Key Insights

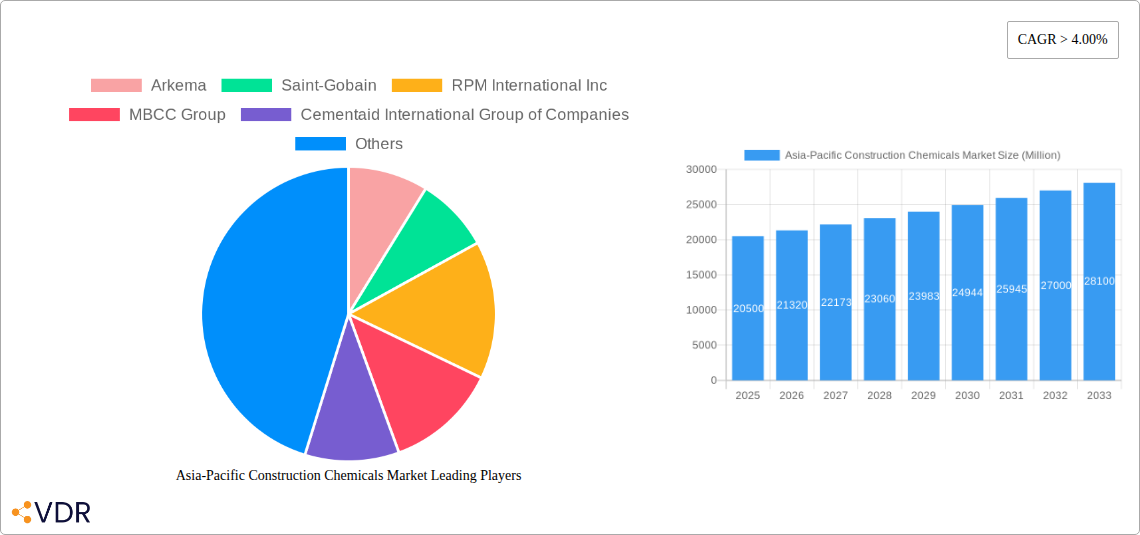

The Asia-Pacific construction chemicals market is poised for robust growth, projected to surpass USD 20,000 million by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 4.00% throughout the forecast period of 2025-2033. This dynamic expansion is primarily fueled by rapid urbanization, significant infrastructure development projects, and increasing investments in residential and commercial construction across key economies like China, India, and Southeast Asian nations. The region's burgeoning population and rising disposable incomes are driving demand for enhanced living spaces and modern commercial facilities, creating substantial opportunities for construction chemical manufacturers. Furthermore, a growing emphasis on sustainable construction practices and the adoption of advanced building materials are also contributing to market vitality, as builders seek solutions that offer durability, energy efficiency, and environmental compliance.

Asia-Pacific Construction Chemicals Market Market Size (In Billion)

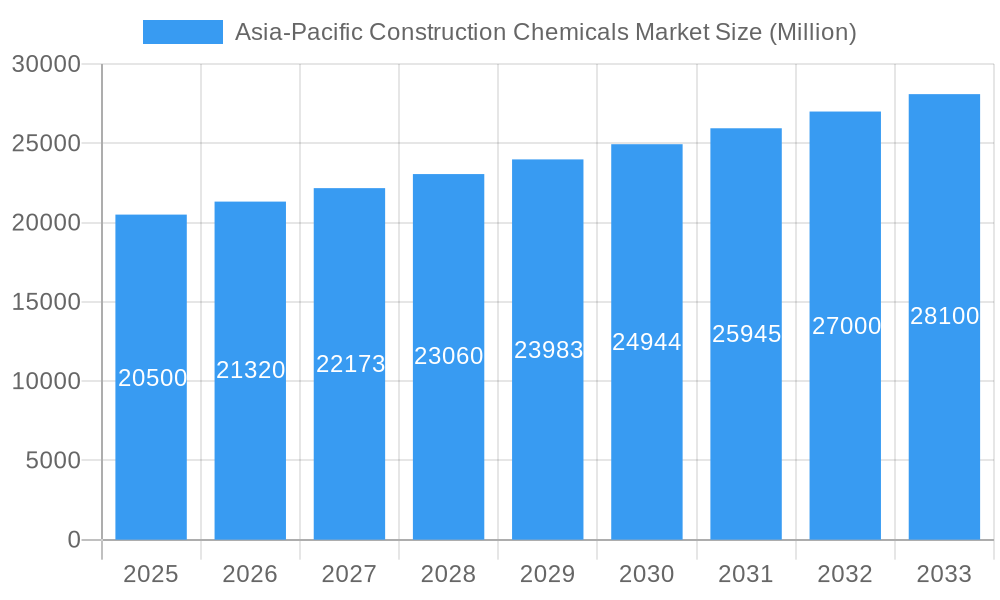

The market is segmented across a wide array of products, including adhesives, anchors and grouts, concrete admixtures, concrete protective coatings, flooring resins, repair and rehabilitation chemicals, sealants, surface treatment chemicals, and waterproofing solutions. Among these, concrete admixtures and waterproofing solutions are expected to witness particularly strong demand, driven by the need to improve concrete performance, enhance structural integrity, and protect buildings from water damage in diverse climatic conditions prevalent across Asia Pacific. Key players such as Arkema, Saint-Gobain, RPM International Inc., MBCC Group, and Sika AG are actively expanding their presence in the region through strategic partnerships, mergers, and acquisitions, further intensifying competition and innovation. The demand for high-performance, eco-friendly construction chemicals is a significant trend, pushing companies to invest in research and development for sustainable product offerings.

Asia-Pacific Construction Chemicals Market Company Market Share

Unlocking Growth: Asia-Pacific Construction Chemicals Market Poised for Expansion

This comprehensive report offers an in-depth analysis of the Asia-Pacific construction chemicals market, forecasting a robust trajectory from 2019 to 2033. Covering a market size of USD XX million in the base year 2025, this study delves into critical growth drivers, emerging opportunities, and the dynamic competitive landscape, providing actionable insights for stakeholders. With a focus on Asia-Pacific construction chemicals market size, construction chemicals market growth, waterproofing solutions market, concrete admixtures market, and construction adhesives market, this report is your essential guide to navigating this lucrative sector.

Asia-Pacific Construction Chemicals Market Market Dynamics & Structure

The Asia-Pacific construction chemicals market is characterized by a moderately concentrated competitive landscape, with a few key global players and a growing number of regional and local manufacturers vying for market share. Technological innovation remains a primary driver, with companies continuously investing in research and development to create more sustainable, high-performance, and user-friendly products. Stringent regulatory frameworks, particularly concerning environmental impact and safety standards, are shaping product development and market entry strategies. Competitive product substitutes are emerging, especially in the realm of advanced materials, prompting manufacturers to differentiate through product efficacy and specialized applications. End-user demographics are shifting, with a growing demand for solutions that enhance building longevity, energy efficiency, and aesthetic appeal across residential, commercial, industrial, institutional, and infrastructure sectors. Mergers and acquisitions (M&A) are a significant trend, consolidating the market and expanding product portfolios. For instance, the acquisition of MBCC Group by Sika in May 2023 significantly reshaped the competitive dynamics. The report details market share percentages for leading players and quantifies M&A deal volumes, alongside qualitative factors like innovation barriers and the impact of evolving building codes on market penetration.

- Market Concentration: Dominated by a blend of multinational corporations and emerging regional champions.

- Technological Innovation: Driven by the pursuit of sustainable, high-performance, and eco-friendly construction chemical solutions.

- Regulatory Frameworks: Increasing emphasis on environmental sustainability, worker safety, and stringent building codes influencing product development.

- Competitive Product Substitutes: Emergence of novel materials and advanced formulations challenging traditional offerings.

- End-User Demographics: Growing demand for solutions that improve building resilience, energy efficiency, and aesthetic appeal.

- M&A Trends: Strategic acquisitions are consolidating market share and expanding product offerings, exemplified by Sika's acquisition of MBCC Group.

Asia-Pacific Construction Chemicals Market Growth Trends & Insights

The Asia-Pacific construction chemicals market is projected to witness substantial expansion, driven by rapid urbanization, significant infrastructure development, and a growing emphasis on sustainable building practices. The market size is expected to grow from USD XX million in the base year 2025 to an estimated USD XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. The adoption rates of advanced construction chemicals, such as high-performance concrete admixtures and specialized waterproofing solutions, are on the rise, fueled by the need for durable and efficient construction. Technological disruptions, including the integration of digital technologies in product application and monitoring, are enhancing the value proposition of construction chemicals. Consumer behavior is shifting towards a preference for solutions that offer long-term cost savings, improved building performance, and reduced environmental impact. This evolution is further supported by government initiatives promoting green building standards and investments in smart city projects, which necessitate the use of cutting-edge construction materials. The report analyzes these trends using XXX data, providing a detailed look at market penetration of key product categories and the impact of evolving consumer preferences on the construction chemicals market forecast.

Dominant Regions, Countries, or Segments in Asia-Pacific Construction Chemicals Market

The Infrastructure end-use sector, alongside the China and India construction chemicals markets, are identified as the primary growth engines within the broader Asia-Pacific construction chemicals market. These regions and segments are experiencing unprecedented levels of investment in new construction projects, driven by a combination of rapid economic development, burgeoning populations, and government-led initiatives aimed at modernizing infrastructure and urban landscapes. The sheer scale of ongoing and planned infrastructure projects, including high-speed rail networks, airports, roads, bridges, and dams, creates a sustained demand for a wide array of construction chemicals, from concrete admixtures that enhance performance and durability to waterproofing solutions that protect vital assets from environmental degradation.

Within the product landscape, Concrete Admixtures are witnessing remarkable growth, accounting for a significant XX% market share. This segment's dominance is attributed to the increasing use of advanced concrete formulations that require specialized admixtures like high-range water reducers (superplasticizers) to achieve higher strength, workability, and durability. The demand for accelerators and retarders also remains strong, enabling better control over concrete setting times in diverse climatic conditions prevalent across the region.

Waterproofing Solutions, particularly membranes, are another pivotal segment, driven by the need to protect buildings and infrastructure from water damage, which is a pervasive issue in many parts of Asia, prone to heavy rainfall and humidity. The growth in this segment is further propelled by increasing awareness of the long-term costs associated with water ingress and the demand for sustainable building envelopes.

In the China construction chemicals market, the sheer volume of construction activity across all end-use sectors – residential, commercial, industrial, and infrastructure – fuels its leading position. Robust government support for the construction industry, coupled with technological advancements and a strong manufacturing base for construction chemicals, underpins its dominance.

The India construction chemicals market is rapidly catching up, fueled by ambitious government plans for infrastructure development (e.g., Smart Cities Mission, National Infrastructure Pipeline) and a booming real estate sector. Increasing disposable incomes and a growing middle class are driving demand for residential and commercial construction, further boosting the consumption of construction chemicals.

- Dominant End Use Sector: Infrastructure, driven by massive government spending on public works and transportation networks.

- Dominant Countries: China and India, owing to their large populations, rapid urbanization, and substantial construction investments.

- Key Product Segments: Concrete Admixtures (especially High Range Water Reducers) and Waterproofing Solutions (Membranes) are leading the growth.

- Growth Drivers in Infrastructure: High-speed rail, smart cities, urban regeneration, and public transport expansion.

- Drivers in China: Unprecedented construction volumes across all sectors, supportive government policies, and strong manufacturing capabilities.

- Drivers in India: Smart Cities Mission, Affordable Housing initiatives, and significant investments in transportation and energy infrastructure.

Asia-Pacific Construction Chemicals Market Product Landscape

The Asia-Pacific construction chemicals market is defined by continuous product innovation, aiming to enhance performance, sustainability, and ease of application. Concrete Admixtures, such as high-range water reducers and shrinkage-reducing admixtures, are crucial for achieving superior concrete properties in demanding applications. Waterproofing Solutions, particularly advanced membrane technologies and liquid-applied systems, offer superior protection against moisture ingress. Adhesives are evolving with the development of hot-melt and reactive formulations for diverse bonding needs, while Sealants, especially silicone-based, provide durable and flexible sealing for joints. The market also sees advancements in Repair and Rehabilitation Chemicals, including high-strength micro-concrete mortars and fiber wrapping systems, extending the lifespan of existing structures. Flooring Resins like polyaspartic are gaining traction for their rapid curing times and exceptional durability. Innovations are focused on low-VOC (Volatile Organic Compound) products, energy-efficient solutions, and chemicals that contribute to a circular economy.

Key Drivers, Barriers & Challenges in Asia-Pacific Construction Chemicals Market

Key Drivers:

- Robust Infrastructure Development: Extensive government investments in transportation, energy, and urban development projects across the region.

- Rapid Urbanization: Increasing population density and the demand for new residential, commercial, and industrial buildings.

- Growing Awareness of Sustainable Construction: Demand for eco-friendly and energy-efficient building materials, driving the adoption of advanced construction chemicals.

- Technological Advancements: Development of high-performance, specialized, and easy-to-apply construction chemical solutions.

- Government Support and Regulations: Favorable policies promoting construction and stricter building codes emphasizing durability and safety.

Barriers & Challenges:

- Supply Chain Disruptions: Global and regional logistics challenges impacting the availability and cost of raw materials.

- Fluctuating Raw Material Prices: Volatility in the cost of petrochemicals and other key inputs affecting profitability.

- Skilled Labor Shortage: Lack of trained professionals for the proper application of specialized construction chemicals.

- Intense Competition: Price wars and margin pressures from both global and local players.

- Regulatory Compliance: Navigating diverse and evolving regulatory landscapes across different countries in the Asia-Pacific region.

- Counterfeit Products: The presence of substandard and counterfeit construction chemicals impacting market integrity and end-user trust.

Emerging Opportunities in Asia-Pacific Construction Chemicals Market

Emerging opportunities in the Asia-Pacific construction chemicals market lie in the growing demand for green building solutions and the increasing application of chemicals in renovation and retrofitting projects. The push for energy efficiency is driving innovation in insulation coatings and advanced waterproofing systems. Furthermore, the development of smart construction materials that integrate with IoT technologies presents a novel avenue. Untapped markets in Southeast Asia and Oceania, coupled with the rise of pre-fabricated construction, offer significant growth potential for specialized adhesives and sealants. The increasing adoption of digitalization in construction, from design to application, opens doors for data-driven product development and customer service.

Growth Accelerators in the Asia-Pacific Construction Chemicals Market Industry

Several key factors are accelerating long-term growth in the Asia-Pacific construction chemicals market. Technological breakthroughs in material science are leading to the creation of more durable, sustainable, and efficient chemical solutions, such as self-healing concrete additives and advanced fire-retardant coatings. Strategic partnerships between raw material suppliers, chemical manufacturers, and construction firms are fostering innovation and ensuring the seamless integration of new products into the construction lifecycle. Market expansion strategies, including penetrating secondary cities and rural areas with increasing construction activities, are broadening the customer base. The development of bio-based and recycled content construction chemicals is also gaining momentum, aligning with global sustainability goals and attracting environmentally conscious consumers.

Key Players Shaping the Asia-Pacific Construction Chemicals Market Market

- Arkema

- Saint-Gobain

- RPM International Inc

- MBCC Group

- Cementaid International Group of Companies

- MUHU (China) Construction Materials Co Ltd

- Fosroc Inc

- Sika AG

- MAPEI S p A

- Kao Corporation

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

- Normet

- Jiangsu Subote New Material Co Ltd

Notable Milestones in Asia-Pacific Construction Chemicals Market Sector

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions, signaling a focus on synergistic innovation.

- May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand, significantly consolidating market share and product portfolios.

- March 2023: Sika AG announced its plan to divest its MBCC admixture assets to Cinven, a global private equity firm, as part of its strategy to secure full ownership of MBCC Group, indicating a strategic streamlining of business operations and focus on core competencies.

In-Depth Asia-Pacific Construction Chemicals Market Market Outlook

The future of the Asia-Pacific construction chemicals market is exceptionally bright, driven by a confluence of sustained economic growth, progressive urbanization, and an unwavering commitment to sustainable development. The market is poised for continued expansion, with an increasing demand for high-performance, environmentally responsible products. Strategic investments in R&D, the adoption of digital technologies, and the exploration of untapped regional markets will be crucial for capturing future growth. The ongoing consolidation through M&A activities will further shape a dynamic competitive landscape, favoring players with robust product portfolios and strong market presence. Overall, the outlook is one of robust expansion and significant opportunity for stakeholders adept at navigating evolving market trends and consumer preferences.

Asia-Pacific Construction Chemicals Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

-

2.1. Adhesives

-

2.1.1. By Sub Product

- 2.1.1.1. Hot Melt

- 2.1.1.2. Reactive

- 2.1.1.3. Solvent-borne

- 2.1.1.4. Water-borne

-

2.1.1. By Sub Product

-

2.2. Anchors and Grouts

- 2.2.1. Cementitious Fixing

- 2.2.2. Resin Fixing

- 2.2.3. Other Types

-

2.3. Concrete Admixtures

- 2.3.1. Accelerator

- 2.3.2. Air Entraining Admixture

- 2.3.3. High Range Water Reducer (Super Plasticizer)

- 2.3.4. Retarder

- 2.3.5. Shrinkage Reducing Admixture

- 2.3.6. Viscosity Modifier

- 2.3.7. Water Reducer (Plasticizer)

-

2.4. Concrete Protective Coatings

- 2.4.1. Acrylic

- 2.4.2. Alkyd

- 2.4.3. Epoxy

- 2.4.4. Polyurethane

- 2.4.5. Other Resin Types

-

2.5. Flooring Resins

- 2.5.1. Polyaspartic

-

2.6. Repair and Rehabilitation Chemicals

- 2.6.1. Fiber Wrapping Systems

- 2.6.2. Injection Grouting Materials

- 2.6.3. Micro-concrete Mortars

- 2.6.4. Modified Mortars

- 2.6.5. Rebar Protectors

-

2.7. Sealants

- 2.7.1. Silicone

-

2.8. Surface Treatment Chemicals

- 2.8.1. Curing Compounds

- 2.8.2. Mold Release Agents

- 2.8.3. Other Product Types

-

2.9. Waterproofing Solutions

- 2.9.1. Membranes

-

2.1. Adhesives

Asia-Pacific Construction Chemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. Rest of Asia Pacific

Asia-Pacific Construction Chemicals Market Regional Market Share

Geographic Coverage of Asia-Pacific Construction Chemicals Market

Asia-Pacific Construction Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash

- 3.3. Market Restrains

- 3.3.1. Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Construction Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Adhesives

- 5.2.1.1. By Sub Product

- 5.2.1.1.1. Hot Melt

- 5.2.1.1.2. Reactive

- 5.2.1.1.3. Solvent-borne

- 5.2.1.1.4. Water-borne

- 5.2.1.1. By Sub Product

- 5.2.2. Anchors and Grouts

- 5.2.2.1. Cementitious Fixing

- 5.2.2.2. Resin Fixing

- 5.2.2.3. Other Types

- 5.2.3. Concrete Admixtures

- 5.2.3.1. Accelerator

- 5.2.3.2. Air Entraining Admixture

- 5.2.3.3. High Range Water Reducer (Super Plasticizer)

- 5.2.3.4. Retarder

- 5.2.3.5. Shrinkage Reducing Admixture

- 5.2.3.6. Viscosity Modifier

- 5.2.3.7. Water Reducer (Plasticizer)

- 5.2.4. Concrete Protective Coatings

- 5.2.4.1. Acrylic

- 5.2.4.2. Alkyd

- 5.2.4.3. Epoxy

- 5.2.4.4. Polyurethane

- 5.2.4.5. Other Resin Types

- 5.2.5. Flooring Resins

- 5.2.5.1. Polyaspartic

- 5.2.6. Repair and Rehabilitation Chemicals

- 5.2.6.1. Fiber Wrapping Systems

- 5.2.6.2. Injection Grouting Materials

- 5.2.6.3. Micro-concrete Mortars

- 5.2.6.4. Modified Mortars

- 5.2.6.5. Rebar Protectors

- 5.2.7. Sealants

- 5.2.7.1. Silicone

- 5.2.8. Surface Treatment Chemicals

- 5.2.8.1. Curing Compounds

- 5.2.8.2. Mold Release Agents

- 5.2.8.3. Other Product Types

- 5.2.9. Waterproofing Solutions

- 5.2.9.1. Membranes

- 5.2.1. Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cementaid International Group of Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MUHU (China) Construction Materials Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fosroc Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sika A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAPEI S p A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kao Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Keshun Waterproof Technology Co ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lonseal Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Oriental Yuhong

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Normet

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Jiangsu Subote New Material Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Asia-Pacific Construction Chemicals Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Construction Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 4: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 5: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by Product 2020 & 2033

- Table 11: Asia-Pacific Construction Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Construction Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Asia-Pacific Construction Chemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Asia-Pacific Construction Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Construction Chemicals Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Construction Chemicals Market?

Key companies in the market include Arkema, Saint-Gobain, RPM International Inc, MBCC Group, Cementaid International Group of Companies, MUHU (China) Construction Materials Co Ltd, Fosroc Inc, Sika A, MAPEI S p A, Kao Corporation, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong, Normet, Jiangsu Subote New Material Co Ltd.

3. What are the main segments of the Asia-Pacific Construction Chemicals Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: Sika AG announced its plan to divest its MBCC admixture assets to Cinven, a global private equity firm, as part of its strategy to secure full ownership of MBCC Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Construction Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Construction Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Construction Chemicals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Construction Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence