Key Insights

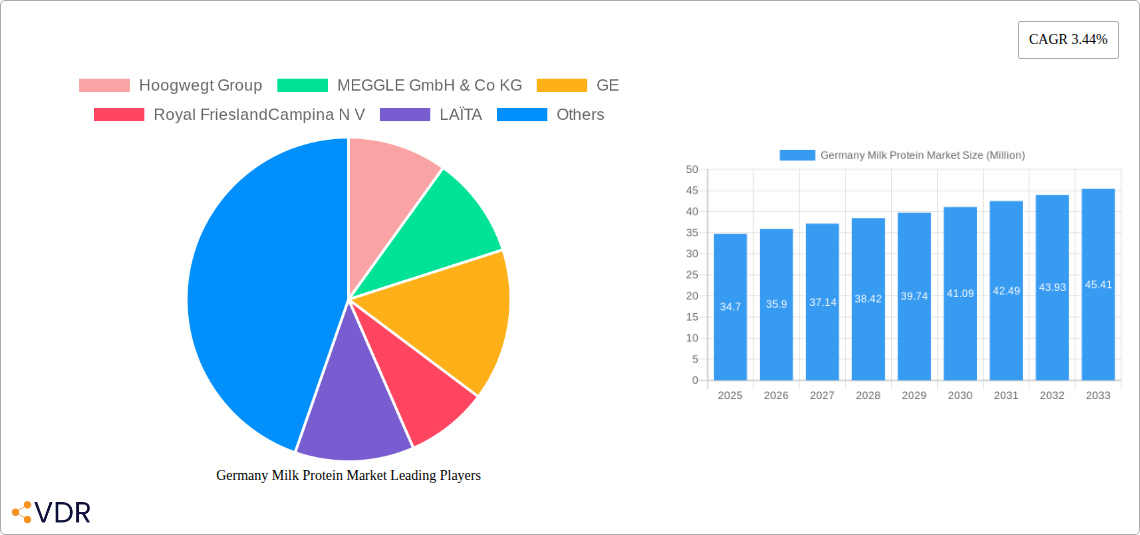

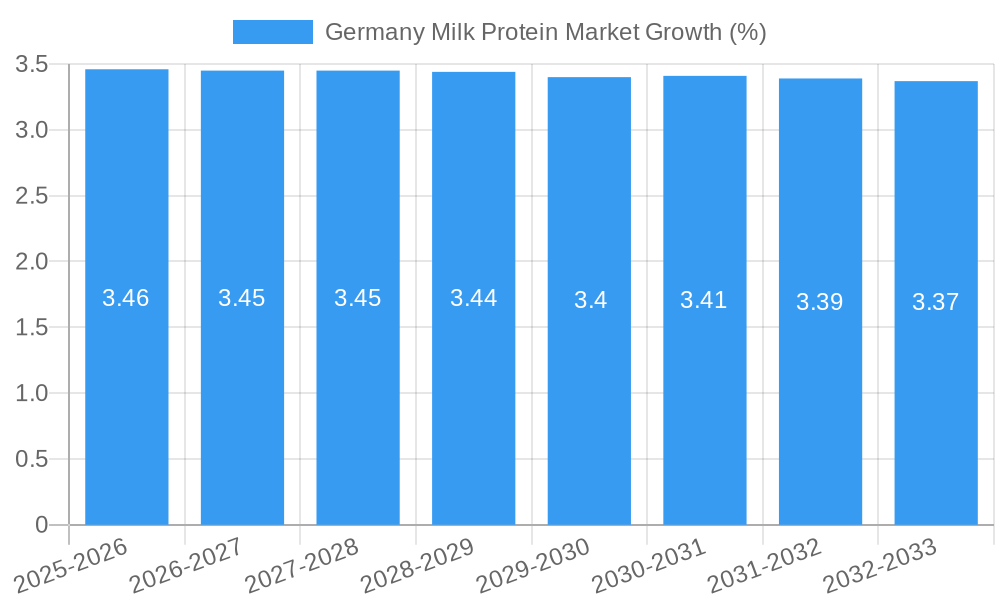

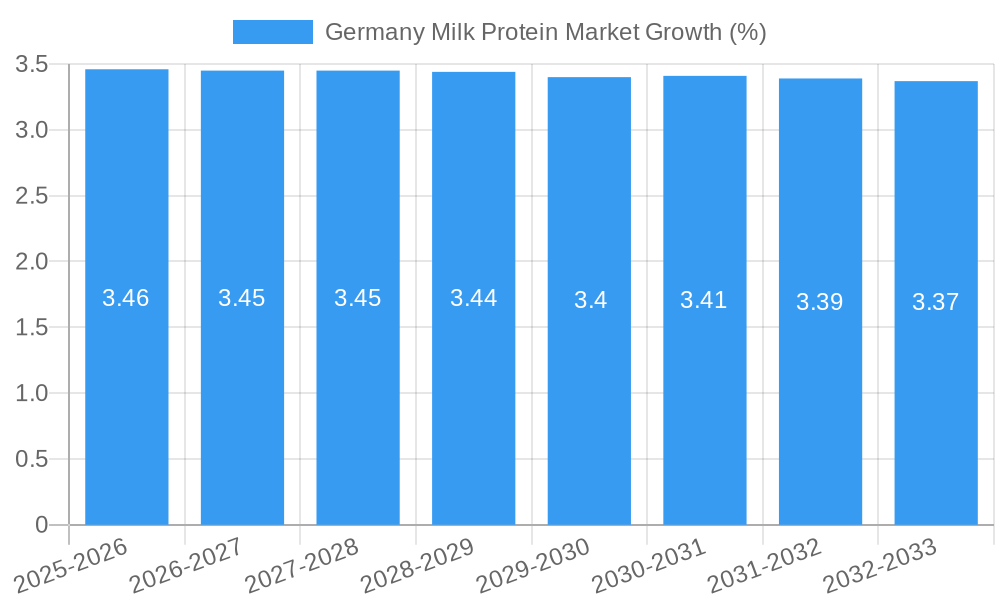

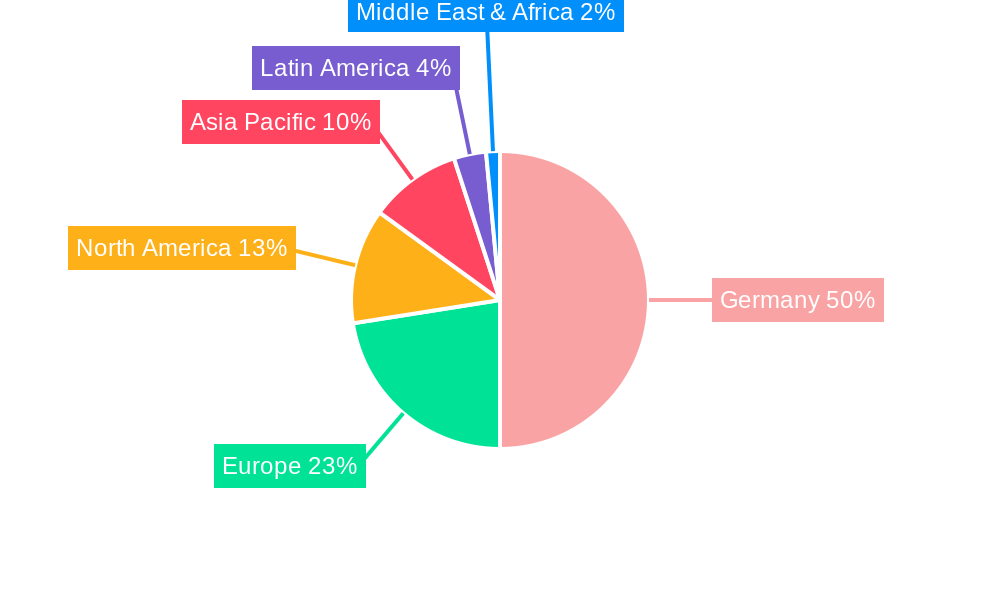

The German milk protein market is poised for steady growth, projected to reach approximately €34.70 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.44% through 2033. This expansion is fueled by a growing consumer preference for high-protein diets, particularly within the health and wellness sector, and the increasing demand for natural, nutritious ingredients in food and beverage applications. The rising popularity of sports nutrition and elderly care products, both significant segments for milk protein derivatives like isolates and concentrates, is a key driver. Furthermore, advancements in processing technologies are enhancing the functionality and appeal of milk proteins, making them versatile ingredients for a wider range of products, including dairy alternatives, bakery items, and convenience foods. The animal feed sector also contributes to this growth, leveraging milk proteins for their nutritional benefits in livestock and pet food formulations.

Despite the positive outlook, the market faces certain restraints, including fluctuating raw milk prices, which can impact production costs and final product pricing. Stringent regulatory frameworks surrounding food additives and nutritional claims may also present challenges. However, the strong emphasis on clean-label products and increasing consumer awareness regarding the benefits of milk-derived proteins are expected to mitigate these challenges. Innovation in product development, focusing on specialized protein fractions and their targeted health benefits, will be crucial for sustained market leadership. Germany, with its robust dairy industry and sophisticated food processing sector, is well-positioned to capitalize on these trends, driven by both domestic demand and export opportunities within the European Union.

Germany Milk Protein Market: Growth, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Germany Milk Protein Market, providing an in-depth analysis of its structure, growth trajectories, and future potential. We explore key market segments, including protein concentrates and isolates, and their applications across diverse end-user industries such as Animal Feed, Food and Beverages (including Bakery, Breakfast Cereals, Condiments/Sauces, Dairy and Dairy Alternative Products, RTE/RTC Food Products, Snacks), and Supplements (Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, Sport/Performance Nutrition). The report covers the historical period from 2019-2024, with a base year of 2025, and forecasts market evolution through 2033. With a keen focus on high-traffic keywords like "Germany milk protein," "whey protein concentrate," "casein isolate," "dairy ingredients Germany," and "food additives market," this analysis is optimized to attract industry professionals, researchers, and business strategists seeking actionable insights into this burgeoning sector.

Germany Milk Protein Market Market Dynamics & Structure

The Germany Milk Protein Market exhibits a moderately concentrated structure, with a few key global players dominating the landscape. Technological innovation is a significant driver, particularly in enhancing extraction efficiency and developing specialized protein fractions. Regulatory frameworks, primarily driven by food safety and labeling standards, influence product development and market entry. Competitive product substitutes, such as plant-based proteins, present a growing challenge, necessitating a focus on the inherent benefits and perceived quality of milk proteins. End-user demographics are shifting, with increasing demand for functional ingredients in health and wellness products. Mergers and acquisitions (M&A) are prevalent, signaling consolidation and strategic expansion efforts by leading companies.

- Market Concentration: Dominated by established dairy cooperatives and ingredient manufacturers.

- Technological Innovation: Focus on advanced filtration techniques for higher purity and functional properties of milk protein concentrates and isolates.

- Regulatory Frameworks: Strict adherence to EU food safety regulations (e.g., EFSA guidelines) is paramount.

- Competitive Substitutes: Rising adoption of plant-based protein alternatives is a key consideration.

- End-User Demographics: Growing demand from the sports nutrition and aging population segments.

- M&A Trends: Strategic acquisitions to enhance product portfolios and market reach are observed. For instance, the proposed divestment of Royal FrieslandCampina N.V.'s German consumer business underscores this trend.

Germany Milk Protein Market Growth Trends & Insights

The Germany Milk Protein Market is poised for robust growth, driven by evolving consumer preferences and increasing awareness of protein's nutritional benefits. The market size is projected to expand significantly from an estimated xx million units in 2025 to xx million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately xx%. Adoption rates for milk protein ingredients are steadily rising across the food and beverage, animal feed, and supplement sectors. Technological disruptions in processing are enabling the development of novel applications and enhanced product functionalities, thereby expanding the market's scope. Consumer behavior shifts, particularly the growing emphasis on health, fitness, and specialized nutrition, are directly fueling the demand for high-quality milk protein concentrates and isolates. The market penetration for these ingredients is expected to deepen as new product formulations and fortified foods become more mainstream.

Dominant Regions, Countries, or Segments in Germany Milk Protein Market

Within the broader Germany Milk Protein Market, the Food and Beverages segment, particularly Dairy and Dairy Alternative Products and Supplements, are expected to exhibit the most significant growth and dominance. This ascendancy is fueled by a confluence of factors, including evolving consumer dietary habits, a heightened focus on health and wellness, and the inherent versatility of milk proteins in various applications. Germany, as a developed European economy with a strong dairy industry and a discerning consumer base, naturally stands out as a key market. The demand for milk protein concentrates, especially in sports nutrition and infant formula, remains exceptionally high due to their superior amino acid profile and bioavailability.

- Dominant Segment Drivers:

- Food and Beverages:

- Dairy and Dairy Alternative Products: Increased use of milk proteins to enhance texture, emulsification, and nutritional value in yogurts, cheese, and dairy-free alternatives seeking a protein boost.

- Bakery & Snacks: Incorporation for improved texture, browning, and nutritional fortification.

- RTE/RTC Food Products: Contribution to satiety and nutritional enhancement.

- Supplements:

- Sport/Performance Nutrition: Sustained high demand for whey protein and casein in protein powders, bars, and ready-to-drink beverages for muscle recovery and growth.

- Baby Food and Infant Formula: Essential ingredient due to its close resemblance to human milk proteins.

- Elderly Nutrition and Medical Nutrition: Growing demand for protein to combat sarcopenia and support recovery.

- Food and Beverages:

- Geographic Influence: Germany's strong dairy infrastructure and consumer preference for high-quality ingredients contribute to its leadership.

- Market Share & Growth Potential: The supplements segment, particularly sports nutrition, is projected to witness substantial expansion, followed closely by the functional food and beverage applications.

Germany Milk Protein Market Product Landscape

The Germany Milk Protein Market is characterized by continuous product innovation focused on enhanced functionality and purity. Whey Protein Concentrates (WPC) and Whey Protein Isolates (WPI) remain prominent, with advancements in processing leading to improved solubility, reduced lactose content, and tailored amino acid profiles. Casein and Caseinates are also crucial, offering slow-release protein benefits for sustained nutrition. Applications span from fortifying beverages and bakery items to creating specialized infant formulas and high-performance sports nutrition products. Unique selling propositions often revolve around sourcing, processing technologies that preserve protein integrity, and certifications ensuring quality and safety. Technological advancements are enabling the development of micro-encapsulated proteins for controlled release and improved stability in various food matrices.

Key Drivers, Barriers & Challenges in Germany Milk Protein Market

Key Drivers:

- Growing Health and Wellness Consciousness: Increasing consumer demand for protein-rich foods and supplements for muscle building, weight management, and overall health.

- Versatility in Applications: Milk proteins are highly functional ingredients, finding use in a wide array of food, beverage, and supplement products.

- Superior Nutritional Profile: Recognized for their complete amino acid profile and bioavailability.

- Technological Advancements: Improved processing techniques lead to higher purity, better functionality, and specialized protein fractions.

- Rising Disposable Incomes: Enabling consumers to invest in premium food and health products.

Barriers & Challenges:

- Competition from Plant-Based Proteins: Growing consumer interest in vegan and vegetarian alternatives poses a significant challenge.

- Price Volatility of Raw Milk: Fluctuations in milk prices directly impact the cost of milk protein ingredients.

- Lactose Intolerance: A segment of the population cannot consume dairy-based products, limiting market reach.

- Regulatory Hurdles: Evolving regulations regarding labeling, ingredient claims, and novel food ingredients can create complexities.

- Supply Chain Disruptions: Potential for interruptions in milk supply due to environmental factors or geopolitical events.

- Consumer Perceptions: Negative publicity surrounding dairy or perceived environmental impact can influence demand.

Emerging Opportunities in Germany Milk Protein Market

Emerging opportunities in the Germany Milk Protein Market lie in the development of novel protein fractions with specific functional benefits, such as improved gut health or enhanced immune support. The expanding market for medical nutrition, catering to the aging population and individuals with chronic diseases, presents a significant untapped potential for specialized milk protein formulations. Furthermore, the increasing demand for sustainable and ethically sourced ingredients provides an avenue for companies to differentiate their offerings. Innovations in alternative protein processing that enhance digestibility and reduce allergenic potential could also unlock new consumer segments.

Growth Accelerators in the Germany Milk Protein Market Industry

Long-term growth in the Germany Milk Protein Market will be significantly accelerated by breakthroughs in precision fermentation for milk proteins, enabling the production of highly specific and functional ingredients. Strategic partnerships between dairy processors and ingredient manufacturers will foster innovation and expand product portfolios. Furthermore, the expansion of functional foods and beverages incorporating milk proteins for targeted health benefits, such as cognitive function or bone health, will be a key growth catalyst. Increased investment in research and development to unlock the full potential of various milk protein components and their synergistic effects in different applications will also drive market expansion.

Key Players Shaping the Germany Milk Protein Market Market

- Hoogwegt Group

- MEGGLE GmbH & Co KG

- GEA

- Royal FrieslandCampina N V

- LAÏTA

- GNC Holdings LLC

- Savencia Fromage & Dairy

- Lactoprot Deutschland GmbH

- Fonterra Co-operative Group Limited

- Agrial Group

- Morinaga Milk Industry Co Ltd

Notable Milestones in Germany Milk Protein Market Sector

- June 2023: GEA unveiled the inauguration of its cutting-edge New Food Application and Technology Centre of Excellence (ATC) in Hildesheim, Germany, focusing on pioneering processes and products within the alternative protein sector, including precision fermentation for milk proteins.

- June 2022: Royal FrieslandCampina N.V. outlined its intentions to divest certain segments of its German consumer business to the German Unternehmensgruppe Theo Müller, including the Landliebe brand and three key German production facilities.

In-Depth Germany Milk Protein Market Market Outlook

The future outlook for the Germany Milk Protein Market is exceptionally promising, driven by a confluence of sustained consumer demand for protein-rich products and ongoing technological advancements. Growth accelerators, including innovations in precision fermentation, the expansion of functional food and beverage categories, and strategic partnerships within the value chain, are set to propel the market forward. The increasing focus on specialized nutrition for diverse demographics, from athletes to the elderly, presents significant market potential. Companies that prioritize sustainability, transparency, and innovative product development are well-positioned to capitalize on the evolving landscape and secure substantial market share in the coming years.

Germany Milk Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

-

2. End-User

- 2.1. Animal Feed

-

2.2. Food and Beverages

- 2.2.1. Bakery

- 2.2.2. Breakfast Cereals

- 2.2.3. Condiments/Sauces

- 2.2.4. Dairy and Dairy Alternative Products

- 2.2.5. RTE/RTC Food Products

- 2.2.6. Snacks

-

2.3. Supplements

- 2.3.1. Baby Food and Infant Formula

- 2.3.2. Elderly Nutrition and Medical Nutrition

- 2.3.3. Sport/Performance Nutrition

Germany Milk Protein Market Segmentation By Geography

- 1. Germany

Germany Milk Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional Food and Beverages; Growing Milk Protein Concentrates Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Milk Protein in Food and Beverages Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. Bakery

- 5.2.2.2. Breakfast Cereals

- 5.2.2.3. Condiments/Sauces

- 5.2.2.4. Dairy and Dairy Alternative Products

- 5.2.2.5. RTE/RTC Food Products

- 5.2.2.6. Snacks

- 5.2.3. Supplements

- 5.2.3.1. Baby Food and Infant Formula

- 5.2.3.2. Elderly Nutrition and Medical Nutrition

- 5.2.3.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hoogwegt Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MEGGLE GmbH & Co KG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 GE

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Royal FrieslandCampina N V

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 LAÏTA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GNC Holdings LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Savencia Fromage & Dairy

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lactoprot Deutschland GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fonterra Co-operative Group Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agrial Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Morinaga Milk Industry Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Hoogwegt Group

List of Figures

- Figure 1: Germany Milk Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Milk Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Germany Milk Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Germany Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Germany Milk Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Germany Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Milk Protein Market?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the Germany Milk Protein Market?

Key companies in the market include Hoogwegt Group, MEGGLE GmbH & Co KG, GE, Royal FrieslandCampina N V, LAÏTA, GNC Holdings LLC, Savencia Fromage & Dairy, Lactoprot Deutschland GmbH, Fonterra Co-operative Group Limited, Agrial Group, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Germany Milk Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional Food and Beverages; Growing Milk Protein Concentrates Application in Processed Food Products.

6. What are the notable trends driving market growth?

Increasing Demand for Milk Protein in Food and Beverages Industry.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

June 2023: GEA unveiled the inauguration of its cutting-edge New Food Application and Technology Centre of Excellence (ATC) in Hildesheim, Germany. Serving as a pivotal hub for pioneering processes and products within the alternative protein sector, the company asserts that its research is dedicated to advancing the field of precision fermentation for milk proteins.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Milk Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Milk Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Milk Protein Market?

To stay informed about further developments, trends, and reports in the Germany Milk Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence