Key Insights

The Bovine Blood Plasma Derivatives Market is projected for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.72% and anticipated to reach a market size of $1.95 billion by 2025. This expansion is primarily fueled by the increasing demand for plasma-derived products across pharmaceutical, biotechnology, and research sectors. Key growth drivers include the expanding applications of immunoglobulin for therapeutic purposes, the rising prevalence of chronic diseases, and the continuous advancements in biopharmaceutical research and development. Fetal Bovine Serum (FBS) and Newborn Calf Serum remain critical components, indispensable for cell culture and vaccine production, thus underpinning their sustained demand. The market is also experiencing a notable trend towards the development of more purified and specialized bovine blood plasma derivatives, catering to the stringent requirements of advanced medical treatments and diagnostics.

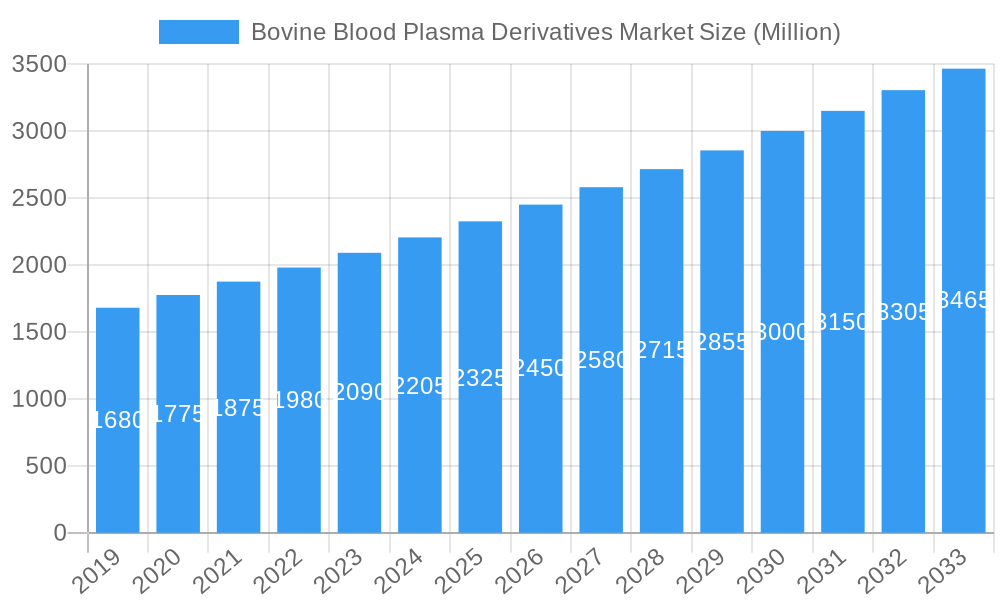

Bovine Blood Plasma Derivatives Market Market Size (In Billion)

However, the market faces certain restraints, including the fluctuating availability and cost of raw bovine plasma, coupled with stringent regulatory frameworks governing the sourcing and processing of animal-derived products. Geographically, North America and Europe currently dominate the market, owing to well-established pharmaceutical and biotechnology industries and robust research infrastructure. Asia Pacific is emerging as a significant growth region, driven by increasing investments in healthcare and biopharmaceutical manufacturing. The competitive landscape is characterized by the presence of several key players, including Thermo Fisher Scientific, Merck KGaA, and LAMPIRE Biological Labs Inc., who are actively engaged in strategic collaborations, mergers, and acquisitions to enhance their product portfolios and expand their global reach. Innovations in processing technologies and the exploration of new therapeutic applications for bovine plasma derivatives are expected to shape the market's future trajectory.

Bovine Blood Plasma Derivatives Market Company Market Share

Bovine Blood Plasma Derivatives Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the global Bovine Blood Plasma Derivatives Market. Covering the historical period from 2019 to 2024, the base year 2025, and a robust forecast period extending to 2033, this study offers critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and a detailed outlook for industry stakeholders. With an estimated market size of $3,500 Million units in 2025 and a projected Compound Annual Growth Rate (CAGR) of XX%, this market is poised for significant expansion driven by advancements in the pharmaceutical, biotechnology, and food industries.

The report segments the market by Derivative (Immunoglobulin, Fibrinogen, Bovine Serum Albumin, Fetal Bovine Serum, Newborn Calf Serum, Thrombin, Other Derivatives) and End-user Industries (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Food Industry, Other End-user Industries). Key companies analyzed include LAMPIRE Biological Labs Inc, Auckland BioSciences Ltd, Kraeber & Co GmbH, ROCKY MOUNTAIN BIOLOGICALS, Bovogen Biologicals, Merck KGaA, TCS Biosciences, SeraCare, Lake Immunogenics Inc, Tissue Culture Biologicals, Thermo Fisher Scientific, and MP BIOMEDICALS.

Bovine Blood Plasma Derivatives Market Dynamics & Structure

The Bovine Blood Plasma Derivatives Market is characterized by a moderate to high level of market concentration, with established players like Thermo Fisher Scientific and Merck KGaA holding significant shares. Technological innovation is a primary driver, with ongoing research focused on improving extraction techniques, purity levels, and the development of novel applications for bovine plasma derivatives. Regulatory frameworks, particularly concerning animal health, product safety, and import/export regulations, play a crucial role in shaping market access and compliance.

- Market Concentration: The presence of key global players indicates a moderately concentrated market, though regional players also contribute to the competitive landscape.

- Technological Innovation: Advancements in cell culture media formulation, therapeutic protein development, and diagnostic reagent manufacturing are continuously pushing the boundaries of application.

- Regulatory Frameworks: Stringent quality control measures and adherence to Good Manufacturing Practices (GMP) are paramount for market participants.

- Competitive Product Substitutes: While direct substitutes are limited, alternative biological sources and synthetic alternatives in specific applications present indirect competition.

- End-User Demographics: The primary end-users are research institutions and pharmaceutical companies, with growing demand from the food industry for specific additives.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies aim to expand their product portfolios, enhance R&D capabilities, and gain market reach. For instance, the period saw XX significant M&A deals valued at over $XXX Million units.

Bovine Blood Plasma Derivatives Market Growth Trends & Insights

The Bovine Blood Plasma Derivatives Market has witnessed a steady and significant expansion over the historical period, driven by an increasing demand from the life sciences sector and a growing appreciation for the versatile applications of these biological products. The estimated market size of $3,500 Million units in 2025 underscores its current prominence. Looking ahead, the market is projected to experience robust growth, with a projected CAGR of XX% during the forecast period of 2025–2033. This growth trajectory is supported by evolving consumer behavior favoring biologically derived ingredients and the continuous technological disruptions that enhance product efficacy and broaden their application scope.

The adoption rates of bovine blood plasma derivatives are particularly high within pharmaceutical and biotechnology companies for the development of therapeutics, vaccines, and diagnostic kits. Academic and research institutes also represent a substantial segment, utilizing these derivatives for fundamental research, cell culture, and experimental procedures. The food industry's adoption, while smaller in scale, is growing due to the functional properties of certain derivatives, such as proteins and growth factors. Market penetration is expected to deepen as research uncovers new therapeutic and industrial applications.

Technological advancements in purification techniques, such as chromatography and ultrafiltration, have led to higher purity and specific activity of derivatives, thereby enhancing their value proposition. Furthermore, improvements in plasma collection and processing methods ensure consistent quality and supply, mitigating potential disruptions. Shifts in consumer preferences towards natural and biologically sourced ingredients in both healthcare and food products are also acting as a significant tailwind for the market. The increasing prevalence of chronic diseases and the ongoing research into rare diseases necessitate the use of high-quality biological components, directly fueling the demand for bovine blood plasma derivatives. The market penetration is currently estimated at XX% and is expected to reach XX% by 2033, reflecting substantial growth potential.

Dominant Regions, Countries, or Segments in Bovine Blood Plasma Derivatives Market

The global Bovine Blood Plasma Derivatives Market is significantly influenced by regional dynamics, technological advancements, and the specific needs of various end-user industries. Among the derivative segments, Fetal Bovine Serum (FBS) stands out as a dominant force, driven by its indispensable role in cell culture applications across the pharmaceutical, biotechnology, and research sectors. The estimated market share for FBS in 2025 is projected to be around XX%, reflecting its critical importance. Its ability to support cell proliferation, differentiation, and viability makes it a cornerstone for in-vitro research, drug discovery, and vaccine development.

Geographically, North America is anticipated to lead the market, contributing approximately XX% of the global revenue in 2025. This dominance is attributed to the robust presence of leading pharmaceutical and biotechnology companies, extensive government funding for life sciences research, and a well-established network of academic institutions engaged in cutting-edge scientific exploration. The United States, in particular, represents a major hub for drug development and biopharmaceutical manufacturing, creating a sustained demand for high-quality bovine blood plasma derivatives.

The Pharmaceutical and Biotechnology Companies segment is the primary revenue generator within the end-user industries, expected to account for XX% of the market value in 2025. This segment's growth is intrinsically linked to the accelerating pace of drug development, personalized medicine initiatives, and the rising incidence of diseases requiring advanced therapeutic interventions. The demand for derivatives like Immunoglobulin and Bovine Serum Albumin for therapeutic purposes, and Fetal Bovine Serum for cell-based assays and manufacturing, is exceptionally high within this sector.

Key Drivers of Dominance:

- North America:

- Economic Policies: Favorable government incentives and significant R&D tax credits for the life sciences sector.

- Infrastructure: Advanced research facilities, state-of-the-art manufacturing plants, and efficient supply chain networks.

- Research Ecosystem: A high density of leading universities and research centers collaborating with industry.

- Fetal Bovine Serum (Derivative Segment):

- Indispensable for Cell Culture: Its complex mix of growth factors and nutrients is critical for numerous cell lines.

- Therapeutic Development: Essential for the production of biopharmaceuticals and vaccines.

- Pharmaceutical and Biotechnology Companies (End-User Industry):

- High R&D Spending: Continuous investment in novel drug discovery and development.

- Biologics Manufacturing: Increasing production of monoclonal antibodies, recombinant proteins, and gene therapies.

- Diagnostic Innovations: Development of advanced diagnostic kits and assays.

The growth potential within these dominant segments remains substantial, fueled by ongoing innovation and the increasing recognition of the value derived from bovine blood plasma.

Bovine Blood Plasma Derivatives Market Product Landscape

The Bovine Blood Plasma Derivatives Market showcases a diverse product landscape catering to a wide array of critical applications. Key innovations focus on enhancing the purity and specific activity of derivatives, leading to improved performance in demanding scientific and industrial processes. Fetal Bovine Serum (FBS) remains a flagship product, with advancements in its collection, processing, and sterile filtration techniques ensuring lot-to-lot consistency and reduced variability in cell culture experiments. Bovine Serum Albumin (BSA) is another vital product, utilized extensively as a blocking agent in immunoassays, a stabilizer for enzymes, and a nutrient supplement in cell culture.

Innovations also extend to specialized derivatives like Immunoglobulins and Fibrinogen, finding applications in therapeutic treatments and diagnostic tools. The development of cell-culture grade reagents and highly purified enzymes derived from bovine plasma further enhances their utility. Unique selling propositions often lie in the stringent quality control measures, traceability of source material, and the ability to meet specific purity and compositional requirements demanded by regulated industries, thereby driving their widespread adoption.

Key Drivers, Barriers & Challenges in Bovine Blood Plasma Derivatives Market

Key Drivers:

- Advancements in Cell Culture Technology: The growing importance of cell-based assays and biopharmaceutical production directly fuels demand for high-quality bovine blood plasma derivatives, especially Fetal Bovine Serum.

- Expanding Pharmaceutical and Biotechnology R&D: Increased investment in drug discovery, vaccine development, and personalized medicine necessitates the use of these essential biological components.

- Growing Food Industry Applications: Specific derivatives are finding increasing use as functional ingredients and processing aids in the food sector.

- Technological Innovations in Extraction and Purification: Improved methods enhance product quality, purity, and consistency, making derivatives more attractive for sensitive applications.

Barriers & Challenges:

- Ethical Concerns and Regulatory Scrutiny: Concerns regarding animal welfare and stringent regulations surrounding the sourcing and use of animal-derived products can create barriers.

- Supply Chain Volatility: Fluctuations in the availability of raw bovine plasma, influenced by factors like animal disease outbreaks or changes in livestock populations, can disrupt supply.

- Development of Alternative Technologies: The emergence of animal-free media and recombinant protein alternatives in specific applications poses a competitive threat.

- High Cost of Production and Quality Control: Maintaining the high purity and quality standards required for pharmaceutical and research applications incurs significant production costs.

Emerging Opportunities in Bovine Blood Plasma Derivatives Market

The Bovine Blood Plasma Derivatives Market presents several promising emerging opportunities. The increasing focus on regenerative medicine and tissue engineering offers a significant avenue for growth, as derivatives like growth factors and extracellular matrix components derived from bovine plasma are crucial for these advanced therapies. Furthermore, the development of animal-free or serum-reduced cell culture media is an area of intense research, presenting an opportunity for companies to innovate and offer highly defined and optimized formulations that reduce or eliminate the reliance on traditional FBS.

The expanding applications in the veterinary diagnostics and therapeutics sector also represent an untapped market. As research into animal health progresses, the demand for specific bovine plasma derivatives for diagnostic kits and treatment protocols is expected to rise. Additionally, exploring novel applications in cosmeceuticals, leveraging the protein and peptide content of bovine plasma for skincare products, could open new revenue streams. The growing demand for traceable and ethically sourced biological materials also provides an opportunity for companies to differentiate themselves through transparent sourcing and robust ethical practices.

Growth Accelerators in the Bovine Blood Plasma Derivatives Market Industry

Several key catalysts are accelerating the long-term growth of the Bovine Blood Plasma Derivatives Market. Technological breakthroughs in plasma fractionation and purification, leading to higher yields and purer derivatives, are a major growth accelerator. For instance, advances in continuous chromatography techniques are enabling more efficient and scalable production. Strategic partnerships and collaborations between raw material suppliers, manufacturers, and end-users are fostering innovation and ensuring a stable supply chain, crucial for meeting the growing demand.

The increasing focus on biologics manufacturing globally, driven by the need for advanced therapeutics like monoclonal antibodies and vaccines, is a significant growth driver. Companies are investing heavily in expanding their bioprocessing capabilities, which directly translates to a higher demand for essential components like Fetal Bovine Serum and other plasma derivatives. Market expansion into emerging economies, where the pharmaceutical and biotechnology sectors are rapidly developing, also presents substantial growth opportunities. Furthermore, the ongoing research into new therapeutic applications of plasma-derived proteins, such as for wound healing and immune modulation, will continue to fuel market expansion.

Key Players Shaping the Bovine Blood Plasma Derivatives Market Market

- LAMPIRE Biological Labs Inc

- Auckland BioSciences Ltd

- Kraeber & Co GmbH

- ROCKY MOUNTAIN BIOLOGICALS

- Bovogen Biologicals

- Merck KGaA

- TCS Biosciences

- SeraCare

- Lake Immunogenics Inc

- Tissue Culture Biologicals

- Thermo Fisher Scientific

- MP BIOMEDICALS

Notable Milestones in Bovine Blood Plasma Derivatives Market Sector

- 2019: Launch of novel, low-endotoxin Fetal Bovine Serum formulations by leading manufacturers, improving cell culture performance in sensitive applications.

- 2020: Increased demand for Immunoglobulins for potential therapeutic uses in viral infections, spurring research and development in purification techniques.

- 2021: Mergers and acquisitions aimed at consolidating supply chains and expanding product portfolios within the bovine plasma derivatives space.

- 2022: Advancements in animal disease surveillance and testing protocols to ensure the safety and traceability of bovine plasma.

- 2023: Growing interest and investment in developing chemically defined and animal-component-free alternatives for certain serum applications.

- 2024: Introduction of specialized bovine plasma derivatives for advanced cell therapy manufacturing and gene editing applications.

In-Depth Bovine Blood Plasma Derivatives Market Market Outlook

The Bovine Blood Plasma Derivatives Market is poised for continued robust growth, driven by sustained demand from the pharmaceutical, biotechnology, and research sectors. Key growth accelerators, including ongoing technological innovations in purification and fractionation, the expanding biologics manufacturing landscape, and strategic market expansions, will underpin this expansion. The increasing adoption of these derivatives in emerging economies and the continuous exploration of novel therapeutic applications, particularly in regenerative medicine and advanced cell therapies, represent significant future market potential. Companies that focus on product quality, ethical sourcing, and innovative solutions, such as highly defined media components, are well-positioned to capitalize on the evolving demands of the global market. Strategic partnerships and a commitment to regulatory compliance will be critical for navigating the dynamic market landscape and securing long-term success.

Bovine Blood Plasma Derivatives Market Segmentation

-

1. Derivative

- 1.1. Immunoglobulin

- 1.2. Fibrinogen

- 1.3. Bovin Serum Albumin

- 1.4. Fetal Bovin Serum

- 1.5. Newborn Calf Serum

- 1.6. Thrombin

- 1.7. Other Derivatives

-

2. End-user Industries

- 2.1. Pharmaceutical and Biotechnology Companies

- 2.2. Academic and Research Institutes

- 2.3. Food Industry

- 2.4. Other End-user Industries

Bovine Blood Plasma Derivatives Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Bovine Blood Plasma Derivatives Market Regional Market Share

Geographic Coverage of Bovine Blood Plasma Derivatives Market

Bovine Blood Plasma Derivatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Reserach and Develpment Activity in Pharmaceutical and Biotechnology Industries; Increasing Use of Bovine Plasma Derivatives in the Production of Plasma Powder in Animal Feed Insustry.; Technological Advancements in Processing Techniques of Bovin Plasma Derivatives

- 3.3. Market Restrains

- 3.3.1. High Chances of Zoonotic Diseases Transmit From Bovine Blood Plasma Derivatives; Alternative Available for Bovine Plasma Derivatives

- 3.4. Market Trends

- 3.4.1. Thrombin Segment is Expected to Dominate the Bovine Blood Plasma Derivatives Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Derivative

- 5.1.1. Immunoglobulin

- 5.1.2. Fibrinogen

- 5.1.3. Bovin Serum Albumin

- 5.1.4. Fetal Bovin Serum

- 5.1.5. Newborn Calf Serum

- 5.1.6. Thrombin

- 5.1.7. Other Derivatives

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Pharmaceutical and Biotechnology Companies

- 5.2.2. Academic and Research Institutes

- 5.2.3. Food Industry

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Derivative

- 6. North America Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Derivative

- 6.1.1. Immunoglobulin

- 6.1.2. Fibrinogen

- 6.1.3. Bovin Serum Albumin

- 6.1.4. Fetal Bovin Serum

- 6.1.5. Newborn Calf Serum

- 6.1.6. Thrombin

- 6.1.7. Other Derivatives

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Pharmaceutical and Biotechnology Companies

- 6.2.2. Academic and Research Institutes

- 6.2.3. Food Industry

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Derivative

- 7. Europe Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Derivative

- 7.1.1. Immunoglobulin

- 7.1.2. Fibrinogen

- 7.1.3. Bovin Serum Albumin

- 7.1.4. Fetal Bovin Serum

- 7.1.5. Newborn Calf Serum

- 7.1.6. Thrombin

- 7.1.7. Other Derivatives

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Pharmaceutical and Biotechnology Companies

- 7.2.2. Academic and Research Institutes

- 7.2.3. Food Industry

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Derivative

- 8. Asia Pacific Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Derivative

- 8.1.1. Immunoglobulin

- 8.1.2. Fibrinogen

- 8.1.3. Bovin Serum Albumin

- 8.1.4. Fetal Bovin Serum

- 8.1.5. Newborn Calf Serum

- 8.1.6. Thrombin

- 8.1.7. Other Derivatives

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Pharmaceutical and Biotechnology Companies

- 8.2.2. Academic and Research Institutes

- 8.2.3. Food Industry

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Derivative

- 9. Middle East and Africa Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Derivative

- 9.1.1. Immunoglobulin

- 9.1.2. Fibrinogen

- 9.1.3. Bovin Serum Albumin

- 9.1.4. Fetal Bovin Serum

- 9.1.5. Newborn Calf Serum

- 9.1.6. Thrombin

- 9.1.7. Other Derivatives

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Pharmaceutical and Biotechnology Companies

- 9.2.2. Academic and Research Institutes

- 9.2.3. Food Industry

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Derivative

- 10. South America Bovine Blood Plasma Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Derivative

- 10.1.1. Immunoglobulin

- 10.1.2. Fibrinogen

- 10.1.3. Bovin Serum Albumin

- 10.1.4. Fetal Bovin Serum

- 10.1.5. Newborn Calf Serum

- 10.1.6. Thrombin

- 10.1.7. Other Derivatives

- 10.2. Market Analysis, Insights and Forecast - by End-user Industries

- 10.2.1. Pharmaceutical and Biotechnology Companies

- 10.2.2. Academic and Research Institutes

- 10.2.3. Food Industry

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Derivative

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LAMPIRE Biological Labs Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Auckland BioSciences Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kraeber & Co GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ROCKY MOUNTAIN BIOLOGICALS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bovogen Biologicals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TCS Biosciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SeraCare

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lake Immunogenics Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tissue Culture Biologicals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thermo Fisher Scientific

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MP BIOMEDICALS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 LAMPIRE Biological Labs Inc

List of Figures

- Figure 1: Global Bovine Blood Plasma Derivatives Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bovine Blood Plasma Derivatives Market Revenue (Million), by Derivative 2025 & 2033

- Figure 3: North America Bovine Blood Plasma Derivatives Market Revenue Share (%), by Derivative 2025 & 2033

- Figure 4: North America Bovine Blood Plasma Derivatives Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 5: North America Bovine Blood Plasma Derivatives Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: North America Bovine Blood Plasma Derivatives Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Bovine Blood Plasma Derivatives Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bovine Blood Plasma Derivatives Market Revenue (Million), by Derivative 2025 & 2033

- Figure 9: Europe Bovine Blood Plasma Derivatives Market Revenue Share (%), by Derivative 2025 & 2033

- Figure 10: Europe Bovine Blood Plasma Derivatives Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 11: Europe Bovine Blood Plasma Derivatives Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: Europe Bovine Blood Plasma Derivatives Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bovine Blood Plasma Derivatives Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue (Million), by Derivative 2025 & 2033

- Figure 15: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue Share (%), by Derivative 2025 & 2033

- Figure 16: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 17: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Bovine Blood Plasma Derivatives Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue (Million), by Derivative 2025 & 2033

- Figure 21: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue Share (%), by Derivative 2025 & 2033

- Figure 22: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 23: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Bovine Blood Plasma Derivatives Market Revenue (Million), by Derivative 2025 & 2033

- Figure 27: South America Bovine Blood Plasma Derivatives Market Revenue Share (%), by Derivative 2025 & 2033

- Figure 28: South America Bovine Blood Plasma Derivatives Market Revenue (Million), by End-user Industries 2025 & 2033

- Figure 29: South America Bovine Blood Plasma Derivatives Market Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: South America Bovine Blood Plasma Derivatives Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Bovine Blood Plasma Derivatives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 2: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 5: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 11: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 20: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 21: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 29: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 30: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Derivative 2020 & 2033

- Table 35: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 36: Global Bovine Blood Plasma Derivatives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Bovine Blood Plasma Derivatives Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bovine Blood Plasma Derivatives Market?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Bovine Blood Plasma Derivatives Market?

Key companies in the market include LAMPIRE Biological Labs Inc, Auckland BioSciences Ltd, Kraeber & Co GmbH, ROCKY MOUNTAIN BIOLOGICALS, Bovogen Biologicals, Merck KGaA, TCS Biosciences, SeraCare, Lake Immunogenics Inc, Tissue Culture Biologicals, Thermo Fisher Scientific, MP BIOMEDICALS.

3. What are the main segments of the Bovine Blood Plasma Derivatives Market?

The market segments include Derivative, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Reserach and Develpment Activity in Pharmaceutical and Biotechnology Industries; Increasing Use of Bovine Plasma Derivatives in the Production of Plasma Powder in Animal Feed Insustry.; Technological Advancements in Processing Techniques of Bovin Plasma Derivatives.

6. What are the notable trends driving market growth?

Thrombin Segment is Expected to Dominate the Bovine Blood Plasma Derivatives Market During the Forecast Period.

7. Are there any restraints impacting market growth?

High Chances of Zoonotic Diseases Transmit From Bovine Blood Plasma Derivatives; Alternative Available for Bovine Plasma Derivatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bovine Blood Plasma Derivatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bovine Blood Plasma Derivatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bovine Blood Plasma Derivatives Market?

To stay informed about further developments, trends, and reports in the Bovine Blood Plasma Derivatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence