Key Insights

The Middle East and West Africa pharmaceutical plastic packaging market is projected for significant expansion. Key growth drivers include developing healthcare infrastructures, increased investment in pharmaceutical manufacturing, and a rising incidence of chronic diseases, all escalating demand for advanced and reliable packaging solutions. Pharmaceutical plastic packaging offers superior product protection, extended shelf life, and enhanced patient safety, making it the preferred choice for diverse drug formulations. Growth is further propelled by expanding domestic pharmaceutical production, a thriving generic drug market, and an increasing focus on drug traceability and anti-counterfeiting measures, necessitating sophisticated packaging. The rise of medical tourism and the continuous development of novel drug delivery systems also contribute to the market's upward trajectory.

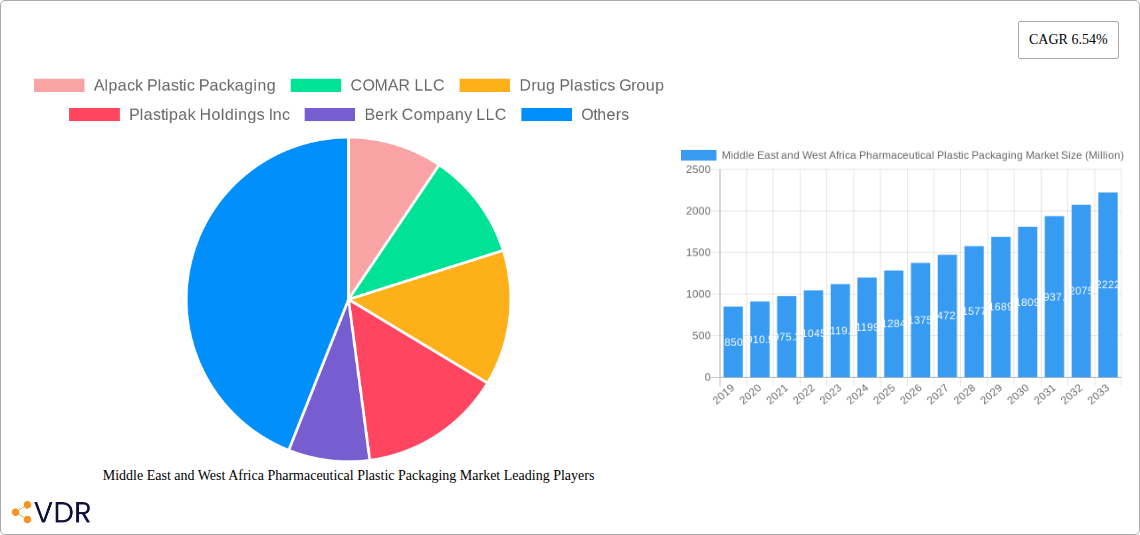

Middle East and West Africa Pharmaceutical Plastic Packaging Market Market Size (In Billion)

The market's growth is significantly influenced by the increasing demand for specialized packaging formats such as dropper bottles, nasal spray bottles, and vials & ampoules, reflecting the evolving therapeutic landscape. Growing healthcare expenditure and rising disposable incomes across the Middle East and West Africa empower consumers to access a wider range of healthcare products. Furthermore, stringent regulatory mandates for product integrity and patient well-being are stimulating innovation and the adoption of high-quality plastic packaging. Emerging trends, including the integration of smart packaging for enhanced monitoring and adherence, and a growing preference for sustainable materials, are shaping the future of pharmaceutical plastic packaging in these dynamic regions.

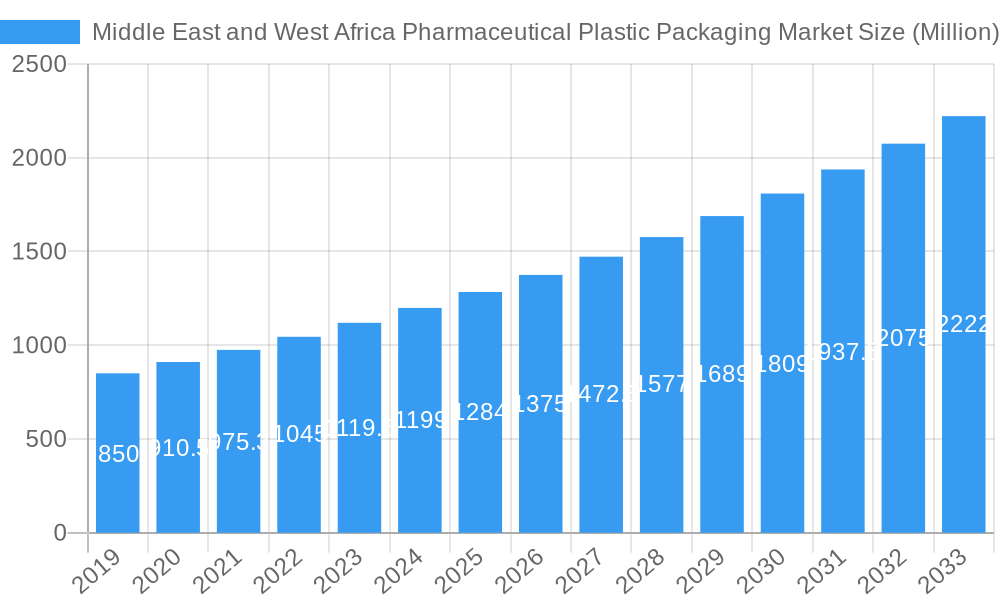

Middle East and West Africa Pharmaceutical Plastic Packaging Market Company Market Share

This comprehensive report provides an SEO-optimized analysis of the Middle East and West Africa Pharmaceutical Plastic Packaging Market, designed for high search engine visibility and industry professional engagement.

This in-depth report delivers a critical analysis of the Middle East and West Africa Pharmaceutical Plastic Packaging Market, offering detailed insights into market dynamics, growth trends, regional dominance, and the competitive landscape. Covering the period from 2019 to 2033, with a base year of 2024 and a forecast period of 2024–2033, this report is an indispensable resource for stakeholders seeking to understand the evolving pharma packaging sector in these dynamic regions. We delve into the parent and child markets of pharmaceutical plastic containers, drug packaging solutions, and medical plastic packaging, evaluating opportunities within solid containers, dropper bottles, nasal spray bottles, liquid bottles, oral care products, pouches, vials & ampoules, cartridges, syringes, and caps & closures. The analysis is underpinned by robust data, with a projected market size of 3330.2 million and a Compound Annual Growth Rate (CAGR) of 9.

Middle East and West Africa Pharmaceutical Plastic Packaging Market Market Dynamics & Structure

The Middle East and West Africa pharmaceutical plastic packaging market exhibits a moderately concentrated structure, with key players vying for market share through technological innovation and strategic expansions. Regulatory frameworks are gradually aligning with international standards, fostering greater demand for high-quality, compliant pharmaceutical packaging materials. The adoption of advanced manufacturing techniques, such as those highlighted by ALPLApharma's expansion in flexible extrusion blow molding (EBM), is a significant driver of technological innovation, enabling the creation of more sustainable and customer-specific solutions. Competitive product substitutes exist, primarily from glass packaging, but the inherent advantages of plastic – including cost-effectiveness, durability, and design flexibility – continue to propel its dominance. End-user demographics, characterized by a growing middle class and increasing healthcare expenditure, are fueling demand for a wider array of pharmaceutical products, thereby stimulating the pharmaceutical plastic packaging market. Merger and acquisition (M&A) trends are also evident, as companies seek to consolidate their market position, expand their product portfolios, and enhance their geographical reach. For instance, recent M&A activities in the broader packaging sector indicate a strategic consolidation aimed at capturing a larger share of the burgeoning healthcare packaging market in these regions. The market is segmented by raw material, with Polypropylene (PP) and Polyethylene Terephthalate (PET) being dominant, and by product type, where liquid bottles and caps & closures represent significant portions of the market.

Middle East and West Africa Pharmaceutical Plastic Packaging Market Growth Trends & Insights

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is poised for robust growth, driven by a confluence of factors including increasing healthcare infrastructure development, rising prevalence of chronic diseases, and a growing demand for packaged pharmaceutical formulations. Market size evolution will be characterized by steady expansion, projected to achieve a significant compound annual growth rate (CAGR) throughout the forecast period. Adoption rates of advanced plastic pharmaceutical packaging are accelerating, influenced by stringent regulatory requirements and a heightened focus on patient safety and drug integrity. Technological disruptions, such as the development of novel barrier materials and smart packaging solutions, are set to further enhance product performance and consumer trust. Consumer behavior shifts, including a growing preference for convenient and single-dose packaging, are also influencing product development and market penetration strategies. The demand for sustainable pharmaceutical plastic packaging, utilizing materials like recycled PET (r-PET), is on the rise, reflecting a global trend towards environmental responsibility and circular economy principles. Insights reveal a growing market penetration of specialized packaging formats like nasal spray bottles and dropper bottles, catering to specific therapeutic needs and improving drug delivery mechanisms. The increasing investment in domestic pharmaceutical manufacturing across both regions is a key growth accelerator, creating sustained demand for local and regional pharma plastic suppliers.

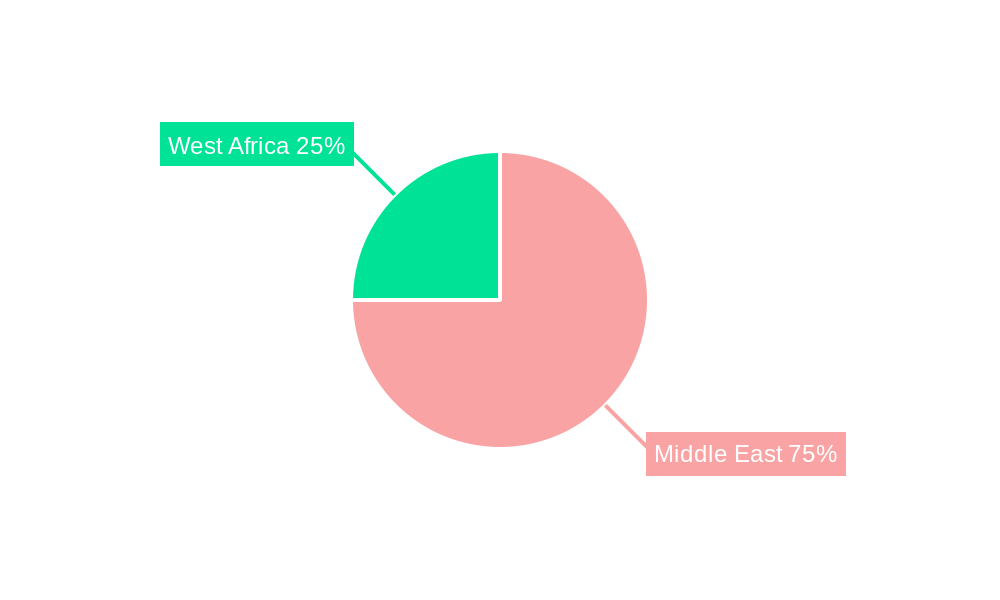

Dominant Regions, Countries, or Segments in Middle East and West Africa Pharmaceutical Plastic Packaging Market

Within the Middle East and West Africa Pharmaceutical Plastic Packaging Market, the Middle East region, particularly countries like Saudi Arabia, the UAE, and Turkey, is anticipated to be the dominant force in driving market growth. This dominance stems from a combination of factors: significant government investment in healthcare infrastructure, a high disposable income supporting increased healthcare spending, and the presence of well-established pharmaceutical manufacturing hubs. Economically, these nations are focused on diversifying their economies, with healthcare and pharmaceuticals playing a pivotal role.

- Key Drivers in the Dominant Region:

- Advanced Healthcare Infrastructure: Extensive development of hospitals, clinics, and specialized medical facilities necessitates a high volume of pharmaceutical packaging.

- Growing Pharmaceutical Manufacturing: Local and international pharmaceutical companies are establishing or expanding their manufacturing capabilities in the Middle East, creating a strong demand for primary and secondary packaging solutions.

- Favorable Regulatory Environment: While evolving, the regulatory landscape in key Middle Eastern countries is becoming more conducive to investment and innovation in the pharmaceutical sector, including packaging.

- High Disposable Income: Increased purchasing power among the population translates to higher demand for a wider range of healthcare products and associated packaging.

- Strategic Location: The Middle East serves as a logistical hub, facilitating the distribution of pharmaceutical products and packaging materials across the region and beyond.

In terms of raw materials, Polypropylene (PP) and Polyethylene Terephthalate (PET) are expected to maintain their dominance due to their versatility, cost-effectiveness, and suitability for a wide range of pharmaceutical applications. For product segments, liquid bottles are projected to hold a substantial market share, driven by the widespread use of liquid formulations for various medications. However, segments like caps & closures, dropper bottles, and nasal spray bottles are witnessing significant growth due to their specialized functionalities and increasing demand in specific therapeutic areas. The growth potential in these segments is fueled by technological advancements and a focus on improved drug efficacy and patient compliance. The West African market, while still developing, presents considerable untapped potential, driven by a rapidly growing population and increasing efforts to improve healthcare access.

Middle East and West Africa Pharmaceutical Plastic Packaging Market Product Landscape

The product landscape for pharmaceutical plastic packaging in the Middle East and West Africa is characterized by continuous innovation driven by the need for enhanced drug safety, patient compliance, and sustainability. Manufacturers are focusing on developing lightweight yet robust packaging solutions, such as advanced liquid bottles with child-resistant features and tamper-evident seals. Innovations in dropper bottles and nasal spray bottles are enhancing precision and ease of use for various medications. Furthermore, the development of specialized cartridges and syringes for biopharmaceuticals and injectables underscores the market's move towards high-value drug delivery systems. The growing emphasis on sustainability is leading to the increased adoption of recycled content in caps & closures and other components, without compromising on performance or regulatory compliance.

Key Drivers, Barriers & Challenges in Middle East and West Africa Pharmaceutical Plastic Packaging Market

Key Drivers: The Middle East and West Africa pharmaceutical plastic packaging market is propelled by several key drivers. Growing healthcare expenditure and the rising prevalence of chronic diseases are increasing the demand for medicines, thereby stimulating the need for packaging. Advancements in pharmaceutical formulations, particularly for biologics and injectables, are driving the adoption of specialized plastic packaging solutions like pre-filled syringes and vials. Supportive government initiatives focused on developing domestic pharmaceutical manufacturing capabilities further bolster the market. Technological innovations in plastic materials and manufacturing processes, leading to lighter, stronger, and more sustainable packaging options, are also significant growth accelerators.

Barriers & Challenges: Despite the promising growth, the market faces several barriers and challenges. Stringent regulatory compliance, while necessary for patient safety, can increase manufacturing costs and lead times for new packaging development. Fluctuations in raw material prices, particularly for polymers, can impact profit margins. The underdeveloped infrastructure in some parts of West Africa can pose logistical challenges for supply chain management. Intense competition from established global players and the increasing demand for sustainable packaging solutions that require significant investment in new technologies also present challenges. Furthermore, counterfeiting of pharmaceutical products remains a concern, necessitating advanced anti-counterfeiting features in packaging.

Emerging Opportunities in Middle East and West Africa Pharmaceutical Plastic Packaging Market

Emerging opportunities within the Middle East and West Africa Pharmaceutical Plastic Packaging Market lie in catering to the burgeoning demand for specialized packaging for biologics and advanced therapies. The growing focus on sustainable packaging solutions presents a significant avenue, with potential for innovation in biodegradable and recyclable materials, particularly for pouches and bottles. Untapped markets in sub-Saharan Africa offer immense potential as healthcare access expands, requiring cost-effective and reliable pharmaceutical packaging. The increasing adoption of e-commerce for pharmaceutical sales also opens opportunities for robust and tamper-evident packaging solutions that can withstand transit. Furthermore, the development of smart packaging solutions with embedded tracking and authentication features represents a futuristic opportunity to enhance drug traceability and combat counterfeiting.

Growth Accelerators in the Middle East and West Africa Pharmaceutical Plastic Packaging Market Industry

Several catalysts are accelerating the long-term growth of the Middle East and West Africa Pharmaceutical Plastic Packaging Market Industry. Strategic partnerships between packaging manufacturers and pharmaceutical companies are crucial for co-developing innovative solutions tailored to specific drug needs. Market expansion strategies, including setting up local manufacturing facilities and distribution networks in key African nations, will be vital for capturing market share. Technological breakthroughs in material science, leading to the development of advanced barrier properties and antimicrobial plastics, will enhance the shelf-life and safety of pharmaceutical products. The increasing trend towards localized pharmaceutical manufacturing across both regions will create sustained demand for domestic and regional plastic packaging suppliers, fostering a more resilient supply chain and reducing reliance on imports.

Key Players Shaping the Middle East and West Africa Pharmaceutical Plastic Packaging Market Market

The Middle East and West Africa Pharmaceutical Plastic Packaging Market is shaped by a diverse range of key players, including:

- Alpack Plastic Packaging

- COMAR LLC

- Drug Plastics Group

- Plastipak Holdings Inc

- Berk Company LLC

- Aptar Pharma

- Berry Plastics Group Inc

- Graham Packaging Company

- Gulf Packaging Industries Limited

- Alpha Packaging

- Amcor Limited

(List Not Exhaustive)

Notable Milestones in Middle East and West Africa Pharmaceutical Plastic Packaging Market Sector

- August 2022: The ALPLA Group's pharma packaging division, ALPLApharma, announced the expansion of its manufacturing technology for OTC bottles by adding flexible extrusion blow molding (EBM), enabling sustainable and customer-specific packaging solutions.

- February 2022: Greiner Packaging extended its selection of sanitizer bottles, introducing a new product line of 16 bottles in various forms and sizes (100-1000 ml capacity). These bottles utilize round bodies formed from up to 100% r-PET, created using the ISBM method.

In-Depth Middle East and West Africa Pharmaceutical Plastic Packaging Market Market Outlook

The future outlook for the Middle East and West Africa Pharmaceutical Plastic Packaging Market is exceptionally positive, driven by sustained growth accelerators. The region's ongoing commitment to enhancing healthcare access and quality will continue to fuel demand for a wide array of pharmaceutical products, thus necessitating robust packaging solutions. Strategic investments in local manufacturing and innovation will foster market resilience and competitiveness. The increasing global emphasis on sustainability will also drive the adoption of eco-friendly packaging materials and processes, creating new market niches. Opportunities for market expansion will remain abundant, particularly in rapidly developing African economies. Stakeholders who can effectively navigate the evolving regulatory landscape, embrace technological advancements, and prioritize sustainable practices will be well-positioned for significant success.

Middle East and West Africa Pharmaceutical Plastic Packaging Market Segmentation

-

1. Raw Material

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Low Density Polyethylene (LDPE)

- 1.4. High Density Polyethylene (HDPE)

- 1.5. Other Types of Materials

-

2. Product

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Pouches

- 2.7. Vials & Ampoules

- 2.8. Cartridges

- 2.9. Syringes

- 2.10. Caps & Closures

- 2.11. Other Product Types

Middle East and West Africa Pharmaceutical Plastic Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and West Africa Pharmaceutical Plastic Packaging Market Regional Market Share

Geographic Coverage of Middle East and West Africa Pharmaceutical Plastic Packaging Market

Middle East and West Africa Pharmaceutical Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Rigid & Flexible Pharmaceutical Plastic Products; Development of Better and More Advanced Healthcare Infrastructure

- 3.3. Market Restrains

- 3.3.1. Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 3.4. Market Trends

- 3.4.1. Bottles to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and West Africa Pharmaceutical Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Low Density Polyethylene (LDPE)

- 5.1.4. High Density Polyethylene (HDPE)

- 5.1.5. Other Types of Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Pouches

- 5.2.7. Vials & Ampoules

- 5.2.8. Cartridges

- 5.2.9. Syringes

- 5.2.10. Caps & Closures

- 5.2.11. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alpack Plastic Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 COMAR LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Drug Plastics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Plastipak Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berk Company LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aptar Pharma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berry Plastics Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Graham Packaging Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gulf Pakcaging Industries Limited

*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alpha Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Alpack Plastic Packaging

List of Figures

- Figure 1: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and West Africa Pharmaceutical Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 2: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 3: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Raw Material 2020 & 2033

- Table 5: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and West Africa Pharmaceutical Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and West Africa Pharmaceutical Plastic Packaging Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Middle East and West Africa Pharmaceutical Plastic Packaging Market?

Key companies in the market include Alpack Plastic Packaging, COMAR LLC, Drug Plastics Group, Plastipak Holdings Inc, Berk Company LLC, Aptar Pharma, Berry Plastics Group Inc, Graham Packaging Company, Gulf Pakcaging Industries Limited *List Not Exhaustive, Alpha Packaging, Amcor Limited.

3. What are the main segments of the Middle East and West Africa Pharmaceutical Plastic Packaging Market?

The market segments include Raw Material, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 3330.2 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Rigid & Flexible Pharmaceutical Plastic Products; Development of Better and More Advanced Healthcare Infrastructure.

6. What are the notable trends driving market growth?

Bottles to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power.

8. Can you provide examples of recent developments in the market?

August 2022 - The ALPLA Group's pharma packaging division ALPLApharma has announced the expanding its manufacturing technology for OTC bottles with the addition of flexible extrusion blow molding (EBM), which makes sustainable and customer-specific packaging solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and West Africa Pharmaceutical Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and West Africa Pharmaceutical Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and West Africa Pharmaceutical Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and West Africa Pharmaceutical Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence