishments embrace plant-based innovation. The dominance of Supermarkets and Hypermarkets in the Off-Trade channel underscores its role as the primary driver of market growth and consumer adoption for TVP in the United States, with the Online Channel emerging as a significant and rapidly growing contender.

United States Textured Vegetable Protein Market Product Landscape

The United States Textured Vegetable Protein (TVP) market is characterized by a diverse and evolving product landscape, focusing on innovation to meet consumer demands for taste, texture, and versatility. Key product innovations include the development of TVP from various protein sources beyond soy, such as pea and fava bean, offering hypoallergenic alternatives and distinct nutritional profiles. Advanced texturization techniques are yielding TVP with superior fibrous structures, closely mimicking the mouthfeel of meat. Applications are expanding from traditional meat extenders to standalone plant-based burgers, sausages, and even intricate culinary ingredients. Performance metrics are increasingly centered on protein content, amino acid profiles, and functional properties like water-holding capacity and binding.

Key Drivers, Barriers & Challenges in United States Textured Vegetable Protein Market

Key Drivers:

- Rising Consumer Demand for Plant-Based Diets: Growing health consciousness, ethical concerns, and environmental awareness are propelling the adoption of plant-based proteins.

- Technological Advancements: Improved processing techniques are enhancing the taste, texture, and nutritional value of TVP, making it a more viable meat alternative.

- Growing Flexitarian Population: An increasing number of consumers are reducing their meat consumption, creating a large market for meat substitutes.

- Government Support and Initiatives: Policies promoting sustainable agriculture and plant-based food research contribute to market growth.

Barriers & Challenges:

- Consumer Perception and Taste Preferences: Overcoming ingrained preferences for traditional meat products and addressing any lingering concerns about the taste and texture of TVP.

- Supply Chain Volatility and Raw Material Costs: Fluctuations in the availability and pricing of agricultural commodities like soybeans and peas can impact production costs.

- Regulatory Hurdles: Evolving labeling requirements and food safety standards can pose challenges for new product development and market entry.

- Competition from Other Plant Proteins: A wide array of alternative plant-based protein sources compete for consumer attention and market share.

- Processing Complexity: Achieving optimal texture and flavor profiles often requires sophisticated processing technologies, which can be capital-intensive.

Emerging Opportunities in United States Textured Vegetable Protein Market

Emerging opportunities in the United States Textured Vegetable Protein (TVP) market lie in the development of novel protein sources, such as microalgae and insect-based proteins, to cater to niche markets and expand product diversity. Further innovation in allergen-free TVP formulations is crucial to address the needs of a growing segment of consumers with dietary restrictions. The untapped potential in the foodservice industry, particularly in developing partnerships with major restaurant chains to introduce innovative plant-based menu items featuring TVP, presents a significant growth avenue. Moreover, exploring TVP's application in functional foods and beverages, beyond traditional meat alternatives, could unlock new market segments.

Growth Accelerators in the United States Textured Vegetable Protein Market Industry

Several key catalysts are accelerating the growth of the United States Textured Vegetable Protein (TVP) market. Technological breakthroughs in extrusion and texturization are continuously improving the sensory attributes of TVP, making it more appealing to a broader consumer base. Strategic partnerships between ingredient manufacturers and food companies are crucial for developing and launching innovative TVP-based products at scale. Market expansion strategies, including aggressive product development and targeted marketing campaigns highlighting the health and environmental benefits of TVP, are further fueling demand. Investment in research and development to enhance the nutritional completeness and functional properties of TVP will also be a significant growth accelerator.

Key Players Shaping the United States Textured Vegetable Protein Market Market

- NOW Health Group Inc

- CHS Inc

- AGT Food & Ingredients Inc

- Dixie Foods

- MGP Ingredients Inc

- International Flavors & Fragrances Inc

- Ingredion Inc

- Bunge Limited

- Wholesome Provisions Inc

- Bob’s Red Mill Natural Foods

- Cargill Inc

- Associated British Foods PLC

- Univar Solutions Inc

- The Scoular Company

- Axiom Foods Inc

- Roquette Freres

Notable Milestones in United States Textured Vegetable Protein Market Sector

- May 2023: Bunge Limited formed a strategic alliance with Nutrien Ag Solutions, the retail division of Nutrien Ltd., to support U.S. farmers in the implementation of sustainable farming practices in order to increase production of low carbon products.

- December 2022: Ingredion Inc., has partnered with the InnovoPro to distribute chickpea protein concentrate in the US and Canada. The chickpea protein offers neutral color and flavor profile as well as emulsification properties that provide a creamy texture making it ideal for a broad range of applications, including dairy and meat alternatives, bakery goods and beverages.

- September 2022: Equinom and AGT Foods announced a collaboration to co-create Minimally processed functional ingredients produced from new varieties of yellow peas. To meet the growing global demand for better plant-based foods, they need more innovative, sustainably-produced ingredients that deliver food functionality and fulfill the demand from both consumers and food companies for high-quality.

In-Depth United States Textured Vegetable Protein Market Market Outlook

The future market potential of the United States Textured Vegetable Protein (TVP) market is exceptionally bright, driven by sustained consumer preference for plant-based options and continuous innovation in product development. Strategic opportunities lie in further segmenting the market based on specific dietary needs and functional benefits, such as high-protein or low-carb TVP formulations. Collaborations with culinary institutions and food scientists will be instrumental in expanding the application range of TVP into more sophisticated food products and exploring its potential in diverse cuisines. The ongoing drive towards sustainable sourcing and production will also present opportunities for companies committed to environmental responsibility.

United States Textured Vegetable Protein Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Channel

- 1.1.3. Supermarkets and Hypermarkets

- 1.1.4. Others

- 1.2. On-Trade

-

1.1. Off-Trade

United States Textured Vegetable Protein Market Segmentation By Geography

- 1. United States

United States Textured Vegetable Protein Market Regional Market Share

Geographic Coverage of United States Textured Vegetable Protein Market

United States Textured Vegetable Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Rising health-conscious consumers across the country drive demand for TVP through various distribution channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Textured Vegetable Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Channel

- 5.1.1.3. Supermarkets and Hypermarkets

- 5.1.1.4. Others

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NOW Health Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CHS Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGT Food & Ingredients Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dixie Foods

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MGP Ingredients Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Flavors & Fragrances Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bunge Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wholesome Provisions Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bob’s Red Mill Natural Foods

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cargill Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Associated British Foods PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Univar Solutions Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 The Scoular Company

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Axiom Foods Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Roquette Freres

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 NOW Health Group Inc

List of Figures

- Figure 1: United States Textured Vegetable Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Textured Vegetable Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United States Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: United States Textured Vegetable Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: United States Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Textured Vegetable Protein Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Textured Vegetable Protein Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the United States Textured Vegetable Protein Market?

Key companies in the market include NOW Health Group Inc, CHS Inc, AGT Food & Ingredients Inc, Dixie Foods, MGP Ingredients Inc, International Flavors & Fragrances Inc, Ingredion Inc, Bunge Limited, Wholesome Provisions Inc, Bob’s Red Mill Natural Foods, Cargill Inc, Associated British Foods PLC, Univar Solutions Inc, The Scoular Company, Axiom Foods Inc, Roquette Freres.

3. What are the main segments of the United States Textured Vegetable Protein Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1617.5 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Rising health-conscious consumers across the country drive demand for TVP through various distribution channels.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

May 2023: Bunge Limited formed a strategic alliance with Nutrien Ag Solutions, the retail division of Nutrien Ltd., to support U.S. farmers in the implementation of sustainable farming practices in order to increase production of low carbon products.December 2022: Ingredion Inc., has partnered with the InnovoPro to distribute chickpea protein concentrate in the US and Canada. The chickpea protein offers neutral color and flavor profile as well as emulsification properties that provide a creamy texture making it ideal for a broad range of applications, including dairy and meat alternatives, bakery goods and beverages.September 2022: Equinom and AGT Foods announced a collaboration to co-create Minimally processed functional ingredients produced from new varieties of yellow peas. To meet the growing global demand for better plant-based foods, they need more innovative, sustainably-produced ingredients that deliver food functionality and fulfill the demand from both consumers and food companies for high-quality,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Textured Vegetable Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Textured Vegetable Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Textured Vegetable Protein Market?

To stay informed about further developments, trends, and reports in the United States Textured Vegetable Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence