Key Insights

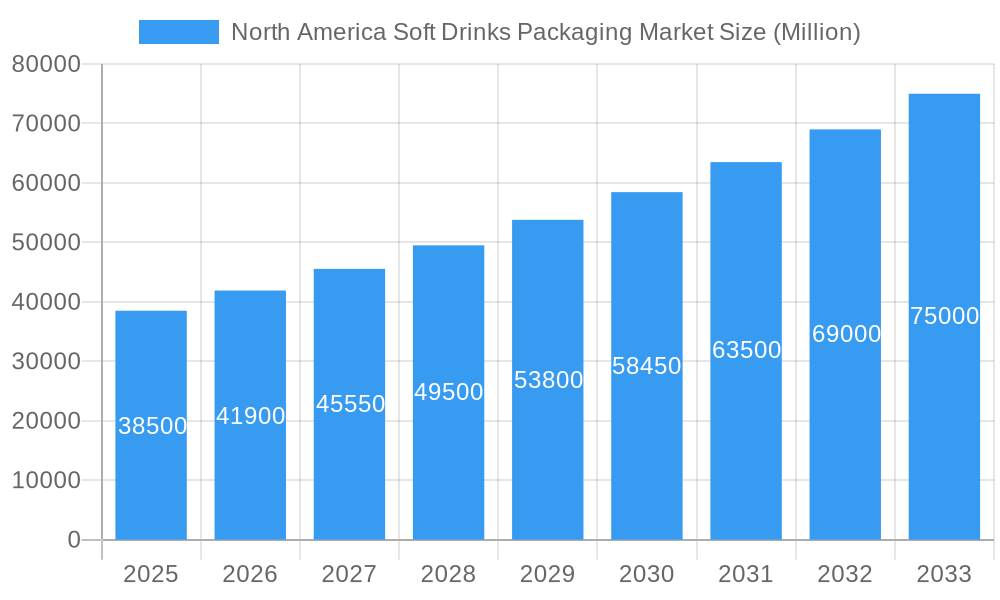

The North America soft drinks packaging market is set for robust growth, projected to reach a market size of 42.16 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.57% from a base year of 2025. This expansion is driven by evolving consumer preferences for convenience, particularly ready-to-drink (RTD) beverages, and a rising demand for healthier options like juices and sports drinks. Innovations in sustainable and convenient packaging materials, including lightweight, recyclable plastics and premium glass, are key growth enablers. Aggressive manufacturer marketing and investments in advanced packaging technologies further support market expansion.

North America Soft Drinks Packaging Market Market Size (In Billion)

While the market outlook is positive, challenges include rising raw material costs for plastics and metals, and stringent environmental regulations. These factors necessitate strategic adaptations, driving innovation in sustainable materials while requiring significant investment. The competitive landscape features established global players and emerging regional manufacturers, emphasizing the need for product differentiation and cost efficiency. Market segmentation reveals diverse demand across packaging materials, beverage types, and geographies, with the United States and Canada being primary consumption centers.

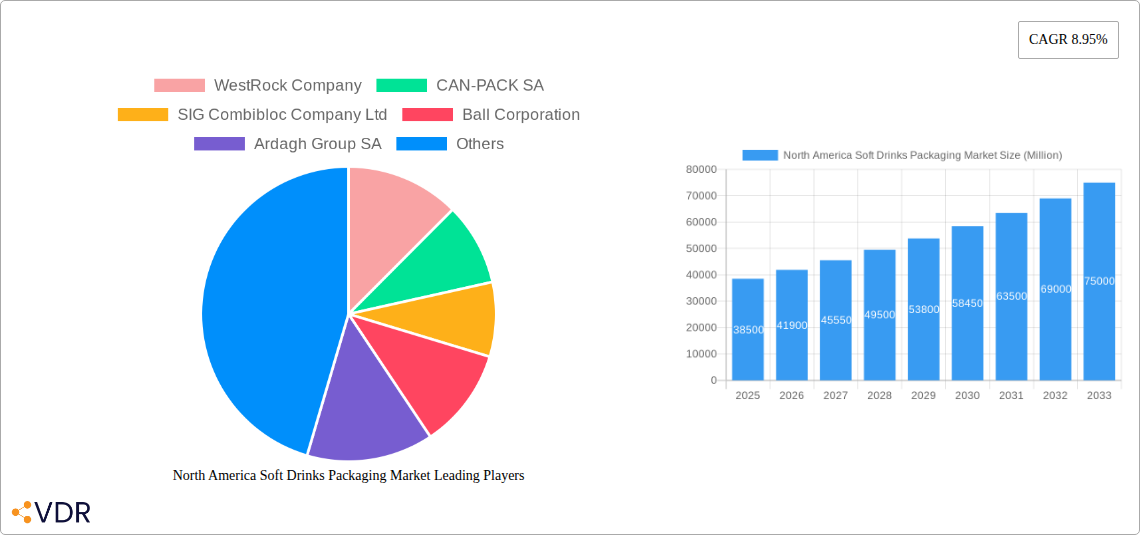

North America Soft Drinks Packaging Market Company Market Share

This comprehensive report analyzes the North America Soft Drinks Packaging Market from 2019 to 2033, focusing on the base year 2025 and forecast period 2025–2033. It provides in-depth insights into market dynamics, growth drivers, segmentation, key players, and emerging trends. The analysis incorporates high-traffic keywords including "soft drinks packaging," "North America beverage containers," "plastic packaging for drinks," "aluminum cans for beverages," "glass bottles for soft drinks," and "sustainable packaging solutions" for optimal search engine visibility.

North America Soft Drinks Packaging Market Market Dynamics & Structure

The North America Soft Drinks Packaging Market is characterized by a moderate level of market concentration, with several large, established players vying for market share alongside a growing number of niche and innovative companies. Technological innovation remains a significant driver, particularly in the pursuit of lightweight, sustainable, and convenient packaging solutions. Regulatory frameworks, including those concerning recyclability, material content, and food safety, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes are constantly emerging, driven by evolving consumer preferences and environmental concerns, with a notable shift towards materials like aluminum and advanced plastics. End-user demographics, particularly the increasing demand for convenience, health-conscious beverages, and on-the-go consumption, directly influence packaging design and functionality. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation within the industry, aimed at expanding product portfolios, enhancing technological capabilities, and securing market reach. For instance, recent years have seen several key players engaging in strategic investments and acquisitions to bolster their positions in specialty packaging segments.

- Market Concentration: Moderate to High, with key players holding significant market share.

- Technological Innovation Drivers: Sustainability, lightweighting, enhanced barrier properties, smart packaging.

- Regulatory Frameworks: Evolving legislation on recycled content, single-use plastics bans, and food contact materials.

- Competitive Product Substitutes: Growing adoption of aluminum cups, bio-based plastics, and reusable packaging options.

- End-User Demographics: Millennial and Gen Z preferences for convenience, health, and sustainability.

- M&A Trends: Strategic acquisitions focused on sustainability technologies, flexible packaging, and market expansion. For example, recent M&A activities in the flexible packaging sector, valued in the tens of millions of USD, underscore the drive for innovative solutions.

North America Soft Drinks Packaging Market Growth Trends & Insights

The North America Soft Drinks Packaging Market is poised for sustained growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period. This expansion is fueled by a confluence of factors, including the increasing per capita consumption of various soft drinks, a growing emphasis on premium and functional beverages, and a persistent demand for convenient packaging formats. The market size, estimated at xx Million units in 2025, is expected to reach xx Million units by 2033. Technological disruptions are continuously reshaping the landscape, with advancements in material science leading to the development of lighter, stronger, and more recyclable packaging options. The adoption rate of sustainable packaging materials, such as recycled PET (rPET) and aluminum, is accelerating as both consumers and manufacturers prioritize environmental responsibility. Consumer behavior shifts are playing a pivotal role, with a marked increase in demand for smaller, single-serve portions, on-the-go solutions, and aesthetically appealing packaging that reflects brand identity. Furthermore, the burgeoning market for Ready-to-Drink (RTD) beverages, including energy drinks and flavored waters, is a significant growth catalyst, driving innovation in flexible packaging and innovative bottle designs. The penetration of smart packaging features, offering enhanced traceability and consumer engagement, is also on an upward trajectory, albeit from a smaller base.

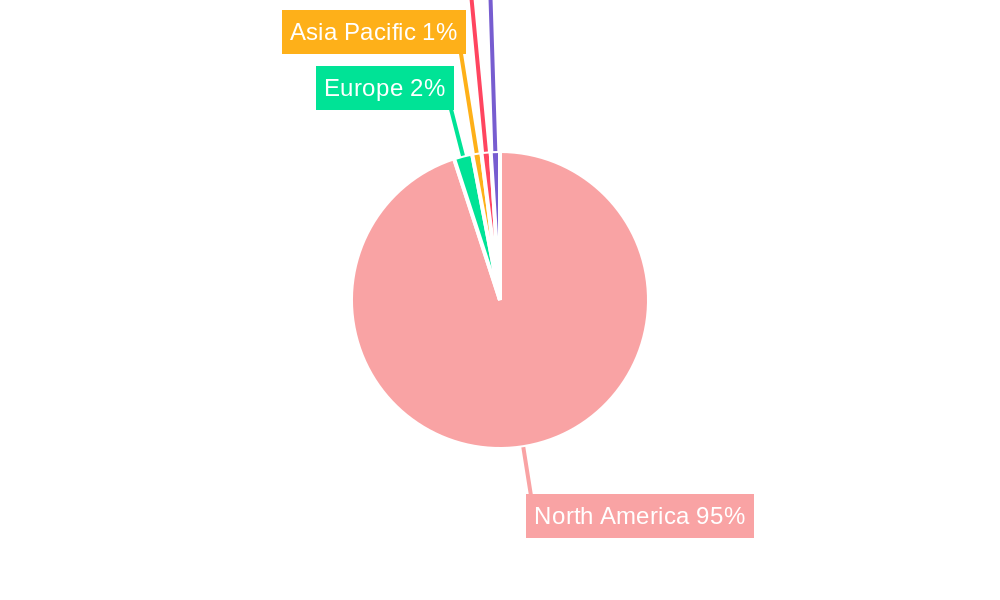

Dominant Regions, Countries, or Segments in North America Soft Drinks Packaging Market

Within the North America Soft Drinks Packaging Market, the United States stands out as the dominant region, driven by its sheer market size, robust economy, and significant per capita consumption of soft drinks. Its dominance is further amplified by advanced manufacturing capabilities, extensive distribution networks, and a high level of consumer adoption of new packaging trends. Plastic remains the dominant Packaging Material Type, accounting for over 50% of the market share due to its versatility, cost-effectiveness, and lightweight properties. However, Metal packaging, particularly aluminum cans, is experiencing robust growth driven by sustainability initiatives and the demand for beverage freshness.

In terms of Product Type, Carbonated Drinks continue to hold a substantial market share, but RTD Beverages are emerging as a high-growth segment, propelled by evolving consumer lifestyles and the demand for convenient, ready-to-consume options. The growth in RTD beverages is a significant factor in the increased demand for flexible packaging and innovative single-serve formats.

Key drivers for the United States' dominance include:

- Economic Policies: Favorable business environments and strong consumer spending power.

- Infrastructure: Well-developed logistics and supply chain networks facilitating efficient distribution.

- Consumer Trends: High disposable income and a propensity for adopting new beverage categories and packaging innovations.

- Innovation Hubs: Presence of leading packaging manufacturers and R&D centers driving technological advancements.

The Canadian market, while smaller, also exhibits strong growth potential, influenced by similar consumer trends and increasing environmental consciousness.

- Dominant Packaging Material: Plastic (e.g., PET bottles, flexible pouches) – Market Share: xx%

- Dominant Product Type: Carbonated Drinks – Market Share: xx%

- High-Growth Segment: RTD Beverages – CAGR: xx%

- Key Geography: United States – Market Share: xx%

North America Soft Drinks Packaging Market Product Landscape

The product landscape for North America Soft Drinks Packaging is dynamic, characterized by a continuous stream of innovations aimed at enhancing consumer convenience, environmental sustainability, and product preservation. Leading companies are focusing on developing lightweight PET bottles with improved barrier properties, recyclable aluminum cans with enhanced designs, and advanced flexible packaging solutions for RTD beverages. Notable product developments include the introduction of multi-layer films for extended shelf life, resealable caps for greater consumer utility, and the increasing use of post-consumer recycled (PCR) content in plastic packaging. Performance metrics such as material reduction, recyclability rates, and carbon footprint are becoming critical differentiators. For instance, the development of thinner yet stronger aluminum cans signifies a commitment to material efficiency and reduced environmental impact.

Key Drivers, Barriers & Challenges in North America Soft Drinks Packaging Market

Key Drivers:

- Growing Demand for Convenience: Consumers' preference for on-the-go consumption and easy-to-use packaging formats.

- Sustainability Initiatives: Increasing consumer and regulatory pressure for eco-friendly packaging solutions, including recyclable and biodegradable materials.

- Product Diversification: Expansion of the soft drinks market into new categories like functional beverages and RTDs, requiring specialized packaging.

- Technological Advancements: Innovations in material science and manufacturing processes enabling lighter, stronger, and more functional packaging.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of plastic resins, aluminum, and paper can impact profitability.

- Stringent Regulatory Landscape: Evolving environmental regulations and policies related to packaging waste and material content.

- Supply Chain Disruptions: Global events and logistical challenges can lead to material shortages and increased lead times.

- Competition from Alternatives: The rise of reusable packaging and concentrated formats poses a competitive threat.

- Consumer Education on Recycling: The need for improved consumer awareness and participation in recycling programs to support circular economy initiatives.

Emerging Opportunities in North America Soft Drinks Packaging Market

Emerging opportunities in the North America Soft Drinks Packaging Market lie in the burgeoning demand for personalized and functional packaging. The growth of direct-to-consumer (DTC) beverage models presents an avenue for innovative e-commerce-friendly packaging solutions designed for safe and efficient shipping. Furthermore, the increasing consumer interest in "better-for-you" beverages fuels opportunities for packaging that communicates health benefits and premium quality. The development of smart packaging solutions, integrating QR codes for traceability or interactive consumer experiences, offers significant untapped potential. The expansion of the RTD coffee and tea market also presents a growing demand for specialized packaging that maintains product integrity and freshness.

Growth Accelerators in the North America Soft Drinks Packaging Market Industry

Catalysts driving long-term growth in the North America Soft Drinks Packaging Market include the continuous pursuit of circular economy principles and the widespread adoption of advanced recycling technologies. Strategic partnerships between packaging manufacturers, beverage brands, and waste management companies are crucial for establishing robust collection and recycling infrastructure. Technological breakthroughs in areas such as chemical recycling and the development of high-barrier biodegradable materials are expected to unlock new avenues for sustainable packaging. Market expansion strategies focusing on underserved demographics and emerging beverage categories, such as plant-based beverages and functional waters, will further accelerate growth.

Key Players Shaping the North America Soft Drinks Packaging Market Market

- WestRock Company

- CAN-PACK SA

- SIG Combibloc Company Ltd

- Ball Corporation

- Ardagh Group SA

- Alcoa Corporation

- Crown Holdings Inc

- Graham Packaging Company

- Tetra Pak International

- The Scoular Company

- Toyo Seikan Group Holdings Ltd

- Pactive LLC

- Placon Corporation

- Genpak LLC

- Owens-Illinois Inc

- Amcor Ltd

Notable Milestones in North America Soft Drinks Packaging Market Sector

- May 2021: Ball Corporation announced the nationwide availability of the Ball Aluminum Cup for soft drinks across all 50 states in the United States, marking a significant retail rollout to over 18,000 food, drug, and mass retailers.

- April 2021: Amcor announced a strategic investment of approximately USD 10 to USD 15 million in ePac flexible packaging, a leader in short-run length digital printing, aiming to enhance its flexible packaging capabilities.

In-Depth North America Soft Drinks Packaging Market Market Outlook

The future outlook for the North America Soft Drinks Packaging Market is exceptionally promising, driven by a robust blend of evolving consumer demands and technological innovation. The ongoing shift towards sustainable and eco-friendly packaging solutions will continue to be a primary growth accelerator, pushing for greater use of recycled content and the development of novel biodegradable materials. Strategic collaborations between industry stakeholders, aimed at enhancing recycling infrastructure and promoting circular economy models, will be critical for long-term success. Furthermore, the expanding RTD beverage category, coupled with the increasing popularity of functional and health-oriented drinks, will fuel demand for specialized and innovative packaging designs that offer convenience, extended shelf life, and enhanced consumer appeal. Investments in advanced manufacturing technologies and material science research will empower the market to meet these evolving needs, positioning North America as a leader in responsible and forward-thinking soft drinks packaging.

North America Soft Drinks Packaging Market Segmentation

-

1. Packaging Material Type

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Metal

- 1.5. Other Materials

-

2. Product Type

- 2.1. Bottled Water

- 2.2. Carbonated Drinks

- 2.3. Juices

- 2.4. RTD Beverages

- 2.5. Sports Drinks

- 2.6. Other Product Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America Soft Drinks Packaging Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Soft Drinks Packaging Market Regional Market Share

Geographic Coverage of North America Soft Drinks Packaging Market

North America Soft Drinks Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Soft Drink Consumption; Increased Demand for Convenience Packaging from Consumers

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. The RTD Beverages Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Soft Drinks Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Metal

- 5.1.5. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottled Water

- 5.2.2. Carbonated Drinks

- 5.2.3. Juices

- 5.2.4. RTD Beverages

- 5.2.5. Sports Drinks

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6. United States North America Soft Drinks Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6.1.1. Plastic

- 6.1.2. Paper and Paperboard

- 6.1.3. Glass

- 6.1.4. Metal

- 6.1.5. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottled Water

- 6.2.2. Carbonated Drinks

- 6.2.3. Juices

- 6.2.4. RTD Beverages

- 6.2.5. Sports Drinks

- 6.2.6. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7. Canada North America Soft Drinks Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7.1.1. Plastic

- 7.1.2. Paper and Paperboard

- 7.1.3. Glass

- 7.1.4. Metal

- 7.1.5. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottled Water

- 7.2.2. Carbonated Drinks

- 7.2.3. Juices

- 7.2.4. RTD Beverages

- 7.2.5. Sports Drinks

- 7.2.6. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 WestRock Company

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 CAN-PACK SA

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 SIG Combibloc Company Ltd

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Ball Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Ardagh Group SA

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Alcoa Corporation*List Not Exhaustive

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Crown Holdings Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Graham Packaging Company

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Tetra Pak International

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 The Scoular Company

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Toyo Seikan Group Holdings Ltd

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Pactive LLC

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Placon Corporation

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 Genpak LLC

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 Owens-Illinois Inc

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.16 Amcor Ltd

- 8.2.16.1. Overview

- 8.2.16.2. Products

- 8.2.16.3. SWOT Analysis

- 8.2.16.4. Recent Developments

- 8.2.16.5. Financials (Based on Availability)

- 8.2.1 WestRock Company

List of Figures

- Figure 1: North America Soft Drinks Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Soft Drinks Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Soft Drinks Packaging Market Revenue billion Forecast, by Packaging Material Type 2020 & 2033

- Table 2: North America Soft Drinks Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: North America Soft Drinks Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Soft Drinks Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Soft Drinks Packaging Market Revenue billion Forecast, by Packaging Material Type 2020 & 2033

- Table 6: North America Soft Drinks Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: North America Soft Drinks Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Soft Drinks Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Soft Drinks Packaging Market Revenue billion Forecast, by Packaging Material Type 2020 & 2033

- Table 10: North America Soft Drinks Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: North America Soft Drinks Packaging Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Soft Drinks Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Soft Drinks Packaging Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the North America Soft Drinks Packaging Market?

Key companies in the market include WestRock Company, CAN-PACK SA, SIG Combibloc Company Ltd, Ball Corporation, Ardagh Group SA, Alcoa Corporation*List Not Exhaustive, Crown Holdings Inc, Graham Packaging Company, Tetra Pak International, The Scoular Company, Toyo Seikan Group Holdings Ltd, Pactive LLC, Placon Corporation, Genpak LLC, Owens-Illinois Inc, Amcor Ltd.

3. What are the main segments of the North America Soft Drinks Packaging Market?

The market segments include Packaging Material Type, Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Soft Drink Consumption; Increased Demand for Convenience Packaging from Consumers.

6. What are the notable trends driving market growth?

The RTD Beverages Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding Usage of Plastic; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

In May 2021, Ball Corporation announced the availability of the first-of-its-kind Ball Aluminum Cup for soft drinks at major retailers in all 50 states across the United States. The product was made available between May and June for the first time to more than 18,000 food, drug, and mass retailers, including Kroger, Target, Albertsons, CVS, and others. The nationwide retail rollout follows the success of a limited pilot that began in 2019. Since then, the cups have been available in select retailers, restaurants, and major sports and entertainment venues such as Ball Arena in Denver, SoFi Stadium in Inglewood, and Allegiant Stadium in Las Vegas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Soft Drinks Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Soft Drinks Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Soft Drinks Packaging Market?

To stay informed about further developments, trends, and reports in the North America Soft Drinks Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence