Key Insights

The Saudi Arabian residential construction sector is poised for substantial expansion, driven by demographic shifts, increasing urbanization, and strategic government housing programs. The market, valued at an estimated $232.14 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.2% between 2025 and 2033. This growth trajectory is underpinned by key drivers. The Kingdom's Vision 2030, a comprehensive economic and social reform agenda, is catalyzing significant investment in infrastructure and residential development. A youthful and expanding population, particularly in major urban hubs such as Riyadh, Jeddah, and Dammam, is creating a robust demand for new housing units. Concurrently, a growing middle class with enhanced purchasing power is fueling demand for higher-quality residential options. Market segmentation analysis indicates strong performance in both apartment and condominium segments, as well as in detached housing and villa construction. While new construction projects are the primary growth engine, renovation and redevelopment initiatives also contribute to market dynamism.

Saudi Arabia Residential Construction Market Market Size (In Billion)

Despite its promising outlook, the market faces certain headwinds. Volatile material costs, potential labor shortages, and evolving regulatory landscapes present challenges to sustained growth. Additionally, the sector's reliance on government expenditure and major projects introduces susceptibility to macroeconomic shifts. Nevertheless, the long-term forecast remains optimistic, supported by ongoing infrastructure development and economic diversification efforts aligned with Vision 2030. The participation of leading firms such as Nesma & Partners, Dar Al Arkan, and Emaar highlights strong investor confidence. Effectively addressing current challenges will be crucial in cementing the Saudi Arabian residential construction market's role as a pivotal contributor to national economic prosperity.

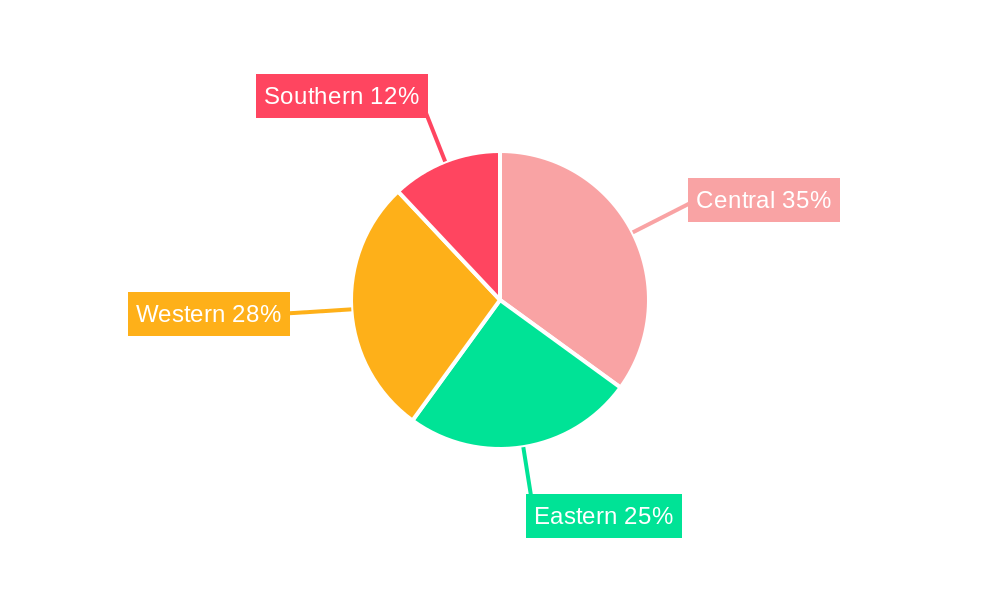

Saudi Arabia Residential Construction Market Company Market Share

Saudi Arabia Residential Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia residential construction market, covering market dynamics, growth trends, key players, and future outlook. The report segments the market by type (Apartments & Condominiums, Landed Houses & Villas, Other Types), construction type (New Construction, Renovation), and key cities (Riyadh, Jeddah, Dammam, Rest of Saudi Arabia), offering granular insights for informed decision-making. The study period spans 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This report is essential for investors, developers, contractors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The total market size is projected to reach xx Million units by 2033.

Saudi Arabia Residential Construction Market Dynamics & Structure

The Saudi Arabian residential construction market is characterized by a moderately concentrated landscape with a few dominant players and a large number of smaller firms. Market share is expected to be dominated by large-scale developers like Emaar and Dar Al Arkan (xx% combined market share estimated in 2025), though numerous smaller contractors contribute to the overall volume of construction. Technological innovation, driven by government initiatives promoting sustainable building practices and smart home technology, is gradually reshaping the sector, though adoption faces some barriers, including cost and expertise. The regulatory framework, including building codes and permits, influences project timelines and costs. Competitive pressure is primarily seen in pricing and project delivery times. End-user demographics are influenced by population growth, urbanization, and evolving lifestyle preferences, with a strong demand for modern, sustainable housing, particularly in major cities. M&A activity has seen moderate levels in recent years, driven by expansion strategies and market consolidation (xx deals in the last five years).

- Market Concentration: Moderately concentrated, with large players holding significant shares.

- Technological Innovation: Growing adoption of sustainable and smart technologies, though cost remains a barrier.

- Regulatory Framework: Influences project timelines and costs.

- Competitive Landscape: Intense competition, mainly focused on pricing and project delivery.

- End-User Demographics: Driven by population growth, urbanization, and evolving preferences.

- M&A Activity: Moderate activity, primarily for expansion and consolidation.

Saudi Arabia Residential Construction Market Growth Trends & Insights

The Saudi Arabian residential construction market experienced significant growth during the historical period (2019-2024), driven by government initiatives like Vision 2030, aimed at diversifying the economy and boosting housing affordability. The Compound Annual Growth Rate (CAGR) during this period is estimated at xx%. Market penetration of modern construction techniques and materials is steadily increasing, reflecting the rising demand for sustainable and high-quality housing. Technological disruptions, such as Building Information Modeling (BIM) and prefabrication, are contributing to improved efficiency and cost optimization. Changing consumer behavior is evident in the increasing preference for villas and apartments in planned communities with integrated amenities. The market is projected to continue its growth trajectory in the forecast period (2025-2033), fueled by ongoing infrastructure development and expanding population, exhibiting a predicted CAGR of xx%.

Dominant Regions, Countries, or Segments in Saudi Arabia Residential Construction Market

Riyadh and Jeddah, the largest cities, dominate the residential construction market, accounting for an estimated xx% and xx% of the total market, respectively, in 2025. These cities benefit from strong economic activity, significant population growth, and substantial government investments in infrastructure. The "New Construction" segment represents the lion's share of activity, driven by increasing demand for new housing, with Renovation representing a smaller, but growing, segment (xx% and xx% market share respectively in 2025). Among housing types, Apartments & Condominiums (xx% market share) and Landed Houses & Villas (xx% market share) are the most prevalent, reflecting diverse consumer preferences. The Rest of Saudi Arabia segment is also experiencing growth, albeit at a slower pace than major cities.

- Key Drivers:

- Government initiatives (Vision 2030) boosting housing development.

- Rapid urbanization and population growth in major cities.

- Increasing demand for modern and sustainable housing.

- Government investment in infrastructure development.

- Dominance Factors:

- Riyadh and Jeddah's high population density and economic activity.

- Strong demand for new construction in all segments.

Saudi Arabia Residential Construction Market Product Landscape

The Saudi Arabian residential construction market showcases a wide range of products, from conventional building materials to advanced technologies like prefabricated units and sustainable building systems. Innovation focuses on enhancing energy efficiency, improving structural integrity, and integrating smart home features. Products are differentiated by their cost-effectiveness, sustainability features, and technological integration. Key selling propositions include superior quality, faster construction times, and enhanced energy efficiency. The adoption of advanced construction technologies is gradually increasing but faces challenges related to initial investment costs and skilled labor availability.

Key Drivers, Barriers & Challenges in Saudi Arabia Residential Construction Market

Key Drivers:

- Government initiatives like Vision 2030 are major drivers, along with the increasing demand fueled by rapid population growth and urbanization.

- Foreign direct investment and rising disposable incomes also stimulate the construction sector.

- Strategic partnerships between both domestic and international firms accelerate development and innovation.

Key Challenges:

- The supply chain faced significant disruptions in recent years, impacting material costs and project timelines. Quantifiable impact: A xx% increase in material costs (estimated).

- Regulatory hurdles, such as obtaining permits, can create delays and increase project costs. Quantifiable impact: Project delays averaging xx months per project.

- Intense competition among contractors puts pressure on profit margins.

Emerging Opportunities in Saudi Arabia Residential Construction Market

- Sustainable Construction: Growing demand for green building materials and energy-efficient technologies.

- Smart Homes: Integration of smart home technologies is gaining traction.

- Affordable Housing: Government initiatives and private sector involvement create substantial opportunities.

- Specialized Housing: Development of niche housing solutions targeting specific demographic needs.

Growth Accelerators in the Saudi Arabia Residential Construction Market Industry

Continued government support through Vision 2030 initiatives, coupled with sustained private sector investment, are key drivers for long-term market growth. Technological advancements, such as prefabrication and 3D printing, will further enhance efficiency and reduce costs. Strategic partnerships between domestic and international companies will enhance expertise and expand market reach. The increasing demand for sustainable and affordable housing, along with the development of new cities and infrastructure, will fuel significant growth over the coming decade.

Key Players Shaping the Saudi Arabia Residential Construction Market Market

- Nesma & Partners

- Dar Al Arkan

- Emaar

- Jabal Omar Development Company

- Al Jaber Building (AJB)

- Almabani

- Jenan Real Estate Company

- Kettaneh Construction

- Abdul Latif Jameel Properties

- Sedco Development

- Nesma United Industries

- Saudi Cyprian Construction CO LTD

- Al Bawani

- Saudi Constructioneers Ltd (Saudico)

Notable Milestones in Saudi Arabia Residential Construction Market Sector

- April 2023: Retal Urban Development Company signs an agreement with the National Housing Company (NHC) to build 327 residential villas in Jeddah's East Albuhirat project. This signifies the government's continued commitment to expanding housing supply.

- December 2022: Partnership between Ajdan and Roshn to build over 270 villas in Riyadh's Sedra development highlights collaboration in large-scale projects and the private sector's role in meeting housing demands.

In-Depth Saudi Arabia Residential Construction Market Market Outlook

The Saudi Arabia residential construction market is poised for sustained growth over the forecast period. The continued implementation of Vision 2030, coupled with robust private sector investment and technological advancements, will create numerous opportunities for market participants. Focusing on sustainable, affordable, and technologically advanced housing solutions will be crucial for success. Strategic partnerships and collaborations will be vital for navigating the evolving market dynamics and capitalizing on emerging trends.

Saudi Arabia Residential Construction Market Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Landed Houses & Villas

- 1.3. Other Types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

-

3. Key Cities

- 3.1. Riyadh

- 3.2. Jeddah

- 3.3. Dammam

- 3.4. Rest of Saudi Arabia

Saudi Arabia Residential Construction Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Residential Construction Market Regional Market Share

Geographic Coverage of Saudi Arabia Residential Construction Market

Saudi Arabia Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices

- 3.3. Market Restrains

- 3.3.1. Uneven Topography; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Increasing Home Ownership Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Residential Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Landed Houses & Villas

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Key Cities

- 5.3.1. Riyadh

- 5.3.2. Jeddah

- 5.3.3. Dammam

- 5.3.4. Rest of Saudi Arabia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nesma & Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dar Al Arkan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emaar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jabal Omar Development Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Jaber Building (AJB)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almabani**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jenan Real Estate Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kettaneh Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abdul Latif Jameel Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sedco Development

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nesma United Industries

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Saudi Cyprian Construction CO LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Al Bawani

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saudi Constructioneers Ltd (Saudico)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Nesma & Partners

List of Figures

- Figure 1: Saudi Arabia Residential Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Residential Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 3: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 7: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 8: Saudi Arabia Residential Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Residential Construction Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Saudi Arabia Residential Construction Market?

Key companies in the market include Nesma & Partners, Dar Al Arkan, Emaar, Jabal Omar Development Company, Al Jaber Building (AJB), Almabani**List Not Exhaustive, Jenan Real Estate Company, Kettaneh Construction, Abdul Latif Jameel Properties, Sedco Development, Nesma United Industries, Saudi Cyprian Construction CO LTD, Al Bawani, Saudi Constructioneers Ltd (Saudico).

3. What are the main segments of the Saudi Arabia Residential Construction Market?

The market segments include Type, Construction Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 232.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices.

6. What are the notable trends driving market growth?

Increasing Home Ownership Driving the Market.

7. Are there any restraints impacting market growth?

Uneven Topography; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

April 2023: Retal Urban Development Company, based in Saudi Arabia, has signed a conditional development agreement with the kingdom's National Housing Company (NHC) to build residential villas under the master plan of the East Albuhirat project in the port city of Jeddah. The East Albuhirat project would have 327 residential units spread across a total area of 98,098.55 sq m, according to Retal's application to the Saudi exchange Tadawul.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Residential Construction Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence