Key Insights

The Russian luxury residential real estate market is projected for robust expansion, driven by heightened demand for premium living spaces and a growing affluent demographic. The market is anticipated to reach approximately USD 600 billion by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 6% from 2024 to 2033. Key growth factors include the increasing population of High-Net-Worth Individuals (HNWIs), a rising preference for branded residences with comprehensive amenities, and substantial infrastructure investments in major urban centers such as Moscow and St. Petersburg. These advancements elevate the desirability of luxury properties, offering enhanced lifestyles and promising capital appreciation. Furthermore, a growing emphasis on sustainable and smart home technologies is influencing new developments, attracting discerning buyers who prioritize both comfort and environmental responsibility.

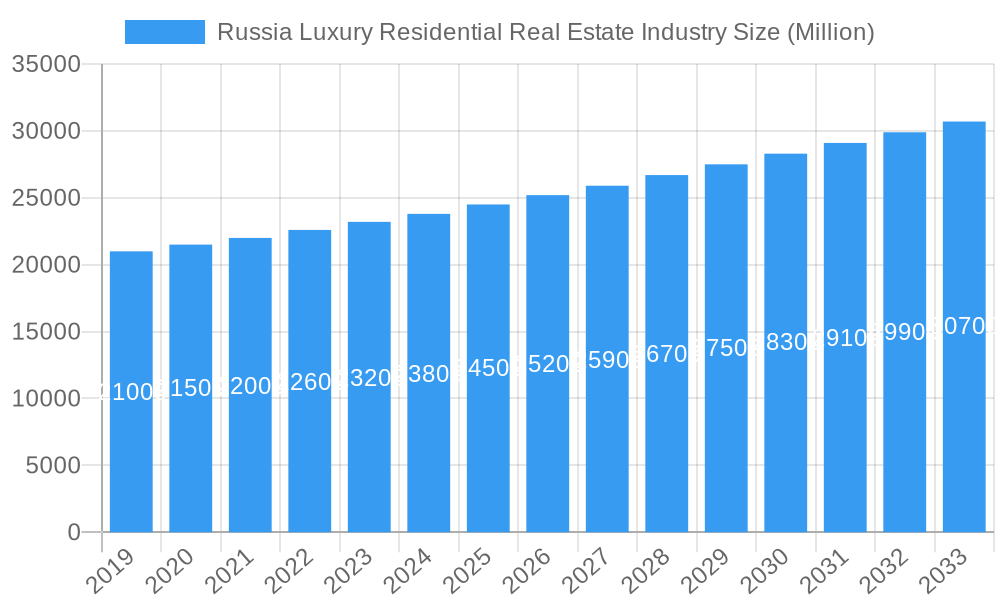

Russia Luxury Residential Real Estate Industry Market Size (In Billion)

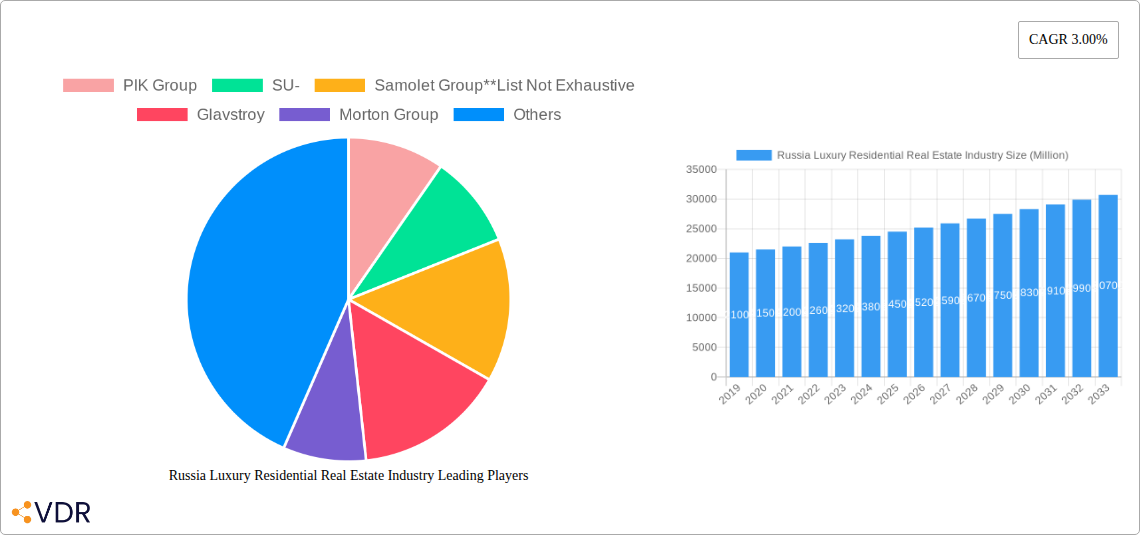

Despite this strong growth outlook, certain market constraints exist. Economic volatility and geopolitical uncertainties may introduce investor caution. Additionally, elevated costs for premium construction materials and skilled labor can impact development profitability and property pricing. However, the inherent resilience of the luxury segment, which often demonstrates less susceptibility to minor economic shifts, combined with the sustained appeal of prime locations and exclusive amenities, is expected to counterbalance these challenges. The market's segmentation into Apartments & Condominiums and Villas & Landed Houses caters to varied buyer preferences. While Moscow and St. Petersburg remain primary demand hubs, emerging luxury enclaves in other cities indicate a potential diversification of luxury real estate investment. Leading entities like PIK Group, SU-, and Samolet Group are actively contributing to market development through innovative projects and strategic growth initiatives.

Russia Luxury Residential Real Estate Industry Company Market Share

Russia Luxury Residential Real Estate Industry: Market Analysis & Forecast 2019–2033

This comprehensive report delivers an in-depth analysis of the Russia Luxury Residential Real Estate Industry, providing critical insights into market dynamics, growth trends, regional dominance, and future outlook. Designed for industry professionals, investors, and stakeholders, this report leverages high-traffic keywords and a structured approach to maximize visibility and deliver actionable intelligence. The study encompasses a detailed examination of the parent and child markets, offering a holistic view of this burgeoning sector.

Russia Luxury Residential Real Estate Industry Market Dynamics & Structure

The Russia Luxury Residential Real Estate Industry exhibits a moderately concentrated market structure, with a few dominant players accounting for a significant portion of the high-end property development and sales. Technological innovation is increasingly playing a pivotal role, with advancements in construction technology, smart home integration, and digital marketing platforms shaping product offerings and consumer engagement. Regulatory frameworks, while evolving, present a mix of opportunities and challenges, influencing development approvals, foreign investment, and property ownership. Competitive product substitutes are primarily emerging from the premium segment of the broader residential market, offering comparable amenities and locations at slightly lower price points. End-user demographics are characterized by an affluent and discerning clientele, comprising high-net-worth individuals, expatriates, and investors seeking exclusive living experiences and robust asset appreciation. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring smaller, niche developers to expand their portfolios and market reach.

- Market Concentration: Dominated by key developers with established brand reputations and extensive project pipelines.

- Technological Innovation Drivers: Smart home technology adoption, sustainable building practices, and advanced visualization tools for property marketing.

- Regulatory Frameworks: Evolving zoning laws, investment incentives, and property taxation policies impacting development and sales.

- Competitive Product Substitutes: High-end standard residential properties and serviced apartments offering alternative luxury living solutions.

- End-User Demographics: Focus on ultra-high-net-worth individuals, successful entrepreneurs, and international buyers.

- M&A Trends: Strategic acquisitions to enhance market share, diversify project portfolios, and gain access to prime locations. Specific M&A deal volumes are estimated at xx Million units in the historical period.

Russia Luxury Residential Real Estate Industry Growth Trends & Insights

The Russia Luxury Residential Real Estate Industry is poised for significant expansion, driven by a confluence of economic recovery, evolving lifestyle aspirations, and a growing demand for premium living spaces. The market size evolution is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% over the forecast period. Adoption rates for smart home technologies and sustainable features are rapidly increasing, reflecting a shift in consumer preferences towards comfort, efficiency, and environmental consciousness. Technological disruptions, such as the increasing use of AI in property management and blockchain for secure transactions, are further enhancing the industry's operational efficiency and transparency. Consumer behavior shifts are evident in the demand for unique property features, such as personalized amenities, expansive green spaces, and access to exclusive lifestyle services. The penetration of luxury residential properties in major urban centers is expected to deepen, as a growing segment of the population aspires to own high-value, premium assets. Insights into these trends are derived from extensive market research, expert interviews, and granular data analysis across the study period of 2019–2033, with the base year and estimated year being 2025.

Dominant Regions, Countries, or Segments in Russia Luxury Residential Real Estate Industry

Moscow stands out as the preeminent region driving growth in the Russia Luxury Residential Real Estate Industry. Its status as the nation's capital and primary economic hub attracts significant domestic and international investment, fostering a vibrant market for high-end properties. The city boasts a concentration of affluent individuals, multinational corporations, and diplomatic missions, creating a sustained demand for luxury apartments and condominiums, as well as exclusive villas and landed houses in its upscale peripheries.

- Moscow:

- Market Share: Estimated to hold xx% of the national luxury residential market.

- Key Drivers: Booming financial sector, presence of global businesses, and a well-developed luxury retail and hospitality ecosystem.

- Growth Potential: Sustained demand fueled by new wealth creation and ongoing urban development projects.

- Dominance Factors: Unparalleled prestige, excellent infrastructure, and a wide array of premium lifestyle amenities.

St. Petersburg, the cultural capital, emerges as a strong second-largest market, appealing to those seeking a blend of historical charm and modern luxury. The city's rich architectural heritage, coupled with burgeoning creative industries and tourism, contributes to a unique demand for bespoke luxury residences.

- St. Petersburg:

- Market Share: Accounts for approximately xx% of the luxury market.

- Key Drivers: Rich cultural heritage, growing tourism sector, and a developing IT and creative industries.

- Growth Potential: Increasing interest from both domestic and international buyers looking for unique, character-filled properties.

- Dominance Factors: Aesthetic appeal, significant historical significance, and a growing number of upscale cultural and entertainment venues.

Novosibirsk, while a major industrial and scientific center, represents a developing luxury market with significant untapped potential. As its economy diversifies and attracts skilled professionals, the demand for higher-quality residential options is on the rise, presenting emerging opportunities for developers.

- Novosibirsk:

- Market Share: Currently represents xx%, with significant growth projections.

- Key Drivers: Strong scientific and industrial base, growing skilled workforce, and improving infrastructure.

- Growth Potential: Early-stage luxury market with considerable room for expansion as wealth increases.

- Dominance Factors: Strategic location in Siberia, potential for economic diversification, and a growing middle class aspiring to premium housing.

Other Cities across Russia are beginning to see a gradual rise in luxury residential demand, particularly in regional economic centers and resort destinations. These markets offer more accessible entry points for investors and a growing appetite for quality housing driven by localized economic growth and an increasing awareness of luxury living standards.

Russia Luxury Residential Real Estate Industry Product Landscape

The product landscape in the Russia Luxury Residential Real Estate Industry is defined by an emphasis on bespoke design, premium materials, and integrated smart technologies. Developers are increasingly offering a range of luxury apartments and condominiums, characterized by expansive living spaces, panoramic views, and high-end finishes. Beyond vertical living, exclusive villas and landed houses in private enclaves are highly sought after, featuring private gardens, swimming pools, and advanced security systems. Performance metrics revolve around exceptional build quality, energy efficiency, and adherence to international luxury standards. Unique selling propositions often include innovative floor plans, access to concierge services, and proximity to elite social and cultural amenities. Technological advancements are evident in the seamless integration of home automation systems, intelligent climate control, and sophisticated entertainment setups, catering to the discerning tastes of affluent buyers.

Key Drivers, Barriers & Challenges in Russia Luxury Residential Real Estate Industry

Key Drivers:

- Economic Growth and Wealth Creation: Rising disposable incomes among the affluent segment fuel demand for premium properties.

- Urbanization and Lifestyle Aspirations: Growing desire for modern, well-appointed homes in desirable urban locations.

- Investment Potential: Luxury real estate is perceived as a stable and appreciating asset class.

- Technological Advancements: Smart home features and sustainable building practices enhance property appeal.

- Government Support and Infrastructure Development: Investments in urban infrastructure and favorable property policies can stimulate growth.

Key Barriers & Challenges:

- Economic Volatility and Geopolitical Factors: Unforeseen economic downturns or political instability can dampen investor confidence and consumer spending.

- Regulatory Hurdles and Bureaucracy: Complex permitting processes and evolving property laws can delay development.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of premium construction materials.

- High Development Costs: Securing prime land and constructing high-specification properties incurs substantial expenses.

- Affordability Concerns: Despite demand, the high price point can limit the addressable market. Estimated market penetration of luxury properties remains at xx% of the total residential market.

Emerging Opportunities in Russia Luxury Residential Real Estate Industry

Emerging opportunities in the Russia Luxury Residential Real Estate Industry lie in the development of mixed-use luxury complexes that integrate residential spaces with premium retail, dining, and wellness facilities, creating self-sufficient lifestyle hubs. Untapped markets in rapidly developing regional cities offer significant potential for early-mover advantage. Innovative applications of proptech, such as virtual reality property tours and AI-driven property management, are set to revolutionize the buying and ownership experience. Evolving consumer preferences are also driving demand for sustainable luxury living, with an emphasis on eco-friendly materials, energy efficiency, and biophilic design principles. The rise of co-living luxury spaces catering to younger affluent demographics presents another exciting avenue for growth.

Growth Accelerators in the Russia Luxury Residential Real Estate Industry Industry

Long-term growth in the Russia Luxury Residential Real Estate Industry will be significantly accelerated by sustained technological breakthroughs in construction and design, leading to more efficient and aesthetically superior developments. Strategic partnerships between developers, luxury brands, and technology providers will create integrated living experiences that command premium valuations. Market expansion strategies focusing on emerging affluent demographics and niche market segments, such as the demand for second homes or investment properties in scenic locations, will also drive expansion. Furthermore, the continued development of robust financial instruments and incentives tailored for luxury real estate investment will play a crucial role in fostering sustainable growth and attracting both domestic and international capital.

Key Players Shaping the Russia Luxury Residential Real Estate Industry Market

- PIK Group

- SU-

- Samolet Group

- Glavstroy

- Morton Group

- Ingrad

- Donstroy

- SETL Group

- LSR Group

- Etalon Group

Notable Milestones in Russia Luxury Residential Real Estate Industry Sector

- 2019: Launch of several large-scale luxury residential projects in Moscow, setting new benchmarks for design and amenities.

- 2020: Increased adoption of digital marketing and virtual tours due to global pandemic restrictions.

- 2021: Significant M&A activity as larger developers consolidated market share. Estimated deal volume: xx Million units.

- 2022: Introduction of advanced smart home technologies in new luxury developments, enhancing user experience.

- 2023: Growing interest in sustainable and eco-friendly luxury housing options.

- 2024: Expansion of luxury residential offerings in St. Petersburg and emerging regional hubs.

In-Depth Russia Luxury Residential Real Estate Industry Market Outlook

The outlook for the Russia Luxury Residential Real Estate Industry remains exceptionally bright, propelled by robust growth accelerators. Sustained economic development and increasing wealth accumulation among the target demographic will continue to underpin demand for high-value properties. Technological innovations in construction and smart living solutions will not only enhance the appeal and functionality of luxury residences but also contribute to greater construction efficiency. Strategic alliances and market expansion into emerging luxury enclaves will unlock new revenue streams and customer bases. The industry is poised for significant growth, driven by a dynamic market that prioritizes exclusivity, sophisticated design, and unparalleled lifestyle experiences, further solidifying its position as a lucrative investment and living opportunity. The forecast period of 2025–2033 is anticipated to witness an upward trajectory in market value, projected to reach xx Billion Rubles by 2033.

Russia Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Cities

- 2.1. Moscow

- 2.2. St. Petersburg

- 2.3. Novosibirsk

- 2.4. Other Cities

Russia Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Russia

Russia Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Russia Luxury Residential Real Estate Industry

Russia Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 3.3. Market Restrains

- 3.3.1. Shortage of Raw Materials

- 3.4. Market Trends

- 3.4.1. Growth in the Apartment Buildings Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Moscow

- 5.2.2. St. Petersburg

- 5.2.3. Novosibirsk

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PIK Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SU-

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samolet Group**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glavstroy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Morton Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingrad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Donstroy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SETL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LSR Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Etalon Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PIK Group

List of Figures

- Figure 1: Russia Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Russia Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Residential Real Estate Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Russia Luxury Residential Real Estate Industry?

Key companies in the market include PIK Group, SU-, Samolet Group**List Not Exhaustive, Glavstroy, Morton Group, Ingrad, Donstroy, SETL Group, LSR Group, Etalon Group.

3. What are the main segments of the Russia Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 600 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets.

6. What are the notable trends driving market growth?

Growth in the Apartment Buildings Driving the Market.

7. Are there any restraints impacting market growth?

Shortage of Raw Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Russia Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence