Key Insights

The United States flexible plastic packaging market is projected to experience robust growth, reaching an estimated $141.03 billion by 2033, with a compound annual growth rate (CAGR) of 3.51% from a base year of 2024. This expansion is driven by sustained demand from the food and beverage sectors, benefiting from flexible packaging's inherent advantages: lightweight design, cost efficiency, superior barrier protection, and extended product shelf life. Consumer preferences for convenient, single-serving, and resealable packaging further fuel market performance. Polyethene (PE) and Bi-oriented Polypropylene (BOPP) are the dominant material types due to their versatility and cost-effectiveness, while pouches and films & wraps are leading product categories.

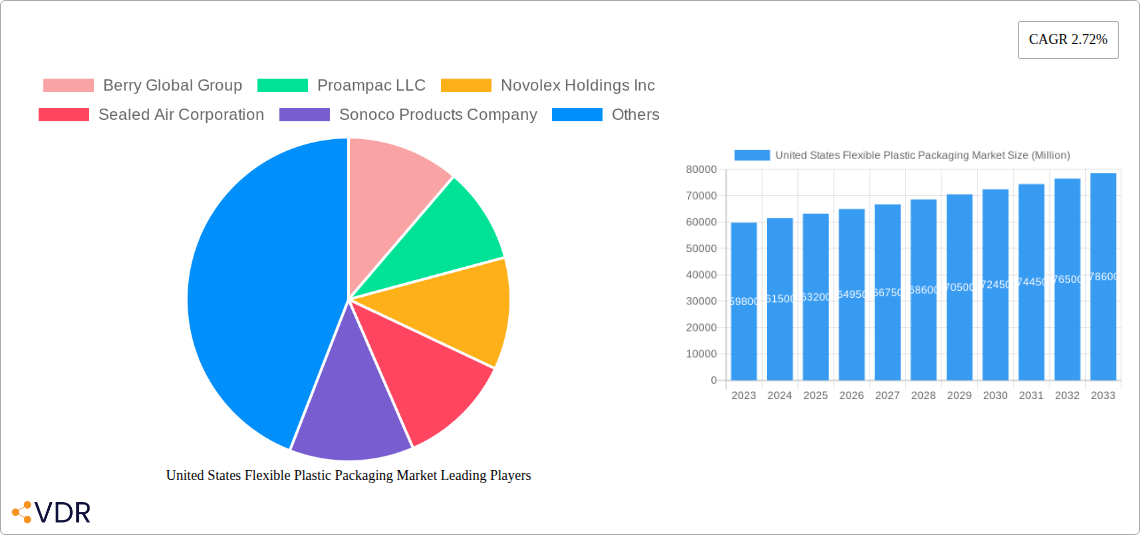

United States Flexible Plastic Packaging Market Market Size (In Billion)

Evolving consumer lifestyles, a growing emphasis on sustainable packaging, and advancements in printing and material technology are key market influences. While resilient, the market faces potential headwinds from increasing environmental concerns and regulations surrounding plastic waste, prompting a shift towards recyclable and biodegradable alternatives. However, ongoing innovation in material science and advanced recycling technologies are expected to mitigate these challenges. The competitive landscape features major global players and emerging specialized manufacturers, fostering innovation through strategic collaborations and product development. The personal care and cosmetics sector's demand for premium, visually appealing packaging also presents a significant growth opportunity.

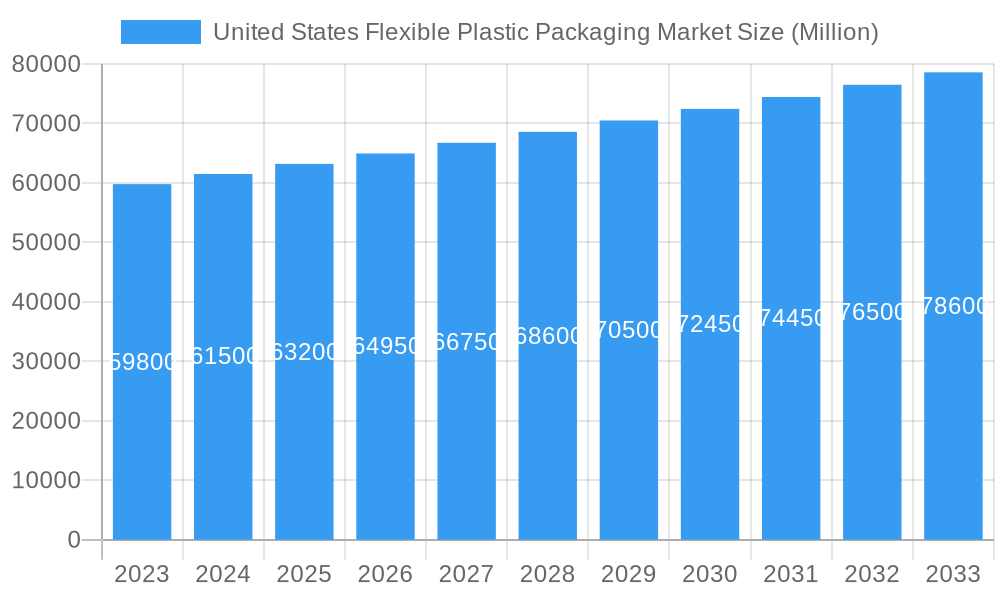

United States Flexible Plastic Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the United States flexible plastic packaging market, covering its growth trajectory, market dynamics, and future outlook from 2019 to 2033. With a base year of 2024, it offers critical insights into market size evolution, key drivers, emerging opportunities, and competitive landscapes. The analysis segments the market by Material Type (Polyethene (PE), Bi-oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), Other Material Types), Product Type (Pouches, Bags, Films and Wraps, Other Product Types), and End-user Industry (Food – including Baked Food, Snacked Food, Meat, Poultry, and Sea Food, Candy/Confections, Pet Food, Other Food; Beverage; Personal Care and Cosmetics; Other End-user Industries). Essential for industry professionals, strategists, and investors, this report provides the knowledge needed to navigate this rapidly expanding sector.

United States Flexible Plastic Packaging Market Market Dynamics & Structure

The United States Flexible Plastic Packaging Market is characterized by a moderate market concentration, with key players continually investing in technological innovation to drive growth. Regulatory frameworks, particularly those concerning sustainability and recyclability, are increasingly shaping market strategies and product development. Competitive product substitutes, though present, are often outmatched by the versatility and cost-effectiveness of flexible plastic solutions. End-user demographics, especially the growing demand for convenience and sustainable packaging from younger generations, are a significant influence. Mergers and acquisitions (M&A) are a consistent trend, with companies consolidating to expand their product portfolios and geographical reach. For instance, the last few years have seen several strategic acquisitions aimed at enhancing capabilities in specialty packaging and sustainable materials. Barriers to innovation include the high cost of developing novel biodegradable or compostable materials and the need for extensive testing to ensure performance and safety. The market's structure is also influenced by the evolving needs of the food and beverage industries, which are major consumers of flexible packaging.

United States Flexible Plastic Packaging Market Growth Trends & Insights

The United States Flexible Plastic Packaging Market is poised for significant expansion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This growth is fueled by escalating consumer demand for convenience, extended shelf life, and aesthetically appealing packaging solutions. The food and beverage sector remains the dominant end-user, driven by the increasing consumption of processed and ready-to-eat meals, as well as the need for robust protection for various food products like meat, poultry, seafood, and confectioneries. The adoption of advanced printing technologies and barrier properties in flexible packaging is enabling manufacturers to meet stringent product preservation requirements.

Shifts in consumer behavior, such as a growing preference for single-serving portions and on-the-go consumption, are further propelling the demand for flexible pouches and bags. Technological disruptions, including the development of innovative materials with enhanced recyclability and biodegradability, are not only meeting regulatory demands but also appealing to environmentally conscious consumers. The market penetration of flexible packaging is expected to rise across various end-user industries, including personal care and cosmetics, where product differentiation and consumer appeal are paramount. The estimated market size for flexible plastic packaging in the US is projected to reach XX million units by 2025, with substantial growth anticipated throughout the forecast period. The increasing urbanization and the rise of e-commerce also contribute to the demand for lightweight, durable, and customizable packaging solutions.

Dominant Regions, Countries, or Segments in United States Flexible Plastic Packaging Market

The United States Flexible Plastic Packaging Market is a multifaceted landscape, with various segments exhibiting strong growth potential. Within Material Type, Polyethene (PE) is expected to continue its dominance, driven by its versatility, cost-effectiveness, and wide range of applications across diverse industries. Its excellent sealing properties and barrier capabilities make it a preferred choice for food packaging, industrial wraps, and consumer goods. The food industry as an End-user Industry segment represents the largest share and is anticipated to be the primary growth driver. This is particularly true for sub-segments like Snacked Food, Meat, Poultry, and Sea Food, and Other Food categories, which rely heavily on flexible packaging for freshness, extended shelf life, and consumer appeal.

In terms of Product Type, Pouches are emerging as a significant growth segment. The rising popularity of stand-up pouches, spouted pouches, and retort pouches, especially in the food and beverage sectors, is a testament to their convenience, portability, and superior product display capabilities. These pouches offer excellent barrier protection and are increasingly being adopted as an alternative to rigid packaging. The Beverage segment is also a significant contributor, with flexible packaging being utilized for water, juices, and other beverages where lightweight and portability are key. The increasing focus on sustainable packaging solutions is also driving innovation in materials like BOPP and the exploration of bio-based alternatives within the broader flexible plastic packaging ecosystem. Economic policies supporting manufacturing and consumer spending, coupled with robust infrastructure for distribution, further solidify the market's growth in key regions.

United States Flexible Plastic Packaging Market Product Landscape

The United States Flexible Plastic Packaging Market is witnessing a surge in innovative product developments. Advancements in multi-layer films and high-barrier materials are enhancing product protection, extending shelf life, and maintaining the freshness of goods. Pouches, in particular, are evolving with features like resealability, child-resistance, and on-the-go convenience, catering to modern consumer lifestyles. Films and wraps are being optimized for specific applications, from high-speed food packaging lines to specialized industrial uses. Technological advancements in printing and converting are enabling intricate designs and brand customization, adding significant value for end-users. The unique selling propositions of these evolving products lie in their ability to offer superior performance, reduced material usage, and enhanced consumer experience, all within a cost-effective framework.

Key Drivers, Barriers & Challenges in United States Flexible Plastic Packaging Market

Key Drivers:

- Growing Demand for Convenience and Extended Shelf Life: Consumers' preference for ready-to-eat meals, single-serving portions, and products with longer shelf lives directly fuels the need for flexible packaging solutions.

- Technological Advancements: Innovations in material science, printing, and converting technologies are leading to the development of more sustainable, functional, and visually appealing packaging.

- E-commerce Growth: The expansion of online retail necessitates lightweight, durable, and protective packaging that can withstand the rigors of shipping and handling.

- Sustainable Packaging Initiatives: Increasing consumer and regulatory pressure for eco-friendly solutions is driving the development and adoption of recyclable, compostable, and biodegradable flexible packaging.

Barriers & Challenges:

- Regulatory Hurdles: Evolving environmental regulations, particularly concerning plastic waste and recyclability, can create compliance challenges and necessitate costly material or process changes.

- Supply Chain Disruptions: Global supply chain volatilities, raw material price fluctuations, and logistics issues can impact production costs and product availability.

- Competition from Sustainable Alternatives: While flexible plastic packaging is innovating, it faces increasing competition from non-plastic or alternative material-based packaging solutions, requiring continuous improvement in its environmental profile.

- Consumer Perception: Negative consumer perceptions surrounding plastic waste and its environmental impact can influence purchasing decisions and create demand for alternatives, even if technically superior.

Emerging Opportunities in United States Flexible Plastic Packaging Market

Emerging opportunities in the United States Flexible Plastic Packaging Market lie in the burgeoning demand for sustainable and high-performance packaging. The development of advanced biodegradable and compostable films, particularly for the food and personal care sectors, presents a significant growth avenue. The expansion of e-commerce creates a need for specialized flexible packaging solutions designed for direct-to-consumer shipping, offering enhanced protection and reduced shipping weight. Furthermore, the increasing focus on a circular economy is driving opportunities in advanced recycling technologies and the use of recycled content in flexible packaging. The healthcare sector is also a growing area for flexible packaging, with demand for sterile and protective packaging for medical devices and pharmaceuticals.

Growth Accelerators in the United States Flexible Plastic Packaging Market Industry

Several catalysts are accelerating the growth of the United States Flexible Plastic Packaging Market. Technological breakthroughs in material science are enabling the creation of thinner yet stronger films with enhanced barrier properties, leading to material reduction and improved product protection. Strategic partnerships between packaging manufacturers, material suppliers, and end-users are fostering innovation and accelerating the adoption of new solutions. Market expansion strategies, including the development of customized packaging for niche applications and emerging consumer trends, are also playing a crucial role. The increasing investment in research and development for sustainable alternatives and enhanced recyclability further solidifies the market's long-term growth trajectory.

Key Players Shaping the United States Flexible Plastic Packaging Market Market

- Berry Global Group

- Proampac LLC

- Novolex Holdings Inc

- Sealed Air Corporation

- Sonoco Products Company

- American Packaging Corporation

- C-P Flexible Packaging

- ePac Holdings LLC

- PPC Flex Company Inc

- Flex Films (USA) Inc (Uflex Limited)

- Printpack Inc

- Sigma Plastics Group Inc

- Amcor Group GmbH

- Constantia Flexibles Group GmbH

- Winpak Co Limited

- Mondi PLC

- Transcontinental Inc

Notable Milestones in United States Flexible Plastic Packaging Market Sector

- January 2024: Amcor Group GmbH announced the expansion of its North American thermoforming capabilities in the healthcare market. The addition of state-of-the-art automated thermoforming equipment will help the company cater to the growing demand from customers in the pharmaceutical, medical, and consumer health sectors.

- December 2023: Myplas USA, the US subsidiary of South African firm Myplas, announced the opening of a recycling facility for flexible films used for shrink wrap, pallet wrap, etc. The new facility can recycle nearly 90 million pounds of end-of-life plastic annually. This would help the company lead toward circular economy goals.

In-Depth United States Flexible Plastic Packaging Market Market Outlook

The future outlook for the United States Flexible Plastic Packaging Market is exceptionally promising, driven by an unwavering commitment to innovation and sustainability. Growth accelerators, such as advancements in bioplastics and enhanced recycling technologies, are positioning the market for substantial expansion. Strategic opportunities abound in catering to the evolving demands of the food and beverage industry, the burgeoning e-commerce sector, and the critical healthcare market. The increasing integration of smart packaging features and the development of circular economy solutions will further solidify flexible plastic packaging's indispensable role. The market is set to witness continued growth, with a focus on delivering high-performance, cost-effective, and environmentally responsible packaging solutions.

United States Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Material Types

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-user Industry

-

3.1. Food

- 3.1.1. Baked Food

- 3.1.2. Snacked Food

- 3.1.3. Meat, Poultry, and Sea Food

- 3.1.4. Candy/Confections

- 3.1.5. Pet Food

- 3.1.6. Other Fo

- 3.2. Beverage

- 3.3. Personal Care and Cosmetics

- 3.4. Other En

-

3.1. Food

United States Flexible Plastic Packaging Market Segmentation By Geography

- 1. United States

United States Flexible Plastic Packaging Market Regional Market Share

Geographic Coverage of United States Flexible Plastic Packaging Market

United States Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Frozen Food Products Drives the Demand; Rising Demand for Lightweight Barrier Packaging Solution

- 3.3. Market Restrains

- 3.3.1. Increasing Consumption of Frozen Food Products Drives the Demand; Rising Demand for Lightweight Barrier Packaging Solution

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Pouch Packaging among Various End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.1.1. Baked Food

- 5.3.1.2. Snacked Food

- 5.3.1.3. Meat, Poultry, and Sea Food

- 5.3.1.4. Candy/Confections

- 5.3.1.5. Pet Food

- 5.3.1.6. Other Fo

- 5.3.2. Beverage

- 5.3.3. Personal Care and Cosmetics

- 5.3.4. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Proampac LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novolex Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sealed Air Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 C-P Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ePac Holdings LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PPC Flex Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Flex Films (USA) Inc (Uflex Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Printpack Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sigma Plastics Group Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Amcor Group GmbH

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles Group GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Winpak Co Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Mondi PLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Transcontinental Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Berry Global Group

List of Figures

- Figure 1: United States Flexible Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Flexible Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Flexible Plastic Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: United States Flexible Plastic Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: United States Flexible Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Flexible Plastic Packaging Market?

The projected CAGR is approximately 3.51%.

2. Which companies are prominent players in the United States Flexible Plastic Packaging Market?

Key companies in the market include Berry Global Group, Proampac LLC, Novolex Holdings Inc, Sealed Air Corporation, Sonoco Products Company, American Packaging Corporation, C-P Flexible Packaging, ePac Holdings LLC, PPC Flex Company Inc, Flex Films (USA) Inc (Uflex Limited), Printpack Inc, Sigma Plastics Group Inc, Amcor Group GmbH, Constantia Flexibles Group GmbH, Winpak Co Limited, Mondi PLC, Transcontinental Inc.

3. What are the main segments of the United States Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Frozen Food Products Drives the Demand; Rising Demand for Lightweight Barrier Packaging Solution.

6. What are the notable trends driving market growth?

Increasing Demand for Pouch Packaging among Various End-user Industries.

7. Are there any restraints impacting market growth?

Increasing Consumption of Frozen Food Products Drives the Demand; Rising Demand for Lightweight Barrier Packaging Solution.

8. Can you provide examples of recent developments in the market?

January 2024: Amcor Group GmbH announced the expansion of its North American thermoforming capabilities in the healthcare market. The addition of state-of-the-art automated thermoforming equipment will help the company cater to the growing demand from customers in the pharmaceutical, medical, and consumer health sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the United States Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence