Key Insights

The Japan Condominiums and Apartments Market is projected to expand significantly, reaching an estimated market size of $16.48 billion by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6% during the forecast period of 2025-2033. Key growth drivers include escalating urbanization, leading to heightened demand in major cities. Furthermore, the increasing preference for compact, manageable residences among Japan's aging population and young professionals fuels market expansion. Evolving lifestyle trends emphasizing convenience, shared amenities, and contemporary designs in multi-unit dwellings also contribute to market growth.

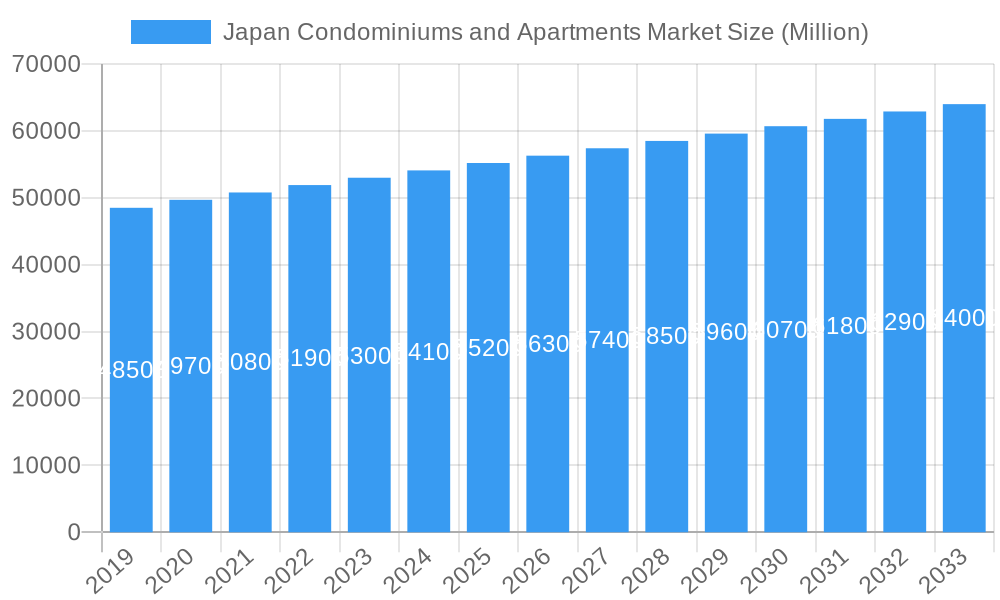

Japan Condominiums and Apartments Market Market Size (In Billion)

Potential restraints impacting market expansion include high land acquisition costs in prime urban areas, which affect project affordability and development. Stringent building regulations and environmental standards, while vital for sustainability, can lengthen development timelines and increase costs. Fluctuations in economic conditions and interest rate policies may also influence consumer purchasing power and investment in real estate. Despite these challenges, the market demonstrates robust segmentation across both condominiums and apartments, serving diverse buyer and renter demographics. Leading market participants, including Sekisui House Limited, Panasonic Homes Co. Ltd., and Asahi Kasei Homes Corporation, are driving innovation and strategic expansion across Japan.

Japan Condominiums and Apartments Market Company Market Share

Japan Condominiums and Apartments Market: Comprehensive Industry Report (2019-2033)

This in-depth report provides a definitive analysis of the Japan Condominiums and Apartments Market, covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025. Leveraging advanced market intelligence and data analytics, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Essential for real estate developers, investors, policymakers, and industry stakeholders, this report navigates the complexities of the Japanese residential property sector, focusing on both the parent market (Japan Condominiums and Apartments Market) and its child markets (Condominiums, Apartments).

Japan Condominiums and Apartments Market Market Dynamics & Structure

The Japan Condominiums and Apartments Market is characterized by a moderately concentrated structure, with a significant presence of large, established developers alongside a growing number of smaller, specialized firms. Technological innovation is a key driver, with advancements in construction materials, smart home integration, and sustainable building practices influencing project design and appeal. Regulatory frameworks, including urban planning laws, building codes, and foreign investment regulations, play a crucial role in shaping market entry and development. Competitive product substitutes, such as single-family homes and rental properties, exert influence, though condominiums and apartments often cater to specific demographic needs and urban lifestyles. End-user demographics, notably an aging population and a rising demand for urban living among younger generations, are significant influencing factors. Merger and acquisition (M&A) trends are observed as companies seek to expand their portfolios, gain market share, and leverage synergistic capabilities.

- Market Concentration: Dominated by a few key players, but with increasing fragmentation in niche segments.

- Technological Innovation Drivers: Smart home technology, modular construction, energy-efficient designs, and AI-powered property management are gaining traction.

- Regulatory Frameworks: Strict seismic building codes, land use regulations, and evolving rental laws impact development and sales.

- Competitive Product Substitutes: Single-family homes, townhouses, and an active rental market provide alternatives.

- End-User Demographics: Urbanization, shrinking household sizes, and the demand for convenient, low-maintenance living are paramount.

- M&A Trends: Consolidation for economies of scale, acquisition of innovative technologies, and strategic diversification.

Japan Condominiums and Apartments Market Growth Trends & Insights

The Japan Condominiums and Apartments Market has demonstrated a robust growth trajectory, driven by evolving lifestyle preferences and economic factors. The market size is projected to reach [Specific Market Size Value in Million Units] by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [Specific CAGR Value]% during the forecast period. Adoption rates of modern residential solutions, particularly in urban centers, are steadily increasing as demand for convenient and accessible living spaces outpaces supply. Technological disruptions are profoundly impacting the sector, with the integration of smart home features, IoT devices, and sustainable building materials becoming standard offerings. This shift is directly influenced by changing consumer behavior, with a growing emphasis on connectivity, energy efficiency, and community amenities. [Insert Specific Market Size Value in Million Units] million units are expected to be transacted in the base year 2025. The market penetration of high-rise condominiums and well-appointed apartments continues to expand, catering to both young professionals and an aging population seeking ease of living.

Dominant Regions, Countries, or Segments in Japan Condominiums and Apartments Market

The Condominiums segment is unequivocally the dominant force driving growth within the Japan Condominiums and Apartments Market. This segment's ascendancy is fueled by a confluence of factors intrinsically linked to Japan's unique demographic and urban landscape. Tokyo, as the nation's economic and population hub, commands the largest market share, with an insatiable demand for residential units driven by a dense population and continuous influx of talent. The development of large-scale, mixed-use condominium projects in metropolitan areas has been a key growth driver, offering a blend of residential, commercial, and recreational facilities that appeal to a wide demographic.

- Key Drivers of Condominium Dominance:

- Urbanization: High population density in major cities like Tokyo, Osaka, and Nagoya creates a perpetual demand for housing.

- Economic Policies: Government initiatives promoting urban regeneration and housing development encourage condominium construction.

- Infrastructure Development: Proximity to public transportation networks, shopping centers, and business districts significantly boosts condominium desirability.

- Demographic Shifts: An aging population seeking convenient, low-maintenance living and a younger generation preferring urban lifestyles contribute to sustained demand.

- Investment Potential: Condominiums are perceived as stable investments, particularly in prime urban locations.

The condominium market in Japan is further propelled by ongoing technological advancements in construction, leading to safer, more sustainable, and amenity-rich living spaces. The sheer volume of units developed and transacted in this segment far exceeds that of standalone apartments, solidifying its position as the primary growth engine for the overall Japan Condominiums and Apartments Market. The estimated market share for condominiums is [Specific Market Share Value]% in 2025.

Japan Condominiums and Apartments Market Product Landscape

The product landscape within the Japan Condominiums and Apartments Market is characterized by a strong emphasis on innovation, efficiency, and resident well-being. Developers are increasingly integrating smart home technologies, offering automated lighting, climate control, and security systems as standard features. Sustainable design principles are gaining prominence, with a focus on energy-efficient appliances, advanced insulation, and the use of eco-friendly building materials. Performance metrics for new developments consistently highlight enhanced seismic resistance, improved soundproofing, and efficient space utilization. Unique selling propositions often revolve around premium amenities such as communal lounges, fitness centers, rooftop gardens, and convenient access to transportation and retail hubs, catering to the modern urban dweller's lifestyle.

Key Drivers, Barriers & Challenges in Japan Condominiums and Apartments Market

Key Drivers:

- Urbanization and Population Density: Continuous migration to cities fuels demand for compact, convenient living solutions.

- Technological Advancements: Smart home integration, energy-efficient construction, and prefabricated building methods enhance desirability and reduce costs.

- Aging Population: A growing segment of seniors seeks accessible, low-maintenance housing options.

- Government Incentives: Policies promoting urban redevelopment and housing affordability stimulate market activity.

- Economic Stability: A generally stable economy supports consumer confidence and investment in residential property.

Key Barriers & Challenges:

- Land Scarcity and High Land Prices: Limited availability of prime real estate significantly inflates development costs.

- Stringent Building Regulations: Strict seismic codes and environmental standards, while ensuring safety, can increase construction timelines and expenses.

- Demographic Shifts: While contributing to demand, the shrinking overall population in some regions could present long-term challenges.

- Construction Labor Shortages: A persistent issue in the construction industry, leading to project delays and increased labor costs.

- Economic Volatility: Fluctuations in interest rates and economic downturns can impact buyer affordability and market demand. The estimated impact of construction labor shortages on project completion is xx%.

Emerging Opportunities in Japan Condominiums and Apartments Market

Emerging opportunities within the Japan Condominiums and Apartments Market lie in the development of senior-living integrated condominiums that offer a blend of independent living with accessible care services. The growing demand for co-living spaces tailored for young professionals and international residents presents a niche yet expanding market. Furthermore, the integration of advanced PropTech solutions for property management, virtual tours, and personalized resident experiences offers significant potential for differentiation and operational efficiency. The focus on sustainable and eco-friendly developments, including passive house designs and the use of renewable energy sources, is no longer a niche but a growing consumer expectation. Untapped markets in secondary cities with developing infrastructure also present opportunities for mid-range and affordable housing solutions.

Growth Accelerators in the Japan Condominiums and Apartments Market Industry

Several catalysts are accelerating growth in the Japan Condominiums and Apartments Market. Technological breakthroughs in construction, such as AI-driven design optimization and robotic construction, are improving efficiency and reducing costs, thereby increasing the viability of new projects. Strategic partnerships between real estate developers and technology firms are leading to the creation of smarter, more connected living environments that appeal to modern consumers. Market expansion strategies by established players into emerging urban centers and the development of more diverse housing typologies, such as micro-apartments and flexible-use spaces, are broadening the market's appeal. The increasing emphasis on green building certifications and sustainable living is also attracting environmentally conscious buyers and investors, further propelling market growth.

Key Players Shaping the Japan Condominiums and Apartments Market Market

- Misawa Homes Co Ltd

- Tama Home Co Ltd

- Nakano Corporation

- Nihon House Holdings Co Ltd

- Asahi Kasei Homes Corporation

- Kajima Corporation

- Yamada Homes Co Ltd

- Sumitomo Forestry's Co Ltd

- Sekisui House Limited

- Panasonic Homes Co Ltd

- [List Not Exhaustive] 63 Other Companies

Notable Milestones in Japan Condominiums and Apartments Market Sector

- 2020 March: Launch of innovative modular construction techniques by Sekisui House Limited, improving construction speed and quality.

- 2021 May: Kajima Corporation announces a focus on smart city integration in new residential developments, enhancing connectivity and resident experience.

- 2022 January: Panasonic Homes Co Ltd introduces advanced IoT-enabled smart home solutions, setting new benchmarks for convenience and security.

- 2023 June: Nihon House Holdings Co Ltd acquires a regional developer, expanding its footprint in emerging urban markets.

- 2024 February: Sumitomo Forestry's Co Ltd unveils a new line of eco-friendly, sustainably sourced building materials for residential construction.

In-Depth Japan Condominiums and Apartments Market Market Outlook

The future outlook for the Japan Condominiums and Apartments Market remains exceptionally strong, underpinned by ongoing urbanization and evolving consumer preferences. Growth accelerators, including technological innovation in construction and smart home integration, will continue to shape product offerings and improve affordability. Strategic partnerships and market expansion into underserved urban areas present significant opportunities for sustained growth. The increasing demand for sustainable and community-focused living environments will further drive development trends. The market is poised for continued expansion, driven by its ability to adapt to demographic shifts and embrace cutting-edge technologies, ensuring a vibrant and dynamic residential property sector.

Japan Condominiums and Apartments Market Segmentation

-

1. Type

- 1.1. Condominiums

- 1.2. Apartments

Japan Condominiums and Apartments Market Segmentation By Geography

- 1. Japan

Japan Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Japan Condominiums and Apartments Market

Japan Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices

- 3.3. Market Restrains

- 3.3.1. Uneven Topography; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Japan’s Shrinking Population is Producing a Surplus of Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums

- 5.1.2. Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Misawa Homes Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tama Home Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nakano Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asahi Kasei Homes Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kajima Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yamada Homes Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sumitomo Forestry's Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sekisui House Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Homes Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Misawa Homes Co Ltd

List of Figures

- Figure 1: Japan Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Condominiums and Apartments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Japan Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Japan Condominiums and Apartments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Japan Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Condominiums and Apartments Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Japan Condominiums and Apartments Market?

Key companies in the market include Misawa Homes Co Ltd, Tama Home Co Ltd, Nakano Corporation, Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie, Asahi Kasei Homes Corporation, Kajima Corporation, Yamada Homes Co Ltd, Sumitomo Forestry's Co Ltd, Sekisui House Limited, Panasonic Homes Co Ltd.

3. What are the main segments of the Japan Condominiums and Apartments Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices.

6. What are the notable trends driving market growth?

Japan’s Shrinking Population is Producing a Surplus of Housing.

7. Are there any restraints impacting market growth?

Uneven Topography; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Japan Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence