Key Insights

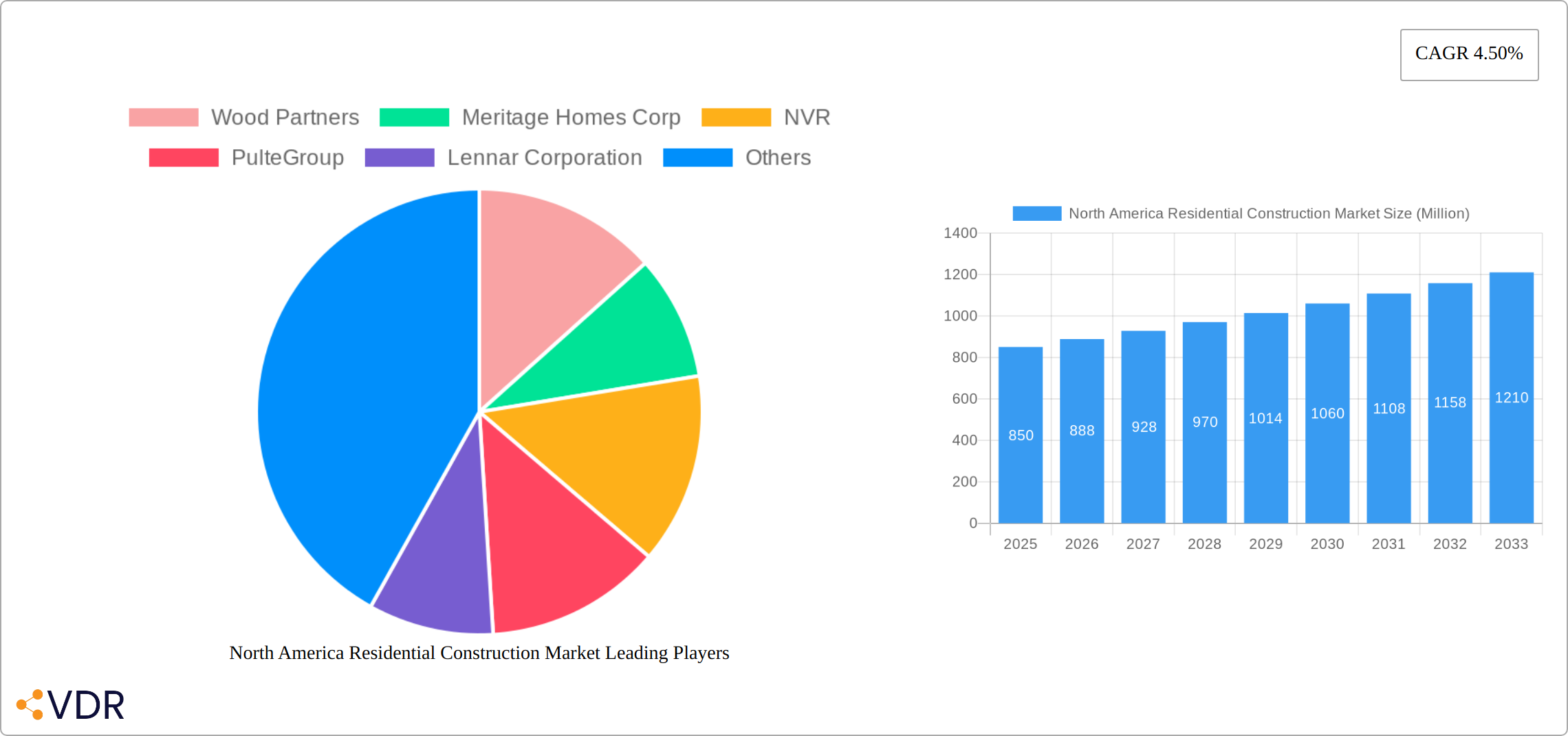

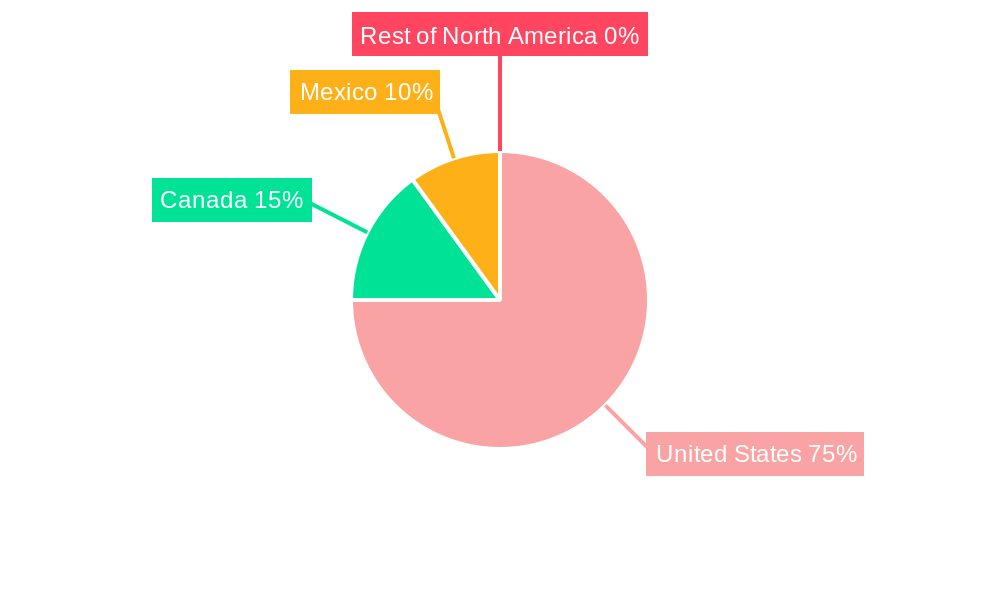

The North American residential construction market, valued at $850 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This expansion is fueled by several key drivers. A growing population, particularly in urban centers, necessitates increased housing supply. Furthermore, improving economic conditions and favorable mortgage interest rates stimulate demand, particularly within the single-family home segment. Government initiatives aimed at affordable housing and infrastructure development also contribute positively. However, the market faces certain constraints. Fluctuations in material costs, particularly lumber and other building supplies, coupled with skilled labor shortages, can impact project timelines and profitability. Increasing land prices in desirable locations and stringent building codes also present challenges to developers. The market is segmented by property type (single-family, multi-family), construction type (new construction, renovation), and region (United States, Canada, Mexico). The United States dominates the market, followed by Canada and Mexico. Major players such as Lennar Corporation, D.R. Horton, PulteGroup, and Toll Brothers are actively shaping the market landscape through strategic acquisitions, innovative construction techniques, and a focus on sustainable building practices. The renovation segment is showing promising growth, driven by increasing homeownership rates and a desire for home improvements. The forecast suggests continued market expansion, though potential economic downturns and policy changes could influence the growth trajectory.

The multi-family segment, encompassing apartments and condos, is expected to witness significant growth driven by urbanization and rental preferences, especially amongst younger demographics. New construction continues to be a major component of the market, though the renovation segment is gaining traction due to the rising cost of new construction and the desire for home customization. Regional variations exist; the US market's performance will likely influence the overall North American market trend. The competitive landscape is characterized by a mix of large national builders and regional players, each vying for market share through differentiation in product offerings, pricing strategies, and geographic focus. Sustained growth will depend on successfully navigating challenges related to material costs, labor shortages, and regulatory compliance.

North America Residential Construction Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America residential construction market, covering the period from 2019 to 2033. With a focus on key segments – single-family and multi-family homes, new construction and renovations – across the United States, Canada, and Mexico, this report is essential for industry professionals, investors, and strategists seeking to navigate this dynamic market. The report leverages robust data and expert insights to deliver actionable intelligence, projecting a market valued at xx Million units by 2033.

North America Residential Construction Market Dynamics & Structure

The North American residential construction market is characterized by a moderately concentrated landscape with several large players vying for market share. Market concentration is influenced by factors such as economies of scale, access to capital, and brand recognition. Leading players include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, and LMC Residential (list not exhaustive). Technological innovation, particularly in sustainable building materials and construction techniques, is a key driver, while regulatory frameworks concerning building codes, environmental standards, and zoning regulations significantly impact market dynamics. The market also faces competition from substitute products, such as manufactured housing and repurposed commercial spaces. Furthermore, M&A activity plays a significant role in shaping the market structure.

- Market Concentration: The top 5 companies hold approximately xx% market share (2024).

- Technological Innovation: Focus on sustainable materials (e.g., cross-laminated timber) and prefabrication techniques is accelerating.

- Regulatory Landscape: Stringent building codes and environmental regulations influence construction practices and costs.

- M&A Activity: An estimated xx M&A deals occurred in the period 2019-2024, primarily focused on consolidation and expansion.

- End-User Demographics: Millennial and Gen Z preferences for sustainable and smart homes are shaping demand.

North America Residential Construction Market Growth Trends & Insights

The North American residential construction market experienced significant volatility between 2019 and 2024, influenced by economic cycles, fluctuating interest rates, and material supply chain disruptions. While the market witnessed a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, reaching xx million units by 2024, this growth was not uniform across all regions or segments. The projected CAGR from 2025 to 2033 is estimated at xx%, driven by several key factors, including sustained population growth, ongoing urbanization trends, particularly in major metropolitan areas, and a persistent, albeit evolving, demand for housing across various price points. This growth is further influenced by the increasing adoption of sustainable building practices (such as LEED certification and net-zero energy designs), the integration of advanced technologies like Building Information Modeling (BIM) and prefabrication, and shifting consumer preferences towards smart homes, energy-efficient features, and flexible living spaces. Regional variations in market performance are notable, with some areas experiencing robust growth while others face headwinds.

Dominant Regions, Countries, or Segments in North America Residential Construction Market

The United States represents the largest segment of the North American residential construction market, accounting for approximately xx% of the total market size in 2024. Strong economic activity, population growth, and comparatively favorable lending conditions contribute to this dominance. Within the U.S., specific regions like the Sun Belt states experience particularly high growth due to population migration and favorable weather.

- By Property Type: The single-family home segment holds a larger market share compared to multi-family, driven by established preferences and changing family structures. However, multi-family construction (apartments, condos) is projected to show higher growth rates, reflecting evolving urban living preferences.

- By Construction Type: New construction dominates, but the renovation segment shows consistent growth, particularly driven by aging housing stock in established urban areas.

- By Region: The U.S. South and West regions showcase robust growth potential, whereas Canada and Mexico exhibit comparatively slower but stable expansion rates.

- Key Drivers: Government incentives for green building, infrastructure development (particularly transportation networks), and favorable demographic shifts are major drivers of growth.

North America Residential Construction Market Product Landscape

The residential construction market offers a diverse range of products and services, from basic construction materials to sophisticated smart home technologies. Innovation focuses on improving energy efficiency, enhancing durability, and incorporating sustainable practices. Prefabricated components, modular construction, and advanced building materials are gaining traction, streamlining construction processes and reducing timelines. Unique selling propositions center around sustainability, affordability, and enhanced features tailored to evolving consumer preferences (e.g., smart home integration, energy-efficient appliances).

Key Drivers, Barriers & Challenges in North America Residential Construction Market

Key Drivers:

- Strong Demographic Trends: Population growth and increasing household formations, especially in rapidly expanding urban centers, fuel the demand for new housing units. Millennial and Gen Z homebuyers are significant drivers of this demand.

- Regional Economic Variations: While some regions experience favorable economic conditions stimulating construction, others face economic uncertainties that impact investment and affordability.

- Technological Innovation & Efficiency Gains: Advancements in construction technologies, including modular construction, 3D printing, and robotics, are improving efficiency, reducing construction timelines, and potentially lowering costs.

- Government Incentives and Policies: In certain areas, government initiatives promoting affordable housing, sustainable construction, and infrastructure development indirectly support market growth.

Key Challenges & Restraints:

- Supply Chain Volatility & Inflationary Pressures: Ongoing disruptions in global supply chains continue to impact material costs and availability, leading to project delays and increased construction expenses. Inflationary pressures also affect affordability.

- Persistent Labor Shortages: A shortage of skilled labor, including carpenters, electricians, and plumbers, remains a significant constraint, delaying projects and increasing labor costs.

- Regulatory Complexity & Permitting Delays: Navigating complex building codes, environmental regulations, and lengthy permitting processes adds time and expense to projects.

- Interest Rate Sensitivity: Fluctuations in interest rates directly impact mortgage affordability, influencing consumer demand and investment decisions in the residential construction sector.

- Material Price Fluctuations: Beyond general inflation, specific material costs (lumber, steel, concrete) remain volatile, impacting project budgets and profitability.

Emerging Opportunities in North America Residential Construction Market

- Sustainable Building Materials & Practices: Growing demand for eco-friendly options presents significant opportunities.

- Smart Home Technology Integration: Integrating smart devices and systems enhances home value and user experience.

- Affordable Housing Solutions: Meeting the demand for affordable homes in rapidly growing urban areas.

- Modular and Prefabricated Construction: Offers faster, more efficient construction processes.

Growth Accelerators in the North America Residential Construction Market Industry

Long-term growth hinges on overcoming existing challenges and leveraging emerging opportunities. Strategic collaborations between developers, technology providers, and material suppliers are crucial for optimizing efficiency and streamlining construction processes. Government support through tax incentives, infrastructure investments, and affordable housing programs plays a vital role. The continued adoption of prefabrication and automation technologies is expected to boost productivity and improve cost-effectiveness. The focus on sustainable and resilient building practices will also attract investment and shape market trends.

Key Players Shaping the North America Residential Construction Market Market

- Wood Partners

- Meritage Homes Corp

- NVR

- PulteGroup

- Lennar Corporation

- Mill Creek Residential

- Clayton Properties Group

- Toll Brothers Building Company

- Alliance Residential

- Taylor Morrison

- D R Horton

- LGI Homes

- Century Communities

- The Michaels Organization

- KB Home

- LMC Residential

Notable Milestones in North America Residential Construction Market Sector

- December 2022: D.R. Horton announced plans for a USD 215 million residential development in southeast Columbus.

- December 2022: Lennar Corp. halted plans to spin off its multifamily subsidiary due to unfavorable market conditions.

- December 2022: Pulte Homes acquired a 17-acre site in Fort Myers, Florida, for USD 2.4 million, planning a 52-home community.

In-Depth North America Residential Construction Market Market Outlook

The future of the North American residential construction market appears promising, with continued growth driven by factors like urbanization, population growth, and technological advancements. Strategic investments in sustainable building practices, innovative construction techniques, and smart home technologies will play a critical role in shaping the market landscape. Opportunities exist for companies to capitalize on the growing demand for affordable housing and adapt to evolving consumer preferences. Addressing challenges like supply chain disruptions and labor shortages will be crucial for long-term success.

North America Residential Construction Market Segmentation

-

1. Property Type

- 1.1. Single Family

- 1.2. Multi-family

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

North America Residential Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend

- 3.3. Market Restrains

- 3.3.1. Interests and Financing; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1 800

- 3.4.2 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Single Family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. United States North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Wood Partners

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Meritage Homes Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NVR

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PulteGroup

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lennar Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mill Creek Residential

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Clayton Properties Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toll Brothers Building Company**List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Alliance Residential

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taylor Morrison

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 D R Horton

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LGI Homes

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Century Communities

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 The Michaels Organization

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 KB Home

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 LMC Residential

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Wood Partners

List of Figures

- Figure 1: North America Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: North America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Residential Construction Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 11: North America Residential Construction Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 12: North America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Residential Construction Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the North America Residential Construction Market?

Key companies in the market include Wood Partners, Meritage Homes Corp, NVR, PulteGroup, Lennar Corporation, Mill Creek Residential, Clayton Properties Group, Toll Brothers Building Company**List Not Exhaustive, Alliance Residential, Taylor Morrison, D R Horton, LGI Homes, Century Communities, The Michaels Organization, KB Home, LMC Residential.

3. What are the main segments of the North America Residential Construction Market?

The market segments include Property Type, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth and Disposable Income; Demand from Office Sector Returning Post COVID-; Non-residential Construction on Upward Trend.

6. What are the notable trends driving market growth?

800. 000 Housing Units Must Be Built Annually in Mexico to Keep Up with Demand.

7. Are there any restraints impacting market growth?

Interests and Financing; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

December 2022: In southeast Columbus, D.R. Horton intends to build homes for USD 215 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Residential Construction Market?

To stay informed about further developments, trends, and reports in the North America Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence