Key Insights

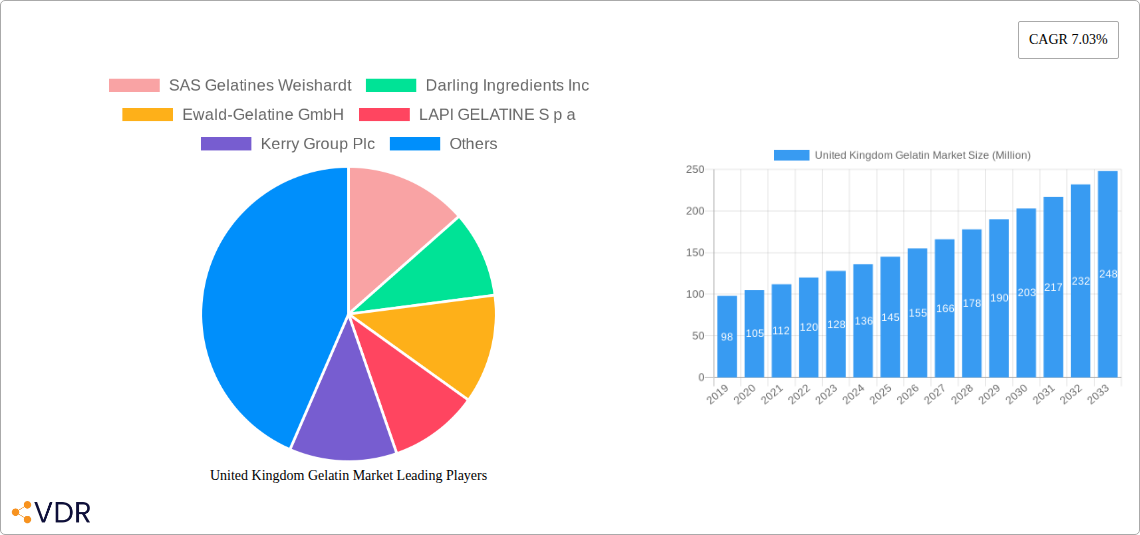

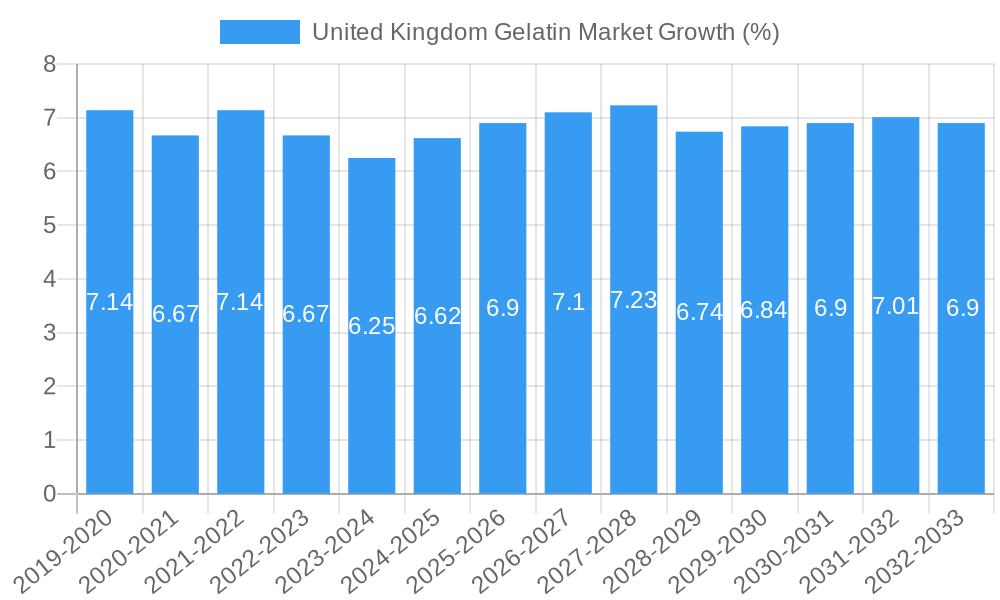

The United Kingdom gelatin market is poised for substantial growth, projected to reach an estimated market size of approximately £150 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.03% expected to persist through the forecast period of 2025-2033. This expansion is primarily driven by escalating consumer demand for protein-rich and functional food products, including bakery items, confectionery, dairy alternatives, and convenient ready-to-eat/cook meals, all of which increasingly incorporate gelatin for texture, stability, and nutritional enhancement. The personal care and cosmetics sector also represents a significant end-user, leveraging gelatin's properties in skincare formulations and hair care products, further fueling market penetration.

The market's dynamism is further characterized by distinct trends such as the rising popularity of marine-based gelatin, catering to a growing segment of consumers seeking alternatives to traditional animal-derived collagen. This shift is supported by ongoing innovation in processing technologies that enhance the quality and versatility of marine sources. However, potential restraints such as fluctuating raw material prices, particularly for animal by-products, and increasing regulatory scrutiny surrounding sourcing and production could pose challenges. Nevertheless, the strong underlying demand and the continuous development of new applications within the UK’s food and personal care industries suggest a resilient and promising future for the gelatin market.

United Kingdom Gelatin Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report provides an in-depth analysis of the United Kingdom gelatin market, covering its dynamics, growth trends, key players, and future opportunities. Leveraging extensive research and data from 2019-2033, with a base and estimated year of 2025, this report offers critical insights for stakeholders. Discover the market's evolution, from animal-based gelatin to nascent marine-based gelatin applications, and its extensive reach across food and beverages (including bakery, condiments/sauces, confectionery, dairy and dairy alternative products, RTE/RTC food products, and snacks) and personal care and cosmetics. With a focus on high-traffic keywords, this report is optimized for maximum search engine visibility and engagement for industry professionals.

United Kingdom Gelatin Market Market Dynamics & Structure

The United Kingdom gelatin market exhibits a moderately concentrated structure, with a few key players dominating production and supply. Technological innovation is a significant driver, particularly in developing specialized gelatin grades for niche applications and improving production efficiency. Regulatory frameworks, primarily focused on food safety and animal by-product utilization, influence manufacturing processes and product approvals. Competitive product substitutes, such as pectin and agar-agar, especially in the vegan and vegetarian segments, present ongoing challenges. End-user demographics are shifting, with increasing demand for healthier, cleaner-label products and a growing interest in functional ingredients derived from gelatin. Mergers and acquisitions (M&A) are strategic maneuvers aimed at expanding market share, diversifying product portfolios, and gaining access to new technologies.

- Market Concentration: Dominated by established global players with specialized manufacturing capabilities.

- Technological Innovation: Focus on developing high-performance gelatin for specific applications, such as confectionery, pharmaceuticals, and nutraceuticals, alongside sustainable production methods.

- Regulatory Landscape: Strict adherence to EU and UK food safety standards, alongside specific regulations for pharmaceutical-grade gelatin.

- Competitive Substitutes: Growing competition from plant-based gelling agents in specific food applications.

- End-User Demographics: Rising demand for health and wellness products, clean-label ingredients, and ethical sourcing.

- M&A Trends: Strategic acquisitions to enhance product offerings and expand geographical reach.

United Kingdom Gelatin Market Growth Trends & Insights

The United Kingdom gelatin market has witnessed consistent growth, driven by evolving consumer preferences and expanding applications across diverse sectors. Market size is projected to continue its upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. The adoption rate of gelatin in functional foods and beverages is a key indicator of this growth, fueled by its perceived health benefits and versatility. Technological disruptions, such as advancements in encapsulation technologies and the development of specialized gelatin types with tailored functionalities, are further stimulating market expansion. Consumer behavior shifts, including a greater emphasis on protein-rich diets and a demand for texture enhancement in food products, directly impact gelatin consumption. The food and beverages segment remains the dominant end-user, with sustained demand from confectionery, dairy and dairy alternative products, and RTE/RTC food products. The personal care and cosmetics sector is also a significant contributor, leveraging gelatin's emulsifying and film-forming properties. The historical period (2019-2024) demonstrated a steady increase in market penetration, a trend anticipated to accelerate in the forecast period due to innovative product development and increasing consumer awareness of gelatin's multifarious benefits. The market's resilience is evident in its ability to adapt to changing dietary trends and technological advancements, ensuring its continued relevance and growth.

Dominant Regions, Countries, or Segments in United Kingdom Gelatin Market

Within the United Kingdom gelatin market, the food and beverages segment overwhelmingly dominates, driven by its extensive applications across numerous sub-categories. Specifically, confectionery represents a substantial portion of this demand, with gelatin being a crucial ingredient for gummies, marshmallows, and jellies, offering unique textural properties and mouthfeel. The growing popularity of dairy and dairy alternative products, including yogurts and desserts, also contributes significantly, utilizing gelatin for stabilization and texture improvement. Furthermore, the convenience food trend fuels demand in RTE/RTC food products and snacks, where gelatin aids in texture, binding, and shelf-life extension. While animal-based gelatin remains the primary form due to its established supply chain and cost-effectiveness, there is a nascent but growing interest in marine-based gelatin as an alternative, particularly in niche markets and for specific allergen-conscious consumers. The personal care and cosmetics sector, while smaller than food and beverages, is a consistent and growing segment, employing gelatin in skincare products for its film-forming and moisturizing properties. Economic policies supporting the food processing industry and robust infrastructure for logistics and distribution within the UK further bolster the growth of these dominant segments. The market share for the food and beverages segment is estimated at over 70% in 2025, with confectionery alone accounting for an estimated 25-30% of the total gelatin consumption. The growth potential within these segments is substantial, driven by product innovation and evolving consumer preferences for texture, stability, and perceived health benefits in a wide array of consumables.

- Dominant Segment: Food and Beverages

- Confectionery: Primary driver due to its use in gummies, marshmallows, and jellies.

- Dairy and Dairy Alternative Products: Growing demand for stabilization and texture.

- RTE/RTC Food Products & Snacks: Essential for texture, binding, and shelf-life.

- Dominant Form: Animal-Based Gelatin

- Established supply chains and cost-effectiveness.

- Emerging Segment: Personal Care and Cosmetics

- Leveraging gelatin's emulsifying and film-forming properties.

- Nascent Form: Marine-Based Gelatin

- Growing interest for niche and allergen-conscious applications.

United Kingdom Gelatin Market Product Landscape

The United Kingdom gelatin market is characterized by continuous product innovation focused on enhancing functionality and catering to diverse end-user needs. Innovations include the development of specialized gelatin grades with precise gelling temperatures, bloom strengths, and viscosity profiles, crucial for optimizing texture and stability in food products like confectionery and dairy and dairy alternative products. In the pharmaceutical sector, highly purified and modified gelatins are being developed for capsule manufacturing and drug delivery systems, emphasizing safety and efficacy. For the personal care and cosmetics industry, advancements focus on gelatin derivatives with superior moisturizing and film-forming capabilities, leading to more effective skincare formulations. The drive for clean-label products is also influencing product development, with a focus on transparency in sourcing and processing.

Key Drivers, Barriers & Challenges in United Kingdom Gelatin Market

Key Drivers:

- Growing Demand in Food & Beverages: Rising consumption of confectionery, dairy and dairy alternative products, and RTE/RTC food products fuels demand for gelatin's textural and stabilizing properties.

- Expanding Applications in Cosmetics: Increasing use of gelatin in skincare and haircare products for its film-forming and moisturizing benefits.

- Technological Advancements: Development of specialized gelatin grades with tailored functionalities for specific applications, enhancing product performance and consumer appeal.

- Health and Wellness Trends: Growing consumer interest in protein-rich diets and functional foods where gelatin can play a role.

Barriers & Challenges:

- Supply Chain Volatility: Reliance on animal by-products can lead to price fluctuations and availability issues based on livestock production and disease outbreaks.

- Competition from Plant-Based Alternatives: Increasing consumer preference for vegan and vegetarian products leads to higher demand for substitutes like pectin and agar-agar, impacting market share.

- Regulatory Compliance: Stringent regulations regarding food safety, traceability, and sourcing can increase production costs and complexity.

- Consumer Perception: Negative perceptions related to the origin of animal-based gelatin can deter some consumer segments, necessitating clear communication and alternative product offerings. The global supply chain disruptions and the aftermath of the COVID-19 pandemic have highlighted the vulnerability of raw material sourcing, with an estimated XX% increase in raw material costs observed in some instances.

Emerging Opportunities in United Kingdom Gelatin Market

Emerging opportunities in the United Kingdom gelatin market lie in the expanding applications of marine-based gelatin as a sustainable and allergen-free alternative, particularly in the food and beverages sector for dairy and dairy alternative products and confectionery. The nutraceutical market presents a significant untapped area, with gelatin's potential in supplements and functional ingredients for bone health and skin vitality. Furthermore, advancements in bio-engineered gelatin offer prospects for highly specialized and sustainable production methods, appealing to environmentally conscious consumers. The growing trend of personalized nutrition and functional foods also opens avenues for customized gelatin formulations.

Growth Accelerators in the United Kingdom Gelatin Market Industry

Long-term growth in the United Kingdom gelatin market is being accelerated by significant technological breakthroughs in enzymatic processing and purification techniques, leading to higher quality and more versatile gelatin products. Strategic partnerships between gelatin manufacturers and food technologists are driving innovation in new product development, particularly in areas like texture modification and encapsulation for improved bioavailability of active ingredients. The increasing global focus on sustainability and circular economy principles is also a catalyst, encouraging the development of more eco-friendly production methods and the utilization of by-products. Market expansion strategies, including the exploration of emerging geographical markets and the development of specialized gelatin for the pharmaceutical and medical device industries, are further solidifying the growth trajectory.

Key Players Shaping the United Kingdom Gelatin Market Market

- SAS Gelatines Weishardt

- Darling Ingredients Inc

- Ewald-Gelatine GmbH

- LAPI GELATINE S p a

- Kerry Group Plc

- GELITA AG

- Koninklijke FrieslandCampina N V

- Reinert Gruppe International GmbH

- Jellice Group

- Trobas Gelatine BV

Notable Milestones in United Kingdom Gelatin Market Sector

- April 2023: Gelita AG introduced Confixx, a rapid-setting gelatin specially designed for fortifying gummy production. Confixx boasts a starch-free composition, ensuring optimal texture for these gummies.

- December 2021: Lapi Gelatine made a strategic move by acquiring Juncà Gelatines of Spain, further expanding its footprint in the industrial gelatine sector, catering to both the food and pharmaceutical industries. This acquisition was accomplished in partnership with DisproInvest, the holding company overseeing the international distribution of raw materials, and Disproquima, a prominent player in the life science market.

- May 2021: Darling Ingredients Inc. announced the expansion of its Rousselot brand's portfolio. They introduced X-Pure® GelDAT - Gelatin Desaminotyrosine, a range of highly purified, pharmaceutical-grade, and modified gelatin products.

In-Depth United Kingdom Gelatin Market Market Outlook

The United Kingdom gelatin market is poised for continued robust growth, driven by an confluence of factors including relentless innovation in product development and expanding application horizons across the food and beverages, personal care and cosmetics, and pharmaceutical sectors. The increasing consumer demand for healthier, functional ingredients and clean-label products provides a fertile ground for the adoption of specialized gelatin formulations. Strategic initiatives by key market players, such as acquisitions and the introduction of novel products like starch-free, rapid-setting gelatins, are set to further propel market expansion. The anticipated growth in the marine-based gelatin segment, fueled by sustainability concerns and allergen awareness, also represents a significant future opportunity. The market's outlook is characterized by resilience, adaptability, and a strong potential for sustained value creation.

United Kingdom Gelatin Market Segmentation

-

1. Form

- 1.1. Animal-Based

- 1.2. Marine-Based

-

2. End-User

- 2.1. Personal Care and Cosmetics

-

2.2. Food and Beverages

- 2.2.1. Bakery

- 2.2.2. Condiments/Sauces

- 2.2.3. Confectionery

- 2.2.4. Dairy and Dairy Alternative Products

- 2.2.5. RTE/RTC Food Products

- 2.2.6. Snacks

United Kingdom Gelatin Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Gelatin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenient and Processed Food; Increasing Usage of Gelatin in Personal Care Products

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Inclination toward Plant-Based Ingredients

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Gelatin-Based Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal-Based

- 5.1.2. Marine-Based

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Personal Care and Cosmetics

- 5.2.2. Food and Beverages

- 5.2.2.1. Bakery

- 5.2.2.2. Condiments/Sauces

- 5.2.2.3. Confectionery

- 5.2.2.4. Dairy and Dairy Alternative Products

- 5.2.2.5. RTE/RTC Food Products

- 5.2.2.6. Snacks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United Kingdom United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Germany United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. France United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Spain United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Italy United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Russia United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Rest of Europe United Kingdom Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAS Gelatines Weishardt

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Darling Ingredients Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ewald-Gelatine GmbH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LAPI GELATINE S p a

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kerry Group Plc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GELITA AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Koninklijke FrieslandCampina N V

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Reinert Gruppe International GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Jellice Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Trobas Gelatine BV

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 SAS Gelatines Weishardt

List of Figures

- Figure 1: United Kingdom Gelatin Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Gelatin Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Gelatin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Gelatin Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United Kingdom Gelatin Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: United Kingdom Gelatin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Gelatin Market Revenue Million Forecast, by Form 2019 & 2032

- Table 20: United Kingdom Gelatin Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 21: United Kingdom Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Gelatin Market?

The projected CAGR is approximately 7.03%.

2. Which companies are prominent players in the United Kingdom Gelatin Market?

Key companies in the market include SAS Gelatines Weishardt, Darling Ingredients Inc, Ewald-Gelatine GmbH, LAPI GELATINE S p a, Kerry Group Plc, GELITA AG, Koninklijke FrieslandCampina N V, Reinert Gruppe International GmbH, Jellice Group, Trobas Gelatine BV.

3. What are the main segments of the United Kingdom Gelatin Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenient and Processed Food; Increasing Usage of Gelatin in Personal Care Products.

6. What are the notable trends driving market growth?

Increasing Consumption of Gelatin-Based Products.

7. Are there any restraints impacting market growth?

Increasing Consumer Inclination toward Plant-Based Ingredients.

8. Can you provide examples of recent developments in the market?

April 2023: Gelita AG introduced Confixx, a rapid-setting gelatin specially designed for fortifying gummy production. Confixx boasts a starch-free composition, ensuring optimal texture for these gummies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Gelatin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Gelatin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Gelatin Market?

To stay informed about further developments, trends, and reports in the United Kingdom Gelatin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence