Key Insights

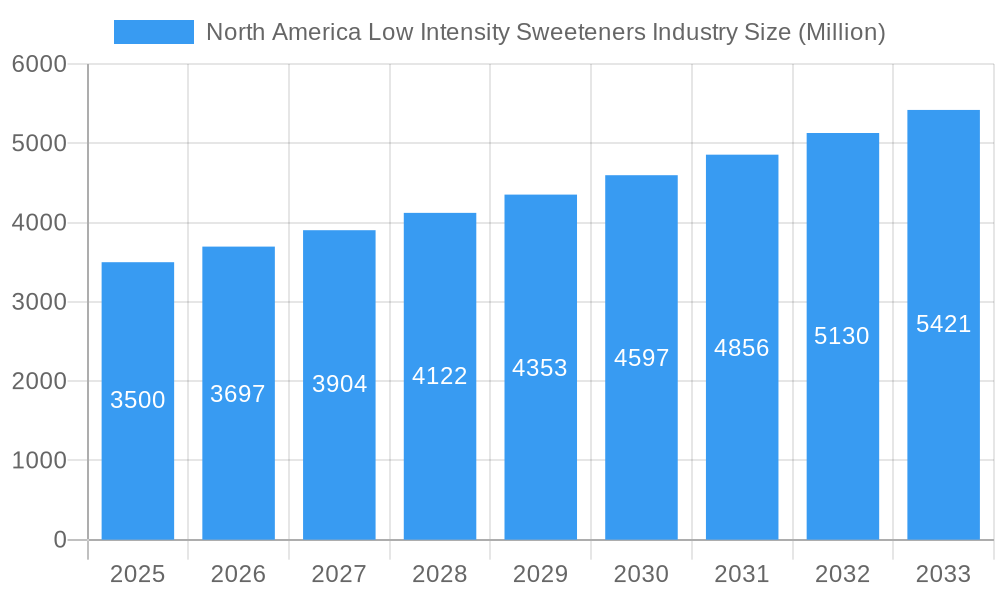

The North American low-intensity sweeteners market is poised for robust growth, projected to reach approximately $3,500 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.62% through 2033. This expansion is primarily driven by an escalating consumer demand for healthier food and beverage options, a direct response to rising global health consciousness and the pervasive concerns surrounding obesity and diabetes. The shift away from high-intensity caloric sweeteners towards low-intensity alternatives is a significant trend, fueled by a growing preference for natural ingredients. This has consequently boosted the demand for natural sweeteners like Stevia, which are increasingly being adopted across various food and beverage applications, including dairy and frozen foods, confectionery, and bakery products. The pharmaceutical sector also presents a growing application, leveraging low-intensity sweeteners for palatability in medicines.

North America Low Intensity Sweeteners Industry Market Size (In Billion)

Despite the strong growth trajectory, certain restraints may temper the market's pace. Fluctuations in the price and availability of raw materials, particularly for natural sweeteners, can impact production costs. Furthermore, stringent regulatory landscapes in some North American regions regarding sweetener approvals and labeling can create hurdles for market penetration and expansion. However, ongoing innovation in sweetener technology and product development, coupled with strategic collaborations among key players such as Cargill Incorporated, Archer Daniels Midland Company, and Tate & Lyle PLC, are expected to mitigate these challenges. The diverse range of applications, from mainstream food and beverages to niche pharmaceutical uses, underscores the market's resilience and its potential for sustained growth across the United States, Canada, and Mexico, with the Rest of North America also contributing significantly.

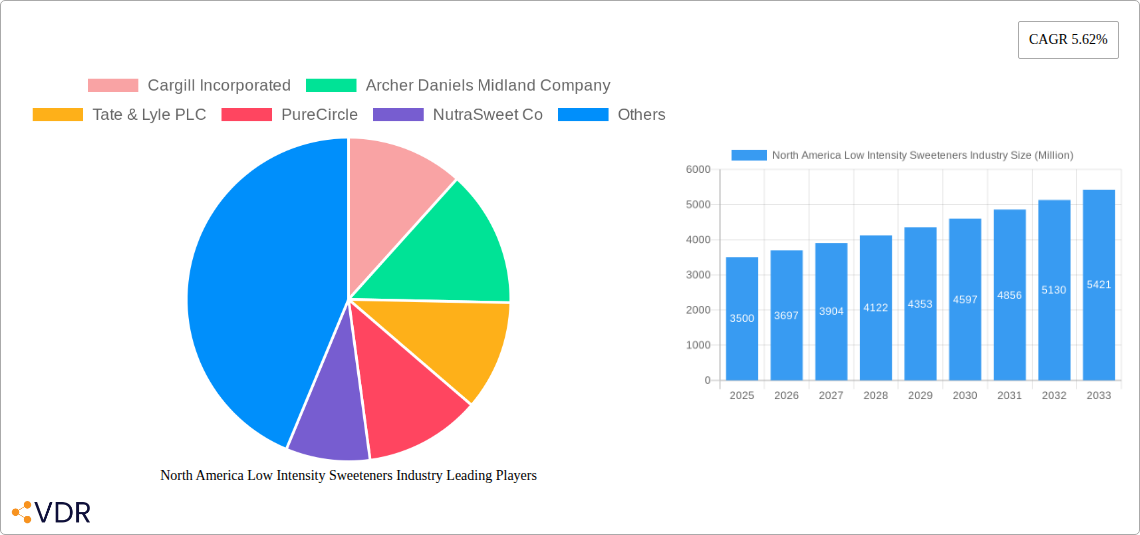

North America Low Intensity Sweeteners Industry Company Market Share

North America Low Intensity Sweeteners Industry Report: Market Analysis, Growth Drivers, and Future Outlook

This comprehensive report delves into the North America Low Intensity Sweeteners Industry, offering an in-depth analysis of market dynamics, growth trends, and future projections. With a study period spanning 2019–2033, this report leverages extensive research to provide actionable insights for stakeholders. The market is segmented by source (Natural, Synthetic), type (Sucralose, Saccharin, Aspartame, Neotame, Advantam, Acesulfame Potassium, Stevia, Others), and application (Food: Dairy and Frozen Foods, Confectionery, Bakery, Others; Beverage, Pharmaceuticals). Key geographies covered include the United States, Canada, Mexico, and the Rest of North America. All values are presented in Million units.

North America Low Intensity Sweeteners Industry Market Dynamics & Structure

The North America low intensity sweeteners market exhibits a moderate to high concentration, with key players such as Cargill Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, PureCircle, NutraSweet Co, Ingredion Incorporated, Ajinomoto Health & Nutrition North America Inc, and Koninklijke DSM N V significantly influencing market direction. Technological innovation remains a primary driver, particularly in enhancing taste profiles, stability, and cost-effectiveness of both natural and synthetic sweeteners. Regulatory frameworks, including approvals and labeling requirements by agencies like the FDA, play a crucial role in market access and product development. Competitive product substitutes, such as other low-calorie sweeteners and sugar itself, exert constant pressure, demanding continuous innovation and value proposition refinement. End-user demographics, driven by increasing health consciousness and a desire for sugar reduction, are shaping demand across various applications. Mergers and acquisitions (M&A) are a significant aspect of market dynamics, with strategic buyouts aimed at expanding product portfolios, gaining market share, and integrating supply chains. For instance, Cargill's acquisition of Steviva Ingredients underscores the trend of consolidating expertise in high-growth natural sweetener segments like stevia.

- Market Concentration: Dominated by a few major players, but with opportunities for specialized niche providers.

- Technological Innovation: Focus on improving sensory experience, cost efficiency, and natural origin.

- Regulatory Landscape: Stringent approval processes and labeling laws influence product development and market entry.

- Competitive Landscape: Intense rivalry from existing sweeteners and the ongoing debate around sugar consumption.

- End-User Demographics: Growing demand from health-conscious consumers and the food & beverage industry seeking sugar alternatives.

- M&A Trends: Strategic acquisitions to enhance product portfolios and expand market reach, e.g., 1 Cargill acquires Steviva Ingredients, a leading producer of stevia sweeteners.

North America Low Intensity Sweeteners Industry Growth Trends & Insights

The North America low intensity sweeteners industry is poised for robust growth, fueled by an escalating consumer demand for healthier food and beverage options. Market size is projected to expand significantly throughout the forecast period, driven by increasing awareness of the health risks associated with high sugar intake, such as obesity and diabetes. Adoption rates for low intensity sweeteners are steadily rising across a diverse range of applications, including Food (Dairy and Frozen Foods, Confectionery, Bakery, Others) and Beverage sectors, where sugar reduction is a key product development imperative. Technological disruptions, such as advancements in the extraction and purification of natural sweeteners like stevia and monk fruit, are making these options more appealing and cost-effective. Furthermore, evolving consumer behavior towards a preference for natural ingredients and clean labels is accelerating the adoption of plant-derived sweeteners over synthetic alternatives. The CAGR for the North America Low Intensity Sweeteners Industry is estimated at XX% between 2025 and 2033. Market penetration is expected to deepen, particularly in the processed food and beverage segments, as manufacturers increasingly reformulate their products to meet consumer demand for reduced sugar content. The United States is anticipated to remain the dominant market, owing to its large consumer base and proactive stance on public health initiatives. The Synthetic segment, while facing increasing scrutiny, continues to hold a significant market share due to its cost-effectiveness and established presence. However, the Natural segment, spearheaded by stevia and its derivatives, is witnessing accelerated growth, driven by consumer preference and product innovation. The Beverage application segment is expected to continue its lead, followed closely by Food applications, particularly in Confectionery and Bakery, where the taste profile of sweeteners is crucial. The overall trend indicates a shift towards sweeteners offering a balance of sweetness, cost, stability, and a perceived natural origin.

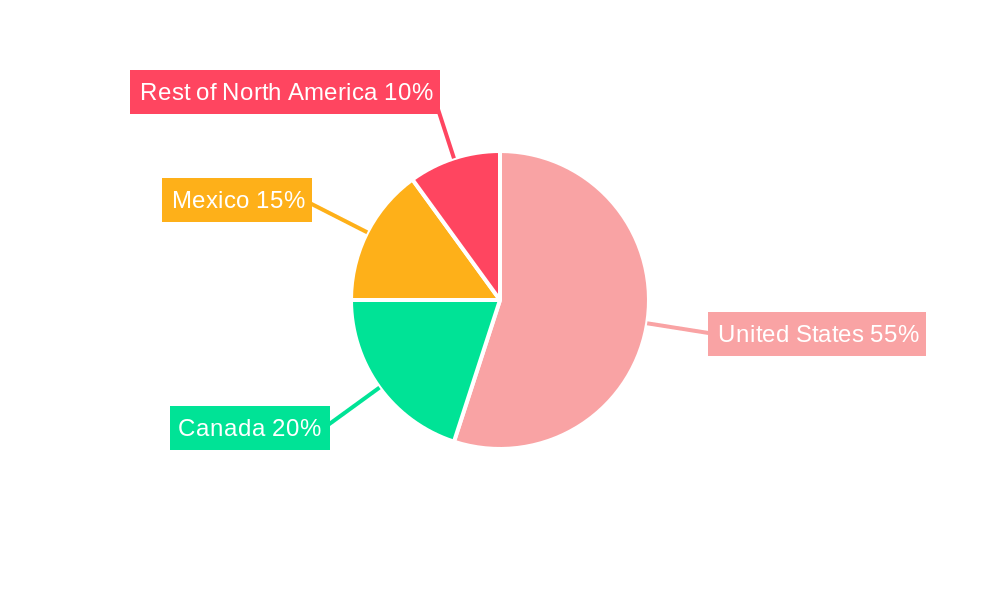

Dominant Regions, Countries, or Segments in North America Low Intensity Sweeteners Industry

The United States stands out as the dominant region in the North America Low Intensity Sweeteners Industry, commanding a substantial market share due to its large and health-conscious consumer base, advanced food and beverage manufacturing sector, and strong regulatory environment that supports product innovation and consumer choice. The country’s robust economy and high disposable income further contribute to the demand for premium and health-oriented products, including those sweetened with low intensity sweeteners. The Natural segment is witnessing particularly strong growth within the United States, driven by increasing consumer demand for plant-based and "clean label" ingredients. Within the Natural segment, Stevia is a leading type, owing to its high sweetness intensity, zero-calorie profile, and favorable perception among consumers seeking sugar alternatives. The Beverage application segment in the United States is the largest, encompassing a wide array of soft drinks, juices, and functional beverages that are actively reformulating to reduce sugar content. The Food application segment, particularly Confectionery and Bakery, also represents a significant market for low intensity sweeteners as manufacturers cater to the growing demand for reduced-sugar treats.

- Dominant Country: United States, driven by a large, health-conscious population and strong food & beverage industry.

- Leading Segment (Source): Natural sweeteners, fueled by consumer preference for plant-based and clean label ingredients.

- Leading Segment (Type): Stevia, due to its high intensity sweetness, zero-calorie profile, and positive consumer perception.

- Leading Segment (Application): Beverage, followed by Food (Confectionery and Bakery), as manufacturers prioritize sugar reduction.

- Growth Drivers in the US: Public health initiatives, R&D investments in sweetener technology, and a high adoption rate of sugar-free products.

- Market Share: The United States accounts for approximately XX% of the North America Low Intensity Sweeteners market.

- Growth Potential: Significant untapped potential remains in specific food categories and emerging beverage types.

North America Low Intensity Sweeteners Industry Product Landscape

The North America low intensity sweeteners market is characterized by continuous product innovation aimed at replicating the taste and mouthfeel of sugar while offering significant calorie reduction. Key advancements include improved purification techniques for natural sweeteners like stevia and monk fruit, leading to cleaner taste profiles and reduced off-notes. The development of blended sweetener systems, combining different low intensity sweeteners, is also a significant trend, allowing for optimized sweetness profiles and enhanced stability in various food and beverage matrices. Furthermore, the introduction of novel sweeteners like Advantam and advancements in the formulation of existing ones like Aspartame are addressing specific application needs, such as heat stability and flavor synergy. The performance metrics being optimized include sweetness intensity, aftertaste, solubility, and compatibility with other food ingredients, directly impacting their utility in products ranging from diet sodas and sugar-free confectionery to baked goods and pharmaceutical formulations.

Key Drivers, Barriers & Challenges in North America Low Intensity Sweeteners Industry

Key Drivers:

- Growing Health and Wellness Consciousness: Consumers are increasingly seeking sugar alternatives to manage weight, blood sugar levels, and overall health.

- Rising Obesity and Diabetes Rates: Public health concerns are prompting individuals and manufacturers to reduce sugar consumption.

- Demand for Sugar Reduction in Food and Beverages: Regulatory initiatives and consumer preferences are pushing the industry towards lower-sugar products.

- Technological Advancements in Natural Sweeteners: Improved extraction and purification of stevia and monk fruit are enhancing their appeal and cost-effectiveness.

- Product Reformulation by Food and Beverage Manufacturers: Companies are actively reformulating products to meet consumer demand for reduced sugar.

Barriers & Challenges:

- Perceived Health Concerns of Some Synthetic Sweeteners: Negative publicity and ongoing scientific debates surrounding certain synthetic sweeteners can dampen consumer acceptance.

- Cost Competitiveness with Sugar: While improving, some advanced low intensity sweeteners can still be more expensive than traditional sugar.

- Taste and Mouthfeel Challenges: Replicating the complex taste and mouthfeel of sugar remains an ongoing area of research and development.

- Regulatory Hurdles and Labeling Requirements: Navigating diverse and evolving regulatory landscapes across different countries can be complex.

- Supply Chain Volatility for Natural Sweetener Ingredients: Dependence on agricultural sources can lead to price fluctuations and supply inconsistencies.

- Consumer Education and Misinformation: The spread of misinformation about sweeteners can create consumer confusion and impact adoption rates.

Emerging Opportunities in North America Low Intensity Sweeteners Industry

Emerging opportunities in the North America low intensity sweeteners industry lie in the expanding market for plant-based and clean-label ingredients. The increasing consumer interest in functional foods and beverages presents a significant avenue, with low intensity sweeteners playing a role in calorie reduction without compromising taste. The development of novel sweeteners with improved sensory profiles and functionality for specific applications, such as high-heat baking or dairy products, offers untapped potential. Furthermore, exploring opportunities in niche markets like pharmaceuticals, where sugar reduction is critical for specific patient populations, and the growing pet food industry, presents promising growth avenues. The demand for ingredient transparency and sustainability is also creating opportunities for manufacturers that can offer ethically sourced and environmentally friendly sweetener solutions.

Growth Accelerators in the North America Low Intensity Sweeteners Industry Industry

The long-term growth of the North America low intensity sweeteners industry is being significantly accelerated by ongoing technological breakthroughs in sweetener production, particularly in enhancing the purity and taste of natural sweeteners. Strategic partnerships between ingredient suppliers and major food and beverage manufacturers are crucial, facilitating wider product integration and consumer exposure. Market expansion strategies, including the development of new product formulations and penetration into emerging application areas, are further bolstering growth. The continuous push for product innovation, driven by both scientific research and evolving consumer preferences, ensures a dynamic and expanding market.

Key Players Shaping the North America Low Intensity Sweeteners Industry Market

Cargill Incorporated Archer Daniels Midland Company Tate & Lyle PLC PureCircle NutraSweet Co Ingredion Incorporated Ajinomoto Health & Nutrition North America Inc Koninklijke DSM N V

Notable Milestones in North America Low Intensity Sweeteners Industry Sector

- 20XX: Cargill acquires Steviva Ingredients, a leading producer of stevia sweeteners.

- 20XX: Tate & Lyle launches a new line of low-calorie sweeteners, including allulose and erythritol.

- 20XX: NutraSweet Co introduces a new aspartame-based sweetener with improved flavor and stability.

In-Depth North America Low Intensity Sweeteners Industry Market Outlook

The future outlook for the North America Low Intensity Sweeteners Industry is highly promising, driven by persistent consumer demand for healthier alternatives to sugar. Growth accelerators include continued investment in R&D for natural sweeteners, leading to improved taste and cost profiles, and strategic collaborations between ingredient developers and major food and beverage brands. Expanding into underserved application segments and addressing evolving consumer preferences for clean labels and ingredient transparency will be key. The industry is well-positioned for sustained growth, with strategic opportunities for market leaders and innovative new entrants alike.

North America Low Intensity Sweeteners Industry Segmentation

-

1. Source

- 1.1. Natural

- 1.2. Synthetic

-

2. Type

- 2.1. Sucralose

- 2.2. Saccharin

- 2.3. Aspartame

- 2.4. Neotame

- 2.5. Advantam

- 2.6. Acesulfame Potassium

- 2.7. Stevia

- 2.8. Others

-

3. Application

-

3.1. Food

- 3.1.1. Dairy and Frozen Foods

- 3.1.2. Confectionery

- 3.1.3. Bakery

- 3.1.4. Others

- 3.2. Beverage

- 3.3. Pharmaceuticals

-

3.1. Food

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Low Intensity Sweeteners Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Low Intensity Sweeteners Industry Regional Market Share

Geographic Coverage of North America Low Intensity Sweeteners Industry

North America Low Intensity Sweeteners Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Aspartame Holds the Prominent Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Low Intensity Sweeteners Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Sucralose

- 5.2.2. Saccharin

- 5.2.3. Aspartame

- 5.2.4. Neotame

- 5.2.5. Advantam

- 5.2.6. Acesulfame Potassium

- 5.2.7. Stevia

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food

- 5.3.1.1. Dairy and Frozen Foods

- 5.3.1.2. Confectionery

- 5.3.1.3. Bakery

- 5.3.1.4. Others

- 5.3.2. Beverage

- 5.3.3. Pharmaceuticals

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. United States North America Low Intensity Sweeteners Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Sucralose

- 6.2.2. Saccharin

- 6.2.3. Aspartame

- 6.2.4. Neotame

- 6.2.5. Advantam

- 6.2.6. Acesulfame Potassium

- 6.2.7. Stevia

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food

- 6.3.1.1. Dairy and Frozen Foods

- 6.3.1.2. Confectionery

- 6.3.1.3. Bakery

- 6.3.1.4. Others

- 6.3.2. Beverage

- 6.3.3. Pharmaceuticals

- 6.3.1. Food

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Canada North America Low Intensity Sweeteners Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Sucralose

- 7.2.2. Saccharin

- 7.2.3. Aspartame

- 7.2.4. Neotame

- 7.2.5. Advantam

- 7.2.6. Acesulfame Potassium

- 7.2.7. Stevia

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food

- 7.3.1.1. Dairy and Frozen Foods

- 7.3.1.2. Confectionery

- 7.3.1.3. Bakery

- 7.3.1.4. Others

- 7.3.2. Beverage

- 7.3.3. Pharmaceuticals

- 7.3.1. Food

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Mexico North America Low Intensity Sweeteners Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Sucralose

- 8.2.2. Saccharin

- 8.2.3. Aspartame

- 8.2.4. Neotame

- 8.2.5. Advantam

- 8.2.6. Acesulfame Potassium

- 8.2.7. Stevia

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food

- 8.3.1.1. Dairy and Frozen Foods

- 8.3.1.2. Confectionery

- 8.3.1.3. Bakery

- 8.3.1.4. Others

- 8.3.2. Beverage

- 8.3.3. Pharmaceuticals

- 8.3.1. Food

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Rest of North America North America Low Intensity Sweeteners Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Sucralose

- 9.2.2. Saccharin

- 9.2.3. Aspartame

- 9.2.4. Neotame

- 9.2.5. Advantam

- 9.2.6. Acesulfame Potassium

- 9.2.7. Stevia

- 9.2.8. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food

- 9.3.1.1. Dairy and Frozen Foods

- 9.3.1.2. Confectionery

- 9.3.1.3. Bakery

- 9.3.1.4. Others

- 9.3.2. Beverage

- 9.3.3. Pharmaceuticals

- 9.3.1. Food

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Archer Daniels Midland Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tate & Lyle PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PureCircle

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NutraSweet Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ingredion Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ajinomoto Health & Nutrition North America Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Koninklijke DSM N V *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: North America Low Intensity Sweeteners Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Low Intensity Sweeteners Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 2: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 7: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 12: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 17: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Source 2020 & 2033

- Table 22: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: North America Low Intensity Sweeteners Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Low Intensity Sweeteners Industry?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the North America Low Intensity Sweeteners Industry?

Key companies in the market include Cargill Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, PureCircle, NutraSweet Co, Ingredion Incorporated, Ajinomoto Health & Nutrition North America Inc, Koninklijke DSM N V *List Not Exhaustive.

3. What are the main segments of the North America Low Intensity Sweeteners Industry?

The market segments include Source, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Aspartame Holds the Prominent Share of the Market.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Cargill acquires Steviva Ingredients, a leading producer of stevia sweeteners. 2. Tate & Lyle launches a new line of low-calorie sweeteners, including allulose and erythritol. 3. NutraSweet Co introduces a new aspartame-based sweetener with improved flavor and stability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Low Intensity Sweeteners Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Low Intensity Sweeteners Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Low Intensity Sweeteners Industry?

To stay informed about further developments, trends, and reports in the North America Low Intensity Sweeteners Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence