Key Insights

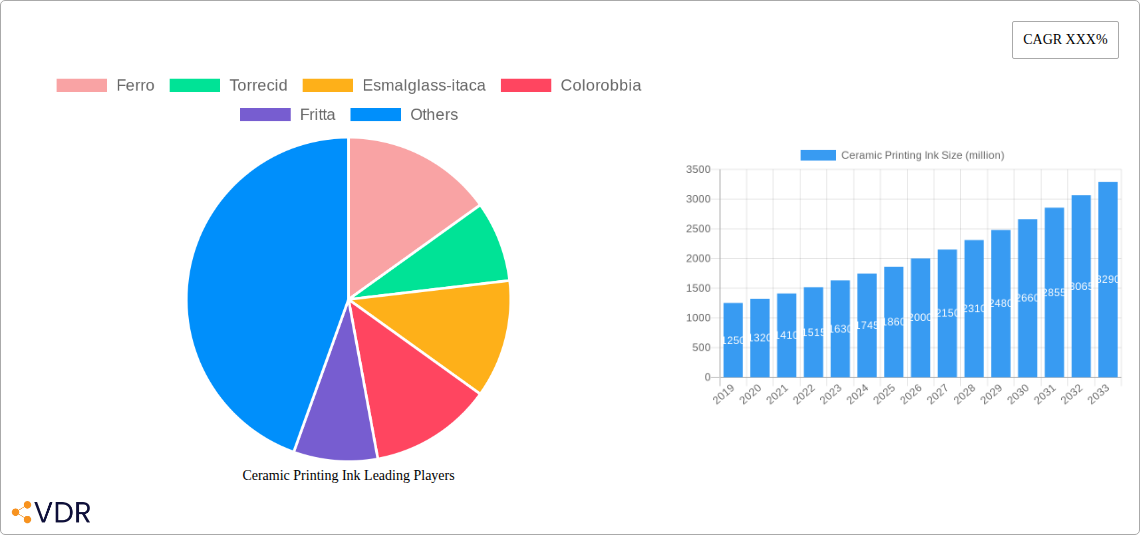

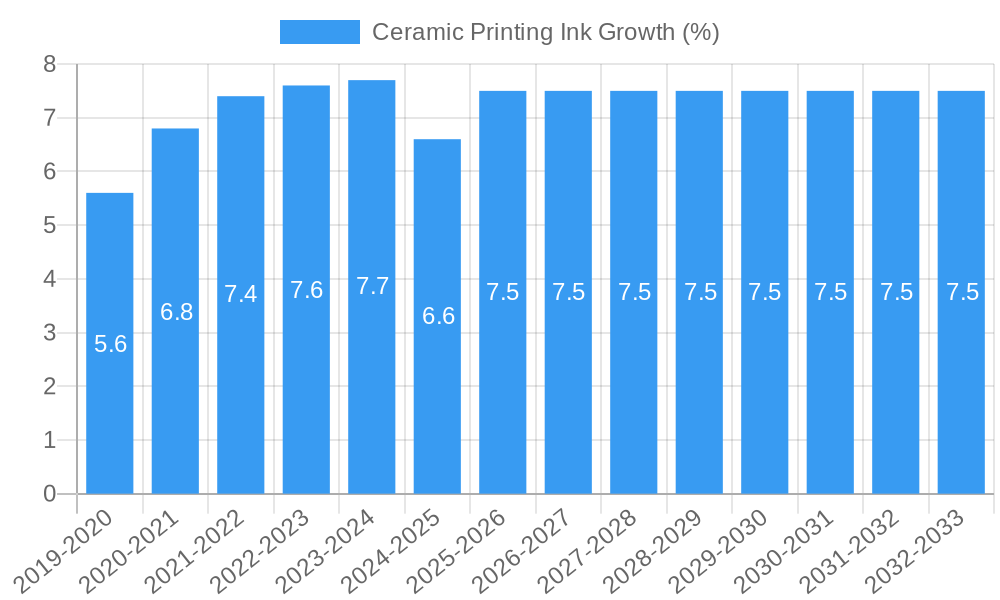

The global ceramic printing ink market is poised for significant expansion, projected to reach a substantial market size of approximately $1.8 billion by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by the escalating demand for aesthetically pleasing and durable ceramic tiles in both residential and commercial construction sectors. Advancements in digital printing technology have revolutionized the ceramic industry, enabling intricate designs, realistic textures, and personalized finishes that were previously unattainable. Functional inks, offering enhanced properties such as anti-bacterial, anti-slip, and self-cleaning capabilities, are emerging as a key growth driver, catering to the increasing consumer preference for value-added products. The "Other" application segment, encompassing sanitaryware, tableware, and decorative items, also presents considerable opportunities for market penetration.

The market's dynamism is further shaped by a series of influential trends and a few restraining factors. The burgeoning construction industry worldwide, coupled with a rising disposable income leading to greater spending on home décor and renovations, are strong market accelerators. Furthermore, the focus on sustainable manufacturing practices and the development of eco-friendly ceramic printing inks align with global environmental consciousness, creating a positive market outlook. However, the market faces certain constraints, including the initial high investment costs associated with advanced digital printing equipment and the fluctuating raw material prices. Despite these challenges, the continuous innovation by leading companies such as Ferro, Torrecid, and Esmalglass-itaca, along with strategic expansions into emerging economies, are expected to propel the ceramic printing ink market towards sustained and impressive growth in the coming years.

This comprehensive report provides an unparalleled deep dive into the global Ceramic Printing Ink market. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this analysis is crucial for understanding current dynamics and anticipating future growth. We meticulously examine parent and child market segments, offering granular insights into applications like Floor Tile, Inner Wall Tile, and Other, as well as ink types including Functional Ink and Normal Ink. With a focus on high-traffic SEO keywords and structured for maximum impact, this report is an indispensable resource for manufacturers, suppliers, distributors, and industry stakeholders.

Ceramic Printing Ink Market Dynamics & Structure

The global Ceramic Printing Ink market is characterized by a moderately consolidated structure, with a few key players dominating the landscape. Technological innovation serves as a primary driver, fueled by the continuous demand for enhanced aesthetic appeal, durability, and functional properties in ceramic products. Regulatory frameworks, particularly concerning environmental impact and chemical safety, are increasingly influencing product development and manufacturing processes. Competitive product substitutes, while present in the form of traditional decorative techniques, are largely being overshadowed by the versatility and efficiency of ceramic printing inks. End-user demographics are shifting towards younger, design-conscious consumers and a growing demand for customizable interior and exterior design solutions. Mergers and acquisitions (M&A) are an ongoing trend, with companies seeking to expand their product portfolios, geographical reach, and technological capabilities. For instance, a significant M&A activity in 2023 involved the acquisition of a smaller functional ink specialist by a larger ceramic ink manufacturer, bolstering the latter's innovation in specialized applications.

- Market Concentration: Moderate to High, with top 5 companies holding an estimated 65% market share in 2025.

- Technological Innovation Drivers: Development of inks with higher color gamut, improved scratch resistance, special effects (metallic, glossy), and eco-friendly formulations.

- Regulatory Frameworks: Strict regulations on VOC emissions and heavy metal content are driving demand for sustainable ink solutions.

- Competitive Product Substitutes: Traditional ceramic decoration methods like decal application and manual painting are being displaced by digital printing.

- End-User Demographics: Increasing preference for personalized and aesthetically sophisticated interior and exterior spaces in residential and commercial sectors.

- M&A Trends: Strategic acquisitions focused on gaining access to advanced printing technologies and expanding market presence. In 2023, an estimated 5 significant M&A deals occurred, valued collectively at over $150 million.

Ceramic Printing Ink Growth Trends & Insights

The global Ceramic Printing Ink market is poised for significant expansion, driven by evolving consumer preferences and continuous technological advancements. The market size, valued at approximately $1,800 million in 2025, is projected to witness robust growth throughout the forecast period. This expansion is underpinned by increasing adoption rates across various ceramic applications, particularly in the flooring and wall tile segments. The advent of advanced digital printing technologies has revolutionized ceramic decoration, enabling intricate designs, faster production cycles, and reduced waste. Consumer behavior shifts are also playing a crucial role, with a growing demand for personalized interior designs that mimic natural materials like wood and stone, a trend perfectly catered to by high-resolution ceramic printing inks. Furthermore, the development of functional inks, offering properties such as antimicrobial surfaces, anti-slip textures, and enhanced durability, is opening up new avenues for market penetration and value creation. The CAGR is estimated to be around 6.5% from 2025 to 2033. Market penetration in emerging economies is expected to accelerate as construction activities surge and aesthetic standards rise. The increasing application of ceramic printing inks in non-tile applications, such as sanitaryware and tableware, further contributes to this positive growth trajectory. The ability to achieve photorealistic textures and complex color gradients digitally is a key disruptor, displacing older, less efficient methods. The market penetration for digital ceramic printing is estimated to reach 85% of the total ceramic decoration market by 2033. The adoption of functional inks is anticipated to grow at a CAGR of 8.2%, significantly outpacing the growth of normal inks.

Dominant Regions, Countries, or Segments in Ceramic Printing Ink

The Floor Tile segment is the most dominant force within the global Ceramic Printing Ink market, accounting for an estimated 55% of the total market share in 2025. This dominance is driven by several key factors. The sheer volume of production for floor tiles, coupled with the continuous demand for aesthetically diverse and durable flooring solutions in both residential and commercial construction, positions this segment at the forefront. Economic policies in rapidly developing regions, such as those promoting infrastructure development and urban expansion, directly correlate with increased demand for construction materials, including floor tiles. Furthermore, significant investment in construction and renovation projects globally, particularly in Asia Pacific and emerging economies, fuels the need for high-quality and visually appealing floor coverings.

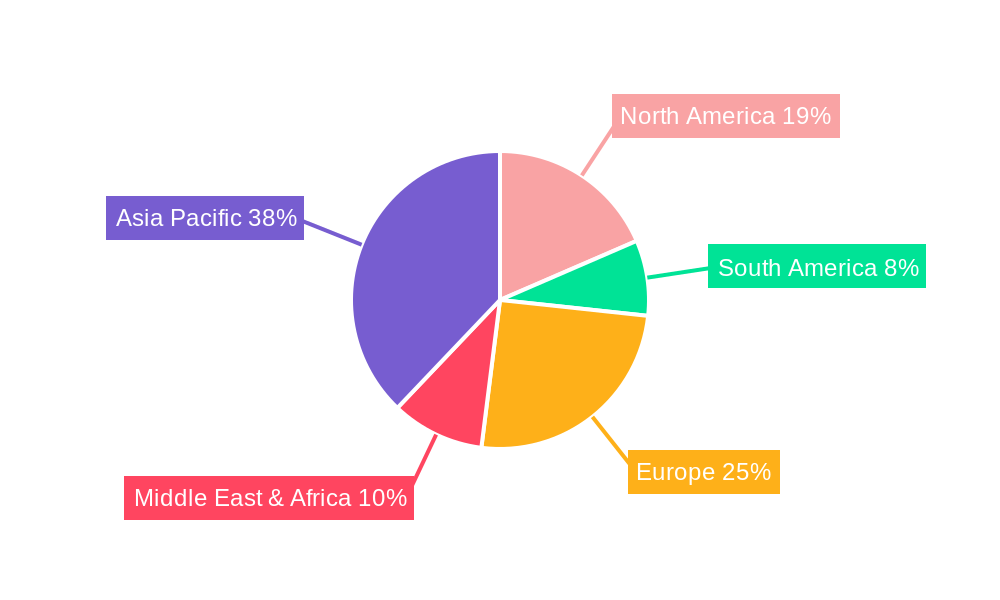

Within the broader market, Asia Pacific stands out as the dominant region, projected to hold over 45% of the global Ceramic Printing Ink market share by 2025. This dominance is attributable to the region's status as a major hub for ceramic production and consumption. China, in particular, plays a pivotal role, representing a substantial portion of both global ceramic tile manufacturing and demand. Favorable economic policies, including government support for manufacturing and export, along with a burgeoning middle class driving demand for improved living standards and interior aesthetics, are key drivers. Robust infrastructure development projects and a high volume of residential and commercial construction further amplify the demand for ceramic printing inks in countries like India, Vietnam, and Indonesia. The competitive pricing of manufacturing in this region also contributes to its market leadership.

- Dominant Segment: Floor Tile Application

- Key Drivers: High production volumes, consumer demand for aesthetic variety and durability, growth in residential and commercial construction.

- Market Share: Estimated 55% of the total market in 2025.

- Growth Potential: Continues to be a primary driver due to ongoing renovation and new construction projects.

- Dominant Region: Asia Pacific

- Key Drivers: Leading ceramic production and consumption hub, favorable economic policies, burgeoning middle class, extensive infrastructure development.

- Market Share: Estimated 45% of the global market in 2025.

- Growth Potential: Significant growth anticipated due to ongoing urbanization and rising disposable incomes.

- Key Countries: China, India, Vietnam, Indonesia.

- Dominant Ink Type: Normal Ink (though Functional Ink is showing accelerated growth)

- Drivers: Established demand for decorative applications, cost-effectiveness for standard designs.

- Growth Potential: While mature, it remains the largest segment. Functional inks are the key growth area.

Ceramic Printing Ink Product Landscape

The Ceramic Printing Ink product landscape is characterized by a rapid evolution driven by innovation in color, effect, and functionality. Manufacturers are consistently introducing inks with enhanced color vibrancy, wider gamut, and improved lightfastness, enabling the replication of complex designs and natural material textures with unprecedented realism. Special effect inks, such as metallic, iridescent, and matte finishes, are gaining prominence, allowing for unique aesthetic customization. Furthermore, the development of functional inks is a significant trend, incorporating properties like antimicrobial protection, enhanced scratch and abrasion resistance, and even self-cleaning capabilities. These advancements cater to the growing demand for not only visually appealing but also more durable and hygienic ceramic surfaces. The unique selling proposition lies in the ability to achieve bespoke designs and performance characteristics that were previously unattainable, bridging the gap between artistic vision and manufacturing reality.

Key Drivers, Barriers & Challenges in Ceramic Printing Ink

Key Drivers: The primary forces propelling the Ceramic Printing Ink market are technological advancements in digital printing machinery and ink formulations, leading to higher quality prints and faster production speeds. The growing consumer demand for personalized and aesthetically diverse ceramic products, driven by interior design trends, is a significant catalyst. Furthermore, the increasing adoption of ceramic tiles in various applications beyond traditional flooring and walls, such as facade cladding and furniture, expands market opportunities. Environmental regulations promoting eco-friendly ink solutions are also driving innovation and market growth.

Key Barriers & Challenges: Supply chain disruptions and the volatility of raw material prices, particularly for pigments and binders, pose significant challenges, impacting production costs and availability. Stringent environmental regulations, while a driver for innovation, can also increase compliance costs for manufacturers. The initial investment required for digital printing equipment can be a barrier for smaller ceramic producers, especially in emerging economies. Intense competition among ink manufacturers, leading to price pressures, is another considerable restraint. The threat of counterfeiting and the need for consistent quality control across different batches further add to the complexity of market operations. The global supply chain for key raw materials is estimated to have faced disruptions impacting production by approximately 10% in 2022.

Emerging Opportunities in Ceramic Printing Ink

Emerging opportunities in the Ceramic Printing Ink market are abundant, particularly in the realm of functional inks and untapped geographical markets. The development of bio-based and sustainable ink formulations is a significant trend, aligning with growing environmental consciousness among consumers and businesses. Innovative applications such as printing directly onto large-format porcelain slabs for countertops and furniture are creating new market segments. Furthermore, the increasing demand for digitally printed ceramics in the sanitaryware and tableware sectors, offering unique designs and personalized branding, presents substantial growth potential. Exploring emerging economies in Africa and Latin America, where ceramic consumption is rising, offers significant untapped market opportunities for both established and new players. The potential for smart ceramic functionalities, such as integrated heating or lighting, through specialized inks, remains a frontier for innovation.

Growth Accelerators in the Ceramic Printing Ink Industry

The Ceramic Printing Ink industry is experiencing significant growth acceleration driven by several key factors. Technological breakthroughs in inkjet printing heads and specialized ink formulations are enabling finer detail, richer colors, and faster printing speeds, directly impacting production efficiency and product quality. Strategic partnerships between ink manufacturers and ceramic tile producers are fostering collaborative innovation, leading to the development of tailored solutions for specific market needs and aesthetic trends. Market expansion strategies, including targeting new applications beyond traditional tiles and penetrating emerging economies with growing construction sectors, are further fueling growth. The ongoing trend towards digitalization across all manufacturing sectors also encourages the adoption of advanced printing technologies in the ceramics industry.

Key Players Shaping the Ceramic Printing Ink Market

- Ferro

- Torrecid

- Esmalglass-itaca

- Colorobbia

- Fritta

- Xennia

- Dip-tech

- Zschimmer-schwarz

- Dowstone

- CREATE-TIDE

- Minst

- Mris

- Huilong

- Santao

- Seqian

Notable Milestones in Ceramic Printing Ink Sector

- 2019: Introduction of a new range of high-opacity white inks, enhancing color vibrancy on darker ceramic substrates.

- 2020: Significant advancements in eco-friendly ink formulations with reduced VOC content, aligning with stricter environmental regulations.

- 2021: Launch of a new generation of functional inks offering enhanced antimicrobial properties for sanitaryware applications.

- 2022: Increased M&A activity as larger players acquire specialized ink technology companies to expand their functional ink portfolios.

- 2023: Development of advanced digital printing technologies capable of replicating the tactile feel of natural materials like wood and stone with unprecedented realism.

- 2024: Growing trend towards the use of ceramic printing inks in non-tile applications, such as facade cladding and furniture surfaces.

In-Depth Ceramic Printing Ink Market Outlook

- 2019: Introduction of a new range of high-opacity white inks, enhancing color vibrancy on darker ceramic substrates.

- 2020: Significant advancements in eco-friendly ink formulations with reduced VOC content, aligning with stricter environmental regulations.

- 2021: Launch of a new generation of functional inks offering enhanced antimicrobial properties for sanitaryware applications.

- 2022: Increased M&A activity as larger players acquire specialized ink technology companies to expand their functional ink portfolios.

- 2023: Development of advanced digital printing technologies capable of replicating the tactile feel of natural materials like wood and stone with unprecedented realism.

- 2024: Growing trend towards the use of ceramic printing inks in non-tile applications, such as facade cladding and furniture surfaces.

In-Depth Ceramic Printing Ink Market Outlook

The future market outlook for Ceramic Printing Ink is exceptionally promising, driven by sustained innovation and expanding application horizons. Growth accelerators, including the continuous evolution of digital printing technology and the escalating consumer demand for personalized and aesthetically sophisticated ceramic products, will continue to shape the market. The increasing focus on functional inks, offering added value through properties like enhanced durability and hygiene, presents a significant avenue for future growth and market differentiation. Strategic investments in research and development, coupled with expansion into untapped geographical markets and novel applications, will be crucial for stakeholders to capitalize on the burgeoning opportunities. The industry is well-positioned for continued expansion and value creation in the coming years.

Ceramic Printing Ink Segmentation

-

1. Application

- 1.1. Floor Tile

- 1.2. Inner Wall Tile

- 1.3. Other

-

2. Type

- 2.1. Functional Ink

- 2.2. Normal Ink

Ceramic Printing Ink Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ceramic Printing Ink REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Floor Tile

- 5.1.2. Inner Wall Tile

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Functional Ink

- 5.2.2. Normal Ink

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Floor Tile

- 6.1.2. Inner Wall Tile

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Functional Ink

- 6.2.2. Normal Ink

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Floor Tile

- 7.1.2. Inner Wall Tile

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Functional Ink

- 7.2.2. Normal Ink

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Floor Tile

- 8.1.2. Inner Wall Tile

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Functional Ink

- 8.2.2. Normal Ink

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Floor Tile

- 9.1.2. Inner Wall Tile

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Functional Ink

- 9.2.2. Normal Ink

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ceramic Printing Ink Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Floor Tile

- 10.1.2. Inner Wall Tile

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Functional Ink

- 10.2.2. Normal Ink

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ferro

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Torrecid

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Esmalglass-itaca

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Colorobbia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fritta

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Xennia

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dip-tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zschimmer-schwarz

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dowstone

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CREATE-TIDE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Minst

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mris

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huilong

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Santao

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Seqian

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ferro

List of Figures

- Figure 1: Global Ceramic Printing Ink Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ceramic Printing Ink Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ceramic Printing Ink Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ceramic Printing Ink Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ceramic Printing Ink Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ceramic Printing Ink Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ceramic Printing Ink Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ceramic Printing Ink Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ceramic Printing Ink Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ceramic Printing Ink Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ceramic Printing Ink Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ceramic Printing Ink Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ceramic Printing Ink Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ceramic Printing Ink Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ceramic Printing Ink Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ceramic Printing Ink Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ceramic Printing Ink Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ceramic Printing Ink Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ceramic Printing Ink Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ceramic Printing Ink Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ceramic Printing Ink Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ceramic Printing Ink Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ceramic Printing Ink Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ceramic Printing Ink Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ceramic Printing Ink Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ceramic Printing Ink Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ceramic Printing Ink Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ceramic Printing Ink Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ceramic Printing Ink Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ceramic Printing Ink Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ceramic Printing Ink Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ceramic Printing Ink Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ceramic Printing Ink Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ceramic Printing Ink Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ceramic Printing Ink Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ceramic Printing Ink Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ceramic Printing Ink Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ceramic Printing Ink Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ceramic Printing Ink Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ceramic Printing Ink Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ceramic Printing Ink Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Printing Ink?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Ceramic Printing Ink?

Key companies in the market include Ferro, Torrecid, Esmalglass-itaca, Colorobbia, Fritta, Xennia, Dip-tech, Zschimmer-schwarz, Dowstone, CREATE-TIDE, Minst, Mris, Huilong, Santao, Seqian.

3. What are the main segments of the Ceramic Printing Ink?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ceramic Printing Ink," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ceramic Printing Ink report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ceramic Printing Ink?

To stay informed about further developments, trends, and reports in the Ceramic Printing Ink, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence