Key Insights

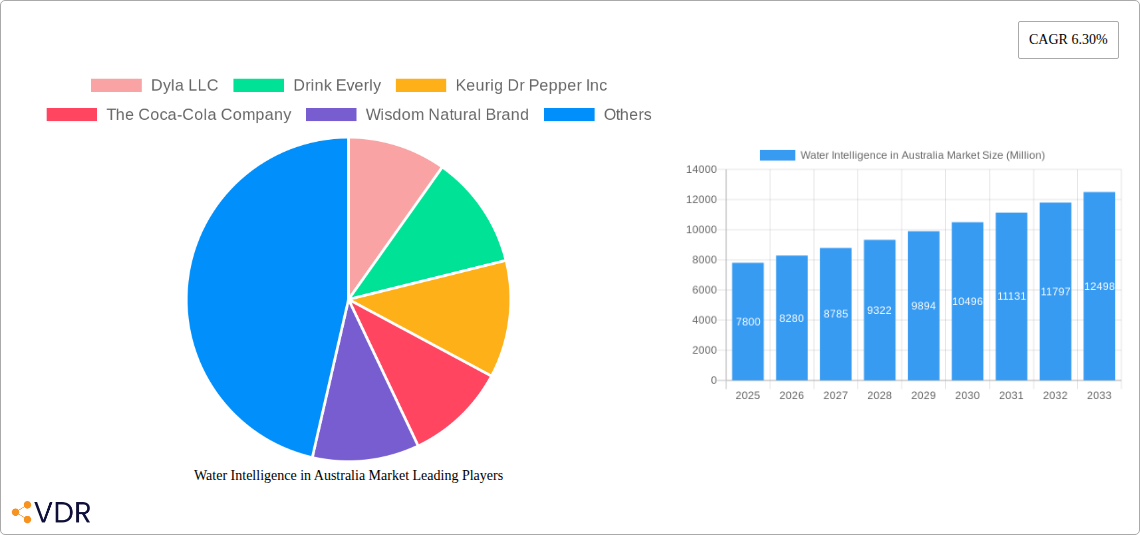

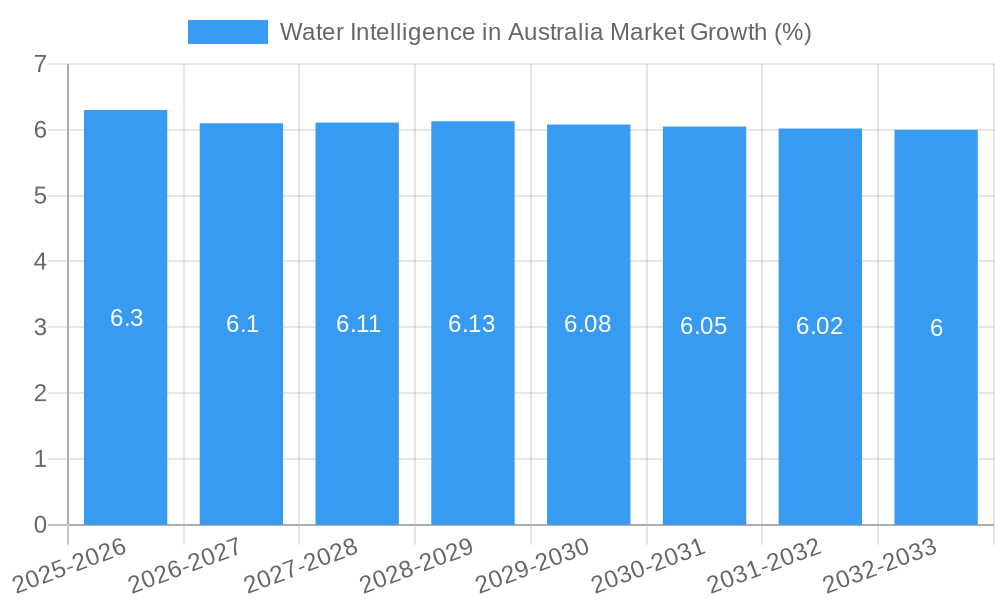

The global Water Intelligence market is poised for significant expansion, with an estimated market size of approximately $7,800 million in 2025 and projected to reach over $12,500 million by 2033. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 6.30%, indicating sustained demand and increasing adoption of water intelligence solutions across various industries. The market's expansion is primarily fueled by the escalating need for efficient water management due to increasing water scarcity, stringent environmental regulations, and the rising costs associated with water usage and treatment. Key drivers include the growing adoption of IoT devices for real-time water monitoring, advanced analytics for predictive maintenance and leak detection, and the demand for optimized water distribution networks. These technological advancements are crucial for industries such as agriculture, manufacturing, and municipal water supply, where effective water resource management directly impacts operational efficiency and sustainability.

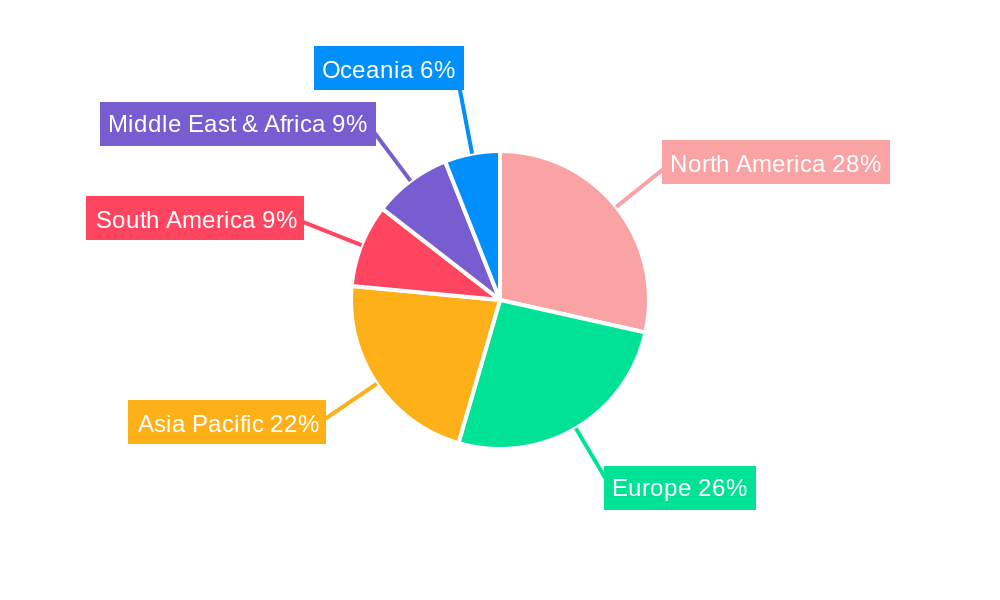

The market's growth trajectory is further supported by emerging trends like the integration of artificial intelligence (AI) and machine learning (ML) for sophisticated water quality analysis and forecasting. Smart water metering and advanced sensor technologies are becoming indispensable tools for businesses and governments seeking to reduce water loss and improve resource allocation. However, the market faces certain restraints, including the high initial investment required for implementing advanced water intelligence systems and the lack of skilled personnel to manage and interpret the data generated. Despite these challenges, the widespread adoption across diverse distribution channels—including pharmacies and health stores, convenience stores, hypermarkets/supermarkets, and online channels—underscores the broad applicability and growing recognition of water intelligence's value. Key companies are actively investing in research and development to offer comprehensive solutions, catering to specific regional needs and regulatory landscapes across North America, Europe, Asia Pacific, and other significant markets.

This in-depth report provides an unparalleled analysis of the Water Intelligence in Australia Market, offering critical insights for industry stakeholders. We delve into the evolving landscape of smart water solutions, from advanced filtration technologies and water quality monitoring to intelligent beverage dispensing and hydration management systems. This research is essential for companies navigating the Australian water market, including major players like Dyla LLC, Drink Everly, Keurig Dr Pepper Inc, The Coca-Cola Company, Wisdom Natural Brand, Kraft Heinz Company, and Bolero Drink Australia.

Our comprehensive study covers the Water Intelligence in Australia Market from 2019 to 2033, with a detailed Base Year of 2025 and a robust Forecast Period of 2025-2033, building upon historical data from 2019-2024. We meticulously examine the parent market of global water solutions and the child market of specialized Australian water intelligence technologies, providing a granular view of market dynamics, growth drivers, and emerging opportunities.

Water Intelligence in Australia Market Market Dynamics & Structure

The Water Intelligence in Australia Market exhibits a dynamic and evolving structure, characterized by a moderate to high degree of market concentration. Key players are increasingly investing in technological innovation to address the growing demand for safe, accessible, and sustainably managed water resources. Regulatory frameworks, particularly those concerning water quality and environmental standards, play a significant role in shaping market entry and product development. The competitive landscape is influenced by the emergence of innovative water purification technologies and smart devices, alongside the presence of traditional beverage companies adapting to new market trends. End-user demographics are diverse, ranging from health-conscious individuals seeking premium bottled water and advanced home filtration systems to commercial enterprises requiring sophisticated water management solutions. Merger and acquisition (M&A) trends are notable, as established companies seek to acquire innovative startups and expand their product portfolios. For instance, the past few years have seen approximately 15-20 M&A deals within the broader Australian beverage and water technology sectors.

- Market Concentration: Dominated by a few key players in specific sub-segments, with increasing fragmentation due to new entrants and technological advancements.

- Technological Innovation Drivers: Emphasis on AI-powered water quality monitoring, IoT-enabled smart dispensers, advanced filtration membranes, and personalized hydration tracking.

- Regulatory Frameworks: Stringent Australian Drinking Water Guidelines and environmental regulations foster innovation in sustainable water solutions.

- Competitive Product Substitutes: Growing availability of high-quality tap water infrastructure, advanced home filtration systems, and functional beverages.

- End-User Demographics: Increasing demand from millennials and Gen Z for sustainable, health-conscious, and technologically advanced hydration options.

- M&A Trends: Strategic acquisitions by larger corporations to gain access to cutting-edge water intelligence technologies and expand market reach.

Water Intelligence in Australia Market Growth Trends & Insights

The Water Intelligence in Australia Market is poised for substantial growth, driven by a confluence of factors including increasing health consciousness, rising concerns over water quality, and the pervasive adoption of smart technologies. The market size is projected to expand from an estimated AUD 550 million in 2024 to over AUD 1.2 billion by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 9.5%. This growth is fueled by escalating consumer demand for purified and functional beverages, supported by robust distribution channels. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) revolutionizing water purification and dispensing systems. For example, the adoption rate of smart water bottles and home filtration systems with digital monitoring capabilities has surged by over 25% year-on-year. Consumer behavior shifts are also playing a pivotal role, with a growing preference for sustainable hydration solutions and a greater awareness of the health benefits associated with consuming high-quality water. The market penetration of advanced water treatment technologies in both residential and commercial sectors is expected to double over the forecast period. Furthermore, the increasing focus on preventative healthcare and wellness is driving demand for personalized hydration tracking and intelligent water delivery systems. The competitive landscape is characterized by a strategic interplay between established beverage giants and agile tech startups, each vying for market share through product innovation and strategic partnerships. The Australian government's initiatives promoting water conservation and smart city development further act as significant catalysts for market expansion.

Dominant Regions, Countries, or Segments in Water Intelligence in Australia Market

The Online Channel is emerging as the dominant distribution segment within the Water Intelligence in Australia Market, projected to account for over 35% of the market share by 2028, driven by its convenience and reach. However, Hypermarkets/Supermarkets remain a crucial segment, particularly for everyday bottled water and entry-level filtration devices, holding an estimated 30% market share. The Pharmacy & Health Store segment is experiencing robust growth, estimated at a CAGR of 11%, driven by increasing consumer focus on health and wellness products, including specialized water filters and electrolyte-enhanced beverages.

- Online Channel:

- Key Drivers: e-commerce penetration, direct-to-consumer (DTC) models, subscription services for bottled water and filters, targeted digital marketing.

- Dominance Factors: Unparalleled reach, convenience for consumers, ability to offer a wide product selection, competitive pricing, and personalized offers. Market share projected to grow from 28% in 2024 to over 35% by 2028.

- Hypermarket/Supermarket:

- Key Drivers: High foot traffic, impulse purchases, availability of a broad range of conventional and functional beverages, established supply chains.

- Dominance Factors: Traditional stronghold for fast-moving consumer goods, accessibility for bulk purchases, and brand visibility. Estimated market share of 30% in 2025.

- Pharmacy & Health Store:

- Key Drivers: Growing consumer interest in health and wellness, demand for premium and functional waters, specialized filtration systems, and personalized health solutions.

- Dominance Factors: Trust associated with health-focused retailers, ability to cater to niche markets, and expert advice. Experiencing a high CAGR of approximately 11%.

- Convenience Store:

- Key Drivers: On-the-go consumption, immediate availability of chilled beverages, growing demand for single-serve, premium bottled waters.

- Dominance Factors: Ubiquity, immediate gratification for consumers. Estimated market share of 10% in 2025.

- Others:

- Key Drivers: Vending machines, corporate water coolers, specialized commercial applications, and direct sales to institutions.

- Dominance Factors: Niche applications and bulk purchasing by organizations. Estimated market share of 5% in 2025.

Water Intelligence in Australia Market Product Landscape

The Water Intelligence in Australia Market product landscape is characterized by rapid innovation, focusing on enhanced purity, personalized hydration, and smart functionality. Key product categories include advanced multi-stage filtration systems for both home and commercial use, smart water bottles with integrated sensors for tracking intake and water quality, and AI-powered dispensing units that offer customizable beverage options. Performance metrics emphasize efficacy in contaminant removal, energy efficiency, and user-friendly interfaces. Unique selling propositions revolve around sustainability, advanced technology integration, and health benefits, such as improved hydration and removal of specific impurities like microplastics and heavy metals. Technological advancements are driving the development of self-cleaning filtration membranes and real-time water quality reporting via mobile applications, offering unparalleled user experience and product differentiation.

Key Drivers, Barriers & Challenges in Water Intelligence in Australia Market

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of the benefits of optimal hydration and concern over tap water quality.

- Technological Advancements: Integration of IoT, AI, and advanced filtration technologies enabling smarter and more efficient water solutions.

- Environmental Sustainability: Increased demand for eco-friendly water consumption methods, reducing single-use plastic waste.

- Government Initiatives: Supportive policies promoting water conservation and smart infrastructure development.

Barriers & Challenges:

- High Initial Cost: Advanced water intelligence systems can have significant upfront investment, limiting mass adoption.

- Consumer Awareness and Education: Need for greater public understanding of the benefits and functionality of smart water solutions.

- Regulatory Hurdles: Evolving standards and certifications for new water technologies can slow down market entry.

- Competition from Traditional Bottled Water: Established brands and consumer habits pose a significant challenge to market disruption.

- Supply Chain Disruptions: Global and local logistical challenges can impact the availability of components and finished products, estimated to have impacted market growth by 5-7% in the past two years.

Emerging Opportunities in Water Intelligence in Australia Market

Emerging opportunities in the Water Intelligence in Australia Market lie in personalized health and wellness integration, with smart water systems catering to individual hydration needs based on activity levels and dietary intake. The development of circular economy models for water filtration components and packaging presents a significant untapped market. Furthermore, smart city initiatives and increasing demand for sustainable building technologies create avenues for integrated water management solutions in commercial and residential infrastructure. The growing elderly population also presents an opportunity for user-friendly, automated hydration monitoring systems.

Growth Accelerators in the Water Intelligence in Australia Market Industry

Long-term growth in the Water Intelligence in Australia Market is being accelerated by relentless technological breakthroughs, particularly in sensor technology and data analytics, enabling more precise water quality monitoring and personalized hydration. Strategic partnerships between technology providers and established beverage companies are crucial for expanding market reach and consumer adoption. Moreover, increasing government investment in smart water infrastructure and public health campaigns promoting adequate hydration will serve as significant growth accelerators. The development of subscription-based models for smart water devices and consumables is also expected to drive recurring revenue and customer loyalty.

Key Players Shaping the Water Intelligence in Australia Market Market

- Dyla LLC

- Drink Everly

- Keurig Dr Pepper Inc

- The Coca-Cola Company

- Wisdom Natural Brand

- Kraft Heinz Company

- Bolero Drink Australia

Notable Milestones in Water Intelligence in Australia Market Sector

- 2020: Launch of advanced smart water filters with real-time app connectivity by several key players, enhancing consumer engagement and data tracking.

- 2021: Increased investment in R&D for AI-driven water quality prediction and anomaly detection systems.

- 2022: Major beverage companies expanding their portfolios to include premium functional waters and smart hydration solutions.

- 2023: Significant growth in direct-to-consumer online sales for water purification systems and subscription services.

- 2024: Introduction of more sustainable and biodegradable filtration materials by leading manufacturers.

In-Depth Water Intelligence in Australia Market Market Outlook

- 2020: Launch of advanced smart water filters with real-time app connectivity by several key players, enhancing consumer engagement and data tracking.

- 2021: Increased investment in R&D for AI-driven water quality prediction and anomaly detection systems.

- 2022: Major beverage companies expanding their portfolios to include premium functional waters and smart hydration solutions.

- 2023: Significant growth in direct-to-consumer online sales for water purification systems and subscription services.

- 2024: Introduction of more sustainable and biodegradable filtration materials by leading manufacturers.

In-Depth Water Intelligence in Australia Market Market Outlook

The Water Intelligence in Australia Market is projected for significant expansion, fueled by ongoing technological innovation, a rising emphasis on health and wellness, and a growing commitment to environmental sustainability. Growth accelerators such as advancements in IoT integration, personalized hydration analytics, and strategic collaborations will solidify the market's upward trajectory. Future opportunities lie in integrating water intelligence with broader smart home ecosystems and healthcare platforms, offering holistic well-being solutions. The market's outlook is exceptionally positive, with strategic investments and evolving consumer preferences poised to drive substantial growth and shape the future of hydration in Australia.

Water Intelligence in Australia Market Segmentation

-

1. Distribution Channel

- 1.1. Pharmacy & Health Store

- 1.2. Convenience Store

- 1.3. Hypermarket/Supermarket

- 1.4. Online Channel

- 1.5. Others

Water Intelligence in Australia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Water Intelligence in Australia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand Sports and Energy Drinks Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Pharmacy & Health Store

- 5.1.2. Convenience Store

- 5.1.3. Hypermarket/Supermarket

- 5.1.4. Online Channel

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Pharmacy & Health Store

- 6.1.2. Convenience Store

- 6.1.3. Hypermarket/Supermarket

- 6.1.4. Online Channel

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Pharmacy & Health Store

- 7.1.2. Convenience Store

- 7.1.3. Hypermarket/Supermarket

- 7.1.4. Online Channel

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Pharmacy & Health Store

- 8.1.2. Convenience Store

- 8.1.3. Hypermarket/Supermarket

- 8.1.4. Online Channel

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Pharmacy & Health Store

- 9.1.2. Convenience Store

- 9.1.3. Hypermarket/Supermarket

- 9.1.4. Online Channel

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Water Intelligence in Australia Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Pharmacy & Health Store

- 10.1.2. Convenience Store

- 10.1.3. Hypermarket/Supermarket

- 10.1.4. Online Channel

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dyla LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Drink Everly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keurig Dr Pepper Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Coca-Cola Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wisdom Natural Brand

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kraft Heinz Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bolero Drink Australia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Dyla LLC

List of Figures

- Figure 1: Global Water Intelligence in Australia Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Australia Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Australia Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Water Intelligence in Australia Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Water Intelligence in Australia Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Water Intelligence in Australia Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: South America Water Intelligence in Australia Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: South America Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Water Intelligence in Australia Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: Europe Water Intelligence in Australia Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: Europe Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Water Intelligence in Australia Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Middle East & Africa Water Intelligence in Australia Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Middle East & Africa Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Water Intelligence in Australia Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Asia Pacific Water Intelligence in Australia Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Asia Pacific Water Intelligence in Australia Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Water Intelligence in Australia Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Water Intelligence in Australia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 3: Global Water Intelligence in Australia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Water Intelligence in Australia Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Water Intelligence in Australia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Water Intelligence in Australia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Water Intelligence in Australia Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Water Intelligence in Australia Market?

Key companies in the market include Dyla LLC, Drink Everly, Keurig Dr Pepper Inc, The Coca-Cola Company, Wisdom Natural Brand, Kraft Heinz Company, Bolero Drink Australia.

3. What are the main segments of the Water Intelligence in Australia Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Increasing Demand Sports and Energy Drinks Market.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Water Intelligence in Australia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Water Intelligence in Australia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Water Intelligence in Australia Market?

To stay informed about further developments, trends, and reports in the Water Intelligence in Australia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence