Key Insights

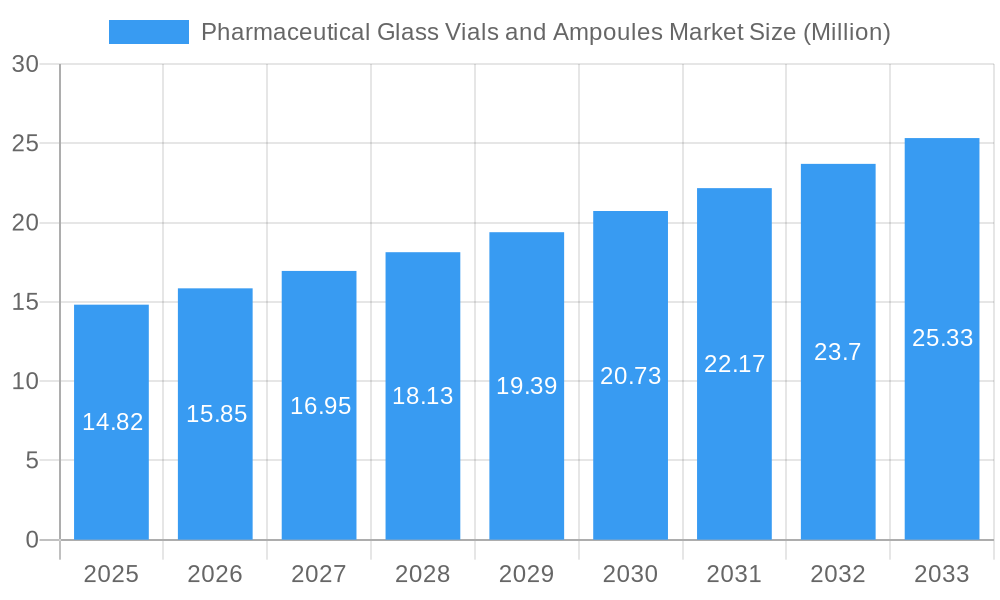

The global Pharmaceutical Glass Vials and Ampoules Market is experiencing robust growth, projected to reach a significant size of $14.82 million. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 6.94% from 2025 to 2033, indicating sustained and healthy demand for these critical pharmaceutical packaging solutions. A primary driver for this market's ascent is the burgeoning global pharmaceutical industry, propelled by increasing healthcare expenditure, an aging global population, and the continuous development of new drugs and vaccines. The indispensable role of glass vials and ampoules in ensuring the sterile storage and safe delivery of a wide array of pharmaceutical products, from life-saving vaccines to essential insulin treatments and complex biopharmaceuticals, positions them as cornerstone components of the healthcare supply chain. Furthermore, the increasing prevalence of chronic diseases and the ongoing research into novel therapeutic agents further fuel the demand for reliable and high-quality pharmaceutical packaging.

Pharmaceutical Glass Vials and Ampoules Market Market Size (In Million)

The market is characterized by several key trends and dynamics that are shaping its trajectory. A notable trend is the increasing preference for Type I borosilicate glass due to its superior chemical resistance and thermal stability, ensuring product integrity and longevity. The growing demand for injectable drugs, coupled with advancements in drug delivery systems, directly translates to a higher requirement for precisely manufactured glass vials and ampoules. Innovation in drug formulation, particularly for sensitive biologics, necessitates packaging that offers exceptional inertness and barrier properties, further solidifying the position of glass. However, the market also faces certain restraints. Fluctuations in raw material prices, particularly for soda-lime glass and borosilicate glass, can impact manufacturing costs and, consequently, market pricing. Stringent regulatory requirements for pharmaceutical packaging, while essential for patient safety, can also add to production complexities and costs. Supply chain disruptions and geopolitical uncertainties can also pose challenges to consistent market supply. Despite these restraints, the overarching growth in pharmaceutical production and the unwavering need for secure and sterile packaging solutions for diverse medicinal applications suggest a promising future for the Pharmaceutical Glass Vials and Ampoules Market.

Pharmaceutical Glass Vials and Ampoules Market Company Market Share

This in-depth report provides a definitive analysis of the global Pharmaceutical Glass Vials and Ampoules Market, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Covering a study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand the evolution and trajectory of this vital segment of the pharmaceutical packaging industry. Our analysis includes detailed breakdowns of market size in millions of units, CAGR projections, and a thorough examination of parent and child market segments to provide a holistic view.

Pharmaceutical Glass Vials and Ampoules Market Dynamics & Structure

The Pharmaceutical Glass Vials and Ampoules Market is characterized by a moderate to high degree of concentration, with key players like Gerresheimer AG, Schott AG, and Stevanato Group SPA holding significant market shares. Technological innovation is a primary driver, with advancements in glass manufacturing, coating technologies, and tamper-evident features continuously shaping product offerings. Regulatory frameworks, particularly stringent quality control standards and evolving pharmacopoeial requirements, are critical determinants of market entry and product development. Competitive product substitutes, such as plastic containers, present a persistent challenge, though glass retains its preference for sterile packaging due to its inertness and barrier properties. End-user demographics are increasingly influenced by the growing biopharmaceutical sector and the expanding global demand for vaccines. Mergers and acquisitions (M&A) are moderately active, driven by companies seeking to expand their geographical reach, product portfolios, and technological capabilities.

- Market Concentration: Dominated by a few major global manufacturers, with regional players also holding niche positions.

- Technological Innovation: Focus on enhanced barrier properties, improved breakability for ampoules, and integration of smart packaging features.

- Regulatory Frameworks: Compliance with USP, EP, and other regional pharmacopoeias is paramount.

- Competitive Substitutes: While plastics are present, glass remains the preferred choice for high-value sterile drug products.

- End-User Demographics: Driven by growth in biologics, vaccines, and specialized injectable drugs.

- M&A Trends: Consolidation aimed at vertical integration and expanded service offerings.

Pharmaceutical Glass Vials and Ampoules Market Growth Trends & Insights

The Pharmaceutical Glass Vials and Ampoules Market is projected to experience robust growth, fueled by the accelerating demand for injectable drug formulations, particularly in the vaccines and biopharmaceutical segments. The COVID-19 pandemic significantly highlighted the critical role of sterile injectable packaging, driving substantial investments and accelerating adoption rates for high-quality glass vials and ampoules. Technological disruptions, such as the development of advanced glass types with lower leachables and extractables, and the introduction of sophisticated coating technologies for enhanced drug stability, are further shaping market trends. Consumer behavior shifts, driven by an increasing awareness of drug safety and efficacy, are reinforcing the preference for glass packaging. The market size evolution is expected to see a consistent upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Market penetration of advanced glass packaging solutions is anticipated to deepen across both developed and emerging economies, as pharmaceutical companies prioritize drug integrity and patient safety.

Dominant Regions, Countries, or Segments in Pharmaceutical Glass Vials and Ampoules Market

The Vaccines segment, within the broader Application category of Pharmaceutical Glass Vials and Ampoules, is currently the dominant driver of market growth. This surge is directly attributable to global public health initiatives, increased vaccine development for novel diseases, and routine immunization programs. North America and Europe currently lead in terms of market share due to their established pharmaceutical industries, strong research and development capabilities, and high per capita healthcare spending. However, the Asia Pacific region, particularly China and India, is exhibiting the fastest growth potential due to a burgeoning pharmaceutical manufacturing base, increasing domestic demand for healthcare services, and favorable government policies promoting local production. The development of advanced manufacturing facilities and a skilled workforce are key economic policies contributing to this regional expansion.

- Dominant Segment: Vaccines, accounting for an estimated 45% of the global market by volume in 2025.

- Leading Regions: North America and Europe hold substantial market share due to advanced infrastructure and high pharmaceutical R&D investment.

- Fastest Growing Region: Asia Pacific, driven by expanding pharmaceutical production and rising healthcare expenditure.

- Key Growth Drivers in Asia Pacific: Favorable government initiatives, increasing disposable incomes, and a growing middle class.

- Market Share (Vaccines Segment): Estimated at 750,000 million units in 2025.

Pharmaceutical Glass Vials and Ampoules Market Product Landscape

The product landscape for pharmaceutical glass vials and ampoules is defined by continuous innovation aimed at enhancing drug safety, stability, and user convenience. Manufacturers are increasingly offering Type I borosilicate glass, known for its superior chemical resistance and thermal stability, minimizing the risk of leachables and extractables. Advanced coating technologies, such as silicone coatings, are applied to improve lubricity, facilitating easier filling and emptying of vials, particularly for high-viscosity drugs. For ampoules, precision scoring and anti-snapping features are becoming standard to ensure safe and efficient administration. The focus is on delivering packaging solutions that meet the stringent requirements of biologics, vaccines, and complex injectable therapies, ensuring product integrity from manufacturing to patient administration.

Key Drivers, Barriers & Challenges in Pharmaceutical Glass Vials and Ampoules Market

The Pharmaceutical Glass Vials and Ampoules Market is propelled by several key drivers. The escalating global demand for injectable drugs, particularly vaccines and biologics, is the foremost catalyst. Advancements in pharmaceutical R&D leading to new drug formulations requiring sterile and inert packaging further bolster growth. Stringent regulatory requirements for drug safety and quality indirectly favor glass packaging due to its inherent inertness and barrier properties.

- Key Drivers:

- Rising global demand for injectable pharmaceuticals.

- Growth in the biopharmaceutical and vaccine sectors.

- Increasing stringency of pharmaceutical quality and safety regulations.

- Technological advancements in glass manufacturing and coatings.

However, the market faces significant barriers and challenges. Fluctuations in raw material prices, particularly for soda ash and sand, can impact production costs. The higher cost of glass packaging compared to certain plastic alternatives remains a persistent restraint, especially for cost-sensitive drug segments. Furthermore, the energy-intensive nature of glass manufacturing contributes to its environmental footprint, and companies are facing increasing pressure to adopt sustainable practices. Supply chain disruptions, as witnessed during recent global events, can impact the availability of essential raw materials and finished products.

- Key Barriers & Challenges:

- Volatility in raw material prices.

- Higher manufacturing costs compared to plastic alternatives.

- Environmental concerns and pressure for sustainable manufacturing.

- Supply chain vulnerabilities and logistical complexities.

- Competition from alternative packaging materials.

Emerging Opportunities in Pharmaceutical Glass Vials and Ampoules Market

Emerging opportunities in the Pharmaceutical Glass Vials and Ampoules Market lie in the development of specialized packaging for advanced therapies, such as gene and cell therapies, which often require unique handling and storage conditions. The increasing adoption of pre-filled syringes, a segment closely related to vial and ampoule technology, presents a significant avenue for growth and integration. Furthermore, the growing demand for personalized medicine and the expansion of telehealth services are creating a need for smaller, more specialized, and highly secure injectable packaging solutions. The untapped potential in emerging economies, where healthcare infrastructure is rapidly developing, offers substantial opportunities for market expansion and increased adoption of high-quality glass packaging.

Growth Accelerators in the Pharmaceutical Glass Vials and Ampoules Market Industry

Long-term growth in the Pharmaceutical Glass Vials and Ampoules Market will be significantly accelerated by ongoing technological breakthroughs in glass formulation and manufacturing processes. Innovations in smart packaging, incorporating features like temperature monitoring or authentication capabilities, will enhance product value and patient adherence. Strategic partnerships between glass manufacturers and pharmaceutical companies, fostering co-development of bespoke packaging solutions, will be crucial. Moreover, a continued focus on sustainability, including the development of recyclable and energy-efficient manufacturing methods, will not only address environmental concerns but also drive market preference. The expansion of vaccine production for emerging infectious diseases and the growing pipeline of biologics will consistently fuel demand for sterile glass containers.

Key Players Shaping the Pharmaceutical Glass Vials and Ampoules Market Market

- BORMIOLI PHARMA SPA

- SISECAM

- Adit Containers Private Limited

- Kapoor Glass India Pvt Ltd

- Schott AG

- NIPRO Corporation

- Stoelzle Oberglas GmbH

- Birgimefar Group

- AAPL Solutions Pvt Ltd

- CORNING INCORPORATED

- Agrado SA

- J Penner Corporation

- BOROSIL

- Stevanato Group SPA

- SGD SA (SGD Pharma)

- Gerresheimer AG

- Accu-Glass LLC

Notable Milestones in Pharmaceutical Glass Vials and Ampoules Market Sector

- November 2023: Glassware brand Borosil is looking to reach INR 500 crore in revenue by 2025, driven by a consistent year-on-year growth rate of 16–17%, with a significant contribution from its growth driver segments – pharma packaging, laboratory benchtop equipment, and process sciences.

- October 2023: Siseecam signed a letter of intent to invest in the Turkish technology firm ICRON, which provides operational and strategic decision optimization services. Sisecam is trying to go one step further with the partnership agreement with ICRON.

In-Depth Pharmaceutical Glass Vials and Ampoules Market Market Outlook

The Pharmaceutical Glass Vials and Ampoules Market is poised for sustained growth driven by the indispensable role of sterile glass packaging in safeguarding drug integrity and patient safety. The increasing prevalence of chronic diseases, coupled with the rapid development of novel injectable therapeutics, will continue to fuel demand. Strategic investments in advanced manufacturing technologies, particularly those focused on sustainability and efficiency, will be critical for market leaders. The expansion of emerging economies, along with increasing healthcare expenditures globally, presents substantial opportunities for market penetration. Furthermore, the ongoing innovation in drug delivery systems will necessitate highly specialized and reliable glass packaging, ensuring the market remains dynamic and resilient.

Pharmaceutical Glass Vials and Ampoules Market Segmentation

-

1. Application

- 1.1. Vaccines

- 1.2. Others (Insulin, Biopharma, Others)

Pharmaceutical Glass Vials and Ampoules Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Pharmaceutical Glass Vials and Ampoules Market Regional Market Share

Geographic Coverage of Pharmaceutical Glass Vials and Ampoules Market

Pharmaceutical Glass Vials and Ampoules Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Pharmaceutical Industry in Emerging Economies; Commodity Value of Glass Increased with Recyclability

- 3.3. Market Restrains

- 3.3.1. Increased Relevance of Alternate Sources

- 3.4. Market Trends

- 3.4.1. Vaccines to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Vaccines

- 5.1.2. Others (Insulin, Biopharma, Others)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Vaccines

- 6.1.2. Others (Insulin, Biopharma, Others)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Vaccines

- 7.1.2. Others (Insulin, Biopharma, Others)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Vaccines

- 8.1.2. Others (Insulin, Biopharma, Others)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Vaccines

- 9.1.2. Others (Insulin, Biopharma, Others)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Vaccines

- 10.1.2. Others (Insulin, Biopharma, Others)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BORMIOLI PHARMA SPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SISECAM*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adit Containers Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kapoor Glass India Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schott AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NIPRO Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stoelzle Oberglas GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Birgimefar Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AAPL Solutions Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CORNING INCORPORATED

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agrado SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 J Penner Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BOROSIL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Stevanato Group SPA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SGD SA (SGD Pharma)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Gerresheimer AG

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Accu-Glass LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 BORMIOLI PHARMA SPA

List of Figures

- Figure 1: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Pharmaceutical Glass Vials and Ampoules Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: India Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia and New Zealand Pharmaceutical Glass Vials and Ampoules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Pharmaceutical Glass Vials and Ampoules Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Glass Vials and Ampoules Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the Pharmaceutical Glass Vials and Ampoules Market?

Key companies in the market include BORMIOLI PHARMA SPA, SISECAM*List Not Exhaustive, Adit Containers Private Limited, Kapoor Glass India Pvt Ltd, Schott AG, NIPRO Corporation, Stoelzle Oberglas GmbH, Birgimefar Group, AAPL Solutions Pvt Ltd, CORNING INCORPORATED, Agrado SA, J Penner Corporation, BOROSIL, Stevanato Group SPA, SGD SA (SGD Pharma), Gerresheimer AG, Accu-Glass LLC.

3. What are the main segments of the Pharmaceutical Glass Vials and Ampoules Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Pharmaceutical Industry in Emerging Economies; Commodity Value of Glass Increased with Recyclability.

6. What are the notable trends driving market growth?

Vaccines to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increased Relevance of Alternate Sources.

8. Can you provide examples of recent developments in the market?

November 2023 - Glassware brand Borosil is looking to reach INR 500 crore in revenue by 2025, driven by a consistent year-on-year growth rate of 16–17%, with a significant contribution from its growth driver segments –pharma packaging, laboratory benchtop equipment, and process sciences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Glass Vials and Ampoules Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Glass Vials and Ampoules Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Glass Vials and Ampoules Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Glass Vials and Ampoules Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence