Key Insights

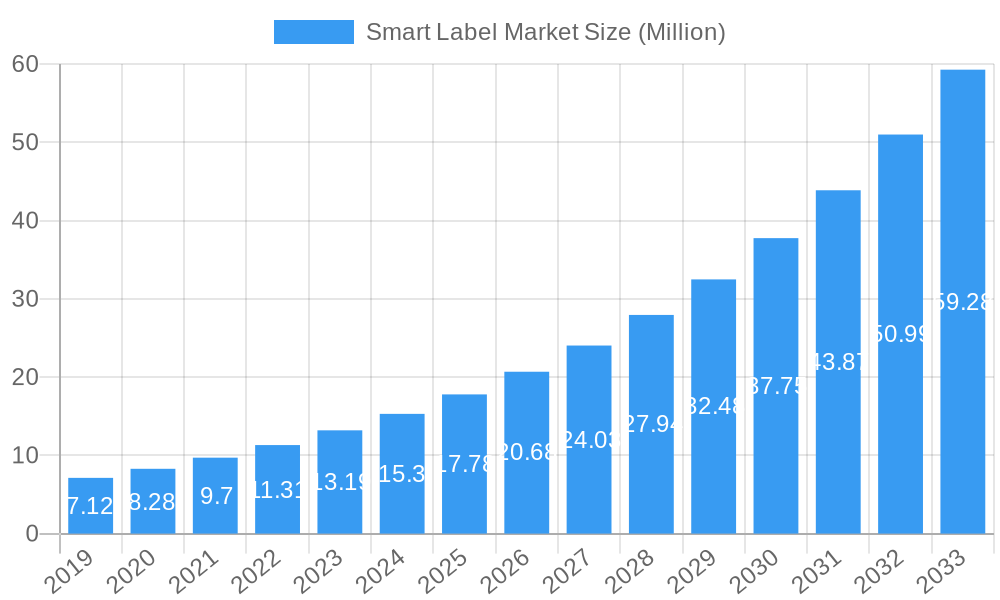

The global Smart Label Market is poised for remarkable expansion, projected to reach an estimated USD 15.67 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 16.34% expected to drive its trajectory through 2033. This substantial growth is fueled by an increasing demand for enhanced supply chain visibility, inventory management efficiency, and improved consumer engagement across diverse industries. Key drivers include the rapid adoption of Radio-Frequency Identification (RFID) and Electronic Shelf Label (ESL) technologies, which offer real-time data tracking and dynamic pricing capabilities. Furthermore, the growing emphasis on product authentication and anti-counterfeiting measures, especially within the healthcare and pharmaceutical sectors, is significantly bolstering market demand. The proliferation of connected devices and the Internet of Things (IoT) ecosystem also provides fertile ground for smart label integration, enabling seamless data exchange and intelligent automation.

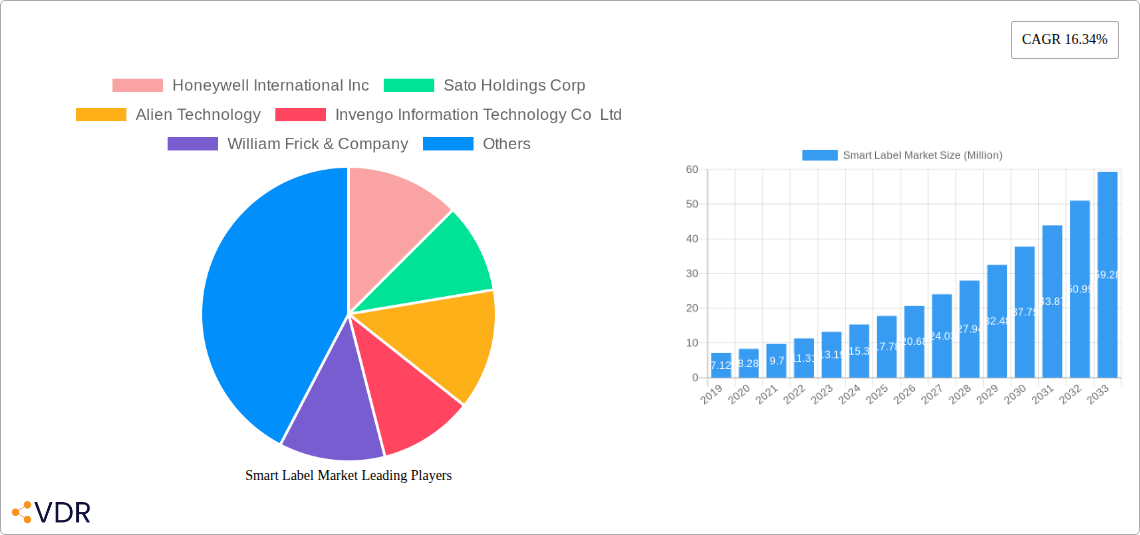

Smart Label Market Market Size (In Million)

The market is characterized by dynamic trends such as the evolution towards more sophisticated sensing labels capable of monitoring environmental conditions like temperature and humidity, crucial for cold chain logistics and sensitive product handling. The integration of Near Field Communication (NFC) technology is also on the rise, facilitating direct consumer interaction with product information and promotional content. While the growth prospects are overwhelmingly positive, certain restraints may influence the pace of adoption. These include the initial capital investment required for implementing smart label systems and the ongoing need for robust data security protocols to protect sensitive information. However, the persistent drive for operational excellence, waste reduction, and enhanced customer experiences across retail, logistics, and manufacturing industries is expected to outweigh these challenges, ensuring sustained market expansion. Major players like Honeywell International Inc., Avery Dennison Corporation, and Zebra Technologies Corp. are at the forefront of innovation, introducing advanced solutions and expanding their market presence.

Smart Label Market Company Market Share

Smart Label Market: Revolutionizing Inventory, Supply Chain, and Consumer Engagement | 2025-2033

This comprehensive report delves into the dynamic Smart Label Market, a rapidly evolving sector driven by technological innovation and increasing demand for efficient data management across diverse industries. Explore the global smart label market size, smart tag market trends, electronic shelf label (ESL) market growth, and the pervasive influence of RFID technology and NFC technology. Gain critical insights into the parent smart label market and its intricate child smart label market segments, understanding their interdependencies and growth trajectories.

The smart label market report provides an in-depth analysis from 2019 to 2033, with a base year of 2025, and a forecast period of 2025-2033. Quantified values are presented in Million units.

Smart Label Market Market Dynamics & Structure

The smart label market is characterized by a moderately concentrated structure, with key players like Honeywell International Inc, Zebra Technologies Corp, and Avery Dennison Corporation holding significant market share. Technological innovation is a primary driver, fueled by advancements in RFID chips, NFC tags, and sophisticated electronic shelf labels (ESLs) that offer real-time data and enhanced operational efficiency. Regulatory frameworks, particularly concerning data privacy and product traceability in sectors like healthcare and pharmaceuticals, are shaping product development and market adoption. Competitive product substitutes, such as traditional barcodes and manual inventory systems, are steadily being displaced by the superior capabilities of smart labels. End-user demographics reveal a growing reliance on smart labels within the retail sector, driven by the need for improved inventory management and personalized customer experiences. M&A trends indicate strategic consolidation as larger companies acquire innovative startups to expand their technology portfolios and market reach, further intensifying competitive dynamics.

- Market Concentration: Dominated by a few key players, with opportunities for niche players in specific technology segments.

- Technological Innovation Drivers: Miniaturization of sensors, improved battery life, enhanced data security, and integration with IoT platforms.

- Regulatory Frameworks: Focus on data security, supply chain transparency, and consumer product information requirements.

- Competitive Product Substitutes: Traditional barcodes, QR codes, manual inventory tracking.

- End-User Demographics: Increasingly tech-savvy consumers and businesses seeking efficiency and real-time data.

- M&A Trends: Strategic acquisitions to gain access to proprietary technology and expand market penetration.

Smart Label Market Growth Trends & Insights

The smart label market is poised for robust expansion, driven by escalating demand for enhanced inventory accuracy, supply chain visibility, and improved customer engagement. Projections indicate a significant CAGR for smart labels throughout the forecast period. The widespread adoption of RFID technology in logistics and retail for item-level tracking and loss prevention, alongside the burgeoning use of NFC labels for contactless payments and product authentication, are key growth accelerators. The rise of electronic shelf labels (ESLs) is revolutionizing the retail landscape by enabling dynamic pricing, promotional campaigns, and real-time stock updates, thereby optimizing store operations and enhancing the shopping experience. Furthermore, the increasing penetration of the Internet of Things (IoT) is creating new avenues for smart labels to collect and transmit data, fostering a more connected and intelligent ecosystem. Consumer behavior shifts, such as the demand for greater product transparency and personalized offers, are also directly fueling the adoption of smart labeling solutions. Market penetration is projected to surge as the cost-effectiveness of smart label solutions improves and their benefits become more widely recognized across industries.

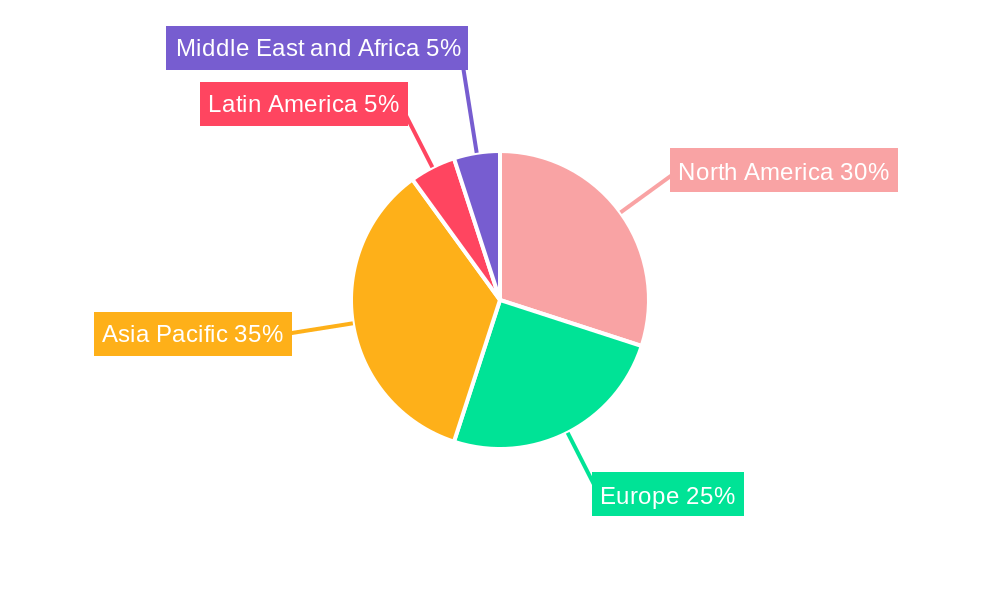

Dominant Regions, Countries, or Segments in Smart Label Market

The global smart label market is experiencing significant growth, with the retail industry emerging as a dominant end-user segment. This dominance is driven by the inherent need for efficient inventory management, streamlined supply chains, and enhanced customer experiences. The adoption of Electronic Shelf Labels (ESLs) in retail is particularly transformative, enabling dynamic pricing, real-time stock updates, and personalized promotions. North America and Europe are leading regions due to their advanced technological infrastructure, high adoption rates of automation, and strong regulatory push for supply chain transparency. Within the technology segments, RFID technology continues to be a cornerstone, offering unparalleled benefits in asset tracking and inventory control, with projected market share of approximately 35% by 2025. Electronic Article Surveillance (EAS) remains crucial for loss prevention, while NFC technology is gaining traction for its applications in consumer engagement and product authentication, especially within the luxury goods and pharmaceutical sectors. The healthcare and pharmaceutical segment is a rapidly growing area, spurred by stringent regulations demanding counterfeit prevention and enhanced traceability of medicines.

- Dominant End-User Industry: Retail, driven by inventory management and dynamic pricing needs.

- Leading Technology Segment: RFID, owing to its broad applications in tracking and identification.

- Key Regional Markets: North America and Europe, with strong technological adoption and regulatory support.

- Growth Potential: Healthcare and Pharmaceutical, fueled by regulatory compliance and patient safety concerns.

- Market Share Drivers: Efficiency gains, cost reduction, enhanced security, and regulatory compliance.

Smart Label Market Product Landscape

The smart label product landscape is characterized by continuous innovation, offering a diverse range of solutions tailored to specific industry needs. From advanced RFID tags with enhanced read ranges and data storage capabilities to sophisticated NFC labels facilitating seamless contactless interactions, the market is witnessing a surge in sophisticated functionalities. Electronic Shelf Labels (ESLs) are transforming retail environments with dynamic pricing, real-time inventory updates, and digital marketing integration, significantly improving operational efficiency. Sensing labels are emerging, equipped with sensors for monitoring environmental conditions like temperature and humidity, crucial for sensitive goods in the healthcare and pharmaceutical and logistics sectors. These products boast unique selling propositions such as real-time data capture, reduced manual intervention, and improved supply chain visibility, paving the way for smarter, more connected operations.

Key Drivers, Barriers & Challenges in Smart Label Market

Key Drivers: The smart label market is propelled by the relentless pursuit of operational efficiency and cost reduction across industries. RFID technology and NFC technology are enabling real-time inventory tracking, reducing stockouts, and minimizing shrinkage. The growing demand for supply chain transparency, particularly in the pharmaceutical and food industries, acts as a significant driver, ensuring product authenticity and safety. Furthermore, the increasing adoption of IoT devices and the need for granular data collection are creating new opportunities for smart label integration.

Barriers & Challenges: Despite the promising growth, the smart label market faces several challenges. The initial implementation cost of smart label systems can be a deterrent for small and medium-sized enterprises. Integration complexities with existing IT infrastructure and the need for specialized knowledge for deployment and maintenance present hurdles. Supply chain disruptions and the availability of raw materials for label production can impact production volumes and pricing. Ensuring data security and privacy in an increasingly connected environment is also a critical concern that needs to be addressed. Competitive pressures from established players and the constant need for technological upgrades to stay relevant add to the market's dynamic nature.

Emerging Opportunities in Smart Label Market

Emerging opportunities within the smart label market are vast and varied, fueled by evolving consumer expectations and technological advancements. The integration of smart labels with augmented reality (AR) presents a significant avenue for enhanced consumer engagement, allowing users to access product information, tutorials, and interactive experiences simply by scanning a label. Untapped markets in emerging economies, where the adoption of advanced inventory management systems is still in its nascent stages, offer substantial growth potential. The increasing focus on sustainability is also driving the development of eco-friendly smart label solutions, appealing to environmentally conscious businesses and consumers. Furthermore, the application of smart labels in specialized sectors like agriculture for monitoring crop conditions and in the automotive industry for tracking component lifecycles, are opening new frontiers for innovation.

Growth Accelerators in the Smart Label Market Industry

Several key catalysts are accelerating the growth of the smart label market. Technological breakthroughs in RFID chip miniaturization and power efficiency are making labels smaller, more affordable, and versatile. The ongoing development of advanced NFC capabilities, enabling richer interactive experiences and enhanced security features, is further boosting adoption. Strategic partnerships between technology providers, label manufacturers, and system integrators are streamlining the deployment of smart label solutions, making them more accessible to a wider range of businesses. Market expansion strategies, particularly in underserved regions and nascent industries, are crucial for long-term growth. The increasing focus on data analytics and the ability of smart labels to provide actionable insights are also significant growth accelerators, enabling businesses to make more informed decisions.

Key Players Shaping the Smart Label Market Market

- Honeywell International Inc

- Sato Holdings Corp

- Alien Technology

- Invengo Information Technology Co Ltd

- William Frick & Company

- Scanbuy Inc

- CCL Industries Inc

- Avery Dennison Corporation

- Zebra Technologies Corp

Notable Milestones in Smart Label Market Sector

- March 2023: The Premier League and Avery Dennison collaborated on the new font, which is only the fourth makeover in Premier League history. The new font has enhanced visibility and impacts both on and off the pitch due to an increase in number height and the incorporation of the Premier League's unique graphic design. The new numbers, names, and sleeve badges will be available in the spring, following the release of each Premier League club's 2023-24 season shirt.

- February 2023: DanavationTechnologies Corp., a North American-founded and based technology provider of tiny e-paper displays, announced that the company had received new contracts for four further installations of new digital smart labels. The firm mentioned installing digital smart labels in ten recent retail locations in Canada and the United States since the start of 2023.

In-Depth Smart Label Market Market Outlook

The smart label market is on an upward trajectory, propelled by the confluence of technological innovation and evolving industry demands for efficiency and transparency. Growth accelerators include the ongoing advancements in RFID and NFC technologies, leading to more sophisticated and cost-effective solutions. Strategic alliances between key market players are fostering wider adoption and driving market penetration. The expansion into new geographical regions and the exploration of novel applications in sectors beyond traditional retail and logistics are poised to further bolster market growth. The increasing emphasis on data-driven decision-making across all industries will continue to fuel the demand for smart labels, positioning them as indispensable tools for operational excellence and competitive advantage in the coming years.

Smart Label Market Segmentation

-

1. Technology

- 1.1. Electronic Article Surveillance (EAS)

- 1.2. RFID

- 1.3. Sensing Label

- 1.4. NFC

- 1.5. Electronic Shelf Label (ESL)

-

2. End-user Industry

- 2.1. Retail

- 2.2. Healthcare and Pharmaceutical

- 2.3. Logistics

- 2.4. Manufacturing

- 2.5. Other End-user Industries

Smart Label Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Smart Label Market Regional Market Share

Geographic Coverage of Smart Label Market

Smart Label Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Security and Tracking Solutions

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Retail End User Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Electronic Article Surveillance (EAS)

- 5.1.2. RFID

- 5.1.3. Sensing Label

- 5.1.4. NFC

- 5.1.5. Electronic Shelf Label (ESL)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Healthcare and Pharmaceutical

- 5.2.3. Logistics

- 5.2.4. Manufacturing

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Electronic Article Surveillance (EAS)

- 6.1.2. RFID

- 6.1.3. Sensing Label

- 6.1.4. NFC

- 6.1.5. Electronic Shelf Label (ESL)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Retail

- 6.2.2. Healthcare and Pharmaceutical

- 6.2.3. Logistics

- 6.2.4. Manufacturing

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Electronic Article Surveillance (EAS)

- 7.1.2. RFID

- 7.1.3. Sensing Label

- 7.1.4. NFC

- 7.1.5. Electronic Shelf Label (ESL)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Retail

- 7.2.2. Healthcare and Pharmaceutical

- 7.2.3. Logistics

- 7.2.4. Manufacturing

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Electronic Article Surveillance (EAS)

- 8.1.2. RFID

- 8.1.3. Sensing Label

- 8.1.4. NFC

- 8.1.5. Electronic Shelf Label (ESL)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Retail

- 8.2.2. Healthcare and Pharmaceutical

- 8.2.3. Logistics

- 8.2.4. Manufacturing

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Electronic Article Surveillance (EAS)

- 9.1.2. RFID

- 9.1.3. Sensing Label

- 9.1.4. NFC

- 9.1.5. Electronic Shelf Label (ESL)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Retail

- 9.2.2. Healthcare and Pharmaceutical

- 9.2.3. Logistics

- 9.2.4. Manufacturing

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Smart Label Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Electronic Article Surveillance (EAS)

- 10.1.2. RFID

- 10.1.3. Sensing Label

- 10.1.4. NFC

- 10.1.5. Electronic Shelf Label (ESL)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Retail

- 10.2.2. Healthcare and Pharmaceutical

- 10.2.3. Logistics

- 10.2.4. Manufacturing

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sato Holdings Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alien Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Invengo Information Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 William Frick & Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Scanbuy Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Avery Dennison Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zebra Technologies Corp *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Label Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: Latin America Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Smart Label Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Smart Label Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Smart Label Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Smart Label Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Smart Label Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Smart Label Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Smart Label Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Smart Label Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Smart Label Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 25: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Smart Label Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Global Smart Label Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Smart Label Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Label Market?

The projected CAGR is approximately 16.34%.

2. Which companies are prominent players in the Smart Label Market?

Key companies in the market include Honeywell International Inc, Sato Holdings Corp, Alien Technology, Invengo Information Technology Co Ltd, William Frick & Company, Scanbuy Inc, CCL Industries Inc, Avery Dennison Corporation, Zebra Technologies Corp *List Not Exhaustive.

3. What are the main segments of the Smart Label Market?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Security and Tracking Solutions.

6. What are the notable trends driving market growth?

Retail End User Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

March 2023: The Premier League and Avery Dennison collaborated on the new font, which is only the fourth makeover in Premier League history. The new font has enhanced visibility and impacts both on and off the pitch due to an increase in number height and the incorporation of the Premier League's unique graphic design. The new numbers, names, and sleeve badges will be available in the spring, following the release of each Premier League club's 2023-24 season shirt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Label Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Label Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Label Market?

To stay informed about further developments, trends, and reports in the Smart Label Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence