Key Insights

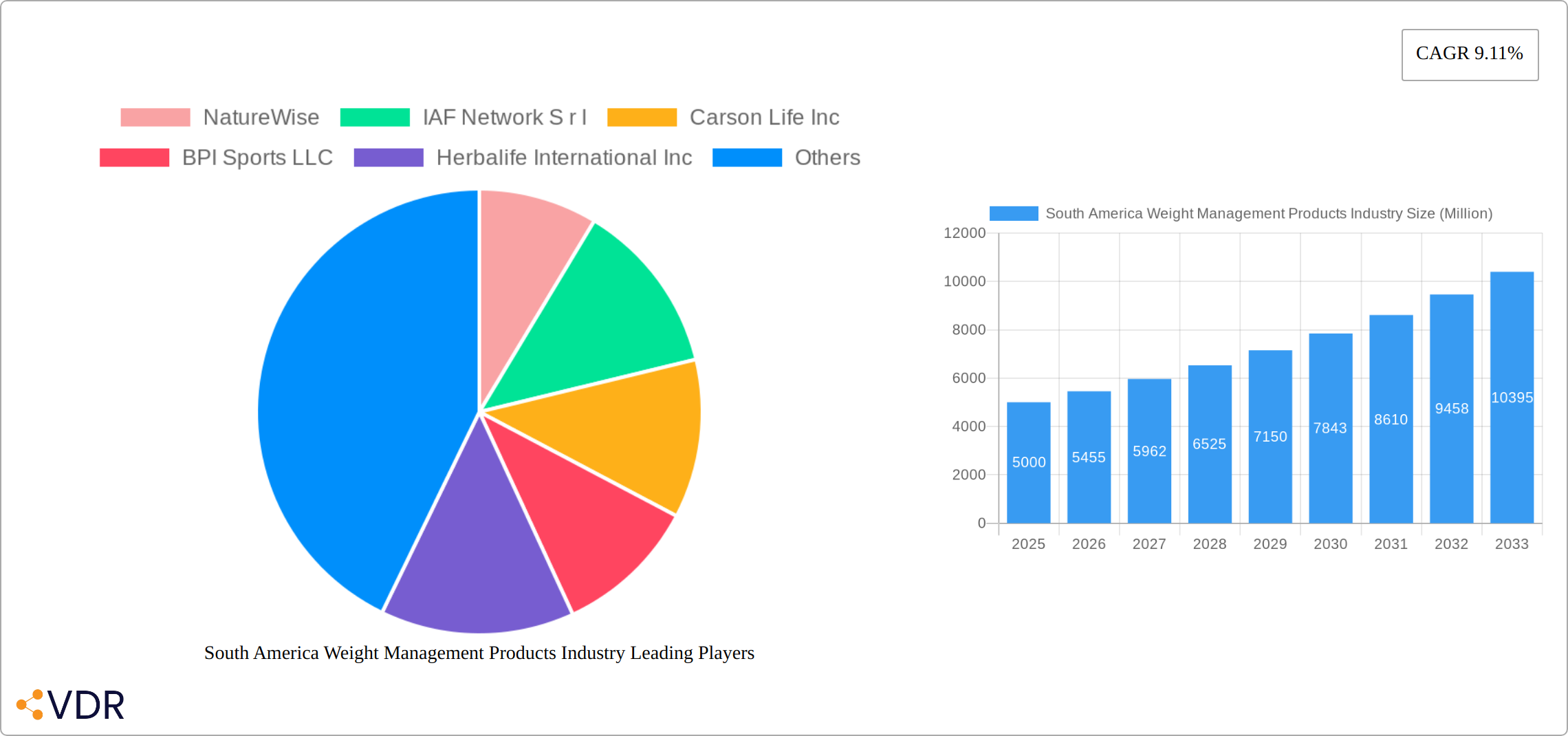

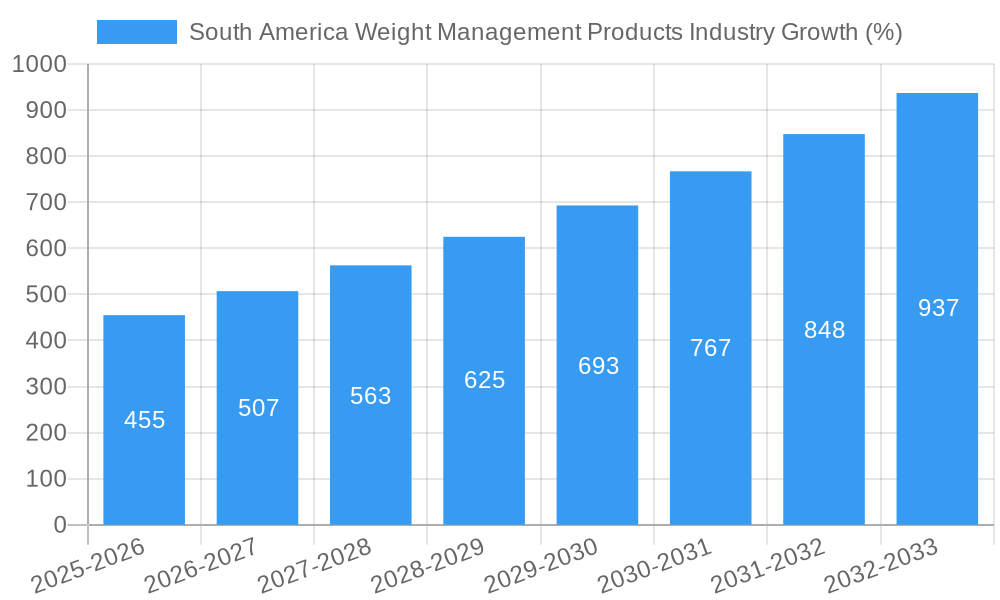

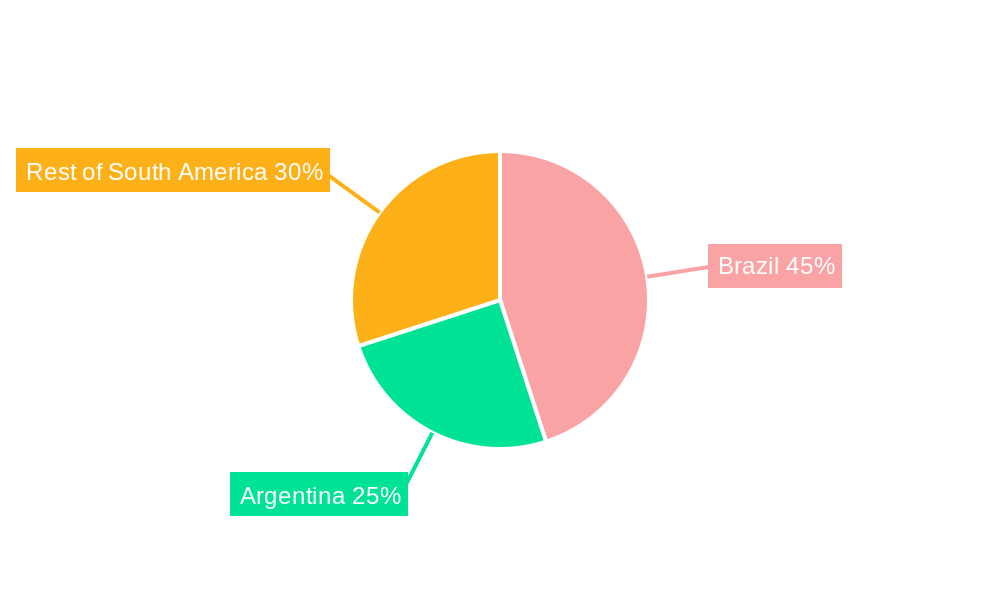

The South American weight management products market, encompassing meal replacements, beverages, supplements, and related items, presents a significant growth opportunity. Driven by increasing health consciousness, rising obesity rates, and a growing awareness of the importance of weight management in preventing chronic diseases, the market is projected to experience robust expansion. The CAGR of 9.11% from 2019-2024 suggests a strong underlying trend, likely to continue into the forecast period (2025-2033). Key distribution channels include hypermarkets/supermarkets, convenience stores, and increasingly, online retail stores, reflecting changing consumer preferences and digital penetration. While Brazil and Argentina represent the largest segments within South America, the "Rest of South America" region also holds potential for future growth. The competitive landscape is characterized by a mix of established multinational corporations like Nestlé and Herbalife, alongside smaller, specialized players focused on specific product niches or geographic areas. The market's success will depend on factors such as effective marketing strategies targeting health-conscious consumers, innovative product development addressing specific needs (e.g., natural ingredients, specific dietary requirements), and the continued expansion of online retail platforms. Regulatory landscape changes concerning supplement labeling and efficacy will also play a crucial role in shaping market dynamics.

The continued growth trajectory of the South American weight management market hinges on addressing key challenges. These include potential price sensitivity among consumers, the need for increased public health education and awareness campaigns promoting healthy lifestyles, and navigating the complexities of diverse regional tastes and preferences. Companies will need to invest in robust distribution networks to reach consumers across a geographically diverse market and focus on building strong brand trust through clear communication on product efficacy and safety. The rising popularity of holistic and natural weight management solutions presents both an opportunity and a challenge. Companies that successfully integrate natural ingredients and sustainable practices into their product offerings are likely to capture greater market share. Successful strategies will balance affordability with product quality and efficacy, catering to a broad consumer base across different socioeconomic strata.

South America Weight Management Products Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America weight management products industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within this rapidly evolving sector. The report segments the market by Type (Meal Replacements, Beverages, Supplements) and Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels), providing a granular understanding of market performance across various segments. The total market size is projected to reach xx Million units by 2033.

South America Weight Management Products Industry Market Dynamics & Structure

The South American weight management products market is characterized by moderate concentration, with several key players holding significant market share. However, the market is also witnessing increased competition from smaller, niche players offering innovative products. Technological advancements, particularly in personalized nutrition and digital health solutions, are driving significant growth. Regulatory frameworks vary across countries, impacting product development and marketing strategies. Consumers are increasingly health-conscious, driving demand for natural and functional ingredients. M&A activity is relatively high, reflecting the desire for market consolidation and expansion into new product categories.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on personalized nutrition, AI-powered weight management apps, and natural ingredients.

- Regulatory Frameworks: Vary significantly across countries, influencing product labeling and claims.

- Competitive Substitutes: Other wellness products, fitness services, and traditional weight-loss methods.

- End-User Demographics: Predominantly focused on health-conscious millennials and Gen Z, but expanding across age groups.

- M&A Trends: Significant activity in recent years, driven by expansion and diversification strategies. xx M&A deals recorded between 2019-2024.

South America Weight Management Products Industry Growth Trends & Insights

The South American weight management products market experienced significant growth during the historical period (2019-2024), driven by rising health consciousness, increasing disposable incomes, and changing lifestyles. The market is projected to maintain a strong Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly the rise of e-commerce and digital health platforms, are significantly impacting market dynamics. Consumer behavior is shifting towards personalized nutrition, natural ingredients, and convenient formats. Market penetration for weight management products remains relatively low, presenting considerable growth potential.

(Note: This section would include a detailed 600-word analysis leveraging XXX – specific data points to support claims on CAGR, market size, and consumer behavior would be inserted here.)

Dominant Regions, Countries, or Segments in South America Weight Management Products Industry

Brazil undeniably stands as the powerhouse of the South America weight management products market. This dominance is fueled by a potent combination of factors: a substantial and growing population, a palpable surge in health consciousness among consumers, and a sophisticated and expansive distribution network that effectively reaches a wide demographic. Within the "By Type" categorization, the supplements segment commands the largest market share, a testament to their perceived efficacy, convenience, and the growing demand for targeted solutions. Following closely are meal replacements and beverages, each catering to distinct consumer preferences and lifestyles. The "By Distribution Channel" landscape is witnessing a dramatic shift, with online retail stores experiencing exponential growth. This rapid expansion is directly attributable to increasing internet penetration across the region and the widespread adoption of e-commerce platforms, offering consumers unparalleled accessibility and convenience.

- Key Drivers in Brazil's Dominance: A vast and dense population base, a steadily increasing disposable income allowing for greater discretionary spending on health and wellness, a deeply ingrained and growing health consciousness among its citizens, and a highly developed and robust e-commerce infrastructure that facilitates seamless product accessibility.

- Supplements Segment Ascendancy: This segment's leadership is driven by a strong consumer preference for convenient, targeted, and often perceived as highly effective solutions for weight management. The availability of a wide array of formulations and the growing consumer trust in scientifically backed ingredients further bolster this segment.

- Online Retail Revolution: The surge in online retail is a direct consequence of widespread internet access, the inherent convenience of shopping from home, and the highly effective targeted marketing strategies employed by businesses on digital platforms. This channel offers greater reach and a more personalized shopping experience.

A comprehensive analysis of the factors contributing to Brazil's dominant position and the specific dynamics of the key segments would delve into detailed market share data, consumer behavior patterns, competitive landscapes, and projected growth figures for each segment over the next five to ten years. This would also include an examination of the influence of governmental health initiatives and the evolving regulatory framework within the weight management sector across South America.

South America Weight Management Products Industry Product Landscape

The weight management product landscape is characterized by innovation in natural ingredients, personalized formulations, and convenient formats. Meal replacement shakes are becoming increasingly sophisticated, incorporating functional ingredients and advanced nutritional profiles. Supplements are being developed with targeted benefits, addressing specific weight management needs. Beverages are incorporating natural extracts and functional ingredients, providing healthier options compared to traditional sugary drinks.

Key Drivers, Barriers & Challenges in South America Weight Management Products Industry

Key Drivers: Rising health awareness, increasing disposable incomes, changing lifestyles, growing prevalence of obesity, and technological advancements. Government initiatives promoting healthy lifestyles also contribute positively.

Key Challenges: Stringent regulatory requirements, counterfeit products, fluctuating raw material prices, inconsistent consumer perception of efficacy, and limited access to healthcare in certain regions pose significant barriers. These challenges impact market growth and profitability; for instance, counterfeit products may represent approximately xx% of the market, impacting the sales of legitimate brands.

Emerging Opportunities in South America Weight Management Products Industry

The South American weight management products industry is ripe with emerging opportunities. A significant area for growth lies in meticulously tapping into underserved markets, where access to quality products and information may be limited. The increasing consumer demand for personalized nutrition, tailored to individual needs and genetic profiles, presents a substantial avenue for innovation. Furthermore, there is a growing imperative to develop sustainable and ethically sourced products, aligning with a global trend towards conscious consumerism. Leveraging advanced digital marketing strategies, including influencer collaborations and data-driven campaigns, will be crucial for effectively reaching and engaging target consumers across diverse demographics and geographies. The development of novel ingredients and advanced delivery systems, coupled with a steadfast commitment to robust scientific evidence and clinical validation, offers significant potential for market leadership and sustained growth within the dynamic South American landscape.

Growth Accelerators in the South America Weight Management Products Industry

Long-term growth will be driven by ongoing technological advancements, strategic partnerships between health tech companies and weight management product manufacturers, and effective government policies promoting healthier lifestyles. Expanding distribution networks and educating consumers about the benefits of effective weight management products will further accelerate market growth.

Key Players Shaping the South America Weight Management Products Market

- NatureWise

- IAF Network S.r.l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut.com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Notable Milestones in South America Weight Management Products Industry Sector

- May 2022: Nestlé Health Science solidified its strategic position in the South American dietary supplements market by acquiring Puravida in Brazil, signaling a significant investment in the region's wellness sector.

- July 2022: Herbalife showcased its commitment to innovation by launching a new weight management product in Brazil featuring prickly pear cactus fiber, a natural ingredient supported by promising clinical trials for its weight management benefits.

- April 2023: Herbalife demonstrated its global dedication to holistic well-being by unveiling 106 innovative wellness products worldwide, with a notable inclusion of offerings specifically designed for the South American market, including Brazil, addressing diverse health and weight management needs.

In-Depth South America Weight Management Products Industry Market Outlook

The South America weight management products market is poised for significant and sustained growth, presenting a compelling landscape for stakeholders. This optimistic outlook is underpinned by a potent synergy of factors, including a progressively heightened health awareness among the populace, rapid advancements in technological innovation driving product development and accessibility, and increasingly favorable regulatory environments within key South American markets. To fully unlock this immense potential and adeptly capitalize on the burgeoning opportunities, strategic imperatives such as forging robust strategic partnerships, pursuing aggressive product diversification to cater to a wider array of consumer needs, and maintaining an unwavering focus on personalized and sustainable product offerings will be paramount. These strategic pillars will be instrumental in navigating the evolving market dynamics and securing a competitive edge in this dynamic region.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 NatureWise

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IAF Network S r l

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Carson Life Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BPI Sports LLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Herbalife International Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nestle SA*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Hut com Limited (Myprotein)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Ultimate Nutrition inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 N V Perricone LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 California Medical Weight Management LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Weight Management Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Weight Management Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Weight Management Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Weight Management Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Weight Management Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Weight Management Products Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Weight Management Products Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence