Key Insights

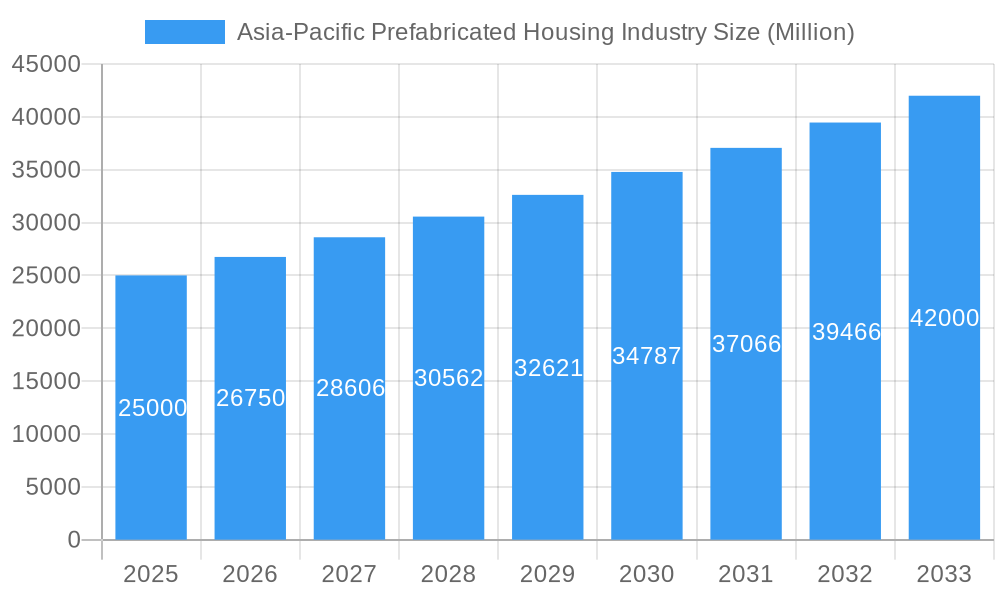

The Asia-Pacific prefabricated housing market is projected for significant expansion, with an estimated market size of 40.56 billion by the base year 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.32% during the forecast period. This growth is driven by increasing demand for affordable and sustainable housing, fueled by rapid urbanization and population growth. Supportive government policies and incentives further bolster the adoption of prefabricated construction to address housing shortages efficiently. Technological advancements in manufacturing and a growing emphasis on environmental sustainability are enhancing the appeal of prefabricated homes. Innovative building techniques contribute to reduced construction time, minimized waste, and improved energy efficiency, aligning with global green development initiatives.

Asia-Pacific Prefabricated Housing Industry Market Size (In Billion)

The market comprises key segments including single-family and multifamily housing units. Prominent players such as Sekisui House, Toyota Housing Corporation, and Panasonic Homes are leading the market through technological innovation and strong brand presence. Companies like Shanghai Star House and Archiblox are also making notable advancements. Challenges include consumer perceptions regarding quality and customization, along with the need for greater standardization of building codes across different regional markets. However, these are expected to be offset by increasing government support, technological progress, and a strong focus on eco-friendly construction, ensuring continued growth in the Asia-Pacific prefabricated housing sector. China, Japan, and Australia are anticipated to be leading markets within the region.

Asia-Pacific Prefabricated Housing Industry Company Market Share

Asia-Pacific Prefabricated Housing Industry Report Description

Gain unparalleled insights into the rapidly evolving Asia-Pacific prefabricated housing market with this comprehensive SEO-optimized report. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis provides deep dives into market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, and emerging opportunities. Essential for industry professionals, investors, and policymakers seeking to understand the future of construction in one of the world's most dynamic regions. Explore market size in Million units and discover the strategic imperatives for success in this high-growth sector.

Asia-Pacific Prefabricated Housing Industry Market Dynamics & Structure

The Asia-Pacific prefabricated housing industry is characterized by a moderately concentrated market, driven by escalating demand for affordable and sustainable housing solutions. Technological innovation, particularly in modular construction and advanced manufacturing processes, is a significant driver, fostering efficiency and reducing construction timelines. Regulatory frameworks across the region are gradually evolving to accommodate and promote offsite construction methods, although varying building codes and land-use policies can present localized challenges. Competitive product substitutes, primarily traditional onsite construction methods, are being increasingly challenged by the cost-effectiveness and speed of prefabricated solutions. End-user demographics are shifting, with a growing middle class and urbanization driving demand for diverse housing types. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring innovative startups to expand their technological capabilities and market reach.

- Market Concentration: Moderately concentrated, with a few dominant players and a growing number of specialized regional manufacturers.

- Technological Innovation: Driven by advancements in BIM, robotics in manufacturing, and sustainable material integration.

- Regulatory Frameworks: Increasing government support for green building and offsite construction, but inconsistent across nations.

- Competitive Product Substitutes: Traditional construction remains a key competitor, but losing ground to efficiency gains.

- End-User Demographics: Young professionals, families, and the elderly seeking faster, more affordable housing options.

- M&A Trends: Strategic acquisitions to gain market share and technological prowess.

Asia-Pacific Prefabricated Housing Industry Growth Trends & Insights

The Asia-Pacific prefabricated housing industry is poised for robust growth, driven by a confluence of economic, social, and technological factors. From a market size of xx million units in 2019, the industry is projected to reach xx million units by 2025, with an impressive CAGR of xx% projected from 2025 to 2033. Adoption rates are accelerating as governments and private developers recognize the benefits of offsite construction, including faster project completion, reduced labor costs, and enhanced quality control. Technological disruptions, such as the integration of AI in design and automated manufacturing, are further streamlining the production process and enabling greater customization. Consumer behavior is also shifting, with a growing preference for modern, sustainable, and smart homes, all of which can be effectively delivered through prefabricated methods. The demand for efficient and cost-effective housing solutions in rapidly urbanizing countries, coupled with the need for disaster-resilient structures, are significant catalysts for this market's expansion. The market penetration of prefabricated housing, currently at xx%, is expected to witness a significant surge as these advantages become more widely understood and accepted across the region.

Dominant Regions, Countries, or Segments in Asia-Pacific Prefabricated Housing Industry

The Asia-Pacific prefabricated housing industry's growth is significantly influenced by the dynamics within its key regions and countries. Within the Type segment, both Single Family and Multifamily housing are experiencing substantial demand. However, the Multifamily segment, particularly in densely populated urban centers, is emerging as a dominant driver due to rapid urbanization, housing shortages, and the need for efficient land utilization.

Key Dominant Countries:

- China: Leads in sheer volume due to massive infrastructure projects, government initiatives promoting affordable housing, and a well-established manufacturing base for prefabricated components. The sheer scale of its urban development projects fuels the demand for both single-family and multifamily prefabricated solutions.

- Japan: A mature market characterized by high-quality standards and technological innovation. Japanese companies are renowned for their advanced modular designs, earthquake-resistant technologies, and premium offerings in both single-family and multifamily sectors, catering to a discerning consumer base.

- Australia: Exhibits strong growth in modular construction, particularly for single-family homes and remote workforce accommodation. Favorable government policies supporting innovation and a skilled labor shortage are accelerating adoption.

- South Korea: Strong focus on smart homes and sustainable building practices. Advanced manufacturing capabilities enable high-quality prefabricated solutions for both residential and commercial applications.

Dominance Factors in Multifamily Segment:

- Urbanization: Rapid city growth necessitates high-density housing solutions that prefabricated construction can deliver efficiently.

- Affordability: Prefabricated multifamily units offer a more cost-effective way to address housing needs compared to traditional construction.

- Speed of Delivery: Essential for meeting the urgent housing demands in burgeoning urban areas.

- Government Policies: Initiatives aimed at increasing housing supply and promoting sustainable development often favor modular and offsite construction.

- Economic Policies: Supportive economic environments and investment in infrastructure create fertile ground for large-scale multifamily projects.

Market Share and Growth Potential: The multifamily segment is projected to capture a larger market share by 2033, driven by its scalability and alignment with urban development strategies. Countries with high population density and aggressive urbanization plans will witness the most significant growth in this segment.

Asia-Pacific Prefabricated Housing Industry Product Landscape

The product landscape of the Asia-Pacific prefabricated housing industry is characterized by continuous innovation, focusing on enhanced sustainability, smart home integration, and modularity. Products range from single-module units to complex, multi-story residential complexes. Unique selling propositions often lie in the speed of assembly, superior thermal performance, and customizable design options. Technological advancements are leading to the use of advanced composite materials, integrated renewable energy systems, and digital fabrication techniques that allow for intricate designs and precise construction.

Key Drivers, Barriers & Challenges in Asia-Pacific Prefabricated Housing Industry

Key Drivers:

- Rapid Urbanization: Increasing demand for housing in densely populated urban areas.

- Affordability Concerns: Prefabricated housing offers a cost-effective alternative to traditional construction.

- Labor Shortages: Offsite construction reduces reliance on skilled onsite labor.

- Sustainability Focus: Growing demand for eco-friendly and energy-efficient buildings.

- Government Support: Favorable policies and incentives promoting offsite construction.

- Technological Advancements: Innovations in manufacturing and design streamline production.

Barriers & Challenges:

- Initial Investment Costs: Higher upfront capital required for manufacturing facilities.

- Regulatory Hurdles: Inconsistent building codes and approval processes across different regions.

- Perception and Acceptance: Overcoming traditional biases against manufactured homes.

- Supply Chain Disruptions: Vulnerability to raw material price fluctuations and logistics issues.

- Financing Challenges: Difficulty in securing financing for projects using non-traditional methods.

- Design Rigidity Concerns: Although improving, some clients perceive a lack of design flexibility.

Emerging Opportunities in Asia-Pacific Prefabricated Housing Industry

Emerging opportunities in the Asia-Pacific prefabricated housing industry lie in catering to niche markets and leveraging new technologies. The demand for affordable housing solutions in developing nations presents a significant untapped market. Furthermore, the rise of co-living spaces and the increasing need for temporary or modular housing in disaster-prone regions offer substantial growth potential. Innovative applications such as prefabricated educational facilities, healthcare clinics, and emergency shelters are also gaining traction. Evolving consumer preferences for smart and sustainable living are driving the development of integrated smart home technologies and eco-friendly materials within prefabricated units.

Growth Accelerators in the Asia-Pacific Prefabricated Housing Industry Industry

Several catalysts are accelerating the growth of the Asia-Pacific prefabricated housing industry. Technological breakthroughs in areas like 3D printing for construction components and advanced robotics for assembly are significantly enhancing efficiency and reducing costs. Strategic partnerships between manufacturing giants, technology providers, and real estate developers are creating synergistic ecosystems that drive innovation and market penetration. Market expansion strategies, including entering new geographic territories and diversifying product portfolios to cater to a wider range of housing needs, are also crucial growth accelerators. The increasing adoption of Building Information Modeling (BIM) throughout the design, manufacturing, and construction phases is further optimizing project delivery and fostering collaboration.

Key Players Shaping the Asia-Pacific Prefabricated Housing Industry Market

- Shanghai Star House

- Ichijo

- Toyota Housing Corporation

- Aussie Modular Solutions

- Archiblox

- Anchor Homes

- Panasonic Homes

- Sekisui House

- Ausco Modular Construction

- Daiwa House Industry

Notable Milestones in Asia-Pacific Prefabricated Housing Industry Sector

- Jan 2023: Apex Modular, a joint venture between JAT Property Group and Apex Asia Holdings in Sri Lanka, appointed Licensed Manufacturer for Estonian-based Mobile Module Supplier for LTG Lofts, chosen for their qualification to produce LTG's 'coodo moon' housing units for the Asian market. The first coodo Resort in Sri Lanka is expected to open in Q2 2023, featuring adaptable modern mobile homes.

- Nov 2022: The Housing and Development Board (HDB) in Singapore launched an initiative for upcoming Build-to-Order (BTO) projects in Tengah town, featuring "beamless" flats with enhanced headroom and layout flexibility. Garden Waterfront I and II at Tengah will incorporate numerous innovations in design, fabrication, and construction for approximately 2,000 units as part of HDB's Construction Transformation Project.

In-Depth Asia-Pacific Prefabricated Housing Industry Market Outlook

The future outlook for the Asia-Pacific prefabricated housing industry is exceptionally bright, driven by persistent demand for efficient, sustainable, and affordable housing solutions. Key growth accelerators include continued advancements in manufacturing automation and material science, enabling more complex and customized designs at competitive price points. Strategic partnerships and collaborations are expected to become more prevalent, fostering innovation and market penetration across diverse geographic and economic landscapes. The industry is also poised to benefit from increasing government initiatives and favorable policies aimed at addressing housing shortages and promoting green building practices. Emerging applications beyond residential construction, such as prefabricated commercial spaces and infrastructure components, represent significant untapped potential, solidifying the industry's trajectory for sustained and robust growth.

Asia-Pacific Prefabricated Housing Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multifamily

Asia-Pacific Prefabricated Housing Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

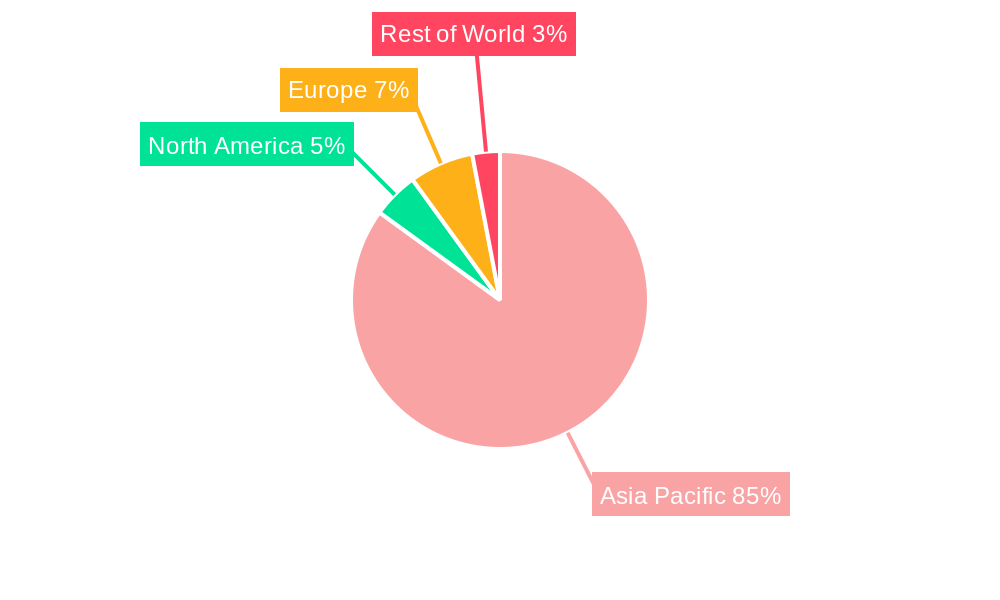

Asia-Pacific Prefabricated Housing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Prefabricated Housing Industry

Asia-Pacific Prefabricated Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Housing Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Prefabricated Housing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multifamily

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shanghai Star House

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ichijo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toyota Housing Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aussie Modular Solutions**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archiblox

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Anchor Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sekisui House

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ausco Modular Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Daiwa House Industry

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shanghai Star House

List of Figures

- Figure 1: Asia-Pacific Prefabricated Housing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Prefabricated Housing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Asia-Pacific Prefabricated Housing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Prefabricated Housing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Prefabricated Housing Industry?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Asia-Pacific Prefabricated Housing Industry?

Key companies in the market include Shanghai Star House, Ichijo, Toyota Housing Corporation, Aussie Modular Solutions**List Not Exhaustive, Archiblox, Anchor Homes, Panasonic Homes, Sekisui House, Ausco Modular Construction, Daiwa House Industry.

3. What are the main segments of the Asia-Pacific Prefabricated Housing Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Increasing Demand for Housing Driving the Market.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

Jan 2023: Apex Modular, a joint venture between JAT Property Group and Apex Asia Holdings in Sri Lanka, was recently appointed the Licensed Manufacturer for Estonian-based Mobile Module Supplier for LTG Lofts. Apex Modular was chosen as the most appropriately qualified and certified manufacturer for LTG's spectacular, retro-futuristic 'coodo moon' housing units for the Asian market, and it is expected to complete the first coodo Resort in Sri Lanka, which is set to open in Q2 2023. Coodo moon housing units are intended to become the most sought-after modern mobile home units, adaptable to a variety of regional climates and weather conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Prefabricated Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Prefabricated Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Prefabricated Housing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Prefabricated Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence