Key Insights

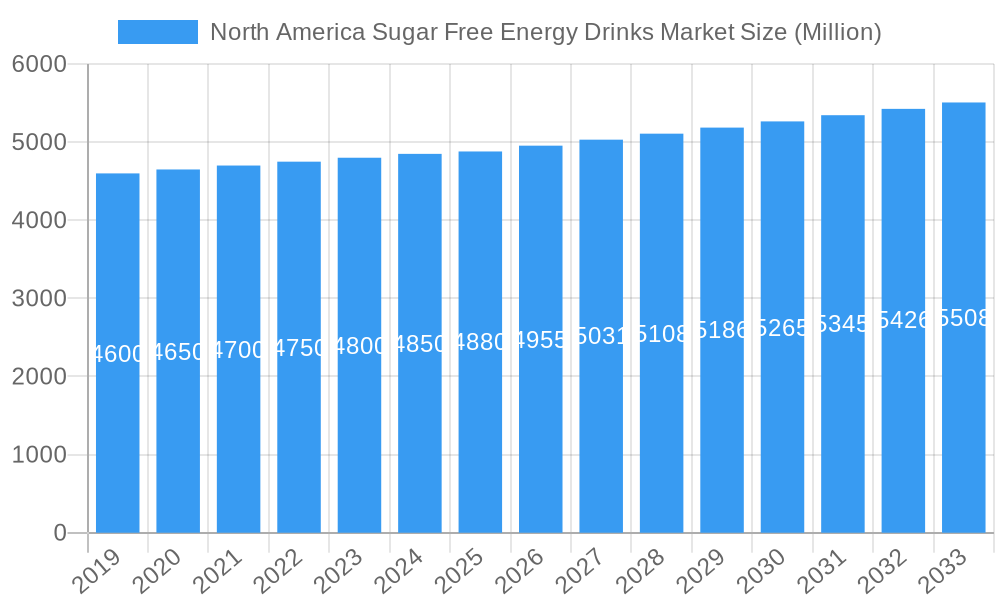

The North American sugar-free energy drinks market is poised for steady expansion, currently valued at approximately $4,880 million. This market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.50% over the forecast period of 2025-2033, indicating a consistent, albeit moderate, upward trajectory. This growth is primarily fueled by an increasing consumer consciousness regarding health and wellness, leading to a preference for beverages with reduced sugar content. Key drivers include the rising demand for functional beverages that offer not only energy but also additional benefits like enhanced focus and improved cognitive function, especially among the young adult demographic and athletes. Furthermore, the expanding distribution networks, encompassing both off-trade channels like convenience stores, online retail, and supermarkets, as well as the on-trade sector, are making these products more accessible to a wider consumer base. The innovation in flavors and product formulations by major players is also contributing to sustained consumer interest and market penetration.

North America Sugar Free Energy Drinks Market Market Size (In Billion)

Despite the positive growth outlook, the market faces certain restraints. The perceived health concerns associated with artificial sweeteners, though often debated, can act as a deterrent for some consumers. Additionally, the intense competition within the broader energy drink market, which includes both sugar-sweetened and other functional beverage alternatives, necessitates continuous product differentiation and marketing efforts. The market segmentation reveals a strong preference for PET bottles, reflecting convenience and portability, alongside a notable presence of glass bottles and metal cans, catering to different consumer preferences and brand positioning. The dominant off-trade channel, with online retail showing significant growth potential, underscores the evolving purchasing habits of consumers. North America, encompassing the United States, Canada, and Mexico, is the primary focus of this market analysis, representing a mature yet dynamic landscape for sugar-free energy drinks.

North America Sugar Free Energy Drinks Market Company Market Share

North America Sugar-Free Energy Drinks Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock critical insights into the booming North American sugar-free energy drinks market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides unparalleled strategic intelligence for manufacturers, distributors, investors, and industry stakeholders. Delve into market dynamics, growth trends, regional dominance, product innovation, key players, and emerging opportunities within the North America sugar-free energy drinks market. Discover detailed breakdowns by packaging type (Glass Bottles, Metal Can, PET Bottles) and distribution channel (Off-trade including Convenience Stores, Online Retail, Supermarket/Hypermarket, Others; On-trade). Navigate the competitive landscape and identify growth accelerators shaping the future of this dynamic sugar-free energy drink industry North America.

North America Sugar Free Energy Drinks Market Market Dynamics & Structure

The North America sugar-free energy drinks market exhibits a moderate to high concentration, with key players like Monster Beverage Corporation, PepsiCo Inc., Red Bull GmbH, and The Coca-Cola Company dominating significant market shares. Technological innovation is a primary driver, with continuous advancements in flavor profiles, ingredient formulations (e.g., natural caffeine sources, added vitamins and antioxidants), and improved delivery systems fueling consumer interest in sugar-free energy drink brands North America. Regulatory frameworks, primarily concerning ingredient labeling, caffeine content, and health claims, play a crucial role in shaping product development and market access. Competitive product substitutes, such as coffee, tea, and other functional beverages, present a constant challenge, emphasizing the need for differentiation through unique value propositions in the North America zero sugar energy drink market. End-user demographics are shifting, with a growing segment of health-conscious millennials and Gen Z consumers actively seeking alternatives to traditional sugary energy drinks, driving demand for low-calorie energy drinks North America. Mergers and acquisitions (M&A) trends are observable, as larger corporations seek to expand their portfolios and acquire innovative startups, contributing to market consolidation. For instance, recent acquisitions by major players aim to tap into niche segments of the North America functional beverage market. Innovation barriers include the high cost of research and development for novel ingredients and formulations, as well as the need to navigate evolving consumer preferences and stringent regulatory approvals.

North America Sugar Free Energy Drinks Market Growth Trends & Insights

The North America sugar-free energy drinks market is experiencing robust growth, propelled by a confluence of evolving consumer preferences and strategic industry advancements. The market size has witnessed a consistent upward trajectory, expanding from xx million units in 2019 to an estimated xx million units in 2025, with a projected CAGR of approximately 8.5% during the forecast period of 2025–2033. This significant expansion is underpinned by increasing consumer awareness regarding the adverse health effects of sugar consumption, leading to a substantial shift towards sugar-free energy drinks North America. Adoption rates for sugar-free variants are particularly high among health-conscious individuals, athletes, and students seeking sustained energy without the caloric and glycemic impact of traditional energy drinks. Technological disruptions are continuously enhancing the product offering. Innovations in natural sweeteners, functional ingredients like nootropics and adaptogens, and the development of novel flavor combinations are attracting new consumer segments and driving repeat purchases in the zero sugar energy drink market North America. Consumer behavior shifts are evident, with a growing demand for transparency in ingredient lists and a preference for beverages with added health benefits beyond just energy boosting, such as improved focus, hydration, and antioxidant support. The market penetration of sugar-free energy drinks is steadily increasing, reflecting their growing acceptance as a mainstream beverage choice. The rise of online retail channels has also played a pivotal role in expanding accessibility and providing consumers with a wider selection of healthier energy drinks North America. Furthermore, the influence of social media and fitness trends continues to shape purchasing decisions, with endorsements from influencers and athletes driving demand for specific brands and product features within the North America clean energy drink market.

Dominant Regions, Countries, or Segments in North America Sugar Free Energy Drinks Market

Within the North America sugar-free energy drinks market, the United States stands out as the dominant country, significantly influencing market growth and trends. This dominance is attributed to a confluence of factors including a large and health-conscious consumer base, a highly developed retail infrastructure, and a strong presence of major beverage manufacturers and innovators. The sheer size of the US population and its increasing propensity to adopt health and wellness trends directly translates into substantial demand for sugar-free alternatives. Economically, the United States offers a robust market with high disposable incomes, enabling consumers to prioritize premium and health-oriented beverage options. Infrastructure, including extensive distribution networks and advanced logistics, ensures widespread availability of sugar-free energy drinks in USA.

Among the segments, Metal Cans as a packaging type hold a leading position due to their convenience, recyclability, and superior barrier properties that preserve product freshness and carbonation. This is particularly favored in the on-the-go consumption patterns prevalent in North America. The Off-trade distribution channel, specifically Supermarkets/Hypermarkets and Online Retail, collectively drive the majority of sales. Supermarkets and hypermarkets offer broad accessibility and product variety, allowing consumers to compare and purchase their preferred sugar-free energy drinks. Online retail, on the other hand, provides unparalleled convenience, a wider selection of niche brands, and competitive pricing, catering to the evolving shopping habits of consumers, especially among younger demographics actively seeking sugar-free energy drink online North America.

The growth potential in these dominant segments is substantial. Continued innovation in can designs and sizes, coupled with strategic placement and promotional activities in retail environments, will further bolster the metal can segment. The online retail segment is expected to witness accelerated growth due to increasing e-commerce penetration and the development of specialized online platforms for beverage sales. Convenience stores also play a crucial role, catering to impulse purchases and immediate consumption needs for sugar-free energy drinks. The overall market share within the US alone accounts for an estimated xx% of the total North American market, with a projected growth rate of xx% annually. The influence of marketing campaigns, especially those highlighting the health benefits and zero-sugar aspect, further solidifies the dominance of these segments and the United States within the North America sugar-free energy drinks market.

North America Sugar Free Energy Drinks Market Product Landscape

The product landscape within the North America sugar-free energy drinks market is characterized by dynamic innovation and a clear focus on delivering enhanced functional benefits. Companies are actively developing sugar-free energy drinks with unique flavor profiles, ranging from classic fruit blends to exotic and novel combinations. Beyond basic energy provision, brands are increasingly incorporating ingredients such as vitamins (e.g., B vitamins), antioxidants, electrolytes for hydration, and nootropics for cognitive enhancement, catering to a more discerning consumer base seeking holistic wellness benefits. Performance metrics are evaluated not only by caffeine content and energy release but also by the absence of artificial sweeteners and the utilization of natural alternatives. Unique selling propositions often revolve around specific functional claims, such as improved focus, enhanced physical performance, or sustained energy release without the jitters and subsequent crash associated with traditional, sugar-laden alternatives. Technological advancements are evident in formulation stability, improved taste masking of artificial sweeteners, and the development of ready-to-drink formats that offer convenience and portability.

Key Drivers, Barriers & Challenges in North America Sugar Free Energy Drinks Market

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of the negative health impacts of sugar is a primary driver, fueling demand for sugar-free energy drinks North America.

- Demand for Functional Benefits: Consumers are seeking energy drinks that offer more than just a caffeine boost, looking for added vitamins, antioxidants, and cognitive enhancers.

- Innovation in Flavors and Ingredients: Continuous product development, including novel flavors and natural sweeteners, attracts a wider consumer base.

- Convenience and On-the-Go Lifestyles: The portable nature of canned and bottled energy drinks aligns with busy lifestyles.

- Influence of Social Media and Fitness Culture: Endorsements and trends promoted on social platforms significantly influence purchasing decisions for sugar-free energy drink brands North America.

Barriers & Challenges:

- Intense Competition: The market is highly competitive, with numerous established and emerging brands vying for consumer attention.

- Regulatory Scrutiny: Evolving regulations concerning ingredient claims, caffeine levels, and labeling pose ongoing challenges.

- Perception of Artificial Ingredients: Some consumers remain skeptical of artificial sweeteners and flavors, leading to a preference for natural alternatives.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials, affecting production and pricing.

- Economic Downturns: Reduced consumer spending during economic slowdowns can impact the sales of premium and non-essential beverages like energy drinks. The impact on market growth can be estimated at a xx% reduction in sales volume during such periods.

Emerging Opportunities in North America Sugar Free Energy Drinks Market

Emerging opportunities in the North America sugar-free energy drinks market lie in the expansion of the plant-based energy drinks segment, catering to a growing vegan and ethically conscious consumer group. Further innovation in functional ingredients, such as adaptogens for stress management and prebiotics for gut health, presents a significant avenue for product differentiation. The development of specialized sugar-free energy drinks tailored for specific demographics, such as gamers, students, or older adults seeking cognitive support, offers untapped market potential. Furthermore, the increasing adoption of sustainable packaging solutions and a commitment to ethical sourcing can resonate with environmentally conscious consumers, creating brand loyalty. The growth of direct-to-consumer (DTC) sales models and subscription services for sugar-free energy drink online North America also presents an opportunity to build stronger customer relationships and gather valuable consumer data.

Growth Accelerators in the North America Sugar Free Energy Drinks Market Industry

Long-term growth in the North America sugar-free energy drinks market will be significantly accelerated by continuous technological breakthroughs in natural sweetener development, enhancing taste profiles while adhering to sugar-free mandates. Strategic partnerships between energy drink manufacturers and popular lifestyle or gaming brands will further expand market reach and consumer engagement. For instance, collaborations leading to limited-edition releases can generate significant buzz and drive sales of sugar-free energy drink brands North America. Market expansion strategies focusing on underserved regions or specific demographic niches, such as functional beverages for active seniors or specialized cognitive enhancers for professionals, will unlock new revenue streams. The increasing integration of e-commerce platforms and the development of sophisticated online marketing campaigns will also play a pivotal role in sustained growth by improving accessibility and consumer reach for sugar-free energy drinks North America.

Key Players Shaping the North America Sugar Free Energy Drinks Market Market

- Monster Beverage Corporation

- Performix LLC

- Vitamin Well Limited

- PepsiCo Inc.

- Jocko Fuel LLC

- Red Bull GmbH

- Living Essentials LLC

- Ghost Beverages LLC

- Woodbolt Distribution LL

- The Coca-Cola Company

- Congo Brands

- G Fuel LLC

Notable Milestones in North America Sugar Free Energy Drinks Market Sector

- April 2023: In partnership with video game development studio CD PROJEKT RED, G Fuel LLC launched a new Immuno-fluid flavor energy drink. G FUEL Immuno-Fluid is an energy formula that is sugar-free and loaded with antioxidants from 18 different fruit extracts, highlighting a strategic move into the gaming and entertainment crossover market.

- April 2023: G Fuel LLC introduced an energy drink called Pickle Juice. This sugar-free beverage claims to have 18 fruit-derived antioxidants, a mere 15 calories per serving, and a caffeine content of 140 mg, showcasing an innovative approach to flavor and functional ingredient combinations.

- January 2023: Monster Beverage Corporation launched Monster Energy Zero Sugar. Monster Energy Zero Sugar is primed with 160 mg of caffeine, demonstrating the company's commitment to expanding its zero-sugar offerings and catering to the growing demand for healthier alternatives.

In-Depth North America Sugar Free Energy Drinks Market Market Outlook

The future outlook for the North America sugar-free energy drinks market remains exceptionally bright, driven by an enduring consumer preference for healthier beverage options and relentless product innovation. Growth accelerators will continue to center on the development of functional ingredients that offer benefits beyond mere energy, such as cognitive enhancement and stress reduction, aligning with holistic wellness trends. Strategic market expansion into untapped demographics and geographical areas, coupled with the increasing sophistication of online retail and direct-to-consumer channels, will further solidify market penetration. Partnerships with prominent entities in adjacent industries, like gaming and fitness, will be crucial for maintaining brand relevance and attracting new consumer segments. The ongoing evolution of sustainable packaging and ethical sourcing practices will also contribute to brand differentiation and consumer loyalty. The market is poised for sustained growth, offering significant opportunities for stakeholders to capitalize on evolving consumer demands for effective, sugar-free, and functionally advanced energy solutions.

North America Sugar Free Energy Drinks Market Segmentation

-

1. Packaging Type

- 1.1. Glass Bottles

- 1.2. Metal Can

- 1.3. PET Bottles

-

2. Distribution Channel

-

2.1. Off-trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Supermarket/Hypermarket

- 2.1.4. Others

- 2.2. On-trade

-

2.1. Off-trade

North America Sugar Free Energy Drinks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Sugar Free Energy Drinks Market Regional Market Share

Geographic Coverage of North America Sugar Free Energy Drinks Market

North America Sugar Free Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sugar Free Energy Drinks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Glass Bottles

- 5.1.2. Metal Can

- 5.1.3. PET Bottles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Supermarket/Hypermarket

- 5.2.1.4. Others

- 5.2.2. On-trade

- 5.2.1. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Monster Beverage Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Performix LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vitamin Well Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jocko Fuel LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Red Bull GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Living Essentials LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ghost Beverages LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Woodbolt Distribution LL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Coca-Cola Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Congo Brands

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 G Fuel LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Monster Beverage Corporation

List of Figures

- Figure 1: North America Sugar Free Energy Drinks Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Sugar Free Energy Drinks Market Share (%) by Company 2025

List of Tables

- Table 1: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Packaging Type 2020 & 2033

- Table 3: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Region 2020 & 2033

- Table 7: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Packaging Type 2020 & 2033

- Table 9: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Sugar Free Energy Drinks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Sugar Free Energy Drinks Market Volume liter Forecast, by Country 2020 & 2033

- Table 13: United States North America Sugar Free Energy Drinks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Sugar Free Energy Drinks Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Sugar Free Energy Drinks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Sugar Free Energy Drinks Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Sugar Free Energy Drinks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Sugar Free Energy Drinks Market Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sugar Free Energy Drinks Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the North America Sugar Free Energy Drinks Market?

Key companies in the market include Monster Beverage Corporation, Performix LLC, Vitamin Well Limited, PepsiCo Inc, Jocko Fuel LLC, Red Bull GmbH, Living Essentials LLC, Ghost Beverages LLC, Woodbolt Distribution LL, The Coca-Cola Company, Congo Brands, G Fuel LLC.

3. What are the main segments of the North America Sugar Free Energy Drinks Market?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4880 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

April 2023: In partnership with video game development studio CD PROJEKT RED, the company has launched a new Immuno-fluid flavor energy drink. G FUEL Immuno-Fluid is an energy formula that is sugar-free and loaded with antioxidants from 18 different fruit extracts.April 2023: G Fuel LLC introduced an energy drink called Pickle Juice. This sugar-free beverage claims to have 18 fruit-derived antioxidants, a mere 15 calories per serving, and a caffeine content of 140 mg.January 2023: Monster Beverage Corporation launched Monster Energy Zero Sugar. Monster Energy Zero Sugar is primed with 160 mg of caffeine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sugar Free Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sugar Free Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sugar Free Energy Drinks Market?

To stay informed about further developments, trends, and reports in the North America Sugar Free Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence