Key Insights

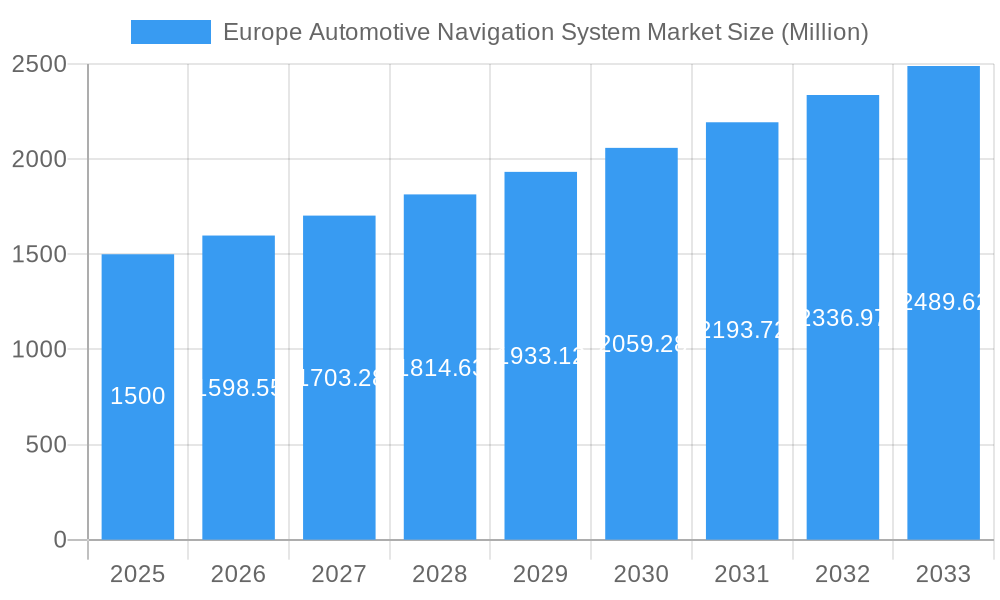

The European automotive navigation system market is projected to reach $11.4 million by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.89% from a 2025 base year. This expansion is propelled by the increasing integration of advanced driver-assistance systems (ADAS) and connected car technologies. Consumer demand for enhanced in-vehicle infotainment and seamless navigation features, including real-time traffic updates and voice control, further drives market growth. The market is segmented by vehicle type (passenger cars, commercial vehicles), technology (aftermarket, factory-fitted, PNDs, smartphones/tablets), and sales channel (OEM, aftermarket). While passenger cars currently lead, the commercial vehicle segment is expected to expand significantly, fueled by fleet management solutions. Key markets include Germany, France, and the UK, with emerging opportunities across the region.

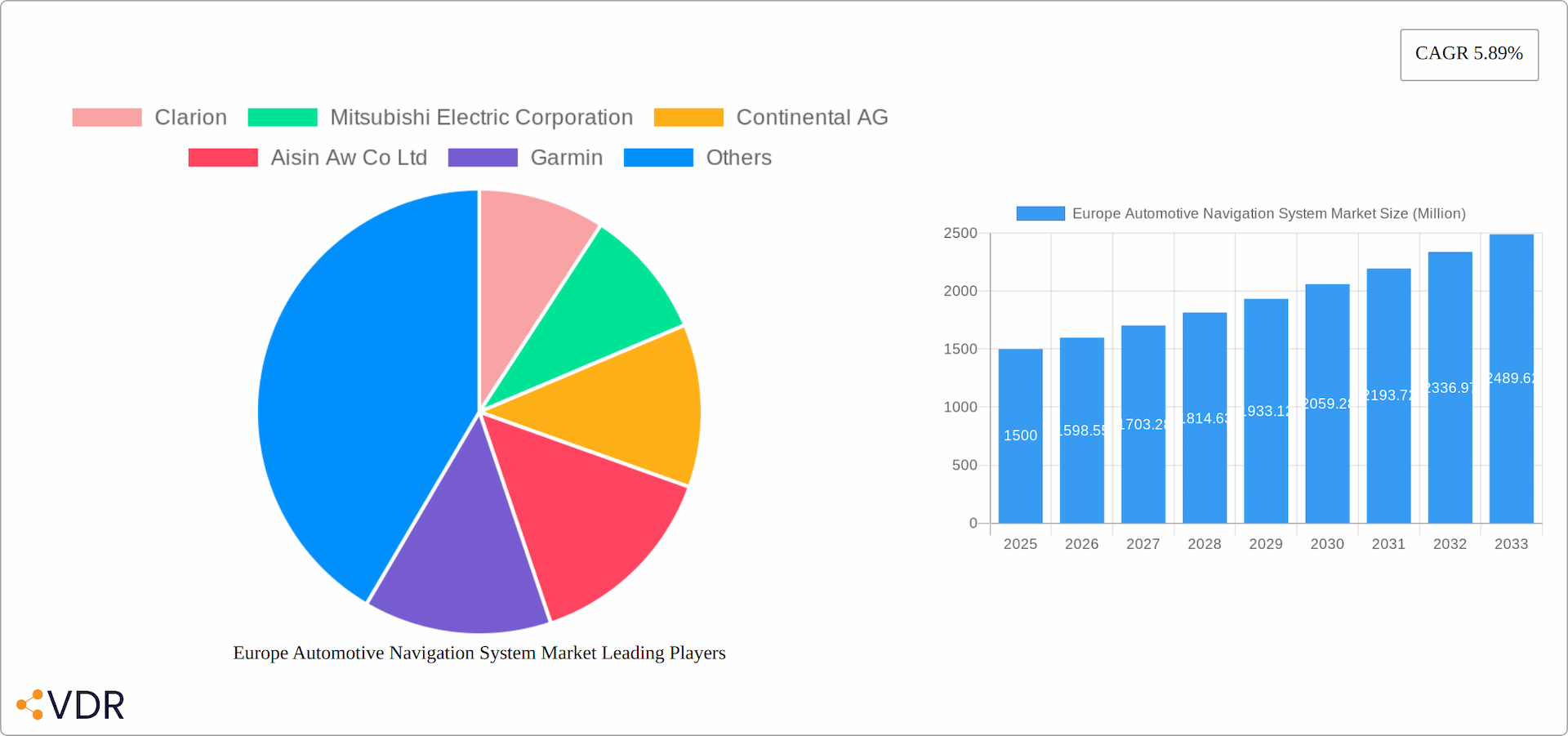

Europe Automotive Navigation System Market Market Size (In Million)

Despite competition from smartphone-based navigation, technological advancements and consumer demand for superior driving experiences sustain a positive market outlook. The integration of navigation into electric vehicle (EV) systems, offering optimized charging routes, presents a substantial growth avenue. Innovations in augmented reality (AR) navigation and machine learning for predictive routing are expected to further enhance user experience and stimulate market expansion. Intense competition among major players like Clarion, Continental AG, and Garmin fosters innovation and accessibility.

Europe Automotive Navigation System Market Company Market Share

Europe Automotive Navigation System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Automotive Navigation System market, covering the period 2019-2033. It delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities within the broader automotive technology sector. This report is crucial for automotive manufacturers, technology providers, investors, and market analysts seeking to understand and capitalize on the evolving landscape of in-vehicle navigation. The report segments the market by Vehicle Type (Passenger Car, Commercial Vehicle), Technology Type (Aftermarket IVS, Factory-fitted IVS, Personal Navigation Devices (PNDs), Smartphones/Tablets), and Sales Channel Type (OEM, Aftermarket). The market is valued in Million Units.

Europe Automotive Navigation System Market Dynamics & Structure

The European automotive navigation system market is characterized by a moderately concentrated landscape with key players like Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin AW Co Ltd, Garmin, Denso Corporation, Pioneer, and Alpine Electronics vying for market share. Technological innovation, particularly in areas like cloud-based navigation, AI-powered route optimization, and augmented reality overlays, is a key driver. Stringent regulatory frameworks concerning data privacy and safety standards significantly influence market dynamics. The rise of smartphone navigation presents a competitive substitute, although integrated in-vehicle systems continue to dominate. The market is largely driven by the demand from the passenger car segment, influenced by consumer preference for advanced features and technological integration within premium vehicles. Recent M&A activity, while not extensive, indicates consolidation among technology providers seeking to enhance their offerings and expand their market reach. Estimated M&A deal volume for the period 2019-2024 was xx Million units.

- Market Concentration: Moderate, with key players holding significant but not dominant shares. xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on cloud-based solutions, AI, and augmented reality features. Barriers to innovation include high R&D costs and integration complexities.

- Regulatory Framework: Strict data privacy regulations (GDPR) and safety standards impacting product development and deployment.

- Competitive Substitutes: Smartphone navigation applications pose a significant challenge to dedicated in-vehicle systems.

- End-User Demographics: Strong demand from premium passenger car segments, growing interest in commercial vehicle navigation solutions.

- M&A Trends: Limited but increasing consolidation among technology providers in recent years.

Europe Automotive Navigation System Market Growth Trends & Insights

The European automotive navigation system market experienced steady growth during the historical period (2019-2024), driven by increasing vehicle production and consumer preference for advanced in-car features. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx%. This growth is expected to continue, albeit at a moderated pace, during the forecast period (2025-2033). Technological advancements such as the integration of real-time traffic updates, improved mapping accuracy, and voice-activated control systems have fueled adoption rates. However, the increasing penetration of smartphone navigation presents a challenge, leading to a shift in consumer behavior towards more integrated and user-friendly in-vehicle systems. The market penetration rate for factory-fitted IVS systems in 2024 was estimated at xx%, projected to increase to xx% by 2033. The predicted CAGR for the forecast period (2025-2033) is xx%. The market is expected to reach xx Million units by 2033.

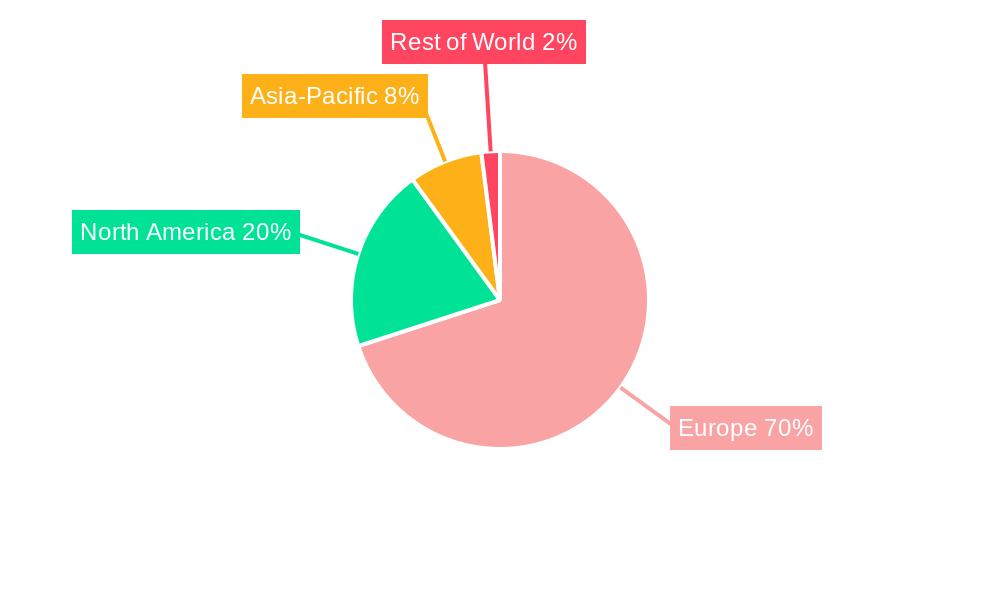

Dominant Regions, Countries, or Segments in Europe Automotive Navigation System Market

The European automotive navigation system market is prominently led by Western European nations, with Germany, France, and the United Kingdom standing out as key contributors. This regional dominance is underpinned by consistently high vehicle ownership rates, the presence of sophisticated transportation infrastructure, and a strong propensity among consumers to embrace technological advancements. Within the market segments, the passenger car sector commands the largest share. This is largely attributable to the increasing consumer preference for seamlessly integrated navigation systems as a standard feature in newly purchased vehicles. Furthermore, factory-fitted Integrated Vehicle Systems (IVS) hold a more substantial market presence than their aftermarket counterparts. This is a direct result of enhanced integration capabilities offered by OEMs and the establishment of robust partnerships between vehicle manufacturers and navigation system developers.

- Key Drivers for Regional Dominance: High vehicle ownership in Western Europe, a culture of strong technological adoption, and a well-developed, modern infrastructure for transportation.

- Germany's Leading Position: The German market is the largest due to its powerful automotive industry and persistent high demand for cutting-edge vehicle features.

- France & UK: Significant Markets: These nations represent substantial markets with high adoption rates for navigation systems, although their growth trajectories may be slightly more measured compared to Germany.

- Passenger Car Segment: The Largest Shareholder: This segment leads due to the growing trend of manufacturers incorporating sophisticated, integrated navigation systems as a desirable feature in new passenger vehicles.

- Factory-fitted IVS: The Dominant Approach: This segment's leadership is driven by superior integration with vehicle electronics and strong, established partnerships with original equipment manufacturers (OEMs).

Europe Automotive Navigation System Market Product Landscape

The automotive navigation system market offers a range of products, from basic GPS navigation systems to sophisticated, cloud-connected solutions with advanced features. These include real-time traffic updates, voice control, augmented reality overlays, and integration with other in-vehicle systems. Key innovations focus on improved mapping accuracy, personalized route suggestions based on user preferences, and enhanced safety features like lane departure warnings and hazard alerts. Unique selling propositions are centered on ease of use, seamless integration, precise navigation, and access to real-time information. Technological advancements are driven by increased processing power, improved sensor technology, and the use of advanced algorithms.

Key Drivers, Barriers & Challenges in Europe Automotive Navigation System Market

Key Drivers Fueling Market Expansion:

- The escalating demand for sophisticated Advanced Driver-Assistance Systems (ADAS), which often integrate navigation functionalities.

- The accelerating adoption of connected car technologies, enabling real-time data exchange and enhanced navigation services.

- The impact of stringent government regulations and safety initiatives that advocate for improved road safety and guidance systems.

- The significant growth of the electric vehicle (EV) market, necessitating specialized navigation solutions for optimal range management and efficient charging station planning.

Key Challenges & Restraints Hindering Growth:

- The considerable initial investment required for the development and implementation of advanced navigation systems.

- The persistent and competitive threat posed by free or low-cost smartphone-based navigation applications.

- Growing consumer and regulatory concerns regarding data privacy and the security of personal navigation data.

- The volatility and potential for disruptions within global supply chains, which can impact the availability and cost of essential electronic components required for navigation systems. These disruptions have historically led to significant production slowdowns, such as an estimated xx% decrease in production observed in Q3 2022.

Emerging Opportunities in Europe Automotive Navigation System Market

- Expansion into the commercial vehicle segment, focusing on specialized navigation solutions for fleet management and logistics.

- Development of augmented reality-based navigation systems providing enhanced visual guidance.

- Increased integration with other in-vehicle systems, creating a more holistic user experience.

- Exploring subscription-based navigation services offering ongoing access to map updates and advanced features.

Growth Accelerators in the Europe Automotive Navigation System Market Industry

The sustained long-term growth trajectory of the European automotive navigation system market is propelled by a confluence of strategic initiatives and technological advancements. Collaborative efforts and strategic alliances between prominent automotive manufacturers and leading technology providers are instrumental in fostering innovation, accelerating product development cycles, and driving down the overall cost of advanced navigation solutions. Furthermore, the widespread adoption of next-generation technologies such as 5G connectivity is a significant catalyst, enabling the delivery of more sophisticated and accurate navigation functionalities. This includes hyper-accurate real-time traffic data, dynamic re-routing capabilities, and enhanced point-of-interest information. Concurrently, the burgeoning market for electric vehicles presents a fertile ground for the development and deployment of specialized navigation systems. These systems are increasingly optimized to address unique EV requirements, such as intelligent range prediction, identification and availability of charging infrastructure, and route planning that considers charging stops.

Key Players Shaping the Europe Automotive Navigation System Market Market

- Clarion

- Mitsubishi Electric Corporation

- Continental AG

- Aisin AW Co Ltd

- Garmin

- Denso Corporation

- Pioneer

- Alpine Electronics

Notable Milestones in Europe Automotive Navigation System Market Sector

- October 2022: Lotus and ECARX partnered with HERE Technologies for integrated navigation in the Lotus ELETRE, featuring over-the-air updates.

- September 2022: Renault launched the Austral with an OpenR screen integrating navigation and Google services.

- August 2022: BMW Group partnered with Linde Material Handling for autonomous navigation technology using SLAM.

In-Depth Europe Automotive Navigation System Market Outlook

The future of the European automotive navigation system market appears promising. Continued technological advancements, strategic partnerships, and the expansion into new segments, particularly commercial vehicles, are poised to drive substantial growth. The increasing integration of navigation systems with other in-vehicle functionalities, creating a more connected and personalized driving experience, presents significant opportunities. The market is expected to experience a sustained period of growth, driven by consumer demand for advanced features and enhanced safety. This growth will, however, be moderated by the continued competitive pressure from smartphone-based navigation applications. The focus will be on delivering highly integrated, user-friendly, and data-secure systems that cater to the evolving needs of consumers and the automotive industry.

Europe Automotive Navigation System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Technology Type

- 2.1. Aftermarket IVS

- 2.2. Factory fitted IVS

- 2.3. Personal navigation device (PND's)

- 2.4. Smartphones/Tablets

-

3. Sales Channel Type

- 3.1. OEM

- 3.2. Aftermarket

Europe Automotive Navigation System Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Europe Automotive Navigation System Market Regional Market Share

Geographic Coverage of Europe Automotive Navigation System Market

Europe Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Online Channel

- 3.3. Market Restrains

- 3.3.1. Increasing Traffic Problems And Reliability Issues

- 3.4. Market Trends

- 3.4.1. E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Aftermarket IVS

- 5.2.2. Factory fitted IVS

- 5.2.3. Personal navigation device (PND's)

- 5.2.4. Smartphones/Tablets

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clarion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Electric Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aisin Aw Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Garmin

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Denso Corporatio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pioneer

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alpine Electronics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Clarion

List of Figures

- Figure 1: Europe Automotive Navigation System Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Europe Automotive Navigation System Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 7: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Europe Automotive Navigation System Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Navigation System Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Europe Automotive Navigation System Market?

Key companies in the market include Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin Aw Co Ltd, Garmin, Denso Corporatio, Pioneer, Alpine Electronics.

3. What are the main segments of the Europe Automotive Navigation System Market?

The market segments include Vehicle Type, Technology Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Online Channel.

6. What are the notable trends driving market growth?

E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking.

7. Are there any restraints impacting market growth?

Increasing Traffic Problems And Reliability Issues.

8. Can you provide examples of recent developments in the market?

October 2022: Lotus and ECARX have chosen HERE Technologies to provide integrated navigation services for the recently launched Lotus ELETRE, the automaker's first pure electric hyper-SUV. The Lotus ELETRE's navigation experience can be updated over the air using HERE navigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence