Key Insights

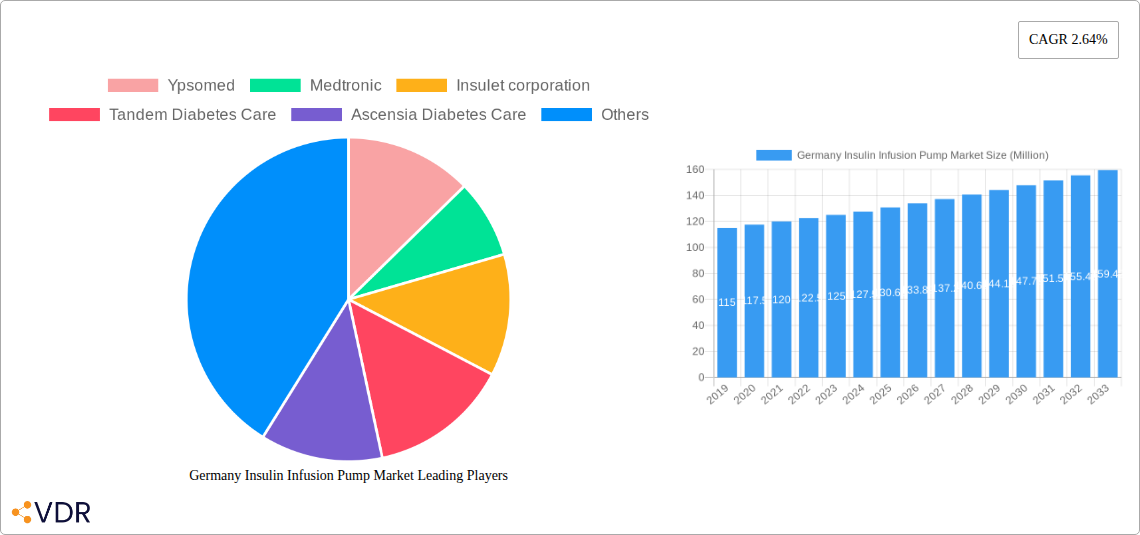

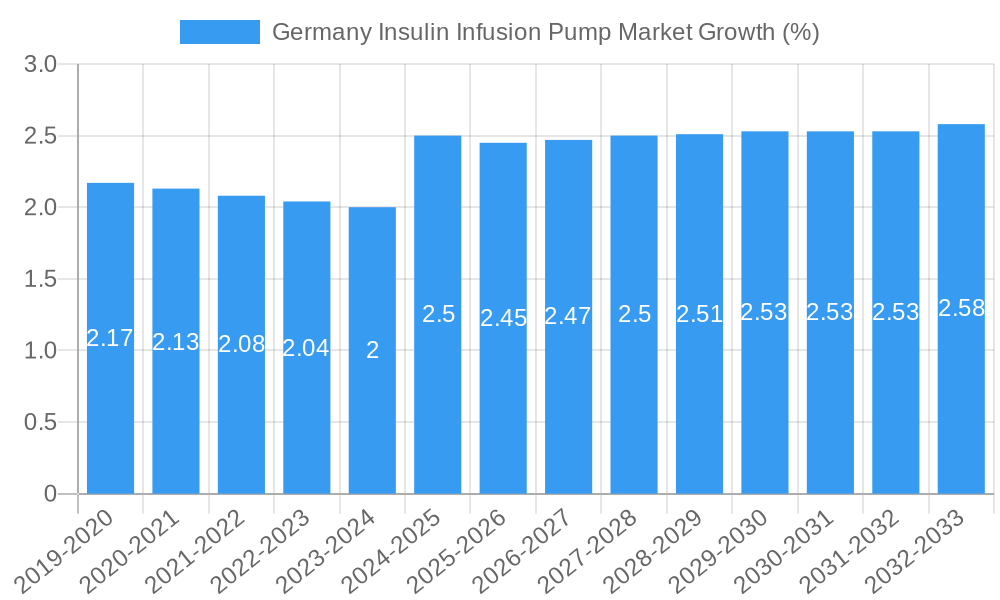

The German Insulin Infusion Pump Market is poised for steady growth, projected to reach approximately USD 130.69 million by 2025. This expansion is driven by an increasing prevalence of diabetes in Germany and a growing patient preference for advanced insulin delivery systems over traditional methods. Factors such as rising disposable incomes, enhanced healthcare infrastructure, and government initiatives promoting diabetes management further contribute to this positive trajectory. The market's compound annual growth rate (CAGR) of 2.64% signals a consistent and sustainable upward trend, indicating that the demand for innovative insulin pump solutions will continue to rise throughout the forecast period. Key players like Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Ascensia Diabetes Care are actively investing in research and development to introduce user-friendly and technologically advanced insulin pumps, including smart pumps and hybrid closed-loop systems. These advancements are crucial in improving glycemic control, reducing the burden of manual injections, and enhancing the quality of life for individuals living with diabetes in Germany.

The market is segmented into Insulin Pump Devices, Infusion Sets, and Reservoirs, with Insulin Pump Devices likely holding the largest share due to their central role in automated insulin delivery. The increasing adoption of these sophisticated devices, coupled with the ongoing development of more comfortable and discreet infusion sets and efficient reservoirs, will fuel market expansion. While the market is generally robust, potential restraints could include the initial cost of insulin pumps, the need for extensive patient training, and reimbursement policies that might not always fully cover the cost of advanced systems. However, the long-term benefits of improved diabetes management and reduced healthcare complications associated with better glycemic control are expected to outweigh these challenges. The continuous innovation in connected devices and smartphone integration for pump management further augments user convenience and adherence, solidifying the market's growth prospects in Germany.

Germany Insulin Infusion Pump Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the dynamic Germany insulin infusion pump market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides a granular view of market trends, growth drivers, competitive landscape, and future opportunities. Essential for stakeholders in diabetes care technology, medical device manufacturers, and healthcare providers seeking to capitalize on the burgeoning demand for advanced insulin delivery solutions.

Germany Insulin Infusion Pump Market Market Dynamics & Structure

The Germany insulin infusion pump market is characterized by a moderately concentrated landscape, driven by significant technological advancements and stringent regulatory frameworks. Innovation is a key differentiator, with companies heavily investing in developing smarter, more integrated, and user-friendly devices. The increasing prevalence of diabetes in Germany, coupled with a growing awareness and adoption of advanced diabetes management tools, fuels market expansion. Competitive product substitutes, primarily insulin pens and traditional injection methods, are gradually being displaced by the superior glycemic control offered by infusion pumps, especially among younger and more tech-savvy patient demographics. Mergers and acquisitions (M&A) play a crucial role in consolidating market share and expanding product portfolios, reflecting a strategic imperative for growth and innovation.

- Market Concentration: Dominated by a few key global players, with increasing potential for new entrants leveraging specialized technologies.

- Technological Innovation Drivers: Focus on miniaturization, wireless connectivity (Bluetooth, Wi-Fi), advanced algorithms for predictive insulin delivery, and seamless integration with Continuous Glucose Monitors (CGMs).

- Regulatory Frameworks: Strict approvals from the German Federal Institute for Drugs and Medical Devices (BfArM) and compliance with European Union medical device regulations (MDR) are paramount.

- Competitive Product Substitutes: Insulin pens and syringes remain relevant but are facing declining market share in favor of pump technology.

- End-User Demographics: Growing adoption among Type 1 diabetes patients, pediatrics, and increasingly, Type 2 diabetes patients seeking better glycemic control and improved quality of life.

- M&A Trends: Strategic acquisitions aimed at bolstering product pipelines, acquiring innovative technologies, and expanding market reach. The recent acquisition by Medtronic of EOFlow Co. Ltd. exemplifies this trend, aiming to enhance their tubeless pump offerings.

Germany Insulin Infusion Pump Market Growth Trends & Insights

The Germany insulin infusion pump market is poised for robust expansion, driven by an escalating demand for advanced diabetes management solutions and a favorable reimbursement landscape. Over the historical period (2019-2024), the market witnessed steady growth, propelled by increasing diabetes diagnoses and a growing preference for continuous insulin delivery over intermittent injections. The base year, 2025, represents a significant inflection point, with projected market size estimated at 1.2 million units. This growth trajectory is expected to continue through the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of 8.5%, reaching approximately 2.5 million units by 2033. This upward trend is underpinned by several key factors, including technological advancements that enhance patient comfort and usability, a growing understanding of the benefits of closed-loop systems, and increasing healthcare expenditure directed towards chronic disease management.

The adoption rates of insulin infusion pumps, while still lower than in some other developed nations, are rapidly accelerating in Germany. This is attributed to the persistent efforts by healthcare providers to educate patients about the advantages of pump therapy, such as improved glycemic control, reduced risk of hypoglycemia, and enhanced lifestyle flexibility. Technological disruptions, such as the development of tubeless and wearable pump systems, and the integration of artificial intelligence and machine learning algorithms for predictive insulin delivery, are fundamentally reshaping the market. These innovations are not only improving the efficacy of insulin delivery but also addressing long-standing patient concerns regarding comfort and convenience.

Consumer behavior shifts are also playing a pivotal role. Patients are increasingly empowered and proactive in their diabetes management, actively seeking technologies that offer greater autonomy and a higher quality of life. The desire for seamless integration with continuous glucose monitoring (CGM) devices, creating semi-closed or fully closed-loop systems, is a significant driver of consumer preference. This trend is further amplified by the increasing availability of data-driven insights and personalized feedback, allowing individuals to make more informed decisions about their diabetes care. The German market, with its well-established healthcare infrastructure and a population that values advanced medical solutions, is particularly receptive to these evolving trends. The push towards personalized medicine and digital health solutions is creating a fertile ground for sustained growth in the insulin infusion pump sector.

Dominant Regions, Countries, or Segments in Germany Insulin Infusion Pump Market

Within the Germany insulin infusion pump market, the Insulin Pump Device segment stands out as the dominant force driving market growth. This segment encompasses the core technological component of the infusion system, responsible for precise insulin delivery. Its dominance is attributed to several interconnected factors, including ongoing innovation in device design, the increasing sophistication of its functionalities, and a higher per-unit value compared to ancillary components. The market penetration of insulin pump devices is a primary indicator of overall market maturity and adoption, making it the most closely watched segment by industry stakeholders.

Insulin Pump Device Dominance: This segment represents the largest share of the Germany insulin infusion pump market, projected to account for approximately 65-70% of the total market value. The continuous development of advanced pump technologies, including patch pumps and tubeless systems, directly fuels the growth of this segment. The increasing demand for automated insulin delivery systems, which rely heavily on sophisticated pump devices, further solidifies its leadership position.

Key Drivers for Dominance:

- Technological Advancements: The introduction of smart pumps with advanced algorithms, connectivity features, and user-friendly interfaces significantly boosts the adoption of insulin pump devices. For instance, innovations in predictive low-glucose suspend functions and integrated CGM data display enhance patient confidence and adherence.

- Improved Glycemic Control: Insulin pump devices, when used with CGM, offer superior glycemic control compared to traditional methods, leading to reduced HbA1c levels and fewer diabetes-related complications. This clinical benefit is a primary driver for physician and patient preference.

- Growing Patient Awareness and Demand: Increased awareness campaigns, patient advocacy groups, and educational initiatives are empowering individuals to seek out pump therapy for better diabetes management, directly impacting the demand for pump devices.

- Reimbursement Policies: Favorable reimbursement policies in Germany for insulin pump therapy, especially for individuals with Type 1 diabetes and specific Type 2 diabetes cases, significantly contribute to the segment's growth.

Market Share and Growth Potential: The Insulin Pump Device segment not only holds the largest market share but also exhibits a strong growth potential due to ongoing innovation and increasing adoption rates. While Infusion Sets and Reservoirs are essential accessories, their market size is directly correlated to the number of active insulin pump devices in use. The demand for these components is expected to grow in tandem with the expansion of the Insulin Pump Device segment. The increasing complexity and miniaturization of pump devices contribute to higher average selling prices, further bolstering the segment's revenue share.

Germany Insulin Infusion Pump Market Product Landscape

The Germany insulin infusion pump market is characterized by a sophisticated product landscape centered on delivering more intelligent, discreet, and integrated insulin delivery solutions. Key innovations focus on miniaturization for improved comfort and reduced visibility, enhanced connectivity for seamless data sharing with healthcare providers and patient apps, and advanced algorithms that increasingly mimic the body's natural insulin secretion. Companies are also emphasizing user-friendly interfaces and simplified set-up processes to broaden appeal and improve patient adherence. The trend towards tubeless and patch pump designs continues to gain traction, offering a less intrusive and more flexible alternative to traditional tethered pumps.

Key Drivers, Barriers & Challenges in Germany Insulin Infusion Pump Market

Key Drivers:

- Technological Innovation: The continuous development of smart pumps, closed-loop systems, and integration with CGM devices is a major propellant for market growth, offering superior glycemic control and convenience.

- Rising Diabetes Prevalence: The increasing incidence of Type 1 and Type 2 diabetes in Germany necessitates advanced treatment options like insulin pumps.

- Favorable Reimbursement Policies: Government and private health insurance coverage for insulin pump therapy in Germany significantly drives adoption rates by reducing out-of-pocket expenses for patients.

- Improved Quality of Life: Patients are increasingly opting for pumps due to the enhanced freedom, flexibility, and better glycemic management they offer, leading to a higher quality of life.

Barriers & Challenges:

- High Cost of Devices: Despite reimbursement, the initial cost of insulin infusion pumps and their associated consumables can still be a significant barrier for some individuals and healthcare systems.

- Technical Complexity and Learning Curve: While user interfaces are improving, some patients may find the technology complex to manage, requiring extensive training and ongoing support.

- Limited Awareness and Access: In certain regions or among specific patient demographics, awareness about the benefits of pump therapy may be limited, or access to trained healthcare professionals may be restricted.

- Supply Chain Disruptions and Component Shortages: Global supply chain vulnerabilities can impact the availability of critical components, leading to potential delays in manufacturing and product availability. The global semiconductor shortage, for instance, has affected the production of electronic components essential for smart pumps.

- Regulatory Hurdles: Stringent approval processes from regulatory bodies like BfArM, while ensuring safety and efficacy, can prolong the time-to-market for new innovations.

Emerging Opportunities in Germany Insulin Infusion Pump Market

Emerging opportunities in the Germany insulin infusion pump market lie in the expansion of smart insulin pen add-ons, integration with other health wearables, and personalized diabetes management platforms. The growing demand for less invasive and more discreet insulin delivery systems presents a significant avenue for growth. Furthermore, the increasing focus on remote patient monitoring and telehealth solutions opens up possibilities for enhanced patient support and data-driven treatment adjustments, particularly for individuals in remote areas or those with mobility challenges. The development of AI-driven predictive analytics for insulin dosing, based on real-time data from CGM and pump usage, represents a substantial opportunity to further optimize glycemic control and reduce the burden of diabetes management.

Growth Accelerators in the Germany Insulin Infusion Pump Market Industry

Several catalysts are accelerating the growth of the Germany insulin infusion pump market. Technological breakthroughs in sensor technology for CGM, leading to more accurate and real-time glucose readings, are directly fueling the adoption of integrated pump systems. Strategic partnerships between insulin pump manufacturers, CGM providers, and pharmaceutical companies developing novel insulin formulations are creating comprehensive diabetes management ecosystems. Market expansion strategies, including increased penetration into the pediatric diabetes segment and targeted outreach to Type 2 diabetes patients, are also driving demand. The growing emphasis on digital health initiatives and the increasing acceptance of connected medical devices by both patients and healthcare providers are further amplifying growth prospects.

Key Players Shaping the Germany Insulin Infusion Pump Market Market

- Ypsomed

- Medtronic

- Insulet Corporation

- Tandem Diabetes Care

- Ascensia Diabetes Care

Notable Milestones in Germany Insulin Infusion Pump Market Sector

- June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, a French company specializing in medical devices including smart add-on devices for pen injectors. This move signals a potential integration of advanced pen delivery systems with broader diabetes management solutions, impacting the future landscape of insulin delivery.

- May 2023: Medtronic plc announced definitive agreements to acquire EOFlow Co. Ltd., the manufacturer of the EOPatch, a tubeless, wearable, and fully disposable insulin delivery device. This acquisition is set to significantly bolster Medtronic's portfolio in the tubeless pump segment and enhance their integrated diabetes management offerings, potentially impacting market share and product innovation.

In-Depth Germany Insulin Infusion Pump Market Market Outlook

The future outlook for the Germany insulin infusion pump market is exceptionally promising, driven by continuous innovation and an increasing patient-centric approach to diabetes care. Growth accelerators such as the ongoing advancements in closed-loop systems, the development of more affordable and accessible pump technologies, and the expanding integration with digital health platforms will solidify market expansion. Strategic collaborations between device manufacturers, pharmaceutical companies, and diagnostic providers are expected to create a more holistic and integrated diabetes management ecosystem. The increasing patient demand for personalized treatment plans and the growing recognition of the long-term economic benefits of effective diabetes management will further propel market growth, positioning Germany as a key market for advanced insulin delivery solutions.

Germany Insulin Infusion Pump Market Segmentation

-

1. Insulin Infusion Pump

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

Germany Insulin Infusion Pump Market Segmentation By Geography

- 1. Germany

Germany Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6. North Rhine-Westphalia Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ypsomed

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Insulet corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tandem Diabetes Care

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ascensia Diabetes Care

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Ypsomed

List of Figures

- Figure 1: Germany Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Insulin Infusion Pump Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 4: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 5: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: North Rhine-Westphalia Germany Insulin Infusion Pump Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North Rhine-Westphalia Germany Insulin Infusion Pump Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Bavaria Germany Insulin Infusion Pump Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Bavaria Germany Insulin Infusion Pump Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Baden-Württemberg Germany Insulin Infusion Pump Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Baden-Württemberg Germany Insulin Infusion Pump Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Lower Saxony Germany Insulin Infusion Pump Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Lower Saxony Germany Insulin Infusion Pump Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Hesse Germany Insulin Infusion Pump Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Hesse Germany Insulin Infusion Pump Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 20: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 21: Germany Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Germany Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Insulin Infusion Pump Market?

The projected CAGR is approximately 2.64%.

2. Which companies are prominent players in the Germany Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronic, Insulet corporation, Tandem Diabetes Care, Ascensia Diabetes Care.

3. What are the main segments of the Germany Insulin Infusion Pump Market?

The market segments include Insulin Infusion Pump.

4. Can you provide details about the market size?

The market size is estimated to be USD 130.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, which would be followed by a mandatory simplified tender offer on all remaining outstanding shares in BIOCORP. BIOCORP is a French company specializing in the design, development, and manufacturing of delivery systems and innovative medical devices, including Mallya, a Bluetooth-enabled smart add-on device for pen injectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the Germany Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence