Key Insights

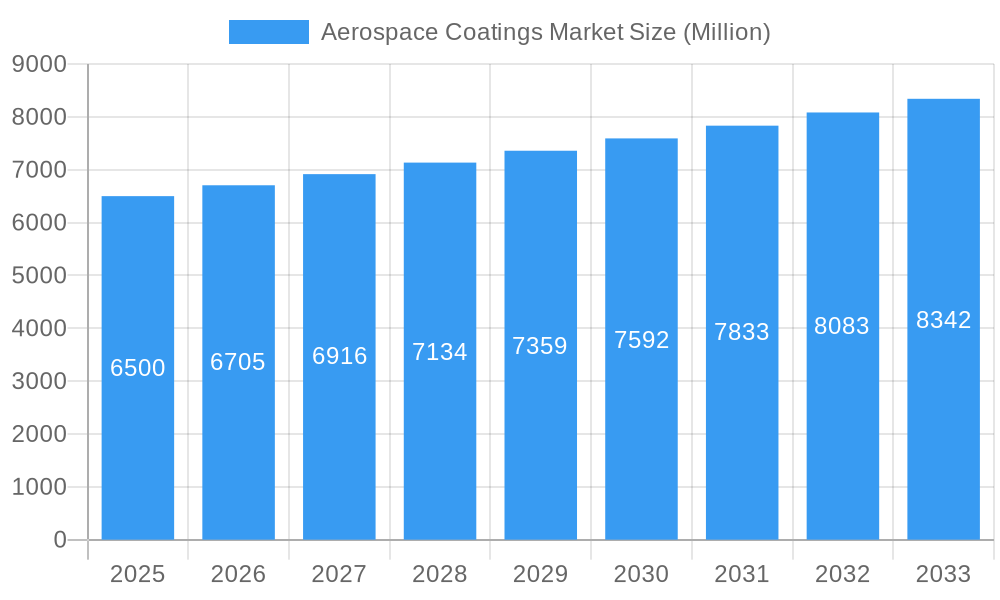

The global Aerospace Coatings Market is projected for robust expansion, with a current market size estimated at approximately USD 6,500 million and anticipated to grow at a Compound Annual Growth Rate (CAGR) exceeding 3.00% throughout the forecast period of 2025-2033. This sustained growth is fueled by an increasing demand for lighter, more durable, and environmentally compliant coatings across commercial, military, and general aviation sectors. Key drivers include the rising global air travel, necessitating fleet expansions and ongoing maintenance, repair, and operations (MRO) activities. Furthermore, advancements in coating technologies, such as the growing adoption of waterborne and advanced composite materials, are contributing to improved fuel efficiency and reduced environmental impact, aligning with stringent regulatory standards. The market's value is further bolstered by the increasing complexity of aircraft designs and the critical need for protective coatings against harsh environmental conditions, corrosion, and wear.

Aerospace Coatings Market Market Size (In Billion)

The market landscape is characterized by a dynamic interplay of technological innovation and evolving end-user requirements. Epoxy, acrylic, and polyurethane resins dominate the market, with continuous research and development focused on enhancing their performance characteristics, including UV resistance, chemical inertness, and adhesion. The shift towards waterborne technologies is a significant trend, driven by environmental regulations that aim to reduce Volatile Organic Compound (VOC) emissions. While solvent-borne coatings still hold a considerable share due to their established performance, their market share is expected to gradually decline. The competitive environment features prominent players like The Sherwin-Williams Company, PPG Industries Inc., and Akzo Nobel N.V., who are actively investing in R&D and strategic collaborations to maintain their market positions. Challenges such as the high cost of specialized aerospace coatings and the stringent certification processes for new products remain influential factors shaping market dynamics.

Aerospace Coatings Market Company Market Share

This in-depth report provides a definitive analysis of the global aerospace coatings market, covering 2019 to 2033. We offer critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and strategic initiatives shaping the industry. With a base year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand the evolving aviation coatings market, including its parent and child markets, and to capitalize on emerging opportunities. Our analysis incorporates high-traffic keywords such as aerospace coatings, aviation paint, aircraft coatings, OEM coatings, MRO coatings, epoxy coatings, polyurethane coatings, and waterborne aerospace coatings to ensure maximum SEO visibility. All values are presented in millions of units.

Aerospace Coatings Market Dynamics & Structure

The aerospace coatings market is characterized by a moderate market concentration, with a few key players holding significant shares. Technological innovation remains a primary driver, fueled by the demand for enhanced performance, reduced environmental impact, and improved application efficiency. Regulatory frameworks, particularly those related to VOC emissions and material safety, significantly influence product development and adoption. The industry is also shaped by the availability of competitive product substitutes, such as advanced polymer films, which necessitate continuous innovation in traditional coating technologies. End-user demographics, primarily Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) providers in commercial, military, and general aviation, dictate market demand patterns. Mergers and acquisitions (M&A) activity, while not excessively high, plays a role in consolidating market presence and expanding technological capabilities. Barriers to innovation include stringent certification processes, high R&D costs, and the need for extensive testing to meet aerospace standards.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized niche players.

- Technological Innovation: Focus on lightweight, durable, corrosion-resistant, and sustainable coatings.

- Regulatory Influence: Stringent environmental regulations (e.g., REACH, EPA) driving the shift towards low-VOC and waterborne technologies.

- Competitive Substitutes: Development of advanced materials and alternative surface treatments.

- End-User Demographics: Strong demand from commercial aviation for aesthetic and protective coatings, and from military aviation for specialized, high-performance solutions.

- M&A Trends: Strategic acquisitions to broaden product portfolios and geographic reach.

- Innovation Barriers: Lengthy qualification processes, high capital investment, and supply chain complexities.

Aerospace Coatings Market Growth Trends & Insights

The global aerospace coatings market is projected to experience robust growth, driven by increasing aircraft production, a growing fleet size, and the continuous need for aircraft maintenance and refurbishment. The market size evolution is closely tied to the health of the global aviation industry. In 2025, the market is estimated to reach approximately $7,500 Million, with a projected Compound Annual Growth Rate (CAGR) of around 5.8% during the forecast period of 2025–2033. This growth is underpinned by technological disruptions such as the development of self-healing coatings, anti-icing solutions, and environmentally friendly formulations. Consumer behavior shifts, particularly from airlines, are leaning towards coatings that offer long-term cost savings through reduced maintenance, fuel efficiency, and enhanced aesthetic appeal for passenger experience.

Adoption rates for advanced coating technologies, especially waterborne aerospace coatings, are steadily increasing due to their lower VOC emissions, aligning with global environmental mandates. The MRO segment is a significant contributor to market growth, as older aircraft require regular refinishing and protective treatments. Furthermore, the expansion of commercial aviation in emerging economies, coupled with increasing defense budgets in key regions, will fuel the demand for both OEM and MRO coatings. The polyurethane aerospace coatings segment, known for its durability and chemical resistance, is expected to witness steady expansion. The epoxy resin type continues to be a cornerstone for its excellent adhesion and corrosion protection.

The integration of digital technologies in application processes and performance monitoring is another trend influencing market dynamics. The demand for coatings that provide superior UV resistance, thermal stability, and chemical inertness in extreme aerospace environments remains paramount. The overall market penetration of specialized aerospace coatings is expected to deepen as aircraft manufacturers and airlines prioritize performance, safety, and sustainability.

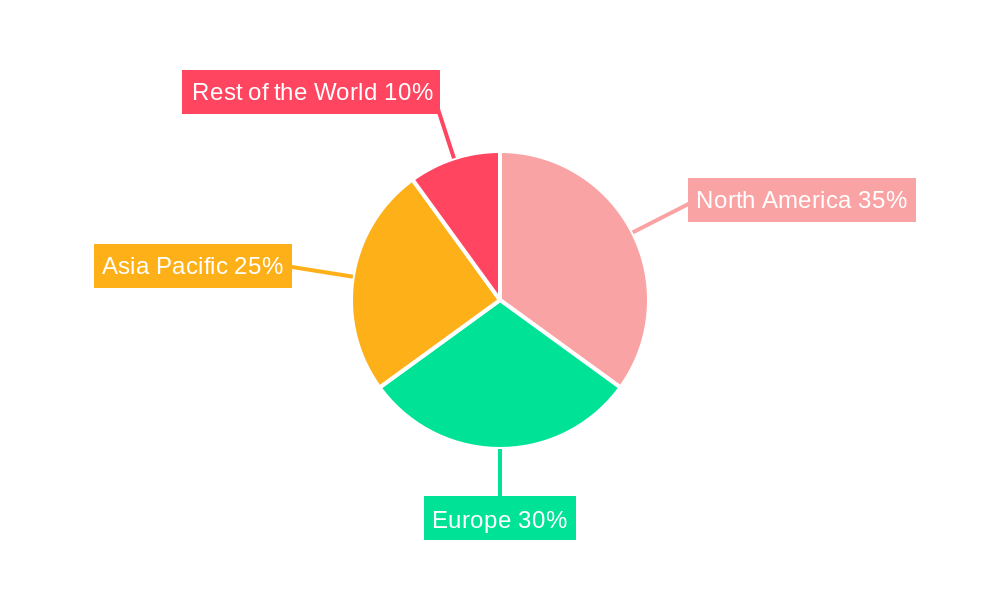

Dominant Regions, Countries, or Segments in Aerospace Coatings Market

The aerospace coatings market exhibits significant regional variations in growth and dominance, with North America and Europe currently leading the charge.

North America holds a substantial market share due to the presence of major aircraft manufacturers like Boeing and a robust commercial aviation sector. The region's strong emphasis on technological innovation, coupled with a mature MRO infrastructure, fuels the demand for advanced aerospace coatings. Government investments in defense also contribute to the sustained demand for specialized military-grade coatings.

Europe is another key region, driven by leading aircraft manufacturers such as Airbus and a significant aftermarket services sector. Stringent environmental regulations in Europe have accelerated the adoption of waterborne aerospace coatings and other eco-friendly solutions. The region's focus on sustainability and advanced manufacturing processes positions it for continued growth in high-performance coatings.

Analyzing the segments:

- Resin Type: Epoxy coatings continue to dominate due to their exceptional adhesion, chemical resistance, and corrosion protection properties, making them indispensable for primary aircraft structures. Polyurethane coatings are also a significant segment, valued for their flexibility, UV resistance, and aesthetic appeal, crucial for exterior finishes. The "Other Resin Types" category, encompassing specialized formulations, is expected to grow as new material science advancements emerge.

- Technology: While solvent-borne technologies still hold a considerable market share, waterborne aerospace coatings are experiencing rapid growth. This shift is primarily driven by increasingly stringent environmental regulations regarding Volatile Organic Compounds (VOCs). The development of high-performance waterborne systems is key to their expanding adoption.

- End User: The Original Equipment Manufacturer (OEM) segment represents a substantial portion of the market, driven by new aircraft production. However, the Maintenance Repair and Operations (MRO) segment is experiencing robust growth as the global aircraft fleet ages, requiring regular refinishing, repair, and protective treatments.

- Aviation Type: Commercial Aviation is the largest driver of the aerospace coatings market, owing to the sheer volume of aircraft in operation and the continuous demand for repainting and aesthetic customization. Military Aviation contributes significantly with its demand for highly specialized, performance-driven coatings designed for extreme conditions and stealth applications. General Aviation also presents a growing market, albeit smaller, with increasing demand for durable and aesthetically pleasing coatings.

Economic policies favoring aerospace manufacturing, infrastructure development supporting aviation hubs, and a skilled workforce are crucial factors contributing to the dominance of these regions and segments. The market share in North America is estimated to be around 35%, with Europe following closely at 30%. The growth potential in Asia Pacific is also noteworthy, driven by expanding airline fleets and increasing manufacturing capabilities.

Aerospace Coatings Market Product Landscape

The aerospace coatings market is defined by a range of sophisticated products designed for extreme performance and durability. Innovations focus on lightweight formulations that reduce fuel consumption, enhanced corrosion resistance for extended airframe life, and superior UV protection to prevent degradation of exterior surfaces. Advanced applications include specialized coatings for engine components requiring high thermal resistance, stealth coatings for military aircraft, and anti-erosion coatings for leading edges. Unique selling propositions often lie in the coatings' ability to meet stringent aerospace certifications, their ease of application, and their long-term cost-effectiveness through reduced maintenance cycles. Technological advancements are increasingly incorporating nanotechnology for enhanced durability and self-cleaning properties, as well as the development of low-VOC and waterborne formulations to meet environmental mandates.

Key Drivers, Barriers & Challenges in Aerospace Coatings Market

Key Drivers:

- Increasing Aircraft Production: Growth in global passenger and cargo demand necessitates the production of new aircraft, directly boosting the demand for OEM coatings.

- Fleet Expansion and Aging: A larger and older global aircraft fleet requires more frequent MRO activities, including refinishing and protective coatings.

- Technological Advancements: Development of high-performance, lightweight, and environmentally friendly coatings drives adoption.

- Stringent Environmental Regulations: Mandates for reduced VOC emissions are pushing manufacturers towards waterborne and low-emission technologies.

- Demand for Enhanced Durability and Performance: Airlines and operators seek coatings that offer superior protection against corrosion, UV radiation, and extreme temperatures.

Key Barriers & Challenges:

- Stringent Certification Processes: Obtaining aerospace certifications is a lengthy, costly, and complex process, acting as a significant barrier to entry and innovation.

- High R&D and Production Costs: Developing and manufacturing aerospace-grade coatings requires substantial investment.

- Supply Chain Volatility: Disruptions in the supply of raw materials and specialized chemicals can impact production and pricing.

- Economic Downturns and Geopolitical Instability: These factors can impact airline profitability and thus their spending on new aircraft and MRO.

- Skilled Labor Shortages: The application of aerospace coatings requires specialized training and expertise, and shortages can impact efficiency.

Emerging Opportunities in Aerospace Coatings Market

Emerging opportunities within the aerospace coatings market lie in the development and adoption of sustainable and smart coating solutions. The increasing focus on reducing the environmental footprint of aviation is driving demand for bio-based coatings, recyclable materials, and coatings that enhance fuel efficiency through aerodynamic improvements. The rise of electric and hybrid-electric aircraft presents new challenges and opportunities for coatings that can manage thermal management and electrical conductivity. Furthermore, the integration of sensors and self-monitoring capabilities within coatings offers the potential for predictive maintenance and enhanced safety. Untapped markets in regions experiencing rapid aviation growth, coupled with innovative applications like advanced anti-microbial coatings for cabin interiors, represent significant growth avenues.

Growth Accelerators in the Aerospace Coatings Market Industry

Several catalysts are accelerating the growth of the aerospace coatings industry. Technological breakthroughs in material science are leading to the creation of coatings with unprecedented durability, self-healing properties, and significantly reduced environmental impact. Strategic partnerships between coating manufacturers and aircraft OEMs are crucial for co-developing innovative solutions and ensuring seamless integration into aircraft production lines. Market expansion strategies, including the penetration of emerging economies and the development of specialized product lines for niche aviation segments like unmanned aerial vehicles (UAVs), are also key growth accelerators. The increasing emphasis on lifecycle cost reduction for airlines, where advanced coatings contribute to lower maintenance and fuel costs, further propels market expansion.

Key Players Shaping the Aerospace Coatings Market Market

- The Sherwin-Williams Company

- IHI Ionbond AG

- BryCoat Inc

- Mankiewicz Gebr & Co

- Hohman Plating

- PPG Industries Inc

- ZIRCOTEC

- BASF SE

- Socomore

- Axalta Coating Systems

- Akzo Nobel N V

- Hentzen Coatings Inc

Notable Milestones in Aerospace Coatings Market Sector

- July 2022: PPG partnered with UK airline brand and design consultancy Aerobrand to provide airline customers with a unique service integrating paint supply with livery design.

- July 2022: Akzo Nobel announced a total of EUR 15 million (USD 17.7 million) investment in the company's aerospace coatings facility in Pamiers, which Mapaero acquired in 2019. Production capacity is expected to be increased by 50%.

In-Depth Aerospace Coatings Market Market Outlook

The aerospace coatings market is poised for significant expansion, driven by a confluence of technological innovation, increasing global air traffic, and a strong commitment to sustainability. Growth accelerators such as the development of advanced, eco-friendly formulations and strategic collaborations between manufacturers and aircraft producers will be instrumental in shaping the future landscape. The increasing demand for coatings that offer superior performance, longevity, and reduced lifecycle costs will continue to fuel market potential. Emerging opportunities in smart coatings and specialized applications for new aviation technologies, such as electric aircraft and UAVs, represent substantial avenues for strategic growth. Stakeholders are encouraged to focus on innovation, regulatory compliance, and market penetration in high-growth regions to capitalize on the dynamic and evolving aerospace coatings market.

Aerospace Coatings Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylic

- 1.3. Polyurethane

- 1.4. Other Resin Types

-

2. Technology

- 2.1. Waterborne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. End User

- 3.1. Original Equipment Manufacturer (OEM)

- 3.2. Maintenance Repair and Operations (MRO)

-

4. Aviation Type

- 4.1. Commercial Aviation

- 4.2. Military Aviation

- 4.3. General Aviation

Aerospace Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. United Kingdom

- 3.4. Italy

- 3.5. Spain

- 3.6. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Aerospace Coatings Market Regional Market Share

Geographic Coverage of Aerospace Coatings Market

Aerospace Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Composites in Aircraft Manufacturing; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Rising Prices of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Aerospace Coatings for Maintenance Repair and Operations (MRO)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylic

- 5.1.3. Polyurethane

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Original Equipment Manufacturer (OEM)

- 5.3.2. Maintenance Repair and Operations (MRO)

- 5.4. Market Analysis, Insights and Forecast - by Aviation Type

- 5.4.1. Commercial Aviation

- 5.4.2. Military Aviation

- 5.4.3. General Aviation

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Acrylic

- 6.1.3. Polyurethane

- 6.1.4. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Waterborne

- 6.2.2. Solvent-borne

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Original Equipment Manufacturer (OEM)

- 6.3.2. Maintenance Repair and Operations (MRO)

- 6.4. Market Analysis, Insights and Forecast - by Aviation Type

- 6.4.1. Commercial Aviation

- 6.4.2. Military Aviation

- 6.4.3. General Aviation

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Acrylic

- 7.1.3. Polyurethane

- 7.1.4. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Waterborne

- 7.2.2. Solvent-borne

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Original Equipment Manufacturer (OEM)

- 7.3.2. Maintenance Repair and Operations (MRO)

- 7.4. Market Analysis, Insights and Forecast - by Aviation Type

- 7.4.1. Commercial Aviation

- 7.4.2. Military Aviation

- 7.4.3. General Aviation

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Acrylic

- 8.1.3. Polyurethane

- 8.1.4. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Waterborne

- 8.2.2. Solvent-borne

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Original Equipment Manufacturer (OEM)

- 8.3.2. Maintenance Repair and Operations (MRO)

- 8.4. Market Analysis, Insights and Forecast - by Aviation Type

- 8.4.1. Commercial Aviation

- 8.4.2. Military Aviation

- 8.4.3. General Aviation

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Rest of the World Aerospace Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Epoxy

- 9.1.2. Acrylic

- 9.1.3. Polyurethane

- 9.1.4. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Waterborne

- 9.2.2. Solvent-borne

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Original Equipment Manufacturer (OEM)

- 9.3.2. Maintenance Repair and Operations (MRO)

- 9.4. Market Analysis, Insights and Forecast - by Aviation Type

- 9.4.1. Commercial Aviation

- 9.4.2. Military Aviation

- 9.4.3. General Aviation

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Sherwin-Williams Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IHI Ionbond AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BryCoat Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mankiewicz Gebr & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hohman Plating

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PPG Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ZIRCOTEC*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BASF SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Socomore

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Axalta Coating Systems

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Akzo Nobel N V

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hentzen Coatings Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: Global Aerospace Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Aerospace Coatings Market Volume Breakdown (Kilo Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 5: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 6: Asia Pacific Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 7: Asia Pacific Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 8: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 9: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Asia Pacific Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 11: Asia Pacific Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 13: Asia Pacific Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Asia Pacific Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Asia Pacific Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 16: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 17: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 18: Asia Pacific Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 19: Asia Pacific Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 21: Asia Pacific Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 23: North America Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 24: North America Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 25: North America Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 26: North America Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 27: North America Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 28: North America Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 29: North America Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: North America Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 31: North America Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 32: North America Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 33: North America Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 34: North America Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 35: North America Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 36: North America Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 37: North America Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 38: North America Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 39: North America Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 40: North America Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 41: North America Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: North America Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Europe Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 44: Europe Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 45: Europe Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 46: Europe Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 47: Europe Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 48: Europe Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 49: Europe Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 50: Europe Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 51: Europe Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Europe Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 53: Europe Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Europe Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Europe Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 56: Europe Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 57: Europe Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 58: Europe Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 59: Europe Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Europe Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 61: Europe Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Europe Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Rest of the World Aerospace Coatings Market Revenue (Million), by Resin Type 2025 & 2033

- Figure 64: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Resin Type 2025 & 2033

- Figure 65: Rest of the World Aerospace Coatings Market Revenue Share (%), by Resin Type 2025 & 2033

- Figure 66: Rest of the World Aerospace Coatings Market Volume Share (%), by Resin Type 2025 & 2033

- Figure 67: Rest of the World Aerospace Coatings Market Revenue (Million), by Technology 2025 & 2033

- Figure 68: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Technology 2025 & 2033

- Figure 69: Rest of the World Aerospace Coatings Market Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Rest of the World Aerospace Coatings Market Volume Share (%), by Technology 2025 & 2033

- Figure 71: Rest of the World Aerospace Coatings Market Revenue (Million), by End User 2025 & 2033

- Figure 72: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by End User 2025 & 2033

- Figure 73: Rest of the World Aerospace Coatings Market Revenue Share (%), by End User 2025 & 2033

- Figure 74: Rest of the World Aerospace Coatings Market Volume Share (%), by End User 2025 & 2033

- Figure 75: Rest of the World Aerospace Coatings Market Revenue (Million), by Aviation Type 2025 & 2033

- Figure 76: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Aviation Type 2025 & 2033

- Figure 77: Rest of the World Aerospace Coatings Market Revenue Share (%), by Aviation Type 2025 & 2033

- Figure 78: Rest of the World Aerospace Coatings Market Volume Share (%), by Aviation Type 2025 & 2033

- Figure 79: Rest of the World Aerospace Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Rest of the World Aerospace Coatings Market Volume (Kilo Tons), by Country 2025 & 2033

- Figure 81: Rest of the World Aerospace Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Rest of the World Aerospace Coatings Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 5: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 7: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 8: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 9: Global Aerospace Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Region 2020 & 2033

- Table 11: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 12: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 13: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 15: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 17: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 18: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 19: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 21: China Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 23: India Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 25: Japan Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 27: South Korea Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 31: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 32: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 33: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 34: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 35: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 36: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 37: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 38: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 39: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 41: United States Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: United States Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 43: Canada Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Canada Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 45: Mexico Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Mexico Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 47: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 48: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 49: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 51: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 53: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 54: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 55: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 57: Germany Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Germany Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 59: France Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: France Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 61: United Kingdom Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: United Kingdom Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 63: Italy Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Italy Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 65: Spain Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Spain Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 67: Rest of Europe Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Europe Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 69: Global Aerospace Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 70: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Resin Type 2020 & 2033

- Table 71: Global Aerospace Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 72: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Technology 2020 & 2033

- Table 73: Global Aerospace Coatings Market Revenue Million Forecast, by End User 2020 & 2033

- Table 74: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by End User 2020 & 2033

- Table 75: Global Aerospace Coatings Market Revenue Million Forecast, by Aviation Type 2020 & 2033

- Table 76: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Aviation Type 2020 & 2033

- Table 77: Global Aerospace Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Aerospace Coatings Market Volume Kilo Tons Forecast, by Country 2020 & 2033

- Table 79: South America Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South America Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

- Table 81: Middle East and Africa Aerospace Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Middle East and Africa Aerospace Coatings Market Volume (Kilo Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Coatings Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Aerospace Coatings Market?

Key companies in the market include The Sherwin-Williams Company, IHI Ionbond AG, BryCoat Inc, Mankiewicz Gebr & Co, Hohman Plating, PPG Industries Inc, ZIRCOTEC*List Not Exhaustive, BASF SE, Socomore, Axalta Coating Systems, Akzo Nobel N V, Hentzen Coatings Inc.

3. What are the main segments of the Aerospace Coatings Market?

The market segments include Resin Type, Technology, End User, Aviation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Composites in Aircraft Manufacturing; Other Drivers.

6. What are the notable trends driving market growth?

Aerospace Coatings for Maintenance Repair and Operations (MRO).

7. Are there any restraints impacting market growth?

Rising Prices of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

July 2022: PPG partnered with UK airline brand and design consultancy Aerobrand to provide airline customers with a unique service integrating paint supply with livery design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Coatings Market?

To stay informed about further developments, trends, and reports in the Aerospace Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence