Key Insights

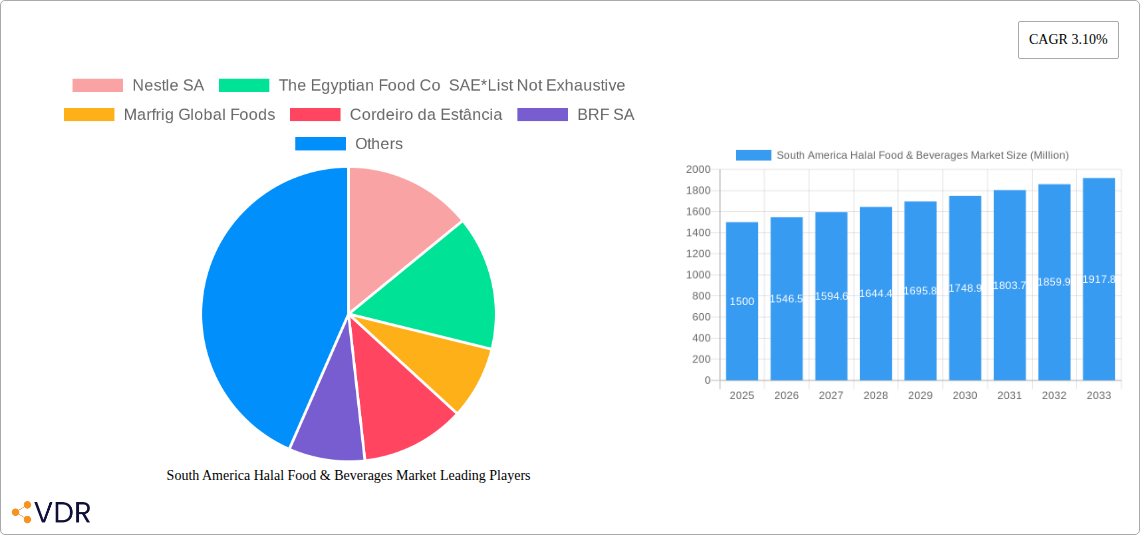

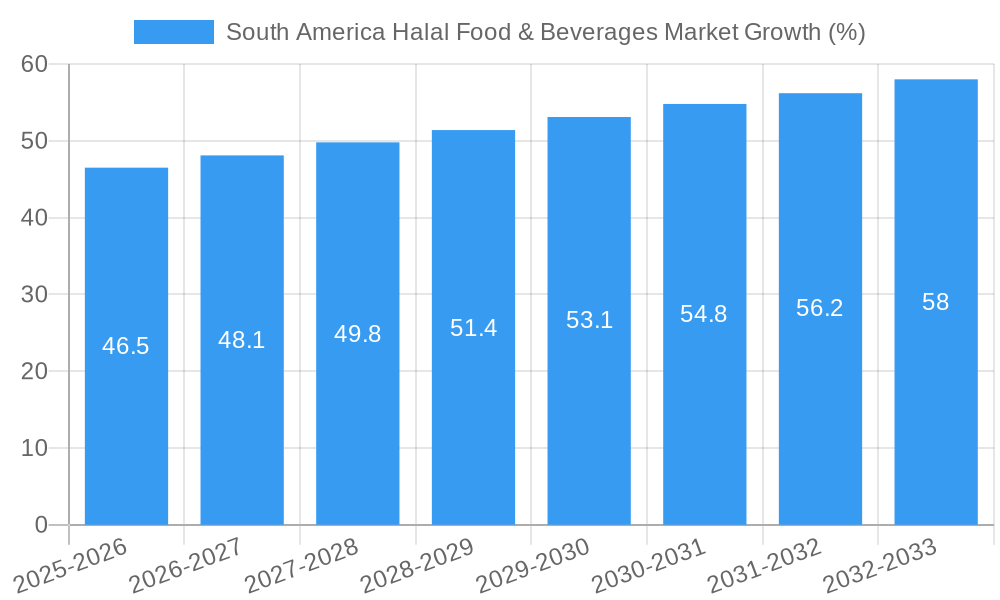

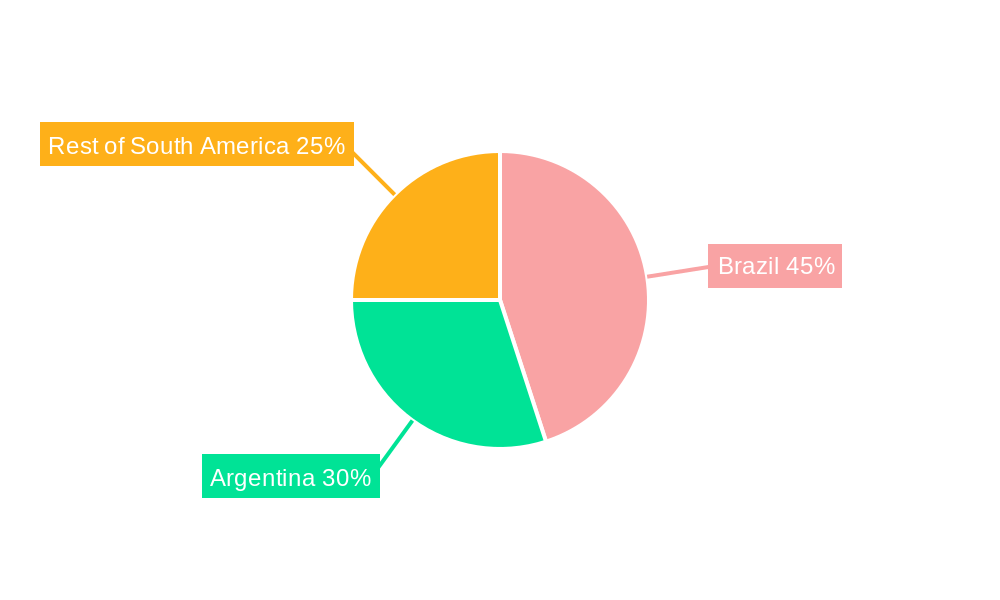

The South American Halal food and beverage market, currently valued at approximately $XX million (estimated based on provided CAGR and market size information not included in the prompt), is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.10% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing Muslim population in South America, coupled with rising disposable incomes and a growing preference for healthier, ethically sourced foods, are significantly contributing to market expansion. Furthermore, the increasing availability of Halal-certified products in major supermarkets and specialty stores is enhancing accessibility and convenience for consumers. The market segmentation reveals a robust demand for Halal food, including meat, poultry, and processed food items, alongside Halal beverages and supplements, demonstrating a diversified consumer base with varied preferences. Brazil and Argentina are currently leading the market within South America, reflecting their larger Muslim populations and more established infrastructure for Halal product distribution. However, opportunities remain significant in the "Rest of South America" segment, presenting potential for future expansion as consumer awareness and demand for Halal products increases. Challenges include maintaining consistent product quality and certification, overcoming supply chain limitations, and adapting marketing and distribution strategies to effectively reach diverse consumer demographics across the region. Established players like Nestle SA, BRF SA, and Marfrig Global Foods are vying for market share, but there is also room for smaller, regional players specializing in local products and catering to specific consumer preferences to establish themselves.

The forecast period of 2025-2033 indicates continued growth, driven by factors such as increasing tourism from Muslim-majority countries, strengthened international trade relationships, and government initiatives to support the Halal industry. However, potential restraints include fluctuations in raw material prices, regulatory complexities around Halal certification, and ensuring that the supply chain aligns with the strict standards necessary for Halal products. Market players must focus on innovation in product development, ensuring transparent and traceable supply chains, and strengthening relationships with both producers and consumers to secure sustained growth in this dynamic market segment.

South America Halal Food & Beverages Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Halal Food & Beverages Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market is segmented by type (Halal Food, Halal Beverages, Halal Supplements) and distribution channel (Hypermarket/Supermarket, Specialty Stores, Convenience Stores, Other Distribution Channels). Key players analyzed include Nestle SA, The Egyptian Food Co SAE, Marfrig Global Foods, Cordeiro da Estância, BRF SA, and Maricota Alimentos. This is not an exhaustive list. The report projects a market size of XX Million in 2025.

South America Halal Food & Beverages Market Dynamics & Structure

The South American Halal food and beverage market exhibits a moderately fragmented structure, with several large players and a significant number of smaller regional producers. Technological innovation, primarily focusing on improved food preservation, packaging, and processing techniques tailored to Halal standards, is a significant driver of market growth. Stringent regulatory frameworks concerning Halal certification and food safety standards influence market dynamics. Competitive product substitutes, such as conventional food and beverages, pose a challenge. The market is largely driven by a growing Muslim population and increasing awareness of Halal products among consumers, regardless of religious affiliation. M&A activity in this sector has been moderate, with a projected XX number of deals in the 2019-2024 period.

- Market Concentration: Moderately Fragmented

- Technological Innovation: Focus on preservation, packaging, and processing

- Regulatory Framework: Stringent Halal certification and food safety standards

- Competitive Substitutes: Conventional food and beverages

- End-User Demographics: Growing Muslim population and increasing awareness of Halal products

- M&A Trends: Moderate activity, XX deals projected (2019-2024)

South America Halal Food & Beverages Market Growth Trends & Insights

The South American Halal food and beverage market has demonstrated robust growth over the historical period (2019-2024), exhibiting a CAGR of XX%. This growth is primarily attributed to the increasing Muslim population, rising disposable incomes, and changing consumer preferences towards healthier and ethically sourced food products. Technological advancements, such as improved cold chain logistics and efficient Halal-certified processing technologies, further support market expansion. Consumer behavior is shifting towards greater convenience and premium-quality products, driving demand for ready-to-eat Halal meals and premium Halal beverages. Market penetration of Halal products has increased significantly in major urban centers, with strong potential for expansion into smaller cities and rural areas. The adoption rate of Halal-certified products is projected to increase by XX% during the forecast period (2025-2033), resulting in a CAGR of XX%.

Dominant Regions, Countries, or Segments in South America Halal Food & Beverages Market

Brazil dominates the South American Halal food and beverage market due to its large Muslim population and developed food processing industry. Other significant countries include Argentina and Colombia, driven by increasing demand and supportive government policies. The Halal food segment currently holds the largest market share, followed by Halal beverages and Halal supplements. The hypermarket/supermarket distribution channel dominates, owing to its extensive reach and established infrastructure.

- Key Drivers (Brazil): Large Muslim population, developed food processing industry, supportive government policies

- Key Drivers (Argentina & Colombia): Increasing demand, growing awareness of Halal products

- Segment Dominance: Halal Food (XX% market share), followed by Halal Beverages and Halal Supplements

- Distribution Channel Dominance: Hypermarkets/Supermarkets

South America Halal Food & Beverages Market Product Landscape

The South American Halal food and beverage market showcases a diverse product range, including ready-to-eat meals, processed meats, dairy products, beverages, and supplements. Product innovations focus on enhancing convenience, improving nutritional value, and incorporating traditional flavors catering to local palates. Technological advancements in packaging and preservation methods maintain product quality and extend shelf life. Unique selling propositions involve emphasizing ethical sourcing, quality ingredients, and compliance with stringent Halal standards.

Key Drivers, Barriers & Challenges in South America Halal Food & Beverages Market

Key Drivers: Growing Muslim population, increasing disposable incomes, rising awareness of Halal certifications, and government support for the halal industry are driving significant growth. Technological advancements in food processing and supply chain management further enhance market expansion.

Challenges: The major challenges include inconsistent Halal certification standards across different regions, supply chain inefficiencies, and potential consumer confusion regarding Halal labeling. Competition from conventional food and beverage products, especially with pricing pressures, also creates a significant hurdle. These challenges pose a potential impact of XX% reduction on projected market growth if not addressed effectively.

Emerging Opportunities in South America Halal Food & Beverages Market

Untapped markets in smaller cities and rural areas present significant opportunities for expansion. Increasing demand for convenient, ready-to-eat Halal meals and innovative product offerings, such as Halal-certified functional foods and beverages, present further growth prospects. Evolving consumer preferences towards organic and sustainably sourced Halal products open up exciting niche markets.

Growth Accelerators in the South America Halal Food & Beverages Market Industry

Technological breakthroughs in food processing and preservation, strategic partnerships between international and local players, and market expansion into underserved regions are pivotal growth accelerators. Effective marketing and communication strategies enhancing consumer awareness of Halal product benefits will also significantly contribute to market expansion.

Key Players Shaping the South America Halal Food & Beverages Market Market

- Nestle SA

- The Egyptian Food Co SAE

- Marfrig Global Foods

- Cordeiro da Estância

- BRF SA

- Maricota Alimentos

Notable Milestones in South America Halal Food & Beverages Market Sector

- 2020: Launch of the first Halal-certified plant-based meat alternative in Brazil.

- 2022: Implementation of stricter Halal certification standards by the Brazilian government.

- 2023: Strategic partnership between a major Brazilian food company and an international Halal certification body.

In-Depth South America Halal Food & Beverages Market Market Outlook

The South American Halal food and beverage market is poised for sustained growth over the forecast period (2025-2033), driven by a combination of factors, including a growing Muslim population, rising disposable incomes, and increasing consumer awareness of Halal-certified products. Strategic opportunities exist in product diversification, expansion into new markets, and the development of innovative product offerings tailored to local preferences. The market is projected to reach XX Million by 2033.

South America Halal Food & Beverages Market Segmentation

-

1. Type

-

1.1. Halal Food

- 1.1.1. Halal Meat

- 1.1.2. Processed Meat

- 1.1.3. Other Products

- 1.2. Halal Beverage

- 1.3. Halal Supplements

-

1.1. Halal Food

-

2. Distribution Channel

- 2.1. Hypermarket/ Supermarket

- 2.2. Specialty Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Halal Food & Beverages Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Halal Food & Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Halal Certified Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Halal Food & Beverages Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Halal Food

- 5.1.1.1. Halal Meat

- 5.1.1.2. Processed Meat

- 5.1.1.3. Other Products

- 5.1.2. Halal Beverage

- 5.1.3. Halal Supplements

- 5.1.1. Halal Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/ Supermarket

- 5.2.2. Specialty Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Halal Food & Beverages Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Halal Food & Beverages Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Halal Food & Beverages Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 The Egyptian Food Co SAE*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Marfrig Global Foods

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Cordeiro da Estância

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 BRF SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Maricota Alimentos

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: South America Halal Food & Beverages Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Halal Food & Beverages Market Share (%) by Company 2024

List of Tables

- Table 1: South America Halal Food & Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Halal Food & Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Halal Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South America Halal Food & Beverages Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Halal Food & Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Halal Food & Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Halal Food & Beverages Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Halal Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South America Halal Food & Beverages Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Halal Food & Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Halal Food & Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Halal Food & Beverages Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the South America Halal Food & Beverages Market?

Key companies in the market include Nestle SA, The Egyptian Food Co SAE*List Not Exhaustive, Marfrig Global Foods, Cordeiro da Estância, BRF SA, Maricota Alimentos.

3. What are the main segments of the South America Halal Food & Beverages Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Surge in Demand for Halal Certified Products.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Halal Food & Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Halal Food & Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Halal Food & Beverages Market?

To stay informed about further developments, trends, and reports in the South America Halal Food & Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence