Key Insights

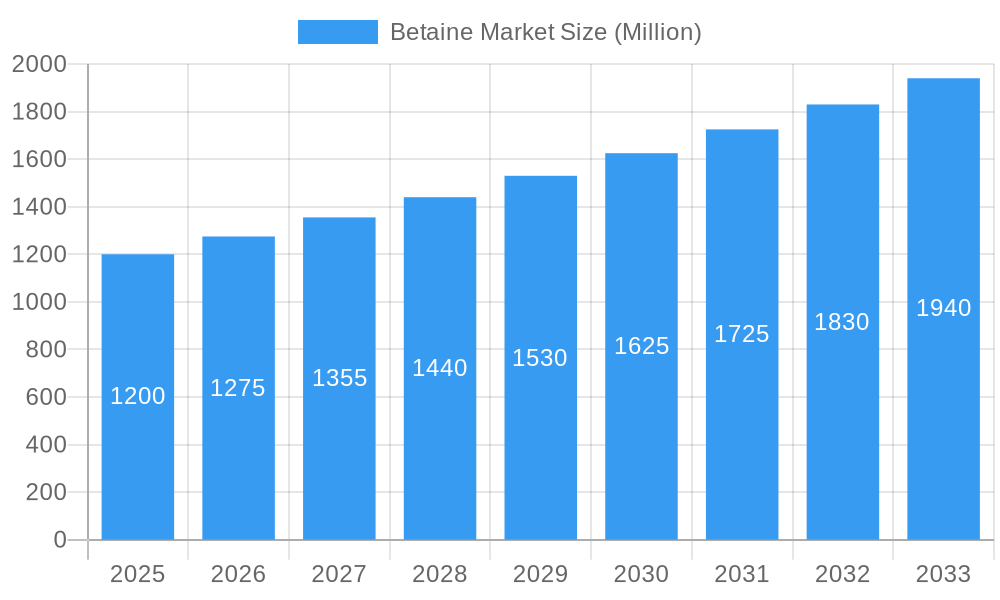

The global Betaine Market is poised for robust expansion, projected to reach a substantial market size by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 6.00%. This growth is fueled by the increasing demand for betaine derivatives across diverse applications, most notably in the food, beverages, and dietary supplements sector, where its humectant, osmolyte, and methyl donor properties are highly valued. The animal feed industry also represents a significant growth driver, with betaine recognized for its ability to improve feed efficiency and animal health, particularly in poultry and aquaculture. Furthermore, the personal care and detergent industries are increasingly incorporating betaine compounds due to their mildness, foaming properties, and biodegradability. Emerging applications in pharmaceuticals and industrial processes are also contributing to the market's upward trajectory, indicating a broad and evolving demand landscape.

Betaine Market Market Size (In Billion)

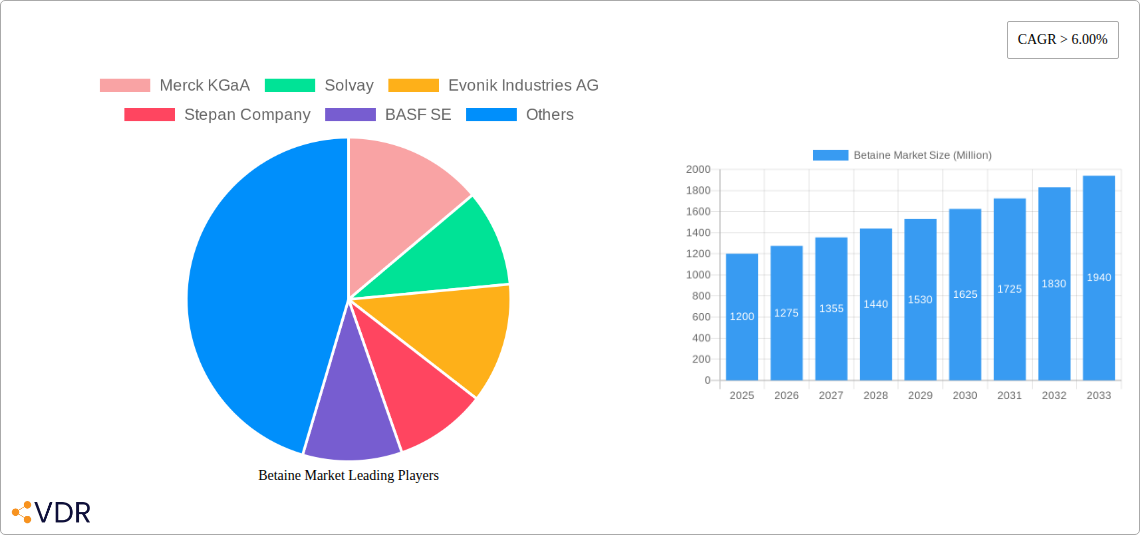

The market is segmented by form, with Betaine Anhydrous and Cocamidopropyl Betaine holding substantial shares due to their widespread use in personal care and detergent formulations. The distinction between synthetic and natural betaine is also becoming increasingly relevant, with a growing consumer preference for naturally derived ingredients influencing purchasing decisions. Key players such as Merck KGaA, Solvay, and Evonik Industries AG are actively investing in research and development to innovate product offerings and expand their global reach. While the market demonstrates strong growth potential, challenges such as fluctuating raw material prices and stringent regulatory landscapes in certain regions could pose restraints. However, the pervasive benefits of betaine across health, nutrition, and consumer products are expected to outweigh these challenges, ensuring sustained market development and increased value, estimated to be in the millions.

Betaine Market Company Market Share

Comprehensive Betaine Market Report: Growth, Trends, and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global Betaine market, meticulously examining its dynamics, growth trajectory, and future potential from 2019 to 2033. Leveraging extensive data and industry expertise, this report offers actionable insights for stakeholders seeking to understand and capitalize on the evolving betaine landscape. We delve into parent and child market segments, exploring the intricate interplay of various betaine forms, types, and applications, alongside a comprehensive review of key industry players and significant developmental milestones.

Betaine Market Market Dynamics & Structure

The global Betaine market is characterized by a moderately concentrated structure, with key players like Merck KGaA, Solvay, Evonik Industries AG, Stepan Company, BASF SE, Nutreco, Sunwin Biotech Shandong Co Ltd, AMINO GmbH, Dow, and Kao Corporation holding significant market shares. Technological innovation is a primary driver, with ongoing research and development focused on enhancing production efficiency and exploring novel applications for betaine derivatives, particularly in natural betaine sourcing and synthetic betaine optimization. Regulatory frameworks, especially concerning food-grade and cosmetic-grade betaine, play a crucial role in dictating product development and market entry strategies. Competitive product substitutes, while present in certain applications, are often outmatched by betaine's unique functional properties. End-user demographics are diverse, spanning the animal feed, personal care, food, beverages, and dietary supplements, and detergent industries, each with specific demands and growth potentials. Merger and acquisition (M&A) trends are observed as companies strategically consolidate their market positions and expand their product portfolios. For instance, the divestment of Evonik's U.S. betaine business in August 2022 signals a strategic realignment within the industry to focus on system solutions.

- Market Concentration: Moderate, with key global players dominating production and supply.

- Technological Innovation Drivers: Focus on bio-based production, enhanced purity, and application-specific formulations.

- Regulatory Frameworks: Stringent quality and safety standards for food, feed, and cosmetic applications influence market access and product differentiation.

- Competitive Product Substitutes: Limited direct substitutes for betaine's osmolytic and surfactant properties, though alternative ingredients exist in specific niches.

- End-User Demographics: Diversified across animal nutrition, personal care, pharmaceuticals, and food & beverage sectors.

- M&A Trends: Strategic acquisitions and divestitures aimed at portfolio optimization and market expansion.

Betaine Market Growth Trends & Insights

The global Betaine market is projected for robust expansion, driven by an increasing demand for functional ingredients across various industries. Market size evolution is anticipated to see significant growth from approximately $1,500 Million in the historical period of 2019-2024 to an estimated $3,200 Million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). Adoption rates for both synthetic betaine and natural betaine are steadily increasing, with a growing preference for naturally derived ingredients in the personal care and food sectors. Technological disruptions, such as advancements in extraction and synthesis methods, are enhancing product quality and reducing production costs, thereby fueling market penetration. Consumer behavior shifts are playing a pivotal role, with heightened awareness of health and wellness promoting the demand for betaine in food, beverages, and dietary supplements, while its emollient and conditioning properties are driving its use in personal care products. The animal feed segment remains a cornerstone of the betaine market, with its efficacy in improving animal health and performance contributing to sustained demand. Emerging applications in pharmaceuticals and industrial processes are also expected to contribute to the market's upward trajectory. The base year of 2025 serves as a crucial benchmark for market assessment and future projections, with the estimated year also set for 2025. The historical period of 2019-2024 provides context for past performance and trends, while the forecast period of 2025-2033 outlines the anticipated market trajectory. The overall market size for 2025 is projected to be around $1,850 Million.

Dominant Regions, Countries, or Segments in Betaine Market

The Animal Feed segment is anticipated to be the dominant force driving growth in the global Betaine market. This dominance stems from the critical role of betaine as a methyl donor, osmoregulator, and lipotropic agent in animal nutrition, contributing to improved feed conversion ratios, reduced stress, and enhanced overall animal health. The increasing global demand for animal protein, coupled with stricter regulations on antibiotic use in livestock, further amplifies the need for effective feed additives like betaine.

Key Drivers for the Dominance of the Animal Feed Segment:

- Nutritional Efficacy: Betaine's multifaceted benefits in improving animal growth, metabolism, and reducing heat stress are well-documented and highly valued by the livestock industry.

- Cost-Effectiveness: As a substitute for choline chloride in certain applications, betaine offers a more efficient and cost-effective solution for animal diets.

- Growing Global Meat Consumption: The escalating demand for meat, poultry, and fish worldwide necessitates efficient and healthy animal production, directly boosting the animal feed additive market.

- Regulatory Landscape: Favorable regulations and growing awareness about animal welfare and sustainable farming practices encourage the adoption of performance-enhancing feed ingredients.

- Technological Advancements in Feed Formulation: Innovative feed formulations are increasingly incorporating betaine to optimize nutrient delivery and animal well-being.

Regional Dominance: North America and Europe currently represent the leading regions in terms of betaine consumption, driven by well-established animal agriculture industries and high adoption rates of advanced feed technologies. However, the Asia-Pacific region is exhibiting the fastest growth due to its rapidly expanding livestock sector and increasing investments in animal nutrition research.

Segmental Dominance (Forms & Types):

- Form: Betaine Anhydrous and Betaine Monohydrate are expected to lead due to their widespread use in animal feed and industrial applications. Cocamidopropyl Betaine is a significant contributor within the Personal Care segment.

- Type: Synthetic Betaine currently holds a larger market share due to its cost-effectiveness and widespread availability. However, Natural Betaine is experiencing a significant surge in demand, particularly in food, beverage, and personal care applications, driven by consumer preference for natural and sustainable ingredients.

The market share of the animal feed application is projected to be around 40-45% of the total market by 2033. The dominance of North America and Europe is estimated at 30-35% each of the global market, with Asia-Pacific projected to grow at a CAGR of 9-10%. The market share for Betaine Anhydrous and Betaine Monohydrate is expected to be 35-40% combined, while Synthetic Betaine is anticipated to hold approximately 60-65% of the Type segment.

Betaine Market Product Landscape

The Betaine market is characterized by continuous product innovation aimed at enhancing purity, functionality, and sustainability. Manufacturers are developing specialized grades of Betaine Anhydrous, Betaine Monohydrate, and Betaine HCl for precise applications in pharmaceuticals and dietary supplements, focusing on improved bioavailability and stability. In the personal care and detergent sectors, Cocamidopropyl Betaine remains a cornerstone ingredient, with ongoing efforts to optimize its performance as a surfactant and its compatibility with other cosmetic ingredients. The development of naturally derived betaine, often extracted from sugar beets or other plant sources, is a significant trend, catering to the growing demand for clean-label and sustainable products. BASF SE's introduction of Euperlan NL Pearl in December 2022, a COSMOS-compliant, wax-based pearlizer incorporating cocamidopropyl betaine, exemplifies this innovation in the personal care sector. These advancements underscore the industry's commitment to offering high-performance, eco-friendly betaine solutions.

Key Drivers, Barriers & Challenges in Betaine Market

Key Drivers:

- Growing Demand in Animal Feed: The increasing global demand for animal protein and the need for improved animal health and performance are significant growth catalysts.

- Rising Popularity in Personal Care: Betaine's hydrating and conditioning properties are driving its adoption in skincare, haircare, and cosmetic formulations.

- Expansion of Dietary Supplements: The increasing consumer focus on health and wellness fuels the demand for betaine in dietary supplements for liver health and sports nutrition.

- Technological Advancements: Improved production processes and the development of new applications are expanding the market's reach.

- Growing Preference for Natural Ingredients: The trend towards natural and sustainable products is boosting the demand for naturally derived betaine.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the prices of sugar beet and other raw materials can impact production costs and profit margins.

- Stringent Regulatory Approvals: Obtaining regulatory approvals for food-grade and pharmaceutical-grade betaine can be a lengthy and complex process.

- Intense Competition: The market is competitive, with several established players and emerging manufacturers vying for market share.

- Supply Chain Disruptions: Global events can disrupt the supply chain of raw materials and finished betaine products.

- Development of Alternative Ingredients: While limited, the development of highly effective alternative ingredients in specific applications can pose a competitive threat.

Emerging Opportunities in Betaine Market

Emerging opportunities in the Betaine market lie in the expansion of its application in novel pharmaceutical formulations and the development of betaine-based ingredients for the plant-based food industry. The potential of betaine in metabolic health and as a component in therapies for certain diseases presents a significant untapped market. Furthermore, as the demand for sustainable and bio-based ingredients intensifies, exploring the extraction and utilization of betaine from alternative, abundant biomass sources could unlock new avenues for growth. The increasing consumer interest in personalized nutrition and supplements also offers opportunities for tailored betaine product development.

Growth Accelerators in the Betaine Market Industry

Growth in the Betaine market is being significantly accelerated by ongoing advancements in production technologies, leading to higher purity and cost-effectiveness. Strategic partnerships between betaine manufacturers and end-user industries, particularly in the animal feed and personal care sectors, are fostering innovation and market penetration. Furthermore, the expansion of betaine into emerging economies, driven by increasing disposable incomes and a growing awareness of its health benefits, is a key growth accelerator. The development of novel applications, such as its use in cryoprotective agents and in certain biotechnological processes, also contributes to long-term market expansion.

Key Players Shaping the Betaine Market Market

- Merck KGaA

- Solvay

- Evonik Industries AG

- Stepan Company

- BASF SE

- Nutreco

- Sunwin Biotech Shandong Co Ltd

- AMINO GmbH

- Dow

- Kao Corporation

Notable Milestones in Betaine Market Sector

- December 2022: BASF introduced Euperlan NL Pearl, the first COSMOS-compliant, wax-based pearlizer designed for rinse-off applications. Euperlan NL Pearl is made up of organically produced substances such as hydrogenated vegetable oil, cocomidopropyl betaine, and glycerol oleate. This launch signifies innovation in sustainable personal care ingredients.

- August 2022: Evonik transformed its portfolio by divesting in U.S. betaine business. The company entered into an agreement with Hopewell, Virginia to sell the whole betaine business in order to transform its care solutions business line to become a system solutions provider for the cleaning and personal care industries. This move indicates strategic portfolio management and a focus on core competencies.

In-Depth Betaine Market Market Outlook

The Betaine market is poised for sustained and robust growth, fueled by a confluence of accelerating factors. The increasing global demand for animal protein will continue to drive the indispensable animal feed segment, while the burgeoning personal care sector, with its emphasis on natural and effective ingredients, offers significant expansion opportunities. The growing awareness of health benefits is propelling betaine into the food, beverage, and dietary supplements market, creating a substantial growth horizon. Innovations in production efficiency and the exploration of novel applications in pharmaceuticals and industrial processes will further solidify its market position. Strategic market expansions into developing economies and an increasing adoption of sustainable, naturally derived betaine will be key drivers of future success, painting a highly optimistic outlook for the Betaine market.

Betaine Market Segmentation

-

1. Form

- 1.1. Betaine Anhydrous

- 1.2. Betaine Monohydrate

- 1.3. Betaine HCl

- 1.4. Cocamidopropyl Betaine

- 1.5. Other Forms

-

2. Type

- 2.1. Synthetic Betaine

- 2.2. Natural Betaine

-

3. Application

- 3.1. Food, Beverages, and Dietary Supplements

- 3.2. Animal Feed

- 3.3. Personal Care

- 3.4. Detergent

- 3.5. Other Applications

Betaine Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Betaine Market Regional Market Share

Geographic Coverage of Betaine Market

Betaine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from Personal Care Sector; Growing Usage in Food and Beverage Industry; Increased Commercial Usage as Surfactant

- 3.3. Market Restrains

- 3.3.1. Synthetic Cosmetics Leading to Skin and Hair Problems; Other Restraints

- 3.4. Market Trends

- 3.4.1. Personal Care Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Betaine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Betaine Anhydrous

- 5.1.2. Betaine Monohydrate

- 5.1.3. Betaine HCl

- 5.1.4. Cocamidopropyl Betaine

- 5.1.5. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Synthetic Betaine

- 5.2.2. Natural Betaine

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Food, Beverages, and Dietary Supplements

- 5.3.2. Animal Feed

- 5.3.3. Personal Care

- 5.3.4. Detergent

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Asia Pacific Betaine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Betaine Anhydrous

- 6.1.2. Betaine Monohydrate

- 6.1.3. Betaine HCl

- 6.1.4. Cocamidopropyl Betaine

- 6.1.5. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Synthetic Betaine

- 6.2.2. Natural Betaine

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Food, Beverages, and Dietary Supplements

- 6.3.2. Animal Feed

- 6.3.3. Personal Care

- 6.3.4. Detergent

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. North America Betaine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Betaine Anhydrous

- 7.1.2. Betaine Monohydrate

- 7.1.3. Betaine HCl

- 7.1.4. Cocamidopropyl Betaine

- 7.1.5. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Synthetic Betaine

- 7.2.2. Natural Betaine

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Food, Beverages, and Dietary Supplements

- 7.3.2. Animal Feed

- 7.3.3. Personal Care

- 7.3.4. Detergent

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe Betaine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Betaine Anhydrous

- 8.1.2. Betaine Monohydrate

- 8.1.3. Betaine HCl

- 8.1.4. Cocamidopropyl Betaine

- 8.1.5. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Synthetic Betaine

- 8.2.2. Natural Betaine

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Food, Beverages, and Dietary Supplements

- 8.3.2. Animal Feed

- 8.3.3. Personal Care

- 8.3.4. Detergent

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Betaine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Betaine Anhydrous

- 9.1.2. Betaine Monohydrate

- 9.1.3. Betaine HCl

- 9.1.4. Cocamidopropyl Betaine

- 9.1.5. Other Forms

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Synthetic Betaine

- 9.2.2. Natural Betaine

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Food, Beverages, and Dietary Supplements

- 9.3.2. Animal Feed

- 9.3.3. Personal Care

- 9.3.4. Detergent

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East and Africa Betaine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Betaine Anhydrous

- 10.1.2. Betaine Monohydrate

- 10.1.3. Betaine HCl

- 10.1.4. Cocamidopropyl Betaine

- 10.1.5. Other Forms

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Synthetic Betaine

- 10.2.2. Natural Betaine

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Food, Beverages, and Dietary Supplements

- 10.3.2. Animal Feed

- 10.3.3. Personal Care

- 10.3.4. Detergent

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Evonik Industries AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stepan Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nutreco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunwin Biotech Shandong Co Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AMINO GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dow

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Betaine Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Betaine Market Revenue (Million), by Form 2025 & 2033

- Figure 3: Asia Pacific Betaine Market Revenue Share (%), by Form 2025 & 2033

- Figure 4: Asia Pacific Betaine Market Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Betaine Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Betaine Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Betaine Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Betaine Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Betaine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Betaine Market Revenue (Million), by Form 2025 & 2033

- Figure 11: North America Betaine Market Revenue Share (%), by Form 2025 & 2033

- Figure 12: North America Betaine Market Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Betaine Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Betaine Market Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Betaine Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Betaine Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Betaine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Betaine Market Revenue (Million), by Form 2025 & 2033

- Figure 19: Europe Betaine Market Revenue Share (%), by Form 2025 & 2033

- Figure 20: Europe Betaine Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Betaine Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Betaine Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Betaine Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Betaine Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Betaine Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Betaine Market Revenue (Million), by Form 2025 & 2033

- Figure 27: South America Betaine Market Revenue Share (%), by Form 2025 & 2033

- Figure 28: South America Betaine Market Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Betaine Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Betaine Market Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Betaine Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Betaine Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Betaine Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Betaine Market Revenue (Million), by Form 2025 & 2033

- Figure 35: Middle East and Africa Betaine Market Revenue Share (%), by Form 2025 & 2033

- Figure 36: Middle East and Africa Betaine Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Betaine Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Betaine Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Betaine Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Betaine Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Betaine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Betaine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 6: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Betaine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 15: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Betaine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 22: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Betaine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 31: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Betaine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Betaine Market Revenue Million Forecast, by Form 2020 & 2033

- Table 38: Global Betaine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Betaine Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Betaine Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Betaine Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Betaine Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Betaine Market?

Key companies in the market include Merck KGaA, Solvay, Evonik Industries AG, Stepan Company, BASF SE, Nutreco, Sunwin Biotech Shandong Co Ltd *List Not Exhaustive, AMINO GmbH, Dow, Kao Corporation.

3. What are the main segments of the Betaine Market?

The market segments include Form, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from Personal Care Sector; Growing Usage in Food and Beverage Industry; Increased Commercial Usage as Surfactant.

6. What are the notable trends driving market growth?

Personal Care Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

Synthetic Cosmetics Leading to Skin and Hair Problems; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: BASF introduced Euperlan NL Pearl, the first COSMOS-compliant, wax-based pearlizer designed for rinse-off applications. Euperlan NL Pearl is made up of organically produced substances such as hydrogenated vegetable oil, cocomidopropyl betaine, and glycerol oleate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Betaine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Betaine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Betaine Market?

To stay informed about further developments, trends, and reports in the Betaine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence